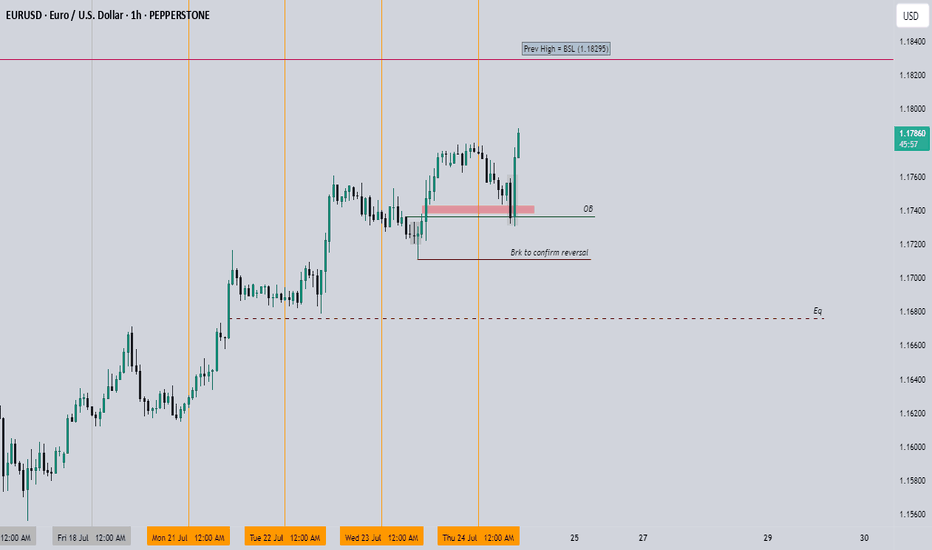

EURUSD Still Bearish | Perfect Sell-on-Rally Zone FormingEURUSD is trading inside a clear descending channel on the H1 timeframe. Price action continues to respect the channel structure, forming lower highs and lower lows, which confirms ongoing bearish momentum.

The pair recently pulled back toward the channel midline / dynamic resistance, where selling pressure re-emerged. Moving averages are also acting as dynamic resistance, keeping price capped to the downside.

As long as price remains below the upper channel boundary, the bearish bias remains valid.

🔴 Sell Trade Setup

Sell Zone: 1.1720 – 1.1730

Stop Loss: 1.1765

Take Profit 1: 1.1690

Take Profit 2: 1.1665

Risk–Reward: 1:2+

📌 Trade Logic

Descending channel intact.

Price below key moving averages.

Rejection from resistance zone.

Bearish structure remains unbroken.

Selling rallies inside the channel offers. the best probability setup.

❌ Invalidation

A strong H1 close above 1.1765 will invalidate this bearish setup and suggest a possible trend shift.

⚠️ Notes:

Watch for volatility during upcoming economic events

Wait for H1 candle confirmation before entry

Apply proper risk management (1–2% per trade)

📊 Market Bias

Trend: Bearish

Strategy: Sell on pullbacks

Timeframe: H1

👍 Like & follow for more clean price action setups.

💬 Comment if you see a breakout or continuation.

Eurusdpattern

Conducting multi-core logical analysisThe policy differences between Europe and the United States form the core support: This is the key driving force for currently going long on the euro against the US dollar. CME data shows that the probability of the Federal Reserve cutting interest rates in December has risen to 82.9%. The expectation of monetary easing continues to weaken the attractive potential of the US dollar's interest rate spread; while the European Central Bank has a hawkish stance, President Lagarde emphasized the need to ensure that inflation stabilizes and returns to the 2% target, and the core inflation rate in the eurozone in October remained stable at 3.4%, and market expectations for the ECB's interest rate cut lag significantly behind those of the Federal Reserve. At the same time, the dominant interest rate in the eurozone remains at 4.5%, which has an interest rate advantage over the current interest rate range of the Federal Reserve, attracting arbitrage funds to flow into euro assets.

The eurozone economy shows marginal improvement: The improvement in economic data has enhanced the inherent resilience of the euro. The final value of the German 10-month services PMI reached 51.4, remaining in the expansion range for two consecutive months; the eurozone's GDP grew by 0.1% in the third quarter, reversing the previous stagnation trend. In addition, the eurozone's 10-month comprehensive PMI climbed to 52.2, reaching a new high in 17 months, indicating that the economy has achieved consecutive 10-month expansion; these data provide fundamental support for the euro.

