EURUSD: Three Targets Swing Buy, One Entry! **EURUSD ANALYSIS**

🔺The daily timeframe suggests a strong bullish price trend is likely to continue. After hitting some important levels and then reversing, with a big push from bullish volume, we expect the upward momentum to keep going. The lowest point of the day was at 1.1474, where the reversal happened and they broke through the main bearish trendline. Then, they tested 1.1510 again, and things have been moving up steadily since then.

🔺Looking at the basics, the US dollar might keep losing value, mainly because of what’s happening with Venezuela. This could hurt the US dollar but help the euro and other metal prices.

🔺The *Blue Marked Zone* is where we think it’s a good time to buy, and we reckon there’s a good chance of a sharp price change with strong buying pressure. We suggest setting your stop-loss order below this zone.

🔺We’ve set up three different places to make a profit, which you can use in your trading plan. When you get to the first profit level, it’s a good idea to close some of your position and move the rest to the second level. You should do the same thing for the last time you enter.

🔺If you find our work helpful, please like and comment so we can share more. We wish you all the best with your trading and really recommend making sure you have good risk management in place. Also, we suggest doing your own thorough analysis and using this information just to learn.

Team SetupsFX_👨💻📊❤️

Eurusdlong

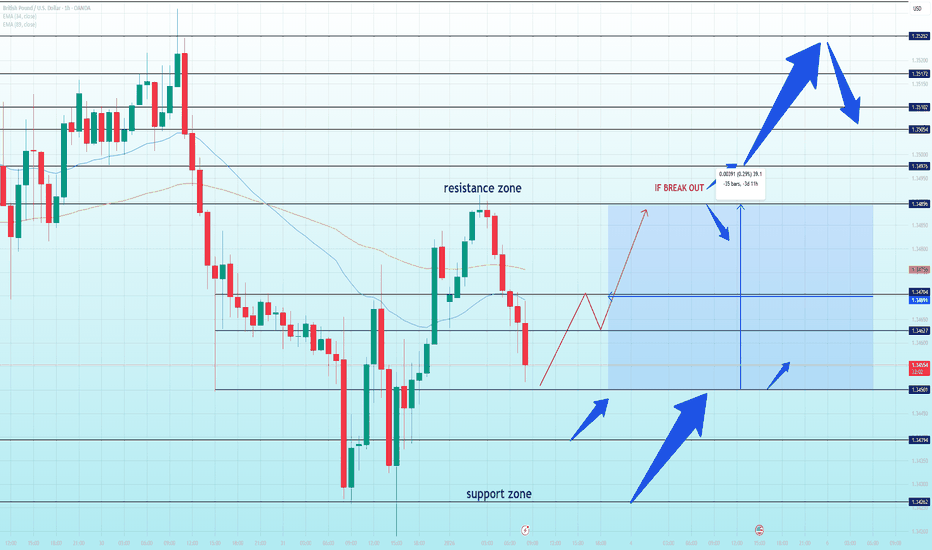

GBP/USD at a Decision Point: Breakout Potential or Another RangeGBP/USD is currently trading inside a clearly defined range structure, with price compressing between a well-respected support zone around 1.3450 and a resistance zone near 1.3490–1.3500. Recent price action shows a sharp recovery from the lower boundary, but upside momentum has stalled again as price re-enters the prior resistance area. This behavior suggests the market is not trending, but rotating liquidity within the range.

From a technical perspective, the rejection from the resistance zone is technically clean. Price failed to hold above the short-term equilibrium and slipped back below the mid-range, indicating that buyers lack conviction at higher levels. The moving averages are flattening and overlapping, reinforcing the idea of balance rather than trend. Until a decisive break occurs, upside moves should be treated as corrective, not impulsive.

The bullish scenario only becomes valid if GBP/USD can break and hold above the 1.3490–1.3500 resistance zone, followed by acceptance above that level. In that case, upside expansion could open toward 1.3510 → 1.3525, where higher-timeframe supply is located. Without that confirmation, any push higher remains vulnerable to rejection.

