SPY The Target Is UP! BUY!

My dear followers,

I analysed this chart on SPY and concluded the following:

The market is trading on 653.12 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 660.90

Safe Stop Loss - 649.43

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

E-signal

NATGAS Sellers In Panic! BUY!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 3.133

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 3.266

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER Buyers In Panic! SELL!

My dear friends,

SILVER looks like it will make a good move, and here are the details:

The market is trading on 5026.1 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 4968.0

Recommended Stop Loss - 5062.5

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

$ETH Market Assessment Incoming FAKEOUT? ETH/USD Perpetual – Market Assessment

Key Zones

Demand: 4737 – 4895

Supply: 3818 – 3994

Fair Value Gaps (FVGs): 4433, 4326

Anchored Volume Node: 4300 (significant liquidity cluster)

Psychological Levels : 4000, 4500, 5000

Recent Swing Points: High 4753, Low 3821

Technical Structure

High-Time Frame (HTF) Analysis:

Pattern: Bullish flag

Interpretation: Indicates potential continuation to the upside if price breaks above the flag resistance.

Daily-Time Frame (DTF) Analysis:

Pattern: Bearish channel

Interpretation: Suggests a slightly bearish pressure on the daily trend; caution required for long positions.

Volume and Liquidity:

Anchored volume node at 4300 aligns closely with FVGs at 4326 and 4433 – this area may act as strong support on pullbacks.

Scenario Planning

Bullish Scenario:

Price holds above demand zone (4737–4895).

Break above recent swing high at 4753 confirms bullish momentum.

Potential targets: 4895, 5000 psychological resistance.

Pullbacks likely to find support at FVGs (4433, 4326) or volume node (4300).

Bearish Scenario:

Price fails to hold demand zone and breaks below recent swing low 3821.

Next support: supply zone 3818–3994, then psychological level at 4000.

FVGs and volume node may temporarily slow the downside movement.

Summary / Notes

HTF indicates bullish continuation potential; daily trend shows bearish pressure.

Demand and supply zones, FVGs, and volume nodes are key levels for trade planning.

Monitor price reactions at swing points, psychological levels, and liquidity clusters to confirm trade setups.

Trade management should consider both bullish and bearish contingencies, with SLs placed near key FVGs or volume nodes.

AUDJPY: Long Signal with Entry/SL/TP

AUDJPY

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy AUDJPY

Entry - 99.978

Stop - 99.860

Take - 100.24

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD The Target Is UP! BUY!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 3952.6 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3966.9

Safe Stop Loss - 3945.0

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF Will Explode! BUY!

My dear subscribers,

This is my opinion on the EURCHF next move:

The instrument tests an important psychological level 0.9307

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.9325

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDNZD Under Pressure! SELL!

My dear friends,

My technical analysis for AUDNZD is below:

The market is trading on 1.1421 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.1391

Recommended Stop Loss - 1.1436

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD: Short Signal Explained

GOLD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GOLD

Entry Point - 3998.8

Stop Loss - 4008.4

Take Profit - 3977.7

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD Expected Growth! BUY!

My dear subscribers,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1573 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.1633

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURAUD Massive Short! SELL!

My dear friends,

Please, find my technical outlook for EURAUD below:

The price is coiling around a solid key level - 1.7666

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.7631

Safe Stop Loss - 1.7684

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

$ETHUSDT Analysis - Oct 10 | 4H Time FrameBINANCE:ETHUSDT Analysis - 4H

Hello and welcome to another analysis from the Satoshi Frame team!

I’m Abolfazl, and today we’re going to analyze Ethereum on the 4-hour timeframe.

After rejecting from the supply zone, Ethereum has reached an IFC, which could cause a price pullback.

On the 15-minute timeframe, look for confirmation signals to enter a long position — the first target is around $4,520, followed by $4,750.

Keep in mind that this setup is very risky, and no entry should be taken without proper confirmation.

The second scenario is a break below $4,200, which could provide a short opportunity targeting $3,950, and then the 4H low. (The break must be confirmed by a full candle close, not just a shadow.)

These scenarios allow you to align with price movement in both directions — the key is to wait for precise confirmations before entering any trade.

See you in the next analyses!

Stay tuned with the Satoshi Frame team...

$BTCUSDT Analysis - Oct 10 | 4H Time FrameBINANCE:BTCUSD Analysis - 4H

Hello and welcome to another analysis from the Satoshi Frame team!

I’m Abolfazl, and today we’re going to analyze Bitcoin on the 4-hour timeframe.

Bitcoin’s current all time high stands at $126,199!

Price has tapped into a demand zone, which could potentially trigger a bullish move toward this high.

This zone is worth the risk, and it’s recommended to look for buy positions on the 15-minute timeframe, targeting $130,000.

See you in the next analyses!

Stay tuned with the Satoshi Frame team...

Buy at the weekly low to target the weekly opening price.The market has been forming two accumulations — a monthly one of buyers and a weekly one of sellers. This week, we can see the market holding at a price level that is generating seller accumulation. In my view, the price has the potential to break the bullish trend to sweep out the buyers involved in it and then create an institutional buy in this weekly liquidity zone, aiming again for the price level where the market opened this Monday.

Price action tends to seek equilibrium between Monday’s opening and Friday’s closing, often closing and opening within the same zone. Therefore, if the price drops, we could look for a buying opportunity. Let’s wait for the setup to form in the coming hours or tomorrow.