Trading Strategy for EUR/USD

buy:1.15600-1.15700

tp:1.15800-1.15900

sl:1.15500

Analysis of the New Dimension of Multi-Core Logic TradingSubdivided highlights of the economic recovery in the Eurozone provide fundamental support: The Eurozone economy is not completely weak; there are structural recovery highlights that support the euro. The comprehensive PMI in October rose to 52.2, reaching a new high in 17 months, and has maintained an expansionary trend for 10 consecutive months. Among the core economies, Germany performed outstandingly, with its PMI index reaching the best since May 2023. Industrial orders rebounded month-on-month, and export data also showed signs of recovery. As the engine of the Eurozone economy, Germany's recovery provided a solid economic foundation for the euro. At the same time, the Eurozone's CPI rose by 2.2% year-on-year in September, approaching the 2% inflation target of the European Central Bank. This moderate inflation state avoided the risk of deflation and did not require concerns about aggressive policy adjustments due to excessive inflation, creating favorable conditions for the stable strengthening of the euro.

Increased potential weakness scenarios for the US dollar are beneficial for the euro's upward movement: The current resilience of the US dollar is not flawless, and there are multiple factors that may trigger a correction. On the one hand, the market's expectation for a 12-month Fed rate cut has reached 65%. If the subsequent US consumer or employment data shows a slight decline, it will further strengthen the expectation of a rate cut, putting pressure on the US dollar index. On the other hand, the US dollar index has been fluctuating around 99.50 recently, lacking the strong momentum for continuous upward movement. If it fails to break through, a large number of profit-taking sell orders may trigger a rapid decline in the US dollar. While the euro is the main rival currency of the US dollar, it often gains significant upward momentum when the US dollar weakens. This provides a favorable external environment for the euro to rise against the US dollar.

Short-term technical indicators show a bullish launch signal: From the short-term K-line perspective, the euro against the US dollar has formed a small upward trend with gradually rising lows at the 1-hour level. At the indicator level, the 5-day moving average is diverging upward, providing effective support for the exchange rate. Although the MACD indicator once contracted the red energy bar, it showed signs of expanding again after the low point of 1.1515, indicating that the short-term bullish momentum is reaccumulating. At the same time, the recent price movement has seen an increase in trading volume simultaneously, with good volume-price coordination, confirming the validity of the current upward trend, and the RSI indicator is in the neutral to strong range of 55, not reaching the overbought threshold, indicating that there is still upward space in the short term, providing technical basis for short-term bullish trading.

Trading Strategy for EUR/USD

buy:1.15000-1.15100

tp:1.15500-1.15800

sl:1.14800

EUR/USD – Short Setup After Retracement to Resistance ZoneChart Context

Pair: EUR/USD

Timeframe: 4H

Current Price: 1.1713

Trend Channel: Ascending parallel channel (light pink/blue zone).

Structure: Price is consolidating mid-channel after a previous bullish leg.

Setup Summary

Entry Zone: Around 1.1860 – 1.1866

Stop Loss: Around 1.1955 – 1.1957

Target Zone: Around 1.1368 – 1.1377

Risk-Reward Ratio: Roughly 1 : 4.5

Technical Breakdown

Price Action:

The pair is currently consolidating near the midpoint of an ascending channel.

The chart suggests an expected bullish retracement to the upper channel boundary (1.1860–1.1950) before reversing lower.

Pattern:

The setup forms a bearish correctional structure — a potential rising wedge / channel top.

The projection shows a short (sell) setup after the retracement to the resistance area.

Key Zones:

Resistance / Sell Zone: 1.1860 – 1.1950

(Coincides with previous swing highs + upper channel boundary)

Support / Take Profit Zone: 1.1368 – 1.1377

(Matches previous structural low support)

Momentum View:

The sideways action indicates weak bullish momentum, possibly preparing for a downside breakout.

If price rejects near 1.1860 with bearish confirmation (e.g., engulfing candle or divergence), a drop toward 1.14 and 1.1360 becomes likely.

Trading Outlook

📉 Bias: Bearish setup (short after retracement)

🎯 Target: 1.1368

⛔ Stop Loss: 1.1955

⚖️ Risk/Reward: Strong, ~1:4.5

🕒 Confirmation Needed: Wait for rejection signals near 1.1860–1.1950 zone before entry.

EURUSD Daily Forecast – Q3 | W37 | D8 | Y25EURUSD Daily Forecast – Q3 | W37 | D8 | Y25 📊

🔹 Market Context

For the past 8 weeks, EURUSD has been held in a weekly range. This can give us clean trading opportunities, but caution is required — I’ll be waiting for a 15M break of structure before committing to either longs or shorts.

