Bitcoin Holds Heavy Support — Bullish Flag Signals Next ImpulseAs I expected in my previous idea , Bitcoin( BINANCE:BTCUSDT ) reached its targets and rose as anticipated.

Currently, Bitcoin is moving within the heavy support zone($78,260-$70,080).

From a classical technical analysis standpoint, on the 15-minute timeframe, Bitcoin seems to be forming a bullish flag pattern, which is a good sign for continued short-term upside.

From an Elliott Wave perspective, it appears Bitcoin is completing a Double Three Correction(WXY) on the 15-minute timeframe. We should expect the start of a 5-wave impulsive move next.

I expect Bitcoin to continue upward in the next few hours, at least toward the Cumulative Short Liquidation Leverage($80,100-$79,450) and possibly fill parts of the upper CME Gap($84,560-$79,660).

What’s your view on Bitcoin’s direction, at least for the next couple of days? I’d love to hear your thoughts!

First Target: Cumulative Short Liquidation Leverage($80,100-$79,450)

Second Target: $80,971

Stop Loss(SL): $76,281

Points may shift as the market evolves

Cumulative Short Liquidation Leverage: $86,170-$84,760

Cumulative Long Liquidation Leverage: $77,460-$76,600

Cumulative Long Liquidation Leverage: $75,000-$74,000

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 15-minute time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Btc-e

BTC – Bearish Pullback Scenario Toward 50% Fibonacci (~63,000$)BTC – Bearish Pullback Scenario Toward 50% Fibonacci (~63,000$)

BTC is currently showing signs of structural weakness after rejection from the upper Fibonacci resistance zone (0.786–0.88). Price failed to hold above this area and has started forming lower highs, suggesting momentum is shifting bearish in the short to mid term.

From a Fibonacci retracement perspective, the 50% level (red line) around 63,000$ stands out as a key magnet price. Historically, BTC tends to revisit this level during deeper corrections within larger bullish cycles.

Key confluences supporting this bearish pullback:

Loss of momentum after ATH rejection

Breakdown below local support and short-term moving average

Market structure shifting from impulsive to corrective

50% Fib aligning with prior consolidation and demand zone

Bearish Scenario:

If BTC fails to reclaim and hold above the 0.618 Fib, continuation to the 50% Fib (~63K) becomes highly probable. This level could act as a major reaction zone for either a strong bounce or further downside.

Bullish Invalidation:

A clean reclaim and hold above the 0.786 Fib resistance would invalidate this bearish outlook and open the door for continuation toward highs.

⚠️ This analysis reflects a correction within a macro uptrend, not a trend reversal.

Not financial advice. Always manage risk.

Please comment what do you think BTC next scenario would be?

BITCOIN and the powerful Stoch RSI Cycle SignalThe Stoch RSI is a very rarely used indicator, in fact the last time we made use of it on Bitcoin (BTCUSD) was around the bottom of the 2022 Bear Cycle. We bring it forward to you once more as December closed with the 1M Stoch RSI below the 20.00 level. Historically, every time the market did that, BTC's new Bear Cycle had already started but it was still in its beginning.

You can see that during the majority of each Bear Cycle, the 1M Stoch RSI settled sideways below the 20.00 mark and when it broke back above it, the new Bull Cycle had already started. The time distance between those signals during the last two Cycles has been just over 1 year (13 months, 396 days). This suggests that by January 2027, BTC's new Bull Cycle will already have started most likely.

As to a potential bottom? The strongest candidate is the 3W MA100 (red trend-line), which has been hit during all previous three Cycles. That is currently around $53000 and rising, so we expect BTC to hit at least this level before a Bear Cycle bottom around October 2026. Additionally, the Mayer Multiple Bands (MMBs) green Zone, offers a Buy Zone, which priced the November 2022 bottom.

So what do you think? Is this Stoch RSI signal useful in your long-term positioning? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

TradeCityPro | Bitcoin Daily Analysis #259Welcome to TradeCity Pro!

After a long break, let’s get back to Bitcoin analysis. This analysis is based on the daily timeframe.

