ETH — The $3,000 Rebound Zone: Multi-Confluence SupportETH has reached a key level around $3,000, a major psychological zone that also aligns with multiple high-timeframe supports. The yearly VWAP sits at $3,023.5, providing the first layer of confluence. Additionally, both the 21-month EMA ($3,028) and the 21-month SMA ($3,100) cluster tightly in this region, reinforcing it as a strong structural support zone.

This creates a long setup with a clear invalidation below the $3,000 level. The primary target is the 0.5 Fibonacci retracement at $3,331, which lines up closely with the yearly open at $3,337.78. This area also contains a fair value gap and the anchored VWAP, forming a solid resistance cluster and a logical take-profit zone.

Support and resistance levels are well-defined, and the trade structure is clean.

R:R ~1:5 if entering directly at the yearly VWAP support

R:R ~1:2 if entering at current price levels

Overall, ETH is positioned at a high-probability long zone with strong multi-confluence support and a clear upside target.

🔍 Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

Multi Timeframe 8x MA Support Resistance Zones → to identify support and resistance zones such as the monthly 21 EMA/SMA.

VWAP

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

Driftline

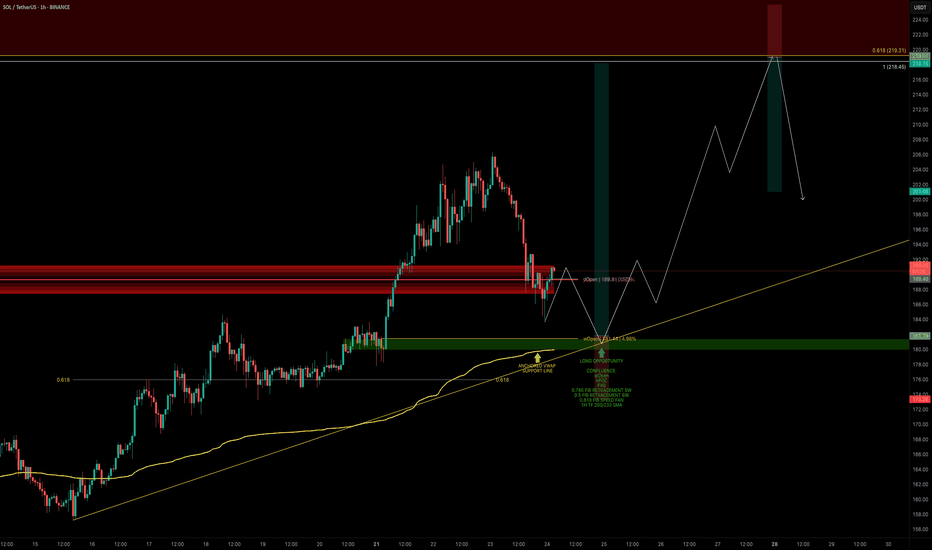

SOL — From Panic to PrecisionLast week, we witnessed a sharp, market-wide crash, a chain reaction of liquidations that flushed out overleveraged long positions. While many altcoins saw 60–90% drawdowns, the majors held relatively firm.

Among them, SOL stood out as one of the most technically precise. Price perfectly tapped the 1.1 trend-based Fib extension, in confluence with the yearly level, the 21 monthly SMA and the 0.666 retracement, providing a high probability long setup.

After that bounce, SOL revisited the lows, approaching the yearly level near $170, which remains the key structural support for maintaining bullish momentum. The support zone between $175–$170 aligns with the 21 EMA/SMA on the monthly timeframe, which currently spans $158–$170 → forming a strong macro confluence cluster that’s critical to hold.

From there, price unfolded into a clean 5-wave impulsive structure, topping within a dense resistance zone between $208–$212, reinforced by:

mOpen at $208.68

21 EMA/SMA (Daily TF) between $211–$212

0.618 Fibonacci retracement at $211.43

This area offered the perfect low-risk short entry.

Currently, SOL appears to be forming an ABC corrective pattern, likely targeting a move back into the $190–$185 range to fill imbalances and complete wave C. As another key element, the yearly open at $189.31 sits mid-range between resistance and support → a critical pivot level. That’s the region I’ll be monitoring for long setups.

🔍 Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

Multi Timeframe 8x MA Support Resistance Zones → to identify support and resistance zones such as the monthly 21 EMA/SMA.

