Hedera: bounce or trap? key levels and targets for the days aheaHedera Hashgraph. Who else just watched that crazy liquidation wick and thought: "ok, someone big just hit the panic button"? After the broad alt selloff, HBAR flushed into the 0.07s and instantly got bought back, and according to industry sources the project is still on the radar for enterprise and tokenization plays, so the market clearly defended those lows.

On the 4H chart we’ve got a sharp V-reversal from the 0.075 area, huge volume, and RSI has ripped out of oversold to around 60. Price is reclaiming the main volume node near 0.09, aiming straight at the first thick supply zone around 0.098-0.105. With that combo I’m leaning toward a short term long bounce instead of fresh lows.

My base case: while HBAR holds above 0.088-0.089, I’m looking for a move to 0.10 first, with extension toward 0.104-0.107 where I’d start unloading longs. I’m stalking entries on dips into 0.09 with a tight invalidation under 0.088. If that support cracks and we close back under the volume cluster, this turns into a failed bounce and opens the door back to 0.08 - I might be wrong, but the current bounce setup looks too juicy to ignore. ✅

Crypto

BTCUSD Intraday Long — Contextual ExpectationWithin the daily composite framework and considering the current intensity of market buying, I’m expecting a continuation of the upside move toward the nearest area of friction.

Key zone of interest:

SP 68,700 – 69,150

Current context:

-sustained market buyer pressure

-divergence in the dynamic volume component

-supportive local structure

-liquidity and liquidation-related factors

Taken together, these elements increase the probability of a move toward the outlined zone in the near term.

Idea invalidation:

Acceptance and consolidation below 64,400.

This is a counter-trend perspective, therefore risk remains elevated. Execution, if any, will be strictly conditional and aligned with my system and risk parameters.

Litecoin: potential bounce or deeper drop? key levels to watchLitecoin. Catching the falling knife or loading a discount alt bluechip here? While the whole crypto market just got washed out on fresh regulatory noise and another wave of BTC volatility, LTC dumped into multi‑month lows and finally printed a nasty but promising wick from the 44–45 area. According to market chatter, majors are seeing rotation back in as panic cools off.

On the 4H chart price bounced to 52–53 after a vertical selloff, RSI was buried under 30 and is curling up, and there’s a clear volume gap above current levels. I’m leaning toward a relief rally: first magnet for me is the 57–58 zone, then stronger supply around 60–62 where the big volume shelf starts. Trend is still bearish overall, so I treat this as a counter‑trend squeeze, not a new bull market… yet. I might be wrong, but dead cats usually bounce higher than this.

My base plan: ✅ look for longs only while price holds above 50–51, targeting 57–58 and possibly 60–62 if momentum stays hot. ⚠️ If 50 gives way again, I expect sellers to drag LTC back to 45–46 and maybe sweep that spike low. I’m stalking a small long on dips toward 51 with stops tucked below 49, and I’ll happily flip bias if we lose that support with volume.

XRP/USDT | Where to next? (READ THE CAPTION)After hitting a new ATH mid-2025 at 3.66, Ripple has been just dropping in price since then. It hit the Bullish breaker once on October 10th 2025, and has hit it again, but this time it didn't go back to 2.52. It hit the Bullish Breaker and went as low as 1.117 before going back up and now being traded at 1.374, above the Bullish Breaker zone. If XRP manages to stay above the 1.336 zone, it can go higher a little bit.

If it manages stay above that level, the targets are: 1.3785, 1.3800, 1.3815 and 1.3830.

If it fails: 1.3700, 1.3690 and 1.3680.

BTC/USDT | Dramatic drop! (READ THE CAPTION)BTCUSDT Almost hit the Weekly Bullish OB last night at 59,800, but it stopped at 60,000 in the demand zone and then went back up, currently being traded at 66,300. If it holds above 66,000, we can expect more of it, but if it fails, it may go lower to the bullish OB.

Bitcoin starts to move toward $100,000 —Thanks for your support!This is what I call beautiful, sublime...

Consider this: The main support at $57,772 was not tested, Bitcoin started recovering right after hitting $60,000. This level is marked on the chart with a blue dashed-line. The long-term 0.786 Fib. retracement, the "unbreakable support."

The higher levels, the highs from April and November 2021, just now are being recovered, right now, today and this very same week.

Notice that this is all happening within a weekly candle. Also consider that it is happening early February. We were expecting February to be shaky at first just to turn hyper bullish later on. This is happening now.

While Bitcoin produced a major crash and the lowest price in more than a year, since October 2024, still, the active session has lower volume compared to February 2025. Showing that the bears ran out of force.

The bulls are already in and they are entering the market with power.

The fact that the bearish move was really strong is now a positive development, because we get a strong bullish wave in reverse. A very strong relief rally.

For Bitcoin, this relief rally can last an entire month. It can last more for the altcoins, the smaller altcoins. The bigger altcoins will continue to move together with Bitcoin. The bigger the project, the stronger the positive correlation.

How far up can Bitcoin go?

Minimum based on TA we get to challenge the last high which sits at $98,000. Other factors make it possible for Bitcoin to go beyond 100K. These are not very strong right now and it is still early so we will leave the description for a different day.

Good morning my fellow Cryptocurrency trader, I hope you are ready for an amazing weekend... The best is yet to come.

Thanks a lot for your continued support.

Namaste.

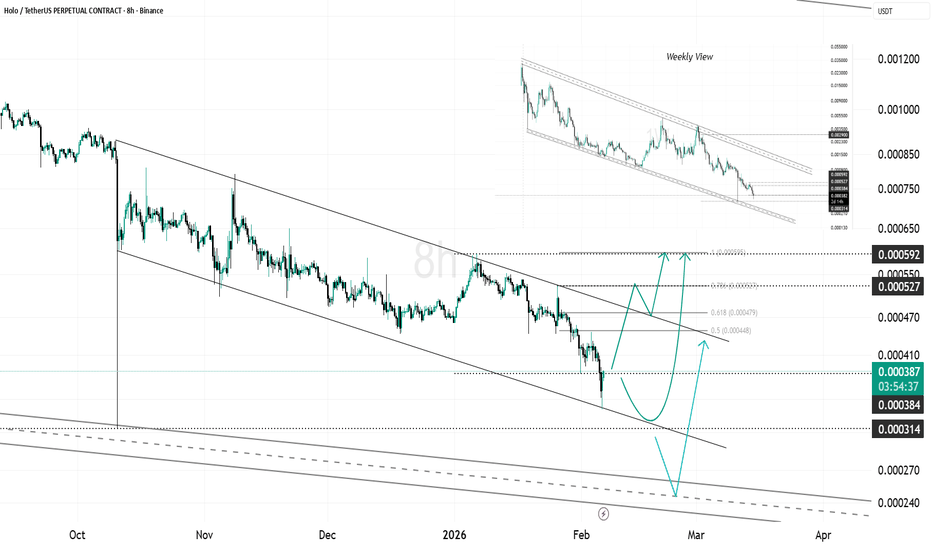

HOT Near Lower Channel Support, Liquidity Zone in FocusHOT continues to trade inside a clear descending channel on the higher time frame and is currently positioned near the lower boundary of the structure.

Price action suggests the market may revisit the previous wick around 0.000314, which sits inside a known liquidity zone. A move into this area could act as a liquidity sweep toward the lower boundary of the larger channel, before any meaningful reaction develops.

As long as HOT remains below channel resistance, the structure stays bearish. A deeper sweep into lower support would still be technically valid within the trend. Only a strong reclaim back above the channel mid-range would start to shift short-term momentum.

This is a high-sensitivity zone where volatility is expected.

Bitcoin - Pullback LevelsOn the larger timeframe, Wave 3 of the decline has been completed.

Locally, within this third wave, the fifth subwave has been completed.

We are currently in an upward corrective move. Let’s define the main targets.

Key targets:

75,000 - local correction

82,000

85,000

The potential move from the current level is 15-30% .

There is also an unfinished sub-division around 55,000 , but it appears unlikely.

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

Stellar: bounce ahead or more pain? key levels to watchStellar. Knife catching or discount hunting? Recently the whole alt sector got hit as traders rotated out of risk after fresh macro comments, and according to market news Stellar just rode that same liquidation wave. Price flushed into fresh lows, sentiment is in the gutter... exactly where interesting bounces usually start.

On the 4H chart we have a waterfall drop into the 0.15 area with a volume spike and RSI buried in oversold, starting to curl up. Local HVN sits around 0.17, so any short squeeze has a natural magnet there, with heavier supply stacked higher near 0.185-0.19. Technically I lean to a relief long scenario, not a fresh trend reversal yet. ✅

My base plan: watch 0.15-0.152 as a bounce zone, with intraday targets at 0.17 first, then 0.185 if buyers stay brave. If 0.145 gives way and price can't reclaim 0.16 quickly, I drop the long idea and expect continuation toward 0.14-0.135 instead. I might be wrong, but this looks more like late capitulation than a comfortable place to open new shorts, so I’m only interested in tactical longs here with tight risk.

