SASOL (SOL)- JSEPrice has recently struggled near key resistance levels and is showing signs of slowdown after multiple attempts to push higher, which could signal a short-term pullback to structural support zones.

📌 Summary

This idea assumes a temporary pullback first, offering a “buy low” opportunity ahead of a larger upside continuation. The trade plan doesn’t chase short-term strength — it anticipates a measured retracement into strong technical support before committing capital.

Candlestick Analysis

31.01.26 Price action Recap BTCUSD (ICT Method)I can see a recent low, 2 fair value gaps, an OrderBlock and the previous days' high.

These matter because Price has just expanded lower.

What I hope to see, or rather how I hope to see price retrace bullishly depends largely on what she does next.

There are two possible scenarios:

- Price could retrace immediately with shallow moves and then expand lower into my weekly point of interest.

- Price could take out the most recent low it created in the form of a stop hunt, rally and then retrace into a point of interest and head for the fair value gap.

The third scenario is that I'm wrong and price will just expand into my weekly point of interest without retracing to the 4H fair value gap.

Let's see.

Cheers.

USDCHF: impulse completed, corrective wave in progressUSDCHF remains under pressure amid demand for safe-haven currencies and expectations of a softer Fed stance. The Swiss franc continues to attract defensive flows, keeping the broader bias bearish. The current price action reflects liquidity redistribution after a strong downside impulse.

From a technical and Elliott Wave perspective, the market has completed a bearish impulse wave (3), sweeping liquidity below local lows. The current consolidation near the weak low suggests the development of a corrective wave (4). The primary scenario expects a corrective rebound toward the 0.8065 – 0.8380 supply zone, aligned with prior structure and EMA resistance. Once wave (4) is complete, a continuation lower in wave (5) is expected. A deeper correction is possible, but the bearish structure remains intact below 0.84–0.85.

Short trade Trade Details

Entry: 82,996.41

Take Profit: 80,831.97 (2.60%)

Stop Loss: 83,240.22 (0.29%)

Risk–Reward: 8.88R

🔴 Directional Bias

Sell-side continuation following buy-side failure:

🧠 Market Sentiment

Prior sessions engineered buy-side liquidity above equal highs

London AM opened with a failure to sustain above the value

Aggressive rejection from the premium confirms the distribution is complete

Sentiment flipped decisively bearish as trapped longs were forced to exit

This reflects institutional unloading, not retail noise.

🧩 Structural Context

Clear lower high formed after buy-side sweep

Breakdown below the intraday range support

Bearish displacement confirms BOS to the downside

No bullish response on retest → sellers in control

Structure strongly favours sell-side expansion.

📊 Liquidity & Value

Entry taken after:

Buy-side liquidity taken

Return to inefficiency / FVG

Price accepted below prior value → premium distribution confirmed

Downside liquidity resting toward prior range lows

We assume this is a liquidity-driven continuation, not exhaustion.

⏱️ Session Advantage (London AM)

London is the primary distribution window

Ideal for:

Reversals after Asia manipulation

Trend continuation after NY positioning

Lack of early London bid strength validated the short bias

Session timing adds a probability edge.

❌ Invalidation Criteria

Reclaim and acceptance above London highs

Bullish displacement through the premium

Failure to expand after sell-side entry

None present at execution.

🧾 Summary

BTCUSD shows sell-side continuation sentiment following a London-session rejection from premium after buy-side liquidity was taken. Bearish BOS and acceptance below the value support further downside expansion toward resting liquidity.

USDJPY: More Growth Ahead 🇺🇸🇯🇵

USDJPY is going to finally fill a gap down opening.

A strong bullish momentum indicates a highly probable

bullish continuation and a test of 155.6 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Nasdaq (Futures) - 1,100-1,300 Ticks Swing OpportunityBullish Strength All Week, Above $26,000 - $26,200 Until Thursday Came Around. The Selling Pressure Was So Great, The Majority Of Gains Throughout The Week Vanished!

I Am Studying Obvious Levels Of Liquidity And Based Of My HTF Analysis, We Could Be In For A Continuation To The Downside With My Interest Resting Below 25365.25 Which Is Over 1,000 Ticks.

Next Weeks NWOG Will Give Me A Clearer View Of When This Delivery Can Occur.

A Premium Gap Open Could Signify One Last Short-Term Rally, Catching Those Who Has Held Onto Their Position Throughout The Weekend And Placed Their Stop Loss Above $25,940 & $26,050

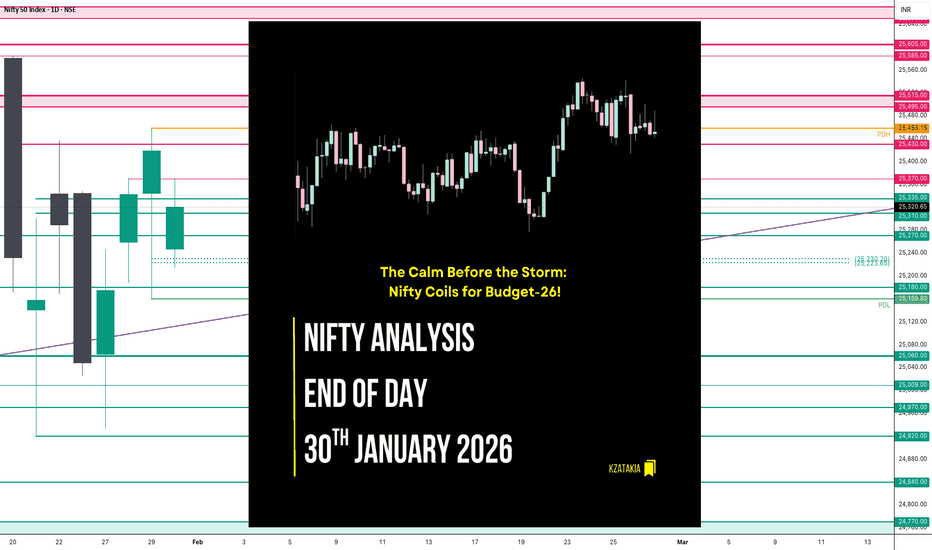

Nifty Analysis EOD – January 30, 2026 – Friday🟢 Nifty Analysis EOD – January 30, 2026 – Friday 🔴

The Calm Before the Storm: Nifty Coils for Budget-26!

🗞 Nifty Summary

As predicted, Friday was a “silent” consolidation session characterized by narrow range-bound movement and pre-event manipulation.

The day started with an unexpected 150-point Gap Down that tested our second support at 25,270. Nifty found its footing at the Fib 0.786 level, which acted as a rock-solid floor throughout the day.

A late-session attempt to break the IBH and the Long-Term Trendline at 1:50 PM briefly crossed the 25,335 mark, but the momentum faded precisely at the Fib 0.618 retracement level.

Nifty eventually closed at 25,320.65 (-0.39%), positioning itself exactly in the center of a high-stakes 700-point battlefield.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The session was a classic “wait-and-watch” game.

The 157-point range—significantly lower than the Gladiator average of 260—confirms that institutional players are sitting on the sidelines ahead of Sunday’s Budget.

While the intraday volatility offered some scalp opportunities, the false IBH breakout served as a trap for those over-anticipating the move.

The market is now balanced on a knife-edge, with the daily close sitting equidistant from major targets on both sides.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,247.55

High: 25,370.70

Low: 25,213.65

Close: 25,320.65

Change: -98.25 (-0.39%)

🏗️ Structure Breakdown

Type: Small Bullish Candle according CDO (Bearish according to PDC)

Range: ≈ 157 points — significantly compressed volatility.

Body: ≈ 73 points — mild selling pressure from the gap-up rejection. (Same size of Previous day)

Upper Wick: ≈ 123 points — strong supply rejection from the 25,370 zone.

Lower Wick: ≈ 34 points — limited buying interest at the extreme lows.

📚 Interpretation

The candle structure is the definition of indecision. The long upper wick proves that sellers are still capping any pre-emptive rallies, while the narrow body reflects a lack of directional conviction. The market has effectively “coiled,” and this compression usually leads to a violent expansion once the Budget news hits the tape.

🕯 Candle Type

Bearish Rejection / Consolidation Candle — Signals a standoff; the Budget session will be the ultimate tie-breaker for this structure.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 254.37

IB Range: 104..20 → Medium

Market Structure: Balanced

Trade Highlights:

12:23 Long Trade: SL Hit (Mistake: Assumed HTF break based on STF trend; recency bias).

13:54 Long Trade: Trailing Hit (1:0.76) (HTF Trendline Breakout).

Psychology Note: As explicitly mentioned in yesterday’s note, today was intended to be a “No-Trade” day due to expected pre-event consolidation. However, greed and recency bias triggered entries in a non-conducive environment.

The market punished the mistake, providing a stern reminder that discipline is more important than catching every tick.

🧱 Support & Resistance Levels

Resistance Zones:

25,370

25,430 ~ 25,460

25,515

25585 ~ 25605

25650 ~ 25,670

Support Zones:

25180 ~ 25160

25,060

25009

24970 ~ 24920

🧠 Final Thoughts

🧠 Special Budget-26 Note :

The Nifty has closed at 25,320, which is exactly the center point between the 25,670 resistance and the 24,970 support (350 points each way).

For the Budget day, it is highly probable that Nifty will test at least one of these extremes.

A sustained breach of the 25,160–25,460 range will be our “Prime Trade” signal.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Long trade 🥈 SI1! — Buy-Side Sentiment & News Analysis (1-Hour)

Date: Mon 28th Jan 2026

Session: NY Session AM

Execution Time: 3:45 pm

Trade Details

Entry: 115.270

Take Profit: 122.555 (6.32%)

Stop Loss: 114.785 (0.42%)

Risk–Reward: 15.02R

🟢 Directional Bias

Buy-side continuation/expansion:

Silver is in a clear re-pricing phase, transitioning from accumulation into sustained expansion, supported by both technical structure and macro conditions.

🧠 Market Sentiment Overview

Prior consolidation resolved decisively to the upside

Pullbacks into value were shallow and aggressively bought

Buyers showed strong acceptance above prior resistance

This reflects institutional accumulation and the continuation of a trend, not speculative exhaustion.

🧩 Structural Context

Higher-high / higher-low sequence firmly established on the 1H

No bearish CHoCH or structural failure

Break and hold above prior range highs confirms trend continuation

Structure strongly favours further upside rather than mean reversion.

📊 Volume Profile & Value

Acceptance above prior value high / POC

Volume supports higher prices — no high-volume rejection

Value migrating upward alongside price

This confirms a healthy bullish auction.

⏱️ Session Behaviour (NY AM)

Asia built the base

London extended structure

NY AM delivered continuation and expansion

NY AM is historically the strongest session for metals trend extension, adding timing confluence.

📰 News & Macro Context (Why Silver Works Here)

Precious metals bid amid:

Cooling expectations around aggressive rate hikes

Persistent inflation hedging demand

📰 Silver benefits from a dual role:

Monetary metal (real-yield sensitivity)

Industrial demand exposure (risk-on alignment)

No adverse USD or yield shock during NY AM

Gold strength provides tailwind confirmation for Silver

Macro conditions are supportive, not conflicting.

🧾 Summary

SI1! shows strong buy-side sentiment following acceptance above value and continuation of a higher-timeframe bullish structure. Shallow pullbacks, bullish FVG support, and a supportive macro backdrop favour continued upside expansion.

Gold Wave Analysis – 30 January 2026

- Gold formed daily Evening Star

- Likely to fall to support level 4600.00

Gold today fell down sharply after the price failed to close above the major resistance level 5500.00, as can be seen from the daily Gold chart below.

The downward reversal from the resistance level 5500.00 formed the daily Japanese candlesticks reversal pattern long-legged Doji – which is now the middle candle of the daily Evening Star.

Given the overbought Stochastic and RSI, Gold can be expected to fall to the next support level 4600.00 (former top if wave 1 from the start of January).

Axis Bank Ltd (NSE) – Bullish Continuation SetupTimeframe: Daily

Trend Bias: Bullish

Current Price: ~₹1,370

Technical Overview

Axis Bank is trading in a strong uptrend, respecting higher highs and higher lows. Price has recently broken above a consolidation range and is sustaining above the key Fibonacci 0.382 retracement zone, indicating strength and acceptance at higher levels.

The structure suggests a bullish continuation rather than exhaustion, with momentum favoring buyers as long as price holds above the breakout base.

Key Levels (as per chart)

Immediate Support: ₹1,325 – ₹1,335 (Fibonacci base & prior range high)

Secondary Support: ₹1,285 – ₹1,270 (demand zone / value area)

Immediate Resistance: ₹1,395 – ₹1,405 (Fibonacci -0.382 to -0.618 zone)

Major Target: ₹1,590 – ₹1,600 (measured move / higher timeframe projection)

Trade Plan

Bullish Scenario (Preferred):

Entry: Buy on dips near ₹1,335–₹1,350 or on a decisive daily close above ₹1,395

Targets:

T1: ₹1,440

T2: ₹1,520

T3: ₹1,590+

Bearish Invalidation:

A daily close below ₹1,315 would weaken the bullish structure and may lead to a deeper retracement towards ₹1,285.

Indicator Confluence

Volume: Expansion visible during the recent breakout, confirming participation

Momentum (RSI/Trend strength): Positive and trending upward, no bearish divergence

Market Structure: Clean breakout + retest behavior

Conclusion

Axis Bank remains structurally bullish on the daily timeframe. As long as price holds above the ₹1,315–₹1,325 zone, the probability favors further upside toward ₹1,590+. Traders should focus on pullback entries or breakout confirmation for optimal risk-reward.

⚠️ This is a technical view only. Not financial advice.

NZDCAD LONG Market structure bullish on HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Daily Structure Point

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

XAUUSD M15 – Corrective Pullback Within DowntrendXAUUSD is analyzed on the 15-minute timeframe (M15).

The broader market context remains bearish as price continues to trade below the EMA200, indicating that the dominant trend is still to the downside. The EMA ribbon is sloping downward, reinforcing bearish momentum in the current structure.

Following a strong impulsive move lower, price has entered a pullback phase. This pullback shows corrective characteristics rather than a trend reversal, as price remains capped below previous structure and dynamic EMA resistance.

Price is currently reacting within a resistance zone that aligns with prior structure and EMA resistance. The rejection from this area suggests that selling pressure is still present and that the pullback may be nearing completion.

Further downside continuation will depend on how price behaves around this resistance area and whether bearish structure remains intact.

This idea is shared for technical and educational purposes only and does not constitute financial advice.

SOLUSDT M30 HTF Supply Rejection and Bearish Continuation📝 Description

BINANCE:SOLUSDT has experienced a strong bearish impulse, breaking below a key H4 balance price range. Price is now consolidating under a 30-minute Fair Value Gap, suggesting a corrective pullback within a broader bearish structure rather than a trend reversal.

________________________________________

📉 Signal / Analysis

Primary Bias: Bearish below the M30 FVG

Preferred Setup:

• Entry: 116.10 (pullback into M30 FVG / supply)

• Stop Loss: Above 116.60

• TP1: 114.89

• TP2: 113.82

• TP3: 112.17

________________________________________

🧠 ICT & SMC Notes

• Strong bearish displacement confirming sell-side dominance

• Rejection from M30 Fair Value Gap in a discount-to-premium retracement

• Clear bearish market structure with lower highs and lower lows

________________________________________

📌 Summary

As long as price remains capped below the 116.60–117.20 resistance zone, bearish continuation remains the favored scenario. The current consolidation is viewed as a pause before a potential continuation toward deeper downside liquidity.

________________________________________

🌍 Fundamental Notes / Sentiment

Weak overall crypto market sentiment, coupled with reduced risk appetite and ongoing capital rotation out of high-beta altcoins, continues to weigh on SOL. Without a strong bullish catalyst, downside pressure remains dominant in the short term.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

GBPUSD M15 – Bearish Confluence at EMA and ResistancePair: GBPUSD

Timeframe: M15

The overall market context remains bearish. Price is trading below the EMA200, confirming that the long-term trend is still to the downside. The EMA ribbon is also turning red and sloping downward, which supports bearish momentum in the current structure.

After the impulsive move down, price has retraced into an appropriate pullback area. This retracement aligns with a key resistance zone and remains below the dynamic resistance provided by the EMA200, indicating that the pullback is corrective rather than a trend reversal.

Within this pullback zone, a reversal candlestick signal has appeared, showing rejection from higher prices. This reaction suggests that selling pressure is returning as price tests the resistance area.

In addition, the pullback level aligns with Fibonacci retracement levels, creating confluence between structure, dynamic resistance, and Fibonacci, which strengthens the technical validity of the setup.

As long as price remains below EMA200 and below the recent swing high, the bearish scenario remains intact. Any continuation to the downside will depend on how price reacts after this pullback.

This analysis is shared for educational and analytical purposes only and does not constitute financial advice.

NZDCAD: Another Pullback Trade For Today 🇳🇿🇨🇦

NZDCAD may pull back from the underlined intraday/daily support.

As a confirmation, I see a double bottom pattern formation on that

and a violation of its horizontal neckline.

Goal - 0.8197

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

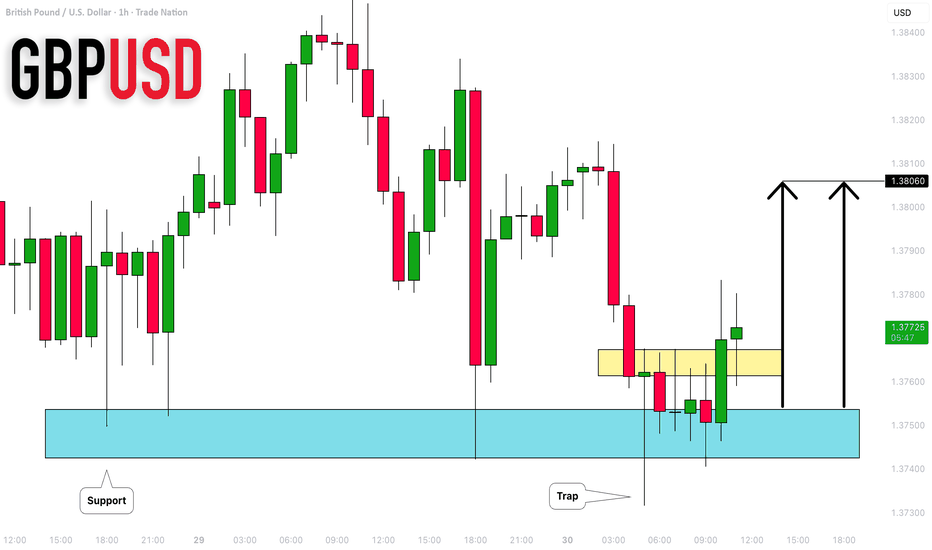

GBPUSD: Buying After Trap 🇬🇧🇺🇸

GBPUSD will likely move up after a confirmed

bearish trap below a key intraday support.

I expect a rise at least to 1.3806 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD M15 – Corrective Pullback Within DowntrendEURUSD is analyzed on the 15-minute timeframe (M15).

The broader market context remains bearish as price continues to trade below the EMA200, indicating that the long-term trend is still to the downside. The EMA ribbon is also sloping downward, supporting sustained bearish momentum.

After the recent impulsive decline, price has entered a pullback phase. This pullback shows corrective characteristics rather than a trend reversal, as price remains capped below dynamic resistance and previous structure levels.

Price is currently reacting within a resistance zone that aligns with EMA resistance and prior structure. The appearance of bearish price rejection in this area suggests that selling pressure is still active.

The highlighted management zone reflects a point where risk can be reduced, such as moving the stop to break-even, depending on individual trade management rules. Further downside continuation will depend on how price behaves after this corrective move.

This idea is based on market structure, EMA trend context, and price reaction on the M15 timeframe, and is shared for educational and analytical purposes only. It does not constitute financial advice.

EURAUD: Bearish Trend Continuation 🇪🇺🇦🇺

EURAUD will likely continue falling after completing

a correctional movement.

The next major historic support is 1.682.

Look for selling, expecting a bearish continuation to that level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD BullishI might be a little early, since I like to wait until the London or USA trade session , but the possibility of this happening is good. In reality, i would wait for more conformation before entering the trade, but so far everything looks good as the 15m, 1h and 4h are starting to align giving bullish signals. I just thought i should share this quick analysis as I'm trying to stay active away from home, Peace! OANDA:XAUUSD

JSW STEEL LTD – Weekly Breakout Setup | SwingSymbol: JSWSTEEL (NSE)

Timeframe: 1W

Trend: Bullish continuation

Technical View

JSW Steel is trading in a strong higher-high, higher-low structure on the weekly chart. Price has respected a rising trendline since mid-2024 and recently reclaimed the 0 Fibonacci level (₹1,226) with a decisive close.

The previous corrective move has now transitioned into a fresh impulse leg, indicating continuation of the primary uptrend.

Key Levels (Fibonacci Projection)

Immediate Support: ₹1,225–1,240 (0 Fib + breakout retest zone)

Strong Support: ₹1,095–1,105 (0.382 Fib)

Trendline Support: Rising weekly trendline (confluence area)

Upside Targets

Target 1: ₹1,354 (−0.382 Fib)

Target 2: ₹1,435 (−0.618 Fib)

Extended Target (Momentum): ₹1,500+ if market strength continues

Invalidation / Risk

Weekly close below ₹1,195 would weaken the bullish structure

Trend remains intact as long as price holds above the rising trendline

RSI & Momentum

Weekly RSI is above 50 and rising, confirming bullish momentum

No bearish divergence visible at current levels

Trade Plan

Bias: Buy on dips / Buy on retest

Entry Zone: ₹1,225–1,250

Conclusion

JSW Steel is structurally bullish on the weekly timeframe. Holding above the breakout zone opens the path toward ₹1,350–₹1,435 in the coming weeks/months. Best suited for swing and positional traders.