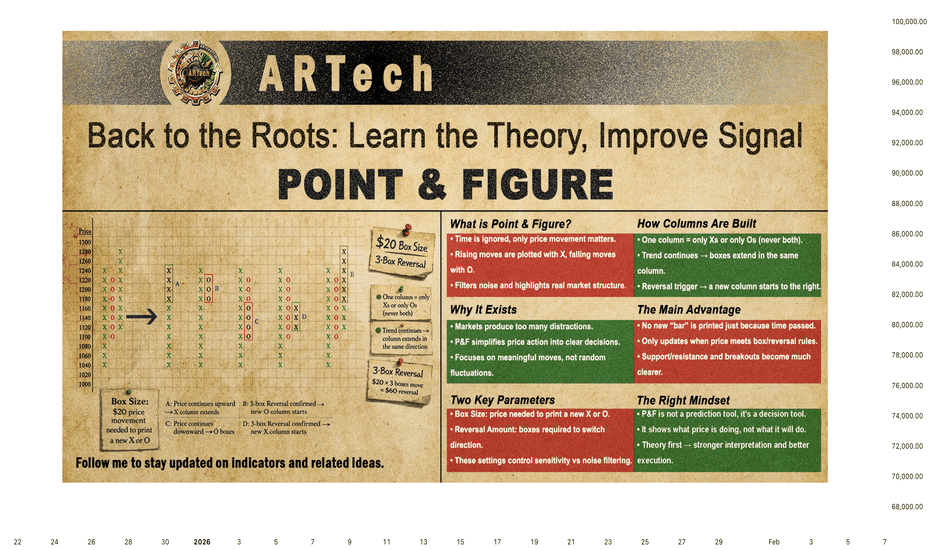

POINT & FIGURE🔸🔸🔸 1 - Back to the Roots: Learn the Theory, Improve Signal 🔸🔸🔸

Many traders believe that history repeats itself. Others think past performance can clearly explain what will happen next. The most common mistake is believing that technical indicators, calculated only from past data, can predict the future.

In reality, price charts do not show the future. They show only what has already happened and what is happening right now. Nothing more.

For this reason, we do not use charts as prediction tools. We use them as decision tools. Their purpose is not to tell us what will happen, but to help us build a roadmap in an uncertain future - a strategy, not a forecast.

To do this properly, we must understand the theory behind price behavior. Without theory, charts become pictures. With theory, they become structure.

That is why learning theory comes first.

🔸🔸🔸 2 - Point & Figure 🔸🔸🔸

Financial markets produce more information than traders can process. Prices move constantly, news never stops, and decisions must often be made under pressure. The real challenge is not accessing data, but turning that data into something useful.

Point & Figure (P&F) charts were created to address this problem. Instead of reacting to every small fluctuation, they record only meaningful price movement. By removing time and minor noise, Point & Figure charts provide a clear and structured view of market behavior.

Point & Figure charts display price movement only. Time is completely ignored. This is the main difference between Point & Figure charts and traditional bar charts.

In bar charts, both price and time are part of the structure. The vertical axis shows price, while the horizontal axis represents time. As time passes, new bars are added to the right side of the chart. Even if price stays the same, a new bar is still printed for each time period.

Point & Figure charts work in a very different way. There is no time axis. The horizontal space does not represent days or hours. The chart grows only when price moves enough to matter.

Price is plotted using fixed price boxes.

When price rises, Xs are added.

When price falls, Os are added.

If price continues moving in the same direction, the chart stays in the same column. For example, if price rises continuously for 5 days without a pullback equal to the reversal amount, this entire move appears as a single column of Xs. In a bar chart, the same move would create 5 separate bars.

If price does not meet the predefined rules, nothing is added to the chart. No X, no O. In contrast, time-based charts will always print a new bar simply because time has passed.

🔸🔸🔸 3 - Point & Figure Graph 🔸🔸🔸

Before drawing a Point & Figure chart, two parameters must be defined:

Box Size

The box size determines how much price movement is required to add a new X or O.

In this example, the box size is set to $20 . This means:

Every $20 rise adds one X upward.

Every $20 drop adds one O downward.

Reversal Amount

The reversal amount defines how many boxes price must move in the opposite direction to start a new column.

In Point & Figure charts, Xs and Os never appear in the same column. Each column contains only Xs or only Os.

In this example:

Box size = $20

Reversal amount = 3 boxes

This means a reversal requires a $60 move in the opposite direction.

Graph A

If the current column is an X column and price continues to rise, new Xs are added to the same column as long as the box size rule is met.

Graph B

When price falls by 3 boxes ($60), a new column begins to the right. Three 0s are placed starting one box below the highest X of the previous column.

Graph C

If price continues to fall, additional Os are added downward in the same column.

Graph D

If price then rises by 3 boxes ($60), another new column starts. Three Xs are placed one box above the lowest O of the previous column.

Graph E

As long as price continues higher without another 3-box reversal, Xs keep extending in the same column.

🔸🔸🔸 4 - The Rules for Plotting Point & Figure Charts 🔸🔸🔸

Before drawing a Point & Figure chart, a few basic rules must be defined. These rules determine which price source will be used and how price movement will be measured. The chart can be built using Close prices or High–Low data , and the box size can be calculated in different ways, such as Fixed value, Percentage, or ATR-based methods.

Each choice affects how sensitive the chart is to price movement and how much noise is filtered out. Understanding these rules is essential, because a Point & Figure chart only reacts when price movement meets the predefined conditions - nothing more, nothing less.

📌 4.1- High-Low Price Source

Preference is always given to price movements that continue the current trend. The price in the opposite direction is considered only if the trend cannot be extended.

The process starts by defining two key parameters: box size and reversal amount. In this example, the box size is set to $20, and the reversal amount is 3 boxes. These values determine when the chart should update.

The algorithm first reads the high and low prices of the current timeframe candle. The next step depends on the current column direction.

4.1.1 - When the Current Column Is Xs (Uptrend)

If the chart is currently in a column of Xs , preference is given to upward price movement.

The algorithm first checks whether the current candle's high is at least one box above the previous high.

If this condition is met and the box is fully filled, new Xs are plotted in the same column.

If the price does not move high enough to extend the X column, only then is the low price checked.

If the candle's low falls at least three boxes below the previous high, a reversal occurs:

A new column begins to the right.

Three Os are plotted, starting one box below the highest X of the previous column.

If neither condition is met, the chart remains unchanged.

4.1.2 - When the Current Column Is Os (Downtrend)

If the chart is in a column of Os , preference is given to downward price movement.

The algorithm first checks whether the current candle's low is at least one box below the previous low.

If the box is fully filled, new Os are added to the same column.

If the price does not extend the O column, the algorithm then checks the high price.

If the candle's high rises at least three boxes above the previous low, a reversal is triggered:

A new column starts to the right.

Three Xs are plotted, starting one box above the lowest O of the previous column.

Again, if neither condition is met, no action is taken.

📌 4.2 - Close Price Source

When the Close Price is used as the price source, the same plotting algorithm applies without any structural changes. The only difference is that high and low values are ignored. All decisions - box extensions and reversals - are made using closing prices only . If the close fills a box in the direction of the current column, new Xs or Os are plotted. If the close reaches the reversal amount in the opposite direction, a new column is started.

📌 4.3 - Box Size Method

Box size defines how much price must move before a new X or O is plotted on a Point & Figure chart. For this reason, box size directly controls the sensitivity of the chart. A small box size produces more signals and more noise, while a larger box size filters noise but reacts more slowly.

Choosing the correct box size is one of the most important decisions in Point & Figure charting. Markets differ in price level and volatility, and these characteristics can also change over time. A single box size cannot work equally well for every instrument or every market condition.

Each method has its strengths and weaknesses. The key is not finding a "perfect" box size, but choosing a method that matches the behavior of the market and the objectives of the trader.

To address this, Point & Figure charts commonly use three different box size methods:

4.3.1 - Fixed Box Size

The box size is defined as a fixed price value (for example, $20 per box). This method is simple and easy to understand, but it does not adapt to changing volatility.

4.3.2 - Percentage Box Size

In the percentage box size method, each box represents a constant percentage of the current price rather than a fixed price value.

Using a percentage-based box size helps normalize charts across markets with different price ranges and makes long-term comparisons more meaningful. However, because the box size is recalculated as price changes, the chart effectively adapts continuously. Rising prices increase the reversal distance, which can delay reversals and extend trends. Falling prices reduce the reversal distance, potentially triggering reversals more quickly.