BTC/USDT | Bitcoin Weekly Update – Key Demand Zone in Play!By analyzing the #Bitcoin chart on the weekly timeframe, we can see that after the rally up to $97,900, price entered a correction. Within just three weeks, Bitcoin dropped around 30% and fell to $66,600, and it is now trading near $67,500.

This current area is a major demand zone. If buyers step in and defend this level, we could see a bullish rebound from Bitcoin. If this scenario plays out, the first upside target will be around $75,500.

This analysis will be updated. We’re back, stronger than ever. Thanks for all your support.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

XRP / USDT — Daily Update (Follow-up)Price continued the downtrend after failing to reclaim the prior breakdown level and has now tapped the lower support zone.

The large wick from the previous move has been fully filled, meaning downside liquidity has been taken.

Current situation

Major support: ~1.25 – 1.35

Reclaim level: ~2.00

Higher resistance: ~3.00

Structure: bearish channel still intact

What this means

The market reached a reaction area where bounces normally occur.

However, as long as price trades below 2.00, the overall structure remains weak and any upside is corrective.

Simple plan

Hold 1.25–1.35 → relief bounce possible

Reclaim 2.00 → short-term strength returns

Break below support → continuation lower likely

Right now this looks like a reaction zone, not a confirmed reversal.

Do you expect XRP to stabilize here or sweep the lows first?

MrC

Chainlink: bounce or break? key levels to watch aheadChainlink. Who’s trying to catch this falling knife and actually grab the handle? After the latest risk‑off wave in crypto, LINK got hammered as traders rotated out of DeFi names, and according to market chatter funding flipped heavily negative and sentiment went full doom mode.

On the 4H chart we’re in a clean downtrend, but the last leg looks like a selling climax: long lower wick, big volume, RSI stuck in oversold around 25. Price is sitting below a fat volume node around 8.8–9.0 that used to be support and now looks like the first serious supply zone. So my base case is a relief bounce into that 8.8–9.5 pocket before bears decide what’s next.

✅ Plan: I’m only interested in a counter‑trend long if price holds above 8.0 and starts building a small base, with targets 8.8 then 9.5. ⚠️ If 8.0 gives way on strong volume, I expect a slide toward 7.2–7.0 where the next demand cluster sits. I might be wrong, but shorting straight into an exhausted dump has rarely been a profitable hobby for me.

[BTCUSDT] Bearish Bias · Techincals → ICT ConceptsFundamental Point of View:

We just had neutral data for FOMC.

We might get a strong nfp for usd.

Technical Point of view

We have a strong Resistance of 8100 If it stays strong we can see a little bearish pressure till 71k.

Better Sells are after a retest of POI.

setup fails if we break POI and break a new higher high in a small Time Frame like 1H or 15m.

**Key notes to keep in mind:**

1. BTC is already in a bearish trend.

2. we have broken a 4H Low which is the POI now and might get retested times before playing the sell move again.

3. we can look for 57K in this week or next week

**Current Market Overview:**

Technically we have broken our last Low and its now a point of interest for sellers.

Fundamentally we are bearish as we dont

lets take a look at different Time frames

**1Week TF:**

We have a strong POI for sellers at 72k If price touches it and stays strong we can see a little bearish pressure till 57k.

Better Sells are after a retest of POI.

setup fails if we break POI and break a new higher high in a small Time Frame like 1H or 15m.

**1D TF:**

We have POI close which will be triggered today for sellls. and sell side liquidity might taken out.

**4H TF:**

keeping eye on the candle breaks we have clean range on the left side.

**1H TF:**

we are currently at no trading zone but will see reaction when it starts moving

**Overall Scenario:**

we are looking for Sells only if we are respecting the 4H POI and breaking Sell side liquidity is another opportunity to trade.

**How will setup fail?**

simple if 4H Poi is broken and a small higher high breaks in 15 min or 1H.

TOTAL Market Cap — Weekly UpdateThe market delivered a strong downside displacement and fully mitigated the weekly orderblock that originated after the US election rally.

That means the entire prior expansion move has now been neutralized and liquidity below the range has been taken.

Price is currently reacting from the next higher timeframe demand zone.

Current situation

Upper weekly OB: taken & mitigated

Price swept sellside liquidity

Reaction from lower weekly demand

Large imbalance left above price

What this means

After a vertical move down, markets usually don’t instantly reverse.

They first stabilize.

So this area is a reaction zone — not yet confirmation of a new uptrend.