🔹 Bullish Bias (Higher Probability)

Weekly (W36) candle closed bullish above the weekly 50 EMA, with a strong wick rejection from the lows.

The previous daily candle also closed bullish above the daily 50 EMA, keeping my bias in favor of long opportunities.

🔹 Bearish Scenario (Range Top Reversal)

Shorts remain possible, but only with confluence.

If price retests previous weekly highs (wick fills → top of the range), I’ll look for:

A 1H / 4H bearish close from that area

Imbalance fill confirming rejection

A 15M break of structure for precise short entries

Target would be previous daily imbalance and down towards the daily 50 EMA, where I expect a reaction/hold.

Summary:

📈 Longs remain the higher-probability setup.

📉 Shorts valid at range highs only with confirmation.

Patience is key — wait for structure breaks before committing.

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

FRGNT 🚀

OANDA:EURUSD

EURUSD after the newsYesterday, EURUSD continued its bullish move, reaching 1,1697.

If the rally continues, the next target is 1,1760.

Some pullbacks are still possible before breaking above the previous high, which could provide opportunities for additional entries.

Focus only on trades in the main direction!

EUR/USD Rises to 2.5-Week High Ahead of ECB MeetingEUR/USD Rises to 2.5-Week High Ahead of ECB Meeting

Today at 15:15 GMT+3, the European Central Bank (ECB) will announce its interest rate decision, followed by a press conference at 15:45 GMT+3. According to Forex Factory, the main refinancing rate is expected to remain unchanged at 2.15% after seven consecutive cuts.

In anticipation of these events, the EUR/USD exchange rate has risen above the 1.1770 level for the first time since 7 July. Bullish sentiment is also being supported by expectations of a potential trade agreement between the United States and the European Union. According to Reuters, both sides are reportedly moving towards a deal that may include a 15% base tariff on EU goods entering the US, with certain exemptions.

Technical Analysis of the EUR/USD Chart

From a technical perspective, the EUR/USD pair has shown bullish momentum since June, resulting in the formation of an ascending channel (marked in blue).

Within this channel, the price has rebounded from the lower boundary (highlighted in purple), although the midline of the blue channel appears to be acting as resistance (as indicated by the arrow), slowing further upward movement.

It is reasonable to assume that EUR/USD may attempt to stabilise around the midline—where demand and supply typically reach equilibrium. However, today’s market is unlikely to remain calm. In addition to the ECB’s statements, volatility could be heightened by news surrounding Donald Trump’s unexpected visit to the Federal Reserve.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EUR/USD "The Fiber" Forex Bank Money Heist Plan (Bearish)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN Zone. It's a Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Neutral Level breakout then make your move at (1.12600) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 (or) 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (1.14200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.10800

💰💵💸EUR/USD "The Fiber" Forex Market Heist Plan (Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/USD remains capped below 1.1400, bullish bias prevailsEUR/USD's near-term outlook is neutral. The pair oscillates below a flat 20 SMA, while longer-term (100/200) SMAs maintain upward slopes. Momentum is flat around 100, and the RSI is only slightly higher near 45, suggesting limited upward potential.

EURUSD: The range is compressing in the sideway zone. Waiting foThe Relative Strength Index (RSI) indicator on the 4-hour chart stays below 50 and EUR/USD failed to make a 4-hour close above the 20-period and 50-period Simple Moving Averages (SMA), reflecting a lack of buyer interest.

On the downside, 1.1300 (static level) aligns as interim support before 1.1270-1.1260 (Fibonacci 238.2% retracement of the latest uptrend, 100-period SMA) and 1.1180 (Fibonacci 50% retracement).

EUR/USD could face strong resistance at 1.1380, where the Fibonacci 23.6% retracement level converge with the 20-period and 50-period SMAs. In case EUR/USD manages to stabilize above this resistance, 1.1450 (static level) and 1.1500 (static level, round level) could be seen as next hurdles.

EUR/USD "The Fiber" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/USD "The Fiber" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (1.08500) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1.13000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/USD "The Fiber" Forex Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets..., go ahead to check 👉👉👉🔗

Detailed Explanation 📝✨

Point 1: Fundamentals = tug-of-war ⚔️; U.S. strength 💪 offset by tariffs 🌧️, Eurozone weakness 🇪🇺 mitigated by ECB stability 🌟.

Point 2: Macro shows U.S. resilience cracking 😟, euro holding ground ⚖️.

Point 3: Global markets mixed 🌐, no clear winner, EUR/USD in range 🔄.

Point 4: COT cautious 📑, speculators less bullish 😐, hedgers bearish 📉.