While this method improves adaptability compared to fixed box sizes, it does not directly measure volatility. In markets where volatility changes sharply without large price changes, fixed percentage-based box sizing may still produce inconsistent signals.

4.3.3 - ATR-Based Box Size

The ATR Box Size method adjusts the box size based on market volatility rather than price alone. Instead of using a fixed value or a percentage of price, each box is calculated as a multiple of the Average True Range (ATR).

ATR measures how much price typically moves over a given period. As volatility increases, ATR rises and box sizes become larger. When volatility decreases, ATR falls and box sizes become smaller. This allows the Point & Figure chart to adapt naturally to changing market conditions.

For example, if the 50-period ATR of an instrument is 8 points and the ATR multiplier is set to 1.0, each box represents 8 points. A 3-box reversal would therefore require a 24-point move. If volatility later doubles, the box size increases automatically, filtering out noise during highly volatile periods.

ATR Box Size does not predict price direction. It simply ensures that the chart reflects meaningful price movement relative to current volatility, keeping the focus on true supply and demand rather than random fluctuations.

🔸🔸🔸 5 - Point & Figure on TradingView 🔸🔸🔸

This section explains how to open Point & Figure charts on TradingView and how to adjust the key parameters properly. Before discussing trading techniques, it is important to understand how to enable Point & Figure charts and configure their settings correctly.

📌 5.1 - Enable Point & Figure from Chart Type Menu

Point & Figure charts can be enabled directly from the Chart Type menu on TradingView. To activate it, open the chart type selector and choose Point & Figure from the list.

Note: Point & Figure charts are available only on TradingView Plus and higher plans.

Good news 🚀 At the end of this article, you can find the link to the indicator I developed based on Point & Figure logic.

📌 5.2 - Chart Settings

To change Point & Figure settings, right-click on the chart and select Settings from the menu. Then, open the Symbol tab to adjust the Point & Figure parameters. These settings allow you to control both the visual appearance of the chart and the logic used to build it.

Up Bars

Customize the color of rising columns (X columns).

Down Bars

Customize the color of falling columns (O columns).

Projected Up Bars

Represents potential rising columns (Xs) based on the current price before the bar is closed.

Projected Down Bars

Represents potential rising columns (Os) based on the current price before the bar is closed.

Source

Selects which price data is used for Point & Figure calculations (such as Close or High/Low). The logic and differences between these source types are explained in Section 4 .

Box Size Assignment Method

Choose how the box size is calculated:

Traditional: A fixed, user-defined box size

Percentage (LTP): Box size is calculated as a percentage of the last closed price

ATR: Box size is based on the Average True Range

The logic and usage of each method are explained in detail under the Box Size Methods section in Section 4.

ATR Length

If the ATR method is selected, this defines the look-back period used to calculate volatility.

Box Size

When using the Traditional method, this value defines the fixed price movement required to add one box.

Reversal Amount

Defines how many boxes price must reverse before a new column is created. The most common setting is a 3-box reversal.

Percentage

When using the Percentage (LTP) method, this value defines the box size as a percentage of the last closest price.

🔸🔸🔸 6 - Point & Figure Trading Technique 🔸🔸🔸

In this section, we will focus on three core trading techniques that are commonly used with Point & Figure charts: Reversal-based entries, Vertical Count, and Horizontal Count. Each method approaches the market from a different perspective - risk control, trend projection, and consolidation analysis - while remaining fully consistent with Point & Figure principles.

📌 6.1 - Reversal Based Entries

Point & Figure trading is based on breakouts to new highs and new lows. The most basic signals are simple and well defined:

Buy when the current column of Xs breaks one box above the previous X column.

Sell when the current column of Os breaks one box below the previous O column.

Using these basic rules, the trader is almost always in the market, reversing positions when an opposite signal appears (except in long-only stock trading).

In the figure above:

A new high is formed by breaking one box above the top of the previous O column, generating a buy signal. The stop-loss is placed one box below the lowest level of the prior column.

Price fails to show sufficient continuation and reverses downward with a 3-box reversal. When price breaks one box below the bottom of the previous X column, a sell signal is triggered, stopping out the previous long position.

After the pullback that follows the breakout, price turns upward again. A new buy signal occurs when price rises one box above the top of the previous O column. The stop-loss is placed one box below the lowest X in the current column.

However, many traders prefer alternative entry techniques to reduce risk and avoid false breakouts. One of the most common approaches is to enter after a pullback, rather than buying immediately at the breakout. This method limits risk while still respecting the Point & Figure structure.

Instead of buying at the first breakout, the trader waits for a reversal and enters at a lower price (or a higher price for short positions) that aligns with an acceptable risk level. This approach aims to reduce risk by waiting for a pullback, allowing entry closer to the stop-loss level. However, this comes with a trade-off: while risk is reduced, some trading opportunities may be missed if price continues in the breakout direction without a meaningful pullback.

📌 6.2 - Horizontal Count

In Point & Figure charting, the time price spends in a consolidation area is considered related to the size of the next price move. The longer the consolidation, the larger the potential breakout.

The horizontal count method is used to estimate price targets based on this idea.

6.2.1 - Upside Horizontal Count

To calculate an upside price objective:

Upside Target = Lowest price of the base + (Width × Reversal Value)

Lowest price of the base is the lowest box in the consolidation area

Width is the number of columns in the base (excluding the breakout column)

Reversal value is the box size multiplied by the reversal amount (for example, 3 (boxes) x 20$ = 60$)

Steps:

Identify the base after the breakout has occurred.

Count the number of columns across the base.

Multiply this number by the reversal value.

Add the result to the lowest price of the base.

This gives a projected upside price target.

6.2.2 - Downside Horizontal Count

The downside objective is calculated in the same way, but in the opposite direction:

Downside Target = Highest price of the top − (Width × Reversal Value)

Highest price of the top is the highest box in the distribution area

Width is the number of columns in the top formation

Reversal value is the box size multiplied by the reversal amount (for example, 3 (boxes) x 20$ = 60$)

Steps:

Identify the top formation after a downside breakout has occurred.

Count the number of columns across the top formation (do not include the breakout column).

Multiply the width by the reversal value.

Subtract the result from the highest price level of the top formation.

Key Notes

Wider bases or tops produce larger price objectives.

Smaller formations usually lead to shorter moves.

Multiple possible widths can be selected; closer targets are easier to reach, while wider counts often align with major support or resistance levels.

Horizontal counts provide price objectives , not guarantees, and should be used together with trend analysis and risk management.

📌 6.3 - Vertical Count

The vertical count is a simpler and more direct method than the horizontal count. It is used to estimate a price objective based on the strength of the first move away from a top or bottom. While the horizontal count measures accumulation or distribution, the vertical count measures volatility and momentum.

Like the horizontal count, the vertical count allows enough time to identify the formation and calculate the target before it is reached.

Purpose of the Vertical Count

Measures the initial price thrust after a confirmed top or bottom

Estimates how far price may travel in the direction of the new move

Often used to project retracements or continuation targets after major reversals

The vertical count relies on the idea that a strong first reversal often leads to a move of proportional size.

6.3.1 - Upside Vertical Count

To calculate an upside vertical count:

Confirm a bottom formation

Identify the first reversal column of Xs after the bottom.

Count the number of boxes in that first reversal.

Multiply this number by the minimum reversal value.

Add the result to the lowest box of the bottom.

Upside Vertical Count = Lowest box + (First reversal boxes × Minimum reversal boxes)

6.3.2 - Downside Vertical Count

The downside vertical count follows the same logic, but in the opposite direction:

Confirm a top formation.

Identify the first reversal column of Os after the top.

Count the number of boxes in that first reversal.

Multiply this number by the minimum reversal value.

Subtract the result from the highest box of the top.

Downside Vertical Count = Highest box − (First reversal boxes × Minimum reversal boxes)

Key Notes

The vertical count is based on volatility , not time.

It often provides conservative targets and may underestimate very strong trends.

Multiple vertical counts from nearby highs or lows can confirm each other.

Vertical counts are price objectives , not predictions, and should be used together with trend analysis and risk management.

🔸🔸🔸 7 - Conclusion 🔸🔸🔸

Finally, it is important to remember a principle that applies to all forms of technical analysis: Point & Figure charts, like any other method, are not a complete buy–sell system on their own.

Point & Figure does not predict the future, and it does not eliminate uncertainty. What it offers is something far more valuable: a structured way to interpret price behavior, free from time-based noise and emotional distraction. It helps us understand where supply and demand are truly in control, where risk is defined, and where decisions can be made logically.

For this reason, trading decisions should never be based on Point & Figure alone - or on any single technique. A robust trading strategy is built by combining multiple tools, perspectives, and confirmations. Trend analysis, support and resistance, market context, volatility, and risk management must all work together.

Even if Point & Figure charts are a core part of your approach, they should be seen as one weapon in a larger arsenal, not the entire strategy. The goal is not to find a perfect indicator, but to build a disciplined process where each tool supports and confirms the others.

Returning to theory gives us that discipline. And with theory in place, Point & Figure becomes not just a chart - but a framework for decision-making in an uncertain market.

Educationalposts

Mastering Technical:DXY Elliott Wave & Multi-Indicators AnalysisTechnical Analysis: DXY Bearish Confluence

This post serves as an educational guide on how various technical analysis tools converge to suggest a strong potential for a continued downtrend in the U.S. Dollar Index (DXY) on the 4-hour timeframe.

Elliott Wave Structure & Bearish Bias

The prevailing Elliott Wave count suggests the DXY is currently completing a corrective minor wave 4 rally within a larger five-wave impulse sequence to the downside. The market bias remains bearish, anticipating the onset of a significant minor wave 5 decline once the current wave 4 correction finishes.

Dow Theory & Price Action Confirmation

Dow Theory principles support the bearish outlook. The price action is clearly establishing a pattern of lower lows and lower highs, a classic signature of an active downtrend. The current rally (wave 4) is simply a higher low correction within this established structure, confirming the overall market direction is down.

Key Confluence Points for Resistance

Multiple technical indicators are clustering at a specific price zone, suggesting a high-probability area where the rally might reverse:

200 EMA Resistance: The price is trading below the 200-period Exponential Moving Average (EMA) on the 4-hour chart. This indicator is positioned just above the current price and is expected to provide significant dynamic resistance (a "hurdle") to the upside.

Fibonacci Retracement Alignment: The crucial 61.8% Fibonacci retracement level of the last major swing low is located very near the 200 EMA. This strong overlap of resistance levels increases the likelihood of a price reversal.

Divergence Analysis

Divergences between price and oscillators further reinforce the bearish sentiment:

Hidden Bearish Divergence: There is existing hidden bearish divergence present. This is a powerful trend-continuation signal that reinforces the expectation that sellers will soon regain control.

Absence of Bullish Signals: A key factor increasing conviction in the bearish bias is the lack of any bullish divergence seen yet on chart. The absence of this potential reversal signal suggests that a strong bullish bounce is not imminent.

Invalidation Level & Potential Targets

Defining risk and reward is essential in trading:

Invalidation Level: The bearish count is only valid as long as the price remains below the critical invalidation level marked at approximately 99.492

Potential Targets: Upon confirmation of the wave 4 top and the start of wave 5, the target for the decline is expected to be lower than the last swing lows (below the wave 3 termination point around 95.100).

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

S&P 500: Institutional Demand Zones vs. Macro HeadwindsS&P 500 (SPCFD) Strategic Market Analysis – 4H Timeframe

1. Market Structure & Price Action Overview

The S&P 500 is currently exhibiting a high-level consolidation within a dominant bullish trend. The price action at these peaks suggests a strategic liquidity engineering phase, where the market is balancing before its next directional expansion.

2. Key Liquidity Pools & Demand Zones

The technical map identifies two primary zones of institutional interest:

Sell-Side Liquidity (SSL) Target (6,789.05): This level represents the immediate swing low where retail stop-losses are likely clustered. An institutional "sweep" below this level would likely serve as the catalyst for the next leg up, providing the necessary liquidity to fill large buy orders.

Primary Interest Zone ($6,700 - $6,740): This marked demand block aligns with a "Discount" pricing array. This is the first high-probability area where institutional accumulation is expected to resume.

Extreme Discount/HTF Support ($6,520 - $6,550): This lower boundary serves as the "line in the sand" for the current bullish structure. Maintaining this level is vital for the long-term integrity of the uptrend.

3. Momentum & Volume Distribution Analysis

Williams %R: Currently hovering in the neutral territory (−48.11), confirming the lack of immediate directional conviction. A dip into the oversold region (below −80) followed by a sharp recovery would be a classic trigger for a long entry.

Accumulation/Distribution (A/D): The curve remains resilient at 195.75B. The lack of a sharp divergence suggests that while the price is stalling, major players are not aggressively offloading positions, supporting a "buy-the-dip" thesis.

4. Institutional Executive Summary

Market Bias: Neutral-Bullish. While the macro trend is intact, the micro-structure favors a corrective move to tap into liquidity before further upside.

Strategic Execution Note:

"Patience is advised until the 6,789 liquidity pool is neutralized. A successful sweep of this level, coupled with a bullish rejection in the 6,740 demand zone, would offer a High-Probability Long Setup. Risk parity should be maintained, eyeing a move back toward the previous highs and beyond."

⚠️ STRATEGIC WARNING: High-Volatility Window

The market is currently entering a high-impact zone. While the technical structure remains bullish on a Higher Timeframe (HTF), the price is stalling at premium levels. We are expecting a liquidity-driven correction before the next sustainable expansion. Do not chase the current highs; wait for the "smart money" footprint.

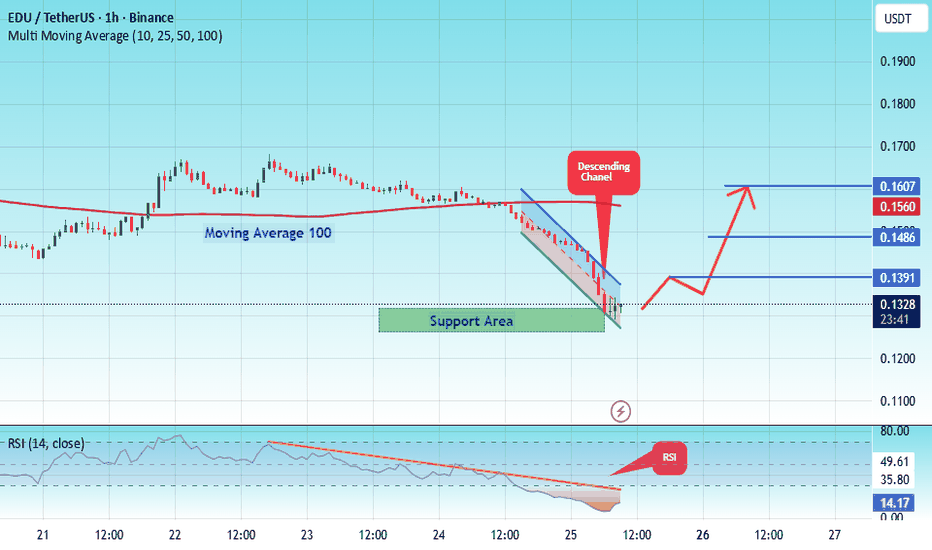

#EDU/USDT Forming Bullish Momentum#EDU

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1286, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1607

Target 1: 0.1391

Target 2: 0.1486

Target 3: 0.1607

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Most Crypto Losses Are Self-Inflicted — Here’s How to Avoid ThemMost traders blame their crypto losses on volatility, market makers, or unexpected news.

That explanation feels safe — because it removes personal responsibility.

But after years of observing real trading behavior across different market cycles, one pattern stands out with brutal consistency:

Most losses in crypto are self-inflicted — not market-inflicted.

And that’s actually good news.

Because what you cause, you can also control.

The Market Is Neutral — Your Behavior Is Not

Crypto doesn’t hunt accounts.

It doesn’t care where you entered.

It doesn’t punish you personally.

Losses usually come from how traders react to price:

- Chasing momentum after late entries

- Panic-selling during healthy pullbacks

- Acting on fear instead of structure

- Forcing trades when the market offers no edge

Price only moves.

Your decisions determine the outcome.

Professionals don’t try to outsmart volatility — they learn to operate calmly within it.

Overtrading: The Most Expensive Habit Nobody Talks About

Many traders aren’t losing because their ideas are bad.

