BTC/USDT — Weekly Outlook✔️ Another test of the triangle’s upper boundary this week, with the candle closing with a small body. Uncertainty remains.

🟢 Growing reasons for a rate cut.

🟢 Hidden QE continues.

🟠 Record crypto ETF inflows have been fully sold. ETF flows are driven by retail money — buy high, sell low.

🟠 It’s still unclear whether this is a bullish triangle or a bearish pennant.

🟠 Market sentiment remains fearful.

🟠 Gold is historically overbought . A correction looks inevitable, and liquidity may rotate into crypto.

🔴 Negative cumulative delta: –$181M.

🔴 The downtrend has not been broken yet.

🔴 Strong resistance at 95k continues to cap price.

🧠 Crypto is currently out of focus — minimal media attention.

But the less attention an asset gets, the more unexpected the rally tends to be,

and the later the crowd jumps on the rocket.

Btc-e

BITCOIN drops by more than -60% when this signal flashes.Bitcoin (BTCUSD) has closed the last 2M candle on a MACD Bearish Cross. Every time this has happened historically (2 times), Bitcoin has dropped by -67.66% and -68.75% from he top of that candle.

If history is repeated, a new -67.66% would deliver $36500 as the bottom of the current Bear Cycle. This time though, that would be below the MA50 (blue trend-line), so a range of 44500 - 36500 might be more appropriate.

In any case, this latest Bearish Cross comes as another confirmation of a 2026 Bear Cycle.

So are you expecting BTC to fall more than -60% from here? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin — Bearish Bias Intact as Price Pressures Interim SupportAs explained in my previous analyses, my medium-term bias on Bitcoin remains bearish, with 75k as the minimum zone I expect to be reached before any meaningful and sustainable bullish reversal can take place.

Looking at the chart:

- After the drop to November lows toward 80k, BTC once again entered a consolidation phase

- This range has been capped by a clear resistance zone around 95k

- Following the latest rejection from that resistance, price rolled over and is now trading just above the interim support area at 89,500–90,000

This puts the market at an important decision point.

⚖️ Two Medium-Term Bearish Scenarios

At this stage, I am working with two possible paths, both ultimately pointing toward the same downside objective.

1️⃣ Support Holds — Final Push Before Deeper Drop

- Bulls manage to defend the 89.5k–90k support

- A corrective rebound follows

- Price could even push above 100k

- This move would, in my view, represent a final distribution phase

➡️ followed by a broader decline toward the 75k target zone

2️⃣ Support Breaks — Direct Continuation Lower

A clean break below the interim support

This would significantly increase the probability of

➡️ a direct move lower toward 75k, without another major upside attempt

📌 Bottom Line

Until price proves otherwise, I remain bearish on BTC.

The market is currently sitting at a level where structure, not opinion, will decide the next move. Whichever scenario plays out, risk management and patience remain key. 🚀

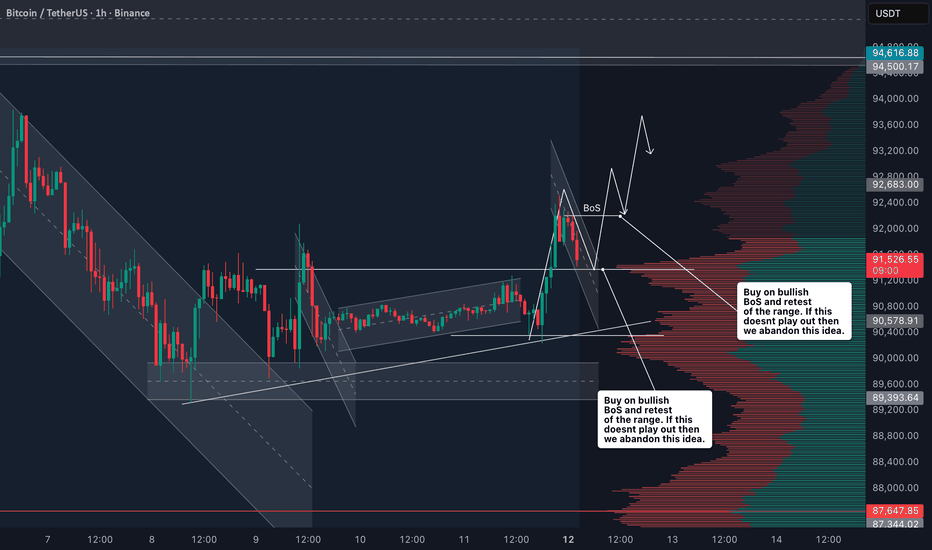

$BTC - 1/12 Market Outlook Bitcoin got rejected at 92.5k once again. Yes, price is still holding the 89k support, but it tapped the top of the range without a clean breakout and slipped back down, which tells me the move up wasn’t very strong or convincing.