As long as price stays below the broken range, market structure remains weak.

Only reclaiming higher levels would indicate strength returning.

Simple plan

Hold current demand → stabilization phase

Reclaim prior range → recovery structure

Fail demand → continuation lower

Right now the market is transitioning, not trending.

Do you expect consolidation here or another expansion leg first?

MrC

BTCUSDT Short: Sellers in Control - Next Stop $69,000 SupportHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTC previously traded within a well-defined consolidation range, where price moved sideways for an extended period, indicating market balance and accumulation. This ranging phase eventually resolved to the upside, leading to a strong impulsive rally. The bullish expansion culminated at a clear pivot high, where buying momentum began to fade and profit-taking emerged. From this pivot point, market structure shifted, and BTC transitioned into a descending channel, characterized by consistent lower highs and lower lows. Price respected the channel boundaries well, confirming controlled bearish pressure rather than a disorderly sell-off.

Currently, BTC has broken below a key Supply Zone around 73,500–74,000, which previously acted as strong resistance. This breakdown confirms a bearish continuation scenario rather than a temporary pullback. Price briefly attempted to reclaim this zone but failed, suggesting acceptance below former resistance. Below current price, the Demand Zone around 69,000 stands out as the next major area of interest. This level represents a strong historical demand area and a potential zone for buyers to step in.

My primary scenario favors further downside continuation as long as BTC remains below the descending supply line and the broken supply zone. Any pullback toward the supply line or the 73,500 area is viewed as a corrective retest and a potential short opportunity rather than a bullish reversal. The main downside objective remains the 69,000 Demand Zone (TP1), where partial profits can be considered and where a stronger reaction is likely. If price reaches this demand area, market reaction will be critical in determining whether BTC forms a base for a bounce or continues lower. However, a strong reclaim and acceptance back above the supply zone and the descending supply line would invalidate the bearish scenario and signal a potential trend shift. Until that happens, structure, trend, and price behavior continue to favor sellers, with downside pressure dominating the current market phase. Manage your risk!

SOL / USDT — Daily Update (Follow-up)After rejecting the prior resistance zone, price accelerated down and tapped the next higher timeframe support area.

The previous range support failed and turned into resistance — confirming continuation pressure.

Current situation

Major support: ~70 – 80

Resistance: ~125

Major S/R flip: ~140 – 145

Structure: bearish continuation after breakdown

What this means

The market moved from distribution into a displacement phase.

Now price is testing a historical demand zone where reactions normally happen.

This is where either:

A relief rally starts

Or the downtrend expands

Simple plan

Hold 70–80 → bounce toward 125 possible

Reclaim 125 → short-term strength returns

Reclaim 140+ → structure improvement

Lose 70 → continuation lower

Currently price is reacting, not reversing.

Do you expect SOL to form a base here or continue trending down?

MrC

DOGE / USDT — Weekly AnalysisFirst time covering DOGE on the higher timeframe.

On the weekly chart price returned to a major historical level after filling the large downside wick — meaning long-term liquidity has been taken.

Structure overview

Major support: ~0.08 – 0.10

Weekly resistance: ~0.14

Major S/R flip: ~0.20

Market structure: macro range after long distribution

What this means

This area has historically been where accumulation starts, not where trends end.

However — holding the level is required first.

Right now price is sitting at decision support:

Hold → multi-week base possible

Lose → continuation into deeper range lows

Market logic

Higher timeframe levels react slower.

So expect consolidation first before any strong move.

Simple plan

Above 0.10 → basing phase

Reclaim 0.14 → bullish momentum returns

Reclaim 0.20 → trend shift on weekly

Lose 0.08 → bearish continuation

This is not a breakout zone — this is a positioning zone.

Do you think DOGE is entering accumulation or preparing another capitulation?

MrC

EURUSD: Buyers Defend 1.1780 - Upside in Focus 1.1870Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a well-defined downward channel, where price consistently respected the descending resistance and support boundaries, forming a series of lower highs and lower lows. This structure confirmed sustained bearish control and orderly downside continuation. During this phase, several bearish pushes developed smoothly within the channel, highlighting strong seller dominance. After breaking the channel, EURUSD continued higher and successfully reclaimed the Support Zone around 1.1780, which acted as a key decision level. The breakout and subsequent hold above this zone confirmed a change from bearish structure into a bullish recovery phase. Price then accelerated toward the 1.1870 Resistance Zone, where supply became active again, resulting in consolidation and multiple breakout attempts.

Currently, price is trading above the rising trend line, while also forming a descending corrective structure beneath the triangle resistance line. Despite the pullback, the market continues to respect higher lows, suggesting that the recent decline is corrective rather than impulsively bearish. The ability of EURUSD to hold above the support zone keeps the bullish structure intact.

My Scenario & Strategy

My primary scenario favors a long continuation as long as EURUSD holds above the 1.1780 Support Zone and respects the rising trend line. The current consolidation appears to be a corrective pause within a broader bullish structure. A successful break and acceptance above the triangle resistance and the 1.1870 Resistance Zone would likely trigger renewed upside momentum. If buyers manage to reclaim and hold above resistance, the next bullish leg could extend higher, following the direction of the dominant trend.

However, a decisive breakdown below the support zone and trend line would weaken the bullish scenario and signal a potential deeper correction or range formation. For now, structure favors buyers, with pullbacks viewed as opportunities for continuation rather than trend reversal. EURUSD remains at a key technical decision area, and price reaction around support will be critical for the next move.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

LINK / USDT — Daily Update (Follow-up)Price continued the downside after the previous update and tapped the lower liquidity zone.

The large wick has now been **fully filled**, meaning the market removed the imbalance and reached a reaction area.

Current situation

Local support: ~7.5 – 8.2

Reclaim level: ~12.2

Major S/R flip: ~18

Structure still bearish (lower highs & lower lows)

What this means

Right now this is a classic decision point:

After liquidity is taken, the market either bases → relief rally, or continues the macro downtrend.

Holding the current level could start a short-term recovery.

But without reclaiming 12.2, it remains only a bounce inside a bearish structure.

Simple plan

Hold 7.5–8.2 → relief move possible

Reclaim 12.2 → market strength returning

Fail to hold → continuation lower likely

So far this looks like a reaction, not a confirmed reversal.

Do you expect a bounce back into resistance or another sweep below support first?

MrC

RENDER / USDT — Daily UpdateAfter the strong impulse move up, price has now retraced and filled all imbalance (FVG) zones created during the rally.

This usually means the market finished correcting inefficient price action and is moving back into equilibrium.

Current situation

Major support: ~1.20 – 1.30

All bullish FVGs below price → filled

Momentum cooled down after distribution at highs

What this means

With imbalances cleared, the chart is no longer in a forced correction phase.

Now the level itself matters:

If support holds → accumulation range likely

If support breaks → continuation of the macro downtrend

Simple plan

Hold above 1.20 → base formation possible → recovery when market strength returns

Lose 1.20 → next liquidity sits lower → bearish continuation

First bullish confirmation → reclaim prior breakdown area (~1.60 zone)

Right now this is a reaction zone, not yet a reversal.

Do you expect buyers to defend this level or will liquidity below get taken first?

MrC

ENA / USDT — Daily Update (Follow-up)Price kept respecting the bearish structure after the previous update.

The rejection at the trendline confirmed sellers are still in control and the market moved back into the lower range.

Current situation

Local support: 0.095 – 0.115

Mid level to reclaim: 0.131

Key S/R flip: ~0.20

Still trading below descending trendline → bearish pressure remains

What this means

Holding below 0.131 keeps the chart weak → continuation range / grind down likely.

A reclaim of 0.131 opens room for a relief move into 0.20 S/R flip area.

Only above 0.20 the structure actually starts improving.

Simple plan

Below 0.131 → bearish / ranging

Reclaim 0.131 → bounce potential

Reclaim 0.20 → trend shift signal

Market now deciding between accumulation at lows or continuation.

MrC

#EURUSD , Time to Fly?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURUSD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup at all but with a valid structure we can have it as QuickScalp

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

WLDUSDT.P:short setup from daily support at 0.3640SETUP SUMMARY

Regarding BINANCE:WLDUSDT.P : after a strong drop, the asset has been consolidating for 5 days. Typically, if an asset comes from above and enters consolidation, it will continue in the same direction — downwards.

This move is reinforced by the fact that BINANCE:BTCUSDT.P is dropping heavily today, dragging the entire market with it. BINANCE:WLDUSDT.P could indeed break the level today, even though it has already moved quite a lot relative to its average statistics.

We are currently seeing a pre-breakout base forming right at the level. If volatility decreases even further, it will be an ideal entry point, as it will allow for placing a tight stop loss.

PRO-THESIS FACTORS:

trend alignment

liquidity vacuum beyond level

market correlation

volatility contraction on approach

prolonged consolidation

lack of rejection after false break ADVERSE FACTORS:

high-volatility approach

no near-level base Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas.