Is Intel a Tech Stock or a Weapon?In 2026, Intel Corporation is going through a major transformation. It is moving away from being just a company that makes chips for personal computers and is becoming a critical partner for the U.S. military. The United States government has officially recognized Intel as a "National Champion," which means the company is now seen as essential for the country's safety and defense. This change is happening because the government wants to ensure it can make its own advanced computer chips at home without relying on foreign countries like Taiwan.

To support this new direction, Intel has secured a massive government contract called "SHIELD," which has a potential value of up to $151 billion. This is very important for traders to understand because it separates Intel’s success from the ups and downs of the regular consumer market. Furthermore, the U.S. government has taken a historic step by buying a 10% ownership stake in Intel. This acts as a safety net, signaling to the market that the government will not allow the company to fail because its factories are now considered as important as nuclear power plants.

The company is currently led by a new CEO, Lip-Bu Tan, who is focused on strict discipline and fixing manufacturing problems. Under his leadership, Intel is building advanced technology for the "Golden Dome," a missile defense system designed to protect the country from high-speed threats. Intel is the only company in the U.S. capable of making the specific high-tech chips needed for this system, using its new "18A" manufacturing process to make equipment lighter and faster.

Looking at what will be, the stock price may still fluctuate (go up and down) in the short term as the new CEO fixes old problems and cuts costs. However, the long-term view shows that Intel is becoming a "hybrid" company that serves both regular customers and the Department of War. Because the government is paying for factory costs and providing steady contracts, Intel is becoming a much safer and more stable investment that is protected from economic inflation.

Defense

Can Speed Win Wars? Textron's Billion-Dollar BetTextron Inc. has transformed from a diversified conglomerate into a focused aerospace and defense integrator positioned at the intersection of geopolitical urgency and technological innovation. The company's strategic pivot centers on the accelerated fielding of the Bell MV-75 tiltrotor aircraft for the U.S. Army's Future Long-Range Assault Aircraft (FLRAA) program, which addresses critical Indo-Pacific operational requirements. With the ability to fly twice as fast and far as legacy Black Hawk helicopters, the MV-75 solves the "tyranny of distance" problem in Pacific theater operations. Simultaneously, Textron Systems has secured significant contracts for unmanned surface vessels and armored vehicles supporting Ukraine, while the Aviation segment maintains robust demand with a $7.7 billion backlog despite supply chain constraints.

The company's Q3 2025 results demonstrated operational strength with adjusted EPS of $1.55, beating consensus estimates, 5% year-over-year revenue growth to $3.6 billion, and impressive 26% segment profit expansion. Management has executed a disciplined capital allocation strategy, divesting underperforming assets like the Arctic Cat powersports business to concentrate resources on high-margin aerospace and defense opportunities. The Aviation segment generated $1.5 billion in revenue with strong pricing power, while Bell's $8.2 billion backlog reflects the long-term nature of defense contracts. Textron's technological moat includes critical patents on High-Speed VTOL systems with folding rotors, additive manufacturing capabilities, and the Nuuva V300 electric cargo drone that achieved first flight in January 2026.

Financial analysts suggest significant undervaluation, with DCF models indicating intrinsic value at $135 per share compared to current trading levels, implying a 30% discount as the market has not fully priced in the FLRAA production ramp. The convergence of expected Federal Reserve interest rate cuts, sustained business jet demand from high-net-worth individuals, and accelerated defense modernization creates multiple tailwinds. While supply chain bottlenecks for titanium and skilled labor shortages remain constraints, Textron's investments in automation, CMMC cybersecurity compliance, and strategic focus position it as a prime architect of next-generation warfare and transport systems with revenue visibility extending through the decade.

Northrop Grumman: Architecting the Future of AI Warfare

Northrop Grumman (NOC) is redefining the defense sector by fusing lethal hardware with digital intelligence. While the delivery of the 1,500th F-35 center fuselage cements its manufacturing legacy, the company’s valuation thesis is shifting. Investors must now analyze Northrop as a master architect of space militarization, autonomous systems, and AI-driven command structures.

Geopolitics and Geostrategy

Global conflicts now demand seamless integration across land, sea, air, and space. Northrop’s Integrated Battle Command System (IBCS) serves as the central nervous system for this new reality. It connects disparate sensors and shooters, creating a unified shield against hypersonic threats. As the space militarization market expands, nations require robust ground systems to command orbital assets. Northrop dominates this geostrategic niche, securing critical infrastructure that nations cannot afford to lose.

Technology and Innovation

The company’s "BattleOne" initiative represents a quantum leap in military logic. This digital ecosystem accelerates decision-making by fusing data from satellites and terrestrial sensors. It utilizes advanced artificial intelligence to predict enemy movements and optimize response times. Northrop is not merely selling weapons; it is selling decision dominance. This move toward software-defined warfare creates a high competitive moat against legacy hardware manufacturers.

Industry Trends: The Rise of Autonomous Mass

The U.S. Air Force currently prioritizes "Collaborative Combat Aircraft" (CCA) to fly alongside manned fighters. Northrop is aggressively targeting this sector with platforms like the "Lumberjack." This one-way attack drone delivers kinetic capabilities at an affordable price point. Furthermore, their ANCILLARY vertical take-off drone eliminates the need for traditional runways. These innovations align perfectly with the industry trend toward "affordable mass" and distributed lethality.

Electronic Warfare and Cyber Security

Nations fight modern warfare in the electromagnetic spectrum. Northrop’s electronic warfare (EW) solutions actively jam enemy communications while shielding friendly networks. These systems integrate cyber resilience directly into the hardware architecture. As adversaries develop sophisticated jamming techniques, Northrop’s multispectral capabilities become non-negotiable for the Pentagon. This ensures recurring revenue streams for constant software and hardware upgrades.

Business Models and Economics

Management is adapting its business model to match tightening fiscal environments. The shift toward platforms like Lumberjack signals a pivot from low-volume, high-cost units to high-volume, lower-cost attrition assets. This diversification protects the balance sheet against potential budget cuts to expensive flagship programs. By balancing the massive F-35 supply chain with agile drone production, the company optimizes its revenue mix.

Management and Leadership

Executive leadership demonstrates strategic agility by embracing digital engineering. They are successfully navigating the transition from a hardware-first mindset to an AI-centric strategy. Their ability to deliver on legacy contracts while funding speculative high-tech ventures instills confidence. Leadership is effectively positioning the firm to capture the lion's share of the Joint All-Domain Command and Control (JADC2) budget.

Conclusion

Northrop Grumman has evolved beyond the definition of a traditional defense contractor. It stands as a technology powerhouse integrating space, AI, and autonomous systems. The company effectively monetizes the complexity of modern warfare. For investors, NOC represents a strategic play on the convergence of silicon and steel in the 21st century.

Is This the Defense Stock That Redefined Modern Warfare?Elbit Systems has positioned itself at the epicenter of a global defense transformation, capitalizing on the shift from counterinsurgency to high-intensity peer conflict. With a record-breaking $25.2 billion backlog and Q3 2025 revenue reaching $1.92 billion (up 12% year-over-year), the company has demonstrated exceptional execution amid European rearmament and Asia-Pacific maritime modernization. Its Land Systems segment surged 41%, driven by artillery and vehicle upgrades that address the munitions-intensive nature of modern warfare.

The company's technological moat centers on breakthrough systems that fundamentally alter combat economics. The Iron Beam laser defense system delivers interceptions at approximately $3.50 per shot versus $50,000 for traditional interceptors, while the Iron Fist active protection system achieved the unprecedented feat of intercepting hypersonic tank rounds in NATO demonstrations. These innovations, combined with advanced electronic warfare suites and cyber-hardened C4I systems, have secured massive multi-year contracts, including a $2.3 billion strategic agreement and a $1.635 billion European "Digital Army" modernization program.

Operating margins expanded to 9.7% despite inflationary pressures, while operating cash flow surged 458% to $461 million in the first nine months of 2025. The company's strategy of localized European manufacturing and technology transfer partnerships has overcome political barriers, positioning it as a domestic supplier across NATO markets. With 38% of its backlog scheduled for execution before end-2026, Elbit offers rare revenue visibility in an industrial sector, justifying its premium valuation as investors price it more like a high-margin technology firm than a traditional defense manufacturer.

PL: room to follow-through Price continues to follow the macro bullish trend structure outlined in the September updates. Watching for further follow-through into the next 24–30 resistance zone.

The earnings gap may offer a delayed-reaction setup if we see a constructive, low-volume pullback in the coming days - ideally with price holding above the 15 local support.

Chart:

Macro view (Weekly):

Previously:

• On macro bullish-trend structure (Sep 14):

www.tradingview.com

• On resistance zone and pullback (Sep 26):

www.tradingview.com

XAR - Lethality Over LeverageXAR - Lethality Over Leverage: Why Trump’s Buyback Ban is a Bullish Pivot for Defense Mid-Caps

The defense sector just experienced one of the most volatile 24-hour periods in its history. On January 7, 2026, President Trump sent the industry into a tailspin by threatening to ban dividends, stock buybacks, and executive pay over $5 million for contractors failing to modernize production. However, a rapid-fire follow-up proposing a record $1.5 trillion military budget for 2027—a massive leap from the current $900 billion—has fundamentally shifted the technical outlook for key ETFs.

Technical Analysis & Price Targets

ITA (iShares U.S. Aerospace & Defense)

As a market-cap-weighted fund, ITA is heavily exposed to "The Primes" (RTX, LMT, NOC). These companies were the primary targets of the buyback rhetoric, causing ITA to plunge before rebounding on the budget news.

Current Action: ITA is testing its 50-day Moving Average (approx. $246).

Bull Case: If it holds this support, the $1.5T budget news could drive a breakout above the $260 resistance.

Price Target: $275.00 by Q2 2026.

XAR (SPDR S&P Aerospace & Defense)

XAR uses an equal-weight strategy, making it the "hidden winner" of this policy shift. Smaller, R&D-heavy firms like Kratos (KTOS) and AeroVironment (AVAV) are better positioned to absorb a "modernization" mandate than the debt-heavy giants.

Current Action: XAR shows a strong bullish configuration with EMAs widening. RSI remains healthy near 65, avoiding "overbought" territory despite the rally.

Price Target: $310.00, representing a 15% upside from current levels as mid-caps capture the "Dream Military" expansion.

PPA (Invesco Aerospace & Defense)

PPA offers the most balanced exposure. While its RSI briefly touched "overbought" levels (80+) during the initial euphoria of the Iran/Maduro successes, the subsequent "buyback scare" provided a much-needed cooling period.

Current Action: Consolidation between $160 and $165.

Price Target: $185.00, contingent on the stabilization of capital allocation rules.

Key Takeaways

The "Modernization" Premium: Investors should rotate toward ETFs like XAR that favor companies focused on production capacity over financial engineering.

Geopolitical Tailwind: The military successes in Venezuela and Iran have provided the political capital for the $1.5 trillion budget, creating a high floor for the sector regardless of executive pay caps.

Volatility is the New Base: Expect heavy "headline risk" as the administration negotiates these terms with the Pentagon and defense large caps.

Stay nimble my friends!

AeroVironment Rallies: $874M Army Deal & Record Q2 RevenueAeroVironment (AVAV) is capitalizing on modern warfare trends. The company continues to secure massive defense contracts, propelling its stock price upward. On January 5, 2026, shares surged 13.82% to close at $291.59. Investors see a clear path to durable revenue growth through these long-term awards. The defense firm is converting pilot programs into massive, scalable income streams.

Geopolitics and Geostrategy: The Conflict Premium

Global instability is directly fueling AeroVironment’s rise. Rising tensions between the U.S. and Iran have sharpened the focus on defense assets. President Trump’s recent warnings to Iran highlight the volatility of the region. Consequently, investors treat agile defense-tech companies as immediate hedges against geopolitical risk. AeroVironment offers a "fast-twitch" response to these shifting security landscapes. The Pentagon’s urgent need for unmanned systems aligns perfectly with current geostrategic threats.

Business Models: Securing the Backlog

The company is evolving its business model. AeroVironment is moving beyond one-off sales toward long-duration program integration. The new U.S. Army awards provide critical backlog visibility. This shifts the investment narrative from speculative growth to secured revenue. Investors now value the company based on multi-year contract performance. This stability allows for better long-term capital planning and R&D investment.

Innovation and Technology: The Open-Architecture Edge

Technological superiority drives these contract wins. The P550 uncrewed aircraft system award highlights the value of modular design. AeroVironment utilizes open-architecture platforms to integrate seamlessly with existing Army systems. This approach supports rapid upgrades and AI integration. The "AV Halo" ecosystem exemplifies this strategy, linking hardware with advanced software services. This technological moat protects their market share against competitors.

Management and Leadership: Executing the Vision

Leadership is projecting confidence. CEO Wahid Nawabi describes the company as operating from a "position of strength." Recent quarterly results underscore this claim. Management has set ambitious targets, aiming for significant revenue milestones by 2028. This requires aggressive execution and consistent year-over-year growth. Meanwhile, executive stock transactions follow routine, pre-arranged plans, signaling no alarm to savvy investors.

Financial Velocity: Surging 13% on Execution

AeroVironment’s stock performance on January 5, 2026, reflects a market waking up to its potential. The 13.82% surge aligns with record-breaking second-quarter revenue of $472.5 million. This represents a staggering 151% year-over-year increase. Much of this growth stems from the strategic BlueHalo acquisition. Additionally, a book-to-bill ratio of 2.9 signals $1.4 billion in new bookings, promising strong future revenue.

Profitability and Balance Sheet Strength

Underlying financials remain robust despite a net loss attributed to acquisition accounting. Adjusted EBITDA came in strong at $45 million. The company boasts a healthy gross margin of 26.5%, indicating strong profitability. Furthermore, a low debt-to-equity ratio of 0.19 ensures financial stability. A current ratio of 5.1 proves that AeroVironment can easily cover its short-term liabilities. This financial health supports their aggressive expansion strategy.

Strategic Wins: The $874 Million Catalyst

Recent contracts solidify AeroVironment’s dominance in unmanned defense. An $874 million U.S. Army deal highlights the portfolio's strength. This agreement includes key platforms like JUMP 20™, P550™, and Puma™. Additionally, a specific $13.2 million award for the P550 system emphasizes long-range reconnaissance capabilities. These wins showcase the firm's leadership in AI-integrated defense solutions.

Conclusion: Managing Risk and Reward

AeroVironment is aggressively growing its influence across global defense sectors. Continued innovation sets the stage for future financial success. However, active traders must balance opportunity with caution. As Tim Bohen of StocksToTrade notes, trading is "more about managing risk than finding the next big mover." Investors should watch for continued execution on these complex agreements as the company scales.

Is Red Cat the Drone King America Has Been Waiting For?Red Cat Holdings (RCAT) stands at the epicenter of a transformative moment in defense technology. The December 2025 FCC ban on Chinese drone manufacturers DJI and Autel has effectively eliminated Red Cat's primary competition, creating a protected market for domestic producers. With Q3 fiscal 2025 revenue surging 646% year-over-year and a balance sheet fortified with over $212 million in cash, Red Cat has positioned itself as the primary beneficiary of America's pivot toward sovereign defense supply chains. The company's "Blue UAS" certification and inclusion on NATO's procurement catalog provide immediate access to both domestic and allied defense markets at a critical moment of global rearmament.

The company's technological architecture differentiates it from competitors through integrated systems spanning air, land, and sea domains. The "Arachnid" family, including the Black Widow quadcopter, Edge 130 hybrid VTOL, and FANG strike drone, creates a closed-loop ecosystem enhanced by partnerships with Palantir for GPS-denied navigation and Doodle Labs for anti-jamming communications. Red Cat's Visual SLAM technology enables autonomous operation in contested electromagnetic environments, directly addressing Pentagon requirements under the Replicator initiative for "attritable mass" autonomous systems. The recent partnership with Apium Swarm Robotics advances one-to-many drone control, multiplying the combat effectiveness of individual operators.

Strategic acquisitions of FlightWave and Teal Drones have rapidly expanded Red Cat's capabilities while maintaining strict supply chain sovereignty. The company's selection as a finalist for the Army's Short Range Reconnaissance Tranche 2 program validates its tactical systems for infantry deployment. With NATO allies ramping up defense spending and the Ukraine conflict demonstrating voracious demand for small unmanned systems, Red Cat faces a multi-year secular tailwind. The convergence of regulatory protection, technological differentiation, financial strength, and geopolitical necessity positions Red Cat not merely as a defense contractor but as a cornerstone of America's robotic warfare infrastructure for the coming decade.

LHX Analysis: $1B Space Deal Signals GrowthThe Strategic Pivot

L3Harris Technologies (NYSE: LHX) is redefining the defense landscape. While the stock has climbed 38.6% year-to-date, recent developments suggest the rally is just beginning. The catalyst is a massive $843 million contract with the Space Development Agency (SDA). This deal confirms L3Harris as a primary player in modern warfare infrastructure. With projected revenues hitting $22 billion and free cash flow nearing $2.7 billion, the fundamentals are robust. This analysis dissects the strategic drivers behind this growth.

Geopolitics & Geostrategy: The High Ground

Modern conflict has shifted to orbit. Major powers are actively militarizing space to secure communications and surveillance advantages. The SDA contract for infrared satellites places L3Harris at the center of this geopolitical contest. Governments demand persistent missile warning capabilities to counter hypersonic threats from rivals. L3Harris provides the "eyes in the sky" necessary for national survival. This geostrategic necessity ensures long-term demand for their orbital assets.

Industry Trends: From Armor to Dat

The defense industry is moving away from heavy manufacturing toward intelligence and connectivity. Tanks and ships are vulnerable without secure data links. L3Harris specializes in this exact niche: avionics, electronic warfare, and sensing. They are not building the metal shell; they are building the brain. This trend favors agile tech integrators over traditional heavy metal defense contractors. The market values high-margin electronics over low-margin hardware.

Technology & Science: Infrared Precision

The science behind the new SDA contract is critical. These satellites utilize advanced infrared sensors to track heat signatures from missile launches. Developing these sensors requires elite engineering and physics capabilities. L3Harris has mastered the suppression of "background noise" in space to detect small targets. This scientific edge creates a high barrier to entry for competitors. Few companies possess the technical heritage to execute this level of precision engineering.

Business Models & Economics: Cash Flow Efficiency

L3Harris operates on a highly efficient financial model. The company generated nearly $2.7 billion in free cash flow (FCF) recently. This liquidity allows them to fund internal Research and Development (R&D) without relying on expensive debt. In a high-interest-rate macroeconomic environment, cash is king. Their ability to self-fund innovation while paying dividends makes them attractive to institutional investors. The economic engine here is stability combined with growth.

Cyber & High-Tech: Hardened Systems

Space assets are prime targets for cyberattacks. L3Harris integrates "cyber-resilience" directly into its satellite architecture. They do not just build communication radios; they build encrypted networks that withstand jamming and spoofing. This convergence of hardware and cybersecurity is a key selling point. Defense clients pay a premium for systems that operate reliably in contested electronic environments.

Management & Leadership: Organic Discipline

The leadership team at L3Harris is executing a disciplined strategy. Instead of relying solely on expensive acquisitions, they are driving "organic growth." The recent financial report highlights this internal efficiency. Management focuses on operational excellence and clearing supply chain bottlenecks. This focus has improved margins and delivery times. Investors trust leadership that delivers on promises without overleveraging the balance sheet.

Patent Analysis: Protecting Intellectual Property

A review of the sector suggests L3Harris holds a "moat" of intellectual property. Their patent portfolio likely covers proprietary sensor integration and waveform technologies. These patents legally protect their market share in tactical communications. Competitors cannot easily replicate their avionics suites without infringing on protected tech. This IP fortress secures future revenue streams and keeps margins high.

Forecast: The Trajectory

L3Harris is currently undervalued relative to its potential. The $843 million contract is a signal, not an anomaly. As global tensions rise, the premium on space-based intelligence will increase. The company’s focus on high-tech sensors, strong cash flow, and strategic positioning makes it a formidable stock. Traders should view the current price as an entry point before the full value of these space contracts materializes in 2026 earnings.

Understanding a Classic Head & Shoulders BreakdownKTOS – Technical Breakdown: Head & Shoulders Distribution in Progress

This chart of Kratos Defense & Security Solutions (KTOS) illustrates a high-quality example of how market structure, volume behavior, and price inefficiencies combine during a transition from trend continuation to distribution. The purpose of this breakdown is educational, not predictive.

1 — Macro Context: Trend Maturity

KTOS spent the majority of the year in a sustained impulsive uptrend, defined by higher highs, higher lows, and expanding participation. As trends mature, price action typically becomes more volatile and emotional, creating the conditions necessary for structural reversal.

Early contextual signals:

Rising volume near the prior base marked accumulation and confirmed a trend reversal higher.

Accelerating volume near the highs later in the year signaled emotional participation and distribution.

2 — Head & Shoulders Distribution

The dominant structure on the chart is a well-defined Head & Shoulders formation:

Left Shoulder: Higher high followed by a controlled pullback on moderate volume.

Head: Vertical expansion into new highs, accompanied by peak volume and momentum exhaustion.

Right Shoulder: Lower high with weaker follow-through and declining demand.

This structure reflects distribution rather than immediate bearishness — buyers are progressively less willing or able to push price higher.

Key takeaway:

Head & Shoulders patterns are not bearish because of the shape — they are bearish because demand fails.

3 — Neckline Interaction and Compression

Price is currently compressing into a descending wedge / triangle near the neckline region.

Why this matters:

Compression following distribution often resolves in the direction of the larger reversal.

Volatility contraction frequently precedes expansion.

A decisive breakdown from this structure confirms seller control.

4 — Gaps as Liquidity Zones

Two major price inefficiencies stand out on the chart:

Gap Down (upper zone): Functions as overhead resistance and a supply magnet on any retrace.

Gap Up (lower zone): Represents an unfilled imbalance below, acting as a potential liquidity target.

While “gaps always fill” is not a rule, unfilled gaps frequently behave as high-probability areas of interest due to liquidity seeking behavior.

5 — Volume as Confirmation

Volume validates the structural narrative:

Expansion into the head reflects emotional buying.

Reduced volume into the right shoulder signals buyer exhaustion.

Rising volume during breakdown attempts confirms seller engagement.

Price patterns without volume context should be treated as incomplete.

6 — Educational Projection (Not a Forecast)

The illustrated path represents a common post–Head & Shoulders sequence:

Structural breakdown from compression

Downside acceleration

Price seeking prior imbalance and liquidity

This projection is intended to demonstrate market tendencies rather than guarantee outcomes.

Final Thoughts

KTOS highlights several repeatable market principles:

Trends typically end through distribution, not collapse

Volume often signals intent before price confirms

Market structure repeats because participant behavior repeats

Understanding why patterns form is more valuable than memorizing the pattern itself

Trade safe. Stay objective. Let structure and volume do the talking.

Can One Company Power America's Nuclear Future?BWX Technologies (BWXT) has positioned itself at the critical intersection of national security and energy infrastructure, establishing dominance in the advanced nuclear sector through strategic contracts and technological leadership. The company's Q3 2025 results reveal remarkable momentum, with revenue reaching $866 million (a 29% year-over-year increase) and total backlog surging to $7.4 billion, a 119% increase. With a book-to-bill ratio of 2.6 times, BWXT demonstrates demand substantially exceeding current capacity, driven by converging forces of decarbonization, electrification, and the explosive growth of AI power requirements.

BWXT's competitive moat extends across multiple dimensions. The company secured pivotal defense contracts worth $1.5 billion for domestic uranium enrichment and $1.6 billion for high-purity depleted uranium production, directly addressing America's strategic vulnerability to foreign fuel dependence. Leading Project Pele, the Department of Defense's first transportable microreactor prototype delivering 1-5 MW, BWXT is manufacturing the reactor core for 2027 delivery, aligned with Executive Order 14299's mandate to accelerate advanced nuclear deployment for national security and AI infrastructure. This first-mover advantage positions the company strongly for follow-on programs like Project JANUS, which aims to deploy a military installation reactor by September 2028.

The company's technical superiority centers on mastery of TRISO fuel manufacturing tristructural isotropic particles that cannot melt under reactor conditions and serve as self-contained safety systems. BWXT controls proprietary patents for specialized HALEU fuel element designs and maintains strategic partnerships with Northrop Grumman (control systems) and Rolls-Royce LibertyWorks (power conversion), ensuring compliance with stringent DoD cybersecurity standards. This integrated approach spanning fuel enrichment authorization, patented component design, validated manufacturing capabilities, and defense-grade partnerships creates formidable barriers to competition while capturing the multi-decade tailwind of institutional nuclear adoption mandated by federal policy and geopolitical necessity.

Can Instability Be an Asset Class?Aerospace and Defense (A&D) ETFs have shown remarkable performance in 2025, with funds like XAR achieving a 49.11% year-to-date return. This surge follows President Trump's October 2025 directive to resume U.S. nuclear weapons testing after a 33-year moratorium, a decisive policy shift responding to recent Russian weapons demonstrations. The move signals the formalization of Great Power Competition into a sustained, technology-intensive arms race, transforming A&D spending from discretionary to structurally mandatory. Investors now view defense appropriations as a guaranteed source of funding, creating what analysts call a permanent "instability premium" on sector valuations.

The financial fundamentals supporting this outlook are substantial. The FY2026 defense budget allocates $87 billion for nuclear modernization alone, a 26% increase in funding for critical programs like the B-21 bomber, Sentinel ICBM, and Columbia-class submarines. Major contractors are reporting exceptional results: Lockheed Martin established a record $179 billion backlog while raising its 2025 outlook, effectively creating multi-year revenue certainty that functions like a long-duration bond. In 2023, global military spending reached $2.443 trillion, with NATO allies driving over $170 billion in U.S. foreign military sales, which extended revenue visibility beyond domestic congressional cycles.

Technological competition is accelerating investments in hypersonics, digital engineering, and modernized command-and-control systems. The shift toward AI-driven warfare, resilient space-based architectures, and advanced manufacturing processes (exemplified by Lockheed's digital twin technology for the Precision Strike Missile program) is transforming defense contracting into a hybrid hardware-software model with sustained high-margin revenue streams. The modernization of Nuclear Command, Control, and Communications (NC3) systems and implementation of Joint All-Domain Command and Control (JADC2) strategy require continuous, multi-decade investments in cybersecurity and advanced integration capabilities.

The investment thesis reflects structural certainty: legally mandated nuclear modernization programs are immune to typical budget cuts, contractors hold unprecedented backlogs, and technological superiority demands perpetual high-margin research and development. The resumption of nuclear testing, driven by strategic signaling rather than technical necessity, has created a self-fulfilling cycle that guarantees future expenditures. With geopolitical escalation, macroeconomic certainty through front-loaded appropriations, and rapid technological innovation converging simultaneously, the A&D sector has emerged as an essential component of institutional portfolios, supported by what analysts characterize as "geopolitics guaranteeing profits."

Nekkar at 10 Year High at 12 - Danske Bank with BUY rating at 18Nekkar weekly chart

Huge sell transaction in september 2024 has taken a long time to absorb, but the stock is finally presenting a bullish movement to the upside that could breach the 10 year high point at around 12 NOK.

Danske Bank recently published BUY recommendation with tp 18 NOK.

DEFENSE SECURITIES OVERVIEW. THE BEST GAMES IN TOWN IN 2025Defense securities, especially leading sector stocks, ETFs, and gold, have significantly outperformed the broad market in 2025 due to distinctive macroeconomic, geopolitical, and policy catalysts, as well as investor sentiment favoring safety, reliability, and growth.

Were you ready twelve months ago or so, when 800-pound Gorilla entered a chat, but Defense securities is the best play on Wall Street so far, since The Second Coming of Trump.

We have checked even all the sparks presented here www.tradingview.com

... and found nothing about 'defense' tag.

The truth - financial markets is not the thing only about fairy tales and memes..

..but something about kind of reality also.

Well.. Lets talk about.

Macro Trends. Geopolitics and Government Spending

Intensifying geopolitical risks, including conflicts in Asia, Eastern Europe, and the Middle East, have accelerated global defense spending, resulting in a 10% surge in budgets for 2024 and continued growth toward $2.7 trillion in 2025. The U.S. alone approved a record $849 billion defense budget, solidifying a stable demand pipeline for contractors such as Lockheed Martin, Northrop Grumman, RTX, Boeing, and General Dynamics.

India, for example, has seen its defense sector deliver outstanding returns of 34.8% in the first half of 2025, vastly outpacing the broad Nifty index which rose just 5.5%. This surge is bolstered by “Make in India” initiatives, defense export policies, and multi-year procurement plans, putting key names like NSE:HAL , NSE:BEL , and NSE:BDL at center stage.

Sectoral Strength. Defense Stocks and ETFs

Defense stocks benefited from robust earnings, contract wins, and backlogs that assure multi-year revenue stability, a sharp contrast to cyclical or growth sectors battered by inflation and rate uncertainty. Top U.S. defense stocks in 2025 include:

Palantir Technologies, Inc. (PLTR): Engages in the business of building and deploying software platforms that serve (in most) Government segments.

Lockheed Martin (LMT): Leading in air, missile, and space systems.

Northrop Grumman (NOC): Pioneer in stealth aircraft and missile production.

General Dynamics (GD): Dominant in shipbuilding and combat vehicles.

RTX Corp. (Raytheon): Leading in missile defense and sensors.

Boeing (BA): Defense and space programs complement commercial operations.

Aerospace and defense-related ETFs have compounded the gains and enhanced portfolio diversification.

Key picks in 2025 include:

VanEck Defense ETF LSE:DFNG Global segment. +43.6% YTD return. Top holdings: Lockheed, RTX, Northrop, BA.

Global X Defence Tech ETF AMEX:SHLD Global segment. +51.8% YTD return. Top hodings: Lockheed, GD, Palantir, L3Harris

SPDR S&P Aerospace & Defense AMEX:XAR US segment. +36% YTD return. Top holdings: RTX, Boeing, Lockheed, GD

WisdomTree Europe Defence LSE:WDEP Europe segment. +38% YTD return. Top hodings: Thales, Leonardo, BAE

Invesco Aerospace & Defense AMEX:PPA US segment. +29% YTD return. Top hodings: Boeing, Lockheed, RTX, GD

These ETFs capture the consistent resilience and upward trajectory of the defense sector, boosted by large government contracts and rising international demand.

Gold's Surge. Hedge Against Turbulence

Gold, traditionally a safe-haven asset, has soared to unprecedented levels in 2025, breaking records with prices peaking above $3,800/oz, up 45% year-to-date as of late September. Key catalysts include persistent inflation, global rate volatility, a weaker U.S. dollar, and especially surging demand from investors seeking stability during times of policy uncertainty and market volatility.

Forecasters such as Goldman Sachs and Deutsche Bank have raised year-end 2025 gold price targets to $3,700/oz and $3,500/oz, respectively, as global central banks accumulated reserves and retail demand climbed.

Tariffs, currency wars, and regional instability have made gold a popular asset for hedging risk, reinforcing its outperformance against broad market indices (S&P 500 up only single digits, NASDAQ and other growth indices posting volatile returns).

Comparative Performance. Why Defence & Gold Outperform

Broad indices face headwinds from interest rate uncertainty, inflationary pressures, and earnings volatility in tech, retail, and pharma sectors.

Defense sector gains are anchored by predictable, multi-year contracts, recurring revenue, and global utility.

Gold’s hedge value rises in tandem with heightened risk aversion and growing macro threats.

Strategic Policy and Technological Innovation

The sector's outperformance is further enhanced by investment in cyber, AI, space, and next-gen technologies, making defense stocks attractive for growth and innovation. Major players in both U.S. and emerging markets (like India’s HAL, BEL, BDL, and Europe’s Thales or Leonardo) benefit from government-led innovation programs and export policies.

Investor Sentiment and Portfolio Positioning

With global investors shifting portfolios toward safety and resilience, defense securities and gold remain key allocations. ETFs provide diversified exposure with reduced single-stock risk, while gold offers pure macro insurance against market shocks.

Summary Table: 2025 Performance

Asset YTD Return (%) Key Drivers

Gold +45% YTD return. Inflation, policy risk, USD weakness

VanEck Defense ETF +43.6% YTD return. Global spending, tech contracts

Global X Defense ETF +51.8% YTD return. U.S. contracts, cyber, AI, space tech

SPDR S&P Defense +36% YTD return. Procurement, multi-year contract pipeline

India Defense Stocks +34.8% YTD return. National policy, exports, reforms

S&P 500 ~+10% YTD return. Earnings pressure, sector volatility.

Conclusion

In 2025, defense securities, including gold, reflect the global pivot toward stability, innovation, and security, thus delivering broad outperformance compared to mainstream equity benchmarks. Their ascent is driven by policy, demand, innovation, and capital flows responding to a world dominated by uncertainty and risk.

--

Best wishes,

@PandorraResearch Team

War is a Racket | DFEN | Long at $28.00The war machine keeps turning. Profits will reign. Direxion Aerospace and Defense 3x AMEX:DFEN never fully recovered from pandemic lows, but world peace is (unfortunately) far from reach. The uptrend in the chart has commenced. Personal entry point at $28.00.

Target #1 = $37.00

Target #2 = $50.00

Target #3 = $64.00

Can One Fund Bridge the $13 Trillion Private Market Gap?The ERShares Private-Public Crossover ETF (XOVR) represents a groundbreaking financial innovation that democratizes access to private equity investments, which have traditionally been reserved for institutional players and accredited investors. Following a strategic relaunch in August 2024, the fund has experienced remarkable growth, with assets under management reaching $481.5 million and attracting over $120 million in inflows since its initial SpaceX Investment. Built on Dr. Joel Shulman's proprietary "Entrepreneur Factor" methodology, XOVR combines the proven ER30TR Index (which accounts for over 85% of its portfolio) with carefully selected private equity holdings, creating a unique structure that offers daily liquidity and transparency while capturing pre-IPO value creation.

The fund's investment thesis centers on identifying companies at the convergence of technology, national security, and global strategy. Its marquee private holdings - SpaceX and Anduril Industries - exemplify this approach, representing critical players in a privatized defense industrial base. SpaceX has evolved beyond a commercial space company into a geostrategic asset through Starlink, which serves as essential communication infrastructure in modern conflicts, such as Ukraine. Anduril's AI-powered Lattice platform and its recent $159 million contract with the U.S. Army for mixed reality systems illustrate the military's shift towards agile, software-focused defense solutions. Both companies have constructed formidable competitive moats through technological innovation and robust intellectual property portfolios.

XOVR's performance validates its high-conviction strategy, delivering a 33.46% total return over the past year compared to its benchmark's 26.48%, with three-year annualized returns of 28.11%. The fund's concentrated approach - with top ten holdings comprising over 50% of the portfolio - is a deliberate design choice that enables outsized returns by taking conviction positions in category-defining innovators. Rather than following market trends, XOVR positions investors at the source of innovation, leveraging its unique structure to identify and access the next generation of disruptive companies with the potential to become tomorrow's market leaders.

The fund represents more than an investment vehicle; it embodies a fundamental shift in capital allocation that recognizes the blurring lines between public and private enterprise. By combining the accessibility and liquidity of public markets with the growth potential of private investments, XOVR offers retail investors unprecedented access to value creation opportunities that were once the exclusive domain of institutional players, positioning them to participate in the technological and strategic innovations that will define the next decade.

The timing is right for FEIM - high tight flag before earningsFEIM manufactures technology for timing things. They're an old company that's found newfound relevance with big budgets going to rockets and satellites and military tech that requires absolute precision timing.

THe fundamentals are great and the chart shows a high tight flag pattern getting ready for earnings.