The weekend move was spot-led but relatively in low volume. Orderbooks were thin on both sides, and there wasn’t much real buy support underneath. We also saw open interest get flushed, meaning shorts were squeezed on the way up, and price has now faded back toward 90k.

Now it really comes down to whether 89k can hold into the New York session. If it doesn’t, there’s a higher chance that CRYPTOCAP:BTC will rotate back toward the yearly open around 87k, chop around a bit, and potentially slide lower into the 84–82k area.

12/01/26 Weekly OutlookLast weeks high: $94,802.73

Last weeks low: $89,312.98

Midpoint: $92,057.85

The first trading week of 2026 continued the same patterns as the end of 2025. With $94,000 still very much the key level that the bears are defending, and defending well. However, the 4H 200 EMA has been reclaimed by the bulls with consistent support bounces when tested indicating a level of strength.

For this week that is what I think is most important for BTC, the bulls are building a base to attempt a rally through $94,000 resistance, should this level be breached with volume $100,000 big even level is the target.

The bears will continue their defense of $94,000 with the objective of pushing price back below the 4H 200 EMA (currently $90,400).

CPI takes place tomorrow and so an increased level of volatility should be expected, especially if the result is different to the 2.7% forecast.

Altcoins have seen a steady rally relative to BTC & ETH, also flipping the 4H 200 EMA with an eye to retest the 1D 200 EMA resistance. If altcoins were to get back above the 1D with acceptance the market would look a lot healthier.

Bitcoin at a Long-Term Inflection Point — Hold the Base or RESETBTCUSD 1W – Long Term Market Analysis

1. Current Market Structure (Macro View)

On the weekly timeframe, Bitcoin remains in a macro bullish structure, but is currently in a late-stage consolidation / distribution phase below major resistance.

After the strong impulsive rally from the 2022–2023 accumulation base, price expanded aggressively and is now digesting gains rather than reversing.

However, momentum has clearly slowed, and recent weekly candles show overlapping ranges, signaling indecision and profit-taking.

Importantly:

- The primary uptrend is still valid

- But BTC is no longer in impulsive expansion it is in a decision zone

This is where long-term trends either:

- Continue after re-accumulation, or

- Correct deeply to reset structure

2. Key Long-Term Zones & Market Positioning

Major Resistance Zone: 120,000 – 126,000

→ Previous weekly highs, strong sell pressure

→ This zone must be broken and accepted to unlock the next macro leg up

Current Distribution / Range Zone: 85,000 – 100,000

→ Price is compressing here, showing balance between buyers and sellers

Critical Macro Support: 67,000 – 69,000

→ Previous breakout level

→ Confluence with EMA 200 on weekly

→ This level defines bull vs bear control

Bearish Breakdown Support (Last Line): 49,000 – 50,000

→ Loss of this zone would signal a full macro trend reset

As long as BTC holds above 67K, the macro bullish thesis remains intact.

3. Liquidity, Volume & Smart Money Behavior

Volume has declined significantly compared to the impulsive rally phase

This confirms the market is not in expansion, but in absorption

Multiple failed pushes near resistance indicate:

- Profit distribution

- Liquidity building above highs

The key insight:

Smart money is not aggressively selling but they are not buying breakouts either

This behavior aligns with re-accumulation below resistance, not a top yet.

However, failure to hold support would trigger sell-side liquidity acceleration.

4. Long-Term Market Scenarios

🔼 Primary Scenario – Bullish Continuation (High Probability if Support Holds)

Expected macro flow:

- BTC holds above 67K

- Extended consolidation (weeks to months)

- Momentum rebuilds

- Clean weekly break and acceptance above 126K

- Next macro expansion phase begins

➡️ This scenario supports new all-time highs later in the cycle.

