NZDJPY: Confirmed BoS 🇳🇿🇯🇵

NZDJPY will most likely continue rising after a confirmed

bullish break of structure on a daily time frame.

The next strong resistance is 95.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex

GBP/USD Forecast: Navigating Volatility in 2026The GBP/USD pair currently consolidates near the 1.37 mark as February 2026 begins. A partial U.S. government shutdown has clouded the immediate outlook. This event delays critical labor market data, leaving traders in a state of cautious observation. While Sterling remains resilient, the Greenback faces unique pressures from domestic policy shifts.

Geostrategy and the US Power Shift

Geopolitical maneuvers define the current currency landscape. President Trump’s recent decision to lift tariffs on India has improved global risk appetite. This move reduced the immediate demand for the "safe-haven" U.S. Dollar. However, tensions remain high as the administration balances aggressive trade stances with domestic economic stability. Investors now watch for shifts in global alliances that could redefine the Dollar’s dominance.

Leadership Tensions at the Federal Reserve

A significant legal cloud hangs over the American central bank. Recent news of a Grand Jury subpoena targeting the Federal Reserve has shaken investor confidence. Markets fear that political pressure on Chairman Jerome Powell could undermine the Fed’s independence. If leadership changes occur, a more "interest-rate-friendly" chair might take over. Such an event would likely weaken the Dollar and drive the Pound higher.

Bank of England: Professional Stability

The Bank of England (BoE) provides a contrast in leadership style. Ahead of the February 5th policy meeting, the BoE maintains a steady, data-led approach. While analysts expect interest rates to remain unchanged, recent inflation upticks suggest a hawkish tone. This professional consistency supports Sterling’s value. It positions the Pound as a stable alternative to the volatile American political environment.

Technological Innovation and Patent Analysis

London’s "Silicon Roundabout" continues to drive Sterling’s long-term appeal. The UK leads in blockchain and fintech patent filings for 2026. These high-tech innovations attract significant foreign direct investment (FDI) into the British economy. Institutional investors view these patents as a "moat" protecting the UK's financial services sector. As a result, the Pound benefits from structural support beyond simple interest rate differentials.

Macroeconomics: The Shutdown Effect

The U.S. government shutdown is the primary macroeconomic driver today. It creates "data gaps" that make traditional fundamental analysis difficult for novice traders. Without non-farm payroll reports, the market relies on behavioral sentiment. Historically, prolonged shutdowns hurt GDP growth, which weighs on currency valuation. Traders must navigate this uncertainty by focusing on technical support levels near 1.3650.

Cybersecurity and Financial Science

Cybersecurity has become a core pillar of currency stability. Both the Fed and BoE have invested heavily in "Quantum-Resistant" encryption for payment systems. These scientific advancements ensure the integrity of the GBP/USD exchange infrastructure. A successful defense against rising global cyber threats prevents sudden, catastrophic drops in currency trust. For traders, this technological "shield" provides a layer of invisible security.

Summary for Traders

The GBP/USD pair is currently in a "wait-and-see" phase. The combination of U.S. political instability and UK technological resilience keeps the rate range-bound. Watch the 1.3745 resistance level closely this week. A breakout above this point could signal a new bullish trend for the Pound. Conversely, a prolonged shutdown could eventually trigger a flight to safety, ironically boosting the Dollar.

Bullish reversal setup?USD/CHF is falling towards the support level, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.7696

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 0.7599

Why we like it:

There is a swing low support level.

Take profit: 0.7828

Why we like it:

There is a pullback resistance that aligns with the 50% FIbonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop off?USD/CAD has rejected off the resistance level, which is a pullback resistance and could drop from this level to our take profit.

Entry: 1.3683

Why we like it:

There is a pullback resistance level.

Stop loss: 1.3760

Why we like it:

There is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Take profit: 1.3566

Why we like it:

There is a pullback support level that is a pullback support that aligns with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bearish reversal?US Dollar Index has rejected off the resistance level whic his a pullback resistance that aligns with the 50% Fibonacci retracement andcould drop from this level to our take profit.

Entry: 97.37

Why we like it:

There is a pullback resistance level that aligns with the 50% Finbonacc retracememt.

Stop loss: 97.93

Why we like it:

There is a pullback resistance that is slightly above the 61.8% Fibonacci retracement.

