Candlestick Analysis

NZDUSD: Bullish Continuation 🇳🇿🇺🇸

NZDUSD may continue rising after a test of a key intraday support.

A double bottom pattern on that provides a strong confirmation.

Goal - 0.6047

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER (XAG/USD): Confirmed Break of StructureThere is a confirmed bullish breakout of an important intraday structure BoS on SILVER.

This development suggests a potential for further growth and expansion.

The subsequent medium-term objective for buyers is anticipated to be the 118.00 resistance level.

USDCAD: Time to Recover?! 🇺🇸🇨🇦

USDCAD may finally start recovering after a test of a daily

historic key support.

After a liquidity grab below that, I see some signs of strength of the buyers

on an hourly time frame.

Goal will be 1.36395

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCAD LONGMarket structure bullish on HTFs 3

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Daily Structure Point

Around Psychological Level 1.86500

Touching EMA H4

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 120% TPT 115%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

EURUSD LONGMarket structure bullish on HTFs 3

Entry at Both Weekly And Daily AOi

Weekly Rejection at AOi

Weekly Previous Structure Point

Daily Rejection at AOi

Daily EMA retest

Around Psychological Level 1.17500

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 115% / 145% TPT

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

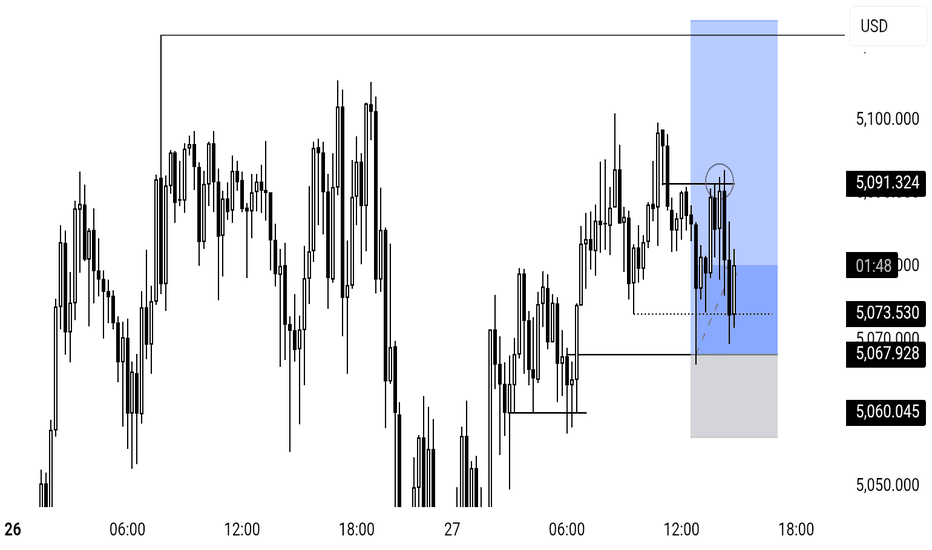

Long trade 🟡 MGC1! — Buy-Side Sentiment Analysis (5-Minute)

Observed: Tue 27th Jan 2026

Session: London Session AM

Time: 3:55 am

Trade Details

Entry: 5,077.1

Take Profit: 5,108.1 (0.61%)

Stop Loss: 5,068.5 (0.16%)

Risk–Reward: 3.6R

🟢 Directional Bias

Buy-side continuation:

Price action reflects sustained institutional accumulation, with a higher-low structure holding and price compressing beneath upside liquidity.

🧠 Market Sentiment Overview

Early-session pullback failed to gain acceptance lower

Sellers were absorbed in the inside discount

Buyers defended value and reasserted control

This is controlled accumulation, not reactive short covering.

🧩 Structural Context

Higher-low structure remains intact

No bearish BOS or displacement observed

Price respects internal range lows before rotating higher

Structure supports continuation rather than distribution.

📊 Volume Profile & Value

Acceptance above key value areas

No sustained trade below POC

Value continues to follow price higher

This confirms a bullish auction environment.

🟦 PD Arrays / Fair Value Gaps

Entry aligned with bullish FVG mitigation

Clean reaction from inefficiency confirms demand

No unfilled downside imbalance of significance

Downside liquidity appears largely neutralised.

⏱️Session Behaviour

Asia consolidated and built a structure

London AM delivered continuation, not manipulation

Typical profile for trend continuation into NY

Session timing supports buy-side intent.

🧾 Summary

MGC1! shows buy-side sentiment during the London AM session, with price holding above value and respecting bullish FVG support. Compression beneath equal highs suggests continuation toward upside liquidity.

Long trade GBPJPY — Buy-Side Sentiment & News Context (15-Minute)

Date: Mon 26th Jan 2026

Session: NY Session PM

Time: 12:30 pm

Bias: Buy-side continuation

Trade Details

Entry: 210.847

Take Profit: 212.590 (0.82%)

Stop Loss: 210.473 (0.17%)

Risk–Reward: 4.66R

Market Sentiment Overview

Sharp sell-off cleared sell-side liquidity below prior equal lows

Rejection from the imbalance zone shows aggressive absorption

Rapid reclaim of value signals institutional participation, not retail short-covering

🧩 Structural Context

Sell-side liquidity sweep completed into the lower range

Bullish displacement back into the prior structure

Formation of a higher low relative to the sweep

📊 Volume Profile & Value

Price re-entered and held above POC / value low

Value acceptance confirms a bullish auction

Volume no longer supports lower prices

⏱️ Session Behaviour (Why NY PM Matters)

London set the range

NY AM delivered the liquidity sweep

NY PM shows continuation intent, not reversal

Textbook London manipulation → NY expansion sequence.

📰 News & Macro Backdrop (Contextual, Not Event-Driven)

JPY remains structurally weak due to persistent yield differentials

No immediate BoJ tightening catalyst priced into this session

GBP sentiment supported by relative yield stability vs JPY

Absence of high-impact NY releases → technicals dominate price

Macro conditions do not conflict with the buy-side GBPJPY continuation model.

🎯 Trade Logic

Sell-side liquidity cleared

Price accepted back above the value

Buyers defended pullbacks

Buyside liquidity is resting higher within the range

🧾 Summary

GBPJPY shows buy-side continuation following a sell-side liquidity sweep and strong absorption during NY. Acceptance above value and supportive macro conditions favour continuation toward premium liquidity.

NZDCHF LONG Market structure bullish on HTFs 3

Entry at Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection At AOi

Previous Daily Structure Point

Touching EMA H4

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 105%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

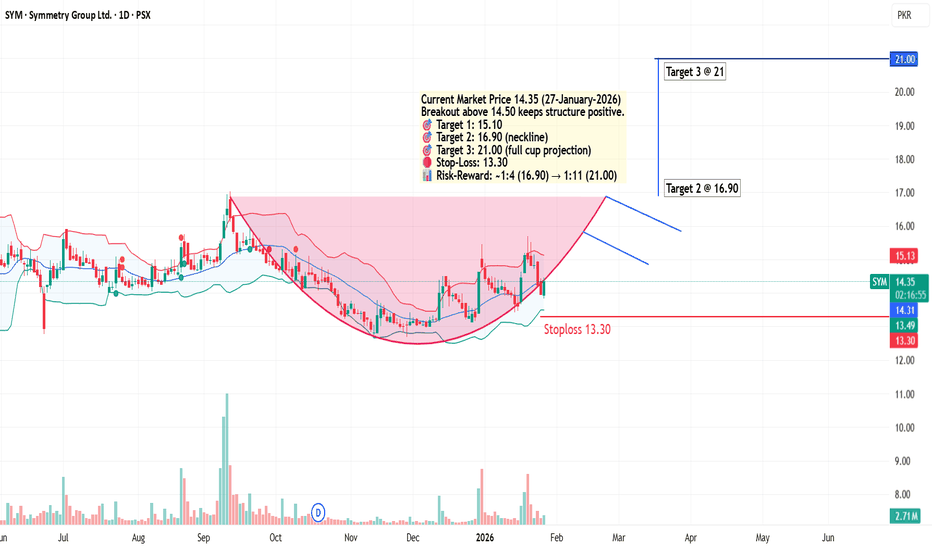

Cup and Handle formation in SYMMETRYPrice has formed a clear Cup & Handle structure, indicating accumulation followed by controlled consolidation. The pattern remains valid above 14.50, with resistance levels at 15.10, 16.90 (neckline), and 21.00 based on classical cup projection.

A daily close below 13.30 would invalidate the setup.

AUDUSD: Ready to Fill the Gap?! 🇦🇺🇺🇸

It looks like AUDUSD is finally going to fill the gap.