🔽 Secondary Scenario – Deep Correction (Still Within Bull Market)

If BTC: Loses 67K decisively on a weekly close

Then expect:

- Sharp correction toward 50K

- Long-term EMA retest

- Full reset of leverage and sentiment

This would not immediately invalidate the bull market, but it would delay the next expansion significantly.

5. Long-Term Trading & Investment Perspective

- Macro Bias: Bullish above 67K

- Investor Strategy: Accumulate fear, not euphoria

- Trader Strategy: Avoid chasing highs near resistance

- Risk Zone: Between 100K–126K without confirmation

Bitcoin is currently at a structural crossroads, not a breakout zone.

Patience is the edge here.

WHAT DO YOU THINK ABOUT BITCOIN IN 2026?

Reversal or Breakdown Will Define the Next Major MoveBitcoin is currently trading at a critical decision zone, where price action will determine whether the market stages a bullish reversal from demand or transitions into a deeper bearish continuation.

1. Market Structure Overview

- BTC has been in a short-term corrective / bearish structure, trading below the EMA 50, which continues to act as dynamic resistance.

- After the recent impulsive drop, price is now pressing directly into a well-defined demand zone around 89,600 – 90,000.

This area has previously triggered strong reactions, making it a high-probability response zone, not a place to chase entries.

2. Demand Zone Significance

The highlighted demand zone represents:

- Prior accumulation

- Strong historical buying interest

- Liquidity resting below recent lows

Current price action shows selling pressure slowing down as BTC enters this zone, which increases the probability of at least a technical bounce.

3. Two Key Scenarios to Watch

Bullish Scenario (Reversal from Demand)

If price holds above the demand zone and prints bullish confirmation (strong rejection wicks, bullish engulfing, or structure shift):

BTC could rotate back toward:

- 92,464

- 92,976

- 93,745

- Extension toward 94,416 if momentum builds

This would align with a range-to-expansion move, trapping late sellers below demand.

Bearish Scenario (Breakdown & Continuation)

A clean breakdown and acceptance below 89,233 would invalidate the reversal idea.

This would open downside liquidity targets toward:

- 88,415

- 87,269

The red arrow on the chart highlights this bearish expansion risk if demand fails.

4. EMA & Momentum Insight

EMA 50 remains overhead any upside move will need to reclaim and hold above it to shift short-term bias bullish.

Without that reclaim, rallies should still be viewed as corrective.

5. Trading Plan

❌ Avoid trading in the middle of the zone.

✅ Wait for:

Bullish confirmation at demand for longs

Or confirmed breakdown below demand for continuation shorts

Let price show its hand this is a reaction zone, not a prediction zone.

Conclusion

Bitcoin is at a make-or-break level. Demand zones like this often produce sharp reactions, but only confirmation separates reversals from traps. The next impulsive move — up or down — will likely be fast and decisive.

💬 Do you expect BTC to defend this demand zone, or is a deeper sell-off coming? Share your bias below!

BTC LOOKS WEAKMorning folks,

So, as we suggested, the pullback from 90K area has happened. At the same time, our base case position is deeper action. Even upward bounce to 95-96K resistance will be still an AB=CD pullback shape. Besides, now we're not sure that we will get it at all.

As we said last time, we still keep on the table scenario with drop back to 75-78K lows before real upside reaction could start. Aggressive US administration rhetoric about Venezuela, Cuba, Iran, Greenland etc makes investors nervous and keep demand for safe haven. This makes additional pressure on BTC.

So, currently action around 90K support looks more like upside AB-CD bounce rather than real upside reversal. In current circumstances we do not want to buy.

Monster Trade Blueprint: How To Compound BTC to All-Time HighsIs BTC Bitcoin finally ready to reclaim its All-Time High? The daily and weekly charts are signaling a massive potential trend reversal, but entering blindly is a mistake. In this video, I break down the specific confirmation I'm waiting for on the 4-hour timeframe before pulling the trigger.

In the video we look at my "Monster Trade" idea—a compounding strategy designed to maximize profits during a strong bullish run. You will discover exactly how to scale into new positions while locking in gains from previous entries, allowing you to ride the wave to the All-Time High (ATH) with reduced risk and exponential upside.

Key Takeaways:

📊 Multi-Timeframe Analysis: Breaking down the Daily vs. 4-Hour structure for precision entries.

