Chartanalysis

USD/JPY 4H –analysis Buy setupUSD/JPY (U.S. Dollar / Japanese Yen)

Timeframe: 4-Hour (4H)

Trend: Bullish Trendline Support – Price is respecting a strong ascending trendline.

Indicators: Ichimoku Cloud is visible; current price is above the cloud = bullish bias.

Current Price: Around 147.95.

---

✅ Buy Entry:

Entry Zone: Between 147.90 – 148.10

(As price is bouncing from the trendline support and Ichimoku cloud.)

🎯 Buy Targets:

1. Target 1: 148.99 (Previous structure resistance)

2. Target 2: 150.50 (Next resistance level)

3. Target 3 (Swing): 152.00+ (If momentum continues)

🛑 Stop Loss:

Below trendline + Ichimoku support = 146.80 (safe zone)

---

🔖 Chart Title Suggestion:

"USD/JPY 4H – Trendline Rebound with Bullish Momentum Targeting 150+"

GOLD Weekly Recap & Outlook (Week 31 | July 28 – Aug 01)Note: Some elements may shift depending on your screen size. View the full snapshot in perfect layout:

📈 CAPITALCOM:GOLD

Timeframe: 30m | MJTrading View

⸻

🔹 Weekly Performance

• Open: 3,320.06

• High: 3,363.63

• Low: 3,268.05

• Close: 3,363.05

Gold delivered a classic Smart Money move this week: liquidity sweep, structural shift, and bullish expansion.

⸻

🔹 Price Action Breakdown

1️⃣ Early Week: Bearish Continuation

• Price opened around 3,320 with a gap and extended last week’s bearish leg.

• Formed lower lows (LL) and a bearish flag, signaling continuation.

2️⃣Midweek: Liquidity Grab, Reversal Point and

• Last Bearish leg marks the exhaustion gap and stop run.

• Market printed a liquidity sweep below 3,310 then 3,280 (weekly low), trapping late sellers.

• Smart Money likely absorbed sell-side liquidity before initiating the reversal leg.

• This aligns perfectly with SMC principles: sweep → accumulation → expansion.

3️⃣ Late Week Rally

• Following NFP & Unemployment Rate news, price broke 3,333 and rallied strongly to 3,363.63 confirming a Bullish Market Structure Shift (MSS).

• Resistance turned into support, validating the accumulation phase.

• Price rallied strongly to 3,363.63,.

• The weekly candle flipped bullish, closing near the high, with Smart Money leaving a clear footprint of accumulation and expansion.

⸻

🎯 Key Levels & Outlook

• Support: 3,355 → 3,333 - 3,340

• Resistance: 3,377 → 3,380+

• Bias: Bullish above 3,333.

• Watch for liquidity sweeps of intraday lows to catch new long entries, targeting 3420-3440.

⸻

💡 MJTrading View:

A structural shift and weekly strong close confirms bullish intent into next week.

As long as 3,333 holds, dips are buying opportunities.

⸻

Please share your opinions...

#MJTrading #GoldAnalysis #SmartMoney #LiquiditySweep #PriceAction #MarketStructure #Forex #TradingView #ChartDesigner #BullishMarket

Fortnight Overview:

Psychology Always Matters:

"BTC Sweeps Liquidity – Eyeing 115K Reclaim?""BTC Sweeps Liquidity – Eyeing 115K Reclaim?"

🔍 Technical Analysis – BTC/USD

On the 1H chart, Bitcoin (BTC) is currently displaying a textbook smart money structure, with price action following key institutional footprints.

🔑 Key Observations:

Liquidity Grab at Weak Low

Price dipped below the local support (~112,500), sweeping sell-side liquidity and tapping into a possible reversal zone.

Rejection from Demand Zone (Support Area)

A strong reaction occurred right at the support level, suggesting buyer interest is still present.

Order Block & Fair Value Gap

A visible Fair Value Gap (FVG) sits above current price action, aligning with an Order Block near the 115,000 level — this is a key magnet for price to rebalance.

Target Zone

Immediate upside target is 115,000, where an order block lies. If price reaches that level, expect potential short-term resistance or reversal.

Break of Structure (BOS) Confirmations

Multiple BOS and CHoCHs indicate bearish-to-bullish attempts, but the current structure still needs confirmation above 113,500+ for bullish continuation.

🧠 Conclusion & Expectation:

BTC has swept liquidity to the downside and may now seek to fill the FVG and revisit the 115K order block. However, confirmation is required — watch for bullish engulfing candles, volume spikes, or a CHoCH above 113,500.

“Smart money doesn’t chase — it waits for liquidity, then repositions. BTC may be following the same script.”

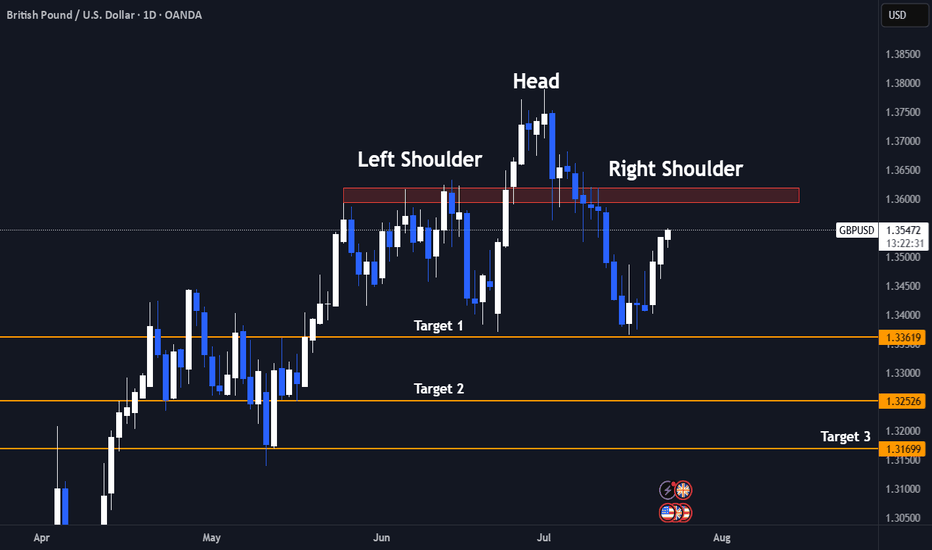

GBP/USD 4H Chart – Head and Shoulders Breakdown with Bearish Currency Pair: GBP/USD (British Pound vs US Dollar)

Timeframe: 4-Hour (4H)

Platform: TradingView

---

🔍 Pattern Identified:

Head and Shoulders Pattern

Left Shoulder, Head, and Right Shoulder are marked.

The neckline is broken, confirming a bearish trend reversal.

The trendline from March to June was also broken, supporting a downtrend.

---

📍 Current Price (at screenshot time):

Around 1.32778

---

🎯 Sell Setup – Target Levels:

🔻 First Target:

Price: 1.30072

Labelled: "1st TARGET POINT"

This is a near-term support level or conservative projection of the Head and Shoulders move.

🔻 Second Target:

Price: 1.28023

Labelled: "2nd TARGET POINT"

This is a deeper target, likely the full measured move of the pattern.

---

📈 Entry & Risk Management:

Suggested Sell Entry Zone: Around 1.32778

Stop-Loss (SL): Consider placing above the Right Shoulder area (around 1.3350–1.3380)

Take-Profit (TP):

TP1: 1.30072

TP2: 1.2802

AUD/USD Bearish Breakout – Retest & Sell Continuation SetupAUD/USD (Australian Dollar vs. US Dollar)

Likely a 4H (4-hour) timeframe based on candlestick density and scale.

---

2. Structure & Patterns:

Rising wedge/ascending channel: Already broken to the downside.

Breakout zone: Around 0.6480–0.6500, clearly marked and now acting as resistance.

Retest confirmed: Price returned to the broken zone, touched resistance, and dropped.

Ichimoku Cloud: Price is below the cloud → strong bearish signal.

Downward projection: You’ve drawn a possible bearish path with lower highs and lower lows.

---

3. Key Support & Target Levels:

✅ Current Price (as per chart):

Around 0.6468

🎯 Target Points (as per your drawing):

1. First Target Point → 0.6400

This aligns with previous minor support.

2. Second Target Point → 0.6370

Likely based on a Fibonacci or historical support level.

---

✅ Clear Trade Setup Summary:

Component Value

Direction Sell (Short)

Entry 0.6475–0.6485

Stop-Loss 0.6520

TP1 0.6400

TP2 0.6370

---

📌 Conclusion:

You are currently in a bearish setup after a breakdown from a rising structure. The market structure favors lower prices with clearly marked TP1 at 0.6400 and TP2 at 0.6370. Your entry zone (0.6475–0.6485) is technically sound, especially if there's a minor retracement.

Let me know if you want:

A Fibonacci analysis

RSI/MACD confirmation

BTC/USDT Bearish Continuation SetupChart Identification:

Timeframe: Likely 1H or 4H

Pair: BTC/USDT

Indicators: Ichimoku Cloud

Pattern: Price broke down from cloud resistance and is retesting previous support

Setup: Bearish continuation with consolidation before next leg down

---

✅ Trade Setup (Sell):

🔹 Entry Point:

Sell Entry: Below 113,500.84

This level marks the neckline of a small consolidation zone.

Wait for clean candle close below this level.

---

🎯 Target Levels (Take Profit):

1. TP1: 110,955.16

Previous minor support

2. TP2: 108,091.84

Key support/demand area

---

🧠 Optional Confirmation:

You can wait for:

Bearish candlestick pattern at 112.1K zone

Rejection of retest near 113.7K–114.3K (top of cloud)

---

📌 Summary:

> BTC/USDT Short Setup

🟢 Entry: Below 113,500.84

🎯 Target 1: 110,955.16

🎯 Target 2: 108,091.84

Bearish bias as price remains below the Ichimoku cloud and shows signs of continuation.

Bull Trap Confirmed: GBPUSD's 8% Rally Faces ExhaustionLets Face it we had a great 6 months already clocking 60%+ Returns already.

And after sitting ducks for almost 2 months now we finally have a trade.

- Its a very self explanatory chart

- Trading at resistance

- Head & Shoulder pattern

And the best part the right shoulder is still yet to be formed! My favourite type of entry.

1.It gives a better risk reward ratio (1:7 expected)

2.Better Entry (No long red candles)

3. And even if the pattern fails it we may still reach the neck line which is target 1.

Entry Criteria

- A Red candle at the entry Line Marked

- Stoploss Above the Entry Candle

Target 1- 1.3361

Target 2- 1.3252

Target 3- 1.3169

Keep Your Risk Reward Intact! Not An investment Advice

XAUUSD Gold Trading Strategy August 1, 2025

Yesterday's trading session, gold prices recovered to the 3315 area and then continued to decrease to the 3281 area. Currently, gold prices are fluctuating quite unpredictably due to the impact of tariff news and investor confidence.

Basic news: The Federal Reserve FED continues to maintain the federal funds benchmark interest rate in the range of 4.25% - 4.50%, in line with policy since 2025. Chairman Powell did not give any signal about the next interest rate cut on September 16 - 17.

Technical analysis: After falling sharply to the 3269 area, gold prices are showing signs of recovery. In the current downtrend channel, there has been a higher bottom than the bottom at H1. We can see that if the bullish pattern at H1 is confirmed, combined with the reversal candlestick appearing at H4, the possibility of gold bouncing back to reach the resistance area of 3330, even 3350 is completely possible. In the weekend trading session, we will wait at the support zones to trade.

Important price zones today: 3280 - 3285 and 3269 - 3274.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3283 - 3285

SL 3280

TP 3288 - 3300 - 3310 - 3330.

Plan 2: BUY XAUSD zone 3269 - 3271

SL 3266

TP 3274 - 3284 - 3300 - 3320.

