Parabolic Moves Don’t Always End in Collapse — Silver ExplainedI’ve seen many analyses from my colleagues where 1980 and 2011 are used not as upside projections, but as collapse templates for silver.

The argument is simple and visually convincing: silver has already gone parabolic, therefore the next chapter must be a collapse similar to those historical episodes.

I understand the logic.

I don’t predict the future, and I can’t categorically deny that such an outcome is possible.

But here’s where I draw a clear line: similar-looking charts do not guarantee similar outcomes, especially when the underlying drivers are fundamentally different.

And in silver’s case, they are different.

Let’s be precise about what 1980 really was (and why it collapsed)

The 1980 silver collapse is often treated as a “natural law of parabolic moves”.

In reality, it was not a natural market outcome.

It was the direct consequence of extreme concentration and leverage, driven by the Hunt brothers.

What made 1980 fragile by design

- The Hunts accumulated an extraordinary share of the global silver supply, both physical and paper.

- They used massive leverage in a relatively small and illiquid market.

- The price did not rise because global demand structurally changed — it rose because supply was artificially constrained.

- Once exchanges changed the rules (margin hikes, liquidation-only trading), the entire structure collapsed under its own weight.

This is critical:

The collapse of 1980 was not caused by silver being “too expensive”.

It was caused by the system forcibly unwinding a concentrated position.

So when someone says “this looks like 1980”, the real question is:

- Where is today’s equivalent of that concentration?

- Who controls 30–40% of deliverable supply?

- What single entity is forced to liquidate?

If that element is missing, then the collapse logic weakens dramatically.

2011: parabolic, yes — structurally unstable, also yes

2011 is a more honest comparison, and this is where many collapse arguments focus.

Silver:

- rallied aggressively,

- became a retail darling,

- and eventually collapsed hard.

But again, the reason it collapsed matters.

Why 2011 unraveled

- The rally was dominated by financial demand, not structural necessity.

- ETFs, leverage, and macro fear created fast money flows.

- When liquidity tightened and risk appetite faded, demand evaporated quickly.

- There was no structural constraint on supply forcing price stability.

In other words:

- 2011 collapsed because demand was reversible.

- Once sentiment flipped, there was nothing underneath to slow the fall.

Now comes the disagreement: why I don’t expect a 1980/2011-style collapse this time

Yes — I fully agree on one thing: extreme volatility is coming, or is already here (yes, more extreme than we've seen!)

Silver doesn’t trend quietly. It never has.

But volatility and collapse are not the same thing.

The key difference today: the type of demand

Today’s silver market is not driven solely by:

- fear,

- speculation,

- or monetary narratives.

A large and growing portion of demand is industrial and strategic:

- electrification,

- energy transition,

- technology infrastructure.

That demand:

- doesn’t disappear overnight,

- doesn’t panic-sell because RSI is overbought,

- and doesn’t care about chart symmetry.

This changes the downside dynamics.

Supply cannot respond the way people assume

Another overlooked point:

- most silver production is a by-product of other metals.

- higher prices do not instantly bring new supply online.

In 1980 and 2011, supply dynamics were not a binding constraint.

Today, they are.

That doesn’t mean price can’t drop — it means drops are more likely to be violent corrections, not structural collapses.

About the “parabolic = must collapse” logic

This is where I respectfully disagree with many analysts.

A parabolic move tells you:

- volatility is increasing,

- positioning is crowded,

- risk management becomes essential.

It does not automatically tell you:

- the entire move must fully retrace,

- or that price discovery was fake.

Markets can:

- correct through time instead of price,

- form wide ranges,

- or retrace partially and rebase.

History offers multiple outcomes, not a single script.

My base case (clear and unemotional)

- Yes, I expect extreme swings.

- Yes, I expect sharp pullbacks that will scare most participants.

- No, I do not see a clear mechanism today for a 1980-style forced collapse.

- And unlike 2011, I don’t believe demand disappears just because momentum cools.

This is not optimism.

It’s structure-based reasoning.

Trading perspective (grounded)

Because I expect volatility:

- I don’t chase vertical candles.

- I respect levels, not narratives.

- I scale, I take partial profits, and I allow room for noise.

- I treat silver as a dangerous instrument, not a lottery ticket.

Being right about direction is useless if volatility kicks you out first.

Final thought

My colleagues may be right — markets can always surprise.

But assuming collapse just because the chart looks familiar is lazy analysis.

1980 collapsed because of forced concentration unwind.

2011 collapsed because of reversible financial demand.

Today, silver is volatile — not hollow.

And that distinction matters more than any historical overlay.

The market will decide.

My job is to respect risk, not marry analogies 🚀

Best of luck!

Mihai Iacob

Educationalpurpose

Radio Yerevan: Is Crypto the Biggest Wealth Transfer in History?Answer: Yes. But not in the direction people hope.

In the last decade, crypto marketing has repeated one grand promise:

“This is the biggest wealth transfer in human history!”

And in classic Radio Yerevan fashion, this statement is both true and misleading.

Yes — a historic wealth transfer took place.

No — it did not empower the average investor.

Instead, it efficiently moved wealth from retail… back to the very entities retail thought it was escaping from.

Let’s break it down: structured, clear, and with just the right amount of irony.

1. The Myth: A Decentralized Financial Uprising

The early crypto narrative was simple and beautiful:

- The people would reclaim financial independence.

- The system would decentralize power.

- Wealth would flow from institutions to individuals.

The idea was inspiring — almost revolutionary.

Reality check: Revolutions are expensive.

And someone has to pay the bill.

In crypto’s case, the average investor volunteered enthusiastically.

2. The Mechanism: How the Transfer Actually Happened

To call crypto a wealth transfer is not an exaggeration.

The numbers speak loudly:

Total market cap peaked above $3+ trillion.

Most of the profit was extracted by:

- VCs who bought early,

- teams with massive token allocations,

- exchanges capturing fees on every trade,

- and whales who mastered liquidity cycles.

Retail investors, meanwhile, contributed:

- capital,

- liquidity,

- hope,

- hype

- and a remarkable tolerance for drawdowns.

It was, in essence, the perfect economic loop:

money flowed from millions → to a concentrated few → exactly like in traditional finance, only faster and with better memes.

3. The Irony: A Centralized Outcome From a Decentralized Dream

Here lies the great contradiction:

Crypto promised decentralization. Tokenomics delivered centralization.

When 5 wallets hold 60% of a token’s supply, you don’t need conspiracy theories — you need a calculator.

The “revolution” looked more like:

- Decentralized marketing

- Centralized ownership

- Retail-funded exits

- And a financial system where “freedom” was defined by unlock schedules and vesting cliffs

But packaged correctly, even a dump can look like innovation.

4. Why Retail Was Doomed From the Start

Not because people are unintelligent, but because:

- No one reads tokenomics.

- Unlock calendars sound boring.

- Supply distribution charts kill the romance.

- Liquidity mechanics are not as exciting as „next 100x gem”.

- And hype travels faster than math.

In a speculative market, psychology beats fundamentals until the moment fundamentals matter again — usually when it's too late.

5. The Real Wealth Transfer: From “Us” to “Them”

The slogan said:

“Crypto will redistribute wealth to the people!”

The chart said:

“Thank you for your liquidity, dear people.”

The actual transfer looked like this:

- Retail bought the story.

- Institutions created the tokens.

- Retail bought the bags.

- Institutions sold the bags.

- Retail called it a correction.

- Institutions called it a cycle.

Everyone had a term for it.

Only one group had consistent profits from it.

6. So, Was It the Biggest Wealth Transfer in History?

Yes.

But not because it made the average investor rich.

It was the biggest because:

- no previous financial system mobilized so many people

- so quickly

- with so little due diligence

- to transfer so much capital

- to so few beneficiaries

- under the banner of liberation.

It wasn’t a scam.

It wasn’t a conspiracy.

It was simply financial physics meeting human psychology.

7. The Lesson: Crypto Isn’t the Problem — Expectations Are

- Blockchain remains a brilliant invention.

- Tokenization has real use cases.

- DeFi is a groundbreaking paradigm.