FEIM releases earnings on Thursday, 9/11. I'm planning on prepping to buy if they release positive earnings because it could jump to the next stage of its flag.

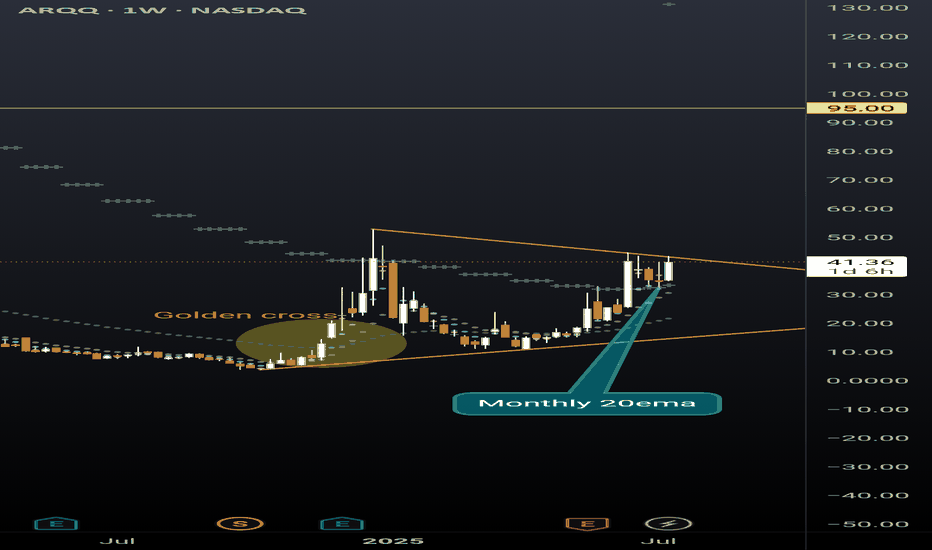

ARQQ weekly pennantBeautiful weekly pennant on ARQQ weekly timeframe. This chart is coiling nicely for a continuation. Still early in the process of reaching breakout but given the recent momentum in this sector a premature break to the upside can happen at any moment.

The ticker is currently sitting above the monthly 20ema (overlayed on this weekly chart), and just had a strong bounce off the daily 20ema (overlayed on this weekly chart). Golden cross is also highlighted that occurred in December 2024 with the daily 50ema retracing back to the daily 200ema and then continuing the uptrend earlier this spring.

Is BigBear.ai the Next Titan of Defense AI?BigBear.ai (NYSE: BBAI) is emerging as a significant player in the artificial intelligence landscape, particularly within the critical national security and defense sectors. While often compared to industry giant Palantir, BigBear.ai carves its niche by intensely focusing on modern warfare applications, including guiding unmanned vehicles and optimizing missions. The company has recently garnered considerable investor attention, evidenced by its impressive 287% rally over the past year and a notable surge in public interest. This enthusiasm stems from several key factors, including a substantial 2.5x increase in backlog orders to $385 million by March 2025 and a significant ramp-up in research and development spending, signaling robust foundational growth.

BigBear.ai's technological prowess underpins its rising profile. The company develops sophisticated AI and machine learning models for diverse applications, from facial recognition systems deployed at major international airports like JFK and LAX to AI-augmented shipbuilding software for the U.S. Navy. Its Pangiam® Threat Detection and Decision Support Platform enhances airport security by integrating with advanced CT scanner technology, while its ConductorOS platform facilitates secure communication and coordination for drone swarm operations under the U.S. Army's Project Linchpin. These cutting-edge solutions position BigBear.ai at the forefront of AI-driven advancements crucial for evolving geopolitical landscapes and increasing defense AI investments.

Strategic collaborations and a favorable market environment further fuel BigBear.ai's ascent. The company recently formed a significant partnership in the UAE with Easy Lease and Vigilix Technology Investment to accelerate AI adoption across key industries like mobility and logistics, marking a major step in its international expansion. Additionally, multiple contracts with the U.S. Department of Defense, including those for J-35 fleet management and geopolitical risk assessment, underscore its vital role in government initiatives. While BigBear.ai faces challenges, including revenue stagnation, escalating losses, and stock volatility, its strategic market position, growing backlog, and continuous innovation in mission-critical AI solutions present a compelling high-risk, high-reward investment opportunity in the burgeoning defense AI sector.

KTOS BUY Kratos Defense (KTOS) is a buy due to escalating global conflicts driving demand for low-cost, high-tech defense systems. KTOS aligns with shifting military priorities. Strong government contracts and rising revenues position it to benefit from sustained geopolitical instability and defense modernization. KTOS is pioneering AI-powered drones and autonomous systems, areas the Pentagon is prioritizing for future warfare capabilities. earnings showed double-digit YoY revenue growth and a rising backlog, confirming increasing contract momentum.

The FY2025 U.S. defense budget remains robust, with a focus on next-gen warfare and drones.

World conflicts not seeing improvement : Russia-Ukraine .. Israel-Iran

LMT sky high rocket stock LMT has been experiencing some intense changes in geopolitical conflict for next week. Leading analysts to observe closely LMT price behavior according to avg volume. We’re al expecting LMT to rise just above $520 by next week in order to accommodate some liquidity. Keep buying if not yet more.