Daily Timeframe

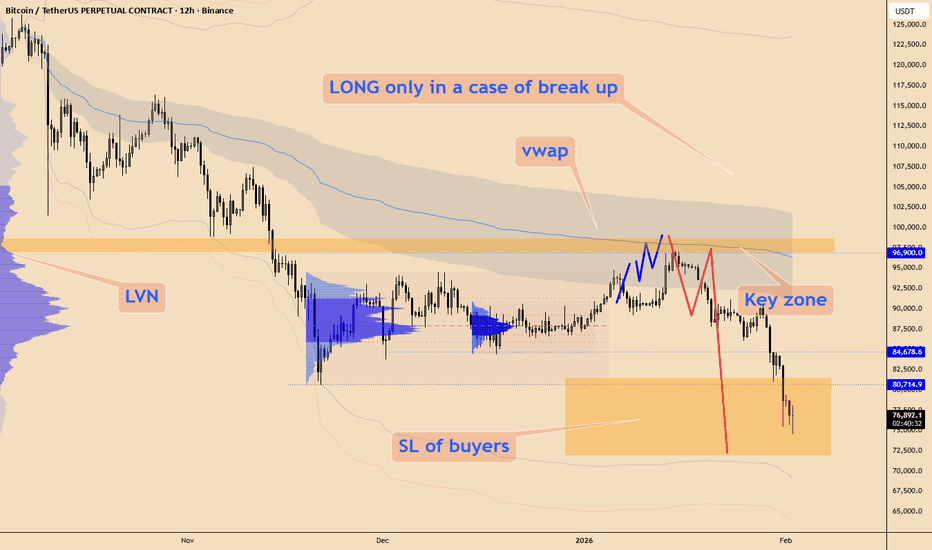

On the daily chart, Bitcoin’s trend turned bearish after stabilizing below 108,000, and the first bearish leg played out down to 85,000.

After a period of consolidation and a corrective move up to 97,000, Bitcoin started its next leg lower by breaking the 85,000 low, pushing price down to 76,000.

The 76,000 zone is a very important support area for Bitcoin and overlaps with the 0.618 Fibonacci Extension. We also have another support level around 72,000, so overall we can consider a major support range between 72,000 and 76,000.

A clean break of this zone would give us strong confirmation of a bearish trend, and if that happens, Bitcoin would officially enter a bearish cycle. As discussed before, this downside move could extend as far as 44,000.

At the same time, during this bearish leg, the RSI has dropped to its support around 22.27 and is now sitting at a momentum support level. If price continues to move lower without consolidation and RSI breaks below 22.27, we could see a very sharp sell-off.

Given the strength of the bearish trend, the next downward move could extend toward 65,000, 60,000, or even 53,000.

Personally, I’ll be looking to open short positions on a break below 76,000. However, if price fakes a breakdown in the 72,000–76,000 range, or finds support there and starts forming higher highs and higher lows, we can look for long opportunities on lower timeframes—because this 72k–76k zone is a very strong support area and won’t be easy to break.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

USDT: are we due for a relief rally? key levels to monitorMarket Cap USDT Dominance. Ready for a crypto relief rally or is fear just getting started? While majors cooled off after the latest macro jitters and profit taking, traders have been hiding in stables, and dominance spiked hard according to market data. Now price is stalling right at the local highs, so this level suddenly matters a lot.

On the 4H chart we’ve got a vertical pump into 7.1–7.3% plus RSI sitting in overbought and already curling down – classic “too much, too fast” vibes. Biggest volume shelf is down around 6.3–6.4%, so any unwind of fear can send dominance back into that value zone, which usually means a bounce for BTC and alts. I might be wrong, but current structure looks more like a blow‑off than the start of a calm uptrend.

My base case ✅ rejection below 7.2% and a pullback toward 6.4% and possibly 6.2%, where I’d look to add risk on strong coins. Trigger for me is a 4H close back under 7.0% with RSI dropping from overbought. ⚠️ If buyers smash through 7.3% and hold above, then I’ll respect the squeeze, expect 7.5%+ on dominance and stay defensive on alt exposure.

USDCAD Breakout DoneUSDCAD is showing a bullish reversal structure after breaking out of a sustained descending channel, with price reclaiming short term resistance and forming higher lows, signaling a shift from bearish control into accumulation and early trend transition. The recent upside momentum aligns with firm US dollar demand driven by resilient US economic data, elevated Treasury yields, and cautious risk sentiment, while the Canadian dollar faces mixed pressure from fluctuating crude oil prices, softer growth expectations, and a more measured Bank of Canada stance compared to prior tightening cycles. Technically this breakout and consolidation above former supply suggests a classic breakout retest scenario, where the market is building acceptance before continuation, favoring bullish momentum, trend reversal, liquidity grab recovery, and higher high expansion setups as long as price holds above the reclaimed zone, keeping upside targets in play with dip buying interest and sustained USD strength supporting further gains.

