Crypto

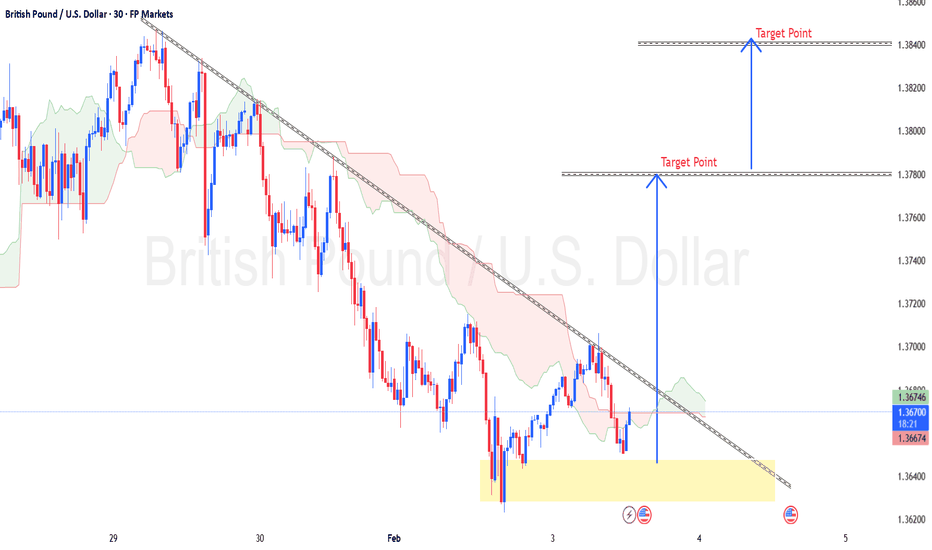

GBP/USD Chart Pattern..Overall downtrend (descending trendline respected)

Price reacted from a demand zone (yellow box)

Now attempting a trendline break / pullback

Ichimoku cloud still acting as dynamic resistance

This looks like a corrective move up, not full trend reversal yet.

🎯 Targets (Buy-from-demand → correction)

✅ Upside Targets (if holding buy)

🎯 Target 1 (TP1):

1.3775 – 1.3785

Previous structure + minor resistance

Good partial profit zone

🎯 Target 2 (TP2):

1.3830 – 1.3845

Major resistance / trendline retest

Matches My drawn “Target Point”

👉 I would book most profits here

❌ Invalidation / Risk Area

If price breaks and closes below 1.3640

Demand fails → continuation down likely

🔄 Alternative Scenario (If rejection happens)

If price rejects strongly from:

1.3780 or

1.3830

Then downside targets reopen:

1.3680

1.3640 (demand retest)

📌 Quick Summary

Bias: Pullback bullish, overall trend still bearish

Main Target: 1.3780

Extended Target: 1.3835

Trend traders: sell near upper target

Scalpers: partial at TP1, trail rest

BTCUSDT Long: Breakdown, Fakeout & Potential Rebound To $79,300Hello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT was previously trading within a well-defined ascending channel, where price consistently respected rising support and resistance, printing higher highs and higher lows. This structure confirmed strong bullish control and healthy trend continuation. However, as price reached the upper boundary of the channel near the pivot point, buying momentum started to fade. After failing to sustain above the channel resistance, BTC broke below the lower channel boundary, marking the first clear breakdown of bullish structure and signaling a potential trend shift. Following the channel breakdown, price entered a consolidation range, where the market paused and volatility compressed. This range acted as a distribution phase rather than accumulation, as buyers failed to reclaim previous highs. Eventually, BTC broke down from the range, confirming bearish continuation and accelerating the move to the downside. The sell-off gained strength with successive breakdowns, pushing price toward the lower part of the chart.

Currently, BTCUSDT is reacting around a key Demand Zone near 75,700, where a fake breakout below demand suggests that selling pressure is temporarily weakening. Buyers have stepped in aggressively from this area, triggering a short-term rebound. Above the current price, the 79,300 Supply Zone stands out as a major resistance level, aligning with previous support turned resistance and acting as a critical decision point for the market.

