XAGUSD: breakout of the support trend line🛠 Technical Analysis: On the 4-hour timeframe, Silver (XAGUSD) has been in a sustained bullish rally, characterized by a well-defined Support trend line that has successfully propped up price action since late November. However, the pair has now reached a critical Resistance zone between $65.70 and $67.00.

The price action is currently showing signs of exhaustion at this peak, as it struggles to break higher. The analytical projection suggests a breakdown of the support trend line, which would trigger a corrective move toward the horizontal support levels below. A shift in momentum is expected as the price moves away from the overextended resistance toward the $58.50 target.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on the break of the Support trend line (approx. $64.68 - $65.72).

🎯 Take Profit: $58.496 (Support).

🔴 Stop Loss: $67.775 (Above the current resistance zone).

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Commodities

GOLD: Bullish Continuation & Long Trade

GOLD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry - 4328.1

Sl - 4319.1

Tp - 4342.9

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

DeGRAM | GOLD formed an ascending wedge📊 Technical Analysis

● XAU/USD is capped below a descending resistance line near 4,340–4,350, where multiple intraday highs failed, forming a lower-high structure. The latest bounce lost momentum inside a rising corrective channel, signaling exhaustion.

● Price is rolling over from resistance and drifting back toward key support at 4,300–4,280. A breakdown below the rising support line would confirm short-term bearish continuation toward the lower support zone.

💡 Fundamental Analysis

● Gold faces pressure from firmer US yields and reduced safe-haven demand as markets reassess near-term rate expectations.

✨ Summary

● Short bias below 4,340–4,350. Key supports: 4,300 and 4,280. Rejection from resistance keeps downside risk dominant.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAUUSD: Market Analysis and Strategy for December 19thGold Technical Analysis:

Daily Resistance: 4382, Support: 4260

4-Hour Resistance: 4371, Support: 4290

1-Hour Resistance: 4350, Support: 4302

From the 1-hour chart, gold is currently consolidating at a high level, but the overall upward trend remains unchanged. Structurally, after the previous surge, the upward momentum failed to continue, with multiple attempts to break through resistance and subsequent pullbacks, leading to a short-term consolidation pattern. The current price pullback to the lower part of the consolidation range is a normal correction after the initial rise. In terms of moving averages, the price has returned to the vicinity of the short-term moving averages and the middle Bollinger Band; the Bollinger Bands have not expanded significantly, indicating that volatility remains within a controllable range, and short-term consolidation may continue. The first upward resistance level for gold is at the upper Bollinger Band at $4352. A break above this level could lead to a challenge of the historical high of $4382, and subsequently the psychological level of $4400. On the other hand, if bearish candlesticks appear and prices remain below the December 17th low of $4300, short-term sellers will control the market, and prices will continue to decline. Support levels to watch are $4300, $4371, and $4357. The key resistance levels for the NY market are $4352 and $4380. The short-term reversal point is at $4302!

NY Market Reference Strategies:

Risk Strategy: SELL: $4345-$4353

Safe Strategy: SELL: $4368-$4376

If a significant pullback occurs, buying suggestions:

BUY: $4300-$4292

BUY: $4272-$4265

More Analysis →

Platinum Futures On A Weekly TimeframeRight now PL1! along with other rare metals are entering a very strong bullish phase with the first movement of the phase already taken place

I expect it price to evolve into a large expanding wedge as can be seen on chart

Vertical lines show lengths of bear markets and how we have moved out of the last bear market on this timeframe.

GOLD - Consolidation amid a bullish trend. To ATH?FX:XAUUSD , after retesting its ATH (to the 4375 zone), is falling amid weak US inflation data. The dollar is strengthening, but despite this, gold is in a bullish trend.

US inflation (CPI) for November was lower than expected, but Trump's statements about the future “dovish” Fed chair are limiting the decline in gold. The market continues to expect the Fed to ease policy in 2026.

Today, data on the US consumer confidence index will be released.

Short-term pressure remains, but the fundamental background does not allow us to talk about a trend reversal. The market structure is bullish, but there is a magnet zone below: 4310 - 4300. MM is likely to test it before moving towards ATH and updating highs...

Resistance levels: 4330, 4353, 4375

Support levels: 4308, 4300, 4291

The dollar is forming a temporary correction due to fundamental factors. A weak dollar will support gold...

The 4308-4300 zone is a liquidity pool, and the market may test this area amid the dollar correction. A long squeeze could bring the market back to growth.

Best regards, R. Linda!

Gold Near Triangle Top — Correction Phase IncomingBased on yesterday’s U.S. economic data, Gold( OANDA:XAUUSD ) failed to post a significant bullish move.

At the moment, Gold appears to be trading within a Symmetrical Triangle pattern and is currently moving near the upper lines of this pattern.

From an Elliott Wave perspective, it seems that Gold has completed a Double Three corrective structure near the upper lines of the symmetrical triangle.

In addition, a Regular Bearish Divergence (RD−) can be observed between the two most recent highs, which weakens the bullish momentum.

I expect that Gold will at least decline toward the lower lines of the symmetrical triangle. If these lower lines are broken, we could even anticipate a breakdown below the Support zone($4,265-$4,240).

First Target: Lower lines of symmetrical triangle

Second Target: Support zone($4,265-$4,240)

Stop Loss(SL): $4,357

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Gold Analyze (XAUUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

XAUUSD Holds Bullish Structure - Resistance at $4,380 in FocusHello traders! Here’s my technical outlook on XAUUSD (Gold) based on the current chart structure. After a corrective phase, Gold established a solid base and transitioned into a bullish recovery, forming higher lows and respecting the rising Support Line. The price previously moved through a consolidation Range, where accumulation took place before a clear breakout confirmed renewed buying momentum. Following this breakout, XAUUSD continued to trade within an ascending channel, showing a well-structured bullish trend. Recently, price pulled back into the Buyer Zone around 4,280, which aligns with the horizontal Support Level and the lower boundary of the rising structure. Buyers successfully defended this area, keeping the bullish structure intact. From this support, Gold has started to rebound and is now pressing higher toward the Seller Zone / Resistance Level near 4,380 (TP1) — a key supply area where sellers may attempt to slow the move. As long as XAUUSD holds above the 4,280 Support, the bullish scenario remains valid. I expect continued upside pressure toward the 4,380 Resistance (TP1). A clean breakout and acceptance above this seller zone would open the path for further bullish continuation. However, rejection from resistance could lead to a short-term consolidation or a healthy pullback back toward support. For now, the structure favors buyers, with 4,280 as key support and 4,380 as the main upside target. Always manage your risk and trade with confirmation. Please share this idea with your friends and click Boost 🚀

DXY: long-term view🛠 Technical Analysis: On the weekly timeframe (W1), the U.S. Dollar Index is displaying a significant structural shift. Despite a brief breach of the psychological 100 level, the price failed to generate a strong downward impulse, suggesting that bearish momentum is exhausted.

As noted on the chart, "sellers are being bought out," paving the way for a recovery back above the 100 level. The primary objective of this move is a test of the long-term descending resistance line, which currently aligns with the 107.384 target.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Confirmation of price holding above the pivot level (approx. 100.524).

🎯 Take Profit: 107.384 (Long-term Descending Resistance).

🔴 Stop Loss: Below the recent accumulation lows (approx. 97.787).

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

XAUUSD: rise to all-time high🛠 Technical Analysis: On the 4-hour timeframe, gold (XAUUSD), after breaking out of accumulation in a wide triangle, continues to show signs of bullish momentum. Analysis suggests a high probability of a final upward push or even a potential "false breakout" (liquidity capture) to the resistance zone around 4,400 to liquidate early short positions. A downward reversal around 4,400 can be considered if appropriate signals are present.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy on the confirmed breakout of the short-term resistance 4,286 (approx. 4294)

🎯 Take Profit: 4,377.47

🔴 Stop Loss: 4,249.74

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

EURUSD: triangle breakdown🛠 Technical Analysis: On the 4-hour timeframe, EURUSD is showing signs of trend exhaustion after a sustained rally within an ascending channel. Although a "Global bullish signal" was previously recorded, price action is now forming a "Triangle pattern" near the critical support level of 1.17300. This pattern, occurring at the bottom of the channel, typically indicates a likely downward movement as buying pressure fades. The analysis anticipates a breakdown from this consolidation zone, leading to a correction toward lower support levels.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on the breakdown of the triangle lower boundary (approx. 1.17211 – 1.17300).

🎯 Take Profit: 1.16500 (Support).

🔴 Stop Loss: Above the recent local peak (approx. 1.17609).

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

EUR/USD | What to expect (READ THE CAPTION!)As you can see in the Hourly chart of EURUSD, after the CPI news, it surged in price, went through the supply zone and sweeped the liquidity above 1.1758 before dropping all the way back to the prior supply zone, now being traded at 1.1711.

I expect the SSL there below the 1.1703 level to be sweeped and then a reaction.

BTCUSD SELL SETUPPOSSIBLE SELL SETUP BTCUSD

SL ABOVE SUPPLY ZONE

TP 1 BELOW DEMAND ZONE

TP 2 OPEN USE PROPER RISK MANAGEMENT

FOLLOW YOUR TRADING PLAN !!!!

