Coffee

Starbucks at Support - Time to Brew a Bullish Move?📈SBUX has been moving inside a clean rising channel for years, respecting both the upper and lower bounds with precision.

⚔️Right now, Starbucks is retesting the lower bound of this long-term channel, a zone that has historically acted as a strong support (blue arrows).

As long as this area holds, we will be looking for trend-following longs, aiming for a continuation toward the mid and upper boundaries of the channel.📈

Nothing is confirmed yet, but this is exactly where buyers have stepped in many times before.

If the structure holds, the next bullish swing could already be brewing. ☕️

Do you think SBUX is ready for its next leg up? Share your thoughts below! 👇

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

We all want COFFEE to be cheaper, but uptrend might hold on! Although most CFD-traders might don't care - COFFEE is an interesting commodity right now, especially with current trends with nervous stock markets/indices.

In general:

- Coffee prices correlate with DXY and stock indices/VIX. Especially when stock markets go down

- Coffee is in higher demand as it is used as hedge against falling stock prices

- Coffee is in a long-term bull-market

If correlations align, especially if stock markets decrease more, there is more upside potential for the Coffee price.

CRITICAL WATCHING POINTS

Correlations for taking a LONG on COFFEE:

DXY (Dollar Index):

- Above 100.50 = BEARISH for coffee

- Below 99.70 = BULLISH for coffee

SPX/Stock Indices:

- Rally (VIX < 18) = BEARISH for coffee

- Weaken (VIX > 23) = BULLISH for coffee

BCOM:

- Break below 107 = BEARISH for commodities/coffee

- Break above 108.50 = BULLISH for commodities/coffee

Coffee Major Support Zone:

Hold above 355 = bull market intact

Break below 350 = could be a major problem (or we finally get cheaper coffee in the supermarket?!)

COFFEE | HMA Support Holds | Bullish Breakout Imminent🎯 COFFEE CFD: The Double-Bottom Espresso Shot Setup ☕💰

📊 Market Overview

Asset: COFFEE (Commodities CFD)

Strategy Type: Swing/Day Trade - Cash Flow Management

Bias: 🟢 BULLISH

Timeframe: 2h

🔍 The Setup - Why This Brew is About to Percolate

Alright coffee addicts and chart nerds, let's break down this caffeinated opportunity! ☕⚡

Technical Confirmation:

🎯 Hull Moving Average (HMA) is acting as our dynamic support level

📍 Double Bottom Formation confirmed after price retested the HMA support TWICE

🔥 Buyers stepped in aggressively at the dynamic support zone, confirming bullish momentum

📈 The trend reversal is LOCKED IN - bulls are taking control

This isn't your average coffee break setup - we've got a textbook double-bottom pattern forming right on our dynamic HMA support. Price knocked twice, buyers answered both times. You know what that means? It's go time! 🚀

💎 Entry Strategy - The "Thief" Layered Approach

Primary Entry Signal:

✅ Breakout Confirmation: Wait for price to breach and CLOSE above @385 resistance zone

⚠️ IMPORTANT: Set your price alerts at 385 on your trading platform so you don't miss this breakout! TradingView, MT4, MT5 - whatever you use, SET THAT ALARM! ⏰

🎯 Layered Entry Zones (Scaling In):

This is the "Thief OG" method - you can choose ANY of these levels post-breakout:

Layer 1: 360

Layer 2: 365

Layer 3: 370

Layer 4: 375

Layer 5: 380

Pro Tip: You don't have to enter all at once! Scale in as price confirms momentum. Buy the dip, catch the rip! 🎢

🛑 Risk Management

Stop Loss: @350

Risk-Reward Ratio: Approximately 1:2 (Solid setup! 💪)

📢 Disclaimer Note:

Dear Ladies & Gentlemen (Thief OG's) - This SL is MY personal level. YOU control YOUR money, YOUR risk. Adjust according to your account size and risk tolerance. Trade smart, not hard! 🧠💰

🎯 Profit Targets - Know When to Take Your Coffee to Go

Target Zone: @420 🎯

Why 420?

Strong historical resistance level

Overbought conditions likely

Potential bull trap zone - don't get greedy!

💡 Strategy: Scale OUT just like you scaled IN. Take profits along the way. Lock in gains before the market locks YOU out! 🔒💵

📢 Disclaimer Note:

Dear Ladies & Gentlemen (Thief OG's) - This TP is MY personal target. YOU control YOUR profits. If you're in the green, secure your bag at your own discretion. Nobody ever went broke taking profits! 💰✨

📈 Correlated Pairs to Watch

Keep an eye on these related markets - they move together like coffee and cream ☕🥛

PEPPERSTONE:SUGAR (SB1!) - Commodity correlation

ASX:BRL (Brazilian Real) - Brazil = #1 coffee producer, currency strength matters

PEPPERSTONE:COCOA (CC1!) - Soft commodities sector correlation

DXY (US Dollar Index) - Inverse relationship; weaker dollar = stronger commodities

Key Point: If sugar and cocoa are rallying, coffee usually follows the party! Also, watch weather reports from Brazil - drought conditions = bullish coffee prices. ☀️🌧️

⚡ Key Takeaways

✅ Double-bottom pattern confirmed on HMA dynamic support

✅ Bullish momentum building

✅ Wait for 385 breakout confirmation

✅ Layer entries between 360-380

✅ Manage risk with SL @350

✅ Secure profits near 420 resistance

✅ Watch correlated pairs for confirmation

🎭 The "Thief Style" Philosophy

This is the Thief OG strategy - we steal opportunities from the market like a caffeinated ninja!

This analysis is for educational and entertainment purposes. We're here to learn, laugh, and hopefully make some money along the way!

Remember: The market doesn't care about your feelings. Stick to YOUR plan, manage YOUR risk, and protect YOUR capital. This is a game of probabilities, not certainties!

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#Coffee #CommoditiesTrading #CFDTrading #SwingTrading #DayTrading #TechnicalAnalysis #DoubleBottom #HullMovingAverage #HMA #Breakout #BullishSetup #TradingStrategy #PriceAction #SupportAndResistance #RiskManagement #ThiefStyle #CoffeeMarket #CommodityTrading #TradingIdeas #ChartAnalysis #ForexCorrelation #SoftCommodities

Cup & Handle - BROS (Monthly Chart)As you can see in the monthly chart of BROS, a cup and handle pattern is forming.