My primary scenario favors a corrective bullish rebound as long as price holds above the 75,700 Demand Zone. A sustained defense of this level could allow BTC to recover toward the 79,300 Supply Zone as a first upside target, representing a technical pullback within a broader bearish structure. However, strong rejection from the 79,300 supply would likely confirm that sellers remain in control, potentially leading to another bearish continuation leg. A decisive breakdown and acceptance below the Demand Zone would invalidate the bounce scenario and open the door for further downside expansion. For now, BTC is at a key reaction area, and confirmation from price behavior near supply and demand will be crucial. Manage your risk!

EURUSD Short: Rally Stalls at Supply - Key Reaction Near 1.1800Hello traders! Here’s a clear technical breakdown of EURUSD (1H) based on the current chart structure. EURUSD has recently completed a notable structural shift after trading within a well-defined descending channel. During this phase, price consistently respected the falling resistance and printed lower highs and lower lows, confirming short-term bearish control. This bearish structure eventually reached a key pivot low, where selling pressure weakened and buyers began to step in. From this pivot point, EURUSD broke out of the descending channel, signaling the end of the corrective phase and the start of a bullish recovery.

Currently, EURUSD is pulling back from the supply area along the descending supply line, indicating a corrective retracement rather than a full trend reversal. Below the current price, the Demand Zone near 1.1800 stands out as a key level. This zone represents previous resistance turned support and aligns with the base of the impulsive move, making it a critical area for buyers to defend.

My primary scenario favors a pullback toward the 1.1800 Demand Zone while price remains below the descending supply line and the 1.1880–1.1900 Supply Zone. A controlled retracement into demand could provide a healthy correction within the broader bullish recovery structure, potentially setting the stage for another upside attempt. However, a strong rejection from the supply line followed by a clean breakdown and acceptance below 1.1800 would invalidate the bullish recovery scenario and signal a return to bearish pressure. Conversely, a decisive breakout and acceptance above the 1.1900 Supply Zone would confirm bullish continuation and open the door for further upside expansion. For now, EURUSD is at a key decision point, and patience is required as price reacts between supply and demand. Manage your risk!

BNB: are sellers finally tired? key levels and targets aheadBinance Coin. Who else is watching this post‑crash chop and wondering if the sellers are finally tired? Exchange tokens are still under pressure after the latest regulatory headlines, and BNB just printed a proper elevator‑down move, so everyone’s nerves are fried.

On the 4H chart price got smashed through the 840 support and is now ranging in the 750‑780 pocket where we’ve got a fat horizontal volume node. RSI bounced out of oversold with a small bullish divergence, so I’m leaning toward a relief pop into the first supply band around 810‑830. I might be wrong, but this looks more like capitulation than the start of Armageddon.

My base plan: look for longs on dips while BNB holds above 760, with targets into 810‑830 and a tight invalidation below 740 ⚠️. If 740 gives way on strong volume, I drop the long idea and expect a slide toward 700‑680 with shorts on a clean retest of broken support. I’m waiting for a clear 4H candle confirmation before committing size.

USDT: are we due for a relief rally? key levels to monitorMarket Cap USDT Dominance. Ready for a crypto relief rally or is fear just getting started? While majors cooled off after the latest macro jitters and profit taking, traders have been hiding in stables, and dominance spiked hard according to market data. Now price is stalling right at the local highs, so this level suddenly matters a lot.

On the 4H chart we’ve got a vertical pump into 7.1–7.3% plus RSI sitting in overbought and already curling down – classic “too much, too fast” vibes. Biggest volume shelf is down around 6.3–6.4%, so any unwind of fear can send dominance back into that value zone, which usually means a bounce for BTC and alts. I might be wrong, but current structure looks more like a blow‑off than the start of a calm uptrend.

My base case ✅ rejection below 7.2% and a pullback toward 6.4% and possibly 6.2%, where I’d look to add risk on strong coins. Trigger for me is a 4H close back under 7.0% with RSI dropping from overbought. ⚠️ If buyers smash through 7.3% and hold above, then I’ll respect the squeeze, expect 7.5%+ on dominance and stay defensive on alt exposure.

USDCAD Breakout DoneUSDCAD is showing a bullish reversal structure after breaking out of a sustained descending channel, with price reclaiming short term resistance and forming higher lows, signaling a shift from bearish control into accumulation and early trend transition. The recent upside momentum aligns with firm US dollar demand driven by resilient US economic data, elevated Treasury yields, and cautious risk sentiment, while the Canadian dollar faces mixed pressure from fluctuating crude oil prices, softer growth expectations, and a more measured Bank of Canada stance compared to prior tightening cycles. Technically this breakout and consolidation above former supply suggests a classic breakout retest scenario, where the market is building acceptance before continuation, favoring bullish momentum, trend reversal, liquidity grab recovery, and higher high expansion setups as long as price holds above the reclaimed zone, keeping upside targets in play with dip buying interest and sustained USD strength supporting further gains.

AUDUSD Still PumpingAUDUSD is trading in a strong bullish continuation phase after a clean impulsive breakout, with price currently consolidating above the previous resistance zone that has now flipped into short term support, signaling healthy price acceptance rather than exhaustion. The sharp rally reflects improving risk sentiment, sustained weakness in the US dollar, and supportive fundamentals from Australia including stable RBA policy expectations, resilient labor data, and strength in commodity-linked currencies, while recent US macro data continues to fuel speculation around future Fed easing which keeps downside pressure on USD. Technically this structure favors a pullback and continuation scenario, where shallow retracements are being absorbed by buyers, momentum remains intact, and higher highs with higher lows confirm trend strength, making bullish continuation, trend following, breakout retest, and buy the dip strategies favorable as long as price holds above the key support area and maintains bullish market structure toward higher targets.

Bitcoin: mean-reversion play? key levels and targets aheadBitcoin. Who survived that liquidation nuke and who’s still coping with the PnL trauma? After the latest cascade of longs getting wiped and headlines about cooling ETF flows and tighter liquidity, sentiment flipped from euphoria to “get me out.” That’s exactly when I start hunting for mean‑reversion plays.

On the 4H chart we just bounced off a chunky demand block around 76–77k, with a clear volume spike on the low and RSI crawling out of oversold. Price is now camping under the first supply zone near 79.5–80k, right where the last dump accelerated. That combo looks like a classic relief‑rally setup, so I’m leaning short‑term long, aiming back into the 81–82.5k high‑volume area.

My plan: I want a small dip toward 77.5–78k to join buyers, with invalidation under 76k. Base case – squeeze into 81–82.5k, maybe even a wick toward 83.5k, where I’d start scaling out. If 76k breaks on strong volume, I drop the long idea and look for the next flush into 74–75k support. I might be wrong, but fading a freshly washed‑out Bitcoin has rarely aged well. ✅

Smart Money Reload: Bullish Accumulation After the SweepSMC Overview (M30):

Smart Money Concepts on M30 show a clean Bullish Break of Structure (BOS) at ~78,900, followed by a liquidity sweep to ~78,050 and a strong bullish rejection. Price then defined a bullish Order Block (OB) at 78,150–78,250, backed by 1.7× average M30 volume, signaling an unmitigated accumulation zone.

Trade Framework:

Entry: 78,220 (limit, inside OB)

Stop Loss: 77,437.80 (1.0% below entry, beneath OB and sweep)

Risk (R): 782.20

Targets:

TP1 (1.5R): 79,393.30

TP2 (3R): 80,566.60

TP3 (5R): 82,131.00

Trade is cancelled if the OB is fully mitigated (engulfed).

Confirmation Checks:

Order Block Detection — PASS

AI-optimized OB detection confirms a bullish, unmitigated OB at 78,150–78,250 with 1.7× volume. Execution requires patience: limit entry only on return to the OB, not market buys above it. Optional scaling: 50% on first touch, remainder on a re-test or confirmation candle. Cancel if volume drops below 1.5× avg.

Liquidity Intelligence — PASS

Liquidity Intelligence flags a structured sweep to ~78,050 (equal lows), followed by absorption and bullish rejection—classic stop-run accumulation. The sweep validates the OB but is not an entry by itself; entry remains the OB retest. No sweep or signs of distribution would invalidate the setup.

Momentum & Trend Filters:

RSI (M30): ~58 → bullish continuation bias, not overbought; room to TP1/TP2.

EMAs (M30): Price above 50-EMA (~78,300) and 200-EMA (~77,500) confirms short-term bullish bias and dynamic support into the OB.

MACD (M30): Line above signal with a rising positive histogram; crossover preceded the BOS, reinforcing accumulation.

Structure, Levels & Volume:

Support: 78,050 (sweep low), 78,150–78,250 (OB/discount)

Resistance: 79,200 (local high), 80,500 (next supply)

TP1 clears 79,200; TP2 aligns with 80,500; TP3 targets higher structure.

Volume: 1.6–1.8× spike on rejection confirms institutional buying. Sustained volume on OB retests supports entry; thinning volume warrants cancellation.

Fundamentals:

No relevant news or macro events provided. This is a pure structure/flow trade—monitor execution-time flow.

Final Synthesis & Plan:

Consensus: Bullish BOS + unmitigated OB (1.7× vol) + liquidity sweep/absorption + aligned RSI/MACD/EMAs.

Signal Quality: Strong → Confidence ~72%.

Action: LONG (M30) via limit at 78,220; manage risk via R-based targets.

Invalidate if: OB is mitigated, LI flips to distribution, or OB volume < 1.5× average.

ONE Chart. SIX targets. Thats HYPE!The hyperliquid chart is showing signs of a head and shoulders pattern.

#HYPE has certainly garnered significant attention and acclaim for being one of the few altcoins to experience a surge this cycle.

This is due to the development of an innovative product: a decentralized perpetual DEX.

It has achieved product-market fit.

Receiving considerable attention on X.

However, it is not larger than the ongoing cycle.

At one point, they were purchasing $83M worth of tokens each month—this is why it has created a distorted head and shoulders pattern with multiple necklines.

Yet, in the world of crypto, if you develop something useful,

the code, idea, or platform will inevitably be replicated.

This highlights the fundamental issue with altcoins: the absence of a competitive moat and long-term sustainability.

Recently, they began unlocking a substantial amount of tokens, and it is likely that the team is offloading them through OTC transactions.

While innovation and profitable dapps are commendable... they can also become problematic.

Here are some bear targets for your consideration.

Which you can use to your advantage on their perp DEX ;)

Bitcoin topped versus Gold 11 months ago.On the bright side the cyclical bear market of #BTC vs #GC is actually closer to the end, rather than just starting.

Bitcoin has already lost tremendous value vs the Analog SOV

With previous cyclical Bears lasting maximum 14 months.

Which by that time I believe one if not both of these targets will be met.

The troubling aspect is.

If BTC achieves target 2 --- then once could argue a Double top has formed.

And any subsequent bounce/recovery rally should be treated with suspicion.

And furthers declines and retest of this target 2, could open up the trapdoor for a SECULAR Bear market taking us into 2027 before any meaningful recovery can begin.

This is a merely observation of what has happened and what is currently unfolding with early (pre-coinbase launching) BTC investors unloading supply most of 2025 into their perceived six figure objective.

$100K was always the dream!

Will they buy back next bear?

I suspect only if it becomes cheap enough.

What is cheap for an OG?

