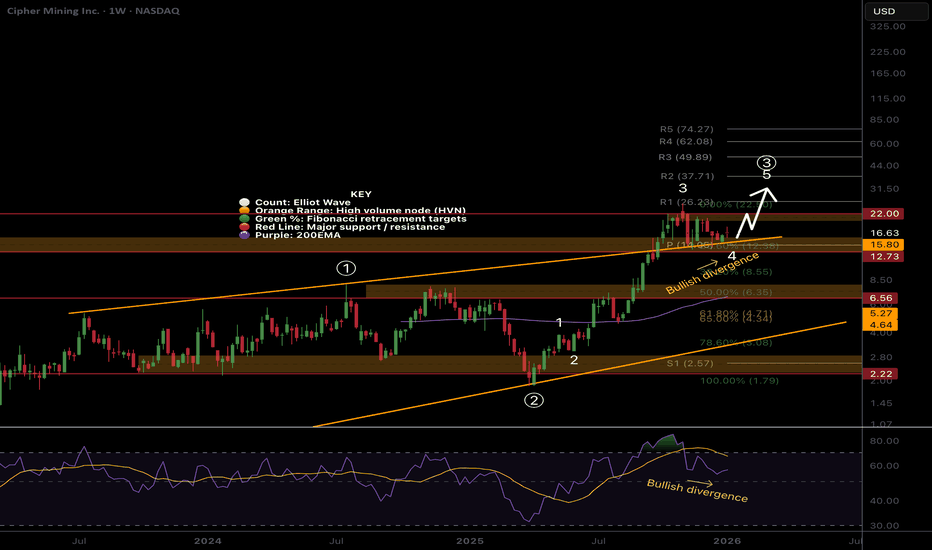

CIFR Macro analysis | The bigger picture | Long-term holdersNASDAQ:CIFR

🎯 CIFR remains in a wave (4) of 3 range, near the all-time high. Wave 4s are expected to be drawn out, often being a triangle or flat correction, where most traders give their money back to the market due to whipsaw and fakeouts.

📈 Weekly RSI has printed bullish divergence above the EQ, but with no strong reaction yet. This can take months to play out sometimes. Falling below the orange trend line will negate this divergence.

👉 Analysis is invalidated if price falls below the 0.5 Fibonacci retracement at $6.35

Safe trading

Btc-e

BTDR Macro analysis | The bigger picture | Long-term holdersNASDAQ:BTDR

🎯 After a 500%+ rally to all-time high, BTDR gave back most of its gain in a single week, alongside Bitcoin, undoing all that hard work. Price is currently finding support just above the weekly 200EMA and low-cap golden pocket, 0.786 Fibonacci retracement. The macro structure is still bullish with a series of higher highs and higher lows. Wave C of (C) appears to be underway with a target of the R3 pivot at $44 once momentum to Bitcoin and AI returns. The weekly pivot is the next resistance, $15.

📈 Weekly RSI is below the EQ with plenty of room to fall until oversold, though historically it never quite reaches this low.

👉 Analysis is invalidated if price falls below wave (B), $6, and the structure will start to look bearish.

