Liquidity Cleared, Gold Setting Up the Next Leg HigherOANDA:XAUUSD has just completed a powerful expansion leg that pushed price into a new all-time high region, and the current pullback should be viewed through the lens of liquidity management, not trend failure. On the one hour timeframe, the market has clearly transitioned from a steady accumulation phase into an impulsive markup, leaving behind multiple unfilled inefficiencies and a well-defined demand zone around five thousand to four thousand nine hundred eighty. This area is not random. it represents the last consolidation before the vertical expansion, where smart money accumulated inventory before driving price higher.

From a structure perspective, the sequence is constructive. The impulsive move from the previous base formed a clean five wave advance, with wave three accelerating through prior resistance and wave five extending toward the five thousand one hundred ninety to five thousand two hundred region. After such a move, it is statistically normal for price to retrace into prior demand to rebalance liquidity. The projected corrective structure labeled as A–B–C is consistent with a healthy bullish continuation: wave A initiates profit-taking, wave B traps late buyers into thinking the uptrend has resumed, and wave C completes the correction by sweeping remaining sell-side liquidity resting below the demand zone.

Liquidity dynamics strongly support this scenario. The all time high area above five thousand one hundred is a major pool of buy side liquidity, but markets rarely move straight through such levels without first clearing internal liquidity below. The current pullback is effectively a liquidity cleanse removing weak long positions and triggering protective stops which resets positioning and allows stronger hands to re-enter at better prices. As long as price holds above the demand zone near four thousand nine hundred eighty to five thousand, the bullish structure remains intact.

On the macro side, gold continues to benefit from persistent uncertainty: elevated geopolitical risk, long-term concerns over sovereign debt, and expectations that global monetary conditions will remain accommodative longer than previously priced. Even when short-term rate expectations fluctuate, gold has shown relative strength, signaling that capital is flowing into it as a strategic hedge rather than a short-term trade. This macro backdrop supports the idea that dips are being accumulated, not sold aggressively.

From a market psychology standpoint, this is the classic late-stage breakout behavior. Retail traders tend to chase strength near all time highs, while professional participants wait for pullbacks into demand. The current retracement is designed to shake confidence, create fear of a “top,” and entice premature short positions fuel that can later drive the next expansion once price reclaims momentum.

Trading Plan & Key Levels:

As long as price respects the demand zone between four thousand nine hundred eighty and five thousand, the bias remains bullish. A strong reaction and higher low from this area would open the path for another push toward five thousand one hundred ninety to five thousand two hundred, with a confirmed break potentially extending the trend further. A sustained breakdown and acceptance below four thousand nine hundred eighty would invalidate the immediate bullish scenario and suggest a deeper correction instead.

Summary:

This is not weakness it is rotation. Gold has already proven strength by reaching new highs. What we are seeing now is a controlled reset of structure and liquidity before the market decides whether it is ready to continue toward the five thousand two hundred objective. Patience here is key; let the market show its hand at demand.

Commodities

Copper: Following Gold and SilverAs the weekly chart indicates, we foresee a pronounced sell-off as part of the green wave , but not before finishing its current run to conclude the magenta wave (Y) and therefore the overreaching green wave around the $7.00 mark.

The then following and before mentioned wave should bring copper down into our green long target zone between $4.56 and $4.06.

Gold long term targetsAs I personally think we will see gold hitting 5600$!

Based on what?

Well this is why I think what I think !

My first target hit long ago(as you can see in the image) and I sold all my Long term position already...Sadly.

I honestly thought price would have retraced a bit but instead it didn't even stop.

This strongly convince me , now that we have created a monthly FVG above 0.75 DRT level, that price will retrace in it and that will give me an advantage to open a light swing trade to last target 5600$.

Check it out and see if you like the idea.

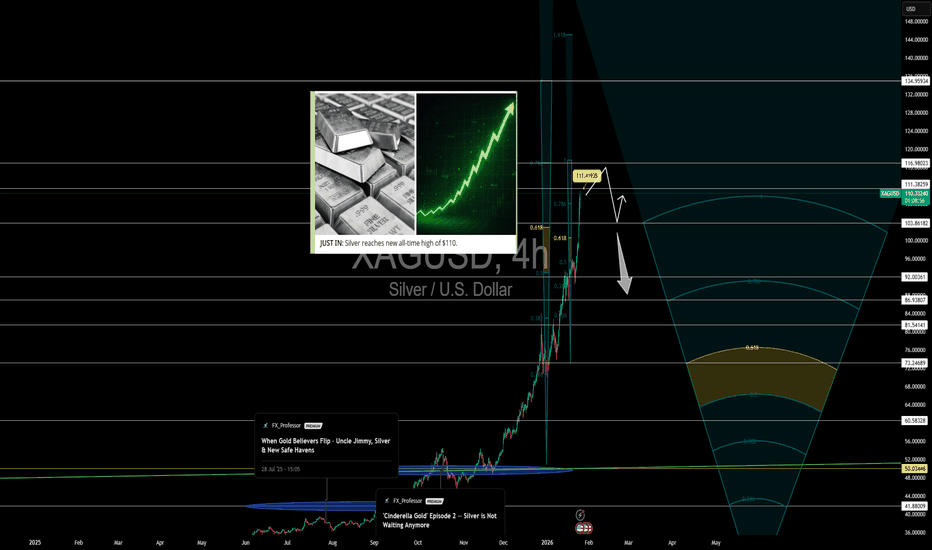

Silver bullish breakout supported at 9900The Silver remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 9900 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9900 would confirm ongoing upside momentum, with potential targets at:

11200 – initial resistance

11617 – psychological and structural level

12070 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 9900 would weaken the bullish outlook and suggest deeper downside risk toward:

9468 – minor support

9010 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 9900. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Gold Options Expiry: The $4,375 "Gravity" vs. StatisticalHey traders!

Tomorrow is a financial battleground for the gold market. It's the major monthly options expiry, and the numbers reveal a fascinating tug-of-war. Let’s break down the forces at play and what they mean for the price.

The Setup: Huge Open Interest

Looking at the latest data, we have over **126,000 open call contracts** and more than **155,000 open put contracts** set to expire. Here’s the breakdown:

Calls:

- In the Money (ITM): 105,859

- At the Money (ATM): 68

- Out of the Money (OTM): 20,572

- Total OI: 126,499

Puts:

- In the Money (ITM): 111

- At the Money (ATM): 47

- Out of the Money (OTM): 154,874

- Total OI: 155,032

That’s a massive pile of open interest, with most puts sitting deep out of the money—a sign that a lot of traders have been betting on a drop or hedge there bull trades.

But the story doesn't end here.

The "Gravity" of Max Pain

The Max Pain level is currently sitting at $4,375.

What is Max Pain? Think of it as the "house's" ideal price. Option sellers (market makers and institutions) collect premiums from buyers. They make the most money if options expire worthless. The Max Pain price is the strike where the maximum number of options (both puts and calls) expire worthless, causing the most financial "pain" to buyers and maximum profit for sellers.

The theory suggests that as expiry approaches, the price will be gravitationally pulled toward this level. If you take this theory at face value, gold should drop from its current to $4,375 by tomorrow's close.

But… Is That Even Possible?

Here’s where we need to pump the brakes. Statistically speaking, the odds of such a move are close to zero—and here’s why.

On developed markets, asset price moves are largely governed by well-known mathematical and statistical boundaries, especially the **expected volatility range**. Hedge funds and institutional traders have relied on these ranges for years to guide their decisions. The range is defined by standard deviations:

- 1st standard deviation:** Price stays within this range 68% of the time (up or down).

- 2nd standard deviation:** 95% probability.

- 3rd standard deviation:** 98% probability.

So, to seriously claim that gold will hit $4,375 by tomorrow’s close, you’d need to calculate the 3rd standard deviation from today’s settlement and see if $4,375 is even in the realm of possibility.

In my experience, I do these calculations right after the daily clearing and plot them on the current gold futures chart. (If you’re not up for the math, just follow my posts—I regularly share these volatility bands and show how well they work. Spoiler: price bounces or stalls at these levels with at least 70% effectiveness.)

Can Gravity Break the Leash?

Now, let's be data-driven analysts and combine our two forces:

Max Pain "Gravity" Target: $4,375.

Statistical "Leash" Range for Today(3rd SD): $4,855-5,300

The conclusion is immediate and powerful: The Max Pain level of $4.375 lies far outside the probable 3rd standard deviation statistical range.

