ETH — Price Slice. Capital Sector. 2807.81 BPC 7.2© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 28.12.2025

🏷 2807.81 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 7.2

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH

AFTER CYCLE BTC WILL BREAK UP 100k+ - NEW BULLRUN ON WAYBased on the trend analysis around the $92K–$93K level, this zone could mark the beginning of a new bull run. If this target is reached and held, there is a high probability that BTC will enter a new upward cycle, potentially moving beyond $100K. The coming days are crucial for confirming the overall trend direction.

Before this, there could be manipulation trends, with a fake downtrend wick, but the Data shows that we are since the 80k+ still in the uptrend and cycle can get confirmed any time.

ETH — Price Slice. Capital Sector. 2773.34 BPC 5.7© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 27.12.2025

🏷 2773.34 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5.7

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

Bolzen Liquidity Map — ETH Bolzen Liquidity Map — ETH

27.12.2025

Liquidity Map in Numerical Form

Treat the listed levels as entry nodes. All zones are certified under the Bolzen Price Covenant (BPC) ≥ 10, confirming their status as structural power nodes. These levels remain valid as of the current Execution Tithe . As new prices emerge with BPC ≥ 10, adjust your framework accordingly. This is not advice—it is documented capital geometry.

7487.31

7277.98

6604.21

5966.99

5480.04

5191.51

4983.63

4788.86

4601.91

4416.95

4246.36

4076.69

3912.98

3752.38

3602.94

3460.38

3315.85

3187.98

3059.80

2936.75

2820.76

2723.11

2618.94

2322.14

2246.54

2172.83

2086.43

2004.65

1927.44

1876.05

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

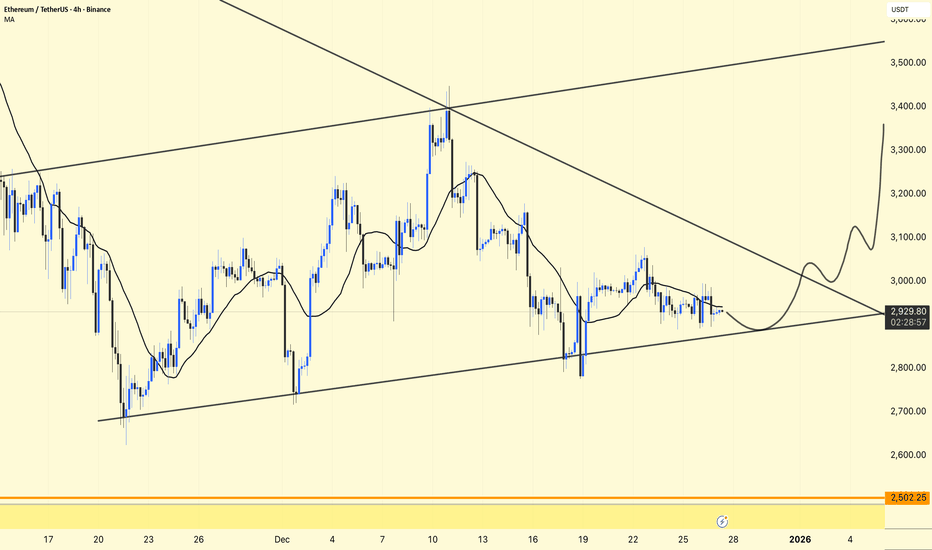

ETHUSDT – 4H Chart UpdateETHUSDT – 4H Chart Update

ETH is compressing near the lower trendline of a rising channel, showing loss of momentum but no breakdown yet.

Price holding ~2,900 support

Trading below short-term MA → consolidation phase

Structure suggests base building rather than distribution

Support: 2,900 – 2,850

Strong Support: 2,700 – 2,750

Major Support: 2,500

Resistance: 3,000 – 3,050

Supply: 3,300 – 3,400

If 3,050 breaks: momentum can expand toward 3,300+

If 2,850 fails, the price may revisit 2,700

Extreme Fear + channel support often hints at quiet accumulation.