Safe trading

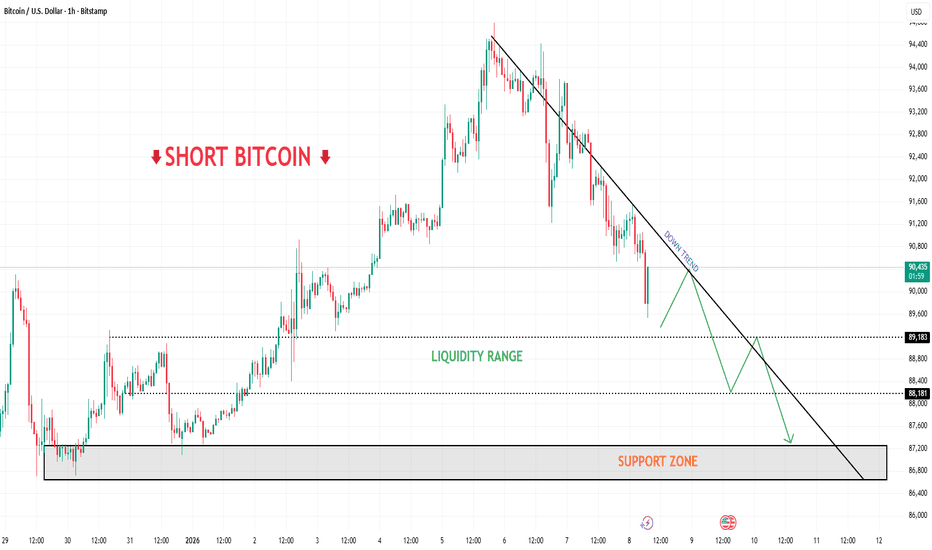

BITCOIN (BTC) - WEEKEND RANGE WRESTLINGTrade Analysis

📅 Jan 10, 2026 | 09:56 CET

💰 Price: $90,436

📉 Weekend vibes: low volume, lower patience

⸻

A) MARKET SUMMARY — “Nothing Happens, But It Happens Slowly”

🌍 Macro & Cycle Context

• Post-2024 halving, mid-cycle digestion phase 🍽️

• Long-term structure still bullish (95% supply mined), short-term reality = range prison

• $90k–$95k box refuses to die

• NFP came in weak (~50k) → dovish-ish, but…

• ETFs said “nah” → -$1.1B outflows

• Tariff ruling delayed = macro fog still thick

👉 Translation: Good story, bad timing.

⸻

📉 Volatility & Regime (a.k.a. Weekend Chop Simulator)

• Range: $90.3k–$90.7k (~0.5%)

• Liquidity: Thin like instant noodles

• Volume: Weekend special (~$20–30B)

• Regime: CONSOLIDATION

BTC is basically buffering ⏳

⚠️ Thin liquidity = moves can be fake and rude

⸻

🗓️ Risk Calendar

• Weekend: No catalysts, only boredom

• Upcoming:

• Fed Jan 29

• Tariff ruling TBD (market hates TBDs)

• Risk Level: 🟡 MEDIUM

Low volume + unresolved macro = surprise candles possible

⸻

B) STRUCTURE — “STUCK, BUT NOT BROKEN”

🧱 HTF (Swing Context)

• Trend: Bullish, but tired

• Support:

• $90,000 (psychological boss level)

• $89,600 (recent low)

• Resistance:

• $91,000 (local buzzkill)

• $94k–$95k (range ceiling of doom)

• Bias: Neutral → Lower range acceptance

⸻

🔬 LTF (Intraday Context)

• 1H: Flat EMA, zero momentum

• Support: $90,280

• Resistance: $90,746

• Bias: Neutral / Chop

👉 If you’re scalping this, you either love pain or spreads.

⸻

💧 Liquidity Check

• Shorts: $89.6k–$90k (juicy downside magnet)

• Longs: $91.5k–$92k (above, but not invited yet)

• Funding: Neutral (no one confident)

• OI: Low (weekend nap mode)

⸻

C) TRADE AVAILABILITY

• Intraday: ❌ NO EDGE

• Swing: ⚠️ YES — Short-biased

Why?

Weekend chop = no intraday structure

Lower range acceptance + ETF outflows = downside favored if support cracks

⸻

D) INTRADAY TRADE

🚫 NO TRADE

Low volume + flat structure = donation environment

Capital preservation > boredom trades

⸻

E) SWING TRADE SETUP — “Fade the Range Until Proven Wrong”

📉 Direction: SHORT

• Entry: $90,400–$90,600 (range rejection)

• Stop-Loss: $91,200 (above range high = idea invalid)

• Targets:

• 🎯 TP1: $89,800 (1R)

• 🎯 TP2: $89,200 (2R)

• 🎯 TP3: $88,500 (3R, liquidity sweep territory)

⏳ Holding: 3–7 days

⚠️ Risks:

• Tariff ruling surprise → face-ripper rally

• ETF inflows randomly turn back on

⸻

F) TRADE LOGIC — “Why This Isn’t Random”

• Macro: Dovish NFP ≠ bullish follow-through due to ETF bleeding

• Structure: Lower range test; failure likely targets $89k liquidity

• Derivatives: Neutral funding + low OI → shorts not overcrowded

• Order Book: Watching $90k for absorption vs breakdown

• Flows: ETFs still exiting → institutions on pause, not buying dips

⸻

G) INVALIDATION — “How This Trade Dies”

❌ Trade is invalid if:

• Price: BTC > $91,200 (range reclaim)

• Time: Still stuck by EOD Jan 13 (pre-Fed noise)

• Macro: Tariff ruling bullish + ETF inflows resume

• Order Book: $90k absorbs aggressively and refuses to break

⸻

🧠 TL;DR — THE TRADER VERSION

• BTC is not bullish, not bearish — just annoying

• Weekend chop = no intraday plays

• Swing short valid only if $90k starts slipping

• Until then: patience, alerts, coffee ☕

BTC short term (4H) bearish Jan 10 BTC/USD 4H Binance chart (Jan 2026):

Price ~$90,529, flat (-0.03%).

SuperTrend bearish (sell), price below it.

EMA 15 crossed below 50 (bearish).

SAR buy signal.

Stoch RSI 71 (nearing overbought).

MACD bearish, histogram negative and widening.

Overall: short-term bearish momentum, consolidation near $90k support/resistance zone.

Bitcoin Update. Bitcoin Update.

Bitcoin is reacting to a strong supply zone, resulting in a short-term rejection. Despite this, the price remains above the ascending support trendline, maintaining the bullish structure.

A bounce off the trendline could initiate a new upward move. However, a clean breakout with confirmation from the current pattern would be the key signal for a strong continuation of the bullish trend in the market.

⚠️ Until then, expect consolidation with volatility—patience and confirmation are crucial.

Bitcoin Trapped Between Supply and Demand — Range Resolution Bitcoin (BTCUSD) on the H1 timeframe is currently trading inside a clearly defined range structure, following the previous impulsive rally and subsequent corrective decline. The market has transitioned from trending conditions into balance, with price oscillating between strong resistance and support zones.

On the upside, BTC continues to face heavy supply around the 91,600–92,000 resistance zone. Multiple rejection wicks and failed attempts to reclaim this area confirm that sellers are actively defending this level, preventing bullish continuation for now.

On the downside, price is repeatedly finding bids near the 89,200–89,600 support zone, which aligns with prior demand and acts as a liquidity buffer. This zone has absorbed selling pressure several times, keeping the market from breaking down impulsively.

Currently, price is trading near the mid-range around 90,700–90,900, close to the EMA 50. This is a high-risk area for entries, as price can rotate aggressively toward either boundary of the range without warning.

Bearish scenario: Rejection from the 91,200–91,600 resistance zone, followed by continuation lower, opens downside targets toward 89,200, with extension risk toward 88,400–87,600 if support fails.

Bullish scenario: A clean break and acceptance above 92,000, followed by a successful pullback, would invalidate the range and open upside toward 93,900–94,500.

For now, Bitcoin remains in range-trading conditions. Patience is essential — the highest-probability opportunities will come from confirmed breakouts or breakdowns, not from trading the middle of the range.

Bitcoin Hits High-Timeframe Demand — Bounce or Breakdown?Price is reacting from a well-defined high-timeframe demand zone around 89,400–89,700, where sell-side momentum has slowed after a sharp bearish impulse. This area is a key liquidity pool that previously fueled strong upside expansion.

A bullish reaction from this demand zone could trigger a corrective recovery toward 90,800–91,600, with further upside extension possible toward 92,300 and 93,200 if buyers regain control.

However, a decisive break and close below 89,400 would invalidate the demand, exposing deeper downside toward 88,800–88,400. Price behavior at this zone will be critical in determining whether this move is accumulation or the start of a larger bearish continuation.

Bitcoin Breakdown Confirmed — Liquidity Below Is CallingPrice is firmly respecting the descending trendline, confirming a clear bearish market structure after the breakdown from the prior high. Selling pressure remains dominant, with each recovery failing to reclaim structure.

A corrective pullback toward the 90,400–90,600 area may occur, but this zone is expected to act as sell-side resistance as long as price remains below the downtrend line.

Failure to reclaim the trendline keeps the bearish bias intact, opening the path toward the liquidity range at 89,200–88,200. A decisive break below this range would expose the major support zone around 87,000–86,800, where a stronger reaction may finally emerge. Only a strong close above the trendline would invalidate the short-term bearish scenario.