Today's early morning price action looks bearish to me

and I anticipate a downward movement to 0.6899 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY – Intervention Risks ElevatedLast week G10 currency markets started moving again after a period of low volatility. It was initially led by a resumption of the ‘sell America’ trade that gained traction when President Trump threatened European allies with new tariffs over his pursuit of Greenland and his constant political attacks on the Federal Reserve independence, which weighed on the dollar.

For USDJPY, the shift to the downside was given more impetus when the Ministry of Finance (MoF) stepped in to check prices with local dealers, after the Bank of Japan (BoJ) left interest rates unchanged at their meeting on Friday morning. This move gathered further momentum when the Federal Reserve of New York did the same later Friday afternoon, adding weight to the theory that the US administration is ready to assist in lowering the USDJPY exchange rate.

FX markets opened on Monday (Jan 26th) in a similar fashion, with traders reacting to comments from Japanese PM Sanae Takaichi on Sunday, where she stated that the MoF would take all necessary measures to address speculative and highly abnormal movements. Taken together these events saw USDJPY fall over 500 points or around 3.7% from a high of 159.21 on Friday morning to a low of 153.30 yesterday.

It could be argued that Japanese and US authorities have stepped in ahead of the important psychological 160.00 level in USDJPY to voice their disapproval at the exchange rate, giving investors a chance to reduce their long exposure, while at the same time providing a warning that they may co-ordinate a future intervention that could result in unwelcome volatility and losses if their message is ignored.

While this seems to have been received loud and clear in the short term, whether that continues as traders react to the potential outcome from tomorrow’s Federal Reserve rate meeting and the future policy decisions of the Japanese PM moving toward the elections on February 8th remains to be seen. USDJPY prices have already rebounded slightly, trading back around 154.50 at the time of writing (0630 GMT).

Technical Update: Deeper Retracement Risk on Intervention Concerns?

Speculation regarding possible intervention triggered increased concerns around overstretched USDJPY levels and prompted position‑squaring into last weekend. Those fears have carried into the new trading week, with prices seeing a sharp continuation lower, and the pair falling 3.7% from Friday’s high to Monday’s low.

However, as the daily chart above shows, the latest price activity is currently testing what could be viewed as the first potential support at 154.12, which is the 38.2% retracement of the September to January advance. Closing breaks below 154.12 could raise questions over whether this can mark the start of a deeper downside phase or is just another brief pullback before buyers return.

In this situation, being able to identify potential key support and resistance levels to monitor could become especially important for traders in the days ahead.

Potential Support Levels:

A closing break below the 38.2% retracement at 154.12 could shift the bias toward risks of a deeper decline, opening potential for tests of lower support levels. If those supports fail to hold, the downside moves could extend further over upcoming sessions.

As the chart above shows, if support at 154.12 is broken to the downside this week on a closing basis, attention may shift to the lower Fibonacci retracements as the next potential supports. The 50% level at 152.48 is the next area that could steady the current decline, however a close below this level may signal further deterioration and even open the door for a deeper fall toward 150.85, which is the 61.8% retracement support.

Potential Resistance Levels:

There is no guarantee that the recent price weakness will extend, so monitoring the next resistance levels could also be key to judging whether a more sustained recovery may materialise. The 38.2% retracement of the latest decline sits at 155.64, and if prices rebound this week, this level may become a marker for assessing how far recovery themes could develop.

While not an outright positive signal, a closing break above 155.64, could open scope toward 156.37, the 50% retracement, and potentially even 157.08, which is the higher 61.8% level.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

USD/JPY: True Bullish Reversal?!The 📈USDJPY pair formed a well-defined inverted head and shoulders pattern following a test of a significant historical support level.

A decisive bullish breakout above its neckline, confirmed by a strong bullish candle, would provide a reliable indication.

I anticipate a correctional movement to at least 155.20.

FreseniusGood monthly setup for Fresenius. Broke up descending channel, then confirmed. Now we have beautiful monthly candle giving probabilities for an upside move (hopefully above 34.60). The 3 years distance from MA shows almost the same (broke up, retest, now moving).

Very clear Fibonacci resistances around 41-44. It seems to me a good defensive play for long term. It pays nice dividend as well.

Always do your own research!

NZD/CAD: Trend-Following SignalThe NZDCAD appears to be showing bullish tendencies following a retest of a significant daily horizontal support level.

It seems the current intraday correction is over.

Further confirmation is provided by a bullish breakout of the resistance line of a bullish flag pattern observed on the hourly timeframe.

The target is set at 0.8221.