The price target of a cup and a handle is the depth of the cup but starting from the the handle's ending candle.

In this graph, you can see that I'm using a little conservative price target: the price target is not from the end of the handle, rather from the support around 47.

That is because the cup depth from the handle would give us 100%+, and though I like such results, I'm a little conservative when it comes to trades of above 50% gain, regardless of trade length (and it's more of personal risk management and it works for me but maybe someone else can see this as a clear sign of consistent buying until PT).

Fundamentally, the earning of 5-Nov-2025 after market, shall play a huge role in succeeding the completion of the cup and handle price target.

My short term price target is 62, and the reason for that is the 20-Aug-2025 and 15-Sep-2025 role reverse from support to resistance (Daily Chart), and considering BROS volatility, it's conservative, yet, risky in nature.

My medium term target is 77.5 which is the highest from the body candle from the left of the cup and handle and not the second one of 79.16, and again, the reason for this is because I want to take a more conservative approach as BROS volatility may hurt high risk-intolerant traders.

The long term target is 105 due to the cup and handle depth.

Generally, I'm a high risk trader. However, with current market conditions and the current phase of uncertainty in U.S. equities due to government shutdown and volatile policies (especially tariffs), one might want to seek more conservativeness in their trading.

That being said, BROS is fundamentally one of the best growth stories I've analyzed. Revenues, earnings, cash management and funding, operational execution, etc., combined they check out the marks of a good investment. Yet, also fundamentally, it has a lot of optimism priced in, and as of this writing, we are confronting investors fears from the current uncertainty, high valuations, and profit taking period. we might see some selling pressure after a strong hike (assuming positive/expectations beat in earnings) due to profit taking and uncertainty. It has a very high valuation comparing to its peers, yet, it also has great growth comparing to its peers...

Not a financial advise, just a guy behind a screen.

Please do not hesitate to share your opinions, as long as it's logical.

COFFEE Could Rise From herePrice on Coffee began consolidating inside a rising wedge, showing controlled accumulation from buyers. Normally, a rising wedge hints at weakness, a signal that buyers are losing momentum.

But here’s the twist: instead of breaking down, price broke out upward with strong momentum.

That’s a sign of buyer dominance, what should’ve been a reversal turned into a breakout.

The upside target would be near 416.50, aligning with the next major resistance level.

As long as price holds above the breakout zone, the momentum remains bullish, with buyers driving this move forward.

1000 USD: Coffee Bull Market Overview: Prices set to DOUBLE ☕ Coffee (Arabica, ICE “KC”) — Outlook to 2026

Where we are: Nearby Arabica trades ~405–410 US¢/lb after a parabolic 2025 on weather stress, thin deliverable stocks, and policy shocks. The Dec ’25 contract is ~400 ¢/lb.

Big picture 2025/26: Official global production is pegged at a record ~178.7 M bags (robusta-led) versus ~169.4 M bags consumption; ending stocks remain tight near ~22.8 M. Inside that headline, arabica is the pinch point: Brazil’s arabica is down year over year on heat/drought, and multiple private houses flag an arabica deficit on the order of ~–8.5 M bags for 2025/26.

________________________________________

🤖 1) Brazil 2025 flowering & 2026 crop execution (↑ to 9.5/10)

Why it matters: Brazil is the swing producer for arabica; 2026 outcomes hinge on Sep–Oct 2025 flowering and the trees’ carryover stress from 2024–25 dryness/frost. Local co-ops in Cerrado report frost-related damage with six-figure bag impacts to 2026 potential.

What we’re seeing: The latest national estimate cuts 2025 output to ~55.2 M bags total (arabica ~35.2 M), confirming a weaker arabica “off” year. Talk of a “super 2026” has faded unless rains arrive and stick through flowering and early fruit set.

Why 9.5/10? A missed flowering or poor fruit set is the cleanest path to a 2026 arabica shortfall big enough to rip futures.

________________________________________

🌍 2) U.S. 50% tariff on Brazilian coffee (new 9.0/10)

Why it matters: The U.S. typically imports ~8 M bags from Brazil. A 50% tariff (effective Aug 6, 2025) distorts flows, inflates U.S. landed costs, and channels more hedging into NY “KC,” structurally supporting futures. Brazil trade groups directly linked August’s vertical move to the tariff shock.

Why 9.0/10? If the tariff persists into 2026, basis stays elevated and retail prices remain sticky even if global aggregates look “adequate.”

________________________________________

🧭 3) EU Deforestation Regulation (EUDR) go-live (↑ 8.8/10)

Why it matters: Traceability/geolocation rules begin Dec 30, 2025 for large/medium operators (SMEs Jun 30, 2026). Compliance temporarily shrinks “eligible” supply and reprices differentials.

Why 8.8/10? Early-2026 could see EU-grade shortages, wider diffs, and higher KC via arbitrage.

________________________________________

📉 4) Exchange (ICE) certified stock drawdown (↑ 8.5/10)

Why it matters: Deliverable supply amplifies squeezes. Arabica certified stocks ~0.67–0.78 M bags in early September—thin for the season.

Why 8.5/10? With low float, any weather or logistics hiccup can air-pocket futures into blow-off spikes.

________________________________________

🌡️ 5) ENSO/La Niña watch & Brazil rainfall tail-risk (holds 8.0/10)

Why it matters: La Niña-skewed patterns risk ill-timed rain (flower knock-off) or too-little rain (poor fruit set) in Minas Gerais during Sep–Oct. Early September dryness was flagged; late-September storms are pivotal.

Why 8.0/10? The timing of rain matters as much as totals; a mis-timed pattern is enough to dent 2026 yields.

________________________________________

🇻🇳 6) Vietnam robusta recovery vs. water stress (↑ 7.8/10)

Why it matters: Robusta tightness forced blend shifts. A rebound toward ~31 M bags in 2025/26 would cap KC via spread relief; persistent water stress/tree fatigue would keep robusta tight, forcing arabica to carry the world.

Why 7.8/10? Binary swing factor: a real rebound cools spreads; a miss extends the squeeze into 2026.