Bitcoin Is Building a Base — Accumulation Before the Next PushPrice is consolidating above the key support zone around 89,800–90,000, showing clear signs of selling pressure absorption after the recent sell-off. Volume behavior suggests potential accumulation rather than aggressive distribution.

As long as price holds above 89,800, the bullish scenario remains favored. A clean break and acceptance above 91,200–91,500 would confirm upside momentum, opening the path toward 93,000, followed by the major target near 94,700–95,000.

Only a decisive breakdown below 89,800 would invalidate the bullish setup. For now, buyers appear to be positioning for the next expansion leg to the upside.

A Familiar Scenario — Downtrend Remains the Dominant BiasBitcoin is now firmly trading in a clear downtrend, which is the main narrative on the H1 timeframe. After failing to hold above the prior highs, price has transitioned from a bullish expansion into a sequence of lower highs and lower lows, confirming that sellers have taken control of market structure.

Recent price action shows repeated rejection from former support levels, which are now acting as resistance. Each recovery attempt is corrective and short-lived, reinforcing the idea that the broader bias remains bearish rather than range-bound or bullish.

The structure clearly favors continuation to the downside. Pullbacks lack momentum, while bearish legs are impulsive and decisive a classic sign of trend strength. Price is currently consolidating below a key resistance area, suggesting distribution before continuation, not accumulation.

The highlighted range between $80,000 – $91,000 reflects temporary consolidation within a downtrend, not a stable trading range. As long as price remains capped below the upper boundary, downside pressure is expected to persist.

Resistance:

91,000 – 91,500 (key structural resistance)

94,800 (major trend invalidation level)

Support:

87,500 – 88,000 (next downside target)

Below this zone opens room for further bearish extension

➡️ Primary Scenario (Downtrend Continuation):

Price remains below the 91k resistance and continues to form lower highs. A breakdown from the current consolidation would likely trigger the next bearish leg, extending toward the 87.5k area and potentially lower.

⚠️ Risk Scenario:

Only a strong bullish breakout and acceptance back above 91.5k would invalidate the downtrend narrative. Until that happens, upside moves should be treated as corrective rallies within a bearish trend.

Bitcoin Is Holding Demand — Bulls May Be Setting Up the Next Price is reacting positively from a well-defined demand zone around 89,700–90,000, where selling pressure has been absorbed after the recent pullback. Despite the prior correction, the broader structure remains constructive as buyers defend this key area.

A sustained hold above the demand zone opens the door for a bullish recovery toward 91,400–92,300, where price may pause near the EMA and prior intraday resistance.

If bullish momentum strengthens and price breaks and closes above 92,300, the upside continuation scenario comes into play, targeting 93,200–93,700 as the next expansion zone. As long as price holds above 89,700, the upside scenario remains the primary focus.

Bitcoin Breaks Structure — Is a Deeper Correction Unfolding?Bitcoin (BTCUSD) on H1 has shifted from a strong bullish trend into a clear corrective phase. After failing to hold above the 94,000–94,500 resistance zone, price reversed sharply, breaking below key moving averages and confirming that upside momentum has faded.

The market is now respecting a descending trendline, with lower highs forming — a classic sign that sellers have taken short-term control. Price is currently trading below both the fast and slow moving averages, reinforcing the bearish bias.

At present, BTC is approaching a key support zone around 89,200–89,600, which previously acted as a demand base during the prior rally. This area is critical: it may trigger a short-term bounce, but a clean break below would confirm a deeper structural correction.

Bearish scenario: As long as price remains below the descending trendline and fails to reclaim 90,400, continuation toward the 89,200 support zone is likely. A confirmed breakdown would open further downside toward 87,100–86,800.

Bullish scenario: A short-term relief bounce may occur from the support zone. However, only a strong reclaim above 91,200 and acceptance back above the moving averages would invalidate the bearish setup and suggest a trend reset.

For now, Bitcoin is in sell-the-rally mode. Patience and discipline are essential — the highest-probability opportunities will come from trendline rejections or confirmed support breaks, not from chasing volatile bounces.