Is #KSM Ready to Recover or will Bears Drag it Further Down? Yello Paradisers! Is #KSM setting up for a nasty flush toward new lows, or are we about to witness a fakeout trap before a bigger move? Here's what the # Kusama chart is showing us:

💎#KSMUSDT is currently trading within a clearly defined symmetrical triangle, with the price consistently being rejected from the descending resistance trendline. This structure has broken down, and as of now, the 50EMA is acting as dynamic resistance, reinforcing the bearish bias.

💎The current price of #KSMUSD is $7.75, sitting right below the strong resistance around the $9.32 zone, where the descending trendline aligns with heavy volume on the visible range. As long as price trades below this $9.32 invalidation level, the bearish setup remains valid. A rejection from this level, combined with a 50EMA retest, would further confirm downside continuation.

💎Next key level to watch is the moderate support zone at $6.65, a potential short-term bounce area. However, the real demand lies lower, with major support at $4.95, where we could see aggressive buyers stepping in. This zone also coincides with the previous swing low and would likely trigger liquidation of late long entries, making it a potential reversal zone if the market reaches there.

💎To flip the structure bullish, #KSM needs to break and hold above $9.32. That would invalidate the descending channel and could spark a rapid move toward the next volume cluster above $10.50. Until then, every retest of resistance remains a potential short opportunity for experienced traders.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

Last Chance For Litecoin Not going much into this one. I only have the bandwidth to focus on one of these wretched coins these days, and for some strange reason it's Litecoin. I have a slight soft spot for it, since it was largely my entry into my crypto phase at the end of 2017.

Just looking for a fun trade. Nothing fundamentally attracts me about crypto these days. But, I still like to play around.

I had a failed long position earlier in the last "cycle" and Litecoin repeatedly failed to break out above the $130-140 range. I got out without much of a loss. Recently, I've been able to buy back in lower, starting with $72 and more recently today at $60.

As it seems somewhat predictable, it also follows that LItecoin has a high probability of eventually doubling from these levels....but, there's still risk here, obviously. It really has one last remaining possible "uptrend," which can be drawn to line up with the $46-48 area currently. Below there, and we could see $20 LTC again.

To see $100+ again we'd have to bank on 1 of 2 things at least happening:

1) Bitcoin holds here and at least bounces around a bit before ultimately heading lower. LTC/BTC rallies, as it characteristically does at the "end" of the cycle. LTC seems unlikely to go up if Bitcoin just continues down from here.

2) Bitcoin pumps from these levels and heads to a new ATH.

Let's see. Targeting these broken uptrends, for starters.

-Victor Cobra

HBAR Breakdown or Bounce? This Zone Decides EverythingYello Paradisers, did you see that perfect tap into our key demand zone? After a prolonged move inside the descending channel, #HBAR has finally reached a critical decision point, and what happens next could define the mid-term trend.

💎#HBARUSDT has been respecting the descending resistance and support flawlessly, but now we’re seeing the first signs of a potential reversal forming right at the confluence of the demand zone and the major support area. This is where real opportunities are born, but also where inexperienced traders often get wrecked by jumping in too early or without confirmation.

💎If buyers step in with strength here and push through the descending resistance, the next upside target sits near $0.11291. Beyond that, we’re eyeing the strong resistance at $0.15125, which would complete a textbook breakout from the current structure. But until then, this is still a reactionary zone, not a confirmed trend shift.

💎A failure to hold above $0.085 would weaken the setup, and any move below 0.070 would completely invalidate the bullish scenario, opening room for further downside. This is why discipline is everything here. No need to rush. The real money is made waiting for the clearest signal, not forcing it.

Patience is key now. This is a moment where discipline will separate the pros from the crowd.

MyCryptoParadise

iFeel the success🌴

EURUSD: Bullish Trap to Bearish Continuation (H1)....This is a 1-hour EURUSD chart showing a fake bullish breakout into a premium supply zone, followed by a clear shift to bearish market structure. After the stop-hunt/liquidity grab (circled), price rolls over and respects a descending channel, confirming bearish control. The Ichimoku cloud aligns as dynamic resistance, and price continues to print lower highs and lower lows. A downside target is projected near prior demand/liquidity, suggesting continuation of the bearish move.

Bitcoin Is Not Bouncing — It’s Sliding Inside a Bearish ChannelBitcoin remains firmly trapped inside a well-defined descending channel, and the structure is doing exactly what a controlled bearish market is supposed to do: lower highs, lower lows, and weak corrective bounces.

From a price structure standpoint, the recent sell-off was impulsive, breaking multiple short-term supports and accelerating price into the lower half of the channel. The bounce we are seeing now is purely corrective, capped below the descending channel resistance and the dynamic EMA, which is acting as active supply, not support.

The orange projection highlights the most probable path:

- A weak relief rally toward channel mid / EMA resistance

- Followed by continuation lower, targeting the next liquidity pocket

The highlighted horizontal zone around 74,500–75,000 is not strong demand, it is a reaction zone, already tested and partially consumed. Once price revisits this area again, the probability favors acceptance below, opening the door toward the next major liquidity magnet near 71,900.

Trend & Momentum Context:

Trend bias: Bearish (lower timeframe)

Market behavior: Controlled distribution, not capitulation

No structural sign of accumulation (no base, no absorption, no higher low)

Macro & Liquidity Logic:

Risk assets are currently repricing under tighter financial conditions and reduced speculative appetite. Until Bitcoin reclaims the upper boundary of the descending channel with acceptance, any bounce should be treated as sell-side liquidity, not trend reversal.

Key Takeaway:

This is not a dip to buy blindly. As long as Bitcoin remains inside this descending channel, rallies are reactions, and continuation risk points lower. The market is leaking liquidity patiently, structurally, and without panic.

ETHUSD CRACK! Wave 3 Warning!🚨When it rains, it pours. We’re seeing concurrent breakdowns across multiple asset classes, consistent with the risks I’ve been flagging for some time.

ETH is at stage 5️⃣ Panic / Liquidity Event, more on this later.

ETH is now down -47% from ATH, after Wave 1 down.

ETH has been trading below the Death Cross X countertrend Wave 2, flagging out "Deeking"(Honey ticking)

Now it is Cracking the Flag. (Like many other asset classes)

🚩 Warning us that Wave 3 down is coming!

1️⃣ Early Drop (-5% to -10%) — Denial Phase

2️⃣ Correction Phase (-10% to -20%) — Reassurance Phase

3️⃣ Official Bear Market (-20%) — Commitment Trap

4️⃣ Deep Decline (-30%) — Moral Pressure Phase

5️⃣ Panic / Liquidity Event (-40% to -50%) — Narrative Flip

6️⃣ Late Stage / Bear Rally — False Hope

At Stage 5️⃣ Panic, you will hear these phrases.

“This was a black swan”

“No one could’ve predicted this”

“It’s different this time — but markets adapt”

“Valuations are now attractive”

“Big Money won’t allow a collapse”

📌 Translation: The damage is done. Rewrite history.

I need to make another post to get you all ready for what is to come, so you don't get suckered like I did when I was first starting out.

I paid the price, so you don't have to.

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Support and Resistance in relation to SMCIn this video I go through a bit of my analysis as it pertains to the concepts of Support and Resistance, and how I use those ideologies to further add confluence to my bias, narrative, and trade setups.

This is in no way a p*ssing contest. Any combination of factors can create a positive edge, especially when experience comes into play. However, I prefer to actually understand what price is doing rather than rely on patterns alone.

- R2F Trading

BOME at Major Support Inside Descending ChannelBOME remains inside a long term descending channel and is currently trading directly above a major horizontal support zone. Price has already reacted from this level and is attempting to build a short term higher low structure.

This area is important because it sits at the lower boundary of the channel, where previous downside moves have slowed. As long as this support continues to hold, price may attempt a corrective move toward the mid range of the channel, followed by a potential test of descending resistance.

A clean breakdown below this support would invalidate the recovery attempt and open the door for further downside continuation. This zone should define the next meaningful move.