- And so on

The issue wasn’t the technology.

It was the narrative that convinced people that buying a token was equivalent to buying financial freedom.

Real freedom comes from:

- understanding liquidity,

- reading tokenomics,

- respecting supply dynamics,

- and asking the only question that matters:

“If I’m buying… who is selling?”

In markets — especially crypto — this question is worth more than any airdrop.

8. Final Radio Yerevan Clarification

Question: Will the next crypto cycle finally deliver the wealth transfer to the masses?

Answer: In principle, yes.

In practice… only if the masses stop donating liquidity.

Gold’s recent rollercoaster- A Lifetime of LessonsThere are plenty of lessons to take from Gold’s recent rollercoaster — lessons about volatility, psychology, and how easily conviction can turn into chaos.

But before we get into technicalities, let’s look at what really happened… and what it means for us as traders.

________________________________________

1️⃣ The Illusion of Strength

When Gold went straight from 4000 to 4400 in just a few days, the move looked unstoppable.

Social media was full of confidence — “China is buying”, “5k incoming”, “This is the new era for Gold.”

But markets don’t move in straight lines forever.

Every parabolic rise eventually collapses under its own weight.

And when it does, it doesn’t just destroy buy positions — it destroys false convictions.

The first lesson?

Moves that look too strong to fade are usually too weak to sustain.

________________________________________

2️⃣ Confidence Can Be Expensive

Believing too much in one direction — especially when price already exploded (see the rise from 3300 to 4k in one month) — is one of the fastest ways to lose money.

A trader who bought at 4350 because he was “sure” China would keep buying quickly learned how expensive “sure” can be.

The market doesn’t reward conviction.

It rewards discipline, flexibility, and risk control.

Confidence without control is just another form of gambling.

________________________________________

3️⃣ Trading ≠ Investing

This move also reminded everyone of a fundamental truth:

You are not China.

China buys Gold as a store of value, not as a speculative trade.

They bought at 2500, 3k, 3.5k and 4400 — not to take profit in two days, but to build long-term reserves.

You, as a trader, operate in a completely different universe.

Mixing trading logic with investment narratives is a silent killer.

You might tell yourself, “If China buys, I’m safe.”

But China doesn’t use a stop loss and don't trade in margin (use laverage),— YOU DO.

If you don’t understand the difference, better stay on the sidelines and watch.

At least you won’t lose money while learning the hard way.

And if you want a more down-to-earth comparison — my mother started buying Gold in the early ’70s, as a store of value through the communist period.

She bought through the gold bubble of the late 1970s, bought at the bottom afterward, continued through the 1990s, and kept doing it until she retired in 2005.

She wasn’t trading — she was preserving value.

That’s what investing is.

What we do here, every day, is something entirely different.

________________________________________

4️⃣ Right vs. Wrong? It’s Not About That

And now that we’ve made the distinction between investing and trading clear,we must also understand something even more important:

Trading is not about being right or wrong — it’s about timing, money management, and perspective.

Let’s take a few real examples from last few day's chaos:

• On Friday, if you bought at 4275 and the price spiked overnight, you could’ve closed with 1000 pips profit — you were “right.”

• But if someone else sold at 4370 during that same night, they were also “right,” catching the drop.

• If you had bought the dip from the all-time high, around 4300, you’d likely be down 1000 pips in drawdown quickly same Friday — and let’s be honest, who really holds that?

• If you sold at 4300 on Monday near resistance, you would have been stopped out as price revisited the ATH — even though your direction was correct eventually.

• Likewise, if you bought yesterday at 4200 during the drop, you’d have been liquidated on the next 2000-pip fall. And if Gold now rises again to 4400 or even 5000 — how does that help you?

Obviously, these are illustrative examples, just to express the point — not literal trades.

And for those who commented under previous posts — either out of boredom or the need to contradict — I have two things to say:

1️⃣ If you don’t understand what I just explained, you have no business being in trading.

2️⃣ If you do understand but still feel the urge to argue, your comment is nothing more than trolling and emotional projection.

Because this isn’t about numbers or ego — it’s about understanding how the market really works, beyond the noise and the narratives.

________________________________________

5️⃣ The Real Lesson

The 4000–4400 move wasn’t just a chart pattern.

It was a psychological test — a reminder that the market exists to expose overconfidence.

When something looks “certain,” that’s usually when it’s most dangerous.

In trading, survival matters more than prediction.

And sometimes, the smartest trade is no trade at all.

________________________________________

6️⃣ Final Thoughts

Gold’s rollercoaster taught more than a dozen books on trading psychology ever could.

It reminded us that:

• Parabolic moves end violently.

• Overconfidence without a stop loss is suicide.

• You’re not an investor — you’re a trader.

• Being “right” means nothing without timing.

• And sometimes, the best position is to stay out.

The market didn’t just move from 4000 to 4400 and back.

It moved through the hearts and minds of every trader watching it —and left behind a few lessons worth remembering for a lifetime.

Why I Didn’t Buy Gold in the Last Few WeeksI’ve been bullish on gold since the beginning of the year — expecting it to reach $3000, and in a very optimistic scenario, maybe even $3500. My previous posts are proof of that.

But I definitely wasn’t expecting $4000, and certainly not $4200, for one simple reason:

Some time ago, my crystal ball broke, and since then I’ve been trying to base my trades on technical analysis and what I’ve actually seen happen in the past — not on wishful thinking.

________________________________________

When Price Doesn’t Correct, But You Still Profit Selling

Ever since gold hit the $3700–$3800 zone, I’ve been expecting a correction.

It never came.

Even so, I still made money selling against the trend — something I usually avoid and definitely don’t recommend anyone to do.

But this post isn’t about my trades. It’s about why I didn’t buy gold in the last two or three weeks.

And the answer is right there — on the chart.

________________________________________

The Chart Tells the Truth

If you look closely, you’ll see yellow rectangles highlighting the sharp drops that happened during this period.

It’s easy to look at the chart after the fact and say:

“I should’ve bought there.”

But imagine you don’t see the right side of the chart.

You’re sitting in front of your screen, looking at the current price, trying to decide what to do.

And then — within minutes — gold drops 700-800 pips out of nowhere.

No signal. No alert on WhatsApp. No warning.

Where do you put your stop?

Do you trade without one?

Just because you know it will bounce?

And what if it doesn’t?

What if it drops another 1000 pips — the same way it just did — without even breathing?

That’s not trading. That’s hope disguised as confidence.

________________________________________

This Is an Exercise in Honesty

This is an exercise in honesty with yourself — not after you’ve seen the chart.

How many of you would’ve stayed in a position that’s -500 pips, just because you “know” it will turn around?

Even now, right after I finished recording the video, it dropped another 500+ pips like it was nothing.

I’ve explained this a thousand times:

1. If a trade is not there, it’s not there. Period.

I don’t force it. I don’t FOMO.

2. A trade must have a clear entry, stop, target — and most importantly, a reason.

“Gold is rising, can’t you see?” is not a reason. It’s FOMO.

________________________________________

If You Want to Be a Real Trader, Remember This

1. The market has two directions, even when it looks like it only has one.

2. In aggressive trends, even my cat becomes a great trader.

3. Every trade must have a clear reason. If it doesn’t, and you enter just because “it’s going up”, that’s FOMO — and we all saw what happened to crypto in 2021. People are still waiting for the mythical altcoin season, while some are still 70- 90% down on the bag

4. We’re all geniuses after seeing the chart: “should’ve bought there, closed there…”

5. The only real truth is in your equity — and mine is higher, even though I’ve been selling.

6. I can guarantee there are gold bulls reading this right now who lost money on long positions over the past month.

7. In the end, it all comes down to money management and timing.

________________________________________

Conclusion:

Trading isn’t about being bullish or bearish.

It’s about being disciplined, timing and money management; the rest is can-can, and "I told you so"

P.S. Once again, I’m looking to sell — and if it works out like my last five trades, that’s perfectly fine with me.

At the club, they don’t ask whether I paid for my champagne with profits from buying or selling gold. 🍾

Being Devil’s Advocate on the “Big Reset” NarrativeI’ll start by saying this clearly: I hold a portfolio of altcoins right now, and honestly, I hope every influencer is right this time.

