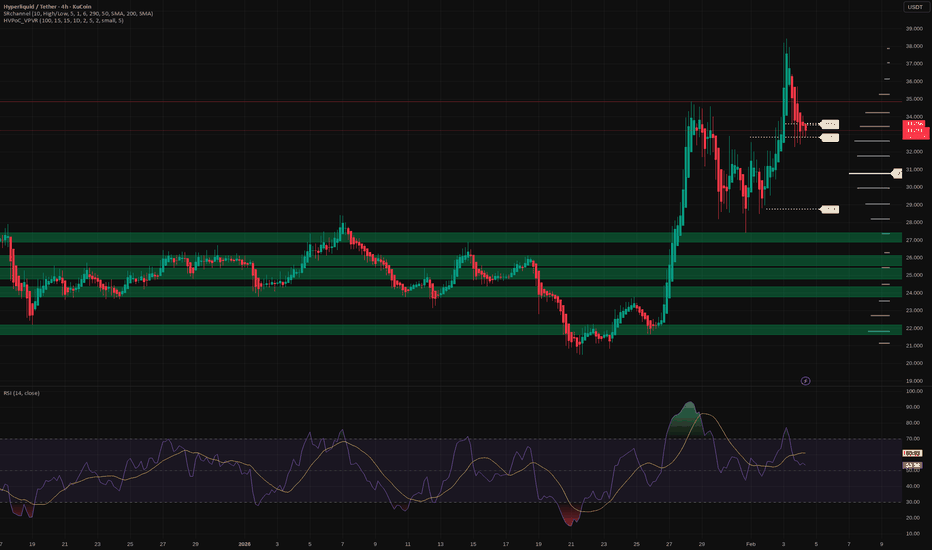

Hyperliquid: bull flag in play? key levels to watch aheadHyperliquid. Who’s riding this new perp beast or just watching from the sidelines? According to market chatter, the recent token launch plus growing derivatives volume keeps Hyperliquid in the spotlight, and today’s headlines about rising on-chain activity only added fuel to the narrative.

On the 4H chart we’ve got a classic post-pump chill phase: sharp vertical move, then a sideways pullback between roughly 31 and 35 that looks like a bull flag. Volume on the run-up was heavy and is now fading while RSI cooled from overbought back to the 50–60 zone - a healthy reset instead of a trend break. I’m leaning long, expecting liquidity grabs toward 32-31 and then a push through 34 with eyes on 36-38.

My plan: ✅ base case is that 31 holds as key support and price grinds higher toward 36 first, 38 if momentum returns. ⚠️ If we start closing 4H candles below 31 and especially under 29.7, I’ll treat it as a local top and look for deeper buys down in the lower green zones. I might be wrong, but I’d rather wait for the dip than FOMO into the last green candle at the highs.

Crypto-trading

BNB: are sellers finally tired? key levels and targets aheadBinance Coin. Who else is watching this post‑crash chop and wondering if the sellers are finally tired? Exchange tokens are still under pressure after the latest regulatory headlines, and BNB just printed a proper elevator‑down move, so everyone’s nerves are fried.

On the 4H chart price got smashed through the 840 support and is now ranging in the 750‑780 pocket where we’ve got a fat horizontal volume node. RSI bounced out of oversold with a small bullish divergence, so I’m leaning toward a relief pop into the first supply band around 810‑830. I might be wrong, but this looks more like capitulation than the start of Armageddon.

My base plan: look for longs on dips while BNB holds above 760, with targets into 810‑830 and a tight invalidation below 740 ⚠️. If 740 gives way on strong volume, I drop the long idea and expect a slide toward 700‑680 with shorts on a clean retest of broken support. I’m waiting for a clear 4H candle confirmation before committing size.

Why the Same Strategy Performs Differently in Crypto and ForexMany traders experience the same frustration. A strategy shows consistency in one market and breaks down in another. The instinctive reaction is to question the rules, indicators, or entries. In most cases, the strategy is not the problem. The environment is.

Crypto and Forex operate under very different structural conditions. Crypto trends tend to expand faster, with sharper volatility and deeper intraday swings. Liquidity is thinner, order books change rapidly, and price frequently overshoots levels before stabilizing. Forex moves more slowly, with deeper liquidity and more controlled reactions, especially during active sessions.

These differences change how a strategy behaves in practice. Stop placement that works well in Forex can be too tight for Crypto, where routine volatility regularly exceeds technical boundaries. Profit targets that feel conservative in Crypto may be unrealistic in Forex, where expansion unfolds more gradually. The logic of the setup remains sound, but the execution parameters no longer match the market.

Time also plays a role. Crypto trades continuously, meaning trends can develop at any hour and extend without the pauses created by session boundaries. Forex activity is concentrated around specific windows, and strategies often perform best when aligned with those periods. Running the same rules outside their optimal timing reduces effectiveness.

Risk sequencing further amplifies these differences. In Crypto, clusters of volatility can create rapid drawdowns even when the strategy remains statistically valid. In Forex, losses are often more evenly distributed, allowing smoother equity curves. Traders who do not adjust position sizing or expectations misinterpret this as inconsistency.

Successful traders adapt execution while preserving logic. Entry criteria, risk models, and trade management evolve to fit the market’s structure. The strategy stays the same. The application changes. Understanding this distinction is what allows traders to remain consistent across asset classes rather than constantly searching for something new.

Prop Firms vs Real Accounts: The Structural Trade-Off Most TradeMost comparisons between prop firms and real accounts focus on capital size, profit splits, or challenge difficulty. What is discussed far less is how each environment reshapes the way traders think, decide, and execute. The difference is structural, and it has a direct impact on performance.

Prop firm accounts are rule-bound by design. Daily drawdown limits, maximum loss thresholds, and evaluation deadlines create a narrow operating window. These constraints reward control and consistency, but they also introduce pressure. Every trade is filtered through the question of survival. Traders become highly sensitive to short-term equity fluctuations because a single mistake can end the account.

This changes behavior in subtle ways. Traders hesitate to hold through normal drawdowns, cut winners early to protect equity, or avoid valid setups late in the day to reduce risk exposure. None of these actions are irrational. They are logical responses to the environment. The issue arises when traders confuse rule compliance with optimal execution.

Real accounts remove these external constraints. There is no forced stop at a daily loss and no expiration date. Drawdowns are uncomfortable but recoverable. This freedom allows for longer holding periods, broader trade selection, and more flexibility in execution. At the same time, it demands a higher level of internal discipline. Without rules enforced externally, risk management becomes entirely self-regulated.

Many traders perform well in one environment and struggle in the other because the skill sets are different. Prop firms reward precision, restraint, and consistency under pressure. Real accounts reward patience, emotional regulation, and long-term thinking. Success in one does not automatically translate to success in the other.

The mistake is treating prop accounts as practice for real trading without acknowledging the incentives involved. The rules shape behavior, expectations, and even strategy selection. Traders who understand this stop blaming themselves for feeling constrained or overly cautious.

Neither model is superior. Each serves a different purpose. Clarity comes from aligning your approach with the structure you are trading under, rather than forcing one mindset into the wrong environment.

Price Returning to Equilibrium After Fast RallyHello everyone,

On the H4 timeframe, ETHUSDT previously experienced a very sharp and aggressive rally, with little time spent consolidating. Price was pushed almost vertically from the 3,10x area up toward 3,35x–3,40x, stretching far away from the EMA cluster in a short period. This created a strong impulsive move, but with a relatively thin price base underneath.

The issue emerged right at the top. ETH failed to maintain acceptance around the 3,35x–3,40x zone, consolidating only briefly before being clearly rejected. On the chart, this reflects a lack of acceptance — the market was not ready to value ETH at those higher levels, forcing price to rotate back toward areas with greater prior trading activity and liquidity.

Once the pullback began, EMA 34 was the first level to give way, signaling that short-term bullish momentum had ended. Price then continued sliding toward EMA 89, which represents the medium-term equilibrium of the trend. ETH stabilizing around the 3,11x–3,12x region suggests the market is mainly correcting the earlier overextended rally, rather than entering a full breakdown phase.

At this point, the key focus is the price reaction around EMA 89. If ETH can hold this zone and avoid a clear H4 close below it, the most reasonable scenario is a period of consolidation to rebuild structure, before potentially attempting a rebound to retest EMA 34.

Wishing you all a great trading session!

BRIEFING Week #4 : Look for the Dollar SignalHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BRIEFING Week #3 : ETH and OilHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BTC/USD H4 – Pausing to Consolidate the UptrendHello everyone,

Looking at the BTC/USD H4 chart, what stands out to me is not the few recent red candles, but the way the market is slowing down after a very decisive rally. After moving from the 88,000 area up toward nearly 95,000, Bitcoin has started to cool off and pull back into the 92,000–93,000 zone. To me, this is a fairly natural price reaction following a strong advance, as capital needs time to rebalance before the market commits to its next directional move.

From a technical standpoint, the medium-term bullish bias has not been compromised. Price is currently pulling back into the confluence zone of EMA 34 and EMA 89 — an area that often acts as a “support base” within a healthy trend. The fact that BTC continues to hold above the slower EMA suggests that bullish momentum has not been broken, and that the current retracement is more consistent with short-term profit-taking than with genuine distribution.

A constructive detail lies in the price behavior during the recent pullback. Selling volume has not expanded, while the corrective candles show narrower ranges compared to the prior impulsive advance. This indicates that supply pressure is fading, while buyers have not stepped aside. Historically, this type of price action often leads to a brief consolidation phase before the market resumes its primary direction.

Stepping back from the chart to look at the broader context, the current macro backdrop remains supportive for Bitcoin. Recent US economic data point to easing inflation while growth remains moderate. This makes a shift toward a more aggressive monetary stance less likely, helping to preserve a relatively stable “risk-on” environment for risk assets.

In addition, early-year market sentiment has improved noticeably after the holiday period.

Capital is flowing back into equities and crypto, and Bitcoin is often among the first beneficiaries when risk appetite improves. Reports from international financial media also suggest that institutional money has not exited the market, but is instead repositioning after the strong year-end rally — a narrative that aligns well with what the H4 chart is currently showing.

Ethereum Is Building a Base — Accumulation Before...FLYEthereum is currently transitioning from a strong bearish impulse into a clear accumulation phase, as shown on the 1-hour timeframe. After an aggressive sell-off from the highs, price has slowed down significantly and begun to compress within a defined range, suggesting that distribution has paused and the market is absorbing sell pressure.

1. Market Structure & Context

- ETH previously respected a bearish structure, trading below the EMA and printing lower highs.

- However, the recent price action shows loss of bearish momentum: candles are overlapping, ranges are tightening, and volatility is contracting.

This behavior is typical of accumulation, especially after a strong markdown.

2. Key Zones on the Chart

- Support Zone: ~3,060–3,080

This zone has been tested multiple times with strong rejection, indicating buyers are actively defending this level.

- Accumulation Range: ~3,080–3,180

Price is rotating inside this box, building liquidity on both sides.

- Upper Resistance / Range High: ~3,160–3,180

A break and acceptance above this level would confirm bullish intent.

3. EMA & Momentum Insight

- Price is currently interacting with the EMA 50, which is flattening — another sign of trend transition, not continuation.

- The failure to aggressively break below the EMA after multiple attempts suggests selling pressure is weakening.

4. Scenario Outlook

Bullish Scenario (Primary):

A successful hold above the support zone, followed by a breakout and acceptance above 3,180, could trigger an expansion toward: 3,240 - 3,280 (next major liquidity target)

Bearish Invalidation:

A strong breakdown and close below 3,060 would invalidate the accumulation idea and reopen downside risk.

5. Trading Plan

Avoid trading inside the middle of the range.

Focus on:

- Longs after confirmed breakout above range high

- Or reaction trades at support with clear bullish confirmation

- Patience is key accumulation phases reward discipline, not anticipation.

Conclusion

Ethereum is no longer trending it is preparing. The current structure favors a range-to-expansion model, where smart money builds positions quietly before the next directional move. Until price leaves the accumulation box, expect choppy conditions — but once it breaks, the move is likely to be decisive.

💬 Do you see ETH breaking up from this range, or is this just a pause before another leg down? Let’s hear your view.

BRIEFING Week #2 / Happy New Year !Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

A retest framework is a processMost traders know support and resistance, but few have a rule set for when those levels become tradable. In crypto, levels are breached constantly. What matters is not the breach. What matters is what the market accomplishes by breaching it and how it behaves once it returns.

The framework starts by defining a clear swing high and swing low. These are the most recent meaningful extremes where price demonstrably changed direction, not intraday noise. The midpoint between them becomes equilibrium, your objective reference for premium versus discount within that swing. This midpoint is not predictive. It simply organizes the playing field.

Next comes liquidity. Equal highs, equal lows, and inefficient consolidation clusters are not decorations on the chart. They are incentives. Stops pool there. Traders position emotionally there. The market goes there to transact. When price moves into that pocket and leaves a wick that is quickly reclaimed, you have the sweep. This is the first proof that the breakout traders were the liquidity, not the beneficiaries.

A sweep alone is not structure. So the next requirement is transition. In an uptrend, buyers defend higher lows. When the last defended low is violated after a sweep, you get the break of micro-structure. In a downtrend, sellers defend lower highs. When the last supplied high is reclaimed after liquidity is taken below, you have transition in reverse. This is where narrative changes from continuation to rotation.

Then comes displacement. This is the market proving participation through momentum. A structural transition followed by compressed candle ranges or low-volume drift lacks authority. But a transition followed by clean directional movement shows that the opposing side stepped in with urgency. This is not retail FOMO. This is participation.

The retest becomes the execution filter. Price returns to the broken zone or swept liquidity level. It interacts there without hesitation, without sweeping back through the same side, and without expanding candle ranges against the narrative you built. This is where professionals position. Not because it is perfect timing, but because it is permissioned timing. The stop goes beyond the narrative fracture point, not a generic percent. The target goes toward the next liquidity incentive in line, not a vague R:R fantasy.

This sequencing matters even more inside funded evaluations. Prop traders fail most often when they cluster mistakes. A retest framework reduces mistake clustering because it forces the trade to form a story before it forms exposure. It narrows invalidation distance, improves average R:R, and protects daily drawdown math naturally. It also gives you neutrality after streaks. The framework does not amplify confidence.

It anchors confidence to conditions.

The retest framework does not promise that a trade works. It promises that a trade has a reason to work. And having reasons before exposure is the edge that compounds careers in crypto, especially when liquidity and volatility drain fast.

Ethereum Is Losing Momentum — Distribution Before a PullbackPrice is currently stalling below the key resistance zone around 3,260–3,300, showing clear signs of bullish exhaustion after a strong impulsive rally. Repeated rejections from this area suggest distribution rather than continuation.

A failure to hold above 3,240–3,250 keeps the short-term bias bearish, opening room for a corrective move toward the first support at 3,210–3,190, where price may attempt a temporary bounce.

If selling pressure persists and price breaks below the EMA50 and 3,190 support, the correction could extend deeper toward 3,150 → 3,130, with a worst-case liquidity target near 3,080. Only a strong reclaim and close above 3,300 would invalidate the bearish pullback scenario and revive upside continuation.

How to audit your own trades like a risk manager would Auditing your trades is not about replaying charts to confirm whether you were right or wrong. A risk manager audits to protect capital durability, reduce mistake frequency, and identify exposures created by process, not emotion. When you adopt this mindset, performance leaks become easy to detect and easier to correct.

A professional audit begins with environment classification. Every trade is labeled by the market phase it was executed in. Volatility is assessed as expanding or compressing. Liquidity incentives are identified before execution, not after it. For example, BTCUSDT and SOLUSDT produce wider candle ranges during expansion and thinner order books when liquidity drains. These are high-invalidation conditions. If you increased size here, you paid an execution tax without a volatility reason. A risk manager never scales into widening ranges. They scale into tightening ranges.

The second step is measuring invalidation distance. Risk officers place stops beyond structure, not arbitrary percentages. A stop below a random 1% or 2% rule means nothing if the structure required 3.5% distance to invalidate the narrative. Your stop must sit beyond the point where the market proves the opposite story. If your invalidation distance widens while volatility expands, that is alignment. If it widens while volatility contracts, that is a process breach.

Next comes execution quality scoring. Professionals deconstruct execution into sequence components: liquidity sweep first, micro-structure break second, displacement third, retest respected fourth, impulse continuation fifth. A trade that triggered on the first touch of a level without displacement is not a good fill. It is the fill the market used for liquidity. Score execution quality based on whether the sequence completed before entry, not whether the P&L was positive.

The fourth layer is correlation risk. Risk auditors measure how many positions were open simultaneously on the same asset or narrative theme. One trade rarely kills a small account. Correlated trades during the same thesis do. Mistake correlation compounds drawdown faster than strategy flaws ever could. Limit correlation by design, not hindsight.

Finally, audit outcomes against process wins. A trade that worked without a reason is not audit approval. A trade that worked because it followed a reasoned sequence is. When you measure behavior instead of candles, you gain intervention points. Intervention points protect capital. Reflection points identify capital already lost.

Small accounts scale when traders audit like capital protection matters more than capturing the entire move. Your audit should produce fewer open questions and more closed rules. The goal is not to defend the trade. The goal is to defend the account.

RSI Is Not a SignalRSI is one of the most widely used tools in trading, yet it is also one of the most misunderstood. Many traders approach it as a switch. When the line reaches a certain level, they expect price to react. When it does not, frustration follows. The issue is not the indicator itself, but the expectations placed on it.

RSI reflects how aggressively price has been moving over a recent period. It gives insight into pressure, participation, and pacing. What it does not do is decide when price should reverse or continue. Markets can remain stretched far longer than most traders anticipate, especially during strong trends. When that happens, RSI staying elevated or depressed is a sign of persistence rather than exhaustion.

Context changes everything. In a clearly trending market, RSI often settles into a higher or lower band and fluctuates within it. Pullbacks that look extreme on the oscillator are often normal pauses in price rather than warnings of a reversal. Traders who react to those readings without considering structure often find themselves trading against the dominant flow.

Range-bound conditions tell a different story. When price rotates between defined highs and lows, momentum naturally fades near the edges. In those environments, RSI extremes tend to align more closely with short-term turning points. The same indicator behaves differently because the market itself is behaving differently.

Another source of confusion comes from fixed thresholds. Levels such as 30 and 70 are treated as universal rules, even though they were never meant to apply across all instruments and conditions. Some markets trend with RSI rarely dropping below 40. Others rotate for weeks without ever reaching classical extremes. Blindly applying static levels removes nuance from decision-making.

RSI becomes useful when it is read as part of a broader process. Structure, liquidity, and location should come first. Momentum then helps assess whether price behavior supports the idea or raises caution. When used this way, RSI adds clarity instead of pressure.

Traders who struggle with RSI are often searching for certainty. RSI does not provide certainty. It provides information. Those who learn to interpret that information within market context stop forcing trades and start aligning with what price is actually doing.

BTC $94.5K Fatigue: Decoding the $92.3K Line in the SandBitcoin (BTC/USD) Technical Breakdown

Bitcoin recently completed a steep impulsive move, encountering significant selling pressure at the Resistance Zone ($94,400 – $94,600). The appearance of long upper wicks (rejection candles) at this level confirms that profit-taking is underway, pushing price back to test internal liquidity.

The pair is currently trading near the blue EMA, which serves as immediate dynamic support. However, the short-term bias remains tilted toward a deeper "healthy pullback" to re-accumulate buy orders. The Support Zone around $92,300 is the critical "pivot area" where institutional demand is expected to resurface.

Key technical scenarios:

- Base-case scenario: Following the projected path on the chart, BTC is likely to continue its retracement toward the $92,300 support. A bullish reversal signature (such as a pin bar or engulfing pattern) at this level would confirm a Higher Low (HL) and set the stage for a recovery test of $93,300 and beyond.

- Bullish continuation: Should the bulls defend the $92,900 level and decisively reclaim $93,500, the correction may end prematurely, opening the door for an immediate retest of the $94,500 supply zone.

- Bearish risk: A decisive close below the $92,000 psychological level would invalidate the immediate bullish structure. This would expose BTC to a deeper correction toward $91,000 or the $90,000 liquidity pool.

Macro Drivers Impacting Bitcoin

As of January 2026, Bitcoin's price action is heavily influenced by institutional flows and global macro shifts:

- ETF Inflows & Institutional Floor: The maturity of Spot ETFs has created a persistent "floor" for price. Current volatility is likely driven by early-year portfolio rebalancing by major asset managers.

- Monetary Policy & Fed Outlook: Market participants are closely monitoring Fed signals. Expectations of quantitative easing or rate pauses in Q2 2026 continue to support the long-term "debasement trade" narrative, favoring BTC.

- Geopolitical Risk Premium: Ongoing tensions in key global regions (Middle East/Eastern Europe) reinforce Bitcoin’s status as "Digital Gold." Safe-haven flows tend to limit the downside during macro uncertainty.

- Risk-On vs. Risk-Off Sentiment: The Fear & Greed Index remains in "Greed" territory. While the trend is bullish, this high sentiment often precedes "liquidity sweeps" where over-leveraged long positions are flushed out at key support levels.

Summary

Technically, Bitcoin is undergoing a textbook correction after hitting a major resistance ceiling. This phase is essential for market health, allowing for the rotation of capital and the removal of weak-handed leverage.

