Oil Target 62$: Sentiment Shifts Amid Geopolitical TensionsWe’re in a non-standard situation for oil markets — with the White House now openly threatening military action against Venezuela.

This dramatically increases the value of oil options sentiment.

You don’t need to be a PhD in geopolitics to understand:

A military operation = major supply disruption risk = price volatility on steroids.

And the market is already pricing it in.

Over the last two days, key levels like 58–60–72 have started appearing more and more in CME options flow — clear signs of positioning for extreme moves.

But here’s what matters most:

The trades that were placed before the Venezuela news broke.

That’s where we focus.

And if I had to summarize:

Two days ago, some guys were actively building spreads targeting 60–62 — betting on a pullback.

📌 Why?

These spreads are aggressive — they can generate 2x–3x returns from just a $2–$3 move, even if price doesn’t fully reach the target.

In short:

They’re not waiting for perfection.

They’re ready for explosion.

🔥 Final Take:

Yes, the option market has been extremely active over the past 48 hours — one of the busiest periods lately.

But beyond the noise, there’s a growing signal:

Oil is primed to explode.

And this "Venezuela narrative"?

It’s looking less like talk — and more like a setup for real movement. Big money is involved

The main question: will it explode before or after the New Year?

Commodities

SOL/USDT – H4 Analysis...SOL/USDT – H4 Analysis (According to My chart)

Market Structure

Price is below the Ichimoku cloud, showing strong bearish control.

Clear lower highs & lower lows → downtrend continuation.

Recent breakdown from consolidation confirms bearish momentum.

---

📉 Sell Scenario

Sell Zone: 122 – 126

🎯 Targets

Target 1: 110

Target 2: 105

---

❌ Invalidation

A strong H4 close above 130 will invalidate this bearish setup.

---

📌 Summary

Trend: Bearish

Bias: SELL

Expectation: Price to continue dropping toward the marked Target Point zone

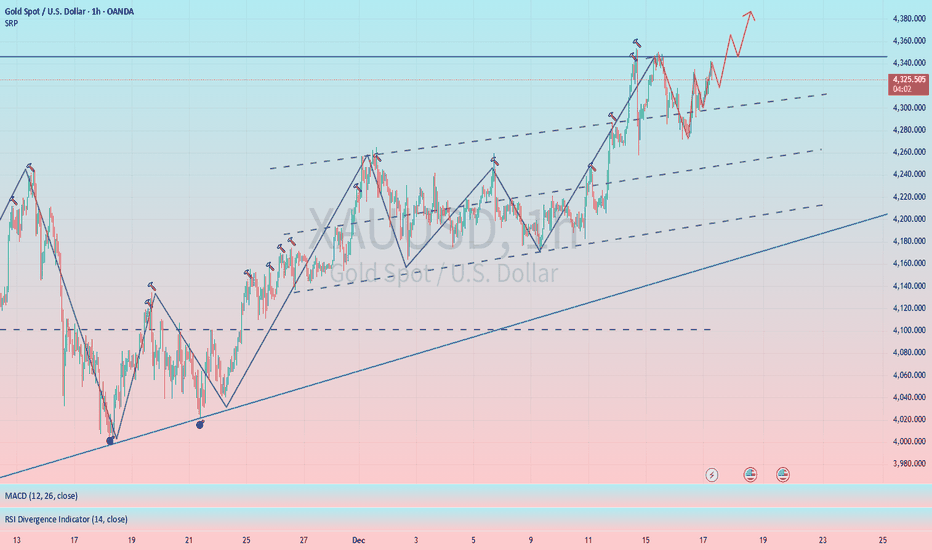

GOLD Local Short! Sell!

Hello,Traders!

GOLD trades into a well-defined supply zone after a strong bullish leg, showing signs of buy-side exhaustion. Expect a reaction from this SMC supply, with potential distribution and a move back toward lower liquidity pools below. Time Frame 1H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH/USD – H4 Analysis....ETH/USD – H4 Analysis (According to My chart)

Market Structure

Price has broken down from the ascending channel.

Strong bearish momentum after rejection from channel resistance.

Price is trading below the Ichimoku cloud, confirming bearish control.

Current move looks like a bearish continuation, not just a pullback.

---

📉 Sell Scenario

Sell Zone: 2,950 – 3,050

🎯 Targets

Target 1: 2,650

Target 2: 2,500

---

❌ Invalidation

A strong H4 close above 3,150 will invalidate the bearish setup.

---

📌 Summary

Trend Shift: Bullish → Bearish

Bias: SELL

Expectation: Price to continue dropping toward lower demand zones around 2.5k

CRUDE OIL Free Signal! Sell!

Hello,Traders!

CRUDE OIL Price has delivered a strong sell-side sweep into a well-defined horizontal supply, followed by clear bearish displacement. This area aligns with prior distribution and unmitigated sell orders, favoring continuation lower toward resting liquidity below recent lows.

--------------------

Stop Loss: 56.76$

Take Profit: 55.55$

Entry: 56.26$

Time Frame: 8H

--------------------

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD STRONG BULISH BIAS|LONG|

✅XAUUSD Price is compressing inside a bullish triangle after respecting ascending ICT structure. Liquidity is building below equal lows while buy-side rests above the supply. A clean breakout and displacement above the range opens the path for bullish continuation toward premium targets. Time Frame 2H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Last XPT Options Insights & What They Mean for Precious MetalsPlatinum Options showed unusual activity last week — and it’s worth your attention.

Why focus on platinum?

It’s a traditional institutional instrument, with minimal retail presence.

Check your terminal: compare spreads in PL vs. gold or silver — you’ll see the difference.

Low liquidity → less noise → clearer signals from funds and smart money.

And here’s the key:

Platinum often leads the way.

Its moves and positioning frequently foreshadow broader precious metals trends.

🔍 What Are We Seeing Now?

Large structured plays emerged in platinum, targeting a range between 1,750 and 2,200.

Most portfolios are hedged, which tells us:

“We’re bullish long-term — but expect pullbacks before the main move.”

This isn’t speculation.

It’s strategic positioning with risk management built in.

📌 In short:

They believe in higher prices — just not in a straight line.

💡 Silver: Similar Sentiment

The same bias appears across the asset- Bullish call spreads actively traded

Targets:

Silver: $65–85

Horizon: from 16 days to March 2026

🧠 Final Takeaway:

Platinum has already spoken. Precious metals bias is bullish, but a price decline is expected.

Silver Potential Bullish ContinuationAfter a considerable retracement, Silver price still seems to exhibit signs of overall potential Bullish momentum as the price action may form a credible Higher Low with multiple confluences through key Fibonacci Levels, Higher timeframe Harmonic Projections and Support levels which presents us with a potential long opportunity.

Trade Plan:

Timeframe : 1D

Entry : 61.204

Stop Loss : 55.64

TP 1 : 66.768

TP 2 : 72.315

BTC/USD – H2 Analysis ...BTC/USD – H2 Analysis (According to my chart)

Market Structure

Price is below the Ichimoku cloud, indicating bearish control.

Lower highs and lower lows → downtrend continuation.

Recent pullback into the cloud looks like a sell-on-rally setup.

---

📉 Sell Scenario

Sell Zone: 87,500 – 88,300

🎯 Targets

Target 1: 83,000

Target 2: 81,000

---

❌ Invalidation

A strong H2 close above 89,500 will invalidate this bearish setup.

---

📌 Summary

Trend: Bearish

Bias: SELL

Expectation: Price to move down toward the marked demand zone near 81k

What has caused silver to grow faster than gold?Considering the fluctuations of silver and the price movement model and the silver chart, it is reporting a price movement towards a price target in the range of $87 per ounce!

What seems to be the main question is why the price of silver is moving faster than gold and why does silver need to fill its price growth gap with gold at this time??!!

The link below is the path to past silver analysis:

What is seen in the silver chart!!!The prospect of $62 per ounce of silver is very much on the horizon, but will this price growth be as fast as the price of silver has ever seen? You can read the factors that contribute to the realization of this prospect after reviewing international articles, but I do not think it will be too early to reach this silver rate!

USD/JPY – H3 Analysis....USD/JPY – H3 Analysis (According to My chart)

Market Structure

Price is moving inside a descending channel.

Multiple rejections from the upper channel + resistance zone.

Price is below/inside the Ichimoku cloud, showing weak bullish momentum.

Overall bias remains bearish continuation.

---

📉 Sell Scenario

Sell Zone: 155.50 – 156.10

🎯 Targets

Target 1: 153.00

Target 2: 152.20

---

❌ Invalidation

A strong H3 close above 156.80 will invalidate the sell setup.

---

📌 Summary

Trend: Bearish

Bias: SELL

Expectation: Price to move down toward lower demand zone near 153 area

GOLD DAILY CHART ROUTE MAPPlease see our Daily chart route map that we are tracking.

Price is currently playing between the longer daily chart range 4259 and 4444, with the channel half-line acting as primary support.

We have a body close above 4259 leaving a long range gap open above at 4444 and will need ema5 lock to further confirm and strengthen this.

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will use our smaller timeframe analysis on the 1H and 4H chart to buy dips from the weighted Goldturns for 30 to 40 pips clean. Ranging markets are perfectly suited for this type of trading, instead of trying to hold longer positions and getting chopped up in the swings up and down in the range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up using our smaller timeframe ideas.

Our long term bias is Bullish and therefore we look forward to drops from rejections, which allows us to continue to use our smaller timeframes to buy dips using our levels and setups.

Buying dips allows us to safely manage any swings rather then chasing the bull from the top.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold Price Analysis - Key Supply & Demand Zones in FocusGold is trading inside a rising channel and currently consolidating below the 4335-40 resistance zone which aligns with the channel top and recent weak highs. Price structure shows mixed momentum indicating indecision after the strong impulsive rally.

As long as gold holds above 4,300–4,295 the bias remains range-to-slightly bullish, but a clear break above 4340-50 is needed to open the upside toward 4380+. Failure to break higher may lead to a pullback toward 426550 with a deeper correction possible toward 4225–4185 (strong demand zone).

📊 Technical Summary

Gold remains bounded within an ascending channel with key horizontal levels playing out:

- Strong Resistance: 4335–4340 (recent highs + channel top)

- Near Support: 4300–4295 (minor demand)

- Deeper Support Zones: 4265–4250 → 4225–4185

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

XAUUSD H1 | Bearish Reaction Off Key Pullback ResistanceMomentum: Bearish

Price is currently within the ichimoku cloud.

Sell entry: 4,296.63

- Strong pullback resistance

- 50% Fib retracement

- 78.6% Fib projection

- Fair value gap

Stop Loss: 4,318.39

- Multi-swing high resistance

Take Profit: 4,271.63

- Swing low support

High Risk Investment Warning

Stratos Markets Limited (tradu.com/uk ), Stratos Europe Ltd (tradu.com/eu ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com/en ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

XAG Analysis

Here is my view for today on XAG.

As per the previous analysis the purple line is important resistance as you see we have had a few reactions on 4h timeframe. need to see how its gonna pass this resistance area and with confirmation decide whether to enter or wait.

Check the yesterday's analysis and How much did yo guys made with our last analysis? ;)

Stay tuned for our next updates.

Gold (XAUUSD) — Structured Long After PullbackGold (XAUUSD) — Structured Long After Pullback

Gold continues to trade within a stable bullish structure despite local pullbacks and intraday volatility. The current situation is not an impulsive “buy the breakout” scenario, but a controlled and structurally justified long formed after a corrective phase.

Market context

After a strong bullish impulse, price entered a corrective leg. During this phase, the market removed weak downside liquidity and transitioned into a balanced consolidation zone. This behavior typically precedes continuation moves when the broader structure remains intact.

Why this setup is considered structured

This idea is based on market structure rather than momentum chasing. Price is currently positioned in a zone where risk boundaries can be clearly defined and invalidation levels are visible. The setup assumes continuation only while the structure holds.

What the indicator highlights

The indicator interprets the current price behavior as a structured long scenario with predefined trade components.

Entry is aligned with the active structure.

Stop Loss is placed at the point where the structure would be invalidated.

Take Profit is projected toward the next expansion area based on historical price behavior.

The goal is not to predict price, but to engage only when the market provides a measurable and controlled risk-to-outcome profile.

Statistical context

On-chart performance metrics provide historical context for similar trade configurations, including win rate, profit factor, drawdown, and total trades. These statistics are used as analytical support, not as a performance guarantee.

Execution logic

This idea represents a continuation-oriented long scenario. It remains valid only while the underlying structure is respected. If invalidation occurs, the scenario is considered canceled rather than adjusted.

Important notice: This publication represents market analysis and educational insight only. It is not financial advice and does not guarantee profitability. Past performance does not guarantee future results. Always apply proper risk management.

SILVER SHORT FROM RESISTANCE

SILVER SIGNAL

Trade Direction: short

Entry Level: 6,544.8

Target Level: 6,229.1

Stop Loss: 6,754.8

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAU/USD | Get Ready for $4400 Target and Beyond! (READ)By analyzing the #Gold chart on the 4 hour timeframe, we can see that price moved exactly as expected. Gold first made a small pullback and dropped to the $4290 demand zone. As soon as price reached this key area, strong buying pressure came in and gold successfully hit the first target at $4343.

So far, this analysis has delivered more than 500 pips in profit. I expect gold to continue moving higher. Even though price is currently inside a supply zone, the strong momentum suggests a possible breakout. The next upside targets are $4351, $4359, and $4382.

the last TA on TVC:GOLD :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Buy on dips as the ascending triangle pattern remains intact#XAUUSD TVC:GOLD OANDA:XAUUSD

Despite yesterday's data releases, the overall long-term trend remains unchanged. Gold prices are currently standing above the daily MA5 and MA10 again, indicating a short-term market bias towards upward movement. Therefore, our trading strategy will continue to focus on buying on dips. While bullish, we will avoid chasing rallies. The 4345-4355 level remains a key short-term resistance level. Short-term support levels to watch are 4320-4305. If gold prices pull back to these levels during the European session, consider going long on gold