AUDUSD Still PumpingAUDUSD is trading in a strong bullish continuation phase after a clean impulsive breakout, with price currently consolidating above the previous resistance zone that has now flipped into short term support, signaling healthy price acceptance rather than exhaustion. The sharp rally reflects improving risk sentiment, sustained weakness in the US dollar, and supportive fundamentals from Australia including stable RBA policy expectations, resilient labor data, and strength in commodity-linked currencies, while recent US macro data continues to fuel speculation around future Fed easing which keeps downside pressure on USD. Technically this structure favors a pullback and continuation scenario, where shallow retracements are being absorbed by buyers, momentum remains intact, and higher highs with higher lows confirm trend strength, making bullish continuation, trend following, breakout retest, and buy the dip strategies favorable as long as price holds above the key support area and maintains bullish market structure toward higher targets.

Bitcoin: mean-reversion play? key levels and targets aheadBitcoin. Who survived that liquidation nuke and who’s still coping with the PnL trauma? After the latest cascade of longs getting wiped and headlines about cooling ETF flows and tighter liquidity, sentiment flipped from euphoria to “get me out.” That’s exactly when I start hunting for mean‑reversion plays.

On the 4H chart we just bounced off a chunky demand block around 76–77k, with a clear volume spike on the low and RSI crawling out of oversold. Price is now camping under the first supply zone near 79.5–80k, right where the last dump accelerated. That combo looks like a classic relief‑rally setup, so I’m leaning short‑term long, aiming back into the 81–82.5k high‑volume area.

My plan: I want a small dip toward 77.5–78k to join buyers, with invalidation under 76k. Base case – squeeze into 81–82.5k, maybe even a wick toward 83.5k, where I’d start scaling out. If 76k breaks on strong volume, I drop the long idea and look for the next flush into 74–75k support. I might be wrong, but fading a freshly washed‑out Bitcoin has rarely aged well. ✅

Bitcoin topped versus Gold 11 months ago.On the bright side the cyclical bear market of #BTC vs #GC is actually closer to the end, rather than just starting.

Bitcoin has already lost tremendous value vs the Analog SOV

With previous cyclical Bears lasting maximum 14 months.

Which by that time I believe one if not both of these targets will be met.

The troubling aspect is.

If BTC achieves target 2 --- then once could argue a Double top has formed.

And any subsequent bounce/recovery rally should be treated with suspicion.

And furthers declines and retest of this target 2, could open up the trapdoor for a SECULAR Bear market taking us into 2027 before any meaningful recovery can begin.

This is a merely observation of what has happened and what is currently unfolding with early (pre-coinbase launching) BTC investors unloading supply most of 2025 into their perceived six figure objective.

$100K was always the dream!

Will they buy back next bear?

I suspect only if it becomes cheap enough.

What is cheap for an OG?

Bitcoin Is Not Bouncing — It’s Sliding Inside a Bearish ChannelBitcoin remains firmly trapped inside a well-defined descending channel, and the structure is doing exactly what a controlled bearish market is supposed to do: lower highs, lower lows, and weak corrective bounces.

From a price structure standpoint, the recent sell-off was impulsive, breaking multiple short-term supports and accelerating price into the lower half of the channel. The bounce we are seeing now is purely corrective, capped below the descending channel resistance and the dynamic EMA, which is acting as active supply, not support.

The orange projection highlights the most probable path:

- A weak relief rally toward channel mid / EMA resistance

- Followed by continuation lower, targeting the next liquidity pocket

The highlighted horizontal zone around 74,500–75,000 is not strong demand, it is a reaction zone, already tested and partially consumed. Once price revisits this area again, the probability favors acceptance below, opening the door toward the next major liquidity magnet near 71,900.

Trend & Momentum Context:

Trend bias: Bearish (lower timeframe)

Market behavior: Controlled distribution, not capitulation

No structural sign of accumulation (no base, no absorption, no higher low)

Macro & Liquidity Logic:

Risk assets are currently repricing under tighter financial conditions and reduced speculative appetite. Until Bitcoin reclaims the upper boundary of the descending channel with acceptance, any bounce should be treated as sell-side liquidity, not trend reversal.

Key Takeaway:

This is not a dip to buy blindly. As long as Bitcoin remains inside this descending channel, rallies are reactions, and continuation risk points lower. The market is leaking liquidity patiently, structurally, and without panic.

Support and Resistance in relation to SMCIn this video I go through a bit of my analysis as it pertains to the concepts of Support and Resistance, and how I use those ideologies to further add confluence to my bias, narrative, and trade setups.

This is in no way a p*ssing contest. Any combination of factors can create a positive edge, especially when experience comes into play. However, I prefer to actually understand what price is doing rather than rely on patterns alone.

- R2F Trading

ISM PMI Comes Into Expansion: FAKE-OUT !?it appears crypto is getting overly optimistic as the ISM Manufacturing PMI ended 26 months of contraction with the January 2026 reading of 52.6

note the ISM gave a similar reading in January 2025 when it came in at 50.9 and then went straight down.

also happened with March 2024 when it came in at 50.3

note CRYPTOCAP:BTC had a dramatic drop the following months in 2024 and 2025 when the ISM subsequently came in lower.

in order for to confirm the business cycle is actually picking up, we need several prints well above 50, otherwise this is just a fake-out like prior times we've seen this.

Bearish continuation?Bitcoin (BTC/USD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 83,564.08

1st Support: 75,639.09

1st Resistance: 86,951.84

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bitcoin ... What nextWhat the chart is showing:

Clear lower highs and lower lows, bearish market structure intact

Price rejected hard from the prior range high and supply zone

Breakdown from a rising trendline confirms structure failure

Volume expanded on the sell-off, pointing to distribution rather than a fake move

Momentum remains weak and capped, with no sustained bullish follow-through

Key takeaways:

This looks like a range breakdown, not a healthy pullback

Until price can reclaim and hold above prior structure, rallies are sell-side reactions

Current area is a decision zone, either short-term relief or continuation lower

Bias: Cautious to bearish until structure flips

Plan: Patience. Let the market show acceptance or rejection before committing.

Not prediction, just reading structure.

IS BITCOIN ABOUT TO CREATE A MASSIVE PUMP!?? (or dump first?) Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Bitcoin at High-Probability Reversal Zone – Long Setup in PlayAs I expected in the previous idea , Bitcoin( BINANCE:BTCUSDT ) started declining and reached its full target.

Right now, Bitcoin has entered the heavy support zone($78,260-$70,080). Generally, strong support and resistance zones don’t break with just one attempt. On a daily timeframe, this is the second attack, but on the 4-hour timeframe, this is the first. We can expect a corrective move upward before Bitcoin attempts another attack on this key zone.

From an Elliott Wave perspective, it appears that Bitcoin is completing wave 5.

Also, we can see a positive Regular Divergence (RD+) between two consecutive valleys.

I expect Bitcoin to start rising from the Potential Reversal Zone(PRZ) and Cumulative Long Liquidation Leverage ($75,000-$74,000) and fill the CME Gap($84,560-$--,---) that will be formed once financial markets open.

Note: If tensions escalate operationally in the Middle East, we could suddenly see Bitcoin sharply decline and lose its heavy support zone($78,260-$70,080).

What do you think—can Bitcoin drop below $70,000, or is this a good buying area?

Target: $78,614

Stop Loss(SL): $71,117

Cumulative Short Liquidation Leverage: $80,000-$79,260

Cumulative Short Liquidation Leverage: $86,170-$84,760

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BTC Dominance: crucial resistance ahead? key levels to monitorBTC Dominance. Tired of watching your alts bleed while BTC soaks up all the liquidity? According to market sources, fresh spot inflows and a bit of risk-off mood just pushed dominance back to the big psychological 60 zone, right into a thick resistance band that has been capping price for weeks.

On the 4H chart we’re sitting under a heavy red supply at 60-60.5 with a bunch of long upper wicks - clear sign of aggressive sellers. RSI is making a lower high while price retests the top, classic bearish divergence, and there’s a fat volume shelf below 59 that often drags price back. So I’m leaning toward a short-term drop in dominance, which usually means some breathing room for alts.

✅ Base case: rejection from 60-60.5 and a move back toward 59, then 58-57 if rotation into alts really kicks in. ⚠️ If dominance closes and holds above 60.5 with strong momentum, I scrap the alt-bounce idea and look for 61+ and more pain for laggards. I don’t trade BTC.D directly, but I’m slowly tilting from BTC into stronger alts here - I might be wrong, but that’s the hill I’m willing to stand on.

Bitcoin | BTC | Healthy Pullback Before Another Pump?So much negativity about this Bitcoin pullback makes the contrarian in me says this is purely a healthy pullback to its current historical mean (see band /lines on chart). I suspect a bounce between $79,800 and $89,720 to potentially match previous highs or form new ones. If not, and the price falls massively through this area... watch out for a wild ride across the markets...

SOLUSDT – Long-Term Accumulation Setup (Not Momentum-Based)Solana (SOL) is approaching a major support zone around $95–$100, potentially setting up for a long-term accumulation opportunity. If broader crypto adoption continues and SOL eventually reclaims and breaks its previous All-Time High (ATH), this level could prove to be a high-conviction entry for patient investors.

🔸 This is NOT a momentum play.

🔸 We're scaling in slowly to manage risk and exposure.

🔸 Idea is to build position during consolidation and fear, not chase breakouts.

🧾 Trade Setup

Entry Zone: $95 – $100

Take Profit 1: $160 – $170

Take Profit 2: $260 – $280

Stop Loss: $77 (below structural support)