They’re losing because they trade too often.

Overtrading usually shows up as:

- Trading out of boredom

- Trading to recover a previous loss

- Trading every small fluctuation

- Trading without a fully defined setup

Every position carries risk.

More trades do not increase opportunity — they increase emotional exposure.

In professional trading, restraint is a skill, not a weakness.

If You Don’t Control Risk, the Market Will Do It for You

You can be directionally right and still lose money.

Self-inflicted losses often come from:

- Oversized positions

- Moving stop-losses under pressure

- Risking too much on a single idea

- Treating one trade as “the big one”

Professionals don’t think in individual trades.

They think in probability over time.

Their priority is simple:

- Capital preservation first

- Consistent execution second

- Profits as a byproduct

Survival always comes before growth.

Complex Charts Create Emotional Decisions

More indicators do not create better trades.

They often create conflicting signals.

Common mistakes:

- Indicator overload

- Strategy hopping

- Constant re-interpretation of the same chart

- Looking for certainty where none exists

Clear charts produce clear thinking.

Clear thinking reduces emotional damage.

Simplicity isn’t basic — it’s advanced.

Revenge Trading Turns Small Losses Into Big Ones

After a loss, the mind seeks relief — not logic.

That’s when traders:

- Increase position size

- Break their own rules

- Enter without confirmation

- Trade to “feel right” again

The market does not respond to frustration.

And it does not reward urgency.

Losses are part of the business.

Trying to erase them emotionally often compounds them financially.

The Hardest Skill in Trading: Doing Nothing

Some of the best trades are the ones you don’t take.

Not trading when:

- Structure is unclear

- Volatility is erratic

- You’re emotionally involved

- Your plan says “wait”

Doing nothing protects capital.

And capital protection is what allows long-term consistency.

How to Avoid Self-Inflicted Losses (A Practical Framework)

- Trade less, but with intention

- Risk small and consistently

- Follow one system until proven otherwise

- Accept losses quickly and emotionally neutral

- Never trade to fix a feeling

- Measure success by discipline, not outcome

Your job is not to win every trade.

Your job is to stay in the game long enough for probability to work.

Final Thought

Crypto is not dangerous because it’s unfair.

It’s dangerous because it exposes:

- impatience

- ego

- fear

- lack of structure

Once you stop fighting the market and start managing yourself, trading becomes clearer, calmer, and far more sustainable.

Most crypto losses are self-inflicted.

Recognize that — and you’ve already taken the first step to avoiding them.

💬 Do you believe psychology causes more losses than analysis in crypto trading?

Share your perspective below — let’s discuss.

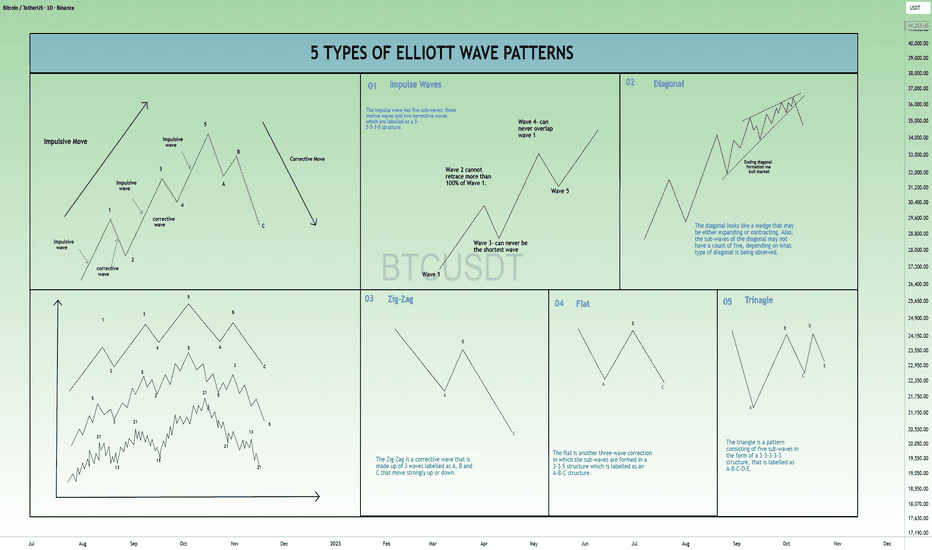

5 IMPOTANT TYPES OF ELLIOTT WAVE PATTERNS !!Hello traders, today we will talk about 5 TYPES OF ELLIOTT WAVE PATTERNS

( FIRST SOME BASIC INFO )

What is Elliott Wave Theory?

The Elliott Wave Theory suggests that stock prices move continuously up and down in the same pattern known as waves that are formed by the traders’ psychology.

The theory holds as these are recurring patterns, the movements of the stock prices can be easily predicted.

Investors can get an insight into ongoing trend dynamics when observing these waves and also helps in deeply analyzing the price movements.

But traders should take note that the interpretation of the Elliot wave is subjective as investors interpret it in different ways.

(KEY TAKEAWAYS)

The Elliott Wave theory is a form of technical analysis that looks for recurrent long-term price patterns related to persistent changes in investor sentiment and psychology.

The theory identifies impulse waves that set up a pattern and corrective waves that oppose the larger trend.

Each set of waves is nested within a larger set of waves that adhere to the same impulse or corrective pattern, which is described as a fractal approach to investing.

Before discussing the patterns, let us discuss Motives and Corrective Waves:

What are Motives and Corrective Waves?

The Elliott Wave can be categorized into Motives and Corrective Waves:

1. Motive Waves:

Motive waves move in the direction of the main trend and consist of 5 waves that are labelled as Wave 1, Wave 2, Wave 3, Wave 4 and Wave 5.

Wave 1, 2 and 3 move in the direction of the main direction whereas Wave 2 and 4 move in the opposite direction.

There are usually two types of Motive Waves- Impulse and Diagonal Waves.

2. Corrective Waves:

Waves that counter the main trend are known as the corrective waves.

Corrective waves are more complex and time-consuming than motive waves. Correction patterns are made up of three waves and are labelled as A, B and C.

The three main types of corrective waves are Zig-Zag, Diagonal and Triangle Waves.

Now let us come to Elliott Wave Patterns:

In the chart I have mentioned 5 main types of Elliott Wave Patterns:

1. Impulse:

2. Diagonal:

3. Zig-Zag:

4. Flat:

5. Triangle:

1. Impulse:

Impulse is the most common motive wave and also easiest to spot in a market.

Like all motive waves, the impulse wave has five sub-waves: three motive waves and two corrective waves which are labelled as a 5-3-5-3-5 structure.

However, the formation of the wave is based on a set of rules.

If any of these rules are violated, then the impulse wave is not formed and we have to re-label the suspected impulse wave.

The three rules for impulse wave formation are:

Wave 2 cannot retrace more than 100% of Wave 1.

Wave 3 can never be the shortest of waves 1, 3, and 5.

Wave 4 can never overlap Wave 1.

The main goal of a motive wave is to move the market and impulse waves are the best at accomplishing this.

2. Diagonal:

Another type of motive wave is the diagonal wave which, like all motive waves, consists of five sub-waves and moves in the direction of the trend.

The diagonal looks like a wedge that may be either expanding or contracting. Also, the sub-waves of the diagonal may not have a count of five, depending on what type of diagonal is being observed.

Like other motive waves, each sub-wave of the diagonal wave does not fully retrace the previous sub-wave. Also, sub-wave 3 of the diagonal is not the shortest wave.

Diagonals can be further divided into the ending and leading diagonals.

The ending diagonal usually occurs in Wave 5 of an impulse wave or the last wave of corrective waves whereas the leading diagonal is found in either the Wave 1 of an impulse wave or the Wave A position of a zigzag correction.

3. Zig-Zag:

The Zig-Zag is a corrective wave that is made up of 3 waves labelled as A, B and C that move strongly up or down.

The A and C waves are motive waves whereas the B wave is corrective (often with 3 sub-waves).

Zigzag patterns are sharp declines in a bull rally or advances in a bear rally that substantially correct the price level of the previous Impulse patterns.

Zigzags may also be formed in a combination which is known as the double or triple zigzag, where two or three zigzags are connected by another corrective wave between them.‘

4. Flat:

The flat is another three-wave correction in which the sub-waves are formed in a 3-3-5 structure which is labelled as an A-B-C structure.