For the price to reach $4,375, it would need to break not just the 1st, but likely the 2nd or even 3rd standard deviation boundary. While not impossible, this is a very low-probability event.

The Bottom Line: What to Expect

So, will gold collapse to $4,375 tomorrow? Statistically, the odds are heavily against it. The "leash" of volatility is too short.

The theory of Max Pain is a vital tool for identifying points of financial interest, but it's not a crystal ball. It works best when the Max Pain level falls inside the statistical volatility range. When it's outside, volatility almost always wins.

In a hot market like gold, where every dip is being bought, a low-probability statistical move becomes even less likely.

Instead of a crash to Max Pain, a more probable scenario is for the price to remain pinned within its statistical range (for today $4,855-5,300), possibly testing the lower bound of that range.

I hope this article has sparked your interest in diving deeper into these topics and prompted you to start incorporating statistical data into your trading decisions. This is precisely the kind of edge that is essential for successful practical trading

💰 Check our account bio for more ADVANTAGE! Trade Smart!

XAUUSD Time to correct for the last time before $8000?Almost 5 months ago (September 05 2025, see chart below) we posted a multi-decade analysis on Gold (XAUUSD), making a case why $8000 was the long-term Target by late 2029:

Now as the price has almost reached the top of its Bull Cycle Channel Up (green) and it is time to start considering a multi-month technical correction.

That was what happened back in March 2008 when the price was almost at the exact point as today. At the top of its Bull Cycle Channel Up, just after the 0.786 Time Fibonacci level and just below the 0.236 Channel Fibonacci level. With just this month's rise (January 2026), Gold managed to reach the 0.236 Channel Fib just a month after it hit the current 0.786 Time Fib.

So that technical confluence initiated an 8-month correction that breached the 0.236 Horizontal Fib (orange), did the same to the 0.618 Channel Fib and just before it hit the 1M MA50 (blue trend-line), it bottomed.

On today's fractal we know where both the 0.618 Channel Fib and 1M MA50 are so what's left is to confirm where the price peaks and draw the 0.236 Fib. If we top a little higher, then the 0.236 Fib will be at 3600, so we can expect to fulfil the 2008 conditions a little lower.

In any case, the moment Gold approaches its 1M MA50 again (remember this is also where the market bottomed in November 2022 and this massive rally started), it will be our choice for a long-term buy again, targeting the top of this Cycle at $8000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold Breaks $5,000 | 2026 Outlook, Risk-Off Rally & Next Price ZOANDA:XAUUSD Gold Outlook 2026 Buy or Sell

📅 26 January 2026

🌍 MARKET OVERVIEW

Gold surged sharply on Friday, January 23, 2026, extending its historic rally as safe haven demand intensified amid geopolitical tensions, US policy uncertainty, and a weaker dollar outlook. COMEX gold futures hit record intraday highs near $4,990 to $4,995 and settled around $4,980 to $4,990, capping a massive weekly gain of over 8 percent.

Spot gold closely followed, pushing toward the key $5,000 psychological level after trading near $4,800 to $4,900 earlier in the week. The rally was driven by strong central bank buying, de dollarization trends, and escalating global risks, with silver also posting explosive gains.

🧠 KEY FUNDAMENTALS

🇺🇸 US Durable Goods Orders

Expected around 8:30 AM ET. Strong data may support the USD and pressure gold, while weak data could boost safe haven demand.

🏭 US Capital Goods Orders

Released alongside durable goods. Impacts growth outlook and USD direction, indirectly affecting gold.

🌍 Other Minor Data

Possible Eurozone or Canada GDP and early regional releases, but no major gold moving impact expected.

🌐 GEO POLITICS

🟡 Gold breaks $5,000

Spot gold surged to new record highs between $5,092 and $5,108 intraday on Monday, January 26, driven by intense safe haven demand.

🇺🇸 US tariff and policy uncertainty

Renewed fears around broad US tariffs involving Europe, trade partners, and Greenland rhetoric revived Trump era volatility, triggering capital flight into gold.

🔥 Rising global geopolitical risks

Ongoing Middle East tensions including Iran concerns, Russia Ukraine dynamics, and shifting US foreign policy are fueling global risk aversion.

🏦 De dollarization and central bank buying

Persistent central bank accumulation and investor hedging continue to underpin gold’s upside momentum.

⚖️ RISK ON RISK OFF ANALYSIS

📉 US 10 Year Treasury Yield

Current level 4.208 percent

Change 0.032 percent lower versus previous close around 4.24 percent

Daily range 4.208 percent to 4.223 percent

52 week range 3.860 percent to 4.660 percent

Trend Yields drifting lower confirming a risk off bias

🧠 WHAT DO ANALYST EXPECT

Gold surged to new all time highs above $5,100, extending its historic breakout into January 26.

The $5,000 level was breached for the first time late on January 25, triggering accelerated upside momentum.

Escalating US tariff threats including potential 100 percent tariffs linked to China and Canada heightened global trade war fears.

Policy uncertainty and confrontational rhetoric increased risk off sentiment, driving safe haven flows into gold.

Gold’s rally is increasingly viewed as a signal of declining confidence in fiat currencies and global policy stability, reinforcing strong bullish momentum.

🟢 CONCLUSION

Gold’s move above $5,000 confirms a strong risk off shift driven by geopolitical stress, tariff fears, and declining confidence in policy stability. Falling yields and a weaker dollar are reinforcing safe haven demand. Central bank buying and de dollarization trends continue to support the rally. The move is structural rather than data driven. Upside momentum remains firmly intact.

Bitcoin vs Gold — Major Support Says “Watch This Now” ⚔️ Bitcoin vs Gold — Major Support Says “Watch This Now” 🏅

This is one of the most underrated charts in macro right now — the BTC/XAU ratio is sitting at multi-year ascending channel support , the same level that triggered massive reversals in 2020 and 2022.

We're talking about a structure that’s been respected for years — and it’s flashing a signal again. Support is between 15.39 and 17.09 , and we’ve just tagged it.

Divergences are present, momentum is slowing, and risk-to-reward is building.

📺 This setup was covered in detail in the full macro video:

🔗 Silver $110, Gold $5K — Bitcoin Pump Next?

This isn’t just about BTC vs Gold. It's about where we are in the rotation cycle :

– Silver just hit $110

– Gold is hovering above $5,000

– Bitcoin has underperformed — until now?

If this level holds again, we could see a sharp reversal in favor of BTC. If it breaks… you already know the play — sit back and wait for a deeper flush.

Mindset Check 🧘

Real macro setups don’t scream — they whisper at key levels. This BTC/Gold chart is whispering now, just like it did before the 2020 breakout. If you’re focused only on dollar pairs, you're missing the real rotations.

Disclaimer: Nothing I post is financial advice. It's perspective. I’ve mastered the art of prognosis, but you are the one behind the trigger. Always know your levels, and respect your risk.

One Love,

The FXPROFESSOR 💙

SilverOver the last 10 trading days, silver futures have exhibited a strong bullish trend, extending a powerful rally that began in late 2025. The price has advanced from roughly $88–90/oz to above $105/oz, with successive higher highs and higher lows

Surpassed ~$100/oz decisively and sustained above this psychological threshold toward recent highs near ~$110/oz

The rally has been supported by risk-on flows as the US dollar softened and safe-haven and industrial demand factors strengthened. Speculative positioning and ETF inflows have underpinned upside interest, though sentiment signals indicate extended bullishness and potential for corrections..

Like and Share

Silver $110, Gold $5K — Bitcoin Pump Next?Silver at $110, Gold at $5K, Bitcoin at Support — The Rotation Has Begun

New all-time highs for silver at $110 mark a historic moment. From $50 in November 2025 to blasting through $70, $80, $90 — and now triple digits — this has been one of the most aggressive moves in precious metals history .

Next resistance? $111.40 , followed by $116 and potentially $134.

Yes, I shorted at $103 and got smashed — life goes on. We adapt. 👊

But this video and analysis isn’t just about silver. It’s about where we are in the macro rotation — across silver, gold, and Bitcoin.

Gold is holding firm above $5,000 , with $5,405 as the next upside target. $5K now acts as psychological support. The metal remains strong — but the key question is: how much longer can gold outperform?

Bitcoin still looks weak — but the BTC/Gold ratio tells a different story . We’re hitting major long-term support from a 2020 ascending channel , backed by positive divergences . From here to the channel midpoint, there’s 73% room for corrective upside . That’s no small move.

The Gold/Silver ratio , using nearly 100 years of history, shows that sharp drops in gold’s relative value happen fast — and reverse just as fast . We’re at 46 now, with 41 as a possible floor. So yes — silver may still squeeze out another 10% outperformance … but exhaustion is near.

BTC/Silver reflects the same dynamic: silver still has the upper hand, but we're nearing major support levels . And when these ratios snap back, they do so hard.

These aren’t trades to chase blindly. They’re rotations to observe, prepare for, and trade with precision. Momentum is shifting — in real time.

Trading Wisdom 📜

When one market peaks, another prepares to rise. Silver's breakout is historic and undeniable — but century-old ratios don’t lie. Bitcoin is approaching key support against both gold and silver simultaneously . If the shift comes, it won’t be slow. It’ll be sharp, fast, and violent. Stay sharp, stay reactive, examine everything.

Disclaimer: What you read here is not financial advice — it’s high-level market philosophy from the FXPROFESSOR himself. Risk is real, and your capital is your responsibility. Learn, adapt, evolve.

One Love,

The FXPROFESSOR 💙

XAUUSD 1H – Bullish Continuation with Mapped TargetsGold (XAUUSD) is trading in a strong bullish structure on the 1H timeframe, characterized by consistent higher highs and higher lows. Price is currently consolidating near recent highs, indicating healthy price action and potential continuation rather than reversal.

This chart highlights:

A clear buy-on-dip zone aligned with previous demand

A well-defined invalidation level to manage risk

Multiple upside targets based on market expansion and liquidity zones

As long as price holds above the key structure support, the bullish bias remains valid. Breakout or pullback confirmations from the marked zone may offer continuation opportunities in the direction of the trend.

⚠️ A strong close below the invalidation level would signal a possible shift into correction or consolidation.

🔑 Key Concepts Used

Market Structure (HH / HL)

Demand & Resistance Zones

Trend Continuation Logic

Risk-to-Reward Target Mapping

Bearish Reversal Setup on XAU/USD (SMC Analysis)The chart depicts a potential short (sell) setup after a significant bullish run. The price is currently trading near all-time highs (marked around $5,091 in this simulation/chart) and is showing signs of exhaustion at a structural resistance level.

Key Technical Elements:

• Trend Context: The price has been moving within an ascending channel (the blue diagonal lines). It recently hit a "Weak Swing High," suggesting the upward momentum may be fading.

• Market Structure: * BOS (Break of Structure): Multiple bullish breaks are visible on the way up.

• CHoCH (Change of Character): Several internal shifts in trend are highlighted in orange, indicating local volatility.

• Supply & Demand Zones: * The red box at the top represents a Supply Zone or a bearish Order Block where the "Smart Money" is expected to enter sell positions.

• The green shaded area below represents the Target/Take Profit zone, aiming for a return to previous support levels around $4,975 - $5,000.

• FVG (Fair Value Gaps): The yellow highlighted areas and text labels indicate gaps in price action that the market often returns to "fill" or rebalance.

• Projected Path: The large pink arrow and the black zig-zag lines predict a breakdown from the current consolidation, moving toward the "Strong Swing Low" identified near the $4,900 handle.

GOLD BEARS WILL DOMINATE THE MARKET|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 5,090.81

Target Level: 5,003.11

Stop Loss: 5,148.67

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

RIOT Short-term analysis | Trading and expectationsNASDAQ:RIOT

🎯 Price completed wave II of 3, reclaiming the daily 200EMA and pivot. The next challenge is to overcome the High Volume Node resistance. The uptrend is strong.

📈 Daily RSI hit oversold with bullish divergence and has room to grow.

👉 Continued downside has a target of the High Volume Node, $10

Volatility analysis | Expected range & extremities

🎯RIOT is behaving as expected in the usual range, sitting above fv, moving along its steady growth path.

👉Fair value is ~$15

safe trading

IREN Short-term analysis | Trading and expectationsNASDAQ:IREN

🎯 Iren wave 4 hit the daily 200EMA, just above 0.382 Fibonacci retracement. Price is at High Volume Node resistance, but above the daily pivot and 200EMA, showing the uptrend is intact. Continued downside has a target of the daily 200EMA, $26.75

📈 Daily RSI has not reached oversold

👉 Analysis is invalidated only at all time high, for now

Volatility analysis | Expected range & extremities

🎯IREN came back down to it’s expected range and jumped back into the SD+2 overbought zone. The incline is steep, reflecting its strong growth, giving strong down days also. Price is above fv

👉Fair value is ~$35

Safe trading

HUT Short-term analysis | Trading and expectationsNASDAQ:HUT

🎯 Price jumped back up following my path. Wave 4 of V was indeed complete at the 0.382 Fibonacci retracement and High Volume Node just above the daily 200EMA. The daily R1 pivot has been claimed. The uptrend is well intact.

📈 Daily RSI is showing bearish divergence as price falters

👉 Analysis is invalidated if we close below wave 4, $30

Volatility analysis | Expected range & extremities

🎯 Hut is in the SD+2 overheated zone, where it is expected to spend <5% of the time. Price has a tendency to rally above the SD+3 threshold before being rejected, characteristic of low-cap assets. Price is well above fv, traders should be cautious

👉Fair value is ~$20

Safe trading

CLSK Short-term analysis | Trading and expectationsNASDAQ:CLSK

🎯 Price is back at the daily 200EMA and above the pivot, below major resistance after finding support at the orange trend line and golden pocket. The direction is ambiguous, but I am leaning to further upside this week

📈 Daily RSI sits at the EW, flipped bullish but with no divergence.

👉 Analysis is invalidated if price falls below wave (2) at $9

Safe trading

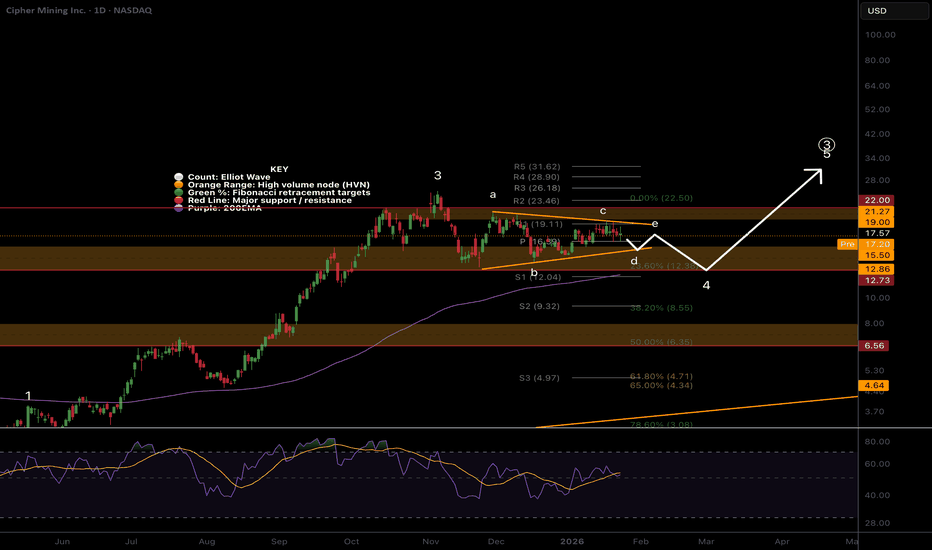

CIFR Short-term analysis | Trading and expectationsNASDAQ:CIFR

🎯 The triangle has flipped to a bearish-looking triangle. This is a penultimate pattern, we can expect price to thrust lower, test the daily 200EMA, end the correction and then makes its way to new highs. l pattern Wave d of the triangle may still be underway, wave e is expected to end at the daily pivot where price currently sits, above the daily 200EMA, showing the uptrend is still intact but flattening.

📈 Daily RSI is neutral, reflecting triangle dynamics

👉 Analysis is invalidated if price falls below wave b or above wave a.

Safe trading

BTDR Short-term analysis | Trading and expectationsNASDAQ:BTDR

🎯 Price overcame the daily 200EMA, major High Volume Node and Pivot, showing a strong bullish trend is in play. It has pulled back to test the 200EMA and support node, normal behaviour. Wave C looks underway toward the $25 target.

📈 Daily RSI printed bullish divergence.

👉 Analysis is invalidated if price falls below wave (B), 9.50, and the structure will start to look bearish.

Safe trading

Silver at $110 in Fierce Rally, Gold Tops $5,100. What’s Behind?(What a chart.)

Silver OANDA:XAGUSD is on a tear. Actually, scratch that — silver is on a mission. Prices have surged more than 250% over the past year, including a blistering 50% jump in January alone, lifting the metal to around $109 an ounce and placing the $110 level firmly in sight .

That performance puts silver ahead of nearly every major commodity and even ahead of gold, the traditional anchor of the precious-metals complex. Momentum has been relentless, headlines have grown louder, and price action has moved from steady to explosive.

When markets accelerate this quickly, attention follows. So does risk.

🪙 Gold Climbs with Purpose

Gold OANDA:XAUUSD has also started 2026 in strong form, trading above $5,100 an ounce for the first time in history. The move builds on a powerful rally that delivered a 60% gain in 2025, driven by familiar macro forces that continue to shape investor behavior.

Compared with silver’s all-over-the-place sprint, gold’s climb looks measured and deliberate. That difference highlights the contrasting roles the two metals play in portfolios. Gold behaves like a heavyweight asset, absorbing large flows with relative calm. Silver responds more sharply to changes in sentiment and positioning.

⚙️ Silver’s Fundamental Case Gains Strength

Silver’s story extends beyond safe-haven demand. Industrial use now forms the backbone of the market. As one of the most efficient conductors of electricity, silver plays a central role in electronics, solar panels, circuit boards, and energy infrastructure.

According to Metals Focus, industrial demand now accounts for around 60% of total silver consumption, up significantly from a decade ago. That shift has aligned silver with long-term trends in electrification and renewable energy investment.

Supply dynamics add further pressure. Roughly three-quarters of new silver supply comes as a byproduct of mining other metals such as copper and zinc. Production responds slowly to price signals, and demand has exceeded supply every year since 2018. Last year’s deficit reached nearly 20%, with another shortfall expected in 2026.

📈 Speculation Takes the Wheel

But also, price behavior suggests fundamentals alone no longer explain silver’s trajectory. Speculative positioning has become a dominant force.

The silver market carries a total value of roughly $5.3 trillion, far smaller than gold’s $33 trillion footprint. That size difference amplifies volatility and accelerates moves when capital flows surge.

Intraday swings have grown aggressive. Moves of several dollars within minutes have become common, shifting hundreds of billions of dollars in market value in short bursts. Traders accustomed to slower commodity cycles have found themselves navigating price action that resembles high-beta equities.

🌍 Politics Add Energy to the Trade

Geopolitical tension is adding support for another leg up. President Donald Trump’s renewed trade and military rhetoric toward Europe, including commentary around Greenland , has reinforced demand for real assets.

At the same time, the administration clarified that tariffs on silver and other critical minerals remain off the table. That clarification did little to slow momentum, raising questions about how much of the rally rests on positioning rather than policy.

🥇 Gold’s Rally Follows Familiar Lines

On the other hand, gold’s advance reflects a broader macro backdrop. Elevated inflation, a weaker US dollar , and continued central-bank buying have supported demand.

Expectations for further Federal Reserve rate cuts in 2026 strengthen the case, as lower yields reduce the appeal of fixed-income alternatives. (Make sure you watch the economic calendar to catch any surprise announcements.)

Gold also benefits from deep scarcity. According to the World Gold Council, total gold mined throughout history amounts to approximately 216,265 tons, enough to fill just about four Olympic-size swimming pools.

The US Geological Survey estimates another 64,000 tons remain underground, though production growth is expected to level off as accessible deposits diminish. That constraint continues to anchor gold’s role as a long-term store of value.

⚖️ Valuation Questions Surface

Debate has shifted toward valuation. Very few analysts expect silver to revisit the $20-to-$30 range last seen in late 2022. Structural demand and supply dynamics suggest a higher baseline.

Prices above $100, however, place silver in rare territory where momentum and leverage exert significant influence. In such environments, price discovery becomes less orderly and reactions grow sharper.

🎁 The Takeaway

Silver and gold are rising for different reasons and behaving in distinct ways. But one thing unites them. Right now, it’s more about speculation than anything else.

Off to you : Are you sleeping on the rally or you’ve bet on either of these metals? Share your approach in the comments!