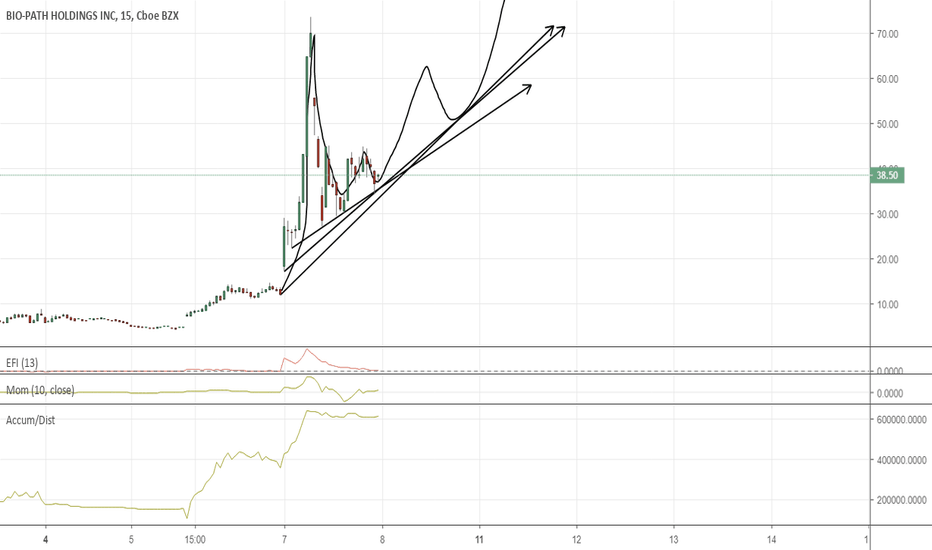

$BVXV 15 Min Wedge Wave Cycle Accelerating Breakout by 2:30$BVXV On Major Overreaction Breakout Watch

Fda

MESOBLAST (MSB) - FDA will likely approve Ryoncil (analysis)MSB is developing Ryoncil - an IV stem cell therapy for the treatment of acute graft versus host disease (aGVHD) in paediatrics. aGCHD is a potentially life threatening (up to 70-90% mortality) complication of bone marrow transplants (indicated for leukemia/lymphoma etc). Ryoncil has been accepted by the FDA for priority review with a PDUFA action date of US 30th September (1st Oct in AUS).

Why might the FDA approve Ryoncil?

Probability wise:

- Oncology therapy's have an average 88% probability of being approved once they have been accepted for review (data averaged from results from Wong et al (2018), Thomas et al (2016), Hay et al (2014), and DiMasi et al (2010)).

- As part of the review, the FDA requested a recommendation from the Oncologist Drugs Advisory Committee (clinical oncology academics and statisticians) who on Aug 13th voted 9:1 that the available data supports the efficacy of Ryoncil.

- Ryoncil has been approved in Japan for the last 5 years with strong yoy growth.

Benefit-risk ethics analysis:

- There are no FDA approved treatments for aGCHD in pediatrics and no therapies are considered standard of care.

- Ryoncil is effective vs placebo (28d survival 64% vs 38%, 100d survival 79% vs 54%).

- Adverse Effects of Ryoncil were not statistically different from placebo. In fact unapproved treatments (steroids) carry high risk of toxicity.

- aGCHD has a 70-90% mortality rate, there are no FDA approved treatments, Ryoncil appears to be effective, risk of doing harm by approving Ryoncil is low. It seems like the ethical decision is to approve Ryoncil.

Why might not the FDA approve Ryoncil?

- The FDA prefers double-blinded, placebo-controlled RCT's to show effectiveness. However, due to the high mortality rate of aGCHD, enrolling children into an RCT is clearly not ethical. I'd argue that the single arm study comparing to an external control population is as good as you're gonna get. It also does not need to be blinded as the primary endpoint is mortality. The 9:1 ODAC vote seems to support this.

- The study was small (N=14, N=13). It might be reasonable for the FDA to ask for another (potentially larger) study to replicate the results which is a risk.

- Quality control concerns. The FDA raised concerns that the way MSB measure the potency of the Ryoncil (CQA's) may not be enough to ensure the clinical effectiveness of the product. I'm no expert in this part but when MSB responded to these concerns in the webcast, they kind of just reiterated the CQA's from their manufacturing were very high but didn't really address the concern that the CQA's might not translate to clinical effectiveness. It might be reasonable for the FDA to ask for more data on this.

- Even if more data is requested, Ryoncil can still be provisionally approved.

Conclusion:

The FDA will likely approve or provisionally approve (with the request of more data) Ryoncil therapy for pediatric aGVHD in the US which will strongly improve the revenue potential of MSB.

NSPR still getting beat downNow like you and many others I'm shocked by NSPR price action, so what could have caused it? Well theres one and that was the FDA IDE approval, yet today was ann that they got the full FDA IDE approval green light.

News

-Got FDA IDE approval in the US today

-Last week they where at LD Micro 500 they gave us some company insights

1: Theres already sales in Brazil for next er. At this time er expectations didn't factor that in, so it is nearly 100% they will be making money instead of losing money.

2: They were very confident in getting the FDA IDA approval last week along with the expansion in France and Asia. Can be shown on the company website roadmap.

TA

Now the news is bullish, yet why hasn't price action reflect that? Well only thing it can be said is that people waited for the FDA IDE approval too long, so where can we go from here?

-Well be shot up 40% this morning so even though I have resistance lines from .4194-.4594, it looks like its a very week in the grandscale of this company, so are primary resistance will be .4397-.4594 with .4922 being the true goal to go full rocket. On webull we went passed it, yet on tradingview we didn't so I'll stand with .4922 being the biggest hurdle.

-Support is nothing since we kept waterfalling lower, yet if any support it ranges at .3913,.3713, and with the red zone .3506 and .3368

-Atm we are makingout withe the ema, which if we can hold it and have a good bounce off of it we can stop buying and it can confirm bullish price action. If it dips below it, it could mean I final acculation zone before we moon.

-MACD is very bullish atm, but if we rise and it gets closer it might be the end short term

-RSI is oversold, so we could suspect sideways movement with massive ranges, slow rise up, or a pure dump. A dump is unlikely in my opinion.

Overall

I've been dca every week, due to the fact of the being in the Brazil market and already having sales. I think this will produce massive gains in the near term, so i'll be holding and will update you guys if we hit lower lows or break the massive resistance.

NSPR still dippingOkay I'm gonna start off with the news

News

-NSPR beat earnings by 44%, yet still losing money. It has been making more money due to its past performance and not losing as much. We can project that they might be profitable next year.

-Their offering that was held in June came out that it was so they can remain compliant with the exchange. That Friday they have became fully compliant so they won't get delisted.

-On their earnings report they got mostly compliant FDA IDE approval, yet on that they will get fully compliant FDA IDE approval in 45days. This should be on the 27th, so next week, which I labeled on the graph.

-Upcoming catalist: they hope to get into the France and China markets soon. Plus with approval in Brazil we could see that profit from the company in q4/ another earnings beat. Maybe over 100%, yet with COVID not sure, but certain in q1 next year.

TA

-Not sure what to say since an earnings beat should have pushed the price higher, yet we saw a sell off with no FDA IDE approval to common investors liking. At the same time the volume showed it being very low compared to the past showing its just small sellers and yesterday someone bought 200k shares touching our old trading zone.

-the low at .4194 was in the middle of the gap of the intial drop from .80 to .39 then gaping up to .42-.47

Final thoughts

I'm DCAing this stock and think its gonna pay off pretty soon. Recent SEC filing shows that their CFO has sign a contract starting in 2022 that he will get an annual renewal of his job. This shows there is some long term potential if a CFO is entering this contract and wants to see growth in this company or he will get fired. There was alot more in the earnings report like and they don't want to do any more offerings and they also have alot of cash on hand to play with, so upside potential is pretty high.

What to expect on ER?Well seems like we continue the sell off of the Brazil news that I didn't sell. So what news is there to push it higher? Well if ER repeats the same pattern we can suspect them beating EPS and and Beating Revenue.

News

-Earnings this wednesday, a week early

-They are hitting their road map this year

www.inspiremd.com

-Atm the FDA IDE is awaiting its pr, yet questions on their recent tweet suggesting it got approved

twitter.com

-The filed for some 8-ks on a past offering that happen over two years ago. These changed the pricing of these investors to .49-.50. Heres some links to the offering it refers too and to a definetion to prospectus supplement.

www.globenewswire.com

prospectus supplement definition: the link looks funny so just google the definition

Now TA

-We been in a downward trend, yet the volume has been low. The average volume ranges from 2.5-over 4million, yet the past week its been dropping and Friday we didn't even hit a million. The only thing I could find is a low volume downward trend article titled "Low Volume Pullback" Again we going back to the FDA IDE news that many common investors suspect the news to already be dropped. Now I'm no expert on how this process works, so I'm just waiting till ER update.

www.investopedia.com

-MACD looks like its gonna turn over, but is neutral on that it is possible for a pretty big move this week in either direction.

-RSI is trending downward suggesting its becoming oversold and we could go bullish, yes it's not super oversold yet.

-I put in a new trade zone that we could just go sideways till earnings from .4499-.4594

Other notes

-I did some DD on the current CEO and notice over 2 years he produces returns for a company from when he gets hired till he leaves. If you can hold for another year and 2/3months you could see a price target of .9023 or a pt of 1.2293. This data is from his recent jobs at ticker ITAMAR and IART, which he produced returns at rougly round 4-44% as he worked for them.

-According to Fintel: on 06/09/2020 Lind Global Macro Fund LP acquired just over 3.9million shares and L1 Capital Global Opportunities Master Fund, Ltd acquired over 650k shares on 06/19/2020

fintel.io

Final thoughts

I'll hold my position, but till earnings. I'll be neutral on the buy half, yet long term you could make 100%-170% return in the next year and 3 months with the CEO past performance. They have hit the Brazil market and is growing in the US. You could see massive market cap growth.

ADAP SHORT TRADE IDEAThis over reaction to news and an approval may result in another handle on this left-facing cup and handle.

Best of luck.

-zm

MNLO - FDA Approval - Trend Is Your FriendAll,

I think this is a buy and hold over weekend scenario. FDA approval is no joke (well at least in trading ;) lol). I think this is a gap up Monday and overall could double actually based on chart positioning.

TA Wise: we are forming an ascending triangle and topping out. However this is a bullish pattern. Very clear on 4H vs 15M we have yet to break full candle above just fake out candles.

ACST is now in the spotlightSo today I sold my NCLH and Bitcoin and went into ACST or Acasti Pharma. We made nice gains with NCLH with a killer premarket but leveled off back under closed, but than exploded 6% and going even higher after I sold at 11.22 with my buy at 9.88. Bitcoin has been bouncing between 1-2%, which had nice support at the emas this morning. is why ACST also caught my eye.

How did i hear about ACST well someone brought up that Amarin or AMRN open 60% down with ending in a 70% lose today and ACST is its competitor, with it being in penny stock territory.

ACST also has gone to the FDA planning on getting in meetings to move on with their drug, I think Its CaPre which is "CaPre is intended to be used as a therapy in conjunction with positive lifestyle changes including diet, and is to be administered either alone or with other drug treatment regimens such as statins (a class of drug used to reduce cholesterol levels). " Which this market is a 50billion dollars with this stock being about 35million dollars valuation with the company owning about 90million and public owning about 70million shares. With their drug ending its testing phase its now up to ACST to work with the FDA, which could happen anytime between now or in 70days is how long till a respose will take for the FDA. There is a high chance it will get approve from many spectators.

Now technicals

-AMRN got hit hard, yet ACST hasn't moved much but its penny stock.

-From its low to now its up about 49%, yet from were its been trading at the $2.30ish is down 82%, so hugh upside with a 450% gain back to original trading range with it going higher as of $3 before the sell preasure hit. ($3 was the original target from what I read with a target in the $8 range if the FDA approves of the drug)

-MACD on the hourly is bearish

-Volume is very low which we could expect a big move soon

-RSI is heading towards overbought, yet its netural to me

-So far on active hours and premarket its holding the 50ema on the hourly, yet we would need a break above the others. maintaining above the the 50ema is always a bullish sign, yet it will need to hold and see upward price movement.

I'm a long buyer just cause the price is near its lowest even though it could go lower, yet I don't see much more room to drop with the marketcap. We would have to wait till premarket tonight for this stock and hopefully its bullish.

BXRX FDA approval lotto playThis idea comes from recent success in a Sprint trade. It was slow in coming, but it did come through very successfully, which is the impetus for this idea of "reading" tickers with binary events.

This is purely a news driven idea in which there is no technical reading of the chart what-so-ever. I have no idea if this will be correct, and am really using this platform for journaling & finding others who use similar methods. I'm getting the tickers from a freely available online calendar with the PDUFA dates.

I use a pendulum and cards I made up to gain information on the "energy" of the situation. Anyone doing anything similar, please contact me to share information. I'm definitely on the fringes here.

BXRX has a deadline for an FDA approval tomorrow (2/20/20).

My indications are that it is APPROVED. I don't read about the details of the application and I don't care, although reading it may help my insomnia ;)

BXRX is currently trading at the LOD $7.88 - 5.97%

Indications are it could go up to $9.14

The ATH is $9.60

We shall see...

LLY Sell the RallyMy dowsing method suggests LLY gets their FDA approval, and the stock will pop, but that in the longer term, this stock is going to breakdown; probably with the entire market.

I'm getting that the resistance will be around that $145-46 zone, which would also be a test of the uptrend line from below. Good luck!

ESPR FDA burn it down?BE CAREFUL!!

I'm getting bad vibes on the news for tomorrow in this one. This is based on my dowsing work and it suggests a drop of 38%. That would rock it down to about $42.50

FYI I don't know anything about the fundamentals or background on this pending approval, and I really don't know anything about the company, nor do I care.

I'm not super confident yet in estimating percent moves, and this is only my second FDA prediction, so we'll see.

$AMPE Ampio Pharmaceuticals Inc A Good Risk/Reward PlayWe are really liking the chart on $AMPE. You have the rounding bottom and there looks to be accumulation going on.

Currently trading at $.62 a share, the 52-week low is $.35 a share.

We believe $AMPE has breakout written all over it and there is an upcoming catalyst that can send the stock flying higher. The company is due to hear from the FDA shortly. Here's what the company said last month in its update:

Ampio Pharmaceuticals has been in contact with the U.S. Food and Drug Administration (FDA) regarding the Special Protocol Assessment (SPA) following its re-submission of a revised protocol for AP-013, which the Company believes implements all of the Agency's recommendations provided since the beginning of the SPA review cycle. The Agency confirmed that it would make every effort to expedite this review, however due to a heavy workload, they were not able to commit to providing a response to the Company's SPA re-submission earlier than the 45-day window outlined in the Guidance for Industry Special Protocol Assessment, leading the Company to expect the response will be in mid-June rather than late May 2019, as previously predicted.

There is some debate on social channels as to when this news will hit the tape. Some are saying any day now, while others are saying after the July 4th holiday.

As always, trade with caution and use protective stops.

Good luck to all!

G1 Therapeutics RALLYEarnings/News

Co's lead cancer therapy, trilaciclib, gets FDA's "breakthrough therapy" status, which is meant to speed up review of drugs that treat life-threatening conditions

GTHX says it will present new data on three of its drugs, including trilaciclib, at an upcoming conference in September

FDA's move is a recognition that clinical data presented so far reflects the potential for trilaciclib to address an urgent unmet medical need - Cowen & Co

Analyst Actions

JP Morgan Upgrades G1 Therapeutics to Overweight From Neutral, PT Raised to $45 From $38

$BPTH Posts Positive Phase 2 Trials for Leukemia DrugBio-Path released updated Phase 2 data for its lead candidate prexigebersen, codenamed BP1001, for treating acute myeloid leukemia, or AML, and also divulged a plan of action for taking the compound through clinical development toward registration.

Updated data from the Stage 1 of the Phase 2 study that evaluated the efficacy and safety of prexigebersen in conjunction with the low-dose chemotherapy regimen cytarabine in 17 newly diagnosed AML patients revealed that the proportion of patients showing a response increased from 47 percent when assessed in April 2018 to 65 percent.

Of the patients showing a response, 5, or 29 percent, showed a complete response compared to the benchmarked percentage of 7-13 percent.

AML: A Cancer Of Blood Cells:

AML is a form of blood cancer that develops in the bone marrow, where blood cells originate. It afflicts a group of white blood cells called myeloid cells that develop into mature blood cells such as red blood cells, white blood cells and platelets.

A patient with AML will see rapid accumulation of immature myeloid cells in the blood, resulting in a drop of other blood cell types.

BP1001's Mode Of Action:

Prexigebersen is a neutral-charge, liposome-incorporated antisense drug designed to inhibit protein synthesis of growth factor receptor bound protein 2, or Grb2.

Grb2 has a role to play in cancer cell activation via the RAS pathway.

Inhibition of Grb2 is found to halt cell proliferation and enhance cell killing by chemotherapeutic agents without added toxicity.

A Lucrative Market:

AML accounts for roughly 36 percent of all leukemias, with about 20,000 new cases diagnosed each year, Bio-Path said, citing National Cancer Institute estimates.

A critically unmet need exists for non-toxic therapies for older, fragile AML patients who are unfit or ineligible for high-dose chemotherapy or a stem cell transplant.

What's Next:

Bio-Path said it believes it now has a plan with definable paths to registration.

It plans to amend the Stage 2 prexigebersen + decitabine Phase 2 AML cohort in untreated new patients to add untreated high-risk myelodysplastic syndrome, or MDS, patients.

The company also intends to cancel the Stage 2 prexigebersen + LDAC Phase 2 AML cohort in untreated de novo patients.

It also plans to test a triple combo of prexigebersen + decitabine + venetoclax for untreated AML and high-risk MDS patients in a registration-directed trial to determine if more durable responses and longer survival are observed compared to patients treated with the decitabine + venetoclax combination.

The next major catalyst for Bio-Path will be the fourth-quarter results expected sometime in the next month.

FDA Discussion Update on HistogenicsIn the HSGX longs community (i.e. Stocktwits) it is expected that there will be another update by the company CEO Adam Grizley by the end of year. As there haven't been any updates on the FDA discussions concerning BLA submission since 11-29-2018. The product NeoCart failed phase 3 because it didn't meet Histogenics criteria, not the FDA's. While the FDA continue to go over the data Histogenics stands by with a steady gain in SP.

Go long, go strong, or go home. I'm in for the ride through 2019. Maybe compounding in the dips along the way. Gonna be a great ride!

EDAP up huge on FDA clearance EDAP has recieved FDA clearance on its prostate device. With a price target of $6 this has room to run. Shorts could get trapped. A mourning dip got caused some panic but it appears to be holding the $3.70 range and looking to setup for another break out after the rsi cools down a bit.

$CELZ Begins Breaking out on High buy Volume on News Release$CELZ broke above prior high on the last leg after a release of 8-Ks showing the clearing up of the rest of the company's debt and notes.

Item 1.01 Entry into a Material Definitive Agreement

Effective April 11, 2018, Creative Medical Technology Holdings, Inc. (the “ Company ”) amended promissory notes issued by it and by its operating subsidiary, Creative Medical Technology, Inc., to Creative Medical Health, Inc. (“ CMH ”), the parent of the Company, to permit the conversion of the notes into restricted shares of common stock of the Company. The 8% promissory notes were originally issued February 2, 2016, in the principal amount of $50,000, on May 1, 2016, in the principal amount of $50,000, and on May 18, 2016, in the principal amount of $25,000. The conversion formula on the principal and accrued interest on the amended notes is 120% of the 30-day volume weighted average price (VWAP) for the Company’s common stock traded March 1, 2018 through March 30, 2018. Immediately upon amendment of the notes, CMH converted the total outstanding principal and interest of the notes, which was $136,003. The VWAP for the 30-day period ended March 30, 2018, was $0.0138 and the number of shares issued to CMH for the conversion was 9,855,290 restricted common shares.

Item 3.02 Unregistered Sales of Equity Securities

In connection with the conversion of the notes disclosed under Item 1.01 above, the Company issued 9,855,290 shares of common stock to CMH without registration. The issuance of these securities was made pursuant to Rule 506(b) of Regulation D promulgated by the SEC under the Securities Act as a transaction not involving any public offering. No selling commissions or other remuneration were paid in connection with the issuance of these shares.

Item 8.01 Other Events

On April 12, 2018, the Company issued a press release announcing the amendment to the CMH notes and the conversion of the notes into common stock of the Company.

From April 12, 2018 through April 19, 2018, we issued an aggregate of 114,017,952 shares upon the conversions of outstanding notes and 15,009,325 shares upon the cashless exercise of outstanding warrants. These conversions were made pursuant to the exemption provided by Section 3(a)(9) of the Securities Act of 1933. As a result of these issuances, we have outstanding 609,062,989 shares of common stock as of April 19, 2018.

$CELZ Creates W on Chart as it gets Accumulated Ahead of Updates$CELZ DD As It Stands, this is now one of my Long Term plays that I have added to my portfolio:

I like what I see here and am glad to have the shares I have. Targeting BILLIONS IN REVENUE FOLKS AND THE TECHNOLOGY IS REAL AND PROVEN. AMAZING!!!

WORTHY OF A MARKET CAP 50-100 MILLION TODAY THATS A PPS .104 - .208!

Fellow investors it looks to me like management has been busy getting their ducks in a row. Cleaning up notes and debt. Using restricted shares and the CEO himself adding a huge chunk. We see almost 30% shares held by insiders.

Are they preparing for something much larger here. I still believe A 2018 BUY OUT IS IN THE WORKS!!!

The "ED" rollout continues and the WORD IS GETTING OUT with Creative Medical Technology Holdings gave the Keynote Speaker at Gathering of Health Care Innovators.

The Company's Stem Cell Therapies to be Main Subject at Dr. James Veltmeyer's Congressional Health Care Symposium.

Finalized with 8K letting us know where everything stands O/S.

TOTAL O/S: 480,035,712

(Nothingness with billions in rev's targeted via multiple diverse procedures! 20-36 Billion "ED" alone 18 Billion "MS" alone.)

INSIDER OWNERSHIP: 29.9% (143,489,101 shares)

FLOAT: 336,546,611 SHARES (This is nothingness folks)

SC 13 d/a

CREATIVE MEDICAL HEALTH INC.

sHARES 68,511,217

PERCENT OF O/S : 14.3%

TIMOTHY WARBINGTON

sHARES 74,977,884

PERCENT OF O/S : 15.6%

TOTAL PERCENT: 29.9% OF O/S INSIDERS HOLD!!!

FORM 4's:

CREATIVE MEDICAL HEALTH INC.

Purchases: 4-11-2018 9.855,290 shares at a price .0138 totaling $136,003

TIMOTHY WARBINGTON

Purchases: 4-12-2018 9,855,290 shares at a price .0138 totaling $136,003

TOTAL PURCHASE DOLLAR VALUE: $272,006

8k - Issued 4-13-2018

RECAP's the over a month of transaction:

From March 2, 2018 through April 12, 2018, we issued an aggregate of 144,585,823 shares upon the conversions of outstanding notes and 92,023,304 shares upon the cashless exercise of outstanding warrants. These conversions were made pursuant to the exemption provided by Section 3(a)(9) of the Securities Act of 1933. As a result of these issuances, we have outstanding 480,035,712 shares of common stock as of April 12, 2018.

TOTAL O/S: 480,035,712 This number matches the O/S number used to calculate the insider percentages above

Creative Medical Technology Holdings to be Keynote Speaker at Gathering of Health Care InnovatorsPress Release | 04/12/2018

Creative Medical Technology Holdings to be Keynote Speaker at Gathering of Health Care Innovators

The Company's Stem Cell Therapies to be Main Subject at Dr. James Veltmeyer's Congressional Health Care Symposium

www.otcmarkets.com

Shareholder Update: Creative Medical Technology Holdings

$CELZ: NEW UPDATED 03/26/18 DD PACKAGE~~A clinical-stage biotechnology company focused on Urology and Neurology using stem cell treatments.

CLICK HERE TO VISIT THE CREATIVE MEDICAL TECHNOLOGY HOLDING, INC WEBSITE

ERECTILE DYSFUNCTION CLINICAL TRIALS

Creative Medical Technology Holdings, Inc. (OTCQB: CELZ) announced today that debt to affiliate company Creative Medical Health, Inc. in the amount of $136,003.00 is being converted to restricted common shares of stock in Creative Medical Technology Holdings, Inc.

"As we certainly have confidence in the fundamentals of Creative Medical Technology Holdings, Inc., in our stem cell technology and in the experience and ability of our network of doctors, scientists and our executives we have determined that this is a prudent action to eliminate additional debt and to continue to build shareholder value.

And as a reminder, May 18-20 we'll be at the American Urological Association (AUA) conference at booth 5870 presenting our CaverstemTM erectile dysfunction technology. Our team is excited and ready to go!"