The EURUSD is in a probable distribution phaseThe EURUSD is in a probable distribution phase, and its hinting signs of the start of a markdown or downtrend. Not sure sure about the fundamentals of this pair at the moment but my technical side shows that selling off the pair at the break of the identified trendline on the 4hr timeframe would have higher chances of being a profitable trade. This trade would probably start showing real entries around Thursday 22nd of January or even later or earlier.

Fibonacci

NVO at Major Fibonacci Resistance — Breakout or Pullback Next?Novo Nordisk (NVO) is testing a key confluence zone at the 1.0 Fibonacci extension (~60.24). Price is approaching strong resistance, and the next move will likely define whether the bullish trend continues toward 71 or pulls back to support at 56.56.

NVO is approaching a critical decision point as price tests the 1.0 Fibonacci extension level around 60.24. This zone aligns with a major resistance area on my chart (red zone), making it a high‑probability reaction level.

The broader trend remains bullish, as price continues to trade above the 0.786 retracement (56.56). However, the current structure suggests that the market is preparing for either a breakout continuation or a corrective pullback.

📈 Bullish Scenario

A clean breakout above 60.24 would confirm bullish continuation. If price closes above this level with strength, the next Fibonacci extension targets become active:

1.618 → 71.02

2.618 → 88.46

3.618 → 105.90

4.236 → 118.48

The 71.02 level is the most realistic first target if momentum expands.

🔻 Bearish Scenario

If price rejects the 60.24 resistance, a pullback is likely. Key support levels below:

0.786 → 56.56 (first major support)

0.618 → 51.57

0.5 → 51.52

0.382 → 49.46

A retest of 56.56 would be a healthy continuation structure as long as buyers defend the level.

🎯 Summary

NVO is testing a major resistance confluence at the Fib 1.0 level.

Breakout → 71.02 becomes the next logical target.

Rejection → pullback toward 56.56 support.

Trend remains bullish while price stays above 56.56.

This is a key moment for NVO, and the next few candles should reveal the direction of the next major move.

USD/CHF Rally Nears Make-or-Break ResistanceUSD/CHF rebounded off confluent support into the close of the year at the 7872/82- a region defined by the July / October / November lows, and the 1.618% extension of the May decline. The pair has held above this key pivot zone for nearly six-months with the recent recovery now extending more than 2.2% off the December low. The advance came within striking distance of resistance this week at the 61.8% extension of the September advance at 8044. Note that the November trendline converges on this threshold over the next few days and the focus is on possible inflection off this zone next week.

USD/CHF is trading within the confines of an ascending pitchfork extending off the December low with an embedded channel (red) guiding the most recent advance. Note that the upper parallel further highlights resistance into 8044 and a breach / daily close above this threshold would be needed to fuel the next leg of the advance. Subsequent resistance objectives are eyed at the 200-day moving average (currently ~8060), the November high-day close (HDC) at 8101 and the August high-close at 8125.

Initial support rests along the median-line, which converges on the December 17 swing high at 7988 next week. Losses below this slope would suggest a more meaningful correction is underway within the late-December uptrend. Subsequent support rests at this week’s low near 7956 with a break / close below the objective yearly open at 7927 needed to suggest a more significant high is in place and a larger trend reversal is underway.

Bottom line: USD/CHF is testing near-term uptrend resistance, and the risk builds for possible exhaustion / price inflection while below the November trendline. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stop- losses should be limited to the median-line IF price is heading higher on this stretch with a daily close above 8044 needed to fuel the next major leg of the advance.

-MB

DASH price analysis💥 Just eight years in a downtrend — that’s the story of #DASH 😅

Following CRYPTOCAP:ZEC , it looks like privacy coin fans are trying to “wake up” #DASHUSDT — and price action is finally showing signs of life 📈

📊 If buyers can hold above $90–100, it will signal a true breakout from the long-term trendline and a solid consolidation above it.

That could open the door for a careful long entry, especially since we still have room for around x5 upside to reach the 2021 highs 💪

🤔 Do you believe #DASH can reclaim its former glory,

or has its time already passed?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

S32 - Long UK tradeS32 - Long UK trade

Price breaking old reactive levels.

Large Bat harmonic pattern

Bullish divergence on RSI and MACD

Only enter if price comes back down to 157 to manage risk... place limit order around there and see if it fills.

Exit 50% at each price level.

Targets line up with old levels and .5 and .618 fib levels.

Moderna - Upside PotentialSince August 2021, Moderna’s stock has been in a downtrend.

The latest decline started in May 2024 and ended in April 2025, dropping from 170 to 23 .

Since April 2025, a corrective move has begun for one of the sub-waves.

This move is nearly complete, with final targets at 36 -> 38 .

This does not mean the uptrend is over - after some time and additional corrections, we should see a move toward 57 .

The longer-term outlook remains clear and largely positive.

For now, let's focus on the targets mentioned. Further developments will be shared in new ideas.

---

Please subscribe and leave a comment.

You’ll get new information faster than anyone else.

---

PNB – Rounding Bottom on Monthly | Reversal in Making?🟦 PNB – Rounding Bottom on Monthly | Reversal in Making?

Punjab National Bank is after many months showing a rounding bottom on the monthly chart, which often signals a medium-to-long term trend reversal.

That said, this is still a pre-emptive stage, so caution is required.

📊 Technical Structure

• Monthly rounding bottom formation emerging

• Early reversal signs, not a confirmed breakout yet

• PSU banks showing strength due to improving results

• Market volatility is high → avoid aggression

• Key hurdle: 61.8% Fibonacci at ₹153.8

• Until 153.8 is crossed & sustained, no major momentum

💰 Trade / Positional Levels

• CMP: ₹132.35

• Stop Loss: ₹115

🎯 Upside Levels

• ₹143 – short-term resistance

• ₹154 – critical zone (61.8% Fib)

• ₹198 – post-confirmation momentum target

• ₹230 – rounding bottom expansion target

📌 Trading Approach

• This is a structure-in-development, not a breakout trade

• Control position sizing strictly

• Prefer small / staggered exposure

• Wait for PNB results before taking any big position

• Momentum likely only after 153.8 is crossed decisively

⚠️ Clarification:

This is an independent analysis. No part of Religare is involved in this view or recommendation.

📝 Important:

I am not responsible for any loss or profit incurred. I am not taking any fees – shared for educational purposes.

📉 Disclaimer:

Not SEBI-registered. Please do your own research or consult a financial advisor before taking any investment decision.

⚠️ Above 153.8 = momentum. Below it = patience.

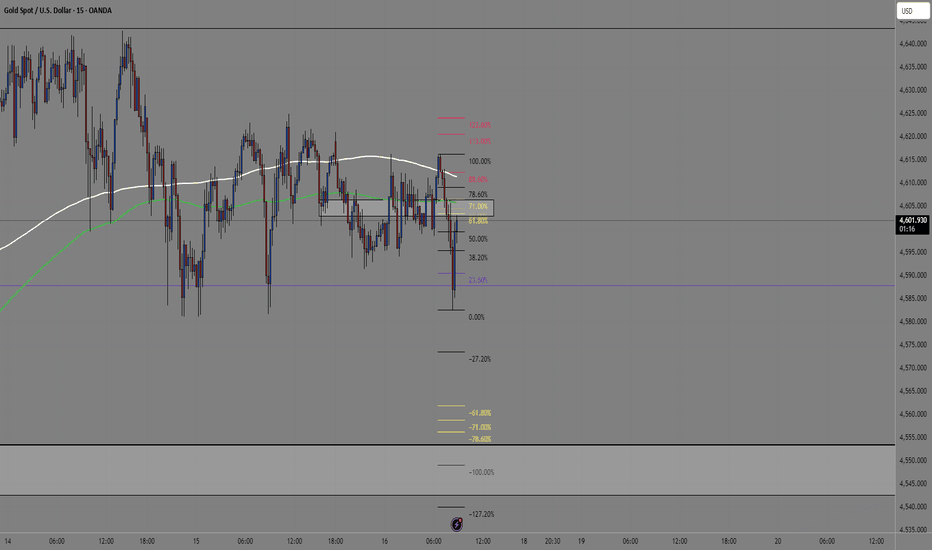

GOLD - Consolidation continues amid bullish trendFX:XAUUSD maintains its upward trend but shows signs of weakening short-term momentum as the market phase has shifted to consolidation. Interest in the metal remains high...

Fundamentals: Tensions between the US and Iran have temporarily eased. Strong US data has reinforced expectations that the Fed will keep rates unchanged until mid-2026, but there will be more news next week... Fed Chair Powell will not be fired, according to Trump, which has eased fears of sudden policy changes.