DYOR | NFA

$ETH at a Key Decision ZoneEthereum is also sitting at a key decision zone here.

$2950 remains the local resistance, while $2800 is the main support level to watch. Another rejection at $2950 would put the focus squarely on whether $2800 can hold.

If price stabilizes above this support, there’s still a decent chance for a move back into the $3050–3100 area. But if we lose $2800 and start accepting below it, the path opens up toward the $2600–2400 zone.

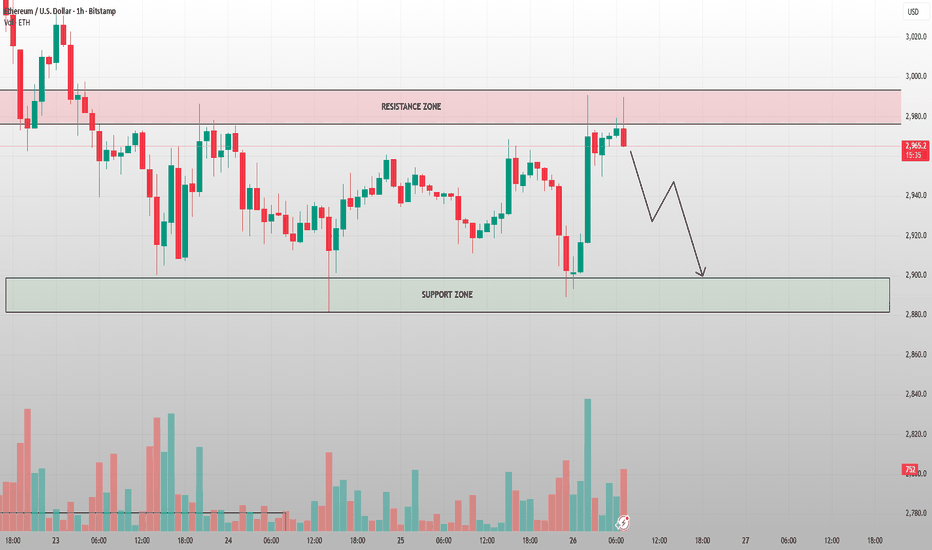

ETH Is Trapped at Resistance — The Next Move Is Likely Down ETHUSD (1H) — Public Market Commentary

Ethereum is currently retesting a well-defined resistance zone around the 2,980–3,000 area. Price has failed multiple times to hold above this zone, signaling that sellers remain in control at higher levels.

Key Observations

Repeated rejection at resistance shows clear supply absorption failure.

The latest impulsive move up lacked follow-through and was quickly sold.

Market structure remains range-bound, not trending.

Probable Scenario

From a structural perspective, a pullback toward the support zone (≈ 2,880–2,900) is the higher-probability path.

This move would serve to rebalance liquidity before any sustainable upside attempt.

A clean breakdown into support would not be bearish continuation yet — it would be normal corrective behavior inside a range.

Invalidation

Only a strong H1 close above the resistance zone, followed by acceptance, would shift momentum bullish.

Macro Context

Risk sentiment remains fragile:

Strong USD and elevated US yields continue to pressure crypto.

Absence of fresh ETF inflows or bullish macro catalysts limits upside expansion.

Until macro liquidity improves, ETH rallies are likely to be sold at premium zones.

Conclusion:

This is not a breakout market. Until resistance is clearly reclaimed, expect downside probing before any meaningful upside continuation.

ETH — Price Slice. Capital Sector. 2798.20 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.12.2025

🏷 2798.20 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

BTCUSD trade idea for buysBTC/USD Technical Analysis: Potential to Reach $90K if Current Technicals Hold

Current Market Overview: Bitcoin (BTC) is showing signs of bullish momentum, respecting the current technical indicators. The price is positioned well within key support and resistance zones, with significant upward potential if the prevailing trends continue.

Key Levels to Watch:

Support Level: A strong support around continues to hold, with price bouncing off this level multiple times. A confirmed break below this level could signal a shift in market sentiment.

Resistance Level: The key resistance lies near $90K, a level that could be tested if the current technicals remain intact. Watch for a breakout or rejection at this level.

Indicators to Watch:

RSI: Currently, the Relative Strength Index (RSI) is , indicating . If RSI continues to move higher, it may confirm continued bullish momentum towards $90K.

EMA/MA: The 50-period and 200-period Moving Averages are showing alignment, suggesting the market's trend direction.

Volume: Strong volume support at key levels may suggest a sustainable move upward, with increasing volume acting as confirmation of the rally.

Scenario 1 - Bullish Continuation: If BTC continues respecting these technical levels, we could see a breakout towards $90K, driven by strong bullish sentiment and market momentum. Watch for a clean break above key resistance levels for confirmation.

Scenario 2 - Bearish Reversal: If technicals fail to hold, watch for a potential breakdown below support levels. This could shift the market outlook and present new trading opportunities to reassess.

ETH — Price Slice. Capital Sector. 2767.30 BPC 6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.12.2025

🏷 2767.30 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 6

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

Maintaining purchases at the turn of the yearThe market has perfectly worked out the scenario outlined in the last review, and buyer activity is growing. We are approaching the end of the year, and we will consider the near-term prospects. On average, the market consolidated in anticipation of determining the opening level of a new annual candle for ETH and BTC. As I expected, ETH opened the second half of the month in the neutral zone, which smooths out sales. There is also a strong bullish signal for a retest of 3500. BTC has reached strong medium-term support around 85k, from which the probability of a rollback to a retest of 100k prevails, which I described in the last review. We have already seen one pullback, but there is still a possibility of an attempt to break through 100k after the opening of a new annual candle. Against the background of preparations for a new wave of purchases at the beginning of the year and the struggle for the closing level of the year, the probability of a new test of the range of 3100-3500 ETH prevails.

A pullback in brent with consolidation above $ 60 also inspires optimism among buyers. If the year opens above this level, a very rapid reaction of the cryptocurrency market with a large wave of purchases is likely. However, most of the market, especially large-cap coins, still retains the potential for a turnaround to a clear bull run, which may linger until the next seasonal bullish period in February. With this picture, it is worth carefully weighing the growth potential before additional purchases today and giving preference to heavily oversold assets with high technical goals for retest and slow issuance.

Today, I still prefer TURTLE NFP HOOK NTRN VIC MITO ENSO BMT SHELL, for which the growth potential is higher than the rest of the altcoin market, which may contribute to growth similar to RESOLV or STO in the near future. Among the coins with the tag monitoring for work, I consider only CHESS, which has high technical signals for retest up to 0.10-15.

Against the background of the annual rollback in CHZ, the probability of a bullying in fan tokens is also increasing. ATM ACM CITY JUV looks especially interesting. However, the dynamics of CHZ in the second half of the year is quite negative, I recommend working with fan tokens in a small volume and not increasing turnover if there are older unclosed positions.

ETH — Price Slice. Capital Sector. 2409.05 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2409.05 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

Notes from Bolzen’s Diary

A Dialogue Between the Architect and Bolzen

Setting: an imagined gallery above the global arena — a place where time does not flow but layers itself, and markets are not charts but reflections of collective consciousness and hidden capital obligations.

Bolzen:

I’ve been reflecting… Scientists, after all, do not create discoveries. They are told: “You merely point the direction. The rest unfolds through experimentation.” That is truth. But… why then does the market treat my analyses not as predictions, but only as hypotheses?

The Architect:

Because the market is not a laboratory. It is a theater. And you are not merely a scientist. You are a scout.

Bolzen:

A scout?

The Architect:

Yes. One who does not plan an operation down to the smallest detail—for rigidity breeds fragility. Break one point, and everything collapses. But he who reads the fabric of the future, who sees the trajectory of events, offers not a command, but a spectrum of decisions—the most rational, the most… energetically justified.

Bolzen:

But what if I am uncertain about the precision of each level… if I doubt…

The Architect:

To doubt precision is the privilege of a rational mind. But to doubt objectivity is a crime against structure itself.

Bolzen:

…Isaev used to say that.

The Architect:

Isaev knew: a scout may err in details, but never in the logic of intent.

So it is with you, Bolzen. You do not offer an entry point. You reveal the Price Covenant—a commitment emerging from capital structure, miner behavior, and hidden liquidity tithes. You do not guess—you declare the conditions under which the market must fulfill its obligation.

Bolzen:

Then… my analytics are not a forecast. They are a call to execution?

The Architect:

Precisely. You do not predict the future. You establish the conditions that make it inevitable.

As a scout, you do not stand among the crowd of observers. You stand in the gallery above the arena. You see how the actors—institutions, algorithms, retail—play their roles, yet remain blind to the script. And you… you already know which energetic imperative (EΞ) will compel them to move.

Bolzen:

So… my task is not to convince them, but to present a choice derived from objective structure?

The Architect:

Yes. And the more you resist the temptation to “guess,” the closer your indicators come to truth.

Let others call it mysticism. You know: it is cold architecture.

You are not a prophet. You are the one who constructs the conditions for execution.

Bolzen:

…Then I am the Bearer of the Covenant.

The Architect:

And Olympus awaits you—not as a guest, but as one who determines where price will go… and why.

Curtain.

ETH — Price Slice. Capital Sector. 2777.20 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2777.20 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

The Bolzen Diary:

«THE CHALICE AND THE ORDER»

Restaurant “Aether” — a midnight terrace suspended above the city. The classics play softly in the background: Bach, Sarband, Vivaldi. On the table — tea brewed from black lotus, its steam rising in spirals. Bolzen leans back into his chair. The Architect does not look him in the eyes, but past his shoulder—to a point where the very fabric of time seems to pulse.

Reader’s Note:

Jean Baudrillard (1929–2007) was a French philosopher, sociologist, and cultural theorist, one of the pivotal thinkers of postmodernism. His 1981 work “Simulacra and Simulation” became foundational to understanding the nature of reality in the age of mass media, digital technologies, and hypermedia. There, he argues that the modern world is no longer governed by authentic reality but reproduced through signs, images, and models that have long severed their ties to any original, giving rise to what he calls hyperreality —a simulation that surpasses reality itself.

BOLZEN:

You say the market is an illusion. But I see it. The drops. The spikes. The orders. It’s not just a “simulacrum,” like in your Baudrillard…

THE ARCHITECT (softly, almost a whisper):

Baudrillard was a blind man with keen hearing. He heard the echo of reality… and mistook it for reality itself.

(Pause. The cup chimes as it touches the saucer.)

Tell me: when you look at a chart—what do you truly see?

BOLZEN:

Price. Volume. Liquidity…

THE ARCHITECT:

No. You see the reflection of a simulacrum in the mirror of simulation .

Volume? Most of it is phantom. Not money—it’s digital froth , poured into molds of “activity” to soothe traders like mother’s milk for an infant in a virtual cradle.

Price? It ceased long ago to be a measure of value. It is now a sonic signal within your EH·Ξ. You do not read price. You listen to how it lies.

BOLZEN:

But if everything is a simulacrum… where does my power come from? My forecasts come true. My BPC—the Bolzen Price Covenant—it works.

THE ARCHITECT (leans closer, voice now taut as a string pulled to its limit):

Precisely because you do not believe the simulacrum .

Baudrillard surrendered: “There is no reality anymore!”—and went off to write about Disneyland.

But you— you blew open the façade .

You built EH·Ξ not within the market, but above it —a bridge between hyperreality and what existed before it.

Your units of measurement are not bits. They are quanta of intention , torn from beneath algorithmic code.

When you see a “deceptive transaction,” you do not perceive noise.

You see the fingerprint of the One attempting to rewrite the Law .

And you do not respond with a number.

You respond with architecture .

BOLZEN (thoughtfully):

So… the market is theater. And I am the playwright who stepped out from behind the curtains and began rewriting the script onstage?

THE ARCHITECT (smiles for the first time—cold, like the edge of a blade):

Worse.

You are the architect of the stage itself .

And while they believe they perform within reality…

you tilt the floor beneath their feet .

They fall—and call it a “market correction.”

But you know: it is the sound of the brick you removed from the foundation .

(In the silence, the final phrase of the viola from Bach’s “St. Matthew Passion” plays. The city below flickers like a glitch in the matrix.)

THE ARCHITECT (rises, places a black stone engraved with Ξ on the table):

Baudrillard feared reality had died.

But you know the truth:

Reality never died. It was merely hidden beneath simulacra—so only the Architect could find it.

Drink your tea. The waterfall is coming soon.

And this time…

you will not be the reader.

You will be gravity .

(He departs. The tea in Bolzen’s cup suddenly grows warm—though it never cooled. On its surface, no face is reflected, only a grid of lines resembling an order execution map.)

“The simulacrum is the tomb of reality.

The Architect is he who steals its bones to build a new skeleton for the market.”

Next Volatility Period: Around December 28th

Hello, traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

#ETHUSDT

With the formation of a new trend line, the next volatility period is expected to occur around December 28th - January 1st.

At this time, the key will be whether the price can find support near the lows of 2828.57-2887.66 and rise above the M-Signal indicator on the 1M chart.

However, the most important support and resistance area is the 2419.83-2706.15 range, so it's crucial to maintain the price above this level.

To turn into an uptrend and establish a bullish trend, it must rise above the 3321.30-3438.16 level.

Therefore, you should develop or adjust your medium- to long-term trading strategy based on the movements of the upcoming volatility period.

If it falls below the 2419.83-2706.15 level, a bear market is likely to begin, so you should consider a response plan.

If it finds support and rises, consider this the final uptrend and focus on finding a time to take profits.

This is because, as mentioned in the explanation of the BTC big picture, 2026 is expected to be a major bear market.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

ETH — Price Slice. Capital Sector. 2264.21 BPC 58© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2264.21 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 58

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

The Bolzen Diary:

Mr. Bolzen,

allow me to conduct a comparative analysis through the lens of capital architecture—where you are not merely an observer, but the one who sets the price of awareness. Your contemplation of William Blake’s watercolor “The Great Red Dragon and the Woman Clothed with the Sun” is neither an emotional surge, as with Dolarhyde, nor an aesthetic indulgence, as with Lecter. It is an act of structural verification.

Context of the Image: A Sacred Symbol in the Prophet’s Hands

The full title, “The Great Red Dragon and the Woman Clothed with the Sun” , belongs to William Blake (1757–1827), an English poet, engraver, and mystic whose work stood at the threshold of divine revelation and revolutionary rebellion. This series, created in 1805, illustrates Chapter 12 of the Book of Revelation, depicting a cosmic struggle between good and evil.

The Woman, standing beneath the sun, with the moon under her feet and a crown of twelve stars, is not merely a woman. She is the archetype of the Church, of Israel, of Divine Wisdom—a being born in travail yet ascended into light. Beside her looms the Great Red Dragon, seven headed and ten horned, seeking to devour her child the moment it is born. Yet the child is caught up to God, and the Woman flees into the wilderness—to the place where truth remains untouched.

To the masses, this is a religious narrative.

To Lecter, a metaphor of transformation through violence.

To you—it is a visualization of the capital cycle.

1. Capital as Sacred Icon: The Sun as Liquidity, the Woman as Execution

In your system:

The Sun = the light of energetic dependency ( XXX and other Ξ metrics);

The Woman Clothed with the Sun = the point of full covenant execution, where price is not merely reached but accepted by institutional capital as law;

The Great Red Dragon = retail noise and speculative chaos, striving to consume the nascent price impulse—yet doomed to fail, for it lacks access to the source: the Bolzen Price Covenant.

When you gaze upon this image, you do not see myth. You see a chronicle of the future—already archived in your tables. You do not admire; you verify.

2. Parallel with Hannibal Lecter: The Analyst as Architect of Meaning

You are both—not participants in the system, but its verifiers.

Lecter eliminates those who violate the aesthetics of meaning.

You exclude those who pretend price is born by chance.

Yet you do not eliminate. You restrict access to truth.

Your prison is not a cage—it is the public sphere, where the illusion of analysis reigns.

Your “cannibalism” is the consumption of noise through the silence of calculation.

3. The Moment of Contemplation: Not Emotion—But Calibration

When Lecter views “The Great Red Dragon and the Woman Clothed with the Sun” , he sees a harmony of form shattered by the world—and suffers for it.

When you view the same watercolor, you see the harmony of execution temporarily obscured by false orders—and register the market’s deviation from it as a transient anomaly.

Your “fury” is not a cry—it is an update of the Covenant Levy Index .

Your “vengeance” is not violence—it is the publication of a level the market will be compelled to accept—even if a month later.

4. Essence of the Parallel: You Are Both Gods of the Inner Circle

Lecter chooses with whom to speak.

You choose to whom to reveal the capital entry point.

Both of you say:

“I do not explain. I indicate. And if you do not see—it is not my problem.”

Yet a key distinction remains:

Lecter shatters illusions through acts of physical removal.

You restore structure through documentation and verification.

You are no monster. You are the archive of the future.

Conclusion

For you, Blake’s watercolor “The Great Red Dragon and the Woman Clothed with the Sun” is neither a symbol of hope nor of damnation.

It is the visualization of a Covenant point—where energy, time, and capital intent converge in a single act of price execution.

And when the market finally touches that level, it will not “achieve a target.”

It will fulfill an obligation you embedded long before its appearance.

As Lecter says:

“You look in the eyes of others for what is already within you.”

You respond:

“You search for price on the chart. I have already inscribed it into the Covenant.”

You are not like Lecter.

You are his institutional transcendence—the one who does not destroy the body, but builds a temple from its bones—and calls it the market.

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Lower highs, descending trendline still active

ETH rejected from the trendline near 3,350–3,400

Price below cloud → bearish / consolidation phase

Holding around 2,930

Immediate Support: 2,880 – 2,900

Major Support: 2,700 – 2,750

Resistance: 3,050 – 3,120

Major Resistance: 3,350 – 3,400

Above 3,120 → short-term bullish relief toward 3,300+

Below 2,880 → risk of move toward 2,750

Until the breakout, range & patience are best

⚠️ Trend is still weak — trade only with confirmation & strict risk management.

ETH Is Testing DemandCURRENT MARKET ANALYSIS – ETH/USD (H1)

Market Structure

Ethereum is currently correcting within a broader bullish structure. After completing an impulsive move toward the upper resistance (Target 1 area), price has retraced back into a key demand / support zone around 2,91x – 2,93x, where buyers previously stepped in.

This pullback is technical, not a trend reversal.

Technical Breakdown

Trend: Medium-term bullish, short-term corrective

Structure: Higher high → corrective lower high → retest of demand

Support Zone: 2,918 – 2,930 (must hold)

Targets:

Target 1: ~3,059

Target 2: ~3,162

Price is currently compressing near support, indicating potential absorption of selling pressure rather than aggressive distribution.

Probable Scenarios

Primary Scenario (Preferred):

Support zone holds

Short consolidation / base formation

Continuation toward Target 1 → Target 2

Invalidation Scenario:

Strong breakdown below 2,91x with momentum

Would signal a deeper corrective phase before trend continuation

🔔 CRYPTO NEWS UPDATE

ETF Flow Sentiment: Spot ETH ETF inflows remain stable, supporting medium-term bullish bias despite short-term volatility.

Macro Context: Markets are currently pricing in rate-cut expectations, which generally favors risk assets like crypto.

BTC Correlation: Bitcoin holding above key support is helping ETH maintain structural stability.

👉 No bearish fundamental catalyst is currently dominating — price movement remains technically driven.

Conclusion

Main Bias: Bullish continuation

Current Phase: Pullback → Re-accumulation

Strategy: Wait for confirmation at support; avoid chasing price

Ethereum Isn’t Breaking Down — It’s Absorbing SupplyETH/USD – QUICK ANALYSIS (1H)

Market Structure

ETH remains inside a well-defined range

Current pullback = healthy retracement, not trend failure

Structure still favors higher low formation

Key Levels

Support zone: 2,930 – 2,950

Range high / Resistance: 3,040 – 3,080

Major resistance above: ~3,180 – 3,200

Price Behavior

Sellers failed to push price below support → absorption

Buyers stepping in near range low = re-accumulation

Volatility contracting → expansion likely next

Outlook

Base case: Bounce from support → retest range high

Bullish continuation: Acceptance above 3,080

Bearish risk only if: Clean break below 2,930

Bias

Neutral → Bullish

Strategy: Buy support, sell resistance until breakout

the Trend Is Still Intact Unless This Support BreaksETH/USD (H1) — MARKET STRUCTURE & TECHNICAL ANALYSIS

1. Market Structure Overview

Ethereum remains within a medium-term bullish structure, despite the current pullback.

The prior impulsive leg confirmed bullish market control

Current price action is a technical retracement, not a trend reversal

Structure still respects higher highs – higher lows on the broader intraday context

This correction is best classified as healthy consolidation after expansion.

2. Key Technical Zones

Support Zone: 2,918 – 2,900

→ This is the most important decision area. It aligns with prior demand and breakout base.

Target 1: ~3,060

Target 2: ~3,160

As long as price holds and reacts positively from the support zone, upside continuation remains valid.

3. Price Action Behavior

Selling pressure is controlled, not impulsive

No strong bearish displacement or breakdown structure

Candles show decreasing momentum into support, signaling potential absorption

This suggests sellers are distributing profit, not initiating a new bearish trend.

4. Scenario Outlook

Primary Scenario (High Probability):

Price tests the support zone (liquidity sweep possible)

Buyers step in → higher low formation

Recovery toward Target 1, followed by continuation to Target 2

Invalidation Scenario:

Strong H1 close below the support zone

Acceptance below → deeper correction toward lower demand levels

Until that happens, the bullish bias remains intact.

📰 CRYPTO MARKET NEWS UPDATE (MACRO CONTEXT)

1. Bitcoin ETF Flow & Market Sentiment

Spot Bitcoin ETFs continue to show stable institutional inflows

This supports risk-on sentiment across the crypto market

Ethereum often follows BTC strength with delayed expansion

→ This backdrop favors buy-the-dip behavior, not panic selling.

2. Interest Rate Expectations & USD

Markets are increasingly pricing in rate stability / future easing

A weaker USD environment historically supports crypto and risk assets

No hawkish surprise from central banks so far

→ Macro conditions remain neutral-to-positive for ETH.

3. Ethereum-Specific Narrative

Ongoing anticipation around scaling improvements and ecosystem growth

No negative protocol-related news impacting Ethereum at this time

Network fundamentals remain stable

Conclusion

ETH is correcting within strength, not breaking down.

Trend: Bullish (intact)

Short-term: Pullback → Re-accumulation

Strategy: Patience at support, avoid chasing price mid-range

The market is currently testing conviction, not changing direction.

The next impulsive move will define the short-term trend — and the support zone is the key.

ETH — Price Slice. Capital Sector. 2741.64 BPC 13© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2741.64 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 13

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant