AXS at ExtremesAXS: Objectives Met

Both Elliott Wave 5 and the ABC sequence have fully completed at the same region, suggesting the upside expansion has done its job.

At this stage, continuation is still possible — but probability shifts only if structure changes.

The marked support zone is the key:

• As long as it holds, price can consolidate or extend

• If it breaks, a corrective move toward the WCL becomes far more likely

This is not a signal or a top call — just structural context and conditional bias based on completed objectives.

Not financial advice. Educational market structure analysis only.

Crypto

Bitcoin Buyer Zone Reaction Signals Potential Move to $90,500Hello traders! Here’s my technical outlook on BTCUSD (3H) based on the current chart structure. Bitcoin previously traded within a broader bullish context, supported by a rising trendline and a well-defined Buyer Zone around the 88,300–88,600 area. After a strong impulsive move higher, price entered a consolidation range and later formed a corrective descending channel, signaling a temporary pause in bullish momentum rather than an immediate trend reversal. During this correction, multiple fake breakouts occurred near the channel boundaries, highlighting indecision and liquidity grabs on both sides of the market. Recently, BTC broke below the descending channel support and briefly dipped into the Buyer Zone, where buyers reacted and defended the level. This area aligns with a key Support Level and prior structure, making it a critical demand zone to watch. The current price action suggests a corrective pullback within the larger structure, as the move down lacks strong impulsive continuation. Above price, the market is capped by the Seller Zone and Resistance Level around 90,500, which coincides with a previous breakout area and the underside of the former range. My scenario: as long as BTC holds above the 88,300 Buyer Zone and maintains higher lows from this support, the broader bullish structure remains valid. A sustained reaction from demand could lead to a recovery move toward the 90,500 Resistance Level (TP1). Acceptance and a clean breakout above this level would signal renewed bullish strength and open the path for continuation higher. However, a decisive breakdown and acceptance below the Buyer Zone would invalidate this scenario and increase the probability of a deeper corrective move toward lower support levels. For now, price is at a key decision point, with buyers and sellers actively battling for control. Please share this idea with your friends and click Boost 🚀

EURUSD Rejection From Resistance, 1.1630 Support in FocusHello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD previously traded within a well-defined bullish channel, supported by a rising trend line and a sequence of higher highs and higher lows. This structure confirmed strong buyer control after price reversed from the broader base and pushed higher with momentum. During this bullish phase, price broke above a key Seller Zone around 1.1680–1.1700, confirming bullish continuation and acceptance above former resistance. The market then extended higher before momentum started to fade near the upper boundary of the channel, where price clearly turned around, signaling exhaustion from buyers. Following the top, EURUSD transitioned into a corrective phase, breaking below the ascending structure and forming a descending channel. This shift marked a short-term change in market control, with sellers gaining strength. Price respected the descending resistance line, producing lower highs and confirming bearish pressure. Several corrective pullbacks occurred, but each rally failed below the Resistance Level near 1.1700, reinforcing this area as a strong supply zone. Fake breakouts and quick rejections from this zone further highlight active selling interest. Currently, EURUSD has broken below the descending resistance line and is trading beneath the Seller Zone, suggesting that recent upside moves are corrective rather than impulsive. Price is now moving toward the Buyer Zone / Support Level around 1.1630–1.1600, which previously acted as a key demand area and structural reaction zone. This level is marked as TP1, where buyers may attempt to slow or pause the decline. My scenario: as long as EURUSD remains below the 1.1680–1.1700 Resistance Level and continues to respect the broader bearish structure, the downside bias remains valid. I expect price to continue lower toward the 1.1630–1.1600 Support Level (TP1). A clean breakdown and acceptance below this zone would open the door for a deeper bearish continuation. However, a strong bullish reaction and acceptance back above resistance would invalidate the bearish scenario and suggest a possible return to consolidation or trend recovery. For now, market structure favors sellers while price trades below resistance. Please share this idea with your friends and click Boost 🚀

$ETH 1W Update: Mostly same story as BTC, different tickerEthereum looks very similar to Bitcoin here. Yes, we had a sharp selloff and the weekly candle was ugly on the surface, but structurally this is still range behavior, not a breakdown.