________________________________________

🏛️ 7) Policy & trade fragmentation beyond U.S. tariffs (↑ 7.5/10)

Why it matters: Frictions and exemptions remain fluid. Retaliation or parallel measures could redirect flows to EU/Asia, move basis, and distort origin diffs.

Why 7.5/10? The tariff is already biting; add-ons would compound tightness.

________________________________________

💵 8) FX (BRL) & producer selling (↑ 7.0/10)

Why it matters: A stronger BRL curbs farmer selling; a weak BRL unleashes hedges and pressures KC. Policy/inflation noise keeps BRL volatile.

Why 7.0/10? Not first-order, but magnifies weather/policy shocks.

________________________________________

🏭 9) Demand elasticity & substitution (holds 6.8/10)

Why it matters: 2025 sticker shock clipped demand by roughly –0.5%. 2026 could stabilize if prices plateau; if retail rises further (tariffs/EUDR), more down-trading or substitution (robusta/other beverages) caps upside.

Why 6.8/10? A genuine headwind to the $10/lb path unless supply breaks further.

________________________________________

🚢 10) Logistics, certifications & differentials (new 6.5/10)

Why it matters: Tight washed/tenderable pools, evolving ICE rules/diffs, and shipping bottlenecks can widen basis and squeeze deliverables.

Why 6.5/10? Secondary, but adds fuel to any fundamental spark.

________________________________________

📈 11) Spec positioning & financial flows (↑ 6.5/10)

Why it matters: 2025’s run featured panic buying in a low-float market. Another weather scare + thin stocks invites CTA/momentum flows through round-numbers.

Why 6.5/10? Not fundamental—but can yank KC vertically.

________________________________________

🧪 12) “Record global production” optics vs. arabica reality (new 6.0/10)

Why it matters: The record headline is robusta-led. Inside, Brazil arabica declines and exporters stay cautious. The market trades the arabica bottleneck, not the aggregate.

Why 6.0/10? This optics gap sustains volatility—bulls can still win if arabica under-delivers.

________________________________________

Updated Catalyst Scorecard

Rank Catalyst Score

1 Brazil 2025 flowering → 2026 crop 9.5

2 U.S. 50% tariff on Brazil 9.0

3 EU EUDR (Dec 30, 2025 start) 8.8

4 Low ICE certified stocks 8.5

5 ENSO/La Niña rainfall risk 8.0

6 Vietnam robusta recovery risk 7.8

7 Wider trade policy fragmentation 7.5

8 FX (BRL) & selling behavior 7.0

9 Demand elasticity/substitution 6.8

10 Logistics, diffs & certification frictions 6.5

11 Spec/CTA flows 6.5

12 “Record crop” optics vs arabica bottleneck 6.0

________________________________________

📊 Supply–Demand Snapshot — Why Arabica Is the Pinch Point

• World 2025/26: Production ~178.7 M; consumption ~169.4 M; ending stocks ~22.8 M (still lean).

• Brazil arabica: ~40.9 M (down ~2.8 M YoY); robusta records elsewhere (Brazil/Indonesia); Vietnam recovery penciled near 31 M.

• Private balance: Arabica deficit ~–8.5 M for 2025/26 (vs ~–5.5 M in 2024/25).

• ICE plumbing: Certified arabica ~0.67–0.78 M bags and trending lower → thin deliverables, higher tail-risk premia.

________________________________________

🔍 Recent Headlines You Should Know

• KC spiked toward/above $4/lb in early 2025 on panic buying, weather, and policy shocks.

• “Record global crop” headlines coexist with lower Brazil arabica and tight ending stocks.

• U.S. 50% Brazil tariff (Aug 6, 2025) credited with a ~30% surge in August.

• EUDR deferred to Dec 30, 2025 for large/medium operators; compliance scramble into 1H26.

• Early-Sep 2025 Minas dryness kept flowering risk live; markets watching late-Sep showers.

________________________________________

🎯 Street & Agency Views (as of Sep 2025)

• Early-2025 consensus had end-2025 ~$2.95/lb, expecting mean reversion. The market disagreed post-tariffs.

• One multilateral outlook saw >50% y/y up in 2025, then –15% in 2026, assuming supply normalization and Colombia recovery.

• Several trade houses continue to highlight a widening arabica deficit into 2025/26.

Takeaway: Consensus expects some 2026 cooling, but policy + compliance + arabica weather can overwhelm “aggregate surplus” narratives.

________________________________________

🧭 Pathways to 1,000 ¢/lb in 2026 (Aggressive Target)

We’re already near 400 ¢. To reach $10/lb, the market needs a stack of arabica-specific shocks that persist into 2026:

1. Brazil under-delivers in 2026: Patchy/failed flowering (Sep–Oct ’25) and/or heat during fruit set reduce yields; 2026 arabica ≤ ~38–40 M.

2. Tariffs persist through 2026: U.S. 50% duty remains in force, lifting U.S. basis and rerouting flows; fewer tenderable lots into ICE.

3. EUDR friction bites in 1H26: Non-compliant lots stranded; compliant premiums surge; differentials widen and pull KC higher.

4. Certified stocks < ~500k bags: Roaster drawdown + limited grading/tendering triggers backwardation and squeeze mechanics.

5. Vietnam misses rebound: Water stress or tree fatigue keeps robusta tight; arabica must carry blends globally.

6. Pro-cyclical flows: Thin deliverables + headlines = momentum/CTA accelerants through round numbers (500 → 700 → 900 → 1,000).

Probability assessment: Not the base case, but plausible if two or more of (1–4) coincide while financial flows amplify. Call it ~20–25% conditional on Q4’25 weather and policy staying restrictive.

________________________________________

🧮 Scenario Framework (NY Arabica, nearby; end-2026)

• Bull (30%) — Squeeze: Brazil 2026 < 40 M; tariff persists; EUDR tight; certifieds < 0.5 M; Vietnam under-shoots.

Price: 800–1,000 ¢/lb (blow-off spikes possible above 1,000 on transient squeezes).

• Base (50%) — Elevated & volatile: Brazil 2026 ~41–44 M; tariff partially eased or offset; EUDR frictions fade by 2H26; Vietnam rebounds.

