Forex

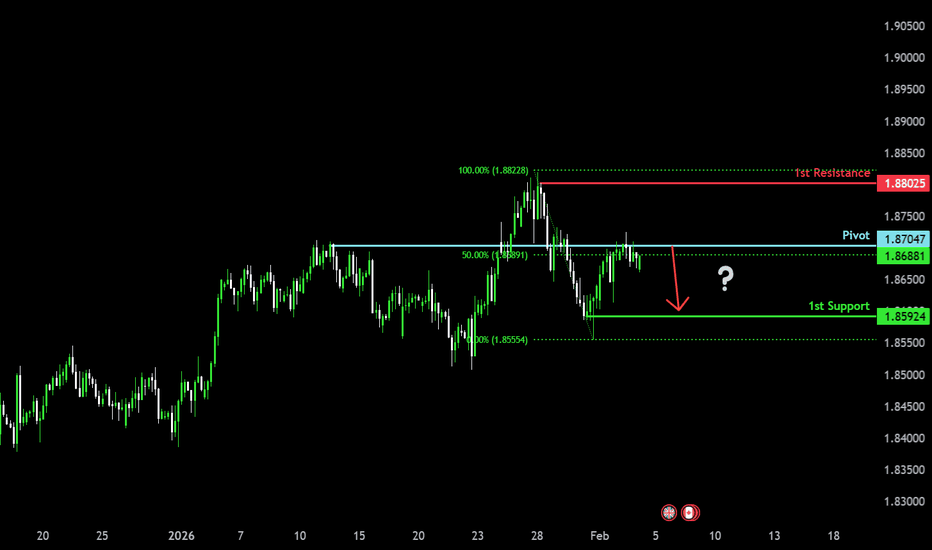

Bearish reversal setup?GBP/CAD has rejected off the pivot, which acts as a pullback resistance, and could drop to the 1st support.

Pivot: 1.8704

1st Support: 1.8592

1st Resistance: 1.8802

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?EUR/JPY has bounced off the pivot and could potentially rise to the 1st resistance.

Pivot: 183.52

1st Support: 182.78

1st Resistance: 185.54

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish continuation setup?EUR/AUD could rise towards the pivot, which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse to the 1st support.

Pivot: 1.6950

1st Support: 1.67841

1st Resistance: 1.70398

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish momentum to extend?AUD/JPY is falling towards the pivot point of 108.52, which is a pullback support and could bounce to the 1st resistance.

Pivot: 108.52

1st Support: 108.09

1st Resistance: 109.76

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off 61.8% Fib support?AUD/CAD is falling towards the pivot, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 0.95095

1st Support: 0.94496

1st Resistance: 0.96141

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDJPY - Global Short PositionFollowing a strong bullish impulse, USD/JPY has entered a corrective phase. Price failed to sustain above key resistance and is now showing signs of trend exhaustion. Current structure favors a bearish continuation toward lower support zones.

🎯 Technical Analysis:

— Clear rejection from recent highs

— Lower highs and lower lows forming on intraday structure

— Breakdown from bullish momentum into corrective bearish leg

📰 Fundamental Context:

Seasonal yen strength remains a relevant factor. During spring, Japanese corporations and institutional investors typically repatriate capital ahead of the fiscal year-end. This recurring flow historically supports JPY appreciation and adds downside pressure to USD/JPY, reinforcing the current bearish technical setup.

USDMXN Daily Trend Remains Under Bearish PressureUSD/MXN continues to trade within a clearly defined bearish structure on the daily timeframe, characterized by a sequence of lower highs and lower lows. Price remains firmly below both the 50-day and 200-day simple moving averages, with the 50-day SMA acting as dynamic resistance and reinforcing the prevailing downtrend. The long-term 200-day SMA is also sloping lower, highlighting sustained downside pressure rather than a short-term correction.

From a structure standpoint, recent price action shows a sharp impulsive move lower followed by a modest rebound. This bounce has so far lacked follow-through and appears corrective, with price still holding beneath prior support zones that have now transitioned into resistance. The inability to reclaim these levels keeps the broader bearish bias intact.

Momentum indicators support this view. RSI recently dipped toward oversold territory and is now attempting to recover, but remains below the neutral 50 level, suggesting that bearish momentum has eased slightly without signaling a trend reversal. MACD remains in negative territory, with the signal and histogram reflecting ongoing downside momentum, even as selling pressure shows signs of slowing.

Overall, USDMXN is displaying a bearish trend with short-term stabilization after an extended decline. Unless price can meaningfully recover above key moving averages and former support levels, the technical picture continues to favor a cautious, downside-leaning bias within the broader trend.

-MW

USD/JPY Daily Structure Holding Within Rising ChannelUSDJPY continues to trade within a well-defined ascending channel on the daily timeframe, highlighting a broader bullish market structure that has been in place for several months. Price action remains above the 200-day SMA, which is gradually turning higher and reinforcing the longer-term trend bias. The recent pullback appears corrective rather than impulsive, with price stabilizing near the midline of the channel.

