Candlestick Patterns - Part3Hanging Man (Bullish Reversal Pattern)

----------------------------------------

The Hanging Man is a bearish candlestick pattern that appears during an uptrend. It has a small body near the top of the trading range, a short upper shadow, and a long lower shadow. It suggests a potential trend reversal, indicating that buyers may be losing control and sellers could take over. Confirmation from subsequent price action is usually needed before taking any trading decisions based on this pattern.

Candlestick Patterns - Bearish Reversal Patterns - Hanging Man

Key components and characteristics

The Hanging Man pattern consists of a single candlestick with the following characteristics:

1. Body: The Hanging Man candlestick has a small body, typically bearish (black or red), representing a narrow range between the opening and closing prices. The body may also be bullish (white or green) but is less common. The small body indicates indecision or a slight preference towards bearishness.

2. Lower shadow/wick: The Hanging Man has a long lower shadow, also known as the tail or wick, extending below the body. The length of the lower shadow should be at least twice the size of the body. This shadow represents the low price reached during the trading period.

3. Upper shadow/wick: The Hanging Man has little to no upper shadow. If present, it is usually very short compared to the lower shadow. This indicates that bulls attempted to push the price higher but failed, signaling potential weakness.

Shooting Star (Bullish Reversal Pattern)

----------------------------------------

The Shooting Star is a candlestick pattern commonly found in technical analysis of financial markets. It is formed when the open, high, and close prices are relatively close to each other, but the high is significantly above the open and close. This creates a candlestick with a small body and a long upper shadow or wick.

The Shooting Star pattern suggests a potential reversal of an uptrend, indicating that buyers may be losing control and sellers are becoming more active. It is often seen as a bearish signal, especially when it appears after a price rally. Traders interpret this pattern as a sign that the market may be overextended and could experience a downward correction or trend reversal.

The significance of the Shooting Star pattern is strengthened when it occurs near key resistance levels or when it is accompanied by other technical indicators or patterns that confirm the bearish sentiment. Traders typically look for confirmation in subsequent price action before making trading decisions based on this pattern.

Candlestick Patterns - Bearish Reversal Patterns - Shooting Star

Key components and characteristics

The Shooting Start candlestick pattern consists of a single candlestick with the following characteristics:

1. Body: The Shooting Star has a small body, indicating that the opening and closing prices are close to each other.

2. Lower shadow/wick: The Shooting Star typically has little to no lower shadow, or if present, it is very short compared to the upper shadow.

3. Upper shadow/wick: The defining characteristic of a Shooting Star is its long upper shadow or wick, which extends above the body. This shadow represents the high price reached during the trading period.

Gravestone Doji (Bullish Reversal Pattern)

------------------------------------------

The Gravestone Doji is a candlestick pattern in technical analysis used to analyze financial markets, particularly in trading stocks or other securities. It is formed when the open, high, and close prices of a trading period are all at or near the low of the period, creating a long upper shadow or wick. The pattern resembles a gravestone, hence its name.

Candlestick Patterns - Bearish Reversal Patterns - Gravestone Doji

Key components and characteristics

The Gravestone Doji candlestick pattern consists of a single candlestick with the following characteristics:

1. Body: In a Gravestone Doji Doji, the opening price, closing price, and high price of the trading session are all at the same level. This creates a small body at the bottom of the candlestick.

2. Lower shadow/wick: The lower shadow, which represents the price range between the opening price and the low of the period, is either non-existent or very short in the Gravestone Doji pattern.

3. Upper shadow/wick: The upper shadow represents the price range between the high of the period and the closing price. In the Gravestone Doji, this upper shadow is usually long and extends above the opening price.

Bearish Engulfing (Bullish Reversal Pattern)

--------------------------------------------

The Bearish Engulfing candlestick pattern is a two-candle pattern that usually signals a potential reversal of an uptrend. It occurs when a small bullish candle is followed by a larger bearish candle that completely engulfs the previous candle's body. The bearish candle's body represents a strong shift in sentiment from buyers to sellers, as it opens above the previous candle's close and closes below the previous candle's open. This pattern suggests that bears have gained control and may lead to further downward movement in the price. Traders often use it as a signal to consider selling or taking a bearish position in the market.

Candlestick Patterns - Bearish Reversal Patterns - Bearish Engulfing

Key components and characteristics

The Bearish Engulfing candlestick pattern consists of two key components:

1. Bullish candle: The first candle is a bullish (green or white) candlestick, indicating that buyers have been in control. It is typically smaller in size compared to the second candle.

2. Bearish candle: The second candle is a larger bearish (red or black) candlestick. Its body completely engulfs the body of the bullish candle, meaning the high and low of the bearish candle's body completely cover the range of the bullish candle.

Evening Star (Bullish Reversal Pattern)

---------------------------------------

The Evening Star is a bearish candlestick pattern that typically signals a potential reversal of an uptrend. It consists of three candles and is formed at the top of a price rally.

Candlestick Patterns - Bearish Reversal Patterns - Evening Star

Key components and characteristics

The key components and characteristics of an Evening Star candlestick pattern are as follows:

1. First Candle: The pattern starts with a bullish candle that occurs during an uptrend. It represents the continuation of the existing upward momentum. This candle often has a long body and indicates the dominance of buyers.

2. Second Candle: The second candle is a small-bodied candle, often a doji or a spinning top, which reflects indecision in the market. It signifies a potential shift in sentiment as the bulls and bears reach a temporary balance. This candle can be bullish or bearish and serves as a warning sign.

3. Third Candle: The final component is a bearish candle that closes below the midpoint of the first candle. This candle demonstrates that selling pressure has increased, overpowering the previous buying pressure. It confirms the Evening Star pattern and suggests a potential reversal of the uptrend.

Three Black Crows (Bullish Reversal Pattern)

---------------------------------------------

The Three Black Crows is a bearish candlestick pattern that often indicates a potential reversal in an uptrend. It consists of three consecutive long-bodied black (or red) candles with each opening within the body of the previous candle and closing near its low. The pattern suggests that sellers have taken control, driving prices lower over three consecutive trading sessions. It typically signifies a strong shift in market sentiment from bullish to bearish and can be a signal for traders to consider selling or taking profits.

Candlestick Patterns - Bearish Reversal Patterns - Three Black Crows

Key components and characteristics

The key components and characteristics of the Three Black Crows candlestick pattern are as follows:

1. Number of candles: The pattern consists of three consecutive candles.

2. Color: Each candle is typically black or red, indicating a bearish sentiment.

3. Shape: The candles are long-bodied, meaning they have relatively large real bodies compared to their wicks or shadows.

4. Opening and closing: Each candle opens within the real body of the previous candle and closes near its low. This shows sustained selling pressure throughout the trading sessions.

5. Trend reversal: The pattern often occurs after an uptrend, indicating a potential reversal in the market sentiment from bullish to bearish.

6. Volume: Ideally, the pattern is accompanied by increasing trading volume, suggesting strong selling pressure.

7. Confirmation: Traders usually wait for confirmation after spotting the Three Black Crows pattern, such as a further decline in prices or a break below a support level, before considering a bearish trade.

It's worth noting that while the Three Black Crows pattern can indicate a bearish reversal, it's essential to consider other technical indicators, market conditions, and confirmation signals to make well-informed trading decisions.

Cheers & have fun!

Candlestickpattern

Candlestick Patterns - Part2Hammer (Bullish Reversal Pattern)

-----------------------------------

The Hammer is a popular candlestick pattern that provides important information about the potential reversal of a downtrend. It is a single candlestick pattern characterized by a small body located at the top of the trading range with a long lower shadow (also known as the tail or wick). The long shadow represents a rejection of lower prices, indicating potential reversal. The upper shadow, if present, is usually very small or nonexistent. Traders may interpret the Hammer as a signal to go long or buy, considering confirmation and other technical analysis tools.

Candlestick Patterns - Bullish Reversal Patterns - Hammer

Key components and characteristics

The Hammer pattern consists of a single candlestick with the following characteristics:

1. Body: The Hammer candlestick has a small body, which represents a narrow range between the opening and closing prices. The body is typically bullish (white or green) but can also be bearish (black or red). The small body indicates that there is indecision in the market.

2. Lower shadow/wick: The most prominent feature of the Hammer is its long lower shadow, which extends below the body. The length of the lower shadow is generally at least twice the size of the body. This shadow represents the low price reached during the trading period.

3. Upper shadow/wick: The upper shadow, if present, is usually very short or nonexistent. This indicates that the bulls were able to push the price up from the lows, suggesting a potential reversal.

Inverted Hammer (Bullish Reversal Pattern)

---------------------------------------------

The Inverted Hammer is a candlestick pattern that typically forms at the bottom of a downtrend and suggests a potential reversal in the price of an asset. It consists of a small body located near the bottom of the candle, with a long upper shadow and little to no lower shadow.

The pattern indicates that sellers initially dominated the market, pushing the price lower. However, buyers stepped in, driving the price back up, resulting in the long upper shadow. The small body indicates indecision between buyers and sellers, with a slight bias towards buyers. The lack of a lower shadow suggests that buyers were able to maintain control without much resistance.

Traders interpret the Inverted Hammer as a signal that the bearish pressure may be weakening, and a bullish reversal might occur. Confirmation of the reversal typically comes with a subsequent bullish candle or a break above the high of the Inverted Hammer. Traders often look for other technical indicators or patterns to strengthen their analysis before making trading decisions based on the Inverted Hammer pattern.

Candlestick Patterns - Bullish Reversal Patterns - Inverted Hammer

Key components and characteristics

The Inverted Hammer candlestick pattern consists of a single candlestick with the following characteristics:

1. Body: The pattern has a small real body near the bottom of the candlestick. The body represents the price range between the opening and closing prices.

2. Lower shadow/wick: The Inverted Hammer typically has little to no lower shadow. The absence of a lower shadow suggests that the low price for the period is near the bottom of the candlestick body.

3. Upper shadow/wick: The Inverted Hammer has a long upper shadow, which extends above the small body. This upper shadow represents the high price reached during the trading period.

Dragonfly Doji (Bullish Reversal Pattern)

-----------------------------------------

The Dragonfly Doji is a candlestick pattern that forms when the opening price, closing price, and high price of a trading session are all equal. This pattern typically occurs at the bottom of a downtrend and suggests a potential reversal in the price direction.

Candlestick Patterns - Bullish Reversal Patterns - Dragonfly Doji

Key components and characteristics

The Dragonfly Doji candlestick pattern consists of a single candlestick with the following characteristics:

1. Body: In a Dragonfly Doji, the opening price, closing price, and high price of the trading session are all at the same level. This creates a small body at the top of the candlestick.

2. Lower shadow/wick: The candlestick has a long lower shadow, which indicates that the price fell significantly during the session but was ultimately pushed back up by buyers. The length of the lower shadow is typically at least twice the length of the body.

3. Upper shadow/wick: Unlike other candlestick patterns, the Dragonfly Doji does not have an upper shadow. This means that the high price of the session was the same as the opening and closing prices.

Bullish Engulfing (Bullish Reversal Pattern)

--------------------------------------------

The Bullish Engulfing candlestick pattern is a bullish reversal pattern that typically occurs at the end of a downtrend. It consists of two candles, a smaller bearish candle followed by a larger bullish candle. The body of the bullish candle completely engulfs the body of the bearish candle, indicating a shift in market sentiment from bearish to bullish.

Candlestick Patterns - Bullish Reversal Patterns - Bullish Engulfing

Key components and characteristics

The bullush engulfing candlestick pattern consists of two key components:

1. Bearish candle: The first candle is a bearish (red or black) candlestick, indicating that sellers have been in control. It is typically smaller in size compared to the second candle.

2. Bullish candle: The second candle is a larger bullish (green or white) candlestick. Its body completely engulfs the body of the bearish candle, meaning the high and low of the bullish candle's body completely cover the range of the bearish candle.

Morning Star (Bullish Reversal Pattern)

----------------------------------------

The Morning Star is a bullish candlestick pattern typically found on price charts. It consists of three candles and is considered a reliable indicator of a potential trend reversal from a downtrend to an uptrend.

Candlestick Patterns - Bullish Reversal Patterns - Morning Star

Key components and characteristics

The key components and characteristics of a Morning Star candlestick pattern are as follows:

1. First Candle: The first candle in the pattern is a long bearish (red or black) candlestick. It signifies a strong selling pressure and suggests that bears are in control of the market.

2. Second Candle: The second candle is a small-bodied candle that can be either bullish or bearish. It forms a gap down from the previous candle, indicating indecision or a weakening of the selling pressure.

3. Third Candle: The third candle is a long bullish (green or white) candlestick that gaps up from the second candle. It confirms the reversal as buying pressure overtakes the selling pressure. This candle suggests that bulls are gaining control and a trend reversal may be imminent.

Three White Soldiers (Bullish Reversal Pattern)

------------------------------------------------

The Three White Soldiers is a bullish candlestick pattern that often signals a reversal of a downtrend and the beginning of an uptrend. It consists of three consecutive long-bodied bullish candles with small or nonexistent wicks or shadows. Each candle opens within the previous candle's body and closes higher than the previous candle's close. The pattern indicates increasing buying pressure and suggests a strong shift in market sentiment toward the bulls. Traders often interpret this pattern as a sign of potential upward momentum and look for opportunities to enter long positions.

Candlestick Patterns - Bullish Reversal Patterns - Three White Soldiers

Key components and characteristics

The key components and characteristics of the Three White Soldiers candlestick pattern are as follows:

1. Three consecutive candles: The pattern consists of three consecutive bullish (upward) candles.

2. Long-bodied candles: Each candle in the pattern should have a relatively long body, indicating strong buying pressure. The longer the bodies, the more significant the pattern.

3. Absence of or small wicks/shadows: The candles should have minimal or no upper or lower wicks, suggesting that the buying pressure was sustained throughout the entire trading session without significant pullbacks.

4. Opening within the previous candle's body: Each candle should open within the body of the previous candle, showing a continuation of the buying pressure from one candle to the next.

5. Closing higher than the previous close: The closing price of each candle should be higher than the previous candle's close, signifying a steady rise in prices and a bullish sentiment.

6. Reversal signal: The Three White Soldiers pattern typically appears after a period of downtrend, indicating a potential reversal and the start of an uptrend.

7. Volume confirmation: Higher trading volume during the formation of the pattern adds strength to the interpretation and suggests increased buying activity.

These components collectively suggest a strong shift in market sentiment from bearish to bullish, often prompting traders to anticipate further upward movement and potential buying opportunities.

To be continued.

Cheers & have fun!

Candlestick Patterns - Part1Candlestick Components

Candlestick components refer to the various elements that make up a candlestick chart, a popular tool used in technical analysis to analyze price movements in financial markets. Each candlestick represents a specific time period, such as a day, week, or hour, and provides valuable information about the price action during that period.

There are four main components of a candlestick:

1. Open: Is the opening price of the time period. It indicates the first traded price during that period.

2. Close: Is the closing price of the time period. It indicates the last traded price during that period.

3. High: Is the highest price reached during the time period is represented by the upper shadow or wick of the candlestick. It extends vertically from the top of the candle body to the high point.

4. Low: Is the lowest price reached during the time period is represented by the lower shadow or wick of the candlestick. It extends vertically from the bottom of the candle body to the low point.

The body of the candlestick is the rectangular area between the open and close prices. It is filled or colored differently to indicate whether the closing price was higher (bullish) or lower (bearish) than the opening price.

How To Read a Candlestick

Reading a candlestick involves analyzing its components and patterns to gain insights into price movements and potential market trends. Here's a step-by-step guide on how to read a candlestick:

1. Identify the trend: Start by determining the overall trend of the market, whether it's bullish (upward) or bearish (downward). This can be done by looking at the sequence of candlesticks and their general direction.

2. Understand the candlestick components: Examine the individual candlestick's open, close, high, and low prices. The open and close prices determine the body of the candlestick, while the high and low prices define the upper and lower shadows.

3. Interpret the candlestick color: Candlesticks are typically colored differently to represent bullish and bearish movements. A green or white candlestick usually indicates a bullish or positive movement, where the close price is higher than the open price. Conversely, a red or black candlestick represents a bearish or negative movement, where the close price is lower than the open price.

4. Analyze the size of the body and shadows: The size of the body and shadows can provide additional information. A long body suggests a significant price movement during the time period, while a short body indicates a relatively small price change. Longer shadows indicate greater price volatility, while shorter shadows suggest price stability.

5. Look for candlestick patterns: Candlestick patterns are specific formations created by multiple candlesticks. They can provide valuable insights into potential reversals, continuations, or indecision in the market. Examples of common candlestick patterns include doji, hammer, engulfing, and shooting star.

6. Consider the volume: Volume is an essential factor to analyze alongside candlestick patterns. Higher volume during specific candlestick formations can confirm the strength of a trend or signal potential market reversals.

7. Combine with other technical indicators: To strengthen your analysis, consider using other technical indicators like moving averages, trendlines, or oscillators. These indicators can provide further confirmation or additional insights into market conditions.

Remember that reading candlesticks is not a foolproof method, and it's crucial to consider multiple factors and employ risk management strategies when making trading or investment decisions. Additionally, learning and practicing candlestick analysis takes time and experience to develop proficiency.

To be continued.

Cheers & have fun!

Understanding Basics of Candlestick Charts

Candlestick patterns play a key role in quantitative trading strategies owing to the simple pattern formation and ease of reading the same.

For using candlestick patterns, you only need to have a basic understanding of how the candlesticks are formed. Also having some idea about the various ways in which these candlesticks can be interpreted would be useful.

However, if you are new to candlesticks trading, this article will help you gain a complete understanding of candlesticks.

______

The anatomy of the Candlesticks has stayed almost similar throughout the ages to give us the current shape and meaning. It consists of 4 distinct values namely:

The opening price,

Closing price,

The highest prices for a given interval, and

The lowest prices for a given interval.

It’s like a combination of a line chart and a bar chart, where each bar represents all four important pieces of information for an interval.

______

Body

The hollow or the filled portion of the candlestick is called as the body of the candlestick.

Long Body - Indicates heavy trading in one direction and strong buying or selling pressure

Small Body - Indicates lighter trading or little buying or selling activity

Shadow

The long thin lines above and below the body is called the shadow of the candlestick.

Upper Shadow - High is marked by the topmost part of the upper shadow

Lower Shadow - Low is marked by the bottom part of the lower shadow.

______

On the chart above, you can see how the body to shadow ratio defines the strength of the candlestick.

Learning to apply that in a combination with other technical tool can help you to quite reliable predict the price movements.

What do you want to learn in the next post?

History: A Brief History Of Candlesticks Introduction:

An important tool in financial analysis, the candlestick chart has a long, illustrious history that dates back several centuries. Candlestick charts, which have their roots in Japan, have developed into a popular way to visualize price changes and market patterns. Lets explore the intriguing history of candlestick charts, with special attention paid to their development, importance, and ongoing relevance in contemporary finance.

Origins in Japan:

Candlestick charts have their origins in Japan, specifically the Edo era in the 18th century. This novel approach to charting price changes is credited to a Japanese rice dealer by the name of Munehisa Homma. The "God of Markets," Homma, used candlestick charts to study and anticipate changes in the price of rice. His ideas and methods were recorded in a book titled "Sakata Rules," which served as the basis for this distinctive graphic display of market data.

Munehisa Homma below

Candlestick Chart Components:

Individual "candles," each of which represents a distinct time period (such as a day, week, or month) in the market, make up the basic building blocks of a candlestick chart. The open, high, low, and close prices are the four main elements that each candle is made up of. The upper and lower wicks or shadows of the candle indicate the peak and low prices that were experienced during the specified time period, while the body of the candle symbolizes the price range between open and close.

Popularization and Spread:

Candlestick charts were mostly exclusive to Japan up until the 19th century, when a British trader by the name of Charles Dow worked to bring them to the attention of the West. During his tour to Japan, Dow, the co-founder of Dow Jones & Company and architect of the Dow Jones Industrial Average, learned about candlestick charts. He translated Homma's findings and added candlestick analysis to his own technical analysis techniques after seeing their potential.

Charles Dow below

Further Development and Modern Application:

In terms of pattern recognition and interpretation, candlestick charts have improved and expanded over time. Steve Nison, an American trader who popularized candlestick analysis on Western financial markets, deserves most of the credit for this development. Nison carefully researched and built upon Munehisa Homma's studies, adding new candlestick patterns and improving the way they were interpreted. His 1991 publication of "Japanese Candlestick Charting Techniques," which is now considered a classic, popularized candlestick charts among Western investors.

Steve Nison below

Today, traders, investors, and technical analysts utilize candlestick charts extensively across a variety of financial markets, including stocks, commodities, and currency. The visual depiction of price patterns and trends aids in spotting potential trend reversals, continuations, and market emotion, offering insightful information for making decisions.

Conclusion:

The development of candlestick charts is proof positive of the value of visual aids in financial analysis. Candlestick charts, which have its roots in Japan from the 18th century, have developed into a widely used and essential instrument in the world of trading and investment. These charts have been improved and adjusted for contemporary markets thanks to the work of pioneers like Munehisa Homma, Charles Dow, and Steve Nison, giving traders a thorough perspective of price movements and insightful knowledge about market dynamics. Candlestick charts are expected to keep guiding traders and assisting them in making educated judgments in the complex world of finance as time goes on.

📊10 Candlestick Patterns You need To Know🔷 Bullish engulfing:

A candlestick pattern where a smaller bearish candle is followed by a larger bullish candle, indicating a potential reversal of a downtrend.

🔷 Bearish engulfing:

The opposite of a bullish engulfing pattern, where a smaller bullish candle is followed by a larger bearish candle, suggesting a potential reversal of an uptrend.

🔷Tweezer tops:

Two consecutive candlesticks with equal or near-equal high prices, indicating possible resistance and a potential reversal from an uptrend.

🔷Tweezer bottoms:

Similar to tweezer tops, but indicates support and a potential reversal from a downtrend.

🔷Bullish harami:

A bullish harami is a candlestick chart indicator used for spotting reversals in a bear trend. It is generally indicated by a small increase in price (signified by a white candle) that can be contained within the given equity's downward price movement (signified by black candles) from the past couple of days.

🔷Morning star:

A three-candle pattern consisting of a bearish candle, a small indecisive candle, and a bullish candle, indicating a potential reversal from a downtrend.

🔷Evening star:

The opposite of a morning star pattern, consisting of a bullish candle, a small indecisive candle, and a bearish candle, suggesting a potential reversal from an uptrend.

🔷Three white soldiers:

Three consecutive long bullish candles, typically seen as a strong bullish reversal pattern.

🔷Three black crows:

Three consecutive long bearish candles, often considered a bearish reversal pattern.

🔷Three inside up :

A bullish reversal pattern composed of a large down candle, a smaller up candle contained within the prior candle, and then another up candle that closes above the close of the second candle.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

🔋Candlestick Power📍Candlestick patterns are powerful tools used in technical analysis to analyze and predict price movements in financial markets, particularly in trading. They provide valuable insights into market sentiment and help traders make informed decisions. The open, close, and various components of a candlestick, such as the body and shadows, are crucial in determining whether it is bullish or bearish.

🔷A candlestick consists of a body and two shadows, also known as wicks or tails. The body represents the price range between the open and close of a trading period, while the shadows represent the high and low points reached during that period.

🔷A bullish candlestick occurs when the closing price is higher than the opening price, indicating buying pressure and market optimism. The body is typically filled or colored, indicating a bullish trend. The longer the body, the stronger the bullish sentiment. Shadows may exist above or below the body, and they represent the price range outside of the open and close. Long shadows indicate higher volatility during the trading period.

🔷A bearish candlestick forms when the closing price is lower than the opening price, reflecting selling pressure and market pessimism. The body is often empty or colored differently to indicate a bearish trend. Again, the length of the body provides information about the strength of the bearish sentiment. Shadows can be found above or below the body, representing the price range outside the open and close. Similar to bullish candles, long shadows suggest increased volatility.

Traders use different candlestick patterns and combinations to identify potential trend reversals, continuation patterns, or price consolidations. For example, a doji candlestick, where the open and close are very close or equal, signals indecision in the market and may precede a reversal. Engulfing patterns occur when one candle fully engulfs the body of the preceding candle, indicating a potential trend reversal. However, it is important to note that candlestick patterns should be used in conjunction with other technical indicators and fundamental analysis to confirm the validity of a potential trade signal.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

What is Heiken Ashi and how to use it?Are you looking for a new way to analyze the markets and identify trends? Heiken Ashi is a powerful charting technique that can help you do just that. It provides traders with an easy-to-read visual representation of price movements that can be used to make more informed trading decisions. In this blog post, we'll cover what Heiken Ashi is, why it's so beneficial, how to read the candlesticks, when to use it, and offer tips for trading with it. With this knowledge, traders can use Heiken Ashi to take their trading to the next level.

Definition of Heiken Ashi

Heiken Ashi is a charting technique used to identify trends and smoothen out price fluctuations. It was derived from the Japanese candlestick charting techniques, and it is based on open, high, low and close prices from the previous session. When these prices are averaged, they form Heiken Ashi candlesticks which can be used to analyse market movements. The colors of the Heiken Ashi candlesticks are determined by the relationship of the current open and close prices compared to the previous session's open and close price. If the current open price is greater than or equal to that of the previous session, then a green or blue candle will appear on your chart; conversely if the current open price is less than that of the previous session, then a red or yellow candle will appear. By using this information traders can make informed decisions about when to enter and exit positions in order to maximize profits. Heiken Ashi also helps reduce volatility in comparison with regular Japanese candlesticks as it takes into account both recent and historical information when plotting candles. This allows traders to see a clearer picture of what’s going on in their chosen markets without being overwhelmed by too much noise or irrelevant data points. Additionally, since Heiken Ashi plots values over time rather than simple one-time snapshots like traditional candlestick charts do, traders can use this information to better predict future trends in their chosen markets. Overall, Heiken Ashi is an incredibly useful tool for any trader who wants to accurately identify trends in their chosen markets and make more informed trading decisions based on real-time data analysis. By leveraging its capabilities traders can gain insight into market movements more quickly and accurately than ever before.

Benefits of Heiken Ashi

The Heiken Ashi charting technique is a valuable asset for traders of any skill level. It can help investors easily identify trends, smoothing out the price action to offer a clearer picture of the market. This strategy is especially useful in range-bound markets, where it can signal when trends are likely to change direction.

Heiken Ashi also assists in identifying potential entry points with greater accuracy by recognizing patterns earlier on. In volatile markets, this technique can be even more beneficial as it helps traders prepare for sudden price movements before they occur. By combining Heiken Ashi with other strategies such as Fibonacci retracements and Elliot Wave Theory, traders have a better chance at predicting market direction and making sound trading decisions for increased profits.

Overall, Heiken Ashi's ability to smooth out price action and recognize potential entry points gives investors an advantage in their chosen markets that unassisted candlestick charts cannot offer. With its multitude of benefits, traders of all levels may find this tool very advantageous when trying to achieve success in their investments and trades.

How to read Heiken Ashi Candlesticks?

Heiken Ashi candlesticks are constructed using open, high, low and close prices from the previous session. The colors of the Heiken Ashi candles indicate whether the current open and close prices are higher or lower than the previous session’s open and close price. Red/black Heiken Ashi candles indicate a bearish candle, while green/white Heiken Ashi candles indicate a bullish candle. If the red/black candle is followed by a green/white candle - this indicates an uptrend, while if the green/white candle is followed by a red/black one - it indicates a downtrend.

The Doji candlestick is another type of Heiken Ashi candle which occurs when the opening and closing prices of a session are equal to each other - this typically indicates some indecision in the market. When trading with Heiken Ashi, it is important to always be aware of support and resistance levels as they can help you identify potential entry points in your chosen markets. Support levels occur when there is enough buying pressure to push prices back up after they have dropped below them, while resistance levels occur when there is enough selling pressure to push prices back down after they have risen above them. A break of either support or resistance could signal an impending trend reversal, so traders should always pay attention to these levels when trading with Heiken Ashi.

Finally, traders should also be aware that false signals may appear on their charts due to lagging indicators like moving averages or oscillators; therefore it's important to use additional strategies such as Fibonacci retracements or Elliot Wave Theory in order to confirm any potential trade opportunities before entering them into your chosen markets. With this knowledge about how to read Heiken Ashi candlesticks combined with other strategies like Fibonacci retracements or Elliot Wave Theory, traders can make more informed decisions when trading with Heiken Ashi.

When to use Heiken Ashi?

When it comes to trading with Heiken Ashi, timing is key. The Heiken Ashi technique can be used to identify trends and trend reversals, allowing traders to make more informed decisions about when to enter or exit the markets. It is especially useful in volatile and ranging markets, where traditional analysis techniques may not provide enough information to accurately predict price movements.

Heiken Ashi candles can also help traders identify entry and exit points. By looking at the color of the candles, traders can determine whether a trend is likely to continue or reverse. For example, if the most recent candle is red, indicating a bearish trend, then this could signal an upcoming reversal in price. Similarly, a green candle indicates that the current bullish trend may continue for some time longer. However, it’s important to remember that Heiken Ashi signals should only be used as part of a larger trading strategy; they should not be relied upon alone as they do not always accurately indicate future market direction.

Many traders use additional indicators such as Fibonacci retracements or Elliot Wave Theory in combination with Heiken Ashi candles for even more accurate signals. When combined with other analysis techniques such as support and resistance levels or moving averages, Heiken Ashi can provide valuable insight into potential entry and exit points in any given market. Additionally, traders should pay attention to volume when using Heiken Ashi candles; if there is an unusually high volume on a particular day this could indicate that there are larger players at play who may influence future market direction.

Finally, it’s worth noting that although Heiken Ashi works on all timeframes from one minute up to monthly charts, it tends to be more accurate on longer timeframes such as daily or weekly charts due to its smoothing effect which reduces noise from shorter-term fluctuations in prices. Ultimately however which timeframe you choose depends on your personal trading preferences and goals; so experiment with different settings until you find something that works for your particular situation.

Tips for Trading with Heiken Ashi

Using Heiken Ashi in trading can be a great way to identify and take advantage of market trends. Here are some tips for using Heiken Ashi in trading:

Utilizing Trend Lines: Utilizing trend lines is an important part of trading with Heiken Ashi. When the candles begin to form a pattern, traders should draw trend lines to better understand the direction of the market. These trend lines can help traders identify potential entry and exit points, as well as any potential stops that need to be set.

Pay Attention To Color and Direction: Traders should pay close attention to changes in color and direction of the Heiken Ashi candles. When there is a change in color or direction, this could be an indication of a potential reversal or continuation of a trend.

Multiple Time Frames: Using multiple time frames can help traders get an overall picture of the trend they are looking at. For example, looking at both daily charts and hourly charts may give traders an idea of whether current trends will continue or if they have reached their peak.

Risk Management: Practice risk management when trading with Heiken Ashi. Risk management includes setting stop loss orders to protect against possible losses due to sudden price movements, utilizing proper position sizing according to your current account balance, and keeping emotions such as fear and greed out of your trading decisions.

Setting Stop Loss Orders: Setting stop loss orders can help protect against unexpected losses due to sudden price movements. By setting these orders ahead of time, it allows traders to minimize their losses if the trade does not work out as expected.

By following these tips for trading with Heiken Ashi, traders can use this technique effectively when making more informed decisions about their trades.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Ichimoku SwingHere a swing forms. The bearish engulfing pattern is followed by a doji harami pattern...there are other patterns but they are incomplete. The cloud helps time entries for late resistance. If the swing is reversing bearish, fill bearish under the engulfing swing -- on the bearish side of the cloud. Note: the lows are first order volatility, so omit them...the highs are second order volatility, so include them.

Learn the Strongest Reversal Candlestick Patterns

Hey traders,

In this educational article, we will discuss powerful reversal candlestick patterns that every trader must know.

Bullish Engulfing Candle

Bullish engulfing candle is one of my favorite ones.

It usually indicates the initiation of a bullish movement after a strong bearish wave.

The main element of this pattern is a relatively big body. Being bigger than the entire range of the previous (bearish) candle, it should completely "engulf" that.

Such a formation indicates the strength of the buyers and their willingness to push the price higher.

Bearish Engulfing Candle

The main element of this pattern is a relatively big body that is bigger than the entire range of the previous (bullish) candle.

Such a formation indicates the strength of the sellers and their willingness to push the price lower.

________________________

Bullish Inside Bar

Inside bar formation is a classic indecision pattern.

It usually forms after a strong bullish/bearish impulse and signifies a consolidation.

The pattern consists of 2 main elements:

mother's bar - a relatively strong bullish or bearish candle,

inside bars - the following candles that a trading within the range of the mother's bar.

The breakout of the range of the mother's bar may quite accurately confirm the reversal.

A bullish breakout of its range and a candle close above that usually initiates a strong bullish movement.

Bearish Inside Bar

A bearish breakout of the range of the mother's bar and a candle close below that usually initiates a strong bearish movement.

________________________

Doji Candle (Morning Star)

By a Doji we mean a candle that has the same opening and closing price.

Being formed after a strong bearish move, such a Doji will be called a Morning Star. It signifies the oversold condition of the market and the local weakness of sellers.

Such a formation may quite accurately indicate a coming bullish movement.

Doji Candle (Evening Star)

Being formed after a strong bullish move, such a Doji will be called an Evening Star. It signifies the overbought condition of the market and the local weakness of buyers.

Such a formation may quite accurately indicate a coming bearish movement.

I apply these formations for making predictions on financial markets every day. They perfectly work on Forex, Futures, Crypto markets and show their efficiency on various time frames.

❤️Please, support my work with like, thank you!❤️

Advantages of Haiken Ashi over traditional candles [CRYPTO]Haiken Ashi candles are a very popular type of charts used in Forex trading. Unlike traditional Japanese candles, the Haiken Ashi chart uses a special algorithm to process the price data, which makes it easier to read trends and market direction.

Benefits:

What are the benefits of using Haiken Ashi candles? First of all, such charts allow us to detect market trends more clearly and easily read. In addition, Haiken Ashi charts allow us to more easily determine entry and exit points of positions, as well as determine stop loss and take profit.

Construction of Haiken Ashi candles:

Let's start by defining what Haiken Ashi candles actually are. These candles differ from traditional Japanese candles in many ways. First of all, in Haiken Ashi charts, the opening price of each new candle is the average of the opening and closing prices of the previous candle. The closing price, on the other hand, is the average of four values: the opening price, the closing price, the highest price and the lowest price. As a result, the opening and closing price of subsequent candles lags behind traditional Japanese candles.

Advantages of Haiken Ashi:

How can we use Haiken Ashi candles in Forex trading? First of all, it allows us to detect market trends more clearly and easily read. As a result, we can more easily determine entry and exit points for positions, and determine stop loss and take profit.

Strategies:

Trend strategy - involves using Haiken Ashi candles to identify market trends. For an uptrend, we wait for a series of green candles to appear, while for a downtrend, we wait for a series of red candles to appear. Once the trend is identified, we can open a position according to its direction.

Double candlestick strategy - involves waiting for the occurrence of two consecutive Haiken Ashi candles of opposite colors. When a red candle is followed by a green candle, this is a buy signal. On the other hand, when a green candle is followed by a red candle, it is a sell signal.

Inner candle strategy - involves waiting for the appearance of the Haiken Ashi candle, the body of which is completely contained in the body of the previous candle. When such a situation occurs, we can open a position according to the direction of the trend.

Reversal candle strategy - consists in waiting for the appearance of a long red candle after a series of green candles or a long green candle after a series of red candles. The appearance of such a candle may indicate a reversal of the trend, which gives a signal to open a position against the existing trend.

In conclusion, Haiken Ashi candles are a tool that can be very useful in Forex technical analysis. With this tool, we can more easily detect market trends, determine entry points.

On the other hand, Haiken Ashi candles are an addition to a set of various indicators for technical analysis. In our Manticore Invesmtents Scalping strategy, we combine Haiken Ashi candles with a strategy based on RSI and Bollinger Bands.

In the next parts of the tutorials, let's describe the use of RSI and BB.

Advantages of Haiken Ashi over traditional Japanese candlesHaiken Ashi candles are a very popular type of charts used in Forex trading. Unlike traditional Japanese candles, the Haiken Ashi chart uses a special algorithm to process the price data, which makes it easier to read trends and market direction.

Benefits:

What are the benefits of using Haiken Ashi candles? First of all, such charts allow us to detect market trends more clearly and easily read. In addition, Haiken Ashi charts allow us to more easily determine entry and exit points of positions, as well as determine stop loss and take profit.

Construction of Haiken Ashi candles:

Let's start by defining what Haiken Ashi candles actually are. These candles differ from traditional Japanese candles in many ways. First of all, in Haiken Ashi charts, the opening price of each new candle is the average of the opening and closing prices of the previous candle. The closing price, on the other hand, is the average of four values: the opening price, the closing price, the highest price and the lowest price. As a result, the opening and closing price of subsequent candles lags behind traditional Japanese candles.

Advantages of Haiken Ashi:

How can we use Haiken Ashi candles in Forex trading? First of all, it allows us to detect market trends more clearly and easily read. As a result, we can more easily determine entry and exit points for positions, and determine stop loss and take profit.

Strategies:

Trend strategy - involves using Haiken Ashi candles to identify market trends. For an uptrend, we wait for a series of green candles to appear, while for a downtrend, we wait for a series of red candles to appear. Once the trend is identified, we can open a position according to its direction.

Double candlestick strategy - involves waiting for the occurrence of two consecutive Haiken Ashi candles of opposite colors. When a red candle is followed by a green candle, this is a buy signal. On the other hand, when a green candle is followed by a red candle, it is a sell signal.

Inner candle strategy - involves waiting for the appearance of the Haiken Ashi candle, the body of which is completely contained in the body of the previous candle. When such a situation occurs, we can open a position according to the direction of the trend.

Reversal candle strategy - consists in waiting for the appearance of a long red candle after a series of green candles or a long green candle after a series of red candles. The appearance of such a candle may indicate a reversal of the trend, which gives a signal to open a position against the existing trend.

Veiling candle strategy - involves waiting for the appearance of a large Haiken Ashi candle, the body of which completely obscures the body of the previous candle. In this case, we can open a position according to the direction of the trend.

In conclusion, Haiken Ashi candles are a tool that can be very useful in Forex technical analysis. With this tool, we can more easily detect market trends, determine entry points.

On the other hand, Haiken Ashi candles are an addition to a set of various indicators for technical analysis. In our Manticore Invesmtents Scalping strategy, we combine Haiken Ashi candles with a strategy based on RSI and Bollinger Bands.

In the next parts of the tutorials, let's describe the use of RSI and BB.

💥 Bullish VS Bearish Candlesticks📍Bullish and bearish candlestick patterns are technical analysis tools used by traders to identify potential market trends and reversals. Bullish patterns indicate a potential rise in the price of an asset, while bearish patterns indicate a potential decline in price.

🔷 Bullish candlestick patterns include the dragonfly doji, hammer, tweezer bottom, morning star engulfing and three white soldiers. These patterns suggest that buying pressure is increasing and that there may be a potential for a trend reversal.

🔷 Bearish candlestick patterns include the gravestone doji, inverted hammer, tweezer top three black crows and more. These patterns suggest that selling pressure is increasing and that there may be a potential for a trend reversal.

🔷When using candlestick patterns for trading, it's important to look for confluence with other signals, such as trend lines, support and resistance levels, and other technical indicators. Combining multiple signals can provide a stronger indication of potential market movements and help traders make more informed trading decisions.

🔷It's also important to note that candlestick patterns should not be relied on as the sole indicator for trading decisions, as they are not always accurate and can produce false signals. Traders should always use a combination of technical analysis tools and fundamental analysis when making trading decisions. This is why its important to create and monitor your own strategy and backtest what works and what doesn't.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

📊 The Doji Candle Pattern📍What is the Doji Candlestick Pattern?

The Doji Candlestick Pattern refers to a chart pattern consisting of a single candle. This pattern appears when the opening and closing prices of a candle are nearly the same or identical, resulting in a small-bodied candle with upper and lower wicks resembling a "+". Different variations of Doji patterns exist, with unique names like the Long-legged Doji, Gravestone Doji, Dragonfly Doji, and Doji star candlestick pattern. Regardless of the type, all Doji patterns provide traders with four critical data points: the open, close, high, and low prices for the given period. Doji patterns can occur on any timeframe and in any market, making them the foundation of many trading strategies

🔹Long-legged Doji

The Long-legged Doji pattern has an elongated upper and lower wick and a small body

The Long-legged Doji can be interpreted in several ways and works best when viewed in context with price action. It is a potential price reversal signal in a defined up or downtrend. If it occurs in a flat market, it suggests further consolidation.

🔹Dragonfly Doji

The Dragonfly Doji sets up when the candle’s open, close, and high is approximately the same. Visually, the Dragonfly looks like a “T,” as depicted in the image below. This formation suggests that heavy selling was present, but the market has rebounded. As a general rule, the Dragonfly is considered a reversal indicator. A retracement in price is expected when it occurs at the top of a bullish trend.

🔹Gravestone Doji

The Gravestone Doji pattern is the polar opposite of the Dragonfly; it appears as an inverted “T” and signals that heavy buying has given way to selling. The Gravestone Doji is a reversal chart pattern that signals downward or upward pressure may be on the way. The Gravestone suggests that a reversal is possible when observed within a defined uptrend. Within a downtrend, bullish price action may be forthcoming.

🔸Reversals

Doji candlesticks can be a great way to get in or out of the market in trending markets. The Gravestone and Dragonfly are ideal for reversal strategies as they indicate forthcoming upward and downward movements in price.

🔸Breakouts

One of the lowest-risk ways to utilize Dojis in the FX market is to trade breakouts. A breakout is a sudden directional move in price. Dojis often precede breakouts, as they are a signal of indecisiveness. As soon as the market makes up its mind, a significant move may be in the offing.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

🔎 A Look Inside The Candlestick Chart📍What Is a Candlestick?

The formation of the candle is essentially a plot of price over a period of time. For this reason, a one minute candle is a plot of the price fluctuation during a single minute of the trading day. The actual candle is just a visual record of that price action and all of the trading executions that occurred in one minute.

[b📍Who Discovered the Idea of Candlestick Patterns?

It is commonly believed that candlestick charts were invented by a Japanese rice futures trader from the 18th century. His name was Munehisa Honma.

Honma traded on the Dojima Rice Exchange of Osaka, considered to be the first formal futures exchange in history.

As the father of candlestick charting, Honma recognized the impact of human emotion on markets. Thus, he devised a system of charting that gave him an edge in understanding the ebb and flow of these emotions and their effect on rice future prices.

📉Bearish Candle

🔹 Open Price: A bearish candlestick forms when the opening price of a currency pair is higher than the closing price of the previous candlestick.

🔹 High and Low Price: During the candlestick's time frame, the price moves higher than the opening price and then declines to form a lower low than the previous candlestick.

🔹 Body: The body of the bearish candlestick is colored red and represents the difference between the opening and closing price. The longer the body of the candlestick, the stronger the bearish sentiment.

🔹 Upper Shadow: The upper shadow of the candlestick represents the highest price achieved during the candlestick's time frame. The longer the upper shadow, the greater the bearish pressure.

🔹 Lower Shadow: The lower shadow of the candlestick represents the lowest price achieved during the candlestick's time frame. The shorter the lower shadow, the stronger the bearish sentiment.

📈Bullish Candle

🔹 Open Price: A bullish candlestick forms when the opening price of a currency pair is lower than the closing price of the previous candlestick.

🔹 High and Low Price: During the candlestick's time frame, the price moves lower than the opening price and then rises to form a higher high than the previous candlestick.

🔹 Body: The body of the bullish candlestick is colored green and represents the difference between the opening and closing price. The longer the body of the candlestick, the stronger the bullish sentiment.

🔹 Upper Shadow: The upper shadow of the candlestick represents the highest price achieved during the candlestick's time frame. The shorter the upper shadow, the greater the bullish pressure.

🔹 Lower Shadow: The lower shadow of the candlestick represents the lowest price achieved during the candlestick's time frame. The longer the lower shadow, the greater the bullish sentiment.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

What is Candlestick Pattern?Candlestick patterns are a charting technique used by traders to analyze the price movement of financial instruments. They originated in Japan in the 18th century and were used to track the price of rice. The technique was later adapted for trading other assets like stocks, currencies, commodities, and cryptocurrency.

Candlestick patterns are an important tool used by traders and investors to analyze the price movement of financial assets. A candlestick is a visual representation of the price movement of an asset during a specific time period. Each candlestick represents the opening, closing, high, and low prices of the asset during the period. The shape and color of the candlestick provide important information about the price movement of the asset.

Candlestick patterns are formed by the combination of one or more candlesticks, and they can indicate a potential trend reversal, continuation, or indecision in the market. Some candlestick patterns are based on just one candlestick, while others are based on combinations of two or more candlesticks.

A bearish candle (red candle) represents a period of trading where the closing price is lower than the opening price. This indicates that sellers were able to push the price down, indicating a negative sentiment in the market. The bearish candle has a long body and a small lower wick, indicating that sellers were in control for most of the trading period.

A bullish candle (green candle) represents a period of trading where the closing price is higher than the opening price. This indicates that buyers were able to push the price up, indicating a positive sentiment in the market. The bullish candle has a long body and a small upper wick, indicating that buyers were in control for most of the trading period.

Both bullish and bearish candles can come in various sizes and shapes, indicating different levels of buying or selling pressure. For example, a long bullish candle with no or a very small upper shadow could indicate strong buying pressure, while a short bullish candle with a long upper wick could indicate weaker buying pressure.

Different types of candlesticks Pattern:

1. Bullish Candlestick Pattern

- Hammer

- Inverse Hammer

- Bullish Harami

- Bullish Engulfing

- Morning Star

- Three white soldiers

2. Bearish Candlestick Pattern

- Shooting star

- Hanging man

- Bearish Harami

- Bearish Engulfing

- Evening star

- Three black crows

Doji: Gravestone Doji

Dragonfly Doji

Long-legged Doji ( Spinning top )

In the upcoming post, we will elaborate on the various types of candlesticks and how to use them.

Thanks

Hexa

📊 Candlestick CheatsheetCandlestick charts are commonly used in trading to analyze market trends and make trading decisions. Candlesticks can be categorized as bullish or bearish, depending on whether the price has increased or decreased over a given period.

It is important to note that while candlestick patterns can be useful in predicting market movements, they should not be used in isolation, and other indicators and analysis should also be considered. It is also important to have a clear understanding of the market and its underlying fundamentals before making any trading decisions.

🔹 Rails

The rails pattern is a two-candlestick pattern that typically occurs during a downtrend. The first candle is a long red candle, followed by a long green candle that opens below the previous day's close but closes above it, creating a rail-like pattern.

🔹 Three White Soldiers

The three white soldiers pattern is a bullish pattern that consists of three consecutive long green candles with small or no wicks. It typically occurs after a downtrend and suggests a reversal in the market's direction.

🔹 Three Black Crows

The three black crows pattern is a bearish pattern that consists of three consecutive long red candles with small or no wicks. It typically occurs after an uptrend and suggests a reversal in the market's direction.

🔹 Mat Hold

The mat hold pattern is a five-candlestick pattern that occurs during a bullish trend. It consists of a long green candle, followed by three small candles with lower highs and higher lows, and ending with another long green candle.

🔹 Pinbar

The pinbar pattern is a single candlestick pattern that has a long tail or wick and a small body. The tail should be at least two times the length of the body. The pattern suggests a reversal in the market's direction.

🔹 Engulfing

The engulfing pattern is a two-candlestick pattern that occurs when the second candle's body completely engulfs the previous candle's body. A bullish engulfing pattern occurs during a downtrend and suggests a reversal in the market's direction, while a bearish engulfing pattern occurs during an uptrend and suggests a reversal in the market's direction.

🔹 Morning Star

The morning star pattern is a three-candlestick pattern that typically occurs after a downtrend. It consists of a long red candle, a small candle, and a long green candle, with the small candle gapping down from the previous day's close. The pattern suggests a reversal in the market's direction.

🔹 Evening Star

The evening star pattern is the opposite of the morning star pattern and typically occurs after an uptrend. It consists of a long green candle, a small candle, and a long red candle, with the small candle gapping up from the previous day's close. The pattern suggests a reversal in the market's direction.

👤 @algobuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

The Three Black Crows PatternThe Three Black Crows or as otherwise known Three Soldiers are a formation of price continuation showing how the bears are taking control over the bulls to reverse the trend as we can see here.

Price comes down buyers try to push it back up only to be reversed by sellers overpowering them so it falls back down the buyers try again but realise the bear is the almighty and with that last attempt they withdraw from the market causing a big sell off with a strong downward movement when just the bears remain

key points:

- last attempt of the bulls

- price goes up and bears push price down every time

- bears in control after a long uptrend shows prelude to sell

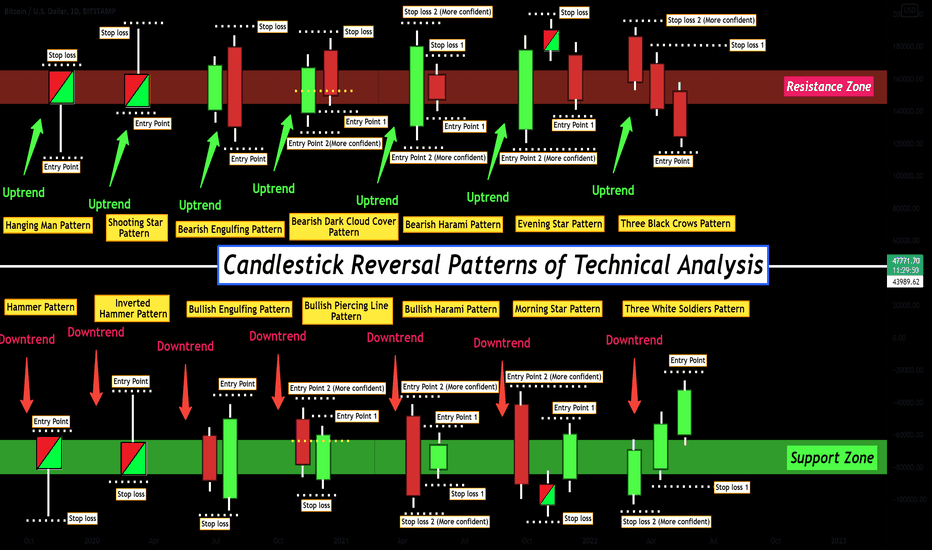

Candlestick Reversal Patterns of Technical Analysis !!!👨🏫 In this post, I tried to show you the most important Candlestick Reversal Patterns of Technical Analysis with Entry points & Stop loss points . you can use these patterns for Triggers of your traders at any timeframe ⏰ (These patterns are more valid at higher timeframes).

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends, Thanks, and Trade safe.

What Is A Candlestick ❗️❓

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and

daily momentum for hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price

(black/red if the stock closed lower, white/green if the stock closed higher).

Bullish Pattern 🌅:

🟢 Hammer Pattern : A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period.

🟢 Inverted Hammer Pattern : The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signaling a potential bullish reversal. The inverted hammer pattern gets its name from its shape – it looks like an upside-down hammer. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick, and a small body.

🟢 Bullish Engulfing Pattern : A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

🟢 Bullish Piercing Line Pattern : A piercing pattern is a two-day, candlestick price pattern that marks a potential short-term reversal from a downward trend to an upward trend. The pattern includes the first day opening near the high and closing near the low with an average or larger-sized trading range. It also includes a gap down after the first day where the second day begins trading, opening near the low and closing near the high. The close should also be a candlestick that covers at least half of the upward length of the previous day's red candlestick body.

🟢 Bullish Harami Pattern : The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

🟢 Morning Star Pattern : A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators.

🟢 Three White Soldiers Pattern : Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high. These candlesticks should not have very long shadows and ideally open within the real body of the preceding candle in the pattern.

Bearish Patterns 🌄:

🔴 Hanging Man Pattern : The hanging man is a type of candlestick pattern. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. The term "hanging man" refers to the candle's shape and what the appearance of this pattern infers. The hanging man represents a potential reversal in an uptrend. While selling an asset solely based on a hanging man pattern is a risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The strength in the uptrend is no longer there.

🔴 Shooting Star Pattern : A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near the open again. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star's body. There should be little to no shadow below the real body.

🔴 Bearish Engulfing Pattern : A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

🔴 Bearish Dark Cloud Cover Pattern : Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle (typically black or red) opens above the close of the prior up candle (typically white or green), and then closes below the midpoint of the up candle. The pattern is significant as it shows a shift in the momentum from the upside to the downside. The pattern is created by an up candle followed by a down candle. Traders look for the price to continue lower on the next (third) candle. This is called confirmation.

🔴 Bearish Harami Pattern : A bearish harami is a two-bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle. An uptrend precedes the formation of a bearish harami.

🔴 Evening Star Pattern : An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. The opposite of the evening star is the morning star pattern, which is viewed as a bullish indicator.

🔴 Three Black Crows Pattern : Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, high, low, and closing prices for a particular security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle. Often, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal.

6 Reliable Bullish Candlestick PatternHello dear traders,

Here are some educational chart patterns that you must know in 2022 and 2023.

I hope you find this information educational and informative.

We are new here so we ask you to support our views with your likes and comments,

Feel free to ask any questions in the comments, and we'll try to answer them all, folks.

6 Reliable Bullish Candlestick Pattern

1) The Hammer

2) Bullish Engulfing Crack

3) Bearish Engulfing Sandwich

4) Morning Star

5) Tweezer Bottom

6) Piercing Line

1. The Hammer:-

Hammer is a bullish candlestick reversal candle.

Which is formed within the next few candles. As the price declines sharply, we anticipate a final bounce.

But how can we estimate without falling into overselling?

That's where Hammer comes into play. This gives us evidence that the selling pressure is subsiding or being absorbed. Furthermore, if the volume signature associated with the hammer candle is significant, it adds even more confidence to our thesis.

We are looking to cash in on shorts who are taking profits and covering, as well as dip buyers who are taking chances here on oversold positions. Expectation? an assembly.

Ideally, you identify a hammer candle, take a long position on a break on the upside of the candle, and set risk on the low or in the body of the hammer.

Bullish Hammer Example;-

Let’s look at a real-life example with BTC. Right off the open, BTC retests the lows from the pre-market. Once it reaches those levels, volume increases slightly as it reverses on the 5-minute chart seen here.

Visibly, there is a “shelf” forming near the low of the hammer candle’s body. The bar to the left and right is also closed and open in that price “shelf” area.

The second 5-minute chart opens with a bit of weakness, then rallies strongly above the Hammer candle.

This is your signal to go long. The break of the Hammer candle body.

Set the stop below the close of this bullish 5-minute candle.

2. Bullish Engulfing Crack:-

You can imagine that shorts will start covering given the rising price of the stock. This adds fuel to the already existing buying pressure.

The result is a bullish candlestick pattern that swallows up the bears' efforts. For the long-biased trader, the opportunity is perfect.

As is the case with any setup, we are looking for evidence to sway our confidence in either direction. The fact that the bears completely got away in this single bar is proof enough for us.

You go long on the break of the previous bar and set the stop on the low.

Bullish Engulfing Examples:-

Here's a snapshot of BTC, which provided us with a beautiful opening range breakout (ORB) opportunity right out of the gate on this particular day:

After the selloff, buyers come in and remove the selling pressure from the pre-market, engulfing the bears before moving up.

To be safe, you enter long when the red candle breaks, setting your risk at the low level or body of the first green candle.

There are some advanced traders who are more aggressive and may take their positions early if they feel a reversal is imminent.

3. Bearish Engulfing Sandwich:-

do not be confused. Just because the name says "bearish" doesn't mean it's a bearish pattern. Far from it, actually. It is often referred to as a stick sandwich.

The name is derived from the sandwiching of a "bearish engulfing" candle by two bullish candles. Thus, it is a bullish candlestick pattern in this context.

Similar to the above example of a Bullish Engulfing Crack, this pattern takes a bit longer to "move through" so to speak. Essentially an extra bar.

The perception is that the trend has reversed and we are now going down. After all, the bearish engulfing candle gives us that confidence,

If you're on the smaller side, there's hope. However, stocks don't always do what we want them to. We have to react to what the market gives us, not what we think should happen.

In this case, the Bearish Engulfing Crack is used by two bullish candles that move upwards. If you are short, hopefully, you have respected your stop loss. If you are a long-time bias, here is a good opportunity for you.

Bearish Engulfing Sandwich Example:-

After opening with a 5-minute candle chart, BTC gives a great view of it in real-time.