On the bearish / range-continuation scenario, failure to reclaim resistance keeps price rotating back toward the 1.3450 support zone. A clean breakdown below this support would expose deeper downside toward 1.3430 and below, extending the range rather than reversing the broader structure.

From a macro standpoint, GBP remains sensitive to the USD side of the equation. Persistent USD resilience—supported by relatively restrictive financial conditions and cautious Fed messaging—continues to cap upside in GBP/USD. At the same time, the Bank of England’s stance remains restrictive but growth concerns limit aggressive GBP inflows. This macro backdrop favors choppy, range-bound price action, not clean directional trends.

Summary:

GBP/USD is in a neutral-to-range environment. The market is waiting for confirmation. A sustained break above resistance is required to unlock upside continuation; otherwise, the higher-probability outcome remains range rotation back toward support. Patience and confirmation are key at this level.

TheGrove | EURUSD Sell | Idea Trading AnalysisYou can expect a reaction in the direction of selling from the specified Support zone

EURUSD moving higher as it tests the strong resistance level..

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

EURUSD ... Buy now!EURUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. EURUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. time to Buy EURUSD..

EURUSD possbly heading to order blockEURUSD with multiple liquidity trigger at the resistance level, forming a double top, price started to reverse late previous week. 4h candlestick pattern shows a strong false breakout with multiple rejection showing price may continue to drop to order block at 1.15297 or below.

Entry to sell on a liquidity sweep is higher probability and if, price hit key level 1.1529 with higher ATR look for buy

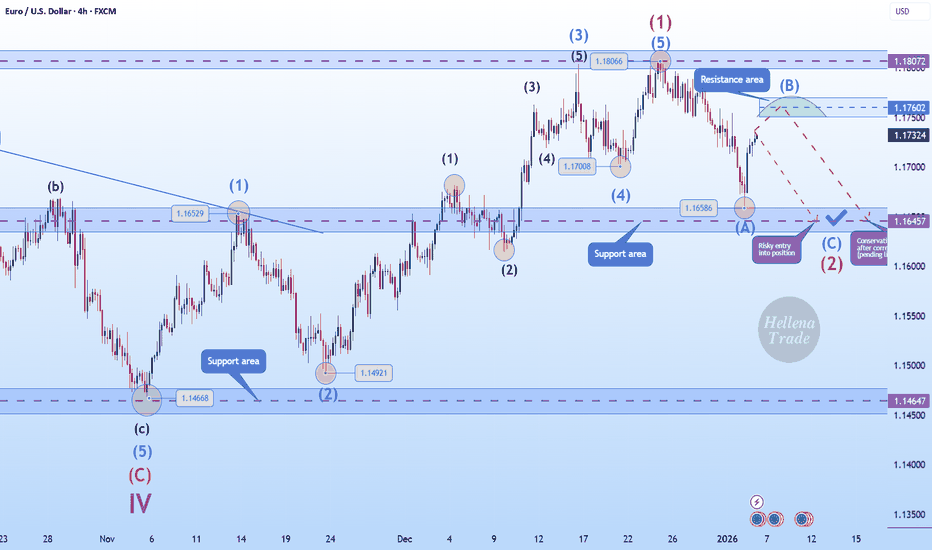

Hellena | EUR/USD (4H): SHORT to support area 1.16457 (ABC).Colleagues, judging by the nature of wave “2” movement, I assume that the correction is not yet complete. This movement is slightly stretched, and we can clearly see waves “A” and ‘B’, which means we can expect an update of wave “A” minimum and reaching at least the support level of 1.16457.

Somewhere below, I expect the completion of wave “C” and wave “2”, but that will be a slightly different forecast.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

EUR/USD 30- MINUTES LONG CHART SETUPEUR/USD 30-minute chart analysis based Market Structure (30-M)

After a strong bearish move, price formed a liquidity sweep / fake breakdown below support.

Sharp bullish impulsive recovery → shows buyers stepping in aggressively.

Current structure is shifting from LH–LL → potential HH–HL (bullish correction phase).

Key Levels

Support Zone

1.1700 – 1.1703

Previous breakdown area + demand reaction

Validation level for bullish bias

Entry Zone (Intraday Buy)

1.1722 – 1.1726

Price is retesting previous resistance turned support

Resistance / Supply

1.1750 – 1.1756

Strong rejection area from the left

Marked as target area

Trade Plan (Bullish Setup)

Bias: Bullish continuation (pullback buy)

Entry:

Buy around 1.1722 – 1.1726 after bullish candle confirmation

Stop Loss:

Below 1.1700 – 1.1702 (structure invalidation)

Take Profit Targets:

TP1: 1.1738

TP2: 1.1750

TP3: 1.1755 – 1.1760

Confirmation Checklist

✔ Bullish engulfing / strong rejection wick at entry

✔ Higher low on 5M–15M

✔ No strong bearish rejection before resistance

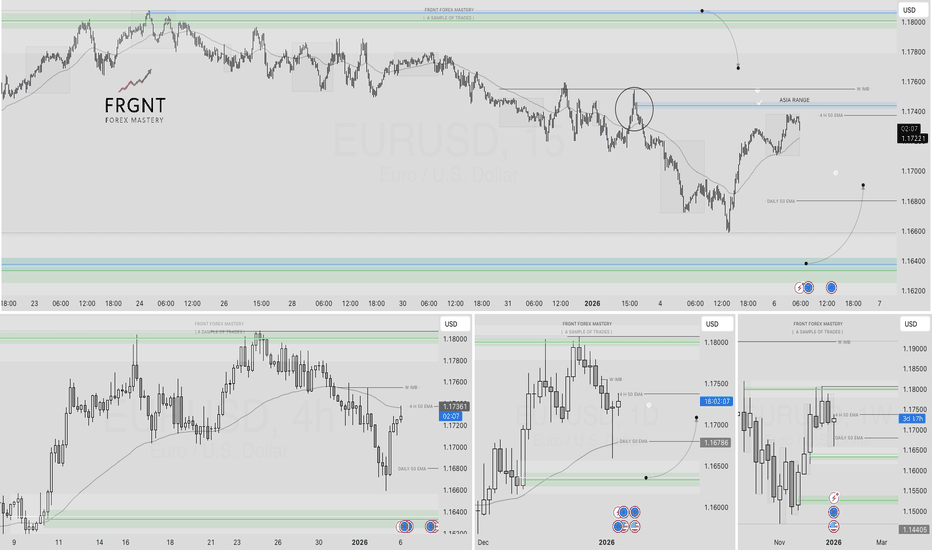

EURUSD — FRGNT DAILY CHART FORECAST Q1 | D6 | W1 | Y26📅 Q1 | D6 | W1 | Y26

📊 EURUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈🔥

FX:EURUSD

EURUSD is in a Downside DirectionHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR/USD 4H Technical OutlookEUR/USD is currently trading in a clear bullish structure, supported by a rising trendline that has held price since the early December lows. The market has been printing higher highs and higher lows, confirming buyers remain in control.

Price recently broke above a prior resistance zone (marked with XXX), turning it into a key support area. The current consolidation above this level suggests healthy bullish continuation, rather than weakness.

The projected path shows a potential pullback toward the ascending trendline, which would offer a higher-low entry opportunity if buyers step in. From there, price is expected to resume its upward move, targeting the next resistance zone and ultimately the major high / highest target around 1.1918, which aligns with previous market structure resistance.

As long as price respects the rising trendline and holds above the broken resistance, the bullish bias remains intact. A clean break below the trendline would be the first warning sign of momentum loss.

EUR/USD OutlookMy outlook this week is similar to GU, however price has already reacted and moved into the current demand zone. From here, I’ll be waiting to see whether this zone holds or if price breaks lower into a more discounted area.

If price breaks below this demand, I’ll wait for price to reach the daily demand zone below and look for potential opportunities from that POI.

Confluences for This Bias:

• Price remains bullish on the higher time frame

• POI sits within the ideal Fibonacci dealing range

• Break of structure to the upside confirms bullish bias

• Liquidity resting above that price may target

• DXY aligns with this overall outlook

P.S. If price continues higher without retracing into my zone, I’ll wait for another bullish break of structure and then identify a new POI to trade from.

DXY – Price Action Review (Daily TF)Bias: Sell on pullbacks, trade with confirmation DXY – Price Action Review (Daily TF)

Market Structure: Overall structure has shifted to lower highs and lower lows, indicating a developing bearish trend.

Supply Reaction: Strong rejection from the major supply zone (101.30–101.00) confirms institutional selling pressure.

Pullback Zone: Current price is retracing toward a minor supply / mitigation zone (~98.40–98.80) — potential sell-on-rally area.

Bearish Continuation Bias: Failure to reclaim previous swing highs keeps bearish momentum intact.

Key Support: 97.45 is a critical support; a clean break may open downside toward 96.80–96.50.

Invalidation: Sustained acceptance above 99.00+ would weaken the bearish setup.

Decision Point — Bounce or Breakdown?EURUSD is trading at a key decision area after a sustained decline from the upper range. Price is now approaching the mid-range support, with momentum slowing, suggesting the market is preparing for either a reaction bounce or continuation lower.

The broader structure remains range-bound, with price capped below the 1.1800–1.1810 resistance zone and buyers historically stepping in near the lower boundary.

Resistance: 1.1800 – 1.1810

Support: 1.1700 – 1.1710

Decision zone: 1.1730 – 1.1740

➡️ Primary: hold above 1.1700 → corrective bounce → rotation back toward 1.1760–1.1780.

⚠️ Risk: clean break below 1.1700 → continuation toward the lower support zone before stabilization.

EURUSD: Bullish Push to 1.1878?As the previous analysis worked exactly as predicted, FX:EURUSD is eyeing a bullish breakout on the 4-hour chart , with price rebounding from higher lows in an upward channel after a breakout candle, converging with a potential entry zone that could ignite upside momentum if buyers push through short-term resistance amid recent volatility. This setup suggests a continuation opportunity in the uptrend, targeting higher levels with overall risk-reward exceeding 1:3.5 .🔥

Entry between 1.1728–1.1738 for a long position. Targets at 1.1820 (first), 1.1878 (second). Set a stop loss at a daily close below 1.1700 , yielding a risk-reward ratio of more than 1:3.5 in total . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's momentum in the channel.🌟

Fundamentally , EURUSD is trading around 1.178 in late December 2025, with key US Dollar events this week potentially weakening USD if data underperforms, favoring euro strength. For the US Dollar, Tuesday, December 23 at 05:30 AM UTC brings GDP Growth Rate QoQ Q3 (forecast 3.3%, previous 4.3%), Core PCE Prices QoQ Q3 (forecast 2.9%, previous 2.9%), PCE Prices QoQ Q3 (forecast 2.8%, previous 2.8%), and Real Consumer Spending QoQ Q3 (previous 3.5%); followed by CB Consumer Confidence DEC at 07:00 AM UTC (forecast 91, previous 89.1). No major high-impact events for the Euro this week, leaving the pair sensitive to USD catalysts. 💡

📝 Trade Setup

🎯 Entry (Long):

1.1728 – 1.1738

(Entry at these levels is valid with proper risk & capital management.)

🎯 Targets:

• 1.1820 (TP1)

• 1.1878 (TP2)

❌ Stop Loss:

• Daily close below 1.1700

⚖️ Risk-to-Reward:

• > 1:3.5 (total)

💡 Your view?

Does EURUSD defend the channel and push toward 1.1878 — or do we see deeper consolidation before continuation? 👇

EURUSD Is Coiling — One Clean Break Will Decide the Next MoveEURUSD (1H)

1) Market Structure

Price is in a sideways accumulation range after a prior bullish leg.

Repeated higher reactions from the same base indicate buyers are absorbing supply near support.

Upper wicks near 1.1800+ show sell pressure overhead → market needs a clean break to expand.

2) Key Levels

Support Zone: 1.1760 – 1.1770

Structural base of the range. Holding this zone keeps bullish scenarios valid.

Target 1 / Resistance: 1.18040

First breakout trigger. Needs a clear H1 close above to confirm strength.

Target 2 / Resistance: 1.18197

Range ceiling. Acceptance above this level confirms a true breakout.

3) Trading Scenarios

Scenario A (Preferred): Buy from Support

Condition: Price sweeps 1.1760–1.1770 and reclaims 1.1775–1.1780 with rejection.

Targets:

TP1: 1.18040

TP2: 1.18197

Scenario B (Breakout Buy):

Condition: H1 close above 1.18040, followed by a shallow pullback holding above 1.1800.

Target: 1.18197, then reassess for extension.

Invalidation:

A clean H1 close below the support zone invalidates bullish structure and opens downside risk.

4) Macro Drivers to Watch

USD strength: Rising US yields, hawkish Fed tone, strong US data → EURUSD capped or pushed lower.

EUR strength: ECB staying restrictive, improving Eurozone data, risk-on sentiment → supports breakout.

High-impact catalysts: CPI, PCE, NFP, PMI, FOMC/ECB speeches, and moves in DXY & US10Y.

The Calm Before the Break: EUR/USDEUR/USD on the 1H chart is trading in a well-defined range environment, with price currently around 1.1775 and repeatedly rotating between a support band near 1.1760–1.1765 and a resistance band near 1.1800–1.1810. The structure is not trending cleanly; instead, it is showing mean-reversion behavior—buyers step in aggressively on dips into support, while sellers defend the upper supply zone, producing the repeated “up-down” swings visible on the chart. Technically, this is reinforced by the moving averages compressing around price: the EMA 34 (~1.1775) and EMA 89 (~1.1773) are almost flat and overlapping, a classic signature of consolidation rather than directional expansion.

From a macro perspective, this type of tight range is typical when the market is waiting for clarity on rate expectations and yield differentials. EUR/USD tends to move higher when U.S. yields soften or the USD weakens, and it tends to stall or pull back when U.S. yields reprice upward or risk sentiment deteriorates. As long as traders are uncertain about the next policy steps from the Fed vs. ECB, price often remains trapped inside these liquidity bands, with both sides fading extremes rather than committing to trend continuation. The practical takeaway is simple: 1.1760–1.1765 is the “line in the sand” for bulls, while 1.1800–1.1810 is the ceiling that must break for upside expansion. A clean hold and rebound off support keeps the range rotation intact and opens the path back toward the top of the box; a decisive break and acceptance below support would invalidate the bullish rotation and shift focus to lower demand zones.

EUR/USD Is Resting — The Break Comes After the TrapEUR/USD – 1H |

Structure: Price is in a sideway consolidation after a bullish leg → trend is still up, not reversed.

Range:

Resistance: ~1.1805–1.1810

Support: ~1.1760–1.1770 (EMA + demand)

Behavior: Rejections at the top suggest liquidity sweep risk before continuation.

Scenarios:

Preferred: Dip toward support → bounce → breakout toward 1.1820+.

Invalidation: Clean breakdown below 1.1755 → range expansion lower.

Bias: Bullish continuation after consolidation. Patience before the move.

EUR/USD Trapped in a Tight Range — Breakout or Another False EUR/USD is currently trading in a clear consolidation structure, bounded by a well-defined resistance and support zone. Price action shows repeated reactions at both boundaries, confirming that the market is rotational rather than trending at this stage.

Technical Analysis

On the 1H timeframe, the resistance zone around 1.1800–1.1820 continues to cap upside attempts. Multiple rejections from this area indicate strong sell-side liquidity and a lack of bullish acceptance above resistance. Conversely, the support zone near 1.1755–1.1765 has held firmly, with buyers consistently stepping in to defend this level.

The internal structure between these zones is characterized by lower momentum swings and overlapping candles, which is typical of a range environment. Until price decisively breaks and closes outside this box, directional bias remains neutral. A clean breakout above 1.1820 would open the door toward the next upside objective around 1.1880–1.1900, while a loss of 1.1755 support would likely trigger a downside move toward 1.1700, where previous demand is located.

Market Behavior & Liquidity

Recent moves into both support and resistance appear to be liquidity-driven probes, not trend initiations. This suggests larger participants are accumulating or distributing positions while keeping price contained. Traders should be cautious of false breakouts, especially during low-volume sessions.

Macro Context

From a macro perspective, EUR/USD remains heavily influenced by USD-side expectations. Markets are closely monitoring:

Federal Reserve rate path expectations, with easing priced further into 2025–2026

Eurozone growth concerns, which continue to limit sustained EUR strength

Thin year-end liquidity, increasing the probability of range-bound and deceptive moves

At present, there is no strong macro catalyst to justify a sustained trend breakout, reinforcing the technical range thesis.

Conclusion

EUR/USD remains range-bound between 1.1755 and 1.1820. Until a decisive breakout and acceptance occurs, the higher-probability approach is to respect the range rather than chase directional moves. Patience is key the market is signaling balance, not conviction.

EUR/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of EURUSD – 4H chart, aligned with SMC + structure + EMA support.

⸻

Market Context (4H)

• Primary bias: Bullish continuation

• Higher-timeframe structure remains higher highs & higher lows

• Price is trading above EMA 200, confirming bullish HTF bias

• Current move is a healthy correction, not trend reversal

⸻

What Price Is Doing

• Price is consolidating inside a descending corrective channel

• The pullback has reached a discount area

• Price tapped a bullish order block (OB) + EMA support

• This is typical re-accumulation before continuation

⸻

Key Zones

HTF Demand / Order Block

~1.1720 – 1.1740

• Marked OB zone

• Confluence with EMA 50 & EMA 200

• Previous resistance → support flip

• Strong reaction zone (green arrow)

Invalidation Zone

~1.1680

• Acceptance below this level weakens bullish structure

⸻

Trade Idea (Primary Scenario)

BUY Setup (Continuation Play)

• Entry: 1.1720 – 1.1740

• Stop Loss: Below 1.1680

• Targets:

• TP1: 1.1780

• TP2: 1.1820

• Final TP: 1.1867 (HTF target / liquidity above highs)

Risk–Reward: ~1:3+

⸻

Confirmation Checklist

Look for:

• Bullish engulfing or strong rejection from OB

• Lower-TF CHoCH

• Failure to close below demand

• Momentum expansion to the upside

⸻

Invalidation

• 4H close below 1.1680

• Acceptance below HTF demand + EMA 200

If invalidated → expect deeper pullback toward lower demand.

⸻ Mr SMC Trading point

Summary

This setup represents a classic bullish continuation:

• Trend intact

• Correction into discount

• OB + EMA confluence

• Clear upside liquidity target

Please support boost this analysis

Is EUR/USD Entering a Bullish Continuation Phase?📌 EUR/USD – “THE FIBRE”

💱 Forex Market Trade Opportunity Guide

(Swing Trade | Day Trade)

🔵 Market Bias

🟢 BULLISH STRUCTURE CONFIRMED

Price action aligns with trend continuation mechanics, supported by multi-indicator confluence and momentum expansion.

🧠 Trade Plan – Technical Confluence

✔️ Triangular Moving Average BREAKOUT

✔️ Hull Moving Average Pullback & Retest (dynamic support confirmation)

✔️ CCI Oscillator Golden Cross (momentum acceleration signal)

📊 This setup reflects trend resumption after healthy retracement, often favored by smart money continuation models.

🎯 Entry Strategy

🟢 YOU CAN ENTER AT ANY PRICE LEVEL

🔹 Traders may scale in using price acceptance above dynamic averages

🔹 Suitable for layered entries based on individual risk frameworks

🛑 Risk Management

🔴 Stop Loss (Reference Level): 1.16500

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

Risk parameters must always be adjusted based on your own strategy, capital, and exposure model.

This level is not mandatory.

🏁 Profit Zone / Exit Logic

🎯 Primary Target: 1.18500

🚓 Police force zone acting as:

Strong historical resistance

Overbought price area

Liquidity trap potential

High probability reaction / correction zone

➡️ Protect profits aggressively near this zone.

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

TP levels are guidelines, not financial advice. Partial profits are encouraged.

🔗 Related Pairs to Watch (Correlation & Confirmation)

💵 USD-Driven Correlation

TVC:DXY (US Dollar Index)

🔻 Weakness in DXY generally supports EUR/USD upside

🔺 Any sharp DXY reversal may cap EUR/USD gains

💶 EUR Strength Basket

OANDA:EURJPY

📈 Bullish momentum confirms EUR strength vs safe-haven JPY

OANDA:EURGBP

🔄 Range behavior here helps identify relative EUR demand

OANDA:EURCHF

🧭 Stability above key levels supports risk-on EUR flows

💷 Cross-Market Confirmation

FX:GBPUSD

✔️ Parallel bullish structure adds USD weakness confirmation

OANDA:USDCHF

🔻 Bearish bias here often aligns with EUR/USD bullish continuation

🧩 Key Insight

📌 When EUR pairs show synchronized strength and USD pairs weaken,

➡️ EUR/USD continuation probability increases significantly.

🏁 Final Note

This setup is built on trend alignment, momentum confirmation, and structured risk logic.

Discipline, patience, and execution consistency are what turn setups into profits.

📈 Trade smart. Manage risk. Protect capital.

EUR/USD Market Structure Signals Upside Potential🔔 EUR/USD Breakout Watch — Is the Fibre Ready for the Next Leg Higher?

📌 Asset

EUR/USD — “THE FIBRE”

FOREX Market Trade Opportunity Guide (Day / Swing Trade)

📈 Market Bias

🟢 Bullish Plan — Pending Order Setup

Momentum is building as price approaches a key resistance breakout zone, suggesting potential continuation once liquidity above the level is cleared.

🎯 Entry Strategy

✅ Buy after confirmed resistance breakout @ 1.18000

📌 You may enter at any price level after breakout confirmation

📌 Patience is key — let the market show acceptance above resistance

🛑 Stop Loss

🔻 Thief SL @ 1.17500

⚠️ Dear Ladies & Gentlemen (Thief OG’s):

Adjust your stop-loss according to your own risk management & position sizing.

I do not recommend blindly following my SL.

🎯 Target Zone

🚔 Police Barricade Area @ 1.18700

Strong resistance zone

Overbought conditions may appear

Possible bull trap & corrective move

👉 Escape with profits once price reacts

⚠️ Dear Ladies & Gentlemen (Thief OG’s):

I do not recommend using only my TP. Secure profits based on your own trading plan.

🔗 Related Pairs to Watch (USD Correlation)

💵 GBP/USD

Positive correlation with EUR/USD

Strength here often confirms USD weakness

💵 AUD/USD

Risk-on sentiment gauge

Bullish AUD/USD supports EUR/USD upside

💵 USD/JPY

Inverse correlation

Weak USD usually pushes USD/JPY lower while EUR/USD rises

💵 DXY (US Dollar Index)

Key driver

Sustained weakness below resistance favors EUR/USD bulls

🌍 Fundamental & Economic Factors to Monitor

📊 Eurozone Factors

ECB policy outlook & interest rate guidance

Inflation (CPI) and PMI data affecting EUR strength

Economic growth stability across core EU economies

📊 US Factors

Federal Reserve rate expectations

Inflation data (CPI, PCE) impacting USD demand

Labor market releases influencing USD volatility

📰 Upcoming High-Impact Events

Central bank speeches

Inflation & employment reports

Risk sentiment from global macro developments

📌 Volatility is expected around major data releases — manage exposure wisely.

🧠 Trader’s Reminder

💡 Trade the confirmation, not the hope

💡 Protect capital first, profits second

💡 Discipline > Emotion

👍 If this setup aligns with your market view, drop a like & share your thoughts below.

📊 Follow for more structured Forex, Index & Commodity trade blueprints.

⚔️ Trade smart. Trade disciplined.