I want the market to recover. I want the reset story to be real.

But as I scroll through social media, I can’t help noticing how my feed is once again flooded with the same old enthusiasm —“The Big Reset happened!”, “This was the flush we needed!”, “Now it’s time to the moon!”

It’s hard not to feel a sense of déjà vu.

Because every time, the same narrative returns: "now it's time to buy", and the same faces repeat it.

And when everyone suddenly agrees on one explanation — that’s exactly when I prefer to be the devil’s advocate.

________________________________________

Friday’s Crypto Crash: What Actually Happened?

Last Friday, the crypto market went through what many now call “The Big Reset.”

Around $20 billion in leveraged positions were liquidated in hours. Bitcoin dropped more than 10%, and most altcoins went way lower.

The event exposed how fragile the market structure is when leverage, liquidity, and optimism align in the wrong way.

It wasn’t surprising that it happened — it was surprising how easily it happened.

The structure that seemed solid only days before crumbled in a few hours.

Now, the new collective story is that this was the great cleansing — the painful but necessary flush before the next bull run.

But let’s pause: is it really that simple?

________________________________________

The “Big Reset” Narrative

Those who promote the reset idea usually say:

1. Leverage purge: The overleveraged traders are gone, giving the market a clean slate.

2. Healthy structure: Open interest dropped, risk is reduced, and the base is stable again.

3. Cycle logic: Every bull market needs a correction — this was simply the reset before new highs.

It’s an appealing story — it makes the pain feel meaningful.

But just because a story feels good doesn’t mean it’s true; in fact, most of the time it is not

________________________________________

Why am I starting to be skeptical?

1. The same voices, the same narrative

The people calling this “the Big Reset” are often the same ones who have been announcing “altcoin season” for two years straight.

Their optimism is permanent, not analytical; they only have ONE IDEA

2. Reset ≠ recovery

Purging leverage doesn’t automatically bring in new capital.

It doesn’t attract institutions, fix liquidity, or change macro conditions. It just resets the scoreboard.

3. No such thing as free money

The idea that “now it must go up” assumes a law of easy profits. But if markets rewarded wishful thinking, no one would lose.

I don’t believe in free meals — and definitely not in free money.

4. Survivor bias

After every big drop, a few traders claim, “That was the bottom.” The rest remain stuck or silent. History is written by survivors.

5. Liquidity remains fragile

After big volatility, liquidity providers retreat. The market becomes thinner and more unstable.

It takes time — and real inflows — before confidence rebuilds.

________________________________________

The Devil’s Advocate View

What if this wasn’t a reset at all — but a warning?

• Maybe it’s a sign of deeper structural weakness.

• Maybe this is the start of a longer, grinding correction rather than a quick purge.

• Maybe the “reset” narrative is just a way to make pain sound constructive — a psychological shield against pain.

In short, what if the “Big Reset” is just another feel-good illusion for traders who need to stay hopeful?

________________________________________

Between Hope and Reality

The truth is that no one knows.

Markets don’t move on declarations — they move on flows, liquidity, and psychology.

So the best we can do is stay realistic:

• Observe, don’t assume.

• Manage risk and emotions.

• Watch key levels and volume, not influencers.

• Accept uncertainty as part of the job.

If the reset truly happened, we’ll see it in structure, trend, and sustained strength — not in hashtags or memes.

________________________________________

Final Thoughts: No Free Lunch, No Free Money

I’d love to be wrong on this one.

I’d love for the market to stabilize and climb again.

But history tells me to be cautious.

Every time the crowd agrees that “this was it”, the market finds a way to humble everyone.

So until proven otherwise, I’ll stay the devil’s advocate —because in trading, skepticism isn’t negativity; it’s survival.

Ascending channels trading applied to Gold current situation🔼 Ascending Channel – Explained Simply

An ascending channel is a bullish pattern — but not always a bullish ending.

It shows a market climbing step by step between two parallel rising lines:

the lower trendline (support) and the upper trendline (resistance).

🧠 Market Psychology

Buyers dominate, but sellers still show up at every swing high.

Each dip gets bought, keeping the trend alive —

until one side finally breaks the rhythm.

⚙️ How to Trade It

• Inside the channel:

Buy near the lower rail, take profit near the upper rail.

• Breakout play:

Go long on a confirmed close above resistance,

or short on a clean break below support.

• Stops:

Just outside the opposite rail — below support for longs, above resistance for shorts.

• Targets:

Use the channel height projected from the breakout point.

⚠️ What to Watch Out For

• False breakouts happen often.

• Too-steep channels usually fail faster.

• Volume must confirm — low volume = fake strength.

• Statistically, breakdowns occur slightly more often than breakouts.

________________________________________

Key takeaway:

An ascending channel isn’t a promise of a bull run —it’s a structured climb that eventually ends.

Trade the rhythm, not the hope. 🎯

Statistically, in 57% of cases, up channels are broken to the downside

Gold now situation: the recent 1k pips is way-way-way to steep

Confirmation came with a drop under 3950 zone

Usually, in the case of such a steep channel, all the move is negated, so a drop to the 3850 zone.

However 3900 zone is strong support now, so a break under 3950 zone could lead to "only" a drop to this support.

Stop Losses: The Good, The Bad and The UglyLet’s be honest — few things trigger more emotion in trading than a stop loss being hit.

But not all stop losses are created equal.

Even though the title says “The Good, the Bad, and the Ugly”, let’s start with the Bad — because that’s where most traders get stuck.

________________________________________

🚫 The Bad Stop Loss

The bad stop loss is the arbitrary one.

You know the type:

“I trade with a 50-pip stop loss.”

“My stop is always 1% below entry.”

No matter what the chart looks like.

No matter what the volatility of the asset is.

No matter if you’re trading Gold, EurUsd, or Nasdaq.

This kind of stop loss doesn’t respect market structure or context — it’s just a random number.

You might get lucky a few times, but over the long run, it’s a losing game.

If your stop loss doesn’t make sense on the chart, then it doesn’t make sense in the market either.

There’s no nuance here — it’s bad, period.

________________________________________

✅ The Good Stop Loss

The good stop loss is strategic.

It’s placed based on structure, volatility, and logic — not habit or emotion.

You define it after you’ve studied:

• Where invalidation occurs on your idea

• The volatility range of the asset

• The natural “breathing room” of the market

When this kind of stop loss is hit, it’s not a tragedy.

It’s information.

It means your prediction was wrong.

You expected the market to go up, but it went down — simple as that.

No panic. No revenge trading.

You step away, clear your mind, and wait until the next day.

Then, you redo your analysis without bias.

If the new structure confirms that the market has truly flipped direction — then, and only then, you can trade the opposite way.

That’s professionalism.

That’s how you stay consistent.

________________________________________

😬 The Ugly Stop Loss

Now, this one hurts.

The ugly stop loss is the good stop loss that gets hit… and then the market reverses immediately.

You were right — but your stop was just a little too tight.

That’s the emotional pain every trader knows.

But here’s the key:

This situation only counts as ugly if your original stop loss was good — meaning, logical and based on structure.

If it was arbitrary, then it’s not ugly — it’s just bad.

So, what do we do when a good stop loss turns ugly?

We do exactly the same thing:

• Wait until the next day.

• Reanalyze the chart with fresh eyes.

• If the setup is still valid, re-enter in the original direction.

It’s rare for both the first and second stop to be “hunted.”

Patience gives you clarity — and clarity gives you edge.

________________________________________

💭 Final Thoughts

Stop losses aren’t just a risk tool — they’re a psychological mirror.

They reveal whether you trade with emotion or with structure.

The bad stop loss shows a lack of respect for the market.

The good stop loss shows discipline and logic.

The ugly one shows that even good decisions can lead to short-term pain.

But pain is not failure — it’s feedback.

So the next time your stop gets hit, don’t see it as punishment.

See it as a test of your ability to stay rational when the market challenges you.

Because in the long run, consistency doesn’t come from winning every trade.

It comes from handling the losing ones correctly. ⚖️

Trading: The Most Relative Profession in the WorldIntroduction

Most professions operate within clear boundaries of right and wrong, success and failure. A doctor either saves the patient or doesn’t. An engineer either builds a stable bridge or one that collapses. But trading doesn’t work like that.

In trading, “being right” and “being wrong” are relative. Two traders can look at the exact same market, take opposite positions, and both can be right. At the same time, they can both be wrong. This relativity is what makes trading not only fascinating, but also psychologically challenging.

________________________________________

Why “Being Right” Is an Illusion in Trading

Many traders fall into the trap of needing to be right. They celebrate when their forecast matches the price action, and they criticize others when opinions diverge. But trading isn’t about intellectual debates — it’s about execution, timing, and money management.

You can make the perfect call, but if you enter at the wrong time or exit poorly, you still lose. Conversely, you can be “wrong” in your forecast, yet still make money because you managed your trade correctly.

________________________________________

A Real Example: Gold’s Price Action Yesterday

Take gold, for instance:

• Trader A says: “Gold will rise.”

• Trader B says: “Gold will fall.”

Who is right? The answer is not straightforward.

• Gold made a new all-time high during the day — Trader A can claim victory.

• Gold sold off after — Trader B can also claim victory.

But here’s the twist:

• Trader A was wrong if he bought at the very top before the selloff.

• Trader B was wrong if he sold too early at 3860 before the new ATH.

This example shows how trading doesn’t operate in absolutes. The market gives both validation and punishment, depending not only on the direction, but also on timing and execution.

________________________________________

Timeframe Relativity: Scalper vs. Swing Trader

This relativity becomes even more visible when we compare a scalper with a swing trader — in fact, this is where it shows itself most clearly.

Consider this scenario:

• The scalper buys against the larger trend, catching a quick 50-pip bounce from intraday volatility.

• The swing trader sells with the dominant trend, holding for several days and capturing 300 pips once the broader move unfolds.

At first glance, their positions contradict each other. One is long, the other is short. Yet both can be right — and both can make money — simply because they operate on different timeframes, with different objectives and risk tolerances.

Don’t believe me? Here’s a real and concrete example: back in 2022, I shorted BTC heavily and made strong profits. At the same time, a good friend of mine kept buying into weakness and applying a DCA strategy.

Who was right?

The answer, again, is relative. I was right in the medium term — profiting from the bearish momentum. My friend was right in the long term — building a position that paid off when the market eventually recovered.

This is the purest example of relativity in trading: the same market, moving in both directions, rewarding two very different strategies.

________________________________________

The Key Lesson

Trading is not about proving a point. It’s not about winning an argument on social media or showing that your market call was correct. It’s about managing trades in a way that consistently extracts profits, regardless of who “guessed” the move better.

The market doesn’t reward opinions. It rewards discipline and risk control. Always remember:

• Entries are relative.

• Exits define success.

• Risk is king. A “right” prediction with poor risk management can still end in disaster.

In other words: you don’t get paid for being right — you get paid for good execution and risk management.

________________________________________

Why Relativity Matters

Understanding the relativity of trading helps in three ways:

1. It kills the ego. You stop caring about being right and start caring about making money.

2. It reduces conflicts. Another trader’s opposite view doesn’t threaten yours; both can co-exist.

3. It shifts focus. The conversation moves from “Was I right?” to “Was my trade profitable?”

________________________________________

Conclusion

Trading is the most relative profession in the world because “truth” in markets is never absolute. Two traders can both be right, both be wrong, or both at once.

What separates successful traders from the rest is not their ability to “predict,” but their ability to trade with discipline, adapt to changing conditions, and manage risk.

In the end, the scoreboard is your trading account — not your pride in being right. 🚀

XAUUSD 2025: Recalibrate Your Thinking or You Won’t SurviveThesis: If you don’t recalibrate your volatility expectations for Gold, you won’t survive this market. What felt like a “big move” in 2021 is just noise in 2025.

________________________________________

1) Context: What Actually Happened (2020 → 2025)

• 2020–2023: Gold largely oscillated in a broad range around the $1,700–$2,000 handles (with occasional spikes beyond). Many traders anchored their risk and target expectations to this regime.

• March–April 2024: A decisive breakout to fresh all-time highs shifted the regime from compression to expansion.

• Late August 2025: Price broke out of a symmetrical triangle around the ~3330 zone and then advanced near-vertically into late September, ushering in a burst of exceptional volatility.

Bottom line: The market transitioned from a four-year consolidation into a powerful expansion phase. Your playbook must evolve accordingly.

________________________________________

2) Volatility Math: Same %, Bigger Dollars → Bigger “Pips”

Many retail platforms quote XAUUSD so that 1 pip ≈ $0.10. Using that convention:

• In the $1,900–$2,000 environment, a 2% move ≈ $38–$40 → 380–400 pips.

• At $3,300–$3,800, the same 2% ≈ $66–$76 → 660–760 pips.

So those “300–400 pip moves” you treated as significant in 2021 or2022 are structurally too small for 2025.

In expansion phases, 1,000+ pip swings are perfectly normal.

Key takeaway: If price doubles, absolute fluctuations for the same percentage move roughly double too. Stop using yesterday’s pip yardstick.

________________________________________

3) Why Recalibration Matters

The market is not static. Traders who survive across cycles are those who adapt to new volatility regimes. Anchoring to outdated benchmarks—whether in pips, percentage moves, or psychological comfort zones—leads to poor decisions.

It is not enough to have a strategy. You need the right frame of reference for volatility, risk, and expectations.

A system built for a $1,800 gold market cannot simply be copied and pasted into a $3,500 gold market without adjustment.

________________________________________

4) The Psychological Shift

Recalibration is not only technical but also mental:

• Old anchors: What once felt like a big move is now an intraday fluctuation.

• Risk perception: A number that once signaled danger may now be just routine volatility.

• Flexibility: The willingness to redefine “normal” is the mark of a trader who lasts.

This is not abstract theory. For example, I started writing this article when Gold was trading at 3860. By the time I reached this paragraph, price had already dropped to 3815, after making a low at 3810—an almost 700-pip drop from today’s all-time high in just three hours.

By the time you read this, it may be trading at a completely different level. That’s the reality of expansion volatility.

And here’s the perspective shift: these days, being happy about booking 100 pips on Gold is like being happy for 10 pips on EURUSD. It’s not that 100 pips don’t matter—it’s that the scale of the game has changed, and your mindset must change with it.

________________________________________

5) Moving Forward

Your survival depends on continuous mental updates. Understand that volatility is relative to price, that regimes change, and that clinging to old measures is a recipe for losses. General principles—risk discipline, patience, and adaptability—remain constant, but their practical application shifts with the environment.

Recalibrate, or the market will do it for you.

Stop Blaming Market Manipulation: It’s Your Wrong InterpretationThe Excuse Factory

Recently, Bitcoin dropped from 118k to 108k. Suddenly, TikTokers, YouTubers, and X posters spiraled into paranoia, copy-pasting the same narrative: the “big masterminds,” reptilians, or aliens manipulated the market to liquidate 1.7 billion in buy orders.

Let’s pause for a second. A 10% pullback in Bitcoin is now considered a “market crash”?

If we look deeper... Ethereum fell about 20% from its top — but this same ETH had already grown 300% since April.

Was that also “manipulation”? Or does manipulation only happen when you are losing money?

How do you think markets work in general? Do they move only upward, just to make you richer?

The truth is simpler: there is no manipulation conspiracy here. There are no “false signals.” What exists are wrong interpretations.

The Market Is Neutral

The market doesn’t care about your position. It doesn’t send “false” signals; it simply moves. Price action reflects the sum of supply and demand in each moment.

When traders label a signal as “false,” what they really mean is:

• They misread the context.

• They didn’t account for a higher timeframe.

• Their stop placement wasn’t aligned with market structure or was too close.

The market doesn’t lie. It only reveals how much or how little you understand it.

Examples of Misinterpretation

• The “false breakout” myth – What you see as a false breakout on the 1H chart may be a perfect retest on the daily timeframe. The market wasn’t wrong—you were looking at it from the wrong lens.

• Stop hunting paranoia – Many traders cry “manipulation” when price takes out a cluster of stops. But think: stops are liquidity, and liquidity is where big players need to fill orders. That’s not manipulation—it’s how markets function.

• News volatility – Many traders call sudden spikes around economic releases “market tricks.” In reality, it’s about liquidity gaps. There aren’t buy and sell orders evenly distributed at every price level. When major news hits, price “rearranges” itself to include the new information and moves sharply until it finds liquidity — usually around strong support or resistance zones.

The Psychology Behind Blame

Blaming manipulation is easier than admitting error. It protects the ego. If the loss was due to some shadowy force, you don’t have to change. But this mindset locks traders into a cycle of frustration. Progress begins when you stop blaming the market and start analyzing your own decision-making.

Case Study: Ethereum’s Current Setup

As the saying goes, a picture says more than a thousand words.

Since April, Ethereum has rallied over 300% in just six months. On this path upward, the chart shows two apparent “false breaks” of support.

The question now is: will the current move be the third “false break,” or the first real break? As I wrote in yesterday’s analysis, confirmation is key...

But even if ETH drops further, say to 3600, nothing truly changes in the broader picture. Such a move would only be a healthy correction of the trend that started in April — perfectly aligning the price with the 38% Fibonacci retracement and the rising trendline support.

Conclusion: The Trader’s Responsibility

There are no false signals. There is no hidden enemy in the market. There is only your interpretation.

Opportunities Return, Lost Money Doesn’tGold is making all-time highs like there’s no tomorrow. And yet, I haven’t joined the trendin the past days. I made some money selling last week, but I didn’t ride the wave higher. Am I sorry? Not at all.

This brings me to a principle that guides my trading: I would rather miss an opportunity than lose money.

________________________________________

Confidence Over FOMO

The most important thing in trading is not catching every move — it’s trading with confidence. Even when I lose, I want to know why I lost.

That way, the loss has meaning. It’s part of a process I can trust and refine.

At this moment, my internal radar simply won’t allow me to buy Gold. Sure, it might rise more, but I’m not upset about “missing out.” Why? Because I need to believe in what I trade.

If I don’t, then every tick against me becomes torture, and I start questioning myself at every piece of market noise.

________________________________________

Why Missed Opportunities Don’t Hurt

• Opportunities always come back. The market is generous in that way.

• Lost money doesn’t come back by itself. You need another trade, another risk, another exposure — and usually more stress.

• Confidence compounds. When you only take trades you truly believe in , you build trust in your own process. That trust is what keeps you alive in the long run.

________________________________________

The Psychological Edge

Traders often think missing a trade is painful. In reality, it’s a sign of strength. It means you didn’t bend your rules, didn’t give in to FOMO, didn’t chase a market just because “everyone else” is.

Trading without belief in your setup is like walking into a fight without conviction. You’re already halfway defeated.

________________________________________

Final Thoughts

Yes, Gold is printing all-time highs. Yes, I could have bought and made some money. But I’m fine with that. Because keeping my confidence and protecting my capital matters more than chasing every rally.

Opportunities are infinite. My capital and my confidence are not.

That’s why I’ll always prefer missing an opportunity over losing money.

Leverage in Crypto: The Sexy Lie vs. The Boring TruthLet’s be honest: the vast majority of crypto traders don’t come with a trading background. Not in stocks, not in futures, and definitely not in leveraged Forex.

Most enter crypto because of hype, the dream of fast money, and stories of overnight millionaires.

That’s why leverage in crypto is so dangerous. It’s not just a tool — it’s a trap for the unprepared.

________________________________________

What leverage really means

To keep it simple: with 100× leverage, every 1% move in your favor doubles your account, but every 1% move against you wipes it out completely.

👉 No matter the asset — Forex, Gold, Bitcoin, or meme coins — at 100× leverage you only have 1% room to be wrong.

________________________________________

Yesterday’s market moves – a perfect example

Yesterday, markets exploded across all asset classes:

• EURUSD → +1%

• Gold (XAUUSD) → +1.5%

• Bitcoin (BTC) → +4%

• Ethereum (ETH) → +8%

• PEPE, other coins and meme coins → +10%+

Now imagine trading them with 100× leverage, catching the bottom and selling at the top:

• EURUSD → +100% (account doubled)

• Gold → +150%

• BTC → +400%

• ETH → +800%

• PEPE → +1000%

Sounds incredible, right?

But here’s the other side: with 100× leverage, a –1% move against you = instant liquidation.

________________________________________

Effective Leverage – The Hidden Concept

Effective leverage — you rarely see it explained. Why?

Because it’s not sexy, not marketable, and most of all… exchanges and brokers don’t want this to be very clear.

Nominal leverage (the 50×, 100×, 200× banners you see everywhere) sells dreams. Effective leverage, on the other hand, shows the brutal reality: how much exposure you actually control compared to your account size.

Formula:

Effective Leverage=Position Size/Account Equity

• Example 1 (Forex): $1,000 account, $5,000 EURUSD position = 5× effective leverage.

• Example 2 (Crypto): $100,000 account, BTC at $100k, controlling 5 BTC ($500,000 position) = 5× effective leverage.

👉 Nominal leverage is the ad. Effective leverage is the invoice.

And once you understand it, the marketing magic disappears.

________________________________________

A concrete example – Solana trade

Let’s take a real setup I shared recently on Solana:

• Entry: buy at $200

• Stop Loss: $185 → risk on the asset = -7.5%

Case 1 – 100× leverage

From 200 → 198 (–1%), you’re liquidated. You never reach your stop at 185.

Case 2 – 10× effective leverage

Every 1% move = 10% account swing. You could survive down to 180, but you’d be under constant stress.

Case 3 – 2× effective leverage (my choice)

Let’s say you control $2,000 worth of SOL, effectively $4,000 exposure.

• If Solana falls to 185 (–7.5%), that’s a –15% hit to your account. Painful, but survivable.

• If Solana rises to 250 (+25%), with 2× leverage you make +50% on allocated capital.

• Risk–reward ratio: ~1:3.3 — sustainable, worth taking.

________________________________________

The psychological factor

This is where leverage breaks most traders.

• With 100× leverage, every 0.2% fluctuation moves your account by 20% (≈ $400 on a $2,000 account). Every 1% move = liquidation. How do you stay calm? You don’t.

• With 2× effective leverage, a 1% fluctuation only moves your account 2% (≈ $40). Boring? Maybe. Survivable? Absolutely.

Now imagine: you enter SOL at 200 with 100× leverage.

• At 202, you’ve doubled your account.

• At 210, you’ve made 5×.

But will you hold? No. Because:

1. If you’re awake, the stress of watching wild swings (in money, not in price) forces you to close early.

2. If you do hold, it’s usually because you were asleep — or the move happened in a single violent candle.

Markets never move in a straight line. They go 200 → 202 → 201 → 203 → 201 → 205…

At 100× leverage, every retracement feels like life or death. At 2× leverage, it’s just noise.

________________________________________

Conclusion

Leverage isn’t evil. It’s just a tool. But in crypto, with insane volatility and inexperienced traders, it becomes a weapon of mass destruction.

• At 100×, you’re gambling on the next 1% very small move.

• At 10×, you’re constantly stressed and one bad move away from ruin.

• At 2×–5× effective leverage, you can actually follow your plan, respect your stop, and let your targets play out.

Trading isn’t about adrenaline. It’s about survival.

High leverage destroys accounts — and discipline. Small, controlled leverage gives you the one thing you need most in trading: time.

P.S.

Of course, the choice is yours — what leverage you decide to use, whether you take into consideration the concept of effective leverage, or how you handle the psychological impact of high leverage.

But at least now, you know. 🙂

Some Traders Only See The Bait, But Not The HookLet’s get one thing straight: if you seriously think you’ve discovered a “secret” setup that you saw in a YouTube video with 1 million views, and it’s right there on the chart – clean, centered, elegant – congrats. You’re already on the hook.

Welcome. You’re liquidity.

🧼 “Clean breakout” = dig your own grave, enthusiastically

It’s honestly beautiful how thousands of traders see the same “clean breakout,” the same “double bottom,” the same “bullish engulfing,” and all believe they’re geniuses. They enter confidently, with a “perfect oversold” RSI, a “confirmed” MACD, and maybe even the moon in Capricorn.

Then, of course, the market spits their orders back in their face at 300 km/h.

Standard response? “It was manipulation.”

No, bro. It was bait. You were the fish. You bit. The market says thank you for your participation and moves on.

🧠 If you see what everyone else sees, it’s useless

What most don’t get is this: if a setup looks “too clean,” it will most probably not work. If you see it, everyone sees it. If everyone thinks something is “about to explode,” that means it’s being used – to attract orders. Your money. Your emotions. Exactly what bigger players need to exit, gracefully – on your dime.

The market is like an exclusive party: if you found out about it, it’s already lame.

💅 That warm feeling of “certainty”? Yeah, you’re screwed

The irony? The moments when a trader feels most certain are exactly the moments when they’re most exposed. The market wants you to feel relaxed. Wants you to think “this is the one.” It’s like a drug dealer giving you your first hit for free, with a smile. Not because he likes you, but because he knows you’re hooked.

So when you feel “sure” – check your mouth. You might already be on the hook.

🤡 “But it was an A+ setup!”

Of course it was. The A+ setup – seen, tested, recycled, and re-sold thousands of times. The one that works great in textbooks, backtests, webinars, and in the wet dreams of those who think they just need “a perfect strategy”.

But the market isn’t here to validate your setup. It’s here to take your money. From whom? From those who still think it’s a “fair game.”

Spoiler: it’s not.

🤔 If you’re gonna bite, at least ask: who’s holding the line?

Look at any “clear opportunity” and ask the magic question:

“Who benefits from what I’m seeing right now?”

If the answer is “me ” – you’re in trouble.

If you don’t know – you’re in even more trouble.

The market is full of traps dressed up as opportunities. Hooks that move slowly, with sexy candles, to lure in the kind of trader who only learned the “buy low, sell high” part – but skipped the chapter on “ don’t bite every shiny thing you see. ”

🎬 Bottom line:

The market doesn’t try to fool you. You’re already doing that yourself.

The market doesn’t need complex tricks. All it needs is people in a hurry, easy to excite, who never ask the right questions. Who see a green candle and think, “This is it.”

Who don’t bother looking for the hook because they’re too busy dreaming about the profits.

If you want to trade seriously, it’s simple:

Don’t ask “Where do I enter?”

Ask: “Where do they want me to enter?”

And if you’re already there… run.

🧭 Alright, now seriously

( I mean, I tried to be funny above – but let’s get real for a second )

Let’s look at a few concrete recent examples from the market:

📉 EUR/USD

On Monday, I mentioned that price was testing resistance and could offer a nice selling opportunity.

But… I changed my mind. (You know... dynamic probabilities )

The pattern was way too clean, too clear, too pretty.

And of course, price broke above.

Because if it looks too obvious – it’s probably already bait.

🟡 XAU/USD (Gold)

Since yesterday, I’ve been talking about the potential for an upside breakout.

Why?

Because 3380–3385 resistance zone is way too clean.

Everyone sees it. Everyone talks about it. Everyone sells there.

Which makes me ask: if everyone’s expecting a drop… isn’t that, once again, just bait?

Here is my Gold analysis from today:

BTC/USD

We all see the confluence of support. The perfect alignment. The setup that screams “Buy me.”

But what if it’s too perfect to be true?

What if it’s just another classic trap – the kind that gets everyone excited before the drop comes.

💡 Now don’t get me wrong – this isn’t about abandoning technical analysis.

Far from it. For me, it’s essential.

But we’ve got to use it differently.

✅ Not as a treasure map

❌ But as a battlefield map showing us where the traps are laid

So maybe… don’t bite like a lizard the second something shiny pops up on your chart.

Instead, ask yourself:

“Does this make sense… or does it make too much sense? ”

Because in trading, when something looks too clean – that’s exactly when it gets dirty.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Mechanical vs. Anticipation Trades: The Fine LineWhen traders talk about discipline, they often refer to following rules — sticking to a plan, being methodical, and avoiding emotional decisions. But there's a subtle and powerful difference between being rule-based and being blindly mechanical. And even more, there's a moment in every trader’s process where discipline demands adaptation.

Let’s look at a recent trade on Gold to understand this better.

On Thursday, I published an analysis on Gold stating that the recent breakdown of support had turned that zone into resistance. A short entry from that level made sense.

It was mechanical, clean, and aligned with what the chart was showing at the time.

And, at first, it worked. Price rose into the resistance area and dropped. Perfect reaction. Textbook setup. Confirmation. The kind of trade you want to see when following a rule-based system.

But then something changed.

Price came back. Quickly.(I'm talking about initial 3315-3293 drop and the quick recover)

So, the very next rally pushed straight back into the same resistance area, hmmm...too simple, is the market giving us a second chance to sell?

That was the first sign that the market might not respect the previous structure anymore.

It dipped again after, but the second drop was different: slower, weaker, choppier.

That told me one thing: the selling pressure was fading.

So I shifted. From mechanical execution to anticipatory mindset.

This is where many traders struggle — not because they don’t have a system, but because they don’t know when to let go of it. Or worse: they abandon it too quickly without cause.

In this case, the evidence was building. The failed follow-through. The loss of momentum. The compression in structure. All signs that a reversal was brewing.

Rather than continuing to blindly short, referring to a zone that no longer held the same weight, I started looking for the opposite: an upside breakout and momentum acceleration.

That transition wasn’t based on emotion. It was based on market behavior.

________________________________________

Mechanical vs. Anticipation: What’s the Real Difference?

A mechanical trade is rule-based:

• If X happens, and Y confirms, then enter.

• No need for interpretation, no second guessing.

• It can (in theory) be automated.

An anticipatory trade is different:

• It’s about reading intent in price action before confirmation.

• Higher risk usually, but higher reward if you’re right.

• Can’t be automated. It requires presence, experience, and context.

And the tricky part? Often, we lie to ourselves. We say we’re "mechanical" while actually guessing. Or we think we’re being smart and intuitive, when in fact, we’re being impulsive.

The key is awareness.

In my Gold ideas, the initial short was mechanical. But the invalidation came quickly — and I was alert enough to switch gears. That shift is not a betrayal of discipline. It’s an upgrade of it.

________________________________________

Final Thoughts:

Discipline is not doing the same thing no matter what. Discipline is doing what the market requires you to do, without emotional distortion.

And that, often, means walking the fine line between the setup you planned for, and the reality that just showed up.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Feed Your Ego or Feed Your Account- Your Choise🧭 From Rookie to Realization

I’ve been trading since 2002. That’s nearly a quarter of a century in the markets.

I’ve lived through it all:

• The early days, when the internet was slow and information was scarce

• The forums, the books, the overanalyzing

• The obsession with finding “the perfect system”

• And later… the dangerous phase: needing to be right, because I have a few years of experience and I KNOW

At one point, I thought that being a good trader meant calling the market in advance — proving I was smarter than the rest.

But the truth is: the market doesn't pay for being right. It pays for managing risk, always adapting and executing cleanly.

________________________________________

😤 The Psychological Trap Most Traders Fall Into

There’s one thing I’ve seen consistently over the last 25 years:

Most traders don’t trade to make money.

They trade to feel right.

And this need — this psychological craving to validate an opinion — is exactly what keeps them from growing.

You’ve seen it too:

• The guy who’s been screaming “altcoin season” for 2 years

• Who first called it when EGLD was at 80, TIA, and others that kept dropping

• But now that something finally moves, he says:

“See? I was right all along, altcoin season is here”

He’s not trading.

He’s rehearsing an ego story, ignoring every failed call, every drawdown, every frozen position.

He doesn’t remember the trades that didn’t work — only the one that eventually did.

This is not strategy.

It’s delusion dressed up as conviction.

________________________________________

📉 The Market Doesn’t Care What You Think

Here’s the reality:

You can be right in your analysis — and still lose money.

You can be wrong — and still come out profitable.

Because the market doesn’t reward your opinion.

It rewards how well you manage risk, entries, exits, expectations, and flexibility

I’ve seen traders who were “right” on direction but blew their accounts by overleveraging.

And I’ve seen others who were wrong on their first two trades — but adjusted quickly, cut losses, and ended green overall in the end.

This is what separates pros from opinionated amateurs.

________________________________________

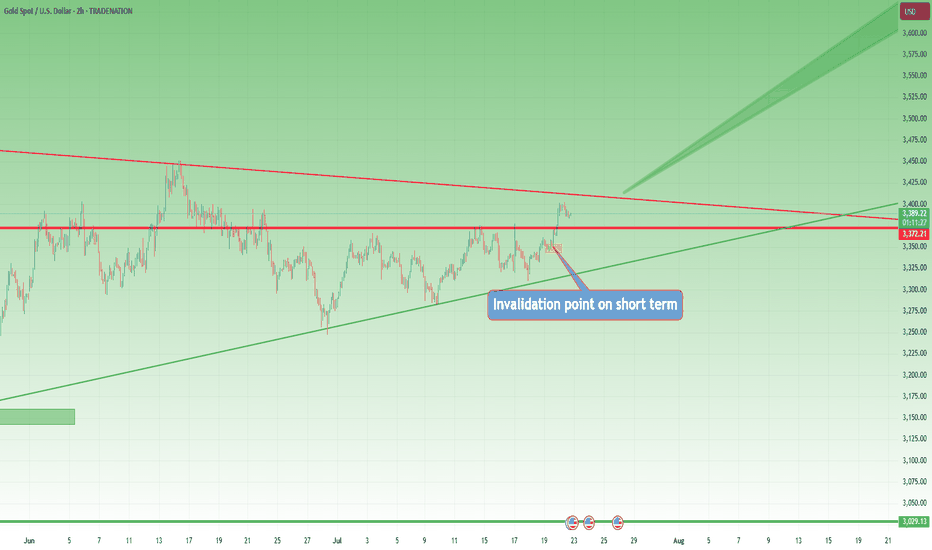

📍 A Real Example: Today’s Gold Analysis

Let’s take a real, current example — my own Gold analysis from this morning.

I said:

• Short-term, Gold could go to 3450

• Long-term, the breakout from the weekly triangle could take us to 3800

Sounds “right,” right? But let’s dissect it:

Short-term:

✅ I identified 3370 as support

If I buy there, I also have a clear invalidation level (below 3350)

If it breaks that and hits my stop?

👉 I reassess — because being “right” means nothing if the trade setup is invalidated

And no, it doesn’t help my PnL if Gold eventually reaches 3450 after taking me out.

Long-term:

✅ The weekly chart shows a symmetrical triangle

Yes — if we break above, the measured move targets 3800

But…

If Gold goes below 3300, that long-term scenario is invalidated too.

And even worse — if Gold trades sideways between 3000 and 3500 for the next 5 years and finally hits 3800 in 2030, that “correct call” is worth nothing.

You can't build a career on "eventually I was right."

You need precision, timing, risk management, and the ability to say:

“This setup is no longer valid. I’m out.”

________________________________________

💡 The Shift That Changed Everything

It took me years to realize this.

The day I stopped needing to be right was the day I started making consistent money.

I stopped arguing with the market.

I stopped holding losers out of pride.

I stopped needing to "prove" anything to anyone — especially not myself.

Now, my job is simple:

• Protect capital

• Execute with discipline

• Let the edge do its job

• And never fall in love with my opinion

________________________________________

✅ Final Thought – Let Go of Being Right

If you’re still stuck in the “I knew it” mindset — let it go.

It’s not helping you. It’s costing you.

The best traders lose small, admit mistakes fast, and stay emotionally neutral.

The worst traders hold on to “being right” while their account burns.

The market doesn’t owe you respect.

It doesn’t care if you called the top, bottom, or middle.

It pays the ones who trade objectively, flexibly, and without ego.

After almost 25 years, this is the one thing I wish I had learned sooner:

Don’t try to win an argument with the market.

Just get paid.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

In trading, the long way is the shortcut⚠️ The Shortcut Is an Illusion — And It Will Cost You

In trading, everyone wants to arrive without traveling.

They want the profits, the freedom, and the Instagram lifestyle — even if it’s fake.

What they don’t want is the process that actually gets you there.

So they chase shortcuts:

• Copy signals without understanding the reason behind them

• Over-leverage on “the perfect setup”

• Buy indicators they don’t know how to use

• Skip journaling and backtesting

• Trade real money without trading psychology

And then they wonder…

Why is my account bleeding?

Why does this feel like a cycle I can't break?

Because:

Every shortcut in trading is just a fast track to disaster.

You will lose. You will restart. And it will take even longer than if you just did it right the first time.

🤡 The TikTok Fantasy: “1-Minute Strategy That Will Make You Millions in 2025”

This is the new wave:

A 60-second video showing you a magical indicator combo.

No context. No testing. No risk management.

Just fake PnL screenshots and promises of millionaire status before next summer.

“This 1-minute scalping strategy made me $12,000 today!”

And people fall for it… because it’s easier to believe in shortcuts than to accept that real trading is boring, repetitive, and hard-earned.

If it fits in a TikTok video, it’s not a strategy. It’s clickbait.

________________________________________

❓ Looking for a System Without Knowing the Basics

Here’s the paradox:

Most people are desperate to find a “profitable strategy” — but they haven’t even mastered the basic math of trading.

• They don’t know how pip value is calculated

• They don’t understand how leverage works

• They confuse margin with risk

• They size positions emotionally, not based on their account

• They can’t define what 1% risk per trade actually means in dollars

But they’re out here, loading indicators, watching YouTube “hacks,” and flipping accounts with 1:500 leverage.

Imagine trying to perform surgery before learning anatomy.

That’s what trying to trade a strategy without knowing pip cost looks like.

________________________________________

🛠️ The Long Way Is the Fastest Way

You want the real shortcut?

Here it is:

• Learn price structure deeply

• Backtest like a scientist

• Journal like a professional

• Risk small while you're learning

• Stay on demo until your edge is proven

• Master basic math: leverage, margin, pip value, position sizing

This is the long way.

But it’s the only way that doesn’t end in regret.

________________________________________

⏳ Most Traders Waste 2–5 Years Looking for a Shortcut

And in the end?

They crawl back to the long path.

Broke, humbled, and wishing they had just started there from the beginning.

The shortcut is a scam.

The long way is the only path that leads to consistency.

You either take it now… or take it later — after your account pays the price.

________________________________________

✅ Final Thought

Don’t ask how fast you can get profitable.

Ask how solid you can build your foundation.

Because in trading:

❌ The shortcut costs you everything

✅ The long way gives you everything

And the longer you avoid it, the longer it takes.

Guide: How to Read the Smart Farmer SystemDear Reader , Thank you for tuning in to my first video publication.

This video explains the 3-step signal validation process—helping you quickly and precisely anticipate market intent and liquidity dynamics before taking action.

We do not react to noise; we respond with structured execution because we understand the market’s true game.

Listen to the market— this guide is here to sharpen your journey.

Correction Notice (16:58 timestamp): A slight clarification on the statement regarding signal validation :

SELL signals: The trading price must close BELOW the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

BUY signals: The trading price must close ABOVE the Price of Control (POC) and Value Average Pricing (VAP) without invalidation occurring in both the confirmation candle and progress candle.

Multiple signals indicate liquidity games are actively unfolding, including accumulation, control, distribution, and offloading.

Gut Feeling Vs. Technical Analysis- How I Take TradesTrading Is Both Art and Science

Every trader, no matter how data-driven, eventually encounters moments when they just know something about the market.

That quiet internal signal:

“Don’t touch this today.”

Or: “Get ready. Something’s coming.”

That’s not random emotion. That’s your gut feeling – and in trading, it's worth paying attention to. But here's the catch:

👉 Gut feeling alone isn’t enough.

👉 Technical analysis alone isn’t either.

The real edge comes when both align.

________________________________________

What Is Gut Feeling in Trading?

“Gut feeling” is a term used to describe intuitive decisions that seem to arise without conscious reasoning. In trading, it often presents as a subtle inner nudge – a warning, a hesitation, or a surge of clarity.

Contrary to popular belief, it’s not just emotion. It’s often the result of:

• Unconscious pattern recognition from years (or decades) of chart-watching

• Internalized market behavior that doesn’t show up on an indicator

• Emotional awareness, sensing when the environment isn’t right to trade

Experienced traders know this isn’t “woo.” It’s pattern memory speaking quietly.

________________________________________

On the Other Hand: What We Call Technical Analysis?

We all know the tools: support/resistance, price action, indicators like RSI, MACD, Bollinger Bands, maybe Smart Money Concepts or just clean trendlines, etc.

Technical analysis gives us structure — measurable, repeatable setups. But let’s not pretend it captures everything:

• News can spike irrationally

• Liquidity can vanish when you least expect it

• And sometimes, the chart says 'yes' but the market mood says 'don’t trust it'

That’s where gut feeling becomes the final filter.

________________________________________

✅ Why I Wait for Alignment

Let’s be honest: most bad trades happen when you force action despite internal hesitation.

Here’s how I frame decisions:

✅ Full alignment

• Gut: Yes

• Technicals: Yes

• 👉 Take the trade

⚠️ Gut says no, but technicals agree

• Gut: No

• Technicals: Yes

• 🚫 Wait – something’s off

⚠️ Gut says yes, but technicals are unclear

• Gut: Yes

• Technicals: No

• 👁 Watch only – do not act

❌ No alignment

• Gut: No

• Technicals: No

• ✅ Stay out – smart decision

You’re not supposed to be in every trade. You’re supposed to be in the right trades.

________________________________________

🔍 Real-Life Example: Gold (XAUUSD)

Yesterday, Gold surged due to geopolitical escalation and renewed tariff tension.

Is looking bullish now: descending trendline broken, above 3350 which acts as confluence support.

📈 The chart said: “Buy.”

🧠 But my gut said: “ No. This is an emotional move. It’s not done correcting .”

So I stayed out.

Why?

Because if I trade while my gut says “no”, I second-guess every tick.

Even if the chart is right, I start hoping it fails — just to prove my feeling was right.

That’s emotional sabotage.

But when gut and chart say the same thing, I don’t hesitate.

Even if the trade loses, I’m at peace. I executed from clarity, not conflict.

That’s not just technical skill. That’s mental edge.

🧠 How to Develop Trustworthy Intuition

If you’re new or inconsistent, your “gut feeling” might just be fear, greed, or FOMO. But over time, real intuition can be trained like a muscle.

1. Screen Time

The more markets you watch, the more silent patterns your brain absorbs. Eventually, you’ll “feel” momentum shifts before indicators print them.

2. Journaling

Write down what you felt before each trade. Did it align with your plan? Over time, you’ll spot which feelings were intuition and which were impulse.

3. Meditation & Clarity

The more you control your emotional noise, the easier it becomes to hear real signals.

________________________________________

⚠️ Common Pitfalls: When Gut Feeling Betrays You

Let’s be clear – not every gut feeling is wise. Here are some red flags:

• Revenge trading disguised as confidence

• FOMO masked as intuition

• Fear of missing out during high volatility sessions

• Fatigue or stress, which distort perception

🧠 Tip: A real gut feeling comes with calm clarity, not urgency or adrenaline.

________________________________________

🎯 Final Thought

Gut Feeling + Technical Analysis = Peace of Mind

The best trades aren’t just technically correct — they’re internally clean. No doubt. No hesitation. No self-conflict.

Wait for alignment. Then execute with full presence.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Positive Psychology in TradingTrading isn’t just about numbers, charts, or quick decisions. It’s an intense emotional experience, a constant mental challenge, and often a major source of stress.

That’s why more traders are turning to positive psychology—a modern psychological approach that explores what makes people thrive, even under pressure and uncertainty.

What is Positive Psychology?

Founded by Martin Seligman, positive psychology focuses on positive emotions, strengths, and the conditions that lead to a fulfilling life. Unlike traditional approaches that look at “what’s wrong,” it asks: What’s going right? and How can we build on it?

The PERMA model (Positive Emotion, Engagement, Relationships, Meaning, Achievement) serves as a powerful framework—even in the world of trading.

________________________________________

How Does It Apply to Trading?

1. Positive Emotions – Calm Before the Click

Trading isn’t about euphoria or panic—it’s about equilibrium. Cultivating positive emotions like gratitude or realistic optimism helps you:

• Reduce impulsivity

• Build emotional resilience

• Make clearer decisions under pressure

Try this: At the end of each trading day, write down 3 things that went well and why. This trains your brain to see progress, not just mistakes.

________________________________________

2. Engagement (Flow) – Get in the Zone

Flow is that state of complete absorption in what you're doing. In trading, it means:

• Deep focus without mental fatigue

• Quick yet thoughtful decisions

• A fulfilling experience, win or lose

How to reach it? Schedule short, focused trading sessions with no distractions and a clear plan.

________________________________________

3. Positive Relationships – You’re Not Alone

Trading can be solitary—and at times, frustrating. A positive community of fellow traders can:

• Reduce isolation

• Offer constructive feedback

• Boost your motivation

Pro tip: Join a trading group that values learning and support, not just fast wins.

________________________________________

4. Meaning – Why Do You Trade?

Without a deeper why, trading becomes a stressful gamble. When you have a clear sense of purpose (financial freedom, personal growth, discipline), it’s easier to:

• Stay consistent during drawdowns

• Stick to your plan

• Avoid burnout

________________________________________

5. Achievement – Celebrate the Process, Not Just the Profits

Positive psychology emphasizes progress over perfection. In trading, this might mean:

• A full week of disciplined trades = success

• Following your strategy = a win

• Avoiding overtrading = growth

________________________________________

Final Thoughts

Positive psychology isn’t about “happy thoughts” or ignoring risk. It’s about building a resilient, balanced, and healthy mindset—a crucial asset for any long-term trader.

If you want to become a high-performing trader, don’t focus only on strategies and charts. Learn to master your emotions, develop your inner strengths, and trade with purpose.

Buy Fear, Not Euphoria: The Trader's EdgeWhen you look back at the greatest trading opportunities in history, they all seem to share a common element: fear. Yet, when you're in the moment, it feels almost impossible to pull the trigger. Why? Because fear paralyzes, while euphoria seduces. If you want to truly evolve as a trader, you need to master this fundamental shift: buy fear, not euphoria.

Let's break it down together.

________________________________________

What Fear and Euphoria Really Mean in Markets

In simple terms, fear shows up when prices are falling sharply, when bad news dominates the headlines, and when people around you are saying "it's all over."

Euphoria, on the other hand, is everywhere when prices are skyrocketing, when everyone on social media is celebrating, and when it feels like "this can only go higher."

In those moments:

• Fear tells you to run away.

• Euphoria tells you to throw caution to the wind.

Both emotions are signals. But they are inverted signals. When fear is extreme, value appears. When euphoria is extreme, danger hides.

________________________________________

Why Buying Fear Works

Markets are pricing machines. They constantly adjust prices based on emotions, news, and expectations. When fear hits, selling pressure often goes beyond what is rational. People dump assets for emotional reasons, not fundamental ones.

Here’s why buying fear works:

• Overreaction: Bad news usually causes exaggerated moves.

• Liquidity Vacuums: Everyone sells, no one buys, creating sharp discounts.

• Reversion to Mean: Extreme moves tend to revert once emotions stabilize.

Buying into fear is not about being reckless. It’s about recognizing that the best deals are available when others are too scared to see them.

________________________________________

Why Chasing Euphoria Fails

At the peak of euphoria, risks are often invisible to the crowd. Valuations are stretched. Expectations are unrealistic. Everyone "knows" it's going higher — which ironically means there's no one left to buy.

Chasing euphoria often leads to:

• Buying high, selling low.

• Getting trapped at tops.

• Emotional regret and revenge trading.

You’re not just buying an asset — you're buying into a mass illusion.

________________________________________

How to Train Yourself to Buy Fear