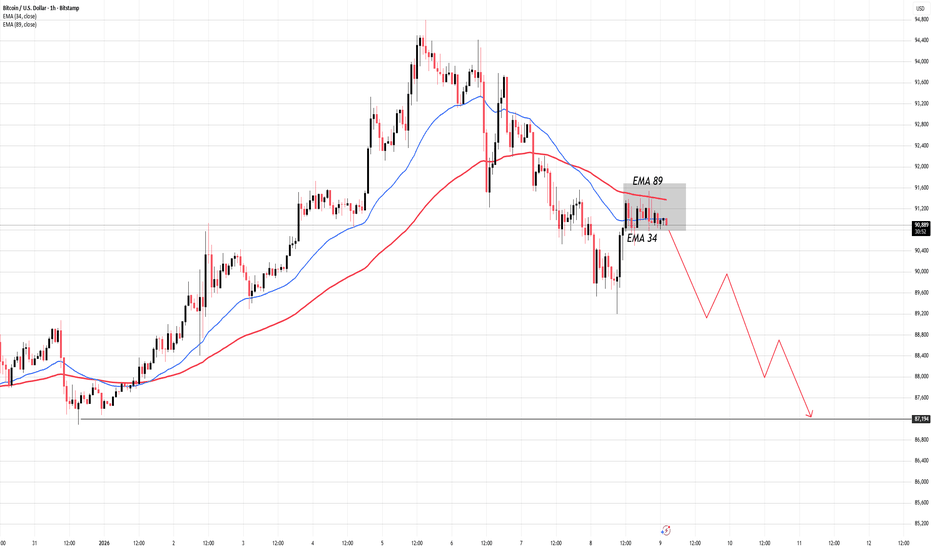

EMA Rejection in Play — Is BTC Setting Up for the Next Bearish Market Context & Structure

Bitcoin is currently trading in a clear bearish market structure on the H1 timeframe. After completing a bullish expansion, price has transitioned into a sustained downtrend, marked by a sequence of lower highs and lower lows. The recent recovery attempts are corrective in nature and have failed to reclaim prior structural levels.

At this stage, price is not showing signs of accumulation. Instead, it is consolidating below key dynamic resistance, indicating that sellers remain in control.

EMA Behavior & Price Action

Price is now reacting directly into the EMA resistance cluster, with EMA 34 acting as short-term resistance and EMA 89 as the higher dynamic ceiling. This EMA alignment is bearish:

- EMA 34 is below EMA 89

- Both EMAs are sloping downward

- Price is trading below both averages

This configuration typically supports a sell-the-rally framework, not a dip-buying environment. The current consolidation near EMA 34 reflects weak bullish momentum, often seen before continuation to the downside rather than a trend reversal.

Repeated failures to close above EMA 34, combined with rejection wicks near EMA 89, strongly suggest that buyers lack strength and that upside moves are being absorbed.

Key Levels

Dynamic Resistance:

- EMA 34 ~ 90,900

- EMA 89 ~ 91,300 (major dynamic resistance zone)

Static Support:

- 89,200 (minor reaction level)

- 87,200 – 87,400 (major downside support / liquidity target)

➡️ Primary Scenario (Bearish Continuation):

Price fails to break and accept above EMA 34–EMA 89 resistance. A rejection from this EMA zone would confirm continuation of the bearish structure, opening the path toward the 89.2k level first, followed by a deeper move into the 87.2k support zone.

This scenario aligns with classic EMA pullback continuation behavior in a downtrend.

⚠️ Risk Scenario:

If price manages a strong bullish close above EMA 89 with follow-through and acceptance, the bearish continuation thesis would be invalidated. In that case, BTC could transition into a broader consolidation or corrective recovery rather than immediate downside continuation.