From a moving average perspective, the 50-day SMA is acting as a dynamic reference point. After a sharp downside spike, price has rebounded back toward this average, suggesting dip-buying behavior within the prevailing uptrend. As long as daily closes remain above the lower boundary of the channel and the 200-day SMA, the broader structure remains intact.

Momentum indicators show mixed but stabilizing signals. RSI has recovered from near the lower end of its recent range and is moving back toward the neutral 50 level, indicating easing downside momentum rather than strong bearish pressure. MACD remains slightly negative but appears to be flattening, which can be consistent with consolidation within an established trend rather than trend reversal.

Overall, USDJPY is displaying signs of short-term consolidation within a larger bullish channel. The technical picture suggests the market is digesting recent volatility while respecting key trend-defining levels, keeping the medium-term bias constructive unless the channel structure is decisively broken.

-MW

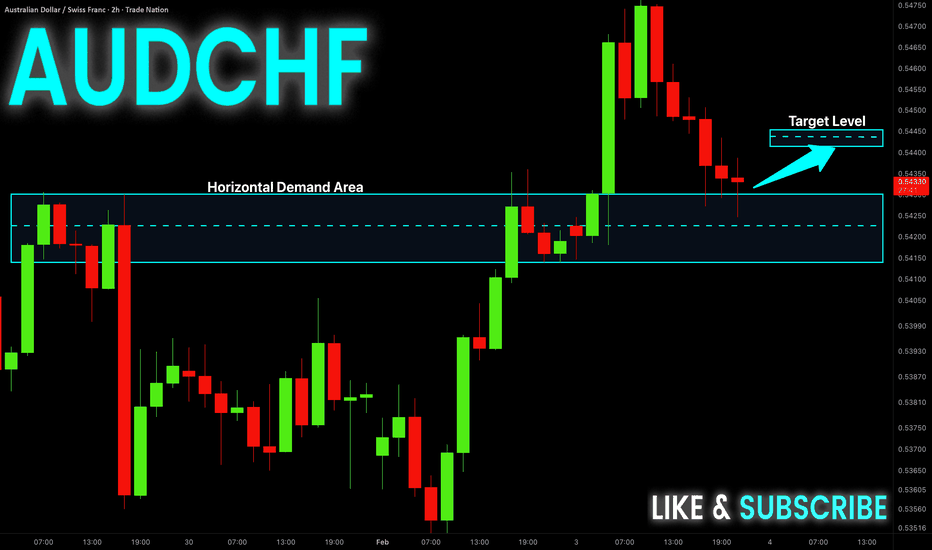

AUD-CHF Will Go UP! Buy!

Hello,Traders!

AUDCHF respects a clearly defined horizontal demand with strong bullish displacement and follow-through. Selling pressure fades after mitigation, pointing to smart money accumulation and a continuation toward higher liquidity. Time Frame 2H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHFJPY FREE SIGNAL|SHORT|

✅CHFJPY reacts inside premium at a refined supply zone with clear bearish displacement. Weak follow-through on highs suggests ICT distribution, favoring downside continuation toward resting sell-side liquidity below.

—————————

Entry: 200.87

Stop Loss: 201.35

Take Profit: 200.20

Time Frame: 3H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPNZD SWING BREAKOUT|SHORT|

✅GBPNZD strong bearish breakout below a key structure confirms ICT continuation. Price trades in discount after decisive displacement, with weak pullbacks suggesting smart money control and downside liquidity draw toward lower imbalance. Time Frame 12H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPAUD: Bulls Will Push Higher

The analysis of the GBPAUD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USD-CHF Will Grow! Buy!

Hello,Traders!

USDCHF taps a well-defined horizontal demand and shows strong bullish reaction with clean displacement. Selling pressure weakens, hinting at smart money accumulation and a push toward higher liquidity pools. Time Frame 3H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD: Bearish Continuation & Short Trade

NZDUSD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell NZDUSD

Entry - 0.6043

Stop - 0.6051

Take - 0.6019

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPUSD LOCAL SHORT|

✅GBPUSD trades in premium and reacts to bearish order flow after tapping a refined supply zone. Weak bullish displacement and rejection wicks suggest smart money distribution, with downside continuation likely toward discounted liquidity. Time Frame 2H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

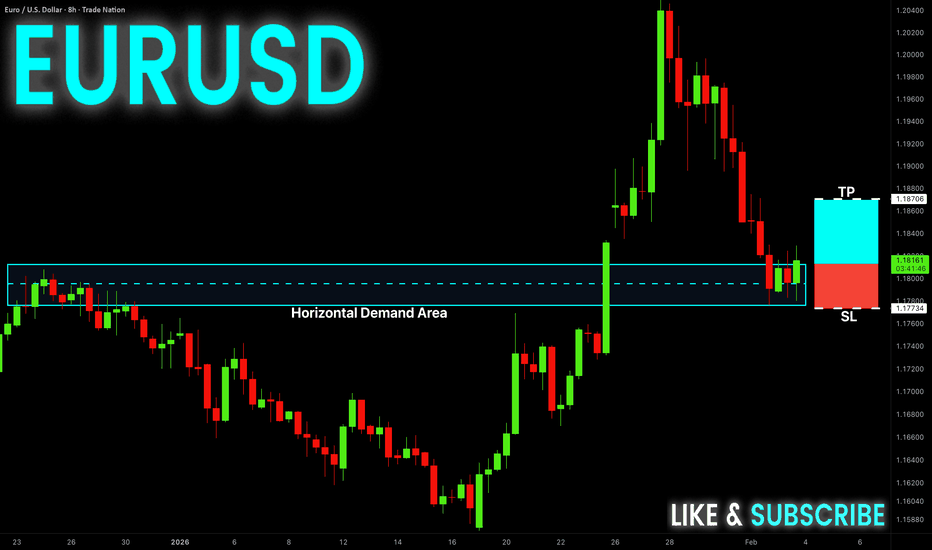

EUR-USD Free Signal! Buy!

Hello,Traders!

EURUSD strong bullish reaction from a well-defined horizontal demand zone. Price shows clean mitigation with displacement higher, suggesting smart money accumulation and continuation toward resting buy-side liquidity above recent highs.

--------------------

Stop Loss: 1.1773

Take Profit: 1.1870

Entry: 1.1812

Time Frame: 8H

--------------------

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Trading Opportunity! SELL!

My dear subscribers,

USDJPY looks like it will make a good move, and here are the details:

The market is trading on 155.70 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 154.52

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCHF Set To Grow! BUY!

My dear friends,

USDCHF looks like it will make a good move, and here are the details:

The market is trading on 0.7750 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.7781

Recommended Stop Loss - 0.7733

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XAUUSD 45-Minute Chart — Bearish Rejection From Resistance, Bearish Rejection From Resistance, Short Setup Toward Support

Market Structure:

Gold printed a strong impulsive rally, followed by loss of momentum and a rounded/curving top, signaling distribution. The sharp sell-off confirms a shift from bullish to bearish intraday structure.

Key Resistance Zone (~5060–5070):

This zone acted as previous consolidation and supply. Price retested it from below and failed to reclaim, validating it as resistance.

Entry Logic (Short):

The highlighted entry near resistance aligns with a classic break-and-retest setup. Sellers stepped in aggressively after the retest.

Stop Loss (~5145):

Placed above the recent lower high and rejection wick, protecting against a false breakdown and trend resumption.

Target / Support Area (~4810–4850):

Clear demand zone and prior accumulation area. This is the most logical downside target where buyers previously defended price.

Risk–Reward:

The setup offers a clean R:R, favoring continuation toward support if bearish momentum holds.

Bias:

📉 Bearish below resistance — continuation lower favored unless price reclaims and holds above the resistance zone.

XAUUSD: Bearish Drop to 4360?As the previous analysis worked exactly as predicted, OANDA:XAUUSD is eyeing a bearish reversal on the 4-hour chart , with price testing a key resistance zone near recent highs, converging with a downward trendline touch and a potential entry area that could trigger downside momentum if sellers defend against further upside. This setup suggests a pullback opportunity amid the ongoing rally, targeting lower support levels with approximately 1:5.5 risk-reward .🔥

Entry between 4900–4950 for a short position (entry from current price with proper risk management is recommended)🎯. Target at 4360 . Set a stop loss at a daily close above 5000 , yielding a risk-reward ratio of approximately 1:5.5 . Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging gold's volatility near highs.🌟

Fundamentally , gold is trading around $4,933 in early February 2026, with key US Dollar events this week potentially strengthening USD if data beats expectations, pressuring gold lower. On February 3 at 10:00 AM ET, Job Openings and Labor Turnover Survey (JOLTS) for December is due, where stronger figures could bolster USD amid labor resilience. February 4 at 8:15 AM ET brings ADP Employment Change (Jan, forecast 41K), signaling private hiring trends. February 6 at 8:30 AM ET features the Employment Report (Jan, forecast 50K Non-Farm Payrolls, 4.4% Unemployment Rate), the week's highlight—robust data could favor USD strength. 💡

📝 Trade Setup

🎯 Entry (Short):

4900 – 4950

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

• 4360

❌ Stop Loss:

• Daily close above 5000

⚖️ Risk-to-Reward:

• ~ 1:5.5

💡 Your view?

Is this the start of a deeper correction toward 4360, or will gold break above 5000 and continue its parabolic run? 👇