Price: 450–650 ¢/lb with episodic spikes on weather or logistics.

• Bear (20%) — Normalization: Strong Brazil flowering → 2026 ≥ 45 M; tariff rolled back; EUDR compliance smoother; certifieds rebuild > 1.2 M; demand softens.

Price: 280–420 ¢/lb (vol still above pre-2024 norms).

________________________________________

🗓️ Watchlist & Timeline (what to track)

• Sep–Oct 2025: Brazil flowering windows (Minas/Cerrado/N. São Paulo). Look for rain onset, follow-up, and heat bursts.

• Nov–Dec 2025: Fruit set confirmation; disease incidence; updated 2026 potential.

• Dec 30, 2025: EUDR go-live (large/medium operators).

• Q1–Q2 2026: Compliance bottlenecks, EU diffs, tenderable quality flows into ICE.

• All 2025/26: Tariff status, BRL swings, certified stock trajectory, Vietnam water/harvest updates.

________________________________________

⚠️ Risk Matrix (what flips the call bearish)

• Timely rains in Sep–Oct 2025 and mild temps → robust fruit set; Brazil 2026 ≥ 45 M.

• Tariff rollback or broad exemptions reduce U.S. basis support.

• Vietnam outperform (> 31 M) relieves spreads; Indonesia robusta stays strong.

• Certified stocks rebuild > 1.2 M bags by mid-2026.

• Demand destruction accelerates (retail fatigue, substitution), capping upside.

________________________________________

📌 Positioning Lens (informational, not advice)

• Drivers of upside convexity: Brazil weather into October, policy stickiness (tariff/EUDR), and certified stock path.

• Tell-tales of a squeeze: Steepening backwardation, diffs blowing out for compliant washeds, and rapid certified draw alongside rising exchange open interest.

• Tell-tales of normalization: Strong flowering reports, improved grading pass-rates, certified rebuilds, and easing EU compliance premia.

________________________________________

Bottom Line

• The base case remains elevated and volatile into 2026, not automatic mean reversion.

• A credible path to 1,000 ¢/lb exists if Brazil’s 2026 arabica disappoints, policy frictions persist, EUDR pins EU-grade supply, and certifieds fall sub-0.5 M, with CTA flows doing the rest.

• Conversely, timely Brazil rains, tariff relief, and a clean EUDR transition cap the rally and pull prices toward the high-$3s/low-$4s.

Analysis Techniques – Arabica Coffee Futures (Dec 2025)Analysis Techniques – Arabica Coffee Futures (Dec 2025)

Date: October 23, 2025 | Timeframe: D1 | Contract Code: ICEUS KCZ25

1. Trend Overview and Price Structure

December 2025 Arabica coffee futures continued to rally strongly, up +2.18% to 423.95 cents/lb, marking the sixth consecutive session of gains and returning to the highest level since early May 2025.

The current technical setup shows clear bullish momentum following a two-week consolidation between 380–400 cents.

If momentum persists, prices could advance toward the strategic resistance zone at 450 cents/lb, corresponding to the March 2025 swing high.

Short-term trend: Strongly bullish – continuing wave (3) within a broader recovery cycle.

2. Key Technical Price Levels

Resistance: 424 – 450 – 480

Support: 388 – 351 – 316

3. Detailed Technical Analysis

(1) Short-Term Trend:

Price has broken above the 400–410 resistance zone and is now aiming for the 450 target area.

A clear horizontal accumulation breakout pattern has formed, signaling that buyers are fully in control of the market.

(2) Trading Volume:

Volume has expanded alongside rising prices over the past week, confirming renewed speculative and commercial participation.

Managed money funds are likely rebuilding net-long positions after September’s liquidation phase.

(3) Wave Structure:

According to Elliott Wave Theory, Arabica is in wave (3) of a bullish sequence that began from the 316.50 low in July 2025.

Wave (1): 316 → 388

Wave (2): correction to 351

Wave (3): currently targeting 450–455, the 161.8% Fibonacci extension.

(4) Confirmation Signals:

Price broke above the accumulation range with long-bodied bullish candles, showing no signs of distribution.

Short-term EMAs (12–36) are expanding upward, confirming strong momentum.

Breakout volume exceeded the 20-session average, validating the move.

4. Strategic View – VNC

According to Bloomberg Intelligence, Arabica’s sharp rally through October has been driven by three fundamental catalysts:

1. Short-Term Supply Tightness in Brazil:

September exports fell nearly 11% year-on-year, as dry weather slowed harvest progress.

ICE-certified stocks dropped sharply, reaching the lowest level in 18 months.

2. Renewed Speculative Flows:

Commodity funds have rotated back into soft commodities (coffee, cocoa, sugar) as the energy complex corrected.

The Arabica-to-Robusta net-long ratio has risen to 1.4x, its highest since April.

3. Stable Consumption Demand:

Roasters in Europe and the U.S. have increased stockpiling ahead of the winter season.

The slightly weaker Brazilian real (5.52 BRL/USD) has discouraged farmer selling, tightening near-term supply.

VNC expects bullish momentum to persist in the short term, with 450 cents/lb as a medium-term target. However, profit-taking or a rebound in the real could trigger corrective pullbacks near 460–470 cents/lb.

5. Suggested Technical Strategies

Primary Long Scenario (Trend-Following):

Entry: 415 – 420

TP1: 450

TP2: 465

SL: 404

Probability: 75%

Risk/Reward Ratio: ~1:2.8

Alternative Short Scenario (Rejection at 450 Resistance):

Entry: 448 – 452

TP: 388

SL: 460

Probability: 25%

Risk/Reward Ratio: ~1:3

6. Corporate Hedging Strategies

For Arabica Exporters (Brazil, Colombia):

Increase forward price fixation around 440–450 cents/lb, as prices approach strong resistance.

Utilize options collars to protect profit margins in case of a near-term correction.

For Importers and Roasters (EU, U.S., Vietnam):

Consider early hedging in the 400–420 zone to lock in costs before a potential breakout above 450.

If prices reach 450–460, consider unwinding older hedges to maintain a neutral exposure.

For Commercial Traders:

Maintain medium-term long positions, targeting 450–455 for partial profit-taking.