In the flat structure, both Waves A and B are corrective and Wave C is motive having 5 sub-waves.

This pattern is known as the flat as it moves sideways. Generally, within an impulse wave, the fourth wave has a flat whereas the second wave rarely does.

On the technical charts, most flats usually don’t look clear as there are variations on this structure.

A flat may have wave B terminate beyond the beginning of the A wave and the C wave may terminate beyond the start of the B wave. This type of flat is known as the expanded flat.

The expanded flat is more common in markets as compared to the normal flats as discussed above.

5. Triangle:

The triangle is a pattern consisting of five sub-waves in the form of a 3-3-3-3-3 structure, that is labelled as A-B-C-D-E.

This corrective pattern shows a balance of forces and it travels sideways.

The triangle can either be expanding, in which each of the following sub-waves gets bigger or contracting, that is in the form of a wedge.

The triangles can also be categorized as symmetrical, descending or ascending, based on whether they are pointing sideways, up with a flat top or down with a flat bottom.

The sub-waves can be formed in complex combinations. It may theoretically look easy for spotting a triangle, it may take a little practice for identifying them in the market.

Bottomline:

As we have discussed above Elliott wave theory is open to interpretations in different ways by different traders, so are their patterns. Thus, traders should ensure that when they identify the patterns.

This chart is just for information

Never stop learning

I would also love to know your charts and views in the comment section.

Thank you

Most Crypto Losses Are Self-Inflicted — Here’s How to Avoid ThemMost traders blame their crypto losses on volatility, market makers, or unexpected news.

That explanation feels safe — because it removes personal responsibility.

But after years of observing real trading behavior across different market cycles, one pattern stands out with brutal consistency:

Most losses in crypto are self-inflicted — not market-inflicted.

And that’s actually good news.

Because what you cause, you can also control.

The Market Is Neutral — Your Behavior Is Not

Crypto doesn’t hunt accounts.

It doesn’t care where you entered.

It doesn’t punish you personally.

Losses usually come from how traders react to price:

- Chasing momentum after late entries

- Panic-selling during healthy pullbacks

- Acting on fear instead of structure

- Forcing trades when the market offers no edge

Price only moves.

Your decisions determine the outcome.

Professionals don’t try to outsmart volatility — they learn to operate calmly within it.

Overtrading: The Most Expensive Habit Nobody Talks About

Many traders aren’t losing because their ideas are bad.

They’re losing because they trade too often.

Overtrading usually shows up as:

- Trading out of boredom

- Trading to recover a previous loss

- Trading every small fluctuation

- Trading without a fully defined setup

Every position carries risk.

More trades do not increase opportunity — they increase emotional exposure.

In professional trading, restraint is a skill, not a weakness.

If You Don’t Control Risk, the Market Will Do It for You

You can be directionally right and still lose money.

Self-inflicted losses often come from:

- Oversized positions

- Moving stop-losses under pressure

- Risking too much on a single idea

- Treating one trade as “the big one”

Professionals don’t think in individual trades.

They think in probability over time.

Their priority is simple:

- Capital preservation first

- Consistent execution second

- Profits as a byproduct

Survival always comes before growth.

Complex Charts Create Emotional Decisions

More indicators do not create better trades.

They often create conflicting signals.

Common mistakes:

- Indicator overload

- Strategy hopping

- Constant re-interpretation of the same chart

- Looking for certainty where none exists

Clear charts produce clear thinking.

Clear thinking reduces emotional damage.

Simplicity isn’t basic — it’s advanced.

Revenge Trading Turns Small Losses Into Big Ones

After a loss, the mind seeks relief — not logic.

That’s when traders:

- Increase position size

- Break their own rules

- Enter without confirmation

- Trade to “feel right” again

The market does not respond to frustration.

And it does not reward urgency.

Losses are part of the business.

Trying to erase them emotionally often compounds them financially.

The Hardest Skill in Trading: Doing Nothing

Some of the best trades are the ones you don’t take.

Not trading when:

- Structure is unclear

- Volatility is erratic

- You’re emotionally involved

- Your plan says “wait”

Doing nothing protects capital.

And capital protection is what allows long-term consistency.

How to Avoid Self-Inflicted Losses (A Practical Framework)

- Trade less, but with intention

- Risk small and consistently

- Follow one system until proven otherwise

- Accept losses quickly and emotionally neutral

- Never trade to fix a feeling

- Measure success by discipline, not outcome

Your job is not to win every trade.

Your job is to stay in the game long enough for probability to work.

Final Thought

Crypto is not dangerous because it’s unfair.

It’s dangerous because it exposes:

- impatience

- ego

- fear

- lack of structure

Once you stop fighting the market and start managing yourself, trading becomes clearer, calmer, and far more sustainable.

Most crypto losses are self-inflicted.

Recognize that — and you’ve already taken the first step to avoiding them.

💬 Do you believe psychology causes more losses than analysis in crypto trading?

Share your perspective below — let’s discuss.

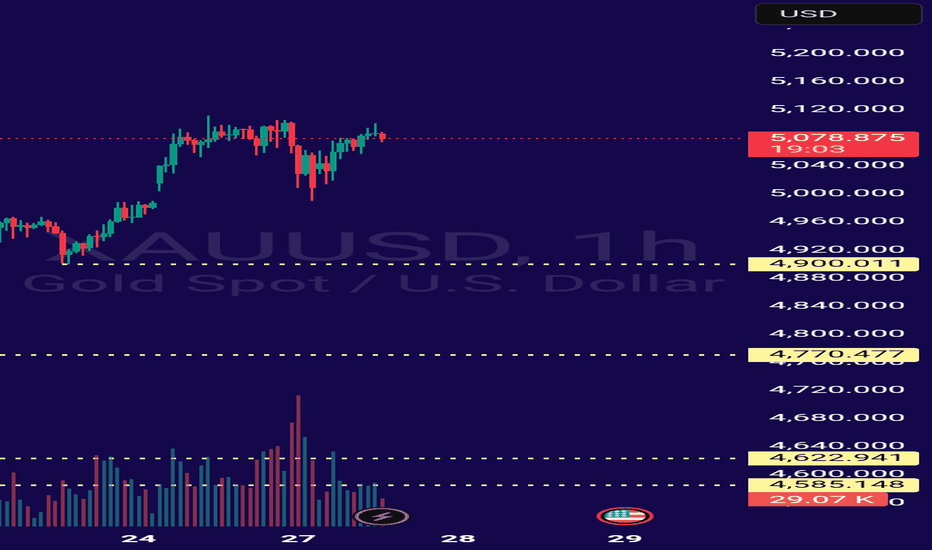

GOLD SellAs gold is concerned i am seeing a bearish move in the commodity because it has reached its physiological level and forming a M pattern which is too early to be predicted as it has formed its first leg and 2nd is going to be formed in nearing time also another confluence being bearish is we have a 78.6% fibb level residing under 1H 4H and daily respectively from up to down 👇 so i have made a sell position from current price if it breaks down

Why Default Strategy Settings Break Down Across MarketsThe Assumption: Defaults Are Good Enough

Most traders start with default indicator settings . RSI at 14. MACD at 12, 26, 9. Moving averages set to familiar values.

Defaults feel safe because they are familiar. They feel reasonable because they are widely used.

The problem: defaults are not designed to work across all symbols, timeframes, or market conditions.

The solution: instead of assuming defaults are acceptable, test how those settings behave when parameters are varied. Small changes often reveal whether a strategy is stable or dependent on coincidence.

The Assumption: If It Works on One Chart, It Should Work Elsewhere

A strategy looks clean on a single chart. Entries make sense. Losses feel explainable. Confidence builds.

The problem: one chart is not a market. Performance on a single symbol or timeframe says very little about robustness.

The solution: test the same logic across multiple symbols and timeframes. When behavior changes dramatically, it’s not failure, it’s information. Consistency across variation is what signals durability.

The Assumption: Indicator Logic Is the Edge

Traders often focus heavily on the logic behind indicators. Momentum, trend, mean reversion. The reasoning feels solid.

The problem: good logic does not guarantee good behavior. Two parameter sets can follow the same logic and produce completely different risk profiles.

The solution: explore how performance shifts as parameters move. Testing ranges, not single values, shows whether logic holds up under pressure or collapses when assumptions change.

The Assumption: Profit Tells the Full Story

Many traders judge strategies by net profit alone.

The problem: profit without context hides risk. Large drawdowns, unstable equity curves, or long stagnation periods often go unnoticed until they’re experienced live.

The solution: test for drawdown, consistency, and trade distribution alongside profit. Seeing how risk expands or contracts across parameter combinations changes how strategies are evaluated.

The Assumption: Defaults Fail Because Markets Changed

When defaults stop performing, traders often blame the market.

The problem: markets always change. A strategy that only works under narrow conditions was fragile from the start.

The solution: testing across broader conditions reveals whether a strategy is regime-dependent or structurally resilient. This allows expectations to adjust before capital is exposed.

What Testing Actually Replaces

Testing doesn’t replace strategy logic.

It replaces assumptions.

It replaces:

“This should work”

“This looks reasonable”

“Everyone uses this”

With:

“This is how it behaves”

“This is where it struggles”

“This is how sensitive it is”

Final Thought

Default settings are not wrong.

They are incomplete.

They are a starting point, not a conclusion.

The moment defaults are tested across parameters, symbols, and timeframes, they stop being assumptions and start becoming data. That shift is where real understanding begins.

"Macro Maps" - Most Underrated TradingView ToolThis Tool is called "Macro Maps", and have never seen anyone cover this gem on yt or anywhere else. So thanks to Macro Maps, you can view multiple macroeconomic indicators such as interest rates, inflation, or unemployment on the world map without spending any time researching for each individual country. You just have to hover through each country and it will pop up the current, for example, interest rate of that specific country. In addition, it can even show third world countries which are really hard to find on Google through your own research. As such, as day traders, as investors, or as any participant in the financial markets, this map is very important as in seconds, you can find out the interest rate, the inflation rate, or the GDP, or even the unemployment rate of any country on the world map. Of course, there are some exceptions like maybe North Korea, as some countries are secluded. Lastly, what you can also do is compare the change in inflation and other metrics through time. So the map allows you to go from 2025 and compare those metrics, for example, to 1980s for all the countries on the world map. And that's very useful as it helps us not waste time searching for all these macroeconomic metrics.

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

Altcoin season is coming, now doubt about this!Yesterday, I wrote something that might sound harsh — but I stand by it:

In my opinion, 99% of altcoins are junk (and I’m putting it nicely).

Not necessarily scams… just assets with weak long-term survival chances.

And what makes smaller alts dangerous isn’t only the volatility.

It’s the bullish bias they create.

Because if you want to be bullish badly enough, you can take almost any chart, build a bullish narrative around it, and sound smart, logical, and “technical”.

In fact, I can prove it.

I can write two bullish analyses on the exact same chart.

The only difference?

In the second one…

I simply flip the chart upside down.

Let’s go.

✅ Analysis #1 (Bullish… on the normal chart)

"As we can see on the chart, after the major market high in December 2024, altcoins went through a sharp and aggressive drop, which finally found support around the $175B zone in April 2025.

From that point, the market managed to recover nicely, pushing higher — but once price reached the $335B resistance area, momentum faded and sellers stepped back in.

That rejection sent the market lower again, and the decline ended with the mid-October flash crash, where price once again reacted strongly from support.

Now, the start of 2026 is showing something important:

✅ a higher low is in place

If this structure continues to hold, the next logical upside is:

🎯 a return toward the $335B resistance zone.

The market still needs confirmation — but the setup is getting cleaner 🚀"

✅ Analysis #2 (Bullish… on the inverted chart)

Now we flip the same chart upside down.

Same data. Same price action. Same bullish bias.

"After the major low formed back in December 2024 around -450, smaller altcoins printed a very strong impulsive leg up, pushing the price all the way to the -175 zone.

The correction that followed was something normal and found solid support around -335, perfectly aligned with the previous lows from March 2024 — a strong technical floor.

Since September 2025, altcoins have been recovering in a controlled way, gradually building higher lows.

Right now, we’re consolidating just below -175 resistance, which also acts as the neckline of a massive inverted Head & Shoulders pattern.

If buyers break and hold above -175, then:

🎯 -80 becomes the obvious target 🚀"

The point? Bias can turn anything bullish.

But here’s the funny part:

It doesn’t matter, because, regardless

Altcoin season is coming:)) 🚀

Have a nice weekend!

Mihai Iacob

Every Candle Has Psychology — Let’s Decode 3 of ThemHave you ever thought that every single candle carries its own psychology behind it?

If not, don’t worry — that’s exactly what this educational idea is about.

In this lesson, we’re going to break down the psychology behind three of the most popular candles, using a skeptical and practical approach.

In this post, I’ll focus only on single-candle structures.

If you’d like me to cover 2-candle or 3-candle patterns next, drop a comment and let me know.

Let’s start with one of the most famous candles of all time:

🔨 1) Bullish/Bearish Hammer — What’s Really Happening?

Assume we’re looking at a bullish hammer.

Sellers tried everything they had to push price lower.

But buyers stepped in aggressively, forced price back up, and closed the candle near the top.

Psychologically, this tells us two things:

Sellers didn’t just fail — they got liquidated

Buyers gained confidence, and new long positions may fuel upside momentum

The small upper wick represents the last desperate attempt by sellers.

Best execution idea:

Placing a stop-buy above the upper wick.

Why?

Shorts above the wick get liquidated

The sellers’ final defense is removed

Price can accelerate upward with momentum

Win rate improves significantly when:

The hammer forms after an uptrend

Price is aligned with moving averages (e.g. SMA)

🔥 2) Bullish/Bearish Engulfing — Momentum Shift Confirmed

This is one of my personal favorites.

Sellers print a solid bearish candle.

The next candle fully engulfs the previous body to the upside.

What does this mean?

Sellers gave up.

Not gradually — instantly.

Buyers completely dominate the zone, reclaiming all previous losses and closing strong.

This candle is especially powerful when it forms:

After a pullback into a box range

Near a trendline

After a support/resistance break

Psychologically, it often signals:

The start of the second impulse wave

A strong continuation opportunity

A very clean and reliable trigger when context supports it.

🧱 3) Marubozu — Beginning or End?

Marubozu candles usually appear in two very different places:

At the end of a trend

At the start of a new trend

Understanding which one you’re dealing with is critical.

Signs of a trend-ending Marubozu:

Price reaches major levels (e.g. above 4H Pivot Points)

A long, aggressive trend precedes it

RSI is overextended

Price is near strong support or resistance

Result?

➡️ Expect range or correction, not continuation.

Psychology:

Participants exhausted themselves just to reach the level —

not to break it.

Signs of a trend-starting Marubozu:

Price was previously ranging or boxed

Volume was compressed before the move

RSI is far from extreme levels

Orders accumulated inside the range

The longer price stays inside a range,

the more orders build up — and once released, the move becomes sharp and fast.

🧠 How to Trade Them Properly

End-of-trend Marubozu:

Take profits or close positions.

Start-of-trend Marubozu:

You can enter, but it’s smarter to:

Wait for confirmation

Enter on later triggers with smaller stop loss

Improve R/R ratios

By the way, I’m Skeptic , founder of Skeptic Lab.

I focus on long-term performance through psychology, data-driven thinking, and tested processes.

That’s it.

Now get outta here.

Why 99% of Altcoins Are “Aerotyne”… With a Fan ClubIf you’ve seen The Wolf of Wall Street, you remember that legendary early scene where Jordan Belfort is being told what the stock market really is.

And he gets the most accurate financial definition ever created:

“Fugazi… fugezi… it’s a wazi, it’s a woozy… who gives a f.”*

Now translate that into crypto language and you get:

- Doesn’t matter what the token is called.

- Doesn’t matter what the whitepaper says.

- Doesn’t matter how many buzzwords they stack on top of it like a cursed lasagna.

Because the truth is simple:

It’s not real. It’s smoke. It’s vibes. It’s marketing dressed as math.

And that, my friend, is exactly how 99% of altcoins work.

They’re not investments.

They’re emotions with candlesticks.

The funniest part is that the whole thing has already happened in the movie.

Remember that “Aerotyne” moment?

That random company name no one can pronounce properly?

Aerotyne… Arotine… Aerotine…

It didn’t matter what it was called because he wasn’t selling the stock.

- He was selling the story.

- He was selling the feeling.

- That little dopamine fantasy that whispers: “You’ll pay your morgage.”

That’s basically the entire altcoin market in one sentence.

Now, let me be clear: this isn’t one of those posts where I tell you to “read the whitepaper”, “DYOR”, “be careful guys”, and other sterile advice that sounds smart but doesn’t stop anyone from clicking Buy.

And no, this isn’t coming from bitterness either.

Yes, I’ve lost some money on altcoins last year.

But at least I knew what game I was playing.

- I didn’t marry them.

- I didn’t become their lawyer on Twitter.

- I didn’t start defending my coin like it was my childhood dog.

I took the loss like a man and moved on with one thought:

Alright… enough with small coins.

Because at some point you stop asking “what if it moons?” …and you start asking the adult question: What if it just dies quietly?

And in the altcoin world, that’s not FUD.

That’s not negativity.

That’s just… normal.

Here’s what most people don’t want to admit:

You didn’t buy a coin.

You bought a conversation topic for beer night.

A reason to sit with your friends and pretend you’re not gambling — you’re “investing”.

You bought hours of:

“Bro, have you seen the tokenomics?”

“No, no, you don’t understand… this is Layer 0.”

“Wait, they’re building a new ecosystem!”

“This will change the planet!”

“They’re solving a real-world problem!”

And suddenly you’re not gamblers anymore.

You’re analysts.

Economists.

Visionaries.

You and your friends start comparing coins the way others compare football teams.

Your friend picks one altcoin. You pick another.

And now it’s war.

You defend your token like it’s your club.

He says his coin is better, and you take it personally like he insulted your family name.

“No bro, mine is stronger.”

“Mine has better community.”

“Mine has bigger partnerships.”

“Yours is VC-backed.”

“Mine is organic.”

“Mine is still early.”

Two grown men. Arguing like football fans. Over who chose the better Aerotyne with a modern logo.

That’s what you bought.

Not a coin.

Not an investment.

You bought a social identity.

- A team.

- A badge.

- A belief.

- A conversational piece.

But you also bought something else — something deeper: you bought hope, hope in a dark world.

So when a coin shows up with a clean website, a shiny roadmap, and a promise that sounds like:

“We’re building the future…”

…it doesn’t just hit your wallet.

It hits your psychology.

It hits the part of you that still wants to believe there’s a shortcut to freedom, out the stress, out the routine.

That maybe this is the one thing that finally makes life feel fair.

And there’s nothing wrong with that.

There’s nothing wrong with wanting to believe.

There’s nothing wrong with dreaming.

The problem starts when that hope gets monetized.

Because in crypto, hope isn’t just an emotion.

Hope is a business model.

And yes, some developers are real builders.

But most of them?

- They’re not selling tech.

- They’re selling meaning.

- They’re selling purpose.

- They’re selling belonging.

And trust me — they don’t do it randomly.

They have marketing teams trained in mass psychology.

They understand human behavior better than most traders understand their own charts.

They know:

- people copy influencers,

- people chase excitement,

- people fear missing out,

- people want a tribe,

- people defend what they paid for,

- people confuse “community” with “safety”.

That’s why even dead projects always sound alive.

“Big announcement coming.”

“Major update soon.”

“Partnership incoming.”

“New exchange listing.”

“Something huge is cooking.”

Because the goal isn’t to create value. The goal is to keep hope alive…

And once you see that, you can’t unsee it.

You realize that many altcoins don’t behave like businesses.

They behave like campaigns.

Hype campaigns.

They don’t need revenue.

They don’t need customers.

They don’t even need product-market fit.

They need narrative.

They need a pump.

They need attention.

They need your hope.

And that’s why the new altcoin cycle always looks the same:

The teaser.

The hype.

The “community”.

The influencer wave.

The green candles.

... And then silence.

A slow bleed that turns every proud investor into a long-term philosopher: “I’m holding because I believe in the project.”

No bro.

You’re holding because selling would force you to admit you bought Aerotyne.

So if I had to give one useful piece of advice, it wouldn’t be “DYOR”.

It would be boring.

It would be simple.

It would be this: Trade only big coins .

BTC.

ETH.

SOL.

Use technical analysis.

And most importantly…

Drop the “moon” fantasy.

Because moon trading is not strategy.

Moon trading is religion.

And since I started with a quote, I’ll end with one too.

From the immortals SNAP:

“Don’t believe the hype, it’s a sequel.”

And that’s exactly what most altcoins are.

- Not innovation.

- Not a revolution.

- Not “the next big thing”.

Just a sequel.

An Aerotyne sequel.

An Aerotyne with a community.

An Aerotyne with an X account posting daily optimism.

An Aerotyne with a Telegram group full of people chanting “LFG” while the chart bleeds.

An Aerotyne with a swarm of paid influencers…

…who get copied by thousands of smaller influencers…

…because human psychology never changes:

If you see enough people cheering, you start cheering too.

Even if you don’t know what you’re cheering for.

Even if the coin name sounds like a typo.

Even if deep down you already know…

It’s Fugazi!

BANK OF MAHARASHTRA - DAILY CHART MY VIEW The Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

We do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy K G

Star Cement — The Quiet Phase Before the Next Big Move?📉 Star Cement — Primary Wave-4 & Wave-5 Context (Elliott Wave Study)

This post is an educational Elliott Wave structure study 📚 based on the current weekly and daily chart of Star Cement.

Star Cement completed a strong multi-year advance 🚀 from the 2022 lows, peaking near the ₹308–310 region . This advance shows classic characteristics of a Primary Wave-3 , including strong momentum, broad participation, and a terminal phase near the highs.

After the peak, price behaviour shifted from trending to overlapping and corrective , suggesting the market has transitioned into a Primary Wave-4 phase . Among the common corrective patterns, a Flat (A-B-C) structure currently best explains the price action.

Within this interpretation, Wave A declined from ~₹308 to ~₹245 and showed overlapping characteristics rather than a clean impulse. Wave B retraced weakly toward ~₹270 and lacked impulsive strength, which is typical behaviour within flat corrections. Wave C is currently unfolding with overlapping internal swings and reduced momentum, supporting the view that this is a corrective decline rather than the start of a new impulsive downtrend.

From a structural and Fibonacci perspective 📐, the chart highlights a broader confluence area between ₹195 and ₹205 , corresponding to the 0.618 retracement of the entire Primary Wave-3 and the 1.272 extension of Wave A. An extended confluence area is also visible around ₹185–190 , near the 0.786 retracement of Primary Wave-3. These zones are presented purely as areas of analytical interest where flat corrections often mature, not as signals.

In educational terms 🎓, a Flat-C phase typically ends quietly rather than dramatically . Behaviour consistent with a maturing correction would include price stabilising within the ₹185–205 zone , smaller and overlapping candles, failed breakdown attempts with quick recoveries, and the emergence of a clean directional move away from the zone. In contrast, continuation of the correction would be suggested by impulsive downside expansion below ~₹185 , increasing range and volume on declines, and weak rebounds that remain capped below prior resistance zones.

The projected Primary Wave-5 🔵 (shown in blue on the chart) is included strictly for higher-degree context. Wave-5 scenarios are only studied after Wave-4 has fully resolved and the structure transitions from corrective to impulsive. Historically, Primary Wave-5 advances tend to be more selective, often shorter than Wave-3, and occur only after prolonged consolidation or correction. The Fibonacci extension zones associated with Wave-5 are theoretical reference levels that illustrate how analysts frame potential future paths, not expectations.

At this stage, Star Cement remains in a Primary Wave-4 corrective environment . The focus is on observing structure, momentum, and confirmation rather than anticipating outcomes 🧠. Higher-degree trend continuation can only be discussed after the correction completes and the market clearly proves a change in behaviour.

📉 Star Cement — Blue Wave-4 on Daily Timeframe (Elliott Study)

After the advance into the ₹308–310 zone 🚀, price behaviour shifted from trending to overlapping and corrective , marking the development of blue Wave-4 on the daily chart. This phase is characterised by segmented declines , frequent counter-trend bounces, and fading momentum , rather than impulsive selling.

Blue Wave-4 is interacting with a key ₹195–205 confluence zone 📐, with a deeper reference near ₹185–190 , areas where corrective waves often stabilise. Wave-4 corrections typically resolve quietly through time and overlap ⏳, not sharp reversals.

This study is shared strictly for educational and analytical discussion and does not constitute investment advice ⚠️.

Trading Center: The Dashboard That Changes EverythingStop Drowning in Data. Start Seeing What Matters.