🏦 Identifying the specific breakout level that signals institutional buying.

🚀 The Monster Trade/s Setup: How to close 50% of positions sequentially to compound gains safely.

🎯 Profit Targets: Mapping the distance from current price to the ATH level.

Accumulation Before Expansion or Breakdown Into Liquidity?Hello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure.

Bitcoin previously delivered a strong bullish impulsive move, establishing clear upside momentum and pushing price into premium territory. Following the peak, the market transitioned into a corrective phase, marked by controlled selling pressure and a gradual loss of bullish momentum rather than panic distribution.

The recent decline brought price back toward a key structural support, where selling pressure has noticeably slowed. Current price action is showing compression and stabilization, suggesting the market is deciding between continuation of the broader bullish trend or a deeper corrective leg.

Major Support / Demand Zone:

The 90,700–91,000 area is a strong support zone, where price has repeatedly reacted and volume has increased. This zone also aligns with previous consolidation and acts as a structural pivot for the broader trend.

Liquidity Range Below:

Below current price sits a liquidity-rich zone near 86,900, corresponding to the prior accumulation range. A breakdown into this area would indicate acceptance of lower prices and a shift toward a bearish continuation phase.

Overhead Resistance Levels:

If price holds support, upside targets are layered at:

- 92,200 – first structure resistance

- 93,200 – prior reaction high

- 94,400–94,800 – major liquidity and range high

These levels define the bullish roadmap if support holds.

Currently, BTC is trading directly on top of a strong support level, with price holding above the EMA and failing to extend lower despite prior sell pressure. This behavior often reflects absorption by buyers, rather than aggressive sell-side continuation.

The market is compressing, not accelerating typically a precursor to expansion.

As long as Bitcoin holds above the 90,700–91,000 support zone, the broader bullish structure remains valid. In this case, current price action can be treated as accumulation after correction, with potential for a push toward 92,200, followed by continuation into the 93,200 and 94,400+ resistance zones.

However, a decisive hourly close below support, followed by acceptance, would invalidate the bullish continuation thesis. That scenario would likely send price into the previous accumulation area near 86,900, confirming a deeper corrective or trend transition phase.

For now, support is holding but it must be respected, not anticipated.

BTCUSDT – Inverse Head & Shoulders Target in SightHi!

BTC is forming a clean inverse head & shoulders inside a rising channel. The right shoulder is holding well, and the price is pushing toward the neckline.

Structure:

Inverse H&S: bullish continuation

Supported by an ascending channel

🎯 Target:

➡️ 91,100 – 91,200 (measured move of the pattern)

As long as the price stays above the channel support, the bullish setup remains valid. A clean push through the neckline should send the price to the target area.

Bearish reversal in play?Bitcoin (BTC/USD) has rejected off the pivot and could reverse to the 1st support.

Pivot: 94,255.27

1st Support: 80,712.26

1st Resistance: 106,846.29

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

BRIEFING Week #2 / Happy New Year !Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Bitcoin: Higher Lows Lead To Higher Highs Watch Longs.After rejecting the 95K key resistance, Bitcoin is now testing the 90K area (old resistance / new support) and is poised to establish a higher low for the coming week. From here the key is to identify bullish reversal patterns in this area, and wait for them to confirm. Upon confirmation risk/reward can be assessed and a swing trade long can be justified. Now lets talk about profit objectives and anticipated price behavior.

The arrow on the chart emphasizes the higher low formation. Higher lows often lead to higher highs. Also notice price continues to consolidate ABOVE the 88K area which I have pointed out extensively as the Wave 1,4 overlap for the broader 5th Wave. It may sound complex, but what it points to is a higher probability that Bitcoin has one more large impulse wave in front of it. This implies that 126K or even higher prices like the 133K area are within range over the next quarter. This is NOT a certainty, but I use this as a road map to shape my own expectations.

Risk can be defined by the 88K level. If price breaks below it again, a retrace into the mid to low 80Ks becomes the expectation. And from there waiting to see if bullish reversal patterns appear. Price NEEDS to stay below 88K for an extensive period, like at least a week or more to strengthen the argument that the current structure is NOT an impulse and that a test of high (126K) is less likely.