SIMPLE BTCUSD TRADING PLAN

1️⃣ Timeframe

15m or 1H only

2️⃣ Indicators

200 EMA → trend

50 EMA → entry

RSI (14) → confirmation

3️⃣ BUY RULES

✅ Price above 200 EMA

✅ Pullback to 50 EMA

✅ RSI above 50

✅ Bullish candle

➡️ Then BUY

4️⃣ SELL RULES

✅ Price below 200 EMA

✅ Pullback to 50 EMA

✅ RSI below 50

✅ Bearish candle

➡️ Then SELL

5️⃣ Risk Rules

Risk 1% per trade

Always use Stop Loss

Target = 2× Stop Loss (1:2)

6️⃣ Management

At 1:1, move stop to breakeven

Do nothing else

7️⃣ Golden Rules

❌ No stop loss = no trade

❌ No emotions

❌ No overtrading

ONE LINE RULE

If all rules aren’t met → NO TRADE

GOLD Is Very Bullish! Long!

Please, check our technical outlook for GOLD.

Time Frame: 1h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 4,320.70.

Considering the today's price action, probabilities will be high to see a movement to 4,339.30.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

XAUUSD Intraday Plan | Price Back Below Key ResistanceGold is once again trading below the 4334 resistance. After reaching the 4362 target yesterday, price sharply retraced and slipped back below 4334, now trading around 4321 and below the MA50.

Price action has turned bearish in the short term. If 4334 continues to hold as resistance, a rotation back into the reaction zone becomes likely. A break below 4270 would increase downside pressure and shift focus toward the support zone for a potential reaction.

For bulls to regain control, price needs to reclaim 4334, followed by a break above 4362 to open the path toward 4395.

📌Key levels to watch:

Resistance:

4334

4362

4395

Support:

4301

4270

4237

4185

GBP/USD | Up or Down? (READ THE CAPTION)In the hourly chart of GBPUSD, we can see that GBP surged in in price after the CPI news, however, it failed to go through the supply zone and sweep the liquidity above there. GBPUSD hit 1.34466 after the CPI news, but dropped all the way to 1.33632, just below the high of the supply zone and it is now being traded at 1.33790.

There's a FVG at 1.34055-1.34097 which could cause a reaction.

We shall monitor the market closely to see how GBPUSD reacts.

XAU/USD | Consolidation! (READ THE CAPTION)By examining the Hourly chart of XAUUSD, we can see that Gold has been ranging between the 4H FVG and the bearish OB. After the CPI news yesterday, Gold went up as high as 4374, before dropping again and touching the high of the 4H FVG at 4317 and then again going up and now it's being traded at 4323. Gold is now consolidating between the Bearish OB and the 4H FVG.

It's not clear yet how Gold might react in the coming hours and weeks before the new year, however, it still is possible for Gold to hit a new ATH by the end of the year.

What Is the Bull Side – and What Is the Bear Side?In trading, there are concepts that everyone has heard of , but not everyone truly understands correctly . “ Bull side ” and “ Bear side ” are two such terms. Many traders use them every day, yet often assign them overly simplistic meanings: bulls mean buying, bears mean selling.

In reality, behind these two concepts lies how the market operates , how capital flows think , and how traders choose which side to stand on .

What Is the Bull Side?

The Bull side (bulls) represents those who expect prices to rise . However, bulls are not simply about buying .

The true essence of the bull side is the belief that the current price is lower than its future value , and that the market has enough momentum to continue moving upward .

The bull side typically appears when:

Price structure shows that an uptrend is being maintained

Active buying pressure controls pullbacks

The market reacts positively to news or fresh capital inflows

More importantly, strong bulls do not need price to rise quickly . What they need is a structured advance , with healthy pauses and clear support levels to continue higher.

What Is the Bear Side?

The Bear side (bears) represents those who expect prices to fall . Like bulls, bears are not merely about selling .

The core of the bear side is the belief that the current price is higher than its true value , and that selling pressure will gradually take control .

The bear side tends to strengthen when:

An uptrend begins to weaken or breaks down

Price no longer responds positively to good news

Every rally is met with clear selling pressure

A market dominated by bears does not always collapse sharply . Sometimes, it shows up as weak rebounds , slow and extended , but unable to travel far .

When Does the Market Lean Toward Bulls or Bears?

The market is never fixed to one side . It is constantly shifting .

There are periods when bulls are in control , times when bears dominate , and moments when neither side is truly strong .

Professional traders do not try to predict which side is right . Instead, they observe:

Which side controls the main move

Which side is reacting more weakly over time

What price is respecting more: support or resistance

These price reactions reveal who is in control , not personal opinions or emotions.

Common Mistakes When Talking About Bulls and Bears

Many traders believe they must “ choose a side ” and remain loyal to it . In reality, the market does not require loyalty .

The market only demands adaptation .

Today’s bulls can become tomorrow’s bears .

A skilled trader is someone who is willing to change perspective when the data changes , rather than defending an outdated view .

Gold Is Being Tested at the TopGOLD (XAUUSD) – Daily Structure & Macro Context

Technical Structure (Daily)

On the 1D timeframe, Gold remains in a primary bullish trend, but price action is now clearly hesitating near the previous ATH zone (~4,380–4,400). This area has historically attracted strong supply, and the current behavior confirms that sellers are actively defending it.

Price is still trading inside an ascending channel, respecting the rising trendline from the November lows. However, momentum has slowed notably as candles compress beneath the old ATH, forming overlapping highs and shallow pullbacks rather than clean continuation. This is a classic distribution vs. re-accumulation zone, not an impulsive breakout phase.

Key technical observations:

- Higher highs and higher lows remain intact → macro trend still bullish

- Repeated rejection near old ATH → supply absorption in progress

- EMA structure (34 & 89) remains supportive below → downside currently corrective

A clean daily close above the old ATH would confirm continuation toward new highs. Conversely, failure to hold the rising trendline opens room for a deeper pullback toward the EMA cluster, without invalidating the broader uptrend.

Macro Drivers (What’s influencing Gold now)

1. US Dollar Stabilization

The recent pause in Gold’s advance aligns with a short-term stabilization in the US Dollar. As USD demand temporarily recovers, Gold loses momentum but does not break structure a sign of balance, not weakness.

2. Fed Policy Expectations

Markets continue to price in eventual rate cuts, but the timing remains uncertain. The absence of immediate dovish confirmation from the Fed keeps Gold capped near highs, as traders reduce leverage and wait for clearer signals.

3. Real Yield Sensitivity

While real yields have stopped rising aggressively, they remain elevated enough to slow Gold’s upside acceleration. This creates consolidation rather than reversal.

4. Geopolitical & Risk Hedging Still Present

Despite short-term hesitation, Gold continues to benefit from structural demand as a hedge, which explains why pullbacks remain shallow and well-supported.

Forward Scenarios

Bullish continuation: Acceptance above old ATH → trend expansion resumes

Corrective scenario: Rejection at ATH → pullback toward trendline / EMAs

Invalidation: Only a sustained break below the rising structure would shift the macro bias

Key Takeaway

Gold is not topping out it is being priced under uncertainty.

The market is balancing strong long-term bullish drivers against short-term macro hesitation. This zone is where decisions are made, not where trends end.

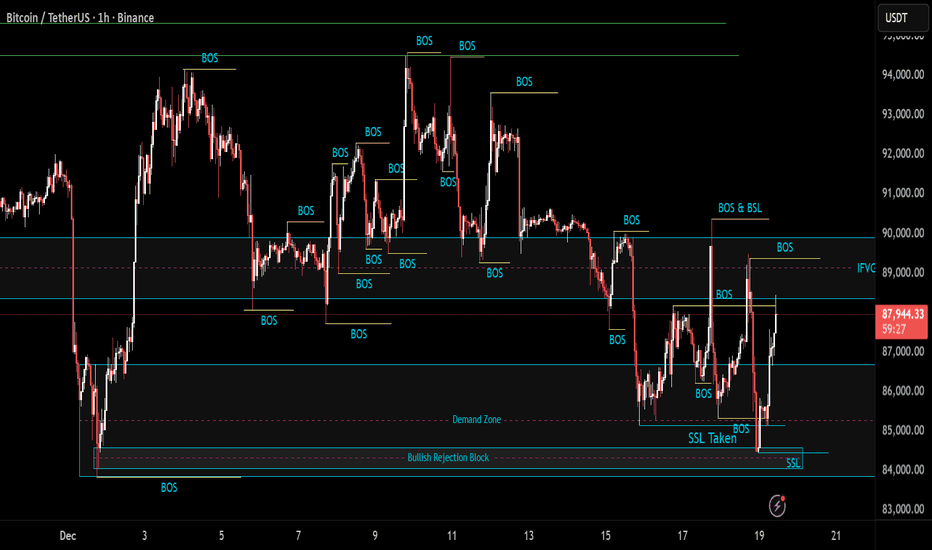

BTC/USDT | No clear movement! (READ THE CAPTION)As you can see in the Hourly chart of BTCUSDT, it surged in price after the CPI news, going as high as 89,477, before dropping to the demand zone again. However, this drop came with BTC going as low as 84,450, reaching the Bullish Rejection Block, and then going upwards towards the IFVG, reaching 88,449 before dropping again in between the demand zone and the IFVG.

So far, BTC is yet to make a strong move towards up or down, consolidating in the range with no clear motif.

GOLD SELL | Idea Trading AnalysisGOLD is moving to the upper boundary of the ascending channel.

The volatility of the movement has decreased.

The price has reached the resistance level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity GOLD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️