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

SUI — Critical $3 ZoneSince completing its 5-wave impulse on July 28, SUI has been in a corrective phase for the past two months. The structure remains clean, with invalidation zones well-defined.

Looking ahead, there’s potential for an ascending triangle formation but for that to play out, it’s crucial that SUI holds the $3 psychological level.

Support Zone ($3.11–$2.93)

0.618 Fib retracement: $3.115

0.702 Fib retracement: $2.934

60 Weekly EMA $2.93 / SMA $3.036

Potential ascending triangle lower support line

📌 This is the last key support zone for bullish momentum. Losing it would break structure, holding it keeps the bullish case alive.

Resistance Zone ($4.12–$4.59)

Yearly Open (yOpen): $4.122 → key level bulls must reclaim

Swing Highs: $4–$4.5

0.786 Fib retracement: $4.59

15B Market Cap: $4.2

This area is loaded with resistance confluence and will act as the major target zone for longs.

🟢 Long Setup

Entry Zone: Between current price and $2.9 → ladder down into support

Stop-Loss: Below 0.702 Fib retracement

Take Profits: TP1 → $3.49, TP2 → $3.89, TP3 → $4.12 (yOpen)

R:R: ~1:4+

Potential Gain: +35%

This is a make-or-break zone for SUI. The $3 level is stacked with support confluences and must hold to keep the bullish structure intact. If bulls reclaim the yearly open at $4.122, momentum could carry toward $4.6.

🔍 Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

Multi Timeframe 8x MA Support Resistance Zones → to identify support and resistance zones such as the weekly 60 EMA/SMA.

Fair Value Trend Model → Calculates a regression-based fair value curve

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

BTC — Sunday Liquidity TrapAfter hitting the BIG resistance at $117,896 (0.618 Fib retracement), BTC rejected as anticipated and started its current downtrend. The anchored VWAP from the $117.9K high has been an excellent guide, acting as resistance → most recently at $113,800, where it provided a clean short entry.

Over the weekend, BTC has traded sideways. We just saw a small pump to clear the range highs and take out buy-side liquidity, a common setup before markets rotate lower to sweep sell-side liquidity.

Key Confluence Zone

The next level of interest sits around $108,250, where multiple factors align:

Monthly Open: $108,246.36

Daily Level: $108,246.35

0.618 Fib Retracement: $108,236.67

Liquidity cluster with many stop-losses residing here

If this zone fails to hold, the next downside interest lies at:

Key Low: $107,255 → possible SFP area

0.666 Fib Retracement: $106,975.52 → additional support

🟢 Long Trade Setup

Entry: Long around $108,250 (mOpen confluence zone)

Stop-Loss: Below 0.666 Fib retracement (~$106,975)

Take Profit: TP1 → $111K, if volume expands → trail stop for higher targets

R:R: ~1:2

Market Insight

Sunday pumps are notoriously unreliable, often designed to trap traders into late longs before a pullback wipes them out. This setup reflects exactly that dynamic.

Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

NEAR — Prime Swing Setup at $2.5NEAR is shaping up for a high-probability swing trade, and the chart is lining up beautifully. The $2.5 zone is packed with confluence, making it one of the most attractive long opportunities on NEAR in a while.

Confluence Support Zone

Previous Monthly Open (Key Level): $2.535

0.786 Fib Retracement: $2.506

Liquidity Pocket: Sitting right at this zone

📌 Together, these factors make the $2.53–$2.50 area a critical support level to watch.

🟢 Long Setup

Entry: $2.53–$2.50 zone

Stop-Loss: Below monthly open at $2.366

Target: $4 (major resistance + TP zone)

Potential Gain: ~+50% if played to target

R:R 1:7+

Trade Outlook

If NEAR reacts strongly off the $2.5 zone, this setup could unfold into a powerful swing trade. The structure suggests this could be the launchpad for the next leg higher.

As always, confirmation is key: I’ll be watching closely for a clean reaction before committing fully. Profit-taking decisions will be refined as price action develops, but the $4 level stands out as the main TP zone.

Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

LINK — Massive $20 Support Zone, Wave 5 Loading?I haven’t seen this much confluence stack in one place for LINK in a long time. The $20–$19 zone is absolutely packed with technical factors, making it a critical level to hold for bullish continuation.

🧩 Confluence at $20–$19

Golden Pocket: $20.19 (0.618) → $19.59 (0.666)

Yearly VWAP: $18.87

21 Weekly EMA/SMA: $19.68 / $18.39

Yearly Open: $20.02

0.666 Fib Speed Fan: aligned with $20 zone

1.0 Trend-Based Fib Extension: at $20 → completion of wave 4

Pitchfork Buy Zone: 0.702–0.75 levels right at $20

Midpoint of 1-Year Trading Range

Anchored VWAP (from $30.94 high, 287 days): $19.55

Daily Level: $19.66

Weekly Level: $19.28

Monthly Level: $19.27

Yearly Level: $19.51

🟢 Long Setup

We’ve already seen a bounce from $20, confirming demand at this zone.

Plan: Buy now and add on retracements if price dips back toward $20/$19.

Stop-Loss: Below 21 SMA weekly at $18.39

TP1 → $30 psychological resistance & prior key high

TP2 → $34.57 (0.618 Fib retracement)

This setup offers an R:R of 1:7+ with a possible yield of +70% if played toward TP2.

Structure Outlook

With this stacked confluence, it looks like wave 4 has completed and LINK could be ready for its next leg up. The $20 zone is make-or-break, and as long as it holds, the case for bullish continuation remains strong.

Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

Multi Timeframe 8x MA Support Resistance Zones → to identify support and resistance zones such as the Weekly 21 EMA/SMA.

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

AVAX — Next Stop $40?AVAX has been one of the stronger high-cap performers recently, but the yearly open at $36 has proven to be a tough ceiling. Price has rejected this level three times already, each time offering short opportunities. This level also aligns with the 15B market cap, making it a key resistance zone.

Now, AVAX is retracing into a prime area for long setups, retracing part of the recent 5-wave impulse.

🟢 Long Entry Zone

0.618 Fib retracement: $32 → first bounce zone

0.786 Fib retracement: $30.85 → deeper entry opportunity

0.886 Fib retracement: $30 → highest confluence long entry

Invalidation: Below $29.41 (origin of the impulse)

Confluence at $30

The $30 level is the strongest support cluster, backed by multiple technical factors:

POC of this trading range

0.886 Fib retracement of the impulse

21 EMA/SMA (daily timeframe)

Anchored VWAP support

$30 psychological round number

0.618 Fib speed fan support

This makes laddering entries from $32 down to $30 the most optimal approach.

Targets

First Target: $36 yearly open → retest of major resistance (fourth attempt)

Main Target: $40 resistance cluster → 0.618 Fib retracement, negative -0.618 Fib extension

R:R: 1:3 up to 1:6 depending on entry

Educational Insight

When analysing trades, confluence is king. A single indicator may provide a signal, but when multiple tools align at the same level the probability of that zone holding increases significantly.

The $30 zone for AVAX is a great example of confluence stacking. This doesn’t guarantee success, but it gives traders a defined edge with a clear invalidation point. The same logic applies to resistance: at $40, multiple technical layers align, making it a high-probability take-profit zone.

Quick Take

AVAX is pulling back into a stacked support zone. With solid confluence at $30–$32, this zone sets up the fourth attempt at breaking the $36 yearly open resistance.

And as the saying goes in trading: the 4th touch often breaks. If it does, AVAX could quickly rally toward the $40 resistance cluster, where multiple confluences align.

Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

Multi Timeframe 8x MA Support Resistance Zones → to identify support and resistance zones such as the Daily 21 EMA/SMA.

LuxAlgo — Liquidity Sentiment Profile (Auto-Anchored)

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

LINEA — $0.033 Key Break Could Unlock Big UpsideLINEA is starting to look interesting. Currently trading around $0.032 (~500M market cap), this level acts as resistance that needs to be broken for bullish continuation.

Earlier today, we already had a clean long setup from $0.03 support, in confluence with the weekly open ($0.02954) and anchored VWAP (yellow line), which held and gave a solid bounce.

Next Long Setup Idea

Entry 1: Watch for a breakout above the key high at $0.03328, then retest for confirmation.

Entry 2: Alternatively, a hold above $0.032 could offer a safer re-entry.

Stop-Loss: Below $0.03 support for now.

Targets

TP1: $0.036

TP2: $0.04

TP3: $0.043

Final Target: $0.065 (aligns with 1B market cap resistance)

This setup could yield:

+30% gain if exited around $0.043

+100% potential if momentum drives price into the $0.065 zone

Quick Take

A breakout and retest of $0.03328 would open the path toward the $0.036–$0.043 zone. If momentum continues, the 1B market cap resistance at $0.065 becomes a realistic macro target.

🔍 Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

AEVO — 230 Days of Accumulation, Breakout AheadAEVO has been consolidating for the past 230 days in what looks like a Wyckoff accumulation between the 100M–150M market cap range. AEVO is now on the verge of breaking its long-term bear trend.

🟢 Long Setup Idea

Entry Zone: $0.13–$0.12

Stop-Loss: Below $0.11

Target: ~$0.35

Key Resistance Levels

Yearly Dynamic VWAP → $0.1384 → current resistance / key S/R zone

Anchored VWAP (Dec 7, 2024 high at $0.6549) → ~$0.17 → key resistance in confluence with the key highs → A clean break above this = bullish

150M Market Cap → $0.164 → major breakout level

Once cleared, significant upside potential opens up.

Higher Timeframe Targets

$0.35 Zone → Primary long target (POC of the 2024 trading range, yearly Open at $0.3614, 0.5 Fib retracement of the downtrend at $0.359)

$0.43 Zone → 0.618 Fib retracement of the downtrend, in confluence with the 400M market cap

$0.50 Zone → Anchored VWAP resistance + psychological level

$0.53 Zone → 0.786 Fib retracement

$0.55 Zone → 500M market cap resistance

Key Levels

Support → $0.12–$0.13

Resistance → $0.1606–$0.17 → $0.35 → $0.43–$0.55

🔍 Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

DRIFT — No More Drifting, Breakout ImminentDRIFT has been trading sideways in a 226-day range, capped by resistance at $0.75. The POC of this entire range sits at $0.6, and price is currently trading above it at $0.62.

Volume spikes within the range show solid participation, and the structure is starting to resemble a Head & Shoulders formation with a neckline at $0.75 that needs to break.

Bullish Confluence (Support Zone)

Trading above:

21 Daily EMA ($0.593) / SMA ($0.592)

21 Weekly EMA ($0.577) / SMA ($0.549)

200 Daily EMA ($0.5828) / SMA ($0.5483)

Monthly Open → $0.5888

0.618 Fib retracement of current move → $0.5987 (long trigger)

Clear invalidation: below weekly 21 SMA ($0.549) / daily 200 SMA ($0.5483)

Resistance Confluence (Target Zone $1.3–$1.38)

nPOC of the end 2024 / early 2025 trading range → $1.3

0.786 Fib retracement → $1.2935

0.382 Fib retracement of entire downtrend → $1.3056

0.618 Fib retracement of smaller wave → $1.3677

Yearly Open → $1.3664

500M Market Cap → $1.38

📌 This creates a resistance cluster between $1.3–$1.38, an ideal take-profit zone and potential short opportunity.

🟢 Long Setup Idea

Entry: $0.62–$0.60 (ladder in near confluence with Fib + support levels)

Stop: Below $0.55 (weekly 21 SMA/ daily 200 SMA invalidation)

Targets:

TP1: $1

TP2: $1.3

Potential Gain: +115%

Quick Take

If $0.75 breaks, DRIFT could move quickly toward $1.3–$1.38, a zone stacked with resistance and confluences, the perfect place to secure profits/look for a short setup.

Key Levels

Support: $0.62–$0.60 (Fib + POC + EMAs)

Resistance: $0.75 neckline, then $1.3–$1.38 (confluence cluster)

🔍 Indicators used

LuxAlgo — Liquidity Sentiment Profile (Auto-Anchored)

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

Multi Timeframe 8x MA Support Resistance Zones → to identify support and resistance zones such as the weekly 21 EMA/SMA.

Fair Value Trend Model → Calculates a regression-based fair value curve

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

ADA — Is Cardano Ready to Break $1?ADA is coiling just beneath the $1 psychological barrier. The chart is setting up for a decisive move: the high-probability long entry aligns with the yearly open (yOpen), supported by multiple confluences.

🧩 Confluence Factors: 7

Yearly Open (yOpen): $0.845

1.0 Trend-Based Fib Extension: $0.8466 (aligned with yOpen)

Weekly Bullish Order Block: $0.8580

0.618 Fib Retracement: $0.8626

Anchored VWAP (green line): Supporting this zone

Sell-Side Liquidity (SSL): Positioned below recent lows

0.886 Fib Speed Fan: Adding further structural support

🟢 Long Trade Setup

Entry Zone: $0.863 – $0.847

Stop-Loss: Below yOpen (~$0.84)

Take-Profit Zone: $1.1747 (Buy-Side Liquidity sweep)

R:R: 1.6+ depending on SL placement

🔴 Short Opportunity

A secondary setup could arise on a sweep of the key high ($1.1757–$1.1879 BSL zone). This would only be valid with confirmation of rejection.

Entry Zone: After sweep/rejection above $1.1747

Stop-Loss: Above ~$1.20 (post-sweep rejection)

Target: Around $1.10

✍️ Confirmation is critical: the long requires strong defense of the confluence zone, while the short requires a failed breakout and rejection above key high (BSL).

Key Levels to Watch:

Support Zone: $0.863 – $0.847

Resistance / GP Zone: $1.1757 – $1.1879

🔍 Indicators used:

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

SOL — High Confluence Buy ZoneFrom 12th–14th August, SOL spiked into the 0.618/0.786 pitchfork resistance zone, where the best short entry presented itself. This rejection also marked the completion of wave 5 of the 5th Elliott Wave, confirming exhaustion in the $205–$210 zone.

After this sharp move, an imbalance has formed that typically gets retraced. When price spikes that quickly into resistance, it often gives the entire move back → meaning a return to the origin of the move. As price approaches this region, it becomes the prime zone for long re-entries.

🧩 Confluence Factors: 9

0.618 Retracement of the 5-wave impulse: $176.47

Daily level: $174.84

nPOC: $175.00

0.786 Trend-Based Fib Extension: $175.00

Anchored VWAP: ~$173.30

Sell-Side Liquidity (SSL): ~$173.50

Pitchfork 0.618 support: Aligning with this zone

Monthly Open (mOpen): $172.22 (major support)

0.786 Fib Speed Fan: Adding further structural support

🟢 Long Trade Setup

Entry Zone: $176.5 – $172

Best Entry: Around $175 (ideal ~ $173, confluence with liquidity + mOpen)

Stop-Loss: Below $167

Target: $219.21 (0.618 retracement of full move)

Potential Gain: +25%

R:R: 1:5+

Technical Insight

The 0.786 pitchfork rejection into wave 5 completion marked exhaustion at $205–$210.

Fast moves into resistance often retrace back to origin, opening the door for imbalances to be filled.

The $176.5–$172 zone clusters multiple technical supports, making it a high-probability long entry.

The mOpen at $172.22 and surrounding liquidity pocket stand out as the most ideal entry point.

With targets up to $219, the setup offers a strong +25% potential move with excellent risk-to-reward.

Key Levels to Watch

Support Zone: $176.5 – $172 (ideal entry ~$173)

Final Target: $219.21

🔍 Indicators used

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

XRP Pullback Play — 0.786 Fib Meets Sell-Side LiquidityXRP is currently in a pullback phase. The next high-probability long setup is at the 0.786 Fibonacci retracement, aligning with a Sell-Side Liquidity (SSL) zone.

🟢 Long Trade Setup

Entry Zone: 0.786 retracement

Stop-Loss: Below $2.80

Take-Profit 1: $3.00 (mOpen)

💡 Educational Insight

Sell-Side Liquidity (SSL) represents the pool of stop-losses and pending buy orders resting below recent swing lows. Price often seeks these liquidity pockets before reversing.

The 0.786 retracement aligns with this SSL zone, creating a high-probability setup.

However, confirmation should come from order flow → monitoring absorption, delta shifts, or footprint imbalances at this level will validate whether buyers are stepping in before entering.

🔍 Indicators used:

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

LINK Rally Cools Off — Next Long Opportunity at $20LINK has awakened with strength, rallying +60% in just 10 days. Price completed a clean 5-wave Elliott impulse, topping at the 1.0 trend-based Fib extension, which aligned with:

0.702 Fib retracement

Pitchfork upper resistance line

Key resistance zone

This perfect confluence marked the 5th wave top, followed by a -13% correction.

🔴 Short Opportunity

The current structure is forming a Head & Shoulders pattern.

➡️ Resistance zone: $23 – $23.5

🧩 Confluence factors:

Anchored VWAP (red line) from the 5th wave top

Fib speed resistance fan – Golden Pocket

➡️ Target: $20 support zone.

🟢 Long Opportunity Zone

The $20 zone offers the strongest confluence for a long entry:

Yearly Open (yOpen): $20.02

0.5 Fib retracement: $20.09 (of the 5 Elliott waves)

Pitchfork golden pocket

Anchored VWAP (green line): $20.28 (swing high)

Fair Value Gap (FVG) / imbalance fill

Liquidity pool

$20 psychological level

Trade Plan:

Entry: $20.5 – $19.5

Stop Loss: Below $19

Take Profit: $25

Potential gain: +25%

R:R: ~1:5

🔍 Indicators used:

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find them on my profile under “Scripts” and apply them directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

HBAR’s ABC Setup — Short-Term Pain, Long-Term Gain?HBAR has been consolidating sideways for the past 30 days, with $0.27 acting as a clear resistance — aligning with the golden pocket (GP). Price failed to sustain above the yearly open (yOpen) at $0.26901, despite multiple attempts. Each breakout attempt lacked follow-through → weakness.

Structurally, HBAR appears to be in a corrective phase after completing five Elliott waves, and is now potentially forming an ABC corrective pattern. Price has also lost the monthly open (mOpen) at $0.25099, which should now act as resistance.

🔴 Short Opportunity

Previous ideal entry: $0.27463 (Golden Pocket) — offered an R:R of ~1:7

Next short zone: Between mOpen ($0.25099) and yOpen ($0.26901)

Target: Around $0.21/$0.2 as take-profit (TP)

🟢 Long Opportunity Zone

➡️ Primary zone: $0.21 – $0.19675

🧩 Confluence factors:

FVG (Fair Value Gap) / imbalance fill

SSL (Support/Stop-Loss liquidity) positioned in the zone

Weekly level: $0.20685

0.55 Fib retracement: $0.20657 (aligned with the weekly level)

0.75 Fib speed resistance fan: Supports this zone if price reaches it between 19 – 25 Aug

1.0 trend-based Fib extension: $0.19675 (projected Wave C target of ABC)

Pitchfork lower support line intersecting with the zone

nPOC & key level: $0.2

With all these aligning, this is the most favourable long setup.

Long Trade Setup Example

Entry: $0.21– $0.19675

Stop Loss: Below $0.19

TP1: ~$0.223

Final target: $0.3+ (swing trade potential)

R:R: 1:6+

🔍 Indicators used:

DriftLine — Pivot Open Zones → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

➡️ Available for free. You can find them on my profile under “Scripts” and apply them directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

ADA Correction Nearing Completion — Is It Time to Load Up?After tagging the golden pocket resistance zone between $0.9208–$0.9527, ADA completed a clean 5-wave Elliott impulse right into a major resistance. Since then, price has corrected -25%, and we’re now likely nearing the end of an ABC correction — the final wave C.

🧩 Technical Breakdown

➡️ Wave A: 5-wave drop after the peak

➡️ Wave B: Bounce rejected at yearly open (yOpen) — that was a great short opportunity around $0.845

➡️ Wave C: Now working toward completion

🎯 C Wave Target Zone: $0.69–$0.65

This zone has strong confluence:

0.618 Fib retracement of the entire 5-wave move at $0.6732

1.0 TBFE (Trend-Based Fib Extension) aligns perfectly

Sell-side liquidity (SSL)

0.786 Fib Speed Fan support

Monthly 21 EMA/SMA adding a final confluence layer

🟢 Long Setup

Entry Zone: $0.69–$0.65 (ladder in)

Stop Loss: Below the monthly 21 EMA/SMA ($0.6)

Target 1: mOpen key resistance

Target 4: 0.666 Fib at ~$0.95

Risk:Reward: ~1:4+

💡 Educational Insight

After a 5-wave impulsive move, ABC corrections are common. Using the Trend-Based Fib Extension tool to project wave C, especially when paired with liquidity zones, VWAP, or moving averages, helps pinpoint high-probability reversal zones. It’s about confluence and reaction — not prediction.

🔍 Indicators

For this analysis, I’m using my own indicators

DriftLine – Pivot Open Zones and

MFT MA Support/Resistance Zones

both available for free. You can find them on my profile under “Scripts” and apply them directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

LTC Wakes Up — Bullish Adam & Eve Targets $150+LTC is gaining serious momentum, breaking through key resistance levels and printing a clean Adam & Eve bullish reversal pattern. The breakout signals a potential shift in the macro trend — and the chart is offering clear setups.

✅ Breakout Through $100 & Pattern Confirmation

LTC confirmed the Adam & Eve double bottom with a breakout above $100, a major psychological resistance.

The neckline retest around $105 acted as a Market Structure Shift (MSS) confirmation, with upside wicks signaling strong demand and a reversal.

$100–$105 Support Zone: Stacked Confluence

This zone offered a high-probability long setup due to multiple overlapping technical factors:

Yearly Open (via DriftLine - Pivot Open Zones ): $103.28

0.382 Fib Retracement: $104.67 (from $76.17 low to $122.29 high)

Anchored VWAP from the $76.17 low

POC of 1-Year Trading Range: ~$102

233 EMA & SMA (4H TF): Both moving averages aligned between $103–$100, acting as dynamic support

✍️ A clean, high-confluence demand zone between $100–$105 — ideal for long setups.

Upside Structure & Next Long Opportunity

➡️ Current Price: ~$127

A fresh long setup may present itself around $120 on a pullback

➡️ Pattern Target: $150

🌀 1.0 TBFE: $149.28

🌀 1.618 TBFE: $147.31

🔺 Key Swing High / Liquidity Pool (BSL): $147–$150 — an area to watch for possible rejection

🔴 Short Setup Consideration

➡️ Short zone: $147–$151

Only short on clear confirmation: SFPs, rejections, or bearish order flow

➡️ Downside target: $135 (1:2 R:R potential)

Macro Bullish Target: $198–$200

If LTC breaks and holds above $150, the next macro target becomes:

🌀 0.618 Fib Retracement (from $295.7 high to $40.3 low): $198.14

$200 Psychological Resistance: Major round number, likely to act as magnet and profit-taking zone

🛠 Indicators Used:

DriftLine — Pivot Open Zones

↳ For key levels like the Yearly Open, crucial in confluence stacking

📚 Educational Insight: Understanding the Adam & Eve Pattern

The Adam & Eve pattern is a classic bullish reversal formation that often marks the end of a downtrend or a major correction phase.

Adam forms first: a sharp, V-shaped low — often panic-driven or capitulation.

Eve follows: a rounded, more gradual bottom, showing accumulation and stabilisation.

Once price breaks above the neckline, the pattern is considered confirmed.

A retest of the neckline (like LTC at ~$105) is often the best entry point, especially when supported by confluence like Fib levels, VWAP, or key levels.

In LTC’s case, the breakout above $100 and successful retest at $100–$105 validates the pattern — with a measured move pointing toward $150, and a macro Fib target at $198.14 aligning with the $200 psychological level.

Summary:

With a confirmed breakout, strong technical confluence, and clearly defined targets, LTC is setting up for continuation. Watch $120 for long entries and monitor $150 for potential rejection.

_________________________________

💬 If you found this helpful, drop a like and comment!

ZORA 5-Wave Completion — 30% Crash Incoming?After exploding +1150% in just 20 days and completing all 5 waves, ZORA is now consolidating — trading sideways just under the $0.10 psychological level for the past 4 days.

📉 Current Market Structure

The current structure shows signs of a developing Head & Shoulders pattern, with price:

Trading below the daily open (dOpen) and weekly open (wOpen) → Bearish signs

Hovering near the prior daily open (pdOpen) → a breakdown here would confirm bearish continuation

🔴 Short Setup - Bearish Scenario

If ZORA breaks below pdOpen, we’re likely heading for:

0.618 Fib retracement at $0.06137 of the final wave 5

Confluence with 1.272 Trend-Based Fib Extension (TBFE) at $0.06148

This zone marks the next high-probability reaction point and a potential long opportunity if price shows a bounce or reversal.

📉 Overall Short Trade Target

The full retracement target sits between $0.0529 and $0.0514, offering multiple layers of confluence:

0.5 Fib retracement of the full 1150% move

0.786 Fib retracement of the final wave 5

Aligned with an old trading range and daily level

This makes it an ideal demand zone for patient bulls but only once price confirms.

💡 Educational Insight

This setup highlights an example of Elliott Wave Theory in action — after a strong 5-wave impulse move, markets often enter a corrective phase. The completion of wave 5, especially near key psychological levels like $0.10, often marks a local top, where price corrects toward key Fibonacci retracement zones.

Combining wave structure with confluence factors like Fib levels, VWAP, and prior trading ranges helps traders identify high-probability reversal zones — allowing for better timing, risk management, and trade planning. Always wait for confirmation before jumping into any trades.

Summary

Bearish continuation confirmed on pdOpen breakdown

First support zone: $0.0613–$0.0614

Final downside target: $0.0529–$0.0514

Look for long opportunities only on reaction + confirmation

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

ZORA — Parabolic Rally Nearing ExhaustionZORA has been on an explosive run, pumping +1239% in just 20 days. But after such a vertical move, the question is:

Is this rally nearing exhaustion?

Let’s dive into the technicals 👇

🧩 Elliott Wave Structure

Looking at price action through the lens of Elliott Wave Theory, ZORA appears to be completing its 5th wave:

➡️ Wave 3–4 zone: Held around the $0.05 trading range

➡️ Wave 5: Now pushing into the $0.097–$0.103 zone

This area aligns with:

The 1.618–2.0 Fib extension pocket — a typical exhaustion zone for wave 5s

The $0.10 psychological level

🔴 Short Trade Setup

This zone between $0.097–$0.103 is the ideal reversal area to consider shorting, with clearly defined targets and confluence:

Entry: $0.097 – $0.103

Stop-Loss: Above the 2.0 Fib Extension

TP1: Around $0.08

TP2: Around $0.064

Confluence: TP1

Daily Open (dOpen)

0.786 Fib of the local move

0.382 Fib of the 5-wave structure

TP2 (Lower Target):

0.618 Fib retracement of the 5-wave move at $0.064

Risk-to-Reward:

TP1 gives an R:R of 1:8

TP2 offers potential 1:13+

Watch for signs of weakness.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

SOL — Bullish Retest in Motion: Time to Strike?SOL has finally broken through the $180 barrier decisively — a key zone it failed to clear back in May.

Now we’re seeing a retest, which may offer one final dip before continuation. Let’s break down the next high-conviction long opportunity.

🧩 Key Retest Zone: $182–$180

➡️ Retesting Prior Resistance as Support

SOL broke above $180 with conviction and is now pulling back.

➡️ First Reaction at $184

A clean bounce occurred at the anchored VWAP, but this might not be the final low.

➡️ Strong Confluence at $180–$182 Zone

This zone is packed with support elements:

Weekly Open (wOpen): $181.44

nPOC: $180.85

Anchored VWAP: ~$179.90

0.5 Fib retracement (of the larger wave)

0.786 Fib retracement (of the smaller wave)

0.618 Fib Speed Fan — projected for tomorrow’s price path

1H 200 & 233 SMAs supporting from below

SOL is currently trading at yOpen — another key pivot level to watch

🟢 Long Trade Setup

Entry: Laddered between $182–$180 (ideal long entry would be at wOpen)

Stop-loss: Invalidation at $173.35

Target (TP): TBFE 1.0: $218.45 / 0.618 Fib retracement: $219.21

R:R: ~1:4.5

Potential Move: ~+20%

🛠 Indicator Used: DriftLine — Pivot Open Zones

For this analysis, I’m using my own published indicator called "DriftLine – Pivot Open Zones " feel free to check it out on my profile.

It helps identify and visualise critical opens (daily, weekly, previous days), providing real-time support/resistance zones.

➡️ You can use it for free — just check my profile under “Scripts” and add it to your chart.

💡 Pro Tip: Support Zones Are Stronger with Confluence

Don’t rely on a single fib or level. When opens, VWAPs, SMAs, and fibs cluster, the probability of a strong reaction increases.

This is how smart traders define clear entries and invalidation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.