Wish you a safe, favorable and profitable trading day.🥰🥰🥰🥰🥰

Analysis BTC/USD Daily ChartAnalysis BTC/USD Daily Chart

**Chart Overview (Daily Timeframe)**

**Current Price**: \~\$114,937

**EMA 7**: \$116,896 (short-term)

**EMA 21**: \$116,561 (medium-term)

**Trendline**: Price is testing the long-term ascending trendline

**Key Zones:**

* **Support 1 (S1)**: \~\$110,000

* **Support 2 (S2)**: \~\$102,000

* **Immediate Resistance Zone**: \~\$116,000–\$120,000

**Bullish Scenario**

**Conditions**:

* Price **holds above the ascending trendline**

* A strong **bounce from current level (\~\$115K)** or a reclaim above **\$116K**

**Buy Setup**:

* **Entry**: \$115,000–\$116,000 (if bounce confirmed)

* **Stop-loss**: Below \$114,000 or the ascending trendline

* **Targets**:

* TP1: \$120,000

* TP2: \$125,000

* TP3: \$132,000+

**Confirmation**:

* Bullish candle formation near the trendline

* Reclaim of EMAs (especially EMA 7)

**Bearish Scenario**

**Conditions**:

* Price **breaks below the ascending trendline** and **closes below \$114K**

* Rejection from \$116K zone with a strong red candle

**Sell Setup**:

* **Entry**: Below \$114,000 (on confirmed breakdown)

* **Stop-loss**: Above \$116,000

* **Targets**:

* TP1: \$110,000 (S1)

* TP2: \$105,000

* TP3: \$102,000 (S2)

**Invalidation**:

* Quick recovery above \$114.5K and trendline reclaim = possible fakeout

**Bias**

**Neutral to Bullish**, as price is **at trendline support**.

Watch closely for **price reaction at current levels** for the next directional trade.

Gold (XAU/USD) on the 1‑hour timeframeGold (XAU/USD) on the 1‑hour timeframe

Chart Structure & Bias

* Price remains trapped in a **rising channel** (\~\$3,328–3,333), pressing against resistance near **\$3,340–3,345**.

* Short-term momentum is bearish: both EMA 7 and EMA 21 sit above current price, with declining volume signaling weakening buyer strength.

* Overall trend leans neutral‑to‑bearish until market clears key zones decisively.

Trade Scenarios

**Bearish Breakdown (Preferred)**

* **Trigger:** Break and close below channel support (\~\$3,326).

* **Targets:** Initial drop toward **\$3,320**, then **\$3,300**, and possibly lower if momentum intensifies.

* **Invalidation:** Price pushes back above **\$3,333–3,335**, negating bearish structure.

**Bullish Breakout (Conditional)**

* **Trigger:** Clean breakout and sustained close above **\$3,342–3,345**.

* **Targets:** Upward stretch toward **\$3,355–3,360**, and if strong, **\$3,367–3,375+**.

* **Invalidation:** Fails to hold structure—retesting from above back beneath **\~\$3,338**.

Macro Drivers & Market Conditions

* Caution prevails pre‑Fed decision and ADP / GDP releases—market awaits cues on interest rate direction.

* Safe‑haven demand has softened as global trade sentiment improves, while U.S. dollar strength continues to cap upside in gold.

* Analysts favor **sell‑on‑rise positioning**, bumping up potential for controlled pullbacks.

Verdict

Gold is consolidating in a tight upward channel, showing short-term bearish pressure. The **bearish breakdown scenario holds the edge** unless price convincingly clears above **\$3,345** on strong volume, which could flip bias. A confirmed break below **\$3,326** sets the stage for downward moves toward **\$3,300** or lower.

Colgate Palmolive – A Safe Haven Stock for Long-Term InvestorsThere are two chart of Colpal.

COLPAL is moving in well defined parallel channel with support near at 1750-1850.

COLPAL is taking support on Ema with near at 2050-2150.

COLPAL is taking support near its AVWAP zone, which lies between ₹1800–₹1900.

If this level is sustain then we may see higher prices in COLPAL.

Thank You !!

Dow Jones Industrial Average (DJI) – 1H Chart Analysis 1. Structure: Broad Range Consolidation

Price remains within a wide horizontal range between 45,137 resistance and 43,792 support. This shows indecision and distribution at highs.

2. Key Rejection Zone

The yellow zone around 45,001–45,137 acted as a strong supply area. Multiple rejections indicate heavy selling interest here.

3. Mid-Zone Compression

Current price is hovering just below 44,765 resistance — acting as a decision point. Break above it may retest the supply zone; rejection could send price lower.

4. Demand Holding at 44,280

The strong bounce from 44,280.25 shows buyers defending this demand zone. It's the key support to watch for bulls.

5. Next Play

Bullish: Break and hold above 44,765 targets 45,001–45,137.

Bearish: Failure leads to 44,280, then 43,973 → 43,792.

Neutral bias unless a clean breakout confirms direction.

BTCUSD – Descending Channel or Bullish Flag?BINANCE:BTCUSDT – Market Maker’s Game Inside a Descending Channel

Timeframe: 2H | MJTrading View

Market Structure Overview:

Bitcoin recently printed a new ATH at $122,000 after a parabolic run from the previous ATH at $111,937.

Since then, price has been consolidating inside a descending channel, which could act as a bullish flag in higher timeframes.

Liquidity pools are clearly formed:

Above $122K – resting stops of late shorts.

Below $115K–$114K – weak long stops and untapped demand near the Order Block (OB).

Key Levels & Liquidity Zones:

Upside:

$122K Liquidity Pool → If swept, could trigger momentum towards $124K–$125K.

Downside:

$116K OB → First defensive zone for bulls.

$112K Strong Support → Aligns with previous ATH breakout base.

Market Maker’s Dilemma:

If you were a market maker… which liquidity pool would you hunt first?

Price is coiling tighter within the channel, and both scenarios are possible:

Upside Sweep → Rapid breakout above $122K to clear shorts, then potential continuation.

Downside Sweep → Sharp drop into $116K–$112K liquidity, flushing longs before any recovery.

⚡ MJTrading Insight:

This is the classic market maker compression – first sweep likely determines direction.

Patience here is key; let the liquidity tell the story.

#BTCUSD #Bitcoin #Liquidity #SmartMoney #PriceAction #MJTrading #ChartDesigner #CryptoAnalysis

Psychology Always Matters:

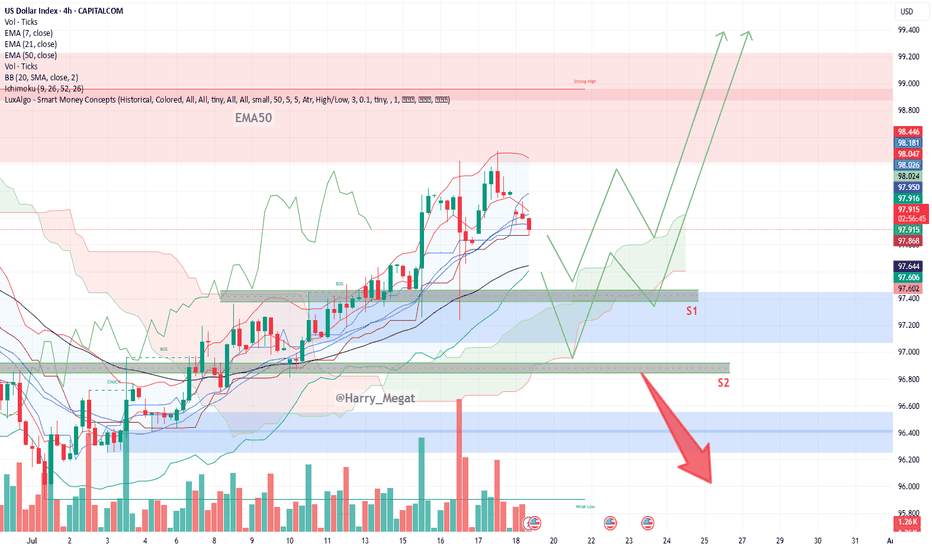

US Dollar Index (DXY) Chart Analysis – 1H TimeframeUS Dollar Index (DXY) Chart Analysis – 1H Timeframe

This chart shows the **US Dollar Index (DXY)** with key price zones, trendlines, and EMA indicators. Here's a detailed analysis:

**Key Observations:**

* **Price:** Currently trading near **98.41**

* **EMAs:**

* **EMA 7** = 98.373 (short-term trend)

* **EMA 21** = 98.356 (medium-term trend)

* **Trendline:** Uptrend line still intact, acting as dynamic support

* **Volume:** Steady, no strong breakout yet

* **Support Zones:** 98.20 – 98.35

* **Price Structure:** Consolidating above support and EMAs after a pullback from highs

**Bullish Scenario**

* If price **holds above EMAs and the green support zone (98.20–98.35)**

* **Breakout above 98.50** would confirm strength

* Targets:

→ **98.70**

→ **99.00+** if trendline support continues to hold

* EMAs are aligned bullishly (7 above 21) – good sign for continued upward trend

**Bearish Scenario**

* If price **breaks below 98.20 and closes under the trendline**

* Watch for rejection near 98.50 followed by strong red candle

* Downside targets:

→ **97.80**

→ **97.60**

* A breakdown below the ascending trendline = trend shift confirmation

**Conclusion**

* **Bias:** Bullish as long as DXY stays above 98.20 and trendline

* **Invalidation:** A break and close below 98.20 + trendline = bearish shift

Gold (XAU/USD) 1H Chart AnalysisGold (XAU/USD) 1H Chart Analysis

**Current Trend:** Consolidation within a range

**Price:** \$3,335–\$3,336

**Indicators:**

* EMA 7: \$3,336.92

* EMA 21: \$3,339.36

* Price trading slightly below both EMAs – **short-term bearish pressure**

---

### 🔍 **Key Levels**

* **Resistance Zone:** \$3,344–\$3,348

* **Support Zone:** \$3,324–\$3,328

---

### 📊 **Trade Scenarios**

#### **Bullish Breakout Scenario**

* **Confirmation:** Clean breakout and candle close above **\$3,348**

* **Buy Entry:** Above \$3,348

* **Targets:**

* TP1: \$3,360

* TP2: \$3,372+

* **Invalidation:** Price falls back below \$3,344 after breakout (fakeout risk)

#### **Bearish Breakdown Scenario**

* **Confirmation:** Break and close below **\$3,324**

* **Sell Entry:** Below \$3,324

* **Targets:**

* TP1: \$3,312

* TP2: \$3,296

* **Invalidation:** Reclaim above \$3,328

---

### ⚖️ **Bias**

Neutral to Bearish until a clear breakout occurs. Monitor volume and candle strength near the support/resistance zones for trade confirmation.

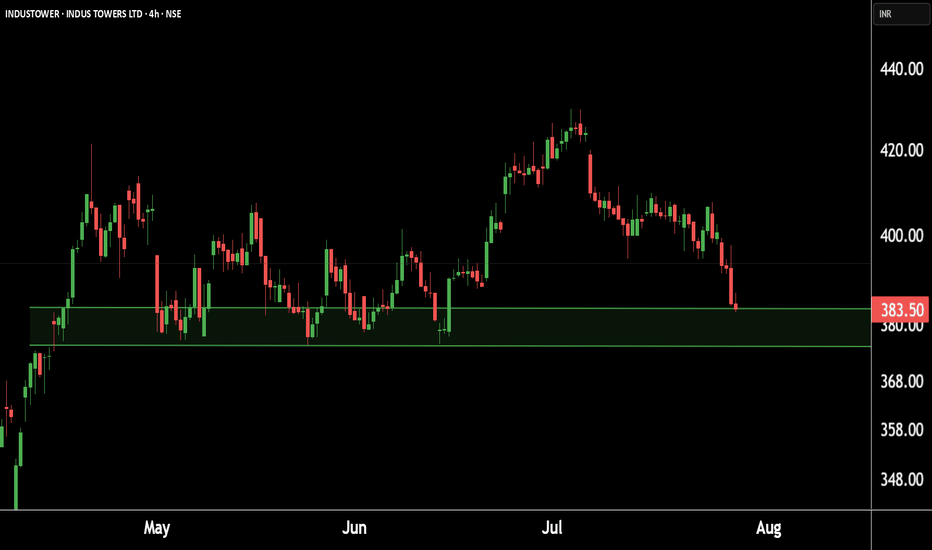

US Dollar Index (DXY) – 4H Chart AnalysisUS Dollar Index (DXY) – 4H Chart Analysis

**Current Trend:** Bearish

Price trades below EMAs, Ichimoku Cloud, and within a bearish channel.

#**Bearish Scenario (Favorable)**

* **Conditions:**

* Price remains below EMA 7 & 21

* Stays under Ichimoku Cloud and 96.812 resistance (R1)

* Lower lows forming, bearish momentum increasing

* **Confirmation:**

Break below **96.37 (blue zone)**

* **Target:**

* TP1: 96.00

* TP2: 95.60 (next weak support)

**Bullish Scenario (Reversal)**

* **Conditions:**

* Price must break above **96.81 (EMA 7 + resistance)**

* Break above **R1 → 96.90**, and then above **R2 → 97.14–97.19**

* Bullish candles close above the Ichimoku cloud

* **Confirmation:**

Break and retest of **97.20**

* **Target:**

* TP1: 97.39

* TP2: 97.58 (key structure)

* TP3: 98.00 (major resistance)

**Bias:** Bearish unless DXY breaks above **97.20** with strong volume and bullish structure.

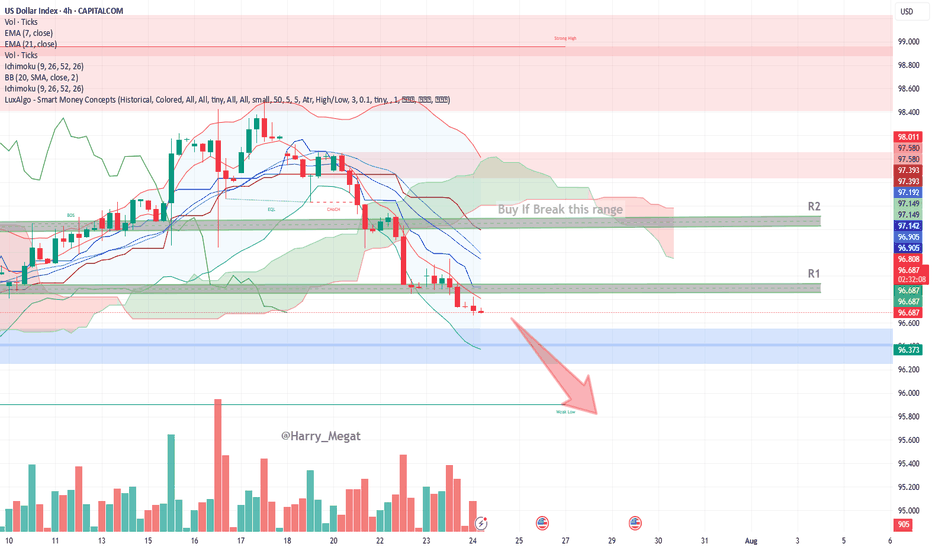

DXY Chart Outlook: Trend, Support, and Price Objectives**DXY Chart Outlook: Trend, Support, and Price Objectives (Reworded Analysis)**

**Trend Overview**

* The DXY chart reflects a **clear upward trajectory**, characterized by a sequence of **ascending highs and higher lows** — a classic sign of bullish momentum.

* Currently, the price is **retracing toward the 50-day EMA**, which appears to be holding as **dynamic support**.

* Two important **horizontal support zones** are marked:

* **Support 1 (S1):** \~97.400 (aligned with EMA-50)

* **Support 2 (S2):** \~96.800 (a deeper correction level)

**Projected Price Zones**

* **Near-Term Objective:** **98.800 to 99.000**

* A rebound from the EMA or S1 could send price higher toward this zone, continuing the current bullish structure.

* **Mid-Term Target:** **99.200 to 99.400**

* If the price successfully clears the 99.000 resistance, further bullish continuation could aim for this intermediate target range.

* **Extended Target:** **100.000+**

* A sustained breakout beyond 99.400 could open the path toward **psychological resistance at 100.000**, possibly higher on strong momentum.

**Support Zones to Watch**

* **S1 (97.400):** This level coincides with the 50-day EMA and represents a **first line of defense**.

* **S2 (96.800):** Should the price fall below S1, this secondary level could provide **stronger support** and potential bounce opportunity.

**Risk Management**

* Consider placing a **protective stop** just below S2 — around **96.500** — to safeguard against a potential trend reversal or deeper correction.

**Summary**

* The DXY remains **technically bullish**, with potential upside targets at **98.800**, **99.400**, and eventually **100.000+**.

* Traders can monitor **S1 and S2** for potential entries or trend confirmation.

* A **breakdown below 96.500** would invalidate the bullish setup and warrant caution.