Take profit: 96.30

Why we like it:

There is a pullback support that is slightly below the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

XAUUSD Pullback Before Continuation to Supply Zone | Bullish SetGold (XAUUSD) on the 1H timeframe is showing a strong recovery after a sharp sell-off, forming a clear bullish structure with higher lows and higher highs. Price is currently approaching a key intraday resistance / supply zone around 5265–5300.

The plan is to wait for a small pullback from this resistance area before continuation toward the marked supply zone. This move is supported by bullish momentum and clean market structure shift after the bottom formation.

🔹 Current structure: Bullish reversal with momentum

🔹 Key resistance / target zone: 5265–5300

🔹 Expectation: Minor retracement → continuation upward

🔹 Entry idea: After pullback confirmation

🔹 Risk management: Below recent higher low Always wait for confirmation and manage risk properly.

NZDUSD || Potential Bullish SetupTechnical Summary

Analysis of currently printing weekly candle of OANDA:NZDUSD indicates a pending expansion phase, with a bullish bias suggested by underlying market conditions.

Strategy Framework

With the weekly candle signalling imminent expansion, we'll position for entries near POI targeting the expansion move toward our Target

Confluence Patterns

✅ Strong directional momentum candles

✅ Equal rejection wicks

✅ Change of character (CHOCH)

✅ Key levels retest

🚩 IDEA INVALIDATION

Impulsive move in a bearish direction beyond POI our pullback range.

💬 LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

👍 FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

🛡 DISCLAIMER

This content is provided for informational and educational purposes—not financial advice. Trading is risky business. Do your homework, manage your risk, and trade responsibly.

GBPCHF: Bulls Are Back 🇬🇧🇨🇭

GBPCHF finally looks bullish after a deep retest

of a recently broken daily structure.

A breakout of a resistance line of a falling channel/flag

on an hourly time frame leaves strong bullish clues.

We can expect a rise at least to 1.0654

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

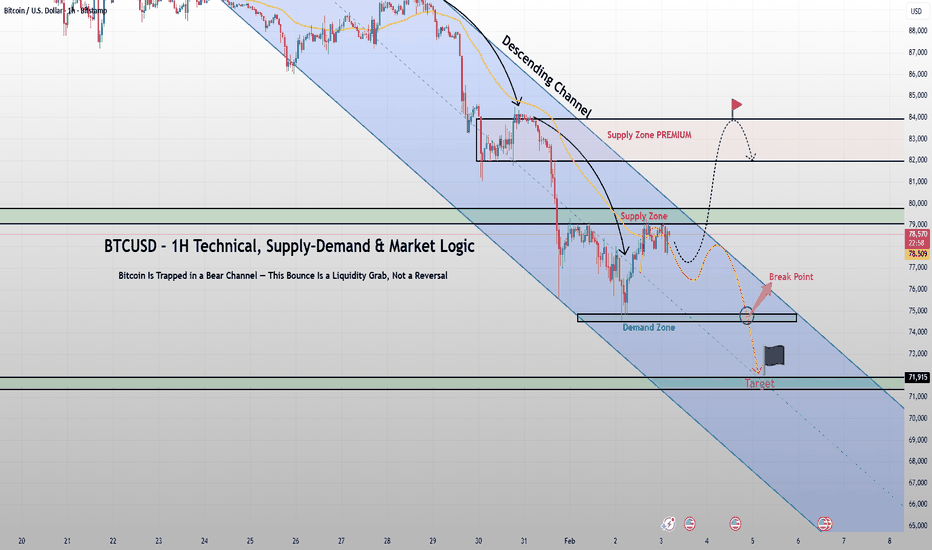

BTCUSD – 1H Technical, Supply–Demand & Market LogicBitcoin is still trading inside a clean, well respected descending channel, and nothing in the current price action suggests trend exhaustion. What looks like a bounce is structurally a corrective pullback into supply, not the start of a new bullish leg.

Technical Structure

- Trend: Clearly bearish consistent lower highs and lower lows

- Channel: Price is reacting perfectly to the upper and lower boundaries of the descending channel

- EMA (dynamic resistance): Every rally into the EMA has been rejected, confirming sellers remain in control

The recent move from the demand zone near 74,800–75,200 is a technical reaction, not accumulation. That demand has already been tested and partially consumed. Price is now pushing back into a supply zone around 78,500–79,500, aligned with:

- Channel resistance

- EMA resistance

- Prior breakdown structure

This confluence makes the area high-probability sell-side liquidity.

Supply–Demand & Liquidity

- The green demand zone below has weak hands, not strong absorption

- The current upside move is best interpreted as stop-hunting and short-term relief

- The dotted projection shows the classic bearish path:

bounce → rejection → continuation lower

If price fails to reclaim and hold above the supply zone, the next move favors a breakdown through the demand zone, opening the path toward the major liquidity target near 71,900.

Macro Context

Risk assets remain under pressure as:

- Financial conditions stay tight

- Volatility picks up

- Speculative positioning continues to unwind

In this environment, Bitcoin behaves like a risk asset in distribution, not a safe haven.

Key Takeaway

As long as BTC remains inside this descending channel, every rally should be treated as a selling opportunity, not a breakout. A real trend shift requires acceptance above channel resistance until then, downside continuation remains the dominant scenario.

This is not panic selling / This is controlled markdown.

Silver Is Rebounding — But This Is Still a Corrective MoveOANDA:XAGUSD on the 1H timeframe remains structurally bearish after the sharp impulsive sell-off from the $117.00–$120.00 region. That drop was aggressive and one-sided, signaling a clear shift from distribution into markdown. The flush reached a major downside support near $71.21, where selling pressure visibly decelerated a classic short-term exhaustion signal. From that low, price is staging a technical rebound, supported by a short-term trendline and higher intraday lows. However, this recovery is corrective in nature. The market is now rotating back into prior supply zones, where sellers previously stepped in with size.

Key Technical Levels

- Major support: $71.21

- Current corrective structure: Higher lows within a countertrend channel

- Short-term upside target: $97.53 (prior support → resistance flip)

- Overhead supply zones: $88.00–$90.00 and $95.00–$97.50

As long as silver trades below $97.50, upside should be treated as a relief rally rather than the start of a new bullish trend. Failure to hold the rising intraday structure would reopen downside risk back toward $71.21.

Silver is oversold by position, bearish by structure. Trade the rebound tactically, but respect that the dominant trend remains down until key supply above $97.50 is decisively reclaimed.

EURUSD: Corrective Pullback Inside a Descending ChannelTICKMILL:EURUSD on the 1 hour timeframe is currently trading within a clearly defined descending channel, signaling that the market is in a corrective phase rather than starting a new bearish trend. The sharp upside spike toward the $1.2000 area marked a liquidity expansion after prior accumulation, followed by distribution and a controlled markdown. Since then, price has respected the channel structure with consistent lower highs, confirming that short-term momentum remains corrective.

Price is now reacting near the lower boundary of the descending channel around $1.1780–$1.1800, which also aligns with a broader support zone below. The slowdown in bearish momentum and the formation of short-term basing candles suggest temporary selling exhaustion, not aggressive continuation. This keeps the door open for a reactionary bounce, but importantly, structure has not yet shifted to bullish — no higher high or key resistance reclaim has occurred.

As long as EURUSD holds above $1.1780, a corrective rebound toward the channel midline or upper boundary near $1.1900–$1.1980 remains technically reasonable. However, any upside should still be treated as countertrend relief, not trend confirmation. A decisive break and acceptance below $1.1760 would invalidate the bounce scenario and expose deeper downside toward lower channel extensions. Let structure dictate bias — trade reactions, not expectations.

USDCAD H4 | Potential Bearish Drop OffBased on the H4 chart analysis, we can see that the price has rejected off our sell entry level at 1.3677, which is a pullback resistance.

Our stop loss is set at 1.3742, which is a pullback resistance that is slightly below the 61.8% Fibonacci retracement.

Our take profit is set at 1.3554, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com/en: Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

USDJPY H4 | Bullish Momentum To ExtendBased on the H4 chart analysis, we could see the price fall towards our buy entry level at 154.51, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 153.58, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 157.19, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

USDCHF H4 | Bullish Bounce SetupThe price is falling towards our buy entry level at 0.7693, which is a pullback support that is slightly below the 50% Fibonacci retracement.

Our stop loss is set at 0.7608, which is a swing low support.

Our take profit is set at 0.7861, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

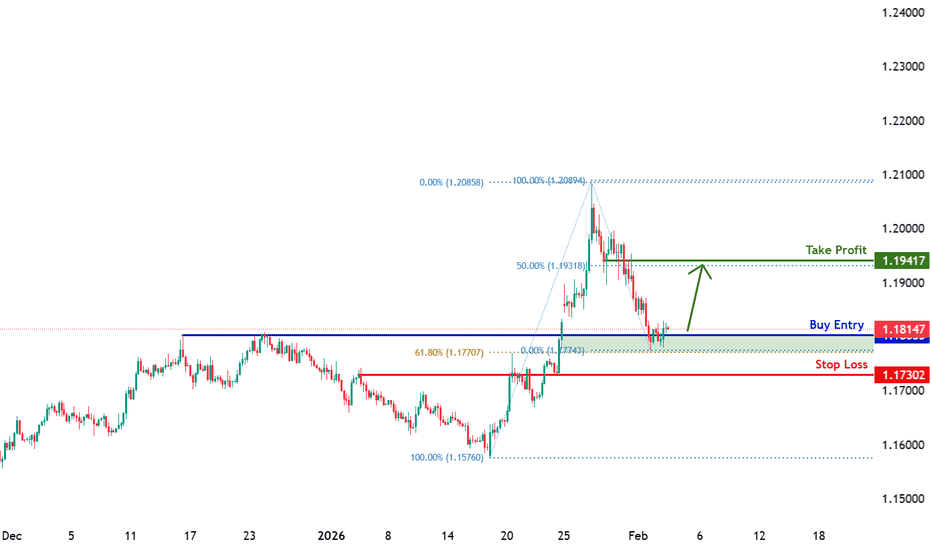

EURUSD H4 | Bullish Bounce OffThe price is reacting off our buy entry levle at 1.1803, which is a pullback support that is slightly above the 61.8% Fibonacci retracement.

Our stop loss is set at 1.1730, which is an overlap support.

Our take profit is set at 1.1941, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

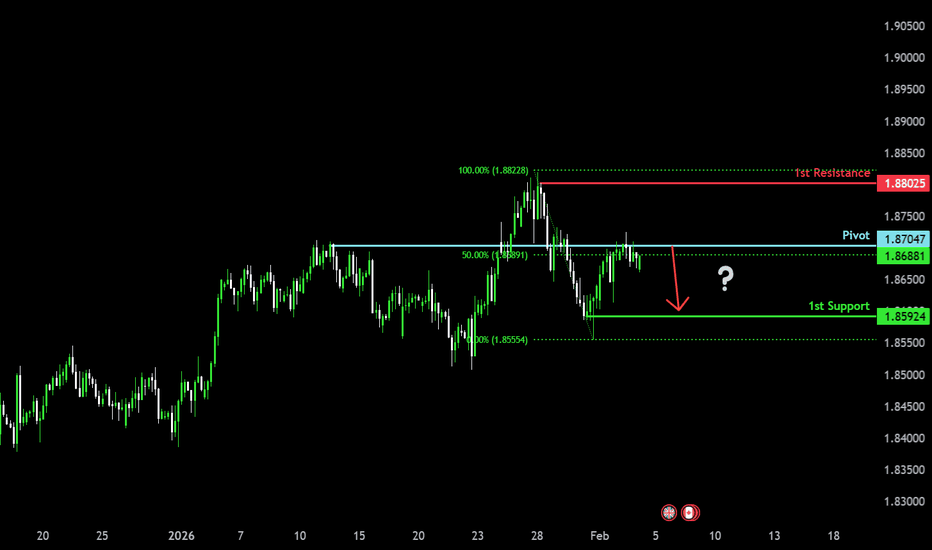

Bearish reversal setup?GBP/CAD has rejected off the pivot, which acts as a pullback resistance, and could drop to the 1st support.

Pivot: 1.8704

1st Support: 1.8592

1st Resistance: 1.8802

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?EUR/JPY has bounced off the pivot and could potentially rise to the 1st resistance.

Pivot: 183.52

1st Support: 182.78

1st Resistance: 185.54

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish continuation setup?EUR/AUD could rise towards the pivot, which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse to the 1st support.

Pivot: 1.6950

1st Support: 1.67841

1st Resistance: 1.70398

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish momentum to extend?AUD/JPY is falling towards the pivot point of 108.52, which is a pullback support and could bounce to the 1st resistance.

Pivot: 108.52

1st Support: 108.09

1st Resistance: 109.76

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off 61.8% Fib support?AUD/CAD is falling towards the pivot, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 0.95095

1st Support: 0.94496

1st Resistance: 0.96141

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party