On the weekly:

• Price is still trading inside the larger range

• The selloff respected higher-timeframe support

• Weekly candles continue to show higher lows

• Trend structure remains upward-biased, just consolidating

This is classic chop in the middle of the range. Volatility shakes confidence, not structure. As long as ETH continues to hold the range lows and build above them, this looks like digestion after a strong impulse, not the start of a larger downside move.

Markets frustrate participants before they move. ETH is doing exactly that right now.

Until we either:

• Lose range support with acceptance, or

• Reclaim range highs with strength

Assume consolidation and positioning. Don’t confuse noise for a trend change, and don’t let chop shake you out of higher-timeframe structure.

BTCUSDT: Bullish Push to 91900?BINANCE:BTCUSDT is eyeing a bullish rebound on the 1-hour chart , with price bouncing from a support zone near cumulative long liquidation, converging with a potential entry area that could trigger upside momentum if buyers defend against further dips. This setup suggests a recovery opportunity after recent pullback, targeting higher resistance levels with more than 1:2.5 risk-reward .🔥

Entry between 88300–88500 for a long position (entry from current price with proper risk management is recommended). Target at 91900 . Set a stop loss at a 4-hour close below 87200 , yielding a risk-reward ratio of more than 1:2.5 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging Bitcoin's resilience post-correction.🌟

📝 Trade Setup

🎯 Entry (Long):

88,300 – 88,500

(Entry from current price is valid with strict risk & position sizing.)

🎯 Target:

• 91,900

❌ Stop Loss:

• 4H close below 87,200

⚖️ Risk-to-Reward:

• > 1:2.5

💡 Your take?

Is this a clean liquidity-sweep rebound toward 91,900, or does BTC need deeper consolidation before any meaningful upside? 👇

EUR/USD 2-Hour Chart: Downtrend Reversal with Upside TargetsThis is a 2-hour EUR/USD price chart illustrating a clear transition from a bearish trend into a bullish reversal, supported by market-structure concepts.

Price initially trades in a well-defined downtrend, forming lower highs and lower lows within descending channels.

Multiple BOS (Break of Structure) points confirm bearish continuation during the decline.

Near the 1.1600 support area, price respects a rising higher-timeframe trendline and forms a base.

A CHOCH (Change of Character) occurs, signaling loss of bearish control and the start of a trend reversal.

Following the reversal, EUR/USD breaks above prior swing highs (bullish BOS), confirming a new uptrend.Price now respects an ascending trendline, showing higher lows and sustained bullish momentum.

Two upside objectives are identified:

1st Target: ~1.1819 (previous resistance / structure high)

2nd Target: ~1.1850 (major resistance zone)

Overall, the chart demonstrates a textbook bearish-to-bullish market-structure shift, with momentum favoring further upside toward marked targets.

BTC Is Not Weak — It’s Just Quiet Before the Next Big WaveIf I look at BTCUSDT right now through the lens of someone who has lived through multiple market cycles, what I see is a market that is calm rather than weak.

Recent news hasn’t delivered a major catalyst, and that is actually a positive sign. There is no new macro pressure, no unexpected bad news, and capital is still staying within Bitcoin. In that context, the market naturally chooses accumulation over panic selling.

On the chart, BTC is far from losing control . Price remains above the Ichimoku cloud, and the medium-term bullish structure is still intact. The 88,000 USD zone is acting as a psychological buffer — a level where sellers are losing momentum and buyers are starting to wait patiently.

The current volatility should be seen as a short-term position clean-up, not a reversal signal . The market is digesting the previous rally, quietly rebuilding energy for the next move.

As long as BTC continues to hold this price base, the probability of a retest toward the 94,000 USD zone remains high. This is the kind of market that does not reward impatience, but favors traders who understand that sustainable uptrends always need a pause in between.

Don’t Panic With SOL – The Market Is Offering an OpportunitySOLUSDT currently looks like a deep correction within a broader uptrend, rather than a trend reversal. Recent news has mainly created short-term psychological pressure across the crypto market, while Solana’s fundamentals remain solid: institutional capital has not exited aggressively, staking levels stay high, and the ecosystem continues to show healthy activity.

On the chart, the recent drop came from a strong rejection at the descending trendline and the upper edge of the Ichimoku cloud. The key point, however, is that after the breakdown, price did not continue to collapse. Instead, it quickly formed a clear consolidation zone around 125 USDT — a sign that selling pressure is fading and buyers are starting to absorb supply.

The 125 area now acts as a critical support zone. As long as price holds above this level, I favor a scenario where SOL continues short-term fluctuations to build a base, followed by a recovery toward the 132–136 zone.

Overall, SOLUSDT is still following the textbook structure of a healthy uptrend: a sharp drop, base formation, consolidation, and recovery. For me, this is a phase that requires patience, because the market tends to reward those who wait for proper structure — not those who rush in.

[LOI] - Levels of Interest - SCRT - SCRT

Key Points

Secret Bridge for XMR Enhances Privacy in Cross-Chain Transfers: It addresses exposure risks in standard bridges by enabling confidential bridging of Monero (XMR) to Secret Network as sXMR, preserving anonymity while allowing DeFi participation without revealing transaction details.

Long-Term Bullish Outlook for SCRT: Driven by growing demand for programmable privacy in DeFi and AI.

Crypto Macro Influences: Recent oil seizures and tariffs may boost illicit trade (estimated at $2-3 trillion globally), increasing need for privacy tools like SCRT; pro-crypto shifts under Trump could spark altcoin growth, but economic pressures like inflation might delay it.

AI Push in Privacy Landscape: Secret Network leads with confidential AI via TEEs, ensuring private data processing; this aligns with rising enterprise adoption (projected 60% by 2027) amid data breach concerns, potentially positioning SCRT as a hub for secure AI.

Please note that this is a preliminary research paper and you should continue to do your own research (DYOR). Information about assets can change rapidly, and it's essential to stay updated with the most recent developments.

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 (Or S1-S3) has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

TheBitcoinGeneration

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by

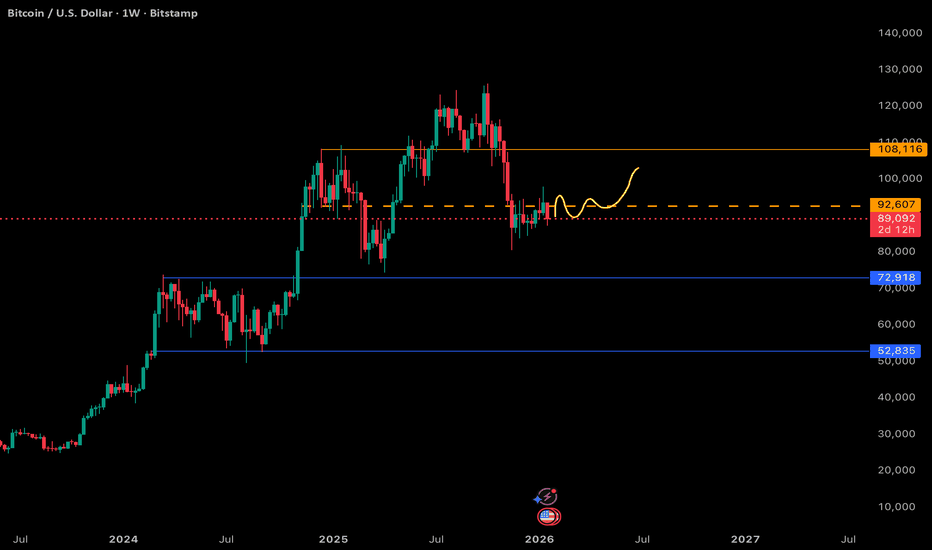

Down to 60kAs I said, Bitcoin pulled back to 93k.

93k support did NOT hold. Green path is invalidated and out of the question at this point.

Slight support around 87k (100 sma), but I would not expect that support to hold either as it was where this bear flag started forming back in November. This is especially clear to us because Bitcoin topped 1st, led equities lower. Equities were stubborn for a bit, but have now given out indicating more selling pressure is coming for Bitcoin. There is no good reason to expect less than -30% downside risk here.

Next major support will be at the 200 sma around 60k.

We will bounce there. No doubt.

The question is whether that bounce will hold and take us to new highs (yellow path), OR whether it flips over and crypto enters the worst crypto winter ever seen before (red path).

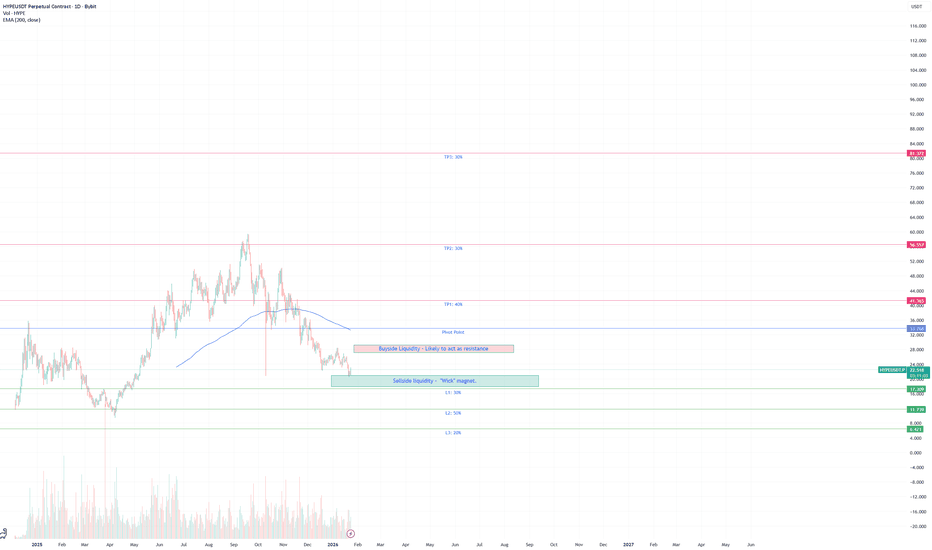

[LOI] - Levels of Interest - HYPETA levels of interest for HYPE

HYPE - THESIS SUMMARY

Key Points

Hyperliquid Overview: Hyperliquid is a decentralized Layer-1 blockchain and perpetual futures exchange offering low-fee, high-leverage trading with CEX-like speed and DEX transparency; its HYPE token enables governance and captures value through protocol fees.

Bearish Bias from Unlocks: Recent and upcoming token unlocks (e.g., ~1.2M HYPE in January 2026 and ~9.92M in February) create short-term selling pressure, diluting circulating supply by ~350K HYPE daily on average, potentially driving prices lower amid bearish trader sentiment and market volatility.

Problems Hyperliquid Solves: Decentralized perps address intermediary risks, high costs, counterparty issues, and access barriers for unbanked users, enabling seamless, transparent trading without KYC or centralized control.

Long-Term Bullish Bias: Strong fundamentals like dominant market share (75%+ in de-perps), deflationary buybacks (~115K HYPE daily at current levels), ecosystem growth (e.g., equities perps), and undervaluation suggest significant upside, with analysts eyeing 100x potential in a maturing DeFi landscape.

Crypto Macro Considerations: Under Trump, pro-crypto policies like the GENIUS Act and executive orders foster growth, but markets face uncertainty from tariffs and mixed Fed signals; creation of Fed-crypto rails (e.g., "payment accounts") could bridge traditional finance and digital assets, potentially sparking an altcoin season in mid-2026 if Bitcoin dominance falls below 55%.

Please note that this is a preliminary research paper and you should continue to do your own research (DYOR). Information about assets can change rapidly, and it's essential to stay updated with the most recent developments.

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 (Or S1-S3) has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

TheBitcoinGeneration

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by

SOLANA (SOL) Pullback to Demand Zone with Upside Recovery TargetThis is a 2-hour SOLANA (SOL/USD) price chart showing a transition from a strong uptrend into a corrective phase and potential recovery.

Price initially moves in a clear bullish structure, making higher highs and higher lows while respecting the Donchian Channel (blue bands).

SOL peaks near the 145–147 zone, where upside momentum weakens and price begins to stall.

A sharp bearish breakdown follows, with price decisively falling below the Donchian mid/upper levels, signaling a trend shift or deep pullback.

The decline finds support around the 125–127 demand zone, which aligns with the lower Donchian band and a rising long-term trendline.

Price is currently consolidating near support, suggesting accumulation and a potential bounce.

Two upside objectives are marked:

1st Target: ~135.31 (prior structure / resistance)

2nd Target: ~145.32 (previous high / major resistance)

Overall, the chart highlights a pullback within a broader bullish context, with defined support, resistance, and recovery targets.

BTCUSD RETEST ANALYSIS (READ CAPTION)hi trader's what do you think about btcusd

BTCUSD is currently showing a bullish market structure, with price holding strongly above a key support level. As long as Bitcoin stays above 88,300, buyers remain in control and the upside momentum is expected to continue.

🟢 Support Level: 88,300

This level is acting as a strong bullish support zone, where buyers have previously stepped in.

Holding above this area confirms market strength and increases the probability of further upside movement.

🔴 Supply Zone: 93,000

The 93,000 area represents a major supply and profit-taking zone.

Price may face temporary resistance or consolidation here due to seller activity.

A clean breakout and strong close above this zone would open the door for further bullish continuation.

📈 Market Outlook

Above 88,300 → Bullish bias remains intact

Pullbacks toward support → Potential buy opportunities

Target → 93,000 supply zone

Breakdown below 88,300 → Bullish setup invalidated

Overall, BTCUSD favors a buy-on-dips bullish continuation strategy, unless the key support level fails.

please like comment and follow

$BTC 1W Update: Don't get shaken out, anon Market update – BTC higher-timeframe context

Yes, there was a sharp dump and, as usual, sentiment flipped to panic quickly. But stepping back to the weekly chart, this move was largely noise within structure, not a trend change.

Price is still chopping in the middle of the broader range. We flushed liquidity below local support, triggered stops, and immediately stabilized back into the prior value area. That’s classic range behavior, not breakdown behavior.

Key points from the chart:

• No weekly range low has been lost

• No high-timeframe support has been decisively broken

• Volatility expanded, but structure remains intact

• This looks more like redistribution and positioning than capitulation

In other words, the market did what ranges do: shake out weak hands in the middle before resolving later.

Until price accepts below the range lows or reclaims range highs, expect continued chop. Getting emotional in the middle is how traders get shaken out of good positioning.

Zoom out, respect the range, and let price confirm before assuming something bigger is happening.

AVAX Testing Key Support – Long Spot OpportunityAVAX is currently testing a significant support zone around the $12.00 – $12.75 range. This area has held historically, and price is showing signs of stabilization, potentially offering a good risk-to-reward setup for a spot long entry.

🎯 Entry Zone: $12.00 – $12.75

✅ Take Profit Targets:

• TP1: $15.00 – $17.00

• TP2: $18.50 – $21.00

🛑 Stop Loss: Just below $11.40 (to protect against breakdown of support)

This setup favors patient accumulation at support with clear upside targets and controlled downside. As always, watch for confirmation signals like volume spikes or bullish structure before entering.

BTCUSDT Short: Lower Highs, Supply Rejection & Demand in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a broader bullish recovery phase, supported by a rising trend line that guided price higher from the lows. During this advance, BTC formed a consolidation range, reflecting accumulation before continuation. This range eventually broke to the upside, confirming buyer control and pushing price toward a major Supply Zone around 91,400. At this level, price reacted sharply, forming a clear pivot high and signaling strong seller presence. Following the rejection, BTC entered a corrective phase, trading within a short-term range near the highs before breaking down. After the breakdown, price lost the ascending demand line and confirmed a structural shift to the downside. Subsequent pullbacks failed to reclaim the broken structure, and former support acted as resistance, reinforcing bearish pressure. The move lower accelerated, bringing price back toward the broader Demand Zone near 88,600–88,700, which aligns with the long-term rising trend line and a key historical reaction area.

Currently, BTCUSDT is trading near this demand zone after a strong bearish impulse. This area is critical, as buyers may attempt to slow the decline or form a short-term base. However, until price shows a clear bullish reaction and regains broken structure, the downside risk remains.

My scenario: as long as BTCUSDT stays below the 91,400 supply zone and fails to reclaim the broken demand line, the bearish bias remains valid. I expect price to test and potentially react from the 88,700 demand area (TP1). A clean break and acceptance below this zone would open the door for a deeper correction. Conversely, a strong bullish reaction from demand followed by a reclaim of key resistance would weaken the bearish outlook and suggest a potential recovery. Manage your risk!

EURUSD Long: Buyers Step In After Bearish Structure FailsHello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. EURUSD previously experienced a corrective bearish phase, trading inside a descending channel after forming a rounding top near the highs. However, this bearish structure has recently weakened. Price broke above the descending channel, signaling a loss of seller control and the beginning of a potential structural shift. After the breakout, EURUSD formed a pivot low and reacted strongly from the Demand Zone around 1.1690, which aligns with previous structure and acts as a key support area. This demand zone is now being defended by buyers, and the latest bullish impulse suggests that the breakout from the descending channel is valid rather than a fake move.

Currently, price is consolidating above demand and below the Supply Zone near 1.1760, indicating short-term compression after the breakout. This consolidation looks constructive, as price is holding above former resistance turned support and is not showing strong bearish rejection.

My scenario: as long as EURUSD holds above the 1.1690 Demand Zone and continues to print higher lows, the bullish bias remains valid. I expect buyers to maintain control and attempt a continuation toward the 1.1760 Supply Zone (TP1). A clean breakout and acceptance above 1.1760 would confirm bullish continuation and open the door for a move toward higher resistance levels. Manage your risk!

Dash Signals Bullish Recovery After Deep CorrectionWe discussed Dash back on December 16, 2025, when we highlighted strong support within the wedge pattern, marking wave C of an ABC corrective structure. That area acted as a key technical floor, increasing the probability of a bullish reaction.

As we can see today, price is recovering strongly from that support, and the advance appears to be unfolding as wave (3) of a new five-wave bullish cycle within wave A/1. This type of impulsive price action typically reflects strengthening momentum and growing bullish participation. As a result, further upside is favored toward the 100 area and potentially higher levels.

That said, while the broader structure remains constructive, traders should remain mindful of a possible wave (4) pullback, which would be a normal corrective pause before another continuation higher into wave (5). As long as key support levels hold, the overall outlook remains bullish.

USDJPY FLYINGUSDJPY is maintaining a strong bullish continuation after a clean break and hold above the prior supply turned support zone, confirming bullish market structure with higher highs and higher lows on the daily timeframe. The recent consolidation acted as a healthy pause before continuation, absorbing supply and building liquidity for the next upside expansion, which aligns with the impulsive breakout now in play. Fundamentally, the pair remains supported by the persistent policy divergence between the Federal Reserve and the Bank of Japan, where US yields stay elevated and risk sentiment continues to favor the dollar, while the yen remains structurally weak despite periodic intervention concerns. As long as price holds above the key demand zone and trend support, bullish momentum, breakout continuation, liquidity sweep, and trend-following strategies remain favored, targeting higher resistance levels with the trend firmly in control for profit-focused execution.

OKB - The 100 Level TestThis one is pretty straightforward.

OKB is still trading inside a clear range, and price is now pushing into the lower bound of that range, right around the $100 round number.

That area matters. It has acted as support before, and it’s doing so again....

As long as:

• the lower range support holds

• and $100 remains intact

➡️ I’ll be looking for long setups , targeting a move back toward the upper bound of the range.

If $100 fails, the idea is invalid.

If it holds, the range trade remains in play.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

QuyetP | Bearish signal on Bitcoin - 1DBITSTAMP:BTCUSD Daily chart just broke Weekly minor structure to the downside.

This chart looks very bearish despite that USD is weak.

I was watching the market for last 2 months and it was just consolidation.

Im looking for sell at lower timeframe now.

Target is 75-78k$.

I plan to open some small positions first then add-in more when the market in trending.

#PHA Ready For a Major Massive Move. Don't Miss this opportunityYello, Paradisers! Is this just another fakeout, or is #PHA about to explode after weeks of silent accumulation? Let's view the #PhalaNetwork trading setup:

💎#PHAUSDT has been trading inside a well-defined descending channel, respecting both the upper resistance and lower support lines for months. But that might be about to change. The price just broke out of the channel and is currently retesting the breakout zone while sitting right above the strong demand area between 0.024 and 0.030.

💎What gives this setup even more power is the clear bullish divergence on the MACD, signaling a loss in bearish momentum right as the breakout occurred. On top of that, we already saw a bullish MACD crossover, adding extra confidence to this move.

💎If buyers manage to hold this support and flip the 50EMA into support, we expect a clean continuation to the upside. The first key target is the moderate resistance at 0.0613, but the real magnet for price is the strong resistance zone between 0.090 and 0.093, where we expect significant supply and profit-taking.

💎However, if #PHAUSD loses the 0.024 support zone, this entire bullish setup gets invalidated. A break below that level would confirm a lower structure and likely trigger another wave of downside.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

ETH 4H: “Cup & Handle” Failed… but the Bounce Setup ETH just delivered the exact type of move that wipes out overconfident “pattern traders”: a clean-looking cup & handle structure, a pivot breakout attempt… then a hard selloff straight back into demand. That doesn’t mean the chart is “wrong.” It means it’s not provable. Patterns are hypotheses and the market only validates them when price reclaims key levels and holds them. Right now, ETH is sitting in the Demand Zone after a sharp liquidation drop. That’s where bounces often start but the trade becomes high-probability only if price reclaims the EMA/supply reclaim test (your marked “trade zone”) and shows acceptance.

Trade Plan

✅ Long idea (ONLY after confirmation)

Trigger: 4H reclaim + hold above the Trade Zone (and ideally above the “handle low” / EMA reclaim area).

Entry: after a strong reclaim candle + retest hold .

Targets:

T1: first push into the marked resistance inside the trade zone

T2: ~3,259 (Target 2 line)

Stretch: ~3,402 (Pivot line) if momentum returns

Invalidation: clean breakdown back below the Demand Zone (no demand = no long thesis).

❌ Bear case (if demand fails)

If ETH loses demand and can’t reclaim the trade zone, this becomes a classic dead-cat bounce setup:

small rebound → rejection at supply/EMA → continuation lower.

Bottom line

This chart is plausible, not provable.

Your edge is not “believing the drawing”. it’s waiting for the market to confirm the idea at the EMA/supply reclaim test.

If it reclaims and holds → you have a structured long with clear targets.

If it rejects or breaks demand → you step aside (or flip bias).