For entries, you can use candle break outs. For example, waiting for a break of a daily high and strong close. The reasonable place for a stop would be the breakout candle low, etc. You can also look for breakout patterns on smaller time frames like 4H ect. How you mange this is really up to your personal preferences and style. The point is, this is a situation where it makes sense to specifically look for breakouts rather than pullbacks into support since the broader structure is coming off of a support level.

The main thing is not to lose sight of the fundamental and technical conflict at the moment. Price has retraced in the face of fundamental strength. There are countless events, actions and developments coming from the macro and institutional side along with an easing monetary policy environment. These factors increase the chances of a bullish outcome EVEN if price probes lower in the shorter time horizon. Keep in mind, markets are highly irrational and react to short term perceptions even while the longer term fundamentals and price structure have yet to change. The bigger picture carries more weight, and serves as an optimal guide for expectations.

Thank you for considering my analysis and perspective.

$ETH 1W: Zoomed out thoughts On the weekly, ETH still looks structurally constructive, but it’s very clearly in range rather than trend right now.

Price is sitting back in the middle of a large multi-year range, roughly bounded by the ~$2,000 area on the downside and ~$4,700 on the upside. The recent pullback from the highs did not break the broader structure, but it also failed to establish acceptance above resistance, which is why ETH has slipped back into chop.

The $3,000–3,100 region is acting as an important short-term pivot. Holding above this area keeps ETH neutral-to-bullish from a higher timeframe perspective. A loss of this level would likely open a deeper retrace toward $2,700 and potentially the $2,000–2,100 region, which remains the most important higher timeframe demand zone on the chart.

What’s constructive is that the prior low near $2,000 was aggressively bought and led to a strong impulse toward the top of the range. That tells me higher timeframe buyers are still active. What’s missing right now is follow-through and expansion above resistance. Until ETH can reclaim and hold above $3,500–3,600, upside moves are still best viewed as range rotations rather than trend continuation.

The projected path on the chart highlights what usually happens in these environments: chop, higher lows, and frustration before a real expansion. If ETH can continue to base above $3,000 and eventually reclaim $3,500, the odds shift toward a push back to the $4,700 range high. If not, more time and rotation inside the range should be expected.

In short, ETH looks healthy but unresolved. This is not a breakout market yet, and it’s not a breakdown either. It’s a classic higher timeframe range where buying dips has historically worked better than chasing strength, until price proves it can escape the range and hold.

Bitcoin: Facing liquidity test We had some interesting developments on the crypto market during the previous week. The BTC and the majority of altcoins started the week with positive sentiment, trying to regain some of the previous strength from previous year. BTC started its attempt to reach the $95K resistance, however, the second part of the week was traded in the reversed mode. BTC retreated toward the $89,3K, but still closed the week around the $90K.

The RSI reached the level of 64, at the start of the week, but did not manage to reach the clear overbought market side. The indicator is closing the week at the level of 51, indicating that the market is still not ready to start its move toward the oversold market side. The MA50 started modest convergence toward the MA200, but the distance between lines is quite high, in which sense, the probability for a cross anytime soon is very low.

The first look at the BTC daily chart provides a bullish setup. However, there are risks toward the upside. The first risk is whether BTC will continue its short term reversal, or it needs first to test the $89,4K as current support line. If this level is broken, then we will see a higher correction in the price of BTC, toward the $85K. Still, if current level holds, then BTC will revert back toward the $95K, but it is unclear whether there is enough liquidity on the market for this level to be broken further to the upside.

BTCUSD – Outlook for the Upcomming daysMonthly View

The monthly timeframe remains bullish overall, but Bitcoin has pulled back to gather strength, it can take previous monthly timeframe low's liquidity. This kind of move is typical when the market is gearing up to break a higher high. The broader structure hasn’t shifted—this is simply a deeper retracement inside a bullish narrative.

Weekly View

The weekly chart is showing a similar story. Price has been dropping consistently without giving even a single proper reversal. If BTC truly wanted to fall aggressively, it would normally make a move up first, trigger traders’ stop-losses near previous highs, and then dump. But this time, it didn’t do that.

This unusual behavior hints that the market may be preparing something different from what most traders expect.

Daily View

The daily timeframe is where things get really interesting. Bitcoin spent more than half the recent sessions moving sideways, collecting liquidity on both sides. After that, it dipped and formed a lower high—but that lower high hasn’t been broken yet.

According to my analysis, BTC is currently sitting in the Discount Zone, an area where buyers often start becoming active.

4-Hour View

On the 4H chart, I already had a clean short setup earlier, but now I’m watching for signs of a potential reversal. That reversal idea is not guaranteed, though—it becomes invalid if BTC fails to break the series of lower highs.

There’s also another scenario: BTC might refuse to break the lower highs and begin forming higher lows at the same time. If that happens, we’ll see a period of sideways consolidation. When the breakout finally comes—whichever direction it chooses—the move is likely to be powerful.

Final Thoughts

Based on my analysis, BTC is showing mixed but promising signals across the higher and lower timeframes. The monthly structure is still bullish, and this pullback looks more like preparation for a stronger push rather than a trend reversal. Weekly price action hasn’t shown any meaningful bounce yet, which is unusual—and that alone hints that the market might be setting up something unexpected.

On the daily chart, BTC has swept liquidity after moving sideways for quite a while, and now it’s resting in the Discount Zone, where smart money usually becomes active. The 4H timeframe already gave clean short opportunities earlier, but now the market is approaching a point where a reversal could begin—unless lower highs remain untouched.

If BTC starts forming higher lows without breaking lower highs, the market will likely slip into a compression phase. When price finally breaks out of that squeeze, the move—up or down—can be very strong.

Again, this is just my personal viewpoint. Please do your own analysis before investing. Your profits and losses are entirely your responsibility—I’m only sharing what the charts are suggesting to me right now. Stay alert to the reaction levels ahead; that’s where the next major direction will reveal itself.

----------------------------------------------------------------------------------------------

Thanks for checking out this analysis! If you enjoyed it, hit that follow button so you don’t miss future updates. And if this breakdown helped you out, drop a like 👍 and share your thoughts in the comments 💬—I always appreciate the feedback!

BTC GOLD ratio: Hidden Predictor hints of BIG SHIFT favors BTC!

BTC GOLD ratio: Hidden Predictor hints of BIG SHIFT favors BTC!

BTC GOLD ratio has always been the less accessed data for the general public because of its indirectness nature of the individual assets as far as price action goes.

Most will opt to disect the main asset data/chart to see the face value of the moving price forgetting that another hidden confluence can bring forth an invaluable advantage.

But with its low key-ness comes a powerful predictor of the market direction. A data that conveys a forthcoming significant rebalance / shift on this two assets.

Based on our long term metrics, BTC GOLD ratio has been respecting its trend curvature since inception from 2013 -- proving that psychological key levels are respected regardless how expansive the data acquired on these timeframes.

Recent 2-year data that started from March 2023 to December 2024 conveyed BTC taking over GOLD in terms percentile momentum growth. From this time space, BTC has parabolically surged from 25k to 100k levels - an impressive X4 price growth. This type of golden milestone explicitly highlights the importance of this unpopular ratio in predicting whats about to transpire in the market in terms of sentiment.

Ratio cycles between contraction and expansion are usually within 1300-1400 day period. So an apparent structural change on this ratio is very special and its foretelling. When this ratio shifts big time it will do what it is bound to DO, no questions asked -- proceed on the intended directional target.

Just the same, using the same ratio from the last few seasons we have seen the shift favoring GOLD, reflecting the massive price expansion of this favored flight-to-safety asset. Rising generously to 4500 from 1800 levels. Meanwhile, BTC took a hefty trim, correcting back to 61.8 FIB levels from 126k back to 80k -- respecting the curve fit taps of the ratio. Healthy cycles that needed to materialized.

Fresh data from the past few weeks is hinting another BIG FLIP in the market, a massive shift in play. Ratio pre-hints of an impending rebalance of power, this time favoring BTC.

The mother coin is currently in prep work to take over the spotlight soon in terms of momentum growth in the next 1000 days.

The last BULL shift for BTC on this ratio was 1000 days ago, and based on recent data, another big one is about to transpire again -- a rare signal that can't missed.

Prepare for another season of NORTH journey for BTC in the next 1000 days, and it starts this month, January 2026. When the BIG SHIFT happens, get SEEDED, relax and enjoy the view -- you will be rewarded tremendously.

Spotted BTC price at 87k.

Long term target 200k or beyond (1000 days).

TAYOR. Trade mindfully.

Live Life more.

BITCOIN PERFECT RANGEThis is the only range to keep an eye on with #bitcoin. short from the middle of the channel, or top of the channel. You can also consider a long from the highs if it gets there, then target the middle of the channel.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

BTC/USDT 3-Day MIDTERM BTC/USDT 3-Day MIDTERM

1. Fractal Cycle and the "Ladder" Structure

The most distinct feature of this chart is the price rising in a continuously repeating loop. In technical analysis, we call this a "Step-up" structure.

The Cycle Logic:

Resistance (Purple Dashed Lines): Price compresses in a specific zone, forming a resistance line (e.g., 30k, 66k, 109k).

Breakout: This resistance is broken with significant volume.

Confirmation & Accumulation (Red Lines & Green Arrows): After the sharp rise, the price enters a "cooling off" phase (RSI resets), tests the broken zone or the previous peak as support (Retest), and gathers strength from there to launch the next green arrow (impulse) movement.

2. Current State: The Post-126k Correction

We are currently on the far right side of the chart, observing the correction process following the $126,000 level.

The chart implies that the movement in the 109k - 126k zone is a fractal (replica) of previous moves like the 30k-45k or 18k-25k phases.

The fact that the price is currently around $90,590 suggests we are inside a massive "bull flag" or corrective structure.

Critical Levels:

The $74,116 level, marked with a thick black line, is a "Rock-solid" major support point as it represents the previous cycle's peak (ATH). Price doesn't necessarily have to drop this low, but as long as it stays above this level, the Macro Trend is Bullish.

At intermediate supports, we can expect the price to hold and print a reversal candle, just like in the previous cycles (indicated by the purple circles).

3. RSI Clues (Momentum)

The RSI Candles indicator on the bottom panel provides a very valuable clue:

Before every major rally in the past (the start of the green arrows), the RSI cooled off from overbought territory and dipped into lower zones.

Currently, the RSI hovering near the bottom zones again suggests that seller exhaustion is near and the "resetting" process is coming to an end. This typically signifies that fuel is being gathered for a new wave of upside.

4. Cryptollica Summary & Expectation

This chart tells us: "Don't panic, trust the structure."

Bitcoin is currently digesting the previous sharp rally. According to the projection drawn by the analyst; once this correction is complete, if the past fractals (similarities) play out, the next target will be the upper band of the channel.

Scenario: Once the price breaks out of the current consolidation zone (the red downtrend line), a new "Impulse" movement, depicted by the green arrow, can be expected.

Core Idea: The trend is up, the structure is intact; we are simply taking a rest stop.

What could be the next step? To monitor whether this structure holds, you might want to set alerts for price action in the 74k - 80k band or check if a "bullish divergence" is forming on the RSI.

WULF Macro analysis | The bigger picture | Long-term holdersNASDAQ:WULF

🎯 Price appears exhausted at the upper channel boundary. The Elliot wave pattern completes a leading diagonal, which hints at higher to go, but after a deep wave 2 pullback, which could end at the 0.382 Fibonacci retracement, $8, but a more likely target is the 0.5 Fib at $5.84 with downside momentum, also the weekly 200EMA.

Breaking out above the channel would change the count and structure and be very bullish.

📈 Weekly RSI is oversold with no divergence and can remain here for months as price keeps increasing.

👉 Analysis is invalidated if we close back above $18

Safe trading

RIOT Macro analysis | The bigger picture | Long-term holdersNASDAQ:RIOT

🎯 Riot tested the upper boundary trend-line after its breakout. Expected behaviour. The uptrend is intact with price above the weekly 200EMA and pivot. Price appears to be in a wave 3 with a target of $40, the R£ weekly pivot.

📈 Weekly RSI has hidden bullish divergence at the EQ

👉 Analysis is invalidated if we close below $6.33

Safe trading

MSTR Macro analysis | The bigger picture | Long-term holdersNASDAQ:MSTR

🎯 Sentiment is low, the asset is hated and misunderstood by TradFi and retail. It’s a recipe for a bottom! Price is now below the weekly 200EMA and pivot, in wave 4, hitting the 0.382 Fibonacci retracement. The bears are in control.

📈 Weekly RSI hit oversold with hidden bullish divergence

👉 Analysis is invalidated if we close back below $101

Safe trading