EURCAD On The Rise! BUY!

My dear followers,

This is my opinion on the EURCAD next move:

The asset is approaching an important pivot point 1.6189

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.6255

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF: Bullish Continuation & Long Signal

EURCHF

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy EURCHF

Entry Level - 0.9308

Sl - 0.9304

Tp - 0.9316

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPCAD Trading Opportunity! BUY!

My dear friends,

Please, find my technical outlook for GBPCAD below:

The instrument tests an important psychological level 1.8662

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.8727

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD Technical Analysis! SELL!

My dear subscribers,

GOLD looks like it will make a good move, and here are the details:

The market is trading on 4039.4 pivot level.

Bias - Bearish

My Stop Loss - 4047.6

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 4026.3

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD: Long Trading Opportunity

EURUSD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long EURUSD

Entry - 1.1616

Sl - 1.1604

Tp - 1.1636

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

LINKUSD – Bullish Impulse Toward D-Point Target

LINKUSDT:

Title: LINKUSD – Bullish Impulse Toward D-Point Target

Price action has completed a corrective ABC structure, finding strong support at point C. The current breakout above mid-structure resistance confirms bullish momentum, aiming toward the D-point completion. Risk is managed below the breakout zone, with potential for trend continuation if price sustains above local support.

Risk Management Notes:

– Entry aligned with breakout confirmation

– Stop-loss below structural support (C-area)

– Take-profit near projected D-point completion

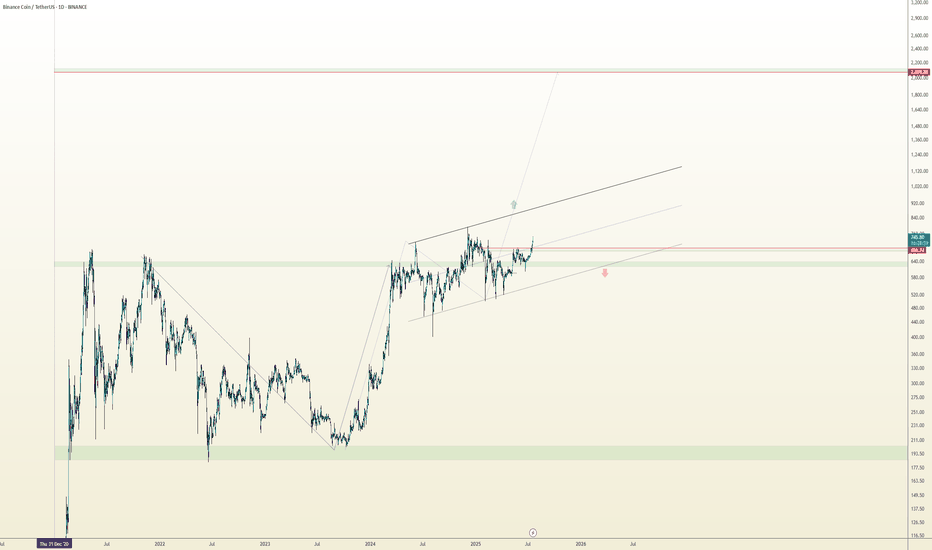

Perfect Sync: V Reversal Meets Bull Flag

Two clean and classic technical structures:

✅ V-Reversal Formation

✅ Bull Flag – still active and building pressure

After a sharp reversal, the price entered a bullish continuation phase.

Currently moving within the flag structure toward its upper edge.

If we see a breakout to the upside, the move could match the flagpole length, which aligns well with the target from the V-reversal pattern.

📍 Bullish scenario remains valid as long as we stay within structure.

📉 Breakdown below $570 invalidates this setup.

🧠 Important Reminder:

Enter only after a confirmed breakout.

✅ Apply strict risk management

✅ Never risk more than 1% of your capital on a single position.

Everything’s clear. No noise. Just wait for confirmation — let the market come to you.

EURAUD Signal : H2 / H4 : Big Long !!!Hello Traders! 👋

What are your thoughts on EURAUD ?

This correction could offer a buy-the-dip opportunity, with potential for a move back toward the recent highs.

EURAUD H2 / H4

Market price : 1.7620

Buy limit : 1.7600 - 1.7550

Tp1 : 1.7700

Tp2 : 1.7820

Tp3 : 1.7940

Tp4 : 1.8150

Sl : 1.7430 ( 145 pip )

Don’t forget to like and share your thoughts in the comments! ❤️

Remember this is a position that was found by me and it is a personal idea not a financial advice, you are responsible for your loss and gain.

$USDT.D Analysis - Oct 8 | 4H Time FrameCRYPTOCAP:USDT.D Analysis - 4H

Hello and welcome to another analysis from the Satoshi Frame team!

I’m Abolfazl, and today we’re going to analyze Bitcoin on the 4-hour timeframe.

USDT dominance has shown a trend reversal on the 4-hour timeframe and has turned bearish.

The OTE zone and the marked supply area could act as potential rejection zones if dominance makes a short-term pullback upward.

On the other hand, we could also see another drop from the current level, moving toward the lower support area near the recent low.

The main target (4%) is already marked on the chart.

See you in the next analyses!

Stay tuned with the Satoshi Frame team...