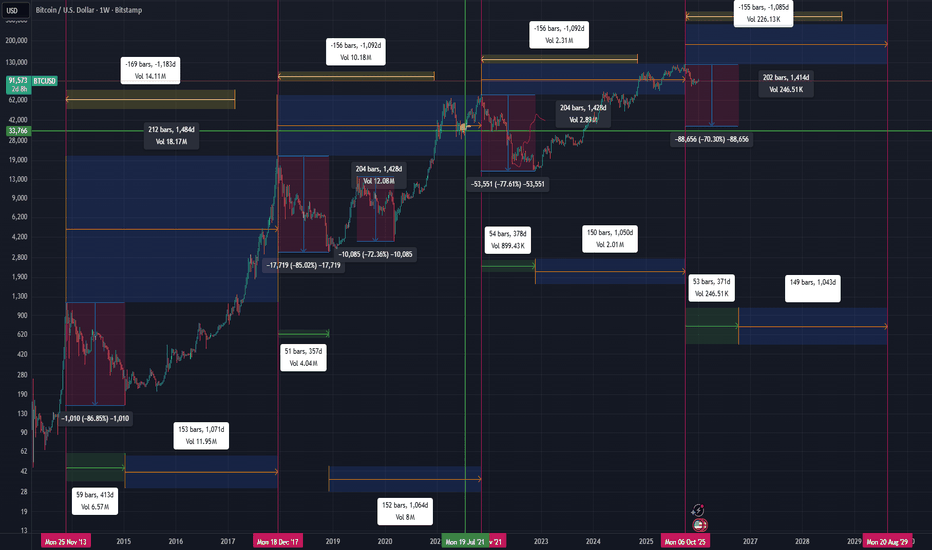

Bitcoin Top Is In — 35 Months Symmetry, Final Bottom TargetThey won't believe me even If I told them...

I’m going to state this plainly and accept that most people will dismiss it.

Bitcoin has already printed its cycle top.

Not because of vibes, not because of fear — but because the cycle math is complete.

The Core Thesis (Simple, Replicable, Unemotional)

The previous bear market bottom → bull market top duration this cycle is 35 months

That is identical to the last cycle

When cycles rhyme this precisely, it is not coincidence — it is structure

The market has already done what it historically does.

Time is the tell. Not price.

What Comes Next (The Downtrend Phase)

From here, Bitcoin enters its true bear market descent, not a “healthy pullback.”

My expectations:

Continued downside into Q4

Final capitulation window:

October (12 months) from the top

or December (14 months) from the top

I am specifically watching October 16th–26th as the most likely window for Bitcoin’s actual bottom.

That is where fear, disbelief, and exhaustion peak — not where hope lives.

Price Targets (No Sugarcoating)

$44k–$48k is a realistic and structurally sound bottom zone

Some argue Bitcoin will not break below $66k due to:

U.S. presidential election cycle effects

perceived structural support

That outcome is possible.

But my base case remains:

A deeper flush that convinces the majority that “Bitcoin is broken again.”

That is how every real bottom forms.

What Happens After the Bottom

Once the October/December bottom is in:

Bitcoin begins a parabolic recovery

Followed by exponential growth through 2027

New all-time highs projected:

Late 2027

or Early 2028

This is not bearish long-term.

This is cycle realism.

The Hard Truth (Why This Will Be Ignored)

Even if this thesis is 80–90% correct, most people will reject it.

Not because it’s wrong — but because:

Humans distrust information that comes too cleanly

They assume there must be a gimmick

They believe “nothing in life is free”

They fear being fooled more than they desire being early

I could give tomorrow’s winning lottery numbers to millions of people —

and I doubt most would even try to run them.

They’d ask:

“How could you possibly know that?”

And then do nothing.

That is human nature.

Final Note

This post is not asking for belief.

It’s documenting a cycle call — ahead of time.

If this plays out, it won’t feel impressive in hindsight.

It will feel obvious.

That’s how markets work.

Not financial advice. Just a timestamped thesis.

Update on my previous analysis (published on Feb 23, 2023):

As of now, Bitcoin appears to have formed a cycle top at the end of the projected period from my previous post.

Based on the same cyclical structure and historical behavior, I believe a new corrective / bearish cycle is starting.

My expectation is that this declining cycle will continue, and the next major cycle top could form roughly 1,400 days from here.

This analysis is based on long-term cycle timing and structural repetition rather than short-term price action.

Not financial advice. Just my personal market view.

Bitcoin Roadmap — Short-Term Bounce Before ContinuationAs I expected in the previous idea , Bitcoin ( BINANCE:BTCUSDT ) started to decline from the upper line of the ascending channel and reached its targets (full target).

Bitcoin is currently near the support zone($90,960-$89,220) around the lower line of the ascending channel and the Cumulative Long Liquidation Leverage($89,125-$88,670).

From an Elliott Wave perspective, it appears that Bitcoin has completed a zigzag corrective pattern at the top of the ascending channel, and we should now expect a corrective wave. However, this corrective wave might still include a temporary upward movement.

Considering the increasing tensions in global affairs, especially between Russia and the U.S. in recent hours, and the conditions of the S&P 500 index ( FX:SPX500 ), we can still expect a bearish trend for Bitcoin.

I expect that after a short-term bullish movement in the coming hours, Bitcoin will once again begin to decline. This decline could involve breaking the lower line of the ascending channel, the support zone, and filling the CME gap($88,720-$88,120).

We can first look for a long position, and if we find a trigger, we can take a short position.

What do you think about Bitcoin in the short term? I’d love to hear your thoughts!

Cumulative Long Liquidation Leverage: $87,125-$86,000

Cumulative Short Liquidation Leverage: $92,620-$92,040

Cumulative Short Liquidation Leverage: $94,630-$93,920

Cumulative Short Liquidation Leverage: $98,480-$96,970

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BTCUSDT.P - January 9, 2026Bitcoin remains capped below resistance at 91,000–91,300, keeping the short-term structure bearish while price trades beneath this key level. A short entry is favored on retracements into 90,900–91,100, with profit targets near 87,600–87,800 at the next major support. A stop-loss should be placed above 92,500–92,700, as a break above this zone would invalidate the downside bias.

$SOL 1D update: Things are looking up SOL is still in the process of breaking out of the broader downtrend, even though the move hasn’t been clean or impulsive yet.

After spending months respecting the descending channel, price has now pushed out of the lower boundary and is holding above the $125 area, which was previously acting as key support inside the downtrend. That’s an important structural shift. Instead of making fresh lower lows, SOL is now forming higher lows and building above former demand.

The recent push toward the $135–140 area shows buyers are willing to step in earlier, rather than waiting for a full return to the lower channel. While price is still below major resistance near $160–180, the character has changed from trend continuation to basing and early breakout behavior.

This doesn’t mean SOL is in a confirmed uptrend yet. Breakouts from long downtrends are often messy, with overlap, pullbacks, and false starts. What matters is that downside follow-through has stalled and price is no longer accelerating lower.

As long as SOL continues to hold above the $125 level and avoids slipping back into the channel, the bias remains that this is an early trend transition rather than just another dead cat bounce. The next key test will be whether this breakout can hold on retests and eventually reclaim higher resistance, but structurally, SOL is still breaking out of the downtrend.

WULF Short-term analysis | Trading and expectationsNASDAQ:WULF

🎯 The triangle analysis appears to be playing out, currently printing wave d. Price lost the daily pivot but remains well above the daily 200EMA. Wave V target is the R2 pivot at $18.74. Triangles are a penultimate pattern.

📈 Daily RSI sits at the EQ

👉 Analysis is invalidated if price falls below wave a, $10.40

Safe trading

RIOT Short-term analysis | Trading and expectationsNASDAQ:RIOT

🎯 Price appears to have completed wave II of 3, reclaiming the daily 200EMA, but still has to overcome the daily pivot, its current resistance.

📈 Daily RSI hit oversold with bullish divergence

👉 Continued downside has a target of the High Volume Node, $10

Safe trading

MSTR Short-term analysis | Trading and expectationsNASDAQ:MSTR

🎯 Price dropped hard wave Y of 4, invalidating the previous analysis. Wave Y can complete any time in this flat correction pattern, but is approaching the 0.382 Fibonacci retracement, a high probability bottom.

📈 Daily RSI went deep into oversold on bullish divergence

👉 Continued downside has a target of the S1 pivot, $136

Safe trading

MARA Short-term analysis | Trading and expectationsNASDAQ:MARA

🎯 Previous downside target was hit, $8. Price dropped hard, changing the Elliott wave count completely, stopping at the golden pocket. Wave (Z) of B appears complete, but we need to see a structure change to add confirmation.

📈 Daily RSI went deep into oversold and has no printed bullish divergence

👉 Continued downside has a target of the High Volume Node bottom, $7

Safe trading

IREN Short-term analysis | Trading and expectationsNASDAQ:IREN

🎯 Iren wave 4 hit the daily 200EMA, just above 0.382 Fibonacci retracement. Price is at High Volume Node resistance, but above the daily pivot and 200EMA, showing the uptrend is intact. Continued downside has a target of the daily 200EMA, $26.75

📈 Daily RSI has not reached oversold

👉 Analysis is invalidated only at all time high for now

Safe trading