Most traders have 47 browser tabs open, three charting platforms running, and still miss important information.

The problem isn't lack of data. It's lack of organization.

A well-designed trading dashboard transforms chaos into clarity — showing you exactly what you need, when you need it.

Why You Need a Dashboard

The Problem:

Information scattered across platforms

Important data buried in noise

Constant tab-switching and distraction

Missing signals while looking elsewhere

Decision fatigue from information overload

The Solution:

A centralized dashboard that:

Shows key metrics at a glance

Alerts you to important changes

Reduces cognitive load

Keeps you focused on what matters

Dashboard Components

1. Market Overview Panel

What to Include:

Major indices (SPY, QQQ, IWM)

Key sectors

VIX/volatility

Market breadth

Futures if relevant

Purpose:

Understand overall market context before any trade.

2. Watchlist Panel

What to Include:

Your active watchlist

Current price and change

Key levels (support/resistance)

Volume vs average

Alerts status

Purpose:

Track potential opportunities without switching screens.

3. Open Positions Panel

What to Include:

All current positions

Entry price and current price

P&L ($ and %)

Stop loss and target levels

Time in trade

Purpose:

Monitor all positions at a glance.

4. Risk Dashboard

What to Include:

Total portfolio exposure

Open risk ($ at risk)

Daily P&L

Drawdown from peak

Correlation warnings

Purpose:

Never lose track of your risk.

5. Economic Calendar

What to Include:

Upcoming economic events

Earnings dates for watchlist

Fed meetings

Major news events

Purpose:

Avoid being surprised by scheduled events.

6. Performance Metrics

What to Include:

Win rate (recent and overall)

Average R-multiple

Profit factor

Current streak

Monthly P&L

Purpose:

Track performance without opening spreadsheets.

7. Alerts and Notifications

What to Include:

Price alerts

Indicator alerts

News alerts

Risk threshold warnings

Purpose:

Get notified of important events without constant monitoring.

Dashboard Design Principles

Principle 1: Hierarchy of Information

Most important information should be most visible.

Critical data: Large, prominent

Supporting data: Smaller, secondary

Reference data: Available but not distracting

Principle 2: Reduce Noise

Only include what you actually use.

If you haven't looked at it in a week, remove it

Every element should serve a purpose

White space is valuable

Principle 3: Consistent Layout

Same information in same place every time.

Build muscle memory

Reduce search time

Faster decision making

Principle 4: Color Coding

Use color meaningfully.

Green: Positive/bullish

Red: Negative/bearish

Yellow: Warning/attention

Neutral: Normal state

Principle 5: Real-Time Where Needed

Not everything needs to update every second.

Price data: Real-time

Performance metrics: Daily update fine

Economic calendar: Daily update fine

AI-Enhanced Dashboards

1. Smart Alerts

AI filters alerts to show only significant ones:

Unusual volume

Pattern completions

Correlation changes

Risk threshold approaches

2. Anomaly Detection

AI highlights unusual conditions:

Abnormal price movements

Unusual options activity

Sentiment shifts

Correlation breakdowns

3. Predictive Insights

AI provides forward-looking information:

Expected volatility

Probability of hitting targets

Risk scenario analysis

4. Personalized Recommendations

AI suggests based on your patterns:

Best times to trade

Setups matching your edge

Risk adjustments needed

Building Your Dashboard

Option 1: TradingView Layout

Multiple chart layout

Watchlists

Alerts

Limited customization but integrated

Option 2: Spreadsheet Dashboard

Google Sheets or Excel

Pull data via APIs or manual

Highly customizable

Requires maintenance

Option 3: Dedicated Dashboard Tools

Notion, Airtable

Trading-specific tools

More features, learning curve

Option 4: Custom Build

Python + visualization libraries

Maximum flexibility

Requires coding skills

Dashboard Checklist

Before Market Open:

Check market overview (futures, indices)

Review economic calendar

Check open positions

Review watchlist for setups

Verify alerts are set

During Trading:

Monitor open positions

Track risk exposure

Watch for alerts

Note market context changes

After Market Close:

Review daily P&L

Update performance metrics

Adjust watchlist

Set alerts for tomorrow

Dashboard Mistakes

Too Much Information — Cramming everything onto one screen. Only include what you actually use daily.

No Hierarchy — Everything same size and prominence. Make critical information stand out.

Inconsistent Layout — Moving things around constantly. Set a layout and stick with it.

Ignoring Mobile — No way to check when away from desk. Have a simplified mobile version.

Not Updating — Dashboard becomes stale and ignored. Regular review and refinement.

Sample Dashboard Layout

Top Row: MARKET OVERVIEW — SPY, QQQ, IWM, VIX at a glance

Left Column: WATCHLIST — Your opportunities with price, change, key levels

Center: OPEN POSITIONS — All positions with P&L, stops, targets

Right Column: RISK DASHBOARD — Exposure, open risk, drawdown

Bottom Left: ALERTS — Price alerts, indicator alerts, warnings

Bottom Right: CALENDAR — Today's events, upcoming earnings

Key Takeaways

A dashboard transforms scattered information into organized clarity

Include only what you actually use — less is more

Design with hierarchy — critical information most prominent

Consistency builds speed — same layout every day

Regular refinement keeps the dashboard useful

Your Turn

What does your current trading setup look like?

What information do you wish you could see at a glance?

Share your dashboard ideas below 👇

Finding Edge Where Others Aren't Looking

The Best Traders Aren't Just Looking at Charts Anymore

While most traders stare at the same charts, indicators, and news feeds...

A new breed of traders is counting cars in parking lots from space, tracking shipping containers across oceans, and analyzing millions of social media posts.

This is alternative data - and it's changing who has the edge.

What Is Alternative Data?

Definition:

Alternative data is any data used for investment decisions that isn't traditional financial data (price, volume, earnings, etc.).

Traditional Data:

Price and volume

Financial statements

Earnings reports

Economic indicators

Analyst ratings

Alternative Data:

Satellite imagery

Social media sentiment

Web traffic and app usage

Credit card transactions

Geolocation data

Weather patterns

Job postings

Patent filings

And much more...

Types of Alternative Data

1. Satellite and Geospatial Data

What It Tracks:

Retail parking lot traffic

Oil storage tank levels

Crop health and yields

Shipping and logistics

Construction activity

Example:

Count cars in Walmart parking lots before earnings.

More cars = more sales = potential earnings beat.

Edge: Information before it appears in financial reports.

2. Social Media and Sentiment Data

What It Tracks:

Brand mentions and sentiment

Product buzz

Consumer complaints

Viral trends

Influencer activity

Example:

Track sentiment around a new product launch.

Negative sentiment spike = potential sales disappointment.

Edge: Real-time consumer reaction before sales data.

3. Web Traffic and App Data

What It Tracks:

Website visits

App downloads and usage

Search trends

E-commerce activity

User engagement

Example:

Track app downloads for a gaming company.

Declining downloads = potential revenue miss.

Edge: Usage data before quarterly reports.

4. Transaction Data

What It Tracks:

Credit card spending

Point-of-sale data

E-commerce transactions

Consumer behavior patterns

Example:

Aggregate credit card data shows spending at restaurants declining.

Restaurant stocks may underperform.

Edge: Spending patterns before earnings.

5. Employment and Job Data

What It Tracks:

Job postings

Hiring trends

Layoff announcements

Glassdoor reviews

LinkedIn activity

Example:

Company suddenly posts many engineering jobs.

Could indicate new product development.

Edge: Corporate strategy signals before announcements.

6. Supply Chain Data

What It Tracks:

Shipping container movements

Port activity

Supplier relationships

Inventory levels

Logistics patterns

Example:

Track shipping from key suppliers to Apple.

Increased shipments before product launch = strong demand.

Edge: Supply chain signals before sales data.

How AI Processes Alternative Data

Challenge:

Alternative data is:

Massive in volume

Unstructured (images, text, etc.)

Noisy

Requires specialized processing

AI Solutions:

1. Computer Vision

Analyzes satellite imagery

Counts objects (cars, ships, tanks)

Detects changes over time

2. Natural Language Processing

Processes social media text

Extracts sentiment

Identifies trends and topics

3. Machine Learning

Finds patterns in transaction data

Predicts outcomes from alternative signals

Combines multiple data sources

4. Time Series Analysis

Tracks changes over time

Identifies anomalies

Forecasts future values