DOGE Can we really time the Cycle bottom??Dogecoin (DOGEUSD) is already deep into its new Bear Cycle and basically since the October 06 2025 flash crash that hit its 1W MA350 (red trend-line) and rebounded, has been trading within that level as Support and the 1W MA50 (blue trend-line) as Resistance.

The 1W MA350 in particular is of the utmost importance as it held as Support during both previous Bear Cycles. As a result, if it breaks now, there are high probabilities to initiate Phase 2 of the Bear Cycle. This either bottoms on the 0.786 Fibonacci retracement level of Doge's historic Fib Channel Up at around $0.0600 or extend to a full -93.00% decline (as much as the previous two corrected by) around $0.03500.

Whatever the price bottom might be, history has shown that it is much more efficient to just buy at the right time rather than at the right price. And that's because the use of the Sinewaves have helped at not only timing the Cycle Tops but also the Cycle Bottoms. And according to this, the next bottom should be around October 2026. So whatever price Doge is trading at around that time, we turn again into long-term buyers.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Doge

DOGEUSDT 2,608% profits potential with 8X leverage —LONG tradeGood morning my fellow Cryptocurrency trader, I hope you are having a wonderful day, a wonderful start to a beautiful and hopefully prosperous and profitable week.

We are now looking at DOGEUSDT. This is a long-term chart. The action has been happening at bottom prices for months.

I will try to explain my thinking real quick to see if you can agree with this trade and the potential I am seeing in this chart setup.

The downtrend is no more, because we are not seeing lower prices. We can argue that a pause isn't necessarily bullish and a bearish resumption can happen at anytime. This can be a valid argument. But, if we go deeper into this chart and consider the whole market, then a reversal can be expected. The best time to buy is when prices are low trading at support. That's the best time to go LONG.

Dogecoin just closed three weeks red yet failed to produce a lower low compared to 29-Dec. 2025. Many altcoins in this same situation are breaking bullish. Bitcoin has been trading with no new lows since 21-November. Marketwide action points to a reversal rather than a bearish continuation.

We can also appreciate the dynamics of a relief rally on Bitcoin and the fact that it hit $98,000 before retracing, which is bullish. Bitcoin's conditions right now are bullish because the retrace happened at a major resistance point. The retrace ends in a higher low and this produces a new advance. Since Bitcoin is set to move forward, and in this case reach beyond $100,000, the altcoins will produce a strong reaction as well and this will lead to higher prices.

Since this is the last major bullish move before Bitcoin's long-term decline, the altcoins will produce one major climax, bull run type of action before a period of long quiet and bearish action. This is the last chance.

With that said, market conditions can always change. This is a high probability chart setup but anything goes. I appreciate you for reading. Thanks a lot for your time. Thanks a lot for your continued support.

Full trade-numbers below:

____

LONG DOGEUSDT

Leverage: 8X

Potential: 2608%

Allocation: 5%

Entry zone: $0.1065 - 0.1250

Targets:

1) $0.1450

2) $0.1759

3) $0.2010

4) $0.2260

5) $0.2615

6) $0.3068

7) $0.3568

8) $0.3878

9) $0.4377

10) $0.5180

Stop: Close weekly below $0.1050

____

I am wishing you tons of profits, health, wealth and success.

Namaste.

#DOGE/USDT - Only One Scenario Left: UP#DOGE

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1210, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1244

First Target: 0.1265

Second Target: 0.1295

Third Target: 0.1331

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Doge and a BIG rise!Hi!

As shown on the chart, DOGE has clearly broken above the long-term descending trendline, which had been acting as resistance for several weeks. Following this breakout, price moved higher and confirmed the shift in market structure.

Importantly, the breakout was supported by a strong bullish engulfing move, taking out the previous local high. This price action strengthens the case for a trend reversal rather than a simple relief bounce.

After the impulsive move up, DOGE is now pulling back toward a key demand zone around $0.11–$0.13, which aligns with prior structure support and the breakout retest area. This zone offers a favorable risk-to-reward opportunity for long positions.

As long as price holds above this support, the upside target remains around $0.17, which corresponds to the next major resistance level and the projected move from the breakout.

DOGE, testing daily pivot as support, not much changed in a weekCRYPTOCAP:DOGE

🎯 Price printed a bullish engulfing 3 white knight candle pattern. It is above the daily pivot, yet testing as support. A critical level to hold. DOGE is still below the daily 200EMA. Overcoming this will be very bullish. The Elliot wave count remains tricky, so I will await more confirmation.

📈 Daily RSI printed bullish divergence, then negated the bearish divergence. The RSI shot up too hard and fast, which often results in a reversal. The reversal took place and tested the daily pivot as suggested last week.

👉 Analysis is invalidated below the swing low, keeping the downtrend alive

Safe trading

Dogecoin could have another rally (4H)The chart shows a clear bullish Change of Character (CHoCH), formed by strong and aggressive buying pressure. This shift in market structure suggests that buyers are currently in control and that bullish momentum is building.

At the moment, price is holding and trading around an important key level, an area that has historically acted as a major decision zone. The ability of price to remain supported here strengthens the bullish outlook.

Above the current price action, a large liquidity pool has formed near the highs. This liquidity remains untapped and may be taken soon, which often acts as fuel for continuation toward higher levels rather than a reversal.

Two potential entry zones have been clearly marked on the chart. Instead of entering all at once, it is recommended to scale into positions using a DCA (Dollar-Cost Averaging) approach, allowing for better risk control during pullbacks.

All targets are marked on the chart.

Once price reaches the first target, it is advised to secure partial profits and then move the stop loss to break-even, ensuring a risk-free trade while allowing the remaining position to aim for higher targets.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

DOGEUSDT – 1D | Bullish SetupAfter an extended corrective phase, DOGE is starting to show signs of strength returning. Price is stabilizing at key demand while bullish confluences begin to stack.

🟢 Bullish Confluences:

Sustained base building after a prolonged downtrend

Price holding above recent demand and short-term structure

Early trend shift signals as selling pressure fades

Compression under resistance suggesting a potential expansion

Buyers defending pullbacks at discount levels

📈 Fibonacci Upside Targets

Measured from the recent swing low to high:

38.2% → ~0.16

61.8% → ~0.18

100% → 0.25 🎯

As long as price holds above the current demand zone, the bullish scenario remains favored, with upside continuation toward 0.25.

❌ Invalidation: Daily close below demand support.

DOGEUSD | The DOG is ready for a jump Vol.2Hello traders,

Looks like DOGE broke a 3 months old heavy trendline with a strong impulsive candle. My trade plan will look for a pullback to fill the FVG then a bullish continuation.

The R:R is very good and the target areas can't be ignored.

Good Luck!

All our analysis is shared with honesty, care, and real effort. If you find value in it, a like or comment means a lot to show your support🙏📊

$DOGE RSI Just Hit This Level ONLY 4 TIMES in 12 Years…RSI Just Hit This Level ONLY 4 TIMES in 12 Years… And Every Time It Was LIFE-CHANGING

Over the past 12 years (2014–2026), Dogecoin's RSI has dropped this low only 4 times.

Every single one was an epic buying opportunity.

Those who loaded up made insane gains — legendary X profits!My 8 years in crypto tell me loud and clear: this is another massive opportunity.

These setups don't come often. You don't want to miss this one! First cycle bottom – All-Time Low

Cycle bottom + COVID crash

Last cycle bottom – All-Time Low

RIGHT NOW

!Math or emotions — which one decides for you?

Only one will take you to the moon.

DOGE : Googel Trends (2013-2026)

#DOGE/USDT is about to blast off! Study internet bubble stocks#DOGE

The price is moving in a descending channel on the 1-hour timeframe. It has reached the upper limit and is heading towards breaking downwards, with a retest of the upper limit expected.

We have an upward trend on the RSI indicator, which has reached near the upper limit, and a downward reversal is expected.

There is a major resistance zone in green at 0.1546. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend of consolidation above the 100-period moving average, as we are moving close to it, which supports a downward move towards touching it.

Entry price: 0.1420

First target: 0.1395

Second target: 0.1355

Third target: 0.1307

Stop loss: Above the resistance zone in green.

Don't forget a simple thing: capital management.

For inquiries, please leave a comment.

Thank you.

DOGE/USDT at Critical Resistance – Breakout or Rejection?DOGE/USDT on the 1D timeframe is still trading in a clear downtrend, characterized by a consistent formation of lower highs and lower lows. Price is currently moving inside a descending channel and is experiencing a relief rally / corrective move toward dynamic resistance.

From a market structure perspective, sellers remain in control, and the current upside move has not yet confirmed any trend reversal.

---

Pattern Explanation

Descending Channel (Bearish Continuation Pattern)

This pattern is defined by:

Upper trendline (red) acting as dynamic resistance

Lower trendline (yellow) acting as dynamic support

Price consistently respecting the channel boundaries

Key characteristics:

Upward moves are typically corrective in nature

A valid breakout requires a strong daily close above the upper trendline

As long as price remains inside the channel, bearish continuation has a higher probability

---

Key Levels

Resistance Zones

0.15500 – Minor resistance & recent rejection area

0.18180 – Mid-term resistance / supply zone

0.20800 – Strong resistance & early bullish confirmation

0.26550 – 0.29000 – Major resistance & upper distribution range

Support Zones

0.13500 – 0.13000 – Intraday support

0.12000 – Lower channel support

0.09500 – Major demand zone & previous low

---

Bullish Scenario

The bullish scenario becomes valid if:

Price breaks and closes above the upper descending channel

Successfully reclaims 0.15500 – 0.16000 as support

Potential upside targets:

0.18180

0.20800

0.26550

Additional confirmation:

Increasing volume on breakout

Structure shift into higher high and higher low

Without a clean breakout, upside movement should still be considered a temporary retracement.

---

Bearish Scenario

The bearish scenario remains dominant if:

Price fails to break above the upper channel

Strong rejection occurs around the 0.15500 resistance zone

Downside targets:

0.13500

0.12000

0.09500 (major support & potential technical bounce)

A breakdown below 0.12000 would strengthen bearish continuation toward lower demand zones.

---

Conclusion

DOGE/USDT remains in a technically healthy downtrend structure. As long as price stays inside the descending channel, any upside move should be treated as a pullback or sell-on-resistance opportunity.

The market bias only shifts bullish after a confirmed breakout with strong volume and a solid daily close above the channel.

#DOGEUSDT #DOGE #Dogecoin #CryptoAnalysis #TechnicalAnalysis #DescendingChannel #BearishTrend #AltcoinTrading #PriceAction #SupportResistance #Downtrend

DOGE/USDT — Structure Check

Price: $0.1388 | 4H

The Read

DOGE is in a clear bearish regime. Price sits below the AVWAP with a heavy volume node overhead at $0.150 acting as a ceiling.

That rally to $0.155 earlier this month? Rejected at POC. Textbook.

Current structure:

Regime: Bearish

AVWAP: ~$0.143 (resistance)

POC: $0.150 (major resistance)

Bias: Sell rallies until reclaim

Key Levels

LevelPrice POC Resistance$0.150

AVWAP$0.143 Current$0.1388

Support$0.130

Bottom Line:

BEARISH — No Long Setup

Price below AVWAP. Structure says sell rallies, not buy dips.

Longs need a regime flip first. We're not there yet.

Full entry zones and targets in the daily briefing.

DOGEUSDT - Consolidation after growth is a positive signBINANCE:DOGEUSDT is testing resistance, but the coin is not going to reverse yet. Focus on the current consolidation at 0.145 - 0.1534. A long squeeze or a breakout of resistance could trigger growth.

Bitcoin has been growing throughout the week, forming a retest of resistance. If the growth continues, it could support a bullish run in altcoins.

After the rally, DOGE moved into consolidation at 0.145 - 0.1533. The market is showing positive dynamics. The altcoin may test the consolidation support before growing. However, a breakout of the 0.1533 resistance and a close above the level could trigger an early rise.

Resistance levels: 0.1534, 0.1648

Support levels: 0.145, 0.139

Regarding the current consolidation in the trading range format, I highlight two levels: 0.1534 and 0.145. If the overall positive background persists, a false breakdown of support at 0.145 or a breakout of resistance at 0.1534 with the price closing above the level could trigger further growth towards the local zone of interest at 0.165.

Best regards, R. Linda!

#DOGE/USDT - Only One Scenario Left: UP#DOGE

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1470. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1490

First target: 0.1500

Second target: 0.1522

Third target: 0.1550

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

DOGE Short-term analysis | Trading and expectationsCRYPTOCAP:DOGE

🎯 Price printed a bullish engulfing 3 white knight candle pattern. It is above the daily pivot, showing a bullish trend is emerging, but still below the daily 200EMA. Overcoming this will be very bullish. The Elliot wave count is tricky, so I will await more confirmation.

📈 Daily RSI has printed bullish divergence. The RSI shot up too hard and fast, which often results in a reversal, potentially testing the daily pivot as support.

👉 Analysis is invalidated below the swing low, keeping the downtrend alive

Safe trading

DOGEUSDT UPDATE#DOGE

UPDATE

DOGE Technical Setup

Pattern: Falling Wedge Pattern

Current Price: 0.1237

Target Price: 0.1490

Target % Gain: 121.32%

Technical Analysis: DOGE is breaking out of a falling wedge pattern on the 1D chart, indicating bullish potential. Price is trading near the lower boundary of the wedge and has started to curl upward, suggesting a possible breakout. A confirmed move above the descending resistance trendline could open the path toward the projected upside target zone shown on the chart.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

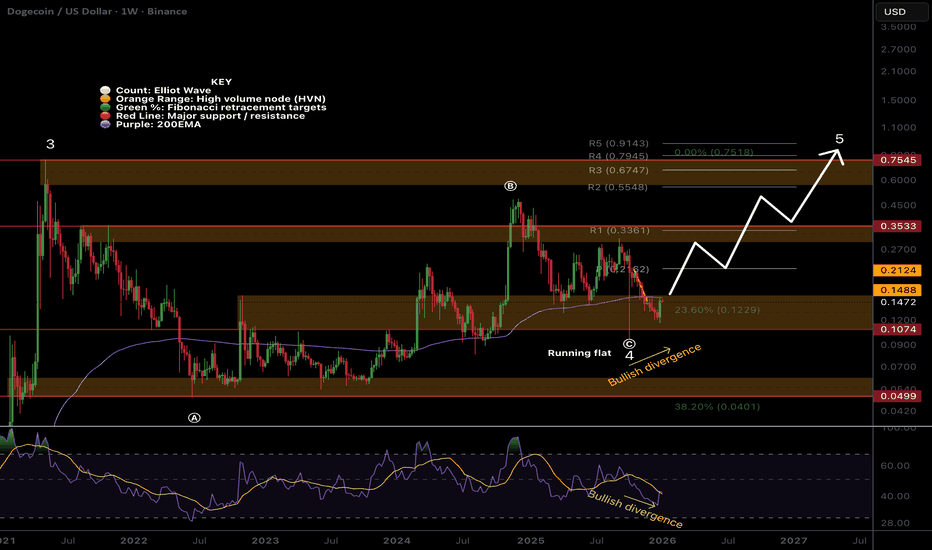

DOGE Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:DOGE

🎯 Uptrend remains intact from the multiyear wave 4 running flat bottom. We could still be in wave 4, as characterised by their long, complex ranges with shallow retracement 0.236 Fibs in this case. The initial upside resistance is the weekly pivot at $0.29, and macro wave 5 has a terminal target off a poke above all-time high at $0.76.

📈 Weekly RSI has printed bullish divergence as price tests the weekly 200EMA. Overcoming this is the first challenge and will add confluence to a bullish move.

👉 Analysis is invalidated below wave 4 and the S1 pivot, $0.0986

Safe trading

DOGE Analysis (1D)Dogecoin has entered the correction phase from the point we marked on the chart.

Based on the structure, an ABC pattern has been identified on the chart, and after wave C is completed, we expect retracement movements to the upside.

Wave C still needs more time to complete, and it is expected to finish between the two vertical time lines drawn on the chart.

Within the time lines and the green zone, one can consider buy/long positions.

As long as wave C has not finished, buying is not wise

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ROAD TO 15 CENTS (4h)ROAD TO 15 CENTS

We can be hopeful that after breaking out of the wedge, we will see significant price growth.AB=CD

Best regards CobraVanguard.💚

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

BNBUSDT | A long way ahead (READ THE CAPTION)By examining the 6h chart of BNBUSDT we can see that after days of struggling, it has finally made a little distance from the Demand Zone, going as high as 891, and now is being traded at 874. However, BNBUSDT still has a long way, and for the time being, I prefer to wait and see the movement before making a move myself.