Point 5: Intermarket neutral ⚖️; dollar-yield link key 📈, equity dips cap extremes 📉.

Point 6: 1.0950 pivot 🎯, breakout or breakdown ahead 🚀📉.

Point 7: Sentiment balanced 😊, retail buys 📈 vs. institutional caution 😐.

Point 8: Trends hinge on 1.0950 🔮; bullish needs breakout 📈, bearish risks below support 📉.

Point 9: Neutral outlook ⚖️, breakout potential either way 🌟📉.

Accurate as of April 7, 2025 ⏰, based on trends & projections. Watch U.S. CPI & Eurozone news 👀!

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/USD | Bearish Breakdown & Retest | Short Setup EUR/USD VIP Short Setup | Smart Money Move 🔥📉"

Chart Analysis:

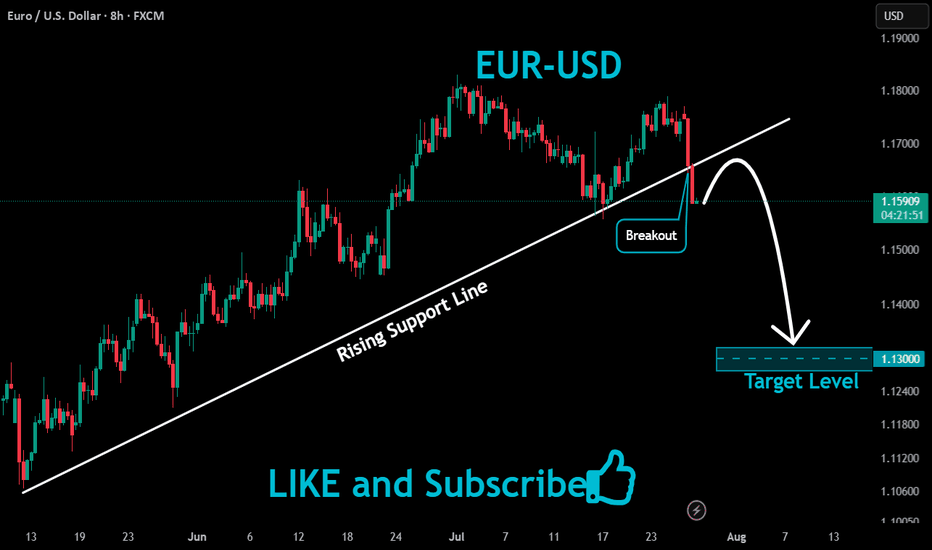

Ascending Channel Breakdown: EUR/USD broke below a well-respected bullish channel, signaling a potential downtrend.

Retest & Resistance: Price is currently retesting the broken structure near 1.08565, a key resistance zone.

Sell Confirmation: The rejection at this level suggests bearish momentum.

Target: The next major support lies at 1.06513, aligning with previous price action levels.

Trading Plan:

✅ Entry: Around 1.08155 - 1.08565 (after rejection confirmation)

✅ Take Profit: 1.06513

✅ Stop-Loss: Above resistance for risk management

Summary: Smart money is eyeing this short trade after a strong bearish breakout. A retest of resistance gives a prime entry for sellers. 📉🔥

EURUSD Going To ShortThe EUR/USD currency pair is likely to experience a short movement due to the presence of a clear hidden bearish divergence. This divergence suggests that despite the price making lower highs and RSI making Higher High, the momentum behind these movements is weakening, indicating potential for a downward reversal. Additionally, the price is approaching an unmitigated order block around the 1.098xx region. An unmitigated order block represents an area where price has previously reversed and not yet been revisited, increasing the likelihood of a reaction when price reaches this zone.

Furthermore, the Fibonacci retracement level of 0.786 aligns closely with this order block, strengthening the case for a bearish reversal. Fibonacci retracement levels are commonly used to predict potential areas of support and resistance, and the 0.786 level is often a key point for reversals in trends. This combination of technical factors suggests that a significant fall is anticipated from the 1.098xx level.

You should watch for confirmation signals, such as a clear break of support or bearish candlestick patterns, to solidify the bearish outlook. Given the confluence of these technical indicators, the probability of a substantial decline is high.

1st TP: 1.075x

2nd TP: 1.065x

EURUSD - There are two levels ahead.- If we can't break through the monthly highs, we'll fall.

It will be a great short with a clear target.

- breakout of the slope on the third touch on the 4h 1h bottom

if you like the idea, please "Like" it. This is the best "Thanks!" for the author 😊 P.S. Always do your own analysis before a trade. Put a stop loss. Fix profits in installments. Withdraw profits in fiat and please yourself and your friends.