Classicalcharting

BEAT #FailedBreakout #HeadandShouldersI've posted twice about H&S forming. Nothing is certain in trading. Example of a failed breakdown. Always have a strategy around your exits and trade management. Identifying the chart pattern is the easy part, the hard part is managing your trades after you enter them.

QSR 3 Month #SymmetricalTriangle #ChartPatternQSR been consolidating its gains after its run up from covid19 bottom. Stock is forming 3+ months ascending triangle and seems ready to begin its next move. Symmetrical triangles (unlike Ascending and Descending triangles) could end up becoming a trend reversal or continuation patterns depending on the direction they breakout into. the 200 MA is smack in the middle of the pattern which makes it even harder to assume a breakout one way or another. Best route as of right now is to leave bias at the door and wait for a decisive daily close outside chart pattern boundaries for direction confirmation.

#CWST setting up a massive #CupandHandle #Breakout #ChartPatternNASDAQ:CWST is forming a 5 and a half months Cup and Handle chart patter on weekly scale. A decisive daily close above pattern horizontal resistance will set the stage to a sizable rally and into All time High (ATH) territory.

#KeepItSimple

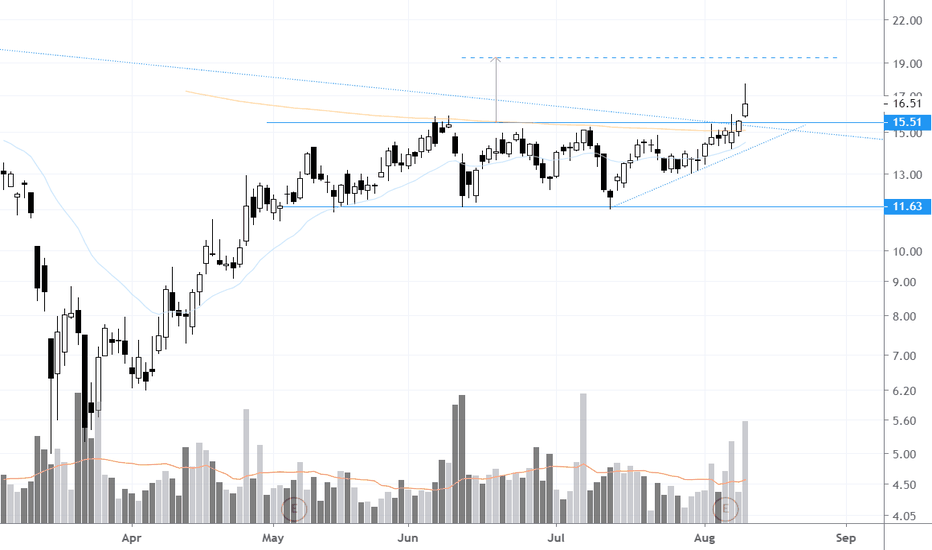

$REAL #Breakout Just got REAL :)and there goes REAL. Breaking out of its 3+ months rectangle chart pattern. Rectangle chart pattern price target added to the chart. i have alerted to this stock twice before. here is the latest chart i posted right before the breakout explaining why this setup is very promising and high probability trade.

#GLD 1 Month #DescendingTriangle #Gold #ChartPatternDescending triangle is bearish in nature. A confirmed breakout (daily close below chart pattern support) could start the next correction phase for gold and take it down to $170/$169 area. I would also be playing the failed chart pattern (close above triangle down sloping line) for a run back to bull market high.