Eurodollar

Coinranger|EURUSD. Uncertainty at 1.19906🔹DXY has completed a full set of downward extensions on h1. Ideally, it should pullback, but its size is still uncertain. We could continue to fall.

🔹Today at 22 UTC+3 is the Fed rate. At 22:30 UTC+3 is the FOMC press conference. The rate is expected to remain at the same level as before - 3.75%.

🔹It's earnings season in the US.

Levels:

Above

1.12319 - the first extension on the h4

1.21042 - the first extension on the h1

1.20600 - a full set on the h4

Below

1.19100 - potential pullback if we don't hold at current levels soon or don't move higher.

It's difficult to say anything specific yet; minor movements are occurring on the euro on the m5/m15, which will likely determine our next move by this evening.

---------------

Share your thoughts in the comments!

W4-2026 EURUSD Bullish ideaThe end of the bullishness approaching the level of 1.1918:

The 3/4 of the amount of taking profits is needed as we go on !! My target was 1.1810 :)

Monday and Tuesday may keep on the HTF momentum in order to see a retracement and a consolidation range going thru the week.

www.tradingview.com

Have a good trading week so far

Coinranger|EURUSD. Potential for a decline to 1.17619🔹DXY fell even more overnight than on Friday. It could go even lower, but it's unlikely to do so without a reversal.

🔹No interesting news on the euro today.

🔹Earnings season is starting in the US, but there's nothing particularly interesting there today.

According to current levels on EUR:

Below:

Preliminary wave set for M15

1.17924

1.17619

1.17060

Above:

1.18448 - the end of the first upward extension

1.18752 - the end of the second upward extension (we may return here)

1.19135 - the first wave in a new set

After a significant rise, we're likely to correct today, most likely to 1.17619

-------------------

Share your thoughts in the comments!

Fundamental Market Analysis for January 26, 2026 EURUSDEUR/USD is holding near 1.18500–1.18600, supported by broad US dollar weakness. The market is discussing reports that US financial authorities reviewed USD/JPY pricing, which strengthened expectations of possible measures to curb excessive swings. Against this backdrop, investors are reducing demand for defensive dollar assets, while interest in the euro is recovering.

In the US, attention is shifting to the upcoming Fed meeting and fresh inflation and activity data. On one hand, the economy remains resilient, limiting the scope for rapid easing. On the other, uncertainty about future economic policy and the market’s sensitivity to the Fed’s independence are weighing on the dollar and encouraging flows into alternative currencies.

For the euro area, the key remains the balance between slowing inflation and weak growth momentum, keeping rate expectations cautious. The euro is also supported by easing concerns around trade restrictions and a calmer tone in talks among major economies. If this backdrop holds, the euro may retain an advantage against the dollar.

Trading recommendation: BUY 1.18550, SL 1.18150, TP 1.19750

EUR/USD Daily Chart Analysis For Week of Jan 23, 2026Technical Analysis and Outlook:

Over the past week, the Euro trading session has shown a notable upward rally, surpassing the Mean Resistance level at 1.164. This ascent continued toward the completed Interim Inner Currency Rally target of 1.180 and subsequently extended to a new level identified at 1.186.

Upon reaching this target, an In Force retracement is anticipated toward the Mean Support level at 1.178. Nevertheless, market participants should be aware that the currency may continue its trajectory to retest the completed Outer Currency Rally at 1.191, via the Key Resistance level at 1.187. At this juncture, a renewed In Force retracement is expected to be initiated from the Outer Currency Rally at 1.191.

Coinranger|EURUSD. Uncertainty at 1.17375. Continued🔹Yesterday, the DXY failed to achieve a reversal, and today there's nothing left to do one.

🔹Davos continues.

🔹All the interesting news on the euro has already been released at the time of this post issue.

The levels are the same:

Below:

Will be recalculated on Monday.

1.16827 - the first wave down on m15

1.16470 and 1.16200 - a potential first wave down on h1

Above:

1.17658 - 1.17788 - the first potential wave in a new uptrend. This is a full set on m15

1.17917 - additional level above on m15 (not marked on the chart)

So far, the story looks more like growth, but there's simply nothing to support a serious one. Therefore, we're moving within the old markings.

------------------

Share your opinion in the comments

Coinranger|EURUSD. Uncertainty at 1.17375🔹DXY has finally decided to fall and has already reached the potential pullback area of 98.3. A non-pullback down to 98.1 is still possible. We'll have to watch what happens next.

🔹Davos continues.

🔹During the DXY decline, the euro made a wave set and its first extension. The second is at 1.17375 - potential pullback point.

Levels:

Below:

Levels are tentatively calculated; it's difficult to say more precisely until the uptrend is complete.

1.16510 - first potential wave down

1.16267 - complete set down

Above:

1.17375 - second extension of the upward waves set, we'll likely take it.

1.17658 - 1.17788 - first potential wave in a new uptrend. This is a new, complete set for M15.

We're waiting for the DXY to behave from 98.1. For now, it's time to wait.

-------------------

Share your thoughts in the comments.

Coinranger | EURUSD. Continued decline to 1.15539🔹The DXY has faded a bit in its rise, but there's no clear indication of a significant reversal on the elder timeframes yet. So, it's very likely that after the pullback is realized, we'll continue to rise to the 99.23 area and higher, to 99.44.

🔹No news today, except for the International Economic Forum in Davos. There's no significant news for the euro this week, except for Friday.

🔹So, we're continuing to decline.

Levels

Below:

1.15700 - second downward extension from the old set

1.15539 - first downward extension from the new set

1.15310 - second downward extension from the new set

Above:

Potential pullback level, but not guaranteed to materialize.

1.16570 - first potential upside wave.

While the DXY is rising, the euro is falling.

-------------------

Share your thoughts in the comments.

EUR/USD buys up to sells ideaThis week’s outlook for EU is slightly different from the other pairs as price is approaching a very clean demand zone. Although the short-term momentum may still appear bearish, I’ll be watching closely for clear confirmation to potentially take a counter-trend buy back to the upside.

The main reason for this is that the nearest supply zone is quite far from current price, so I’ll wait to see how price opens on Sunday night and reacts around this area.

Confluences for EU Buys:

• Price slowing down before tapping demand would be a strong sign

• Overall structure has been bullish over the past month

• DXY approaching supply, which could support upside on EU

• A clean, unmitigated demand zone below price

• Asia high liquidity resting above that price may look to take

P.S. If price breaks cleanly through this demand, I’ll reassess and look for a closer, valid supply zone to potentially trade from instead.

EUR/USD: inside a triangleHi!

EUR/USD is trading within a well-defined descending triangle, a structure that typically reflects corrective price action rather than a strong trending environment. Price remains compressed between declining resistance and rising support, signaling a market in balance and approaching a decision point.

Within this broader structure, the market has formed a Head and Shoulders pattern (left shoulder, head, right shoulder), which has already played out to the downside. However, the bearish follow-through has been limited, suggesting weak downside momentum rather than aggressive distribution.

Currently, price is reacting around a key demand / reaction zone, where buyers have previously defended the market. From this area, two scenarios are technically valid:

A minor bullish correction toward the upper boundary of the wedge, driven by short-term mean reversion.

A continuation lower toward wedge support if price fails to build acceptance above the current zone.

As long as EUR/USD remains inside the triangle, the market should be treated as range-bound with directional uncertainty. A confirmed breakout from either boundary will be required to establish the next sustained directional move.

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

The chart is a 1‑hour EUR/USD The chart is a 1‑hour EUR/USD

1. Seller Zone: A yellow shaded area marking a resistance region where selling pressure is expected, indicating a potential bearish zone.

2. Range: A yellow box highlighting a consolidation or trading range where price has been moving sideways before a breakout.

3. Support Level: Marked at 1.16776, with additional levels shown nearby (1.16849, 1.16674, etc.), indicating where buyers may step in.

4. Target Point: A projected downside move is shown with a purple arrow pointing to a lower price zone (around 1.16428 / 1.16394), suggesting a bearish target if the price breaks below the range.

5. Price Action: The chart shows a descending trendline cutting through the seller zone, indicating a bearish bias. The recent candles are breaking out of the range toward the downside, suggesting potential further decline to the target.

6.

Key takeaway: The setup expects a continuation of selling pressure after the breakout from the range, aiming for the target near 1.16394, with the next support around that level. Resistance remains in the seller zone above.

EURUSD ...Time To Buy Now!EURUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. EURUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. Buy EURUSD now.

The chart shows a GBP/USD price action analysis with a bullish sThe chart shows a GBP/USD price action analysis with a bullish setup.

1. Trend: The pair broke out of a descending channel (blue shaded area), signaling a potential reversal from the bearish to bullish phase.

2. Resistance level: A strong resistance zone is marked between ~1.33750 and ~1.33270 (red shaded box). The price needs to stay above this zone for the bullish momentum to hold.

3. Target point: The projected upward move aims for 1.36018 (or 1.35850 as an immediate target), indicated by the blue arrow in the black box.

4. Current price: The pair is trading around 1.33999, just above the resistance level, suggesting a possible push toward the target if the breakout sustains.

5. Volume: The volume profile at the bottom shows moderate activity, which should increase on a breakout to confirm strength.

Overall, the setup suggests a buy signal if the price maintains above the resistance zone, targeting 1.36018.

The chart shows a GBP/USD forex pair with a technical analysis sThe chart shows a GBP/USD forex pair with a technical analysis setup on a 15-minute timeframe (FXCM). Here’s the breakdown:

1. Price Action: The pair has formed a descending channel (black lines) and recently broke above it with a bullish move, suggesting a potential reversal.

2. Resistance Level: A strong resistance zone is marked in red between ~1.33750 and ~1.33270. The price has previously bounced off this area.

3. Target Point: The blue arrow indicates an expected upward move toward the target at 1.36018 (or a secondary target at 1.35850), assuming the resistance is broken.

4. Current Price: The latest candle closes at 1.33999, near the resistance zone’s upper edge.

5. Strategy Implication: Traders may watch for a clean break above the resistance to confirm the bullish continuation toward the target. If the price fails to break the resistance, a pullback into the channel or consolidation is possible.

EUR/USD Daily Chart Analysis For Week of Jan 9, 2026Technical Analysis and Outlook:

In this week's trading session, the Euro market demonstrated substantial downward movement, followed by the elimination of the Mean Support levels at 1.171 and 1.168, thereby completing the Interim Inner Retracement at Mean Support 1.162, with the possibility of extending this down movement to Mean Support 1.159. However, present market conditions suggest an intermediate rebound is anticipated, targeting the Mean Resistance level at 1.168.

EUR/USD – 30-Minute TF Long Retracement (Before Downside)🟢 EUR/USD – 30-Minute TF Long Retracement (Before Downside)

Looking for a 30-minute timeframe long retracement on EUR/USD before the next move lower. Price is expected to pull back into supply / first, then resume the broader downside move.

Strict risk management applied

⚠️ Disclaimer

This is personal analysis for educational purposes only, not financial advice. Trade responsibly and manage risk.

Fundamental Market Analysis for January 8, 2026 EURUSDOn Thursday, January 8, EUR/USD is holding near 1.16800. Market activity is calmer ahead of tomorrow’s US employment report, while traders balance signals: recent job-opening and hiring indicators pointed to some cooling, but late-2025 services data remained relatively resilient.

The US dollar’s tone is driven by expectations for the Federal Reserve’s interest-rate path. Strong labour-market data increases the likelihood that rates stay high for longer, which supports the dollar. Additional demand for the US currency can also appear when uncertainty rises around US trade decisions and geopolitical developments.

In the euro area, December inflation eased to 2%, leaving the European Central Bank with fewer reasons to adjust its policy stance in the near term. With moderate growth and external risks still present, the euro may lag the dollar if US data confirms economic resilience. This keeps the downside case for the pair in focus.

Trading recommendation: SELL 1.16800, SL 1.17000, TP 1.16200

EUR/USD – Short Idea (Bearish Order Flow)🔴 EUR/USD – Bearish Continuation in Play

EUR/USD remains in a bearish continuation trend, with price respecting lower highs and lower lows. As long as structure holds, downside continuation remains the higher-probability scenario.

Expecting rejection from supply and a move back into the demand zone to see if it holds.

The identified supply presents a strong short opportunity, aligned with the current bearish order flow.

⚠️ Disclaimer

This is my personal analysis for educational purposes only, not financial advice. Trade at your own risk.

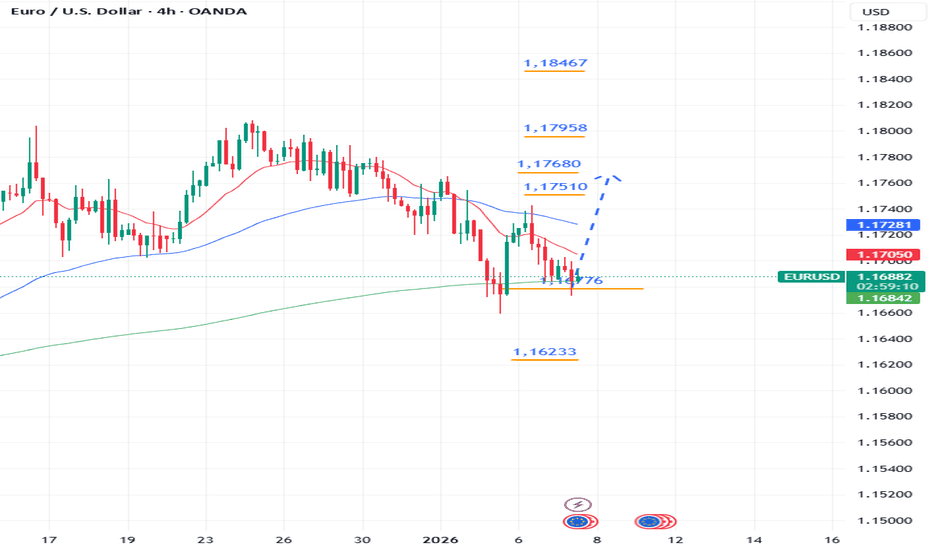

Coinranger | EURUSD. Reversal to 1.17510 and further. 2.0🔹The DXY has completed its full set of upward waves, though it went through suffering during the process. But there's still a chance of completing an extension upward wave for DXY at 98.333, but it's not a given that this will happen. The priority is down for now.

🔹Against this backdrop, the euro could make a decent upward surge into the areas indicated in Monday's forecast. It's still in effect. Let me remind you:

1️⃣ Levels below:

1.16776 is the end of the wave set of the previous decline on h4

1.16233 is the extension of this set on h4 (not necessarily will have been reached)

2️⃣ Levels above:

1.17510 and 17.680 are possible endings of the first (now third) wave of the upward movement on h1

1.17958 is the end of a full set of upward waves on h1

1.18467 is the first extension of a full set of upward waves on h1

Conclusion: for now, the priority is for the DXY to rise and fall.

Fundamental Market Analysis for January 5, 2025 EURUSDEUR/USD on Monday, January 5, is holding near 1.16800–1.17000. The US dollar is strengthening at the start of the first full week of 2026 as investors refocus on fresh US macro data and reduce risk appetite. Sentiment is also influenced by heightened geopolitical uncertainty: when headlines escalate, demand for defensive assets typically supports the dollar.

The key focus today is US manufacturing activity data and its impact on expectations for the Federal Reserve’s policy rate in 2026. If the figures prove resilient, it becomes harder for the market to price in rapid rate cuts, giving the dollar an additional tailwind. Another volatility driver is anticipation of a decision on the next Fed Chair candidate, which increases sensitivity to comments and shifts in forecasts.

In the euro area, there are fewer immediate catalysts. The ECB aims to keep inflation near target, while the recovery remains uneven. With the US agenda dominating and investors staying cautious, the euro may remain under pressure—especially if incoming US data confirms solid demand and employment conditions.

Trading recommendation: SELL 1.16850, SL 1.17150, TP 1.15950