A confirmed breakout above this zone could open the path toward 480–500 cents/lb.

#Coffee – Triangle Formation#Coffee (D1) – Triangle Formation & Potential Wave 5 Extension

Current price: $386.4

Coffee futures are developing a triangle continuation pattern, signaling possible breakout toward the next impulsive wave — likely wave 5 within the broader bullish sequence.

🧩 Technical Context

• The market completed a clean 1–2–3–4 wave sequence since the August low (~$330).

• Current structure consolidates inside a symmetrical triangle, typical before a wave 5 breakout.

• The pattern is forming above key supports, confirming mid-term bullish bias.

📈 Wave 5 Projection

• Potential breakout direction: upward continuation

• Stop-loss: below wave 4 low (~$355)

• Fibonacci-based upside projections:

– 0.786 Fib → $416

– 1.0 Fib → $432

– 1.2 Fib → $448

– 1.618 Fib → $480

– 2.0 Fib → $508

– 2.618 Fib → $556

Expected wave 5 may extend toward $480–$500 if breakout confirms with volume.

🧭 Summary

• D1 structure indicates triangle consolidation in a bullish trend.

• Breakout above $390 would confirm the start of wave 5.

• Stop remains below the wave 4 low (~$355) to protect against false breaks.

• Momentum and volume confirmation are key for trend continuation.

Analysis techniques – Robusta Coffee Futures (Nov 2025)Analysis techniques – Robusta Coffee Futures (Nov 2025)

Date: Oct 06, 2025 | Timeframe: D1 | Contract Code: LRCX25

1. Trend Overview and Price Structure

November Robusta coffee surged to USD 4,528/ton (+4.65%), extending its rebound from the 4,020 – 4,305 support zone.

The price pattern is shaping a falling wedge, a potential reversal setup if the upper boundary near 4,600 – 4,650 breaks.

Medium term, the market is transitioning from a downtrend into a consolidation-recovery phase, targeting 4,926 – 5,646 once resistance breaks.

2. Key Technical Levels

Resistance: 4,650 – 4,926 – 5,646

Support: 4,305 – 4,020 – 3,628

3. Detailed Technical Analysis

(1) Short-term Trend:

The current rally is a corrective move after September’s decline. Holding above 4,305 shows renewed buying strength, supported by a breakout through the descending trendline.

(2) Volume:

Volume expansion during Oct 4–5 sessions indicates active technical buying and bullish participation.

(3) Wave Structure:

Price appears to be forming a wave 3 recovery leg. If the move extends, theoretical targets lie around 4,926 – 5,646.

(4) Confirmation Signals:

A daily close above 4,650 confirms wedge breakout; a break below 4,305 would risk a pullback toward 4,020.

4. Bloomberg Intelligence Strategic View

Short Term: Technical rebound supported by tight ICE inventories and speculative buying in Robusta.

Medium Term: Heavy rains in Vietnam’s Central Highlands and Brazil’s Minas Gerais may improve 2025/26 output, yet Indonesia’s weak supply continues to underpin prices.

Key Risk: A stronger USD or weaker BRL could trigger producer hedging and limit upside momentum.

5. Suggested Technical Strategies

Preferred Long Setup:

Entry: 4,450 – 4,520

TP: 4,926 – 5,646

SL: 4,305

Probability: 65%

Counter-trend Short Setup:

Entry: 4,900 – 4,950

TP: 4,305 – 4,020

SL: 5,000

Probability: 40%

6. Corporate Hedging Guidance

Exporters: Consider forward sales around 4,900 – 5,000 to secure short-term profits.

Roasters/importers: Hedge near 4,400 – 4,500 to mitigate upside exposure in case of a breakout above 4,926.

Short Arabica Coffee🔍 Setup

Price is approaching a well‐defined supply/resistance zone (red area on chart). Historically this zone has acted as overhead resistance.

Below, there is a green demand/support zone which should act as target support area.

My target on the short is around 7.8% downside from entry, with stop loss placed just above the resistance zone / recent swing high to limit risk.

📊 Fundamental & Sentiment Background (COT & Others)

According to the latest COT report (as of 9 Sep 2025), commercial hedgers are significantly net short in Coffee C.

tradingster.com

However, speculators / non-commercials are heavily net long. This suggests that bullish momentum is still in force.

tradingster.com

Open interest is rising, showing participation in current levels. This makes the risk of a breakout (to the upside) real, if bulls hold control.

⚠️ Risks to this trade

Momentum from speculators could drive price through resistance, triggering stop losses and a strong short squeeze.

Any unexpected fundamental shock (weather, export disruption, currency devaluation, etc.) could reduce supply or boost demand, pushing prices higher.

If volume doesn’t drop on advance into resistance, the upward move may be stronger than anticipated.

✅ Conditions / Trigger For Entry

I will consider entering the short position once:

Price touches or re-tests the red supply zone.

There's a clear rejection (candlestick reversal pattern + bearish confirmation).

Momentum or RSI / MACD divergence is visible.

Speculator net longs show signs of plateauing or declining in the COT (next report).

🎯 Targets & Risk/Reward

Entry: around current price near supply, or after confirmed rejection.

Stop Loss: just above resistance / recent high.

Target: green demand/support zone (approx. 7-8% downside).

Risk-Reward Estimate: aiming for at least 1.5-2x potential reward vs. risk, ideally better.

🧐 My Edge vs What Could Go Wrong

My trading strategy gives me an average short profit of 7.8%, so this is in line with my risk appetite. The probability for a profitable trade for a short position is 75%. However, on average I will lose 12% on a losing short trade.

But I’m aware shorting commodities is riskier when there's strong bullish positioning (as is the case with speculators now).

I will monitor upcoming COT reports and fundamentals closely — if speculators increase longs again, I might bail earlier or tighten stops.

Conclusion: The COT data does not overwhelmingly confirm a short at this moment. It offers partial support via hedger short positions, but speculator long bias remains strong. If price shows a credible technical rejection in the supply zone and sentiment shows cracks, I believe this short has good risk/reward.

Coffee Heist: Are You Ready for the Bullish Layup?🚨☕ "COFFEE" Heist Plan – Swing/Day Robbery 🚨

🌟 Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Robbers & Money Makers 🤑💰💸✈️

Based on 🔥 Thief Trading Style Analysis 🔥 here’s our master heist plan to rob the "COFFEE" Commodities CFD Market.

🎯 Plan: Bullish Robbery

Entry 📥: Any price level – Thief always sneaks in at any vault door.

👉 But remember: Thief Strategy = LAYERED ENTRY ⚡

Multiple Buy-Limit Layers:

(390.00) 🏦

(380.00) 💎

(370.00) 🎭

(360.00) 🔑

(Add more layers based on your own robbery plan)

Stop Loss 🛑:

This is Thief SL @ 340.00 ⚔️

Dear Ladies & Gentlemen (Thief OG’s) – Adjust your SL based on your personal robbery strategy & risk appetite.

Target 🎯:

⚠️ Police barricade spotted @ 440.00 🚔

So escape early with the loot @ 430.00 💸 before getting caught!

🏴☠️ Thief Notes:

Our heist is in the bullish zone 🚀

Layer in carefully, don’t rush 💎

Always manage risk – the cops (market makers) are watching 👮♂️

Use alerts, trailing SL & risk management to protect your stolen bags 💰

💥 If you’re riding with the Thief crew – Hit Boost 🚀 & Share Love ❤️ – that fuels our robbery strength!

We rob, we trade, we escape – That’s the Thief Way! 🏆🐱👤

#ThiefTrader #CoffeeHeist #CommoditiesCFD #SwingTrade #DayTrade #LayerStrategy #BuyTheDip #TradingPlan #ForexRobbers #MarketHeist

COFFEE At Crossroads: Up or down?COFFEE has seen a strong impulse to the upside. But guess what? Now price is being coiling into a tight triangle. In this case, there are two scenarios possible, and taking into account that the market conditions are bullish, I am more inclined to say that the price will break to the upside of the triangle formation.

Do you agree? Drop a comment below. Engaging with the TradingView community is always helpful to improve and grow as traders.

Not financial advice, just sharing my thoughts on the charts. Trade safely 😊

COFFEE Price Rising – Is a Correction Ahead?Hello everyone, what do you think about PEPPERSTONE:COFFEE ?

The price of COFFEE is quite interesting at the moment. It has been steadily rising and seems to be forming a familiar triangle pattern. If this pattern continues to develop, there’s a strong chance the price will continue to move upwards. However, I will wait for a strong candle to confirm the signal before making a decision.

My target is 427 , but if the price drops below the triangle, we might see a short-term correction, and we’ll need to reassess.

👉 Do you think the price will continue to rise or is a correction ahead? Share your thoughts in the comments!

Note: This is not financial advice, just a personal view on the chart. Wishing everyone safe and successful trading! 😊

Cocoa, Sugar, Coffee & Cotton Rotation📌 The Soft Commodities Super Guide: Cocoa, Sugar, Coffee & Cotton

Soft commodities — crops grown rather than mined — are among the oldest traded goods in human history. From cocoa beans once used as currency in Central America, to cotton powering textile revolutions, to sugar driving global trade and colonization, and coffee fueling productivity worldwide, these markets remain essential and volatile today.

On exchanges like ICE, CME, and NYMEX, traders can access futures and ETFs to speculate, hedge, or diversify portfolios. Soft commodities are especially attractive because of their strong seasonal patterns, geographic concentration of supply, and sensitivity to weather, politics, and demand shifts.

This guide will cover:

Seasonality of Cocoa, Sugar, Coffee & Cotton

Major Price Drivers

Trading Strategies & ETFs/Stocks

Yearly Rotation Playbook

🔹 1. Seasonality of Major Soft Commodities

Seasonality refers to recurring, predictable patterns of price strength or weakness tied to planting, harvest, and demand cycles.

📈 Cocoa (ICE: CC Futures)

Strongest: Summer (Jun–Sep) → Demand builds, weather risk in West Africa.

Weakest: Winter (Dec–Feb) → Fresh harvest supply hits markets.

📌 Example: June–Sep 2020 rally (+20%) from droughts + demand recovery.

📈 Sugar (ICE: SB Futures)

Best Months: Feb, Jun, Jul, Nov, Dec.

Strong seasonal window: May–Jan (fuel demand + holiday consumption).

Weakest: Mar–Apr (harvest pressure).

📌 Example: Nov–Dec 2020 sugar rally (+15%) as Brazil shifted cane to ethanol.

📈 Coffee (ICE: KC Futures)

Strongest: Late Winter to Summer (Feb–Jul).

Weakest: Fall harvest months (Sep–Oct) → new supply weighs on prices.

📌 Example: Frost in Brazil (Jul 2021) cut supply → Coffee futures spiked +60%.

📈 Cotton (ICE: CT Futures)

Strongest: Winter & Spring (Nov–May) → Textile demand, planting risk.

Weakest: Summer & Fall (Jun–Oct) → Harvest & oversupply pressures.

📌 Example: Nov 2020–May 2021 rally (+25%) from China demand + U.S. weather risks.

🔹 2. What Moves These Markets Most?

~ Cocoa

Weather in Ivory Coast & Ghana (70% of supply).

Labor disputes, political unrest, crop diseases.

Global chocolate consumption, health trends.

~ Sugar

Ethanol demand (linked to oil prices, Brazil cane allocation).

Government subsidies & tariffs (India, EU).

Brazil’s currency (BRL) & weather.

~ Coffee

Brazil & Vietnam crops (60% of global production).

Frosts, droughts, El Niño.

Consumer demand trends (premium coffee, emerging markets).

~ Cotton

U.S., India, China output (~65% global supply).

China’s stockpiling/import policy.

Substitute fabrics (polyester), energy prices.

Apparel demand cycles.

🔹 3. Trading Strategies & Investment Vehicles

Futures

Cocoa (CC), Sugar (SB), Coffee (KC), Cotton (CT) traded on ICE.

Provide direct, leveraged exposure.

ETFs & ETNs

Cocoa: NIB (iPath Cocoa ETN).

Sugar: CANE (Teucrium Sugar Fund), SGG (iPath Sugar).

Coffee: JO (iPath Coffee ETN).

Cotton: BAL (iPath Cotton ETF).

Stocks with Exposure

Cocoa: Hershey (HSY), Mondelez (MDLZ).

Sugar: Cosan (CZZ), ADM, Bunge (BG).

Coffee: Starbucks (SBUX), Nestlé, JM Smucker (SJM – owns Folgers).

Cotton: Levi’s (LEVI), VF Corp (VFC), Ralph Lauren (RL), Hanesbrands (HBI), Gildan (GIL).

🔹 4. Soft Commodities Yearly Rotation Playbook

Here’s how traders can rotate positions through the year for maximum seasonal edge:

📌 Example Rotation:

Start year in Sugar & Cotton (Jan–Feb).

Shift into Cocoa & Coffee (Jun–Aug).

Rotate back into Sugar & Cotton (Nov–Dec).

📌 Conclusion: The Soft Commodities Super Strategy

Soft commodities offer traders multiple edges:

✅ Seasonality: Cocoa (summer), Sugar (winter), Coffee (spring/summer), Cotton (winter/spring).

✅ Macro Drivers: Weather, politics, energy, government policies.

✅ Cross-Market Links: Oil prices → ethanol (sugar); apparel cycles → cotton; consumer demand → cocoa/coffee.

✅ Portfolio Benefits: Diversification vs. equities & metals.

The best strategy is to rotate across the year:

Long Sugar & Cotton (winter/spring),

Long Cocoa & Coffee (summer),

Rotate out during weak harvest windows.

Softs may be volatile, but for disciplined traders, they provide predictable, repeatable seasonal opportunities with both futures and equities exposure.

Long Coffee📌 Coffee Futures: Seasonality, Market Drivers & Trading Insights

Coffee is one of the most important soft commodities in the world, consumed daily by billions of people. Traded for centuries, coffee originated in Ethiopia before spreading through Arabia and later into Europe, becoming a global staple.

Today, two main bean varieties dominate the market:

Arabica (≈70% of global supply): Higher quality, smoother flavor, and the most actively traded on futures exchanges.

Robusta (≈30% of supply): Stronger flavor, more caffeine, used in instant coffee and blends.

Coffee futures (KC contracts, traded on ICE) allow producers, roasters, exporters, and investors to hedge against price volatility or speculate on global demand and supply swings. These futures are physically settled, but most speculative traders roll or close positions before delivery.

🔹 1. Global Coffee Supply Concentration

Nearly 74% of the world’s coffee beans come from just five countries:

🇧🇷 Brazil → Largest producer, dominates Arabica and Robusta exports.

🇻🇳 Vietnam → Largest Robusta producer, key competitor to Brazil.

🇨🇴 Colombia → High-quality Arabica supplier.

🇮🇩 Indonesia → Mix of Arabica & Robusta, weather-sensitive.

🇪🇹 Ethiopia → Birthplace of coffee, major Arabica exporter.

Because of this concentration, traders monitor weather, politics, and economics in these countries closely. A frost in Brazil or political unrest in Vietnam can shake the entire global market.

🔹 2. What Moves Coffee Prices the Most?

Coffee is one of the most weather-sensitive and geopolitically exposed commodities.

1️⃣ Weather in Producing Countries

Frosts and droughts in Brazil (especially during flowering season) can cut supply drastically.

El Niño / La Niña events disrupt rainfall patterns across South America and Asia.

📌 Example: July 2021 frost in Brazil devastated crops → Coffee futures surged over 60% within months.

2️⃣ Political Instability

Strikes, protests, or export restrictions in Brazil, Vietnam, or Colombia can delay shipments.

Political risks in Latin America historically coincide with coffee supply disruptions.

3️⃣ Global Economic Growth

Rising incomes in Asia, Africa, and Latin America increase coffee consumption.

Coffee shifts from a luxury to a daily staple, driving long-term demand growth.

4️⃣ Health Reports & Consumer Trends

Positive studies about coffee’s health benefits (antioxidants, longevity, heart health) boost consumption.

Rising demand for premium Arabica beans (specialty coffee, single-origin) drives price premiums.

🔹 3. Seasonality of Coffee Futures

Like other soft commodities, coffee follows seasonal cycles tied to harvest and demand.

📈 Best Periods: Late winter to early summer (Feb–Jul). Traders often buy into supply fears before Brazil’s winter season (risk of frost).

📉 Weaker Periods: Harvest season in major producing regions (Sep–Oct) when fresh supply pressures prices.

📌 Example: Coffee futures tend to rally into June/July when frost concerns in Brazil peak, then weaken post-harvest in the fall.

🔹 4. How to Trade Coffee

Futures & ETFs

Coffee Futures (KC) → Traded on ICE, standard contract for institutional & speculative traders.

JO ETF (iPath Coffee ETN) → Retail-friendly option for coffee exposure.

Stocks with Coffee Exposure

Starbucks (SBUX): Global leader in coffee retail.

Nestlé (NESN.SW): Owns Nescafé & Nespresso, one of the largest global coffee buyers.

JM Smucker (SJM): Owns Folgers & Dunkin’ brands.

Luckin Coffee (LKNCY): Fast-growing Chinese coffee chain (emerging markets play).

📌 When coffee prices rise → Retailers like Starbucks may face margin compression unless they pass costs to consumers.

📌 When coffee prices fall → Profit margins improve for coffee sellers & roasters.

🔹 5. Coffee Trading Strategies

📈 Strategy #1: Buy and Hold

Buy and hold when the close price today is greater than the 200 Simple Moving Average, and the 14-14 ADX is lower than 50; and

Sell when neither of the above conditions are met.

Additional Notes:

In the 4-HR, a 200 SMA and 30 ADX Threshold can work.

Rallies typically last 120~180 days after the signal is generated.

Stop loss is either the 21 SMA, or the 2.5x Daily ATR.

📈 Strategy #2: Seasonal Long (Feb–Jul)

Go long coffee futures or JO ETF in late winter.

Exit before fall harvest (Sep–Oct).

📈 Strategy #3: Weather Hedge

Track Brazil’s weather models (frost, drought risk).

Enter futures or ETFs ahead of known risk windows.

📈 Strategy #4: Macro Demand Growth

Long-term investors may pair coffee exposure with emerging-market consumer stocks (Nestlé, Starbucks, Luckin Coffee).

📌 Conclusion: Coffee as a Soft Commodity Trade

Coffee is one of the most volatile and globally impactful soft commodities. With supply concentrated in a handful of nations and consumption spread worldwide, it offers both seasonal trading opportunities and long-term growth exposure.

✅ Seasonality Edge: Strongest in Feb–Jul, weakest in harvest season.

✅ Macro Edge: Track Brazil, Vietnam, Colombia → weather & politics drive 70%+ of supply.

✅ Consumer Edge: Health trends + premium coffee demand = long-term bullish.

✅ Diversification Edge: Coffee moves independently from equities & metals, making it an attractive portfolio diversifier.

Traders who align seasonality, weather, and demand cycles can use coffee futures or ETFs to capture repeatable opportunities in this globally essential commodity.

Coffee Futures Hit Weekly Supply Zone with RejectionThis week, Coffee futures have approached a significant weekly supply zone, where the Market

tested the area with a sharp spike, followed by a clear rejection. Currently, traders are watching for a potential re-entry into this same level, aiming for a swing trade targeting the monthly demand area. Additionally, seasonal patterns for coffee suggest a possible bearish trend, reinforcing the outlook for a potential downward move. This confluence of technical resistance and seasonal factors presents a strategic opportunity for traders to position for a downside continuation.

✅ Please share your thoughts about KC1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

The Coffee Vault is Open! Time to Rob the Bulls’ Treasure!☕💰 COFFEE MARKET HEIST – Bullish Loot Run! 💰☕

🌟 Hola, Bonjour, Hallo, Marhaba, Money Makers & Legendary Robbers! 🌟

Today’s target? "COFFEE" Commodities CFD Market – and we’re going in BULLISH 🚀📈

📌 Plan – Moving Average Breakout Entry

💎 Entry Point: The vault door is open – any price level is fair game!

💡 Thief’s Layer Strategy: Stack those buy limits like gold bars –

(345.00) ➡ (340.00) ➡ (330.00) ➡ (320.00) ☑️

(Feel free to increase the layers if your pockets are deep enough 🤑)

🛑 Stop Loss – Thief’s Escape Hatch

This is my Thief SL @300.00 🔒

👑 OG Robbers: Adjust your SL to match your strategy & risk appetite.

Remember, the cops are always closer than you think 🚔💨

🎯 Target – Police Barricade Ahead

🏆 Loot Goal: 410.00

💥 Hit it, bag the profit, and vanish before the sirens get loud!

📢 Thief Trader Pro Tips

Scalpers: Only rob from the Long side 🏴☠️

Swing Traders: Ride the heist wave with patience 🌊

Always trail your SL to protect the loot 💼

⚠️ Market Alert: Big news drops = high volatility.

🚫 Avoid fresh entries during news blasts.

✅ Manage positions like a true market outlaw.

💖 Boost this plan if you want the robbery crew to stay strong & profitable!

Let’s drink the profits ☕, not the losses.

🏆🚀 Thief Trader – Turning Charts into Loot Since Day One! 🏆🚀

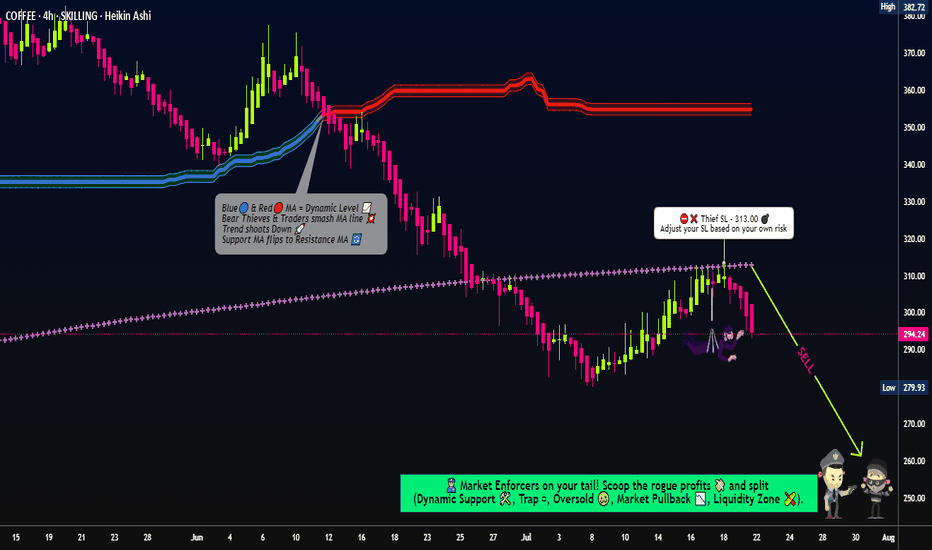

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

COFFEE - My Commodity of ChoiceI've laid out a plan I'm looking at on one of my favorite commodities - COFFEE ☕😍

What makes it so hard is the predictability of the weather - nearly impossible for the future. However, it is odd to see that the price still bonces at key support and resistance zones, almost like any "stock". Which tells me regular market trading still applies despite the odd weather event.

The reason Coffee has fallen so hard over the past few months is supply - due to extremely favorable weather conditions, coffee supply is more than demand. Resulting, as market dynamics goes, in a drop of price.

It's unfortunate though that my favorite pack of beans at the supermarket has not gone down - weird how that works 🙄 I like a medium roast, Columbia single origin.

It's dropped -33% already, but I can clearly see the market structure entering bearish phase after the bullish phase, peak (the new high) and now likely a multi-month bearish season. The question is just where the price can bottom for such a well loved commodity.

I looked at past cycles, not too long ago we dropped roughly 44% during the bearish cycle, taking 2-3 years to move into accumulation before another impulse wave up. That places a target for entry exactly in the highlighted zone around $250ish.

But I wouldn't get too greedy on my favorite commodity, buying orders can't be too low either. This would likely have to be a multiyear hold. Pepperstone sells coffee on cash contract but I usually do futures. Pity that I didn't get in sooner, bullish cycles is also at least a 2 year journey. I'll sell when the weather is bad 😅

Next up? Chocolate for sure...