Inflation in the US (CPI 2.7% y/y) remains above the Fed's target, supporting the regulator's caution.

The market expects the Fed's first rate cut no earlier than June 2026.

Gold maintains a long-term uptrend, but a short-term correction may continue to key liquidity zones. From a fundamental point of view, a resumption of growth will require either a deterioration in geopolitics or weak macro data, and from a technical point of view, a long squeeze or a false breakout of 4581, 4561, 4550...

Resistance levels: 4621, 4639, 4650,

Support levels: 4581, 4561, 4550

The market clearly shows limit support zones behind which a pool of liquidity is hidden. MM will most likely not leave these zones untouched. The capture of liquidity and the bulls' ability to keep prices above key support zones could trigger growth.

Sincerely, R. Linda!

Hindustan Petroleum Corporation Ltd (HPCL) Demand Zone Reversal

HPCL has shown a strong price reaction from a well-defined demand zone, indicating active accumulation at lower levels. The stock has respected this support area multiple times, suggesting downside exhaustion.

From a macro perspective, easing concerns around the global crude oil supply—supported by improving diplomatic dialogue with Iran—have reduced pressure on oil prices. This acts as a sentiment tailwind for OMCs, including HPCL.

Technically, price action indicates:

Potential downtrend reversal with higher buying interest near support

Improving structure after prolonged corrective phase

Early momentum shift favoring bulls if price sustains above the demand zone

If follow-through buying continues, HPCL may attempt a pullback rally towards nearby resistance levels. However, failure to hold the demand zone could invalidate the reversal and resume the broader downtrend.

Trade Outlook:

Bias: Cautiously Bullish

Key Zone to Watch: Demand support area

Confirmation: Sustained price action above short-term resistance with volume

Note: Trade with proper risk management and confirmation, as broader market sentiment remains a key variable.

GBPJPY - The hunt for liquidity within a bullish trendFX:GBPJPY is testing key areas of interest amid an upward trend as part of a deep correction. Fundamentally, the pound is stronger than the yen...

The Japanese yen continues to decline for economic reasons related to the Bank of Japan. Against this backdrop, the pound is strengthening. Focus on the 211.59 - 212.0 zone, where the battle for position is most likely to take place. If the bulls manage to break through 212, the currency pair could return to an upward trend.

The currency pair is forming a fairly deep correction, but there is no break in the trend structure. A retest of the 0.6-0.7 Fibonacci zone and a retest of the consolidation boundary within the bullish trend have been formed.

Resistance levels: 212.08, 213.01

Support levels: 211.59, 211.31

A false breakout and the market holding above the key support zone could give buyers a chance to resume the uptrend after the correction ends.

Best regards, R. Linda!

NQ Power Range Report with FIB Ext - 1/16/2026 SessionCME_MINI:NQH2026

- PR High: 25750.75

- PR Low: 25704.25

- NZ Spread: 104.0

No key scheduled economic events

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 336.46

- Volume: 21K

- Open Int: 272K

- Trend Grade: Long

- From BA ATH: -2.2% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

ETH-USDT long | Wyckoff's accumulative phase Ethereum is in an accumulation phase with potential for a bullish breakout . A long position would make sense if the rebound from support levels is confirmed and the Delta Volume keeps hunting bullish trades liquidated due to high leverage... this maintains positive momentum. The upper levels provide clear targets for scaling profits

Gold Before CPI: Top or Trap?1. STRATEGIC CONTEXT

Primary trend: GOLD remains in an uptrend; the higher-timeframe structure is still intact.

Macro backdrop:

CPI tonight may cause short-term volatility.

However, geopolitics is currently a stronger driver than CPI.

Key geopolitical risks:

Greenland tensions → escalating global strategic rivalry.

Protests in Iran, power and internet cuts → rising Middle East risks.

👉 Strategic implication:

Gold continues to be supported as a safe-haven asset → pullbacks are for buying, not for chasing shorts.

📊 2. CURRENT MARKET STRUCTURE

Price is:

Holding the ascending trendline

Consolidating in a box, compressing ahead of CPI

Market condition:

High probability of false breakouts

Top-catching traps are very likely before the news

📍 3. KEY PRICE LEVELS

🔴 RESISTANCE

4,680 – 4,700

→ Previous high / ATH zone

→ Reactive sells only if clear rejection appears

4,655 – 4,660

→ Intermediate resistance, easily swept pre-CPI

🟣 CONSOLIDATION BOX

4,595 – 4,630

→ Sideways range ahead of CPI

→ No FOMO inside the box

🟢 SUPPORT

4,545 – 4,550 → Major confluence support

4,480 → Medium-term support, trendline retest

4,420 → Deep support, last bullish structure zone

📝 4. IMPORTANT NOTES

Higher CPI:

May trigger a technical pullback

❌ Does NOT automatically mean a top

Lower / in-line CPI:

Gold may consolidate above highs and break ATH

Selling before CPI:

→ Reactive scalps only, no holding

Buying:

→ Only when price reaches key zones with clear reaction

🎯 5. STRATEGIC MINDSET

❌ Don’t force top-catching while geopolitics supports gold

✅ Focus on risk management – wait for zones – wait for confirmation

🧠 Before CPI: survival > profit

Lilly - Clean Chart StructureWe are analyzing the move starting from August 2025.

So far, four out of five waves have been drawn.

The structure of the fourth wave is an expanded flat (with measured moves):

A = 134 -> five-wave move (impulse)

B = 156 -> three-wave move

C = 120 -> five-wave move (zigzag, internal impulses ≈60)

The correction appears complete in both structure and proportions.

Similar to the second wave, the fourth wave retraced 0.382 of the prior move.

Even if price dips slightly, the main targets remain unchanged.

Additionally, we seem to have caught the very start of the next move, and the fifth sub-wave should now begin.

Key targets:

1,171

1,263 (aligns with the higher time frame)

or somewhere within this range

The upside potential from the current level is estimated at 14 - 22 %.

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

#GBPAUD ShortI believe there is a short coming for GA is Friday/ end of the week. Usually, Fridays a bit tricky and risky but at times it continues the trend of Thursday close, and as of now is a strong bearish. Even though I like catching pullbacks, I just believe on a Friday, it will just liquidate is current trend and try to set up the bullish move next week. There is also no price down there in recent months which means orders are waiting to get tapped in and most of them are going to be sell stops because if price falls to that area everyone will predict it will fall as it creating new lows, until the market makers liquidate those sell stops and buy out those orders and push price bullish, while trapping retail traders and small banks. reversing the trend and there planning this move friday to set them up next week.

LTC is in a clear downward trend📉 MARKET STRUCTURE

Main Trend: Down

Sequence: Lower High → Lower Low

Price is moving in a clear downward channel.

Any upward breakout = correction, not a trend change.

📐 KEY LEVELS

🟩 RESISTANCES (sell zones)

84.50 – current S/R flip (was support → now resistance)

94.50 – strong HTF level, where the market has been rejected multiple times

107.50 – key trend reversal level (BOS)

🟥 SUPPORT

72.00–72.50 – key support, currently being tested

63.10 – next strong HTF support

Below → empty space to ~55–58

🔎 PRICE ACTION – WHAT YOU CAN SEE

Recent Bounce:

Weak HH

No volume

Strong rejection from:

Upper channel line

Level ~84.5

Current candle:

Aggressive supply

No demand response

👉 Sellers in full control

📊 STOCH RSI

Turnover from the upper zones

Bearish momentum

No bullish divergence

👉 Oscillator confirms continuation of the downtrend

🧠 SCENARIOS

🔴 BASELINE SCENARIO (60–65%)

Descent lower

Condition:

Close D1 below 72

Target:

63.1

Possible breakout to 60–61

🟡 CORRECTIVE SCENARIO (25–30%)

Bounce Technical

Condition:

Holding 72

Demand candle + follow-up

Target:

84.5

Maximum 94.5

DOES NOT change the trend

🟢 TREND REVERSE SCENARIO (<10%)

Condition:

Close D1 > 94.5

Then reclaim 107.5

👉 Only then can we talk about a bull market

🎯 HOW TO PLAY IT (technically)

Short:

Retest 84–85 or 94–95

SL: above the structure

TP: 72 → 63

Long:

Only a reaction to 63

Short-term scalp / swing

No forcing the low

UsdJpy SellThe trend is bullish, but the price always ends up making a pullback.

At this moment, confirmation of the pullback came with the Choch of the 4H fractal structure.

Price is using the 4H EMA as resistance, took liquidity in the 1H structure and reacted from a premium zone (50% Fibonacci).

The break of the 1H EMA shows alignment and increases the probability of bearish movements continuing - with the aim of taking internal liquidity from the 4H overall structure