The $92,300 support is the line in the sand. As long as price holds above this zone, the broader bullish trend remains intact. Traders should remain disciplined, waiting for confirmed price rejection at support rather than chasing the move mid-range.

Bitcoin Is Not Breaking Out Yet — This Is Classic Box Accumu....Hello everyone,

On the H1 timeframe, the key focus right now is not chasing an immediate breakout, but recognizing that Bitcoin is still consolidating inside a well-defined accumulation box. Despite several sharp intraday swings, price continues to respect clear boundaries, signaling balance rather than trend.

Structurally, BTC has been rotating between the 86,500 support zone and the 90,300–90,400 resistance zone. Multiple attempts to push higher have stalled below resistance, while every pullback into support has been absorbed quickly. This repeated back-and-forth price action is characteristic of box accumulation, where liquidity is being built before a directional expansion.

The recent impulsive rally toward the upper range was followed by an equally sharp rejection, but crucially, price did not break down. Instead, BTC stabilized above the mid-range and began forming higher short-term lows, suggesting that sellers are losing momentum near the bottom of the box while buyers remain active.

From a price action perspective, the market is printing overlapping candles and compressed swings, confirming that this is not a trending environment yet. The projected path on the chart reflects a typical accumulation outcome: continued rotation inside the box, potential liquidity sweeps, and only then a decisive move.

Key levels to watch:

Resistance zone: 90,300–90,400 — range high and breakout trigger.

Support zone: 86,500–86,800 — range low and structural defense.

Mid-range: ~88,500 — equilibrium area where noise dominates.

A clean breakout and acceptance above resistance would confirm bullish continuation and open the door for upside expansion. Conversely, a decisive breakdown below support would invalidate the accumulation structure and shift the bias lower. Until one of these conditions is met, Bitcoin remains range-bound and in preparation mode, not trending.

Wishing you all effective and disciplined trading.

CAKE/USDT – Post-Dump Consolidation and Key Levels to WatchCAKE is currently consolidating after a sharp 28% drop earlier in December, setting the stage for potential liquidity sweeps and reactive plays.

🔼 Upside Scenario

Stop Hunt Setup: Price is pushing toward stops above the Dec 29 high at $1.920. A sweep here may provide bulls a clean exit or set up a reversal.

Key Resistance: Watch the $1.9775 level – the top of the unfilled bearish daily gap from Dec 17, aligned with the 18-day EMA, creating technical confluence.

Extended Bull Case: If momentum continues and BTC stays strong, price may target the Dec 15 gap at $2.0843. This zone marks the next major upside liquidity area.

🔽 Downside Scenario / Support Zones

Immediate Support: Around $1.8665, particularly if Monday’s low holds above Saturday’s high, forming a bullish daily gap.

Rejection Zone: Multiple bearish rejections since Dec 20 reinforce this support area.

Deeper Pullback:

Equal lows at $1.7890 and $1.7670 could become bearish targets.

$1.7943 (Dec 18 rejection) may act as a reaction level for bulls.

Below $1.7670, next structural supports are weak until $1.7200 and $1.7000, which are psychological levels where bulls may step in.

XRP – Daily OutlookXRP Army,

Price is still trading inside a descending channel, keeping the short-term structure bearish.

We recently saw a reaction from daily support, but this move alone is not enough to confirm a reversal.

In the past, this support level has shown clean deviations, where price dipped below and quickly reclaimed the level.

A similar scenario could play out again, but confirmation is required.

Key observation:

For any bullish continuation, XRP needs to reclaim the broken support level and hold above it.

Without a reclaim, this move remains a relief bounce within a downtrend.

I’ll be watching lower timeframes for a potential deviation and reclaim before considering longs.

Until then, caution is warranted.

Levels to watch:

Resistance: reclaimed support + upper channel

Support: current daily support zone

MrC

JTO – Weekly OutlookPrice broke below the previous support and confirmed an S/R flip, turning that level into resistance.

Last wick from October 6th is now fully filled, which means that inefficiency has been resolved.

We are currently trading below key weekly support, and price is consolidating at lows.

At this point, there is no clear confirmation of a reversal yet.

Key observation:

If price creates a deviation below current support, I’ll be watching for long opportunities on lower timeframes, targeting a move back into the range.

If not, this level may act as acceptance and continuation to the downside.

Patience is key here — let the market show its hand.

Levels to watch:

Resistance: previous weekly support (now S/R flip)

Support: current lows after wick fill

What do you think — deviation reclaim incoming or further downside first?