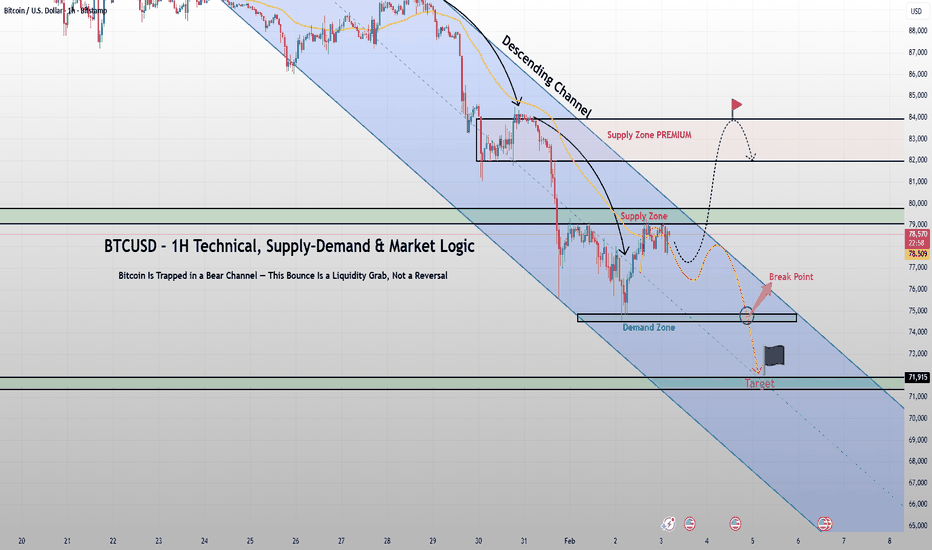

BTCUSD – 1H Technical, Supply–Demand & Market LogicBitcoin is still trading inside a clean, well respected descending channel, and nothing in the current price action suggests trend exhaustion. What looks like a bounce is structurally a corrective pullback into supply, not the start of a new bullish leg.

Technical Structure

- Trend: Clearly bearish consistent lower highs and lower lows

- Channel: Price is reacting perfectly to the upper and lower boundaries of the descending channel

- EMA (dynamic resistance): Every rally into the EMA has been rejected, confirming sellers remain in control

The recent move from the demand zone near 74,800–75,200 is a technical reaction, not accumulation. That demand has already been tested and partially consumed. Price is now pushing back into a supply zone around 78,500–79,500, aligned with:

- Channel resistance

- EMA resistance

- Prior breakdown structure

This confluence makes the area high-probability sell-side liquidity.

Supply–Demand & Liquidity

- The green demand zone below has weak hands, not strong absorption

- The current upside move is best interpreted as stop-hunting and short-term relief

- The dotted projection shows the classic bearish path:

bounce → rejection → continuation lower

If price fails to reclaim and hold above the supply zone, the next move favors a breakdown through the demand zone, opening the path toward the major liquidity target near 71,900.

Macro Context

Risk assets remain under pressure as:

- Financial conditions stay tight

- Volatility picks up

- Speculative positioning continues to unwind

In this environment, Bitcoin behaves like a risk asset in distribution, not a safe haven.

Key Takeaway

As long as BTC remains inside this descending channel, every rally should be treated as a selling opportunity, not a breakout. A real trend shift requires acceptance above channel resistance until then, downside continuation remains the dominant scenario.

This is not panic selling / This is controlled markdown.

Forex

Silver Is Rebounding — But This Is Still a Corrective MoveOANDA:XAGUSD on the 1H timeframe remains structurally bearish after the sharp impulsive sell-off from the $117.00–$120.00 region. That drop was aggressive and one-sided, signaling a clear shift from distribution into markdown. The flush reached a major downside support near $71.21, where selling pressure visibly decelerated a classic short-term exhaustion signal. From that low, price is staging a technical rebound, supported by a short-term trendline and higher intraday lows. However, this recovery is corrective in nature. The market is now rotating back into prior supply zones, where sellers previously stepped in with size.

Key Technical Levels

- Major support: $71.21

- Current corrective structure: Higher lows within a countertrend channel

- Short-term upside target: $97.53 (prior support → resistance flip)

- Overhead supply zones: $88.00–$90.00 and $95.00–$97.50

As long as silver trades below $97.50, upside should be treated as a relief rally rather than the start of a new bullish trend. Failure to hold the rising intraday structure would reopen downside risk back toward $71.21.

Silver is oversold by position, bearish by structure. Trade the rebound tactically, but respect that the dominant trend remains down until key supply above $97.50 is decisively reclaimed.

EURUSD: Corrective Pullback Inside a Descending ChannelTICKMILL:EURUSD on the 1 hour timeframe is currently trading within a clearly defined descending channel, signaling that the market is in a corrective phase rather than starting a new bearish trend. The sharp upside spike toward the $1.2000 area marked a liquidity expansion after prior accumulation, followed by distribution and a controlled markdown. Since then, price has respected the channel structure with consistent lower highs, confirming that short-term momentum remains corrective.

Price is now reacting near the lower boundary of the descending channel around $1.1780–$1.1800, which also aligns with a broader support zone below. The slowdown in bearish momentum and the formation of short-term basing candles suggest temporary selling exhaustion, not aggressive continuation. This keeps the door open for a reactionary bounce, but importantly, structure has not yet shifted to bullish — no higher high or key resistance reclaim has occurred.

As long as EURUSD holds above $1.1780, a corrective rebound toward the channel midline or upper boundary near $1.1900–$1.1980 remains technically reasonable. However, any upside should still be treated as countertrend relief, not trend confirmation. A decisive break and acceptance below $1.1760 would invalidate the bounce scenario and expose deeper downside toward lower channel extensions. Let structure dictate bias — trade reactions, not expectations.

USDCAD H4 | Potential Bearish Drop OffBased on the H4 chart analysis, we can see that the price has rejected off our sell entry level at 1.3677, which is a pullback resistance.

Our stop loss is set at 1.3742, which is a pullback resistance that is slightly below the 61.8% Fibonacci retracement.

Our take profit is set at 1.3554, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com/en: Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

USDJPY H4 | Bullish Momentum To ExtendBased on the H4 chart analysis, we could see the price fall towards our buy entry level at 154.51, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 153.58, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 157.19, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

USDCHF H4 | Bullish Bounce SetupThe price is falling towards our buy entry level at 0.7693, which is a pullback support that is slightly below the 50% Fibonacci retracement.

Our stop loss is set at 0.7608, which is a swing low support.

Our take profit is set at 0.7861, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

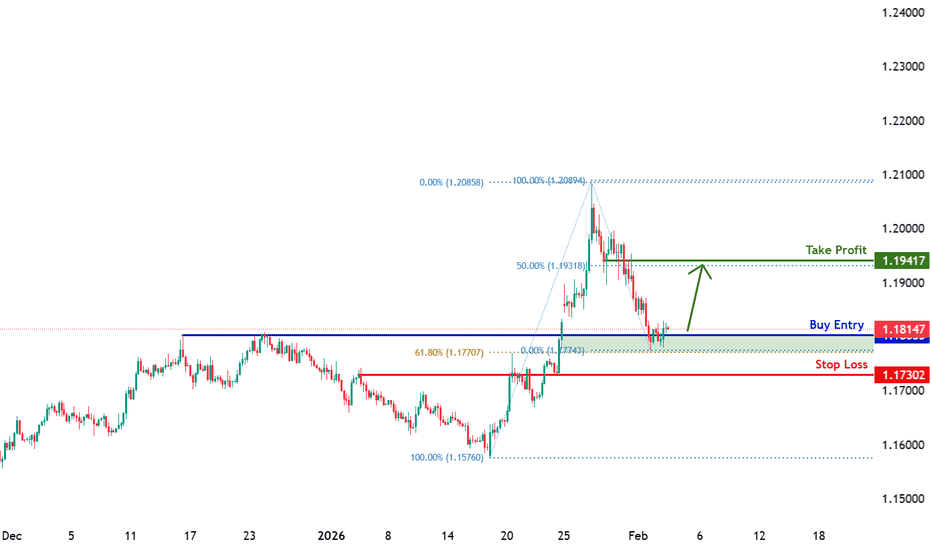

EURUSD H4 | Bullish Bounce OffThe price is reacting off our buy entry levle at 1.1803, which is a pullback support that is slightly above the 61.8% Fibonacci retracement.

Our stop loss is set at 1.1730, which is an overlap support.

Our take profit is set at 1.1941, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

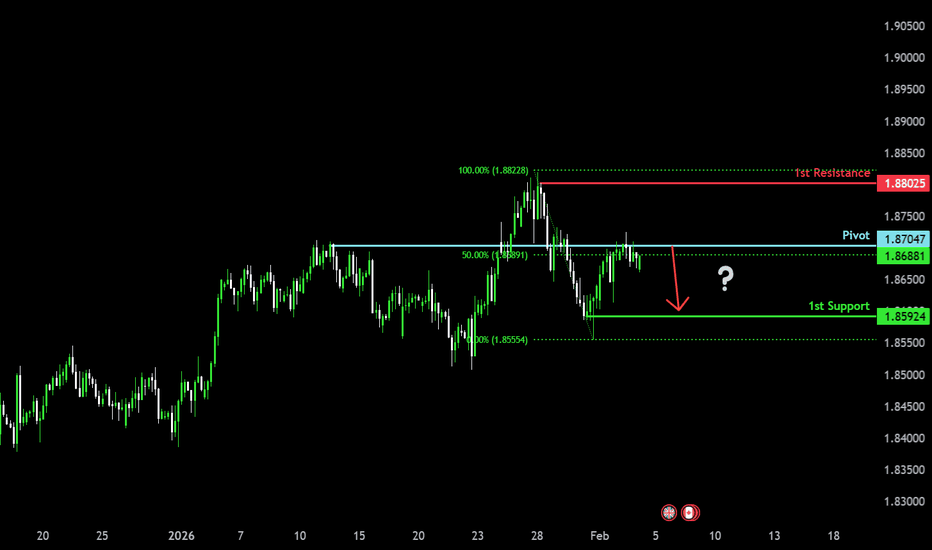

Bearish reversal setup?GBP/CAD has rejected off the pivot, which acts as a pullback resistance, and could drop to the 1st support.

Pivot: 1.8704

1st Support: 1.8592

1st Resistance: 1.8802

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?EUR/JPY has bounced off the pivot and could potentially rise to the 1st resistance.

Pivot: 183.52

1st Support: 182.78

1st Resistance: 185.54

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish continuation setup?EUR/AUD could rise towards the pivot, which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse to the 1st support.

Pivot: 1.6950

1st Support: 1.67841

1st Resistance: 1.70398

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish momentum to extend?AUD/JPY is falling towards the pivot point of 108.52, which is a pullback support and could bounce to the 1st resistance.

Pivot: 108.52

1st Support: 108.09

1st Resistance: 109.76

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off 61.8% Fib support?AUD/CAD is falling towards the pivot, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance.

Pivot: 0.95095

1st Support: 0.94496

1st Resistance: 0.96141

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDJPY - Global Short PositionFollowing a strong bullish impulse, USD/JPY has entered a corrective phase. Price failed to sustain above key resistance and is now showing signs of trend exhaustion. Current structure favors a bearish continuation toward lower support zones.

🎯 Technical Analysis:

— Clear rejection from recent highs

— Lower highs and lower lows forming on intraday structure

— Breakdown from bullish momentum into corrective bearish leg

📰 Fundamental Context:

Seasonal yen strength remains a relevant factor. During spring, Japanese corporations and institutional investors typically repatriate capital ahead of the fiscal year-end. This recurring flow historically supports JPY appreciation and adds downside pressure to USD/JPY, reinforcing the current bearish technical setup.

USDMXN Daily Trend Remains Under Bearish PressureUSD/MXN continues to trade within a clearly defined bearish structure on the daily timeframe, characterized by a sequence of lower highs and lower lows. Price remains firmly below both the 50-day and 200-day simple moving averages, with the 50-day SMA acting as dynamic resistance and reinforcing the prevailing downtrend. The long-term 200-day SMA is also sloping lower, highlighting sustained downside pressure rather than a short-term correction.

From a structure standpoint, recent price action shows a sharp impulsive move lower followed by a modest rebound. This bounce has so far lacked follow-through and appears corrective, with price still holding beneath prior support zones that have now transitioned into resistance. The inability to reclaim these levels keeps the broader bearish bias intact.

Momentum indicators support this view. RSI recently dipped toward oversold territory and is now attempting to recover, but remains below the neutral 50 level, suggesting that bearish momentum has eased slightly without signaling a trend reversal. MACD remains in negative territory, with the signal and histogram reflecting ongoing downside momentum, even as selling pressure shows signs of slowing.

Overall, USDMXN is displaying a bearish trend with short-term stabilization after an extended decline. Unless price can meaningfully recover above key moving averages and former support levels, the technical picture continues to favor a cautious, downside-leaning bias within the broader trend.

-MW

USD/JPY Daily Structure Holding Within Rising ChannelUSDJPY continues to trade within a well-defined ascending channel on the daily timeframe, highlighting a broader bullish market structure that has been in place for several months. Price action remains above the 200-day SMA, which is gradually turning higher and reinforcing the longer-term trend bias. The recent pullback appears corrective rather than impulsive, with price stabilizing near the midline of the channel.

From a moving average perspective, the 50-day SMA is acting as a dynamic reference point. After a sharp downside spike, price has rebounded back toward this average, suggesting dip-buying behavior within the prevailing uptrend. As long as daily closes remain above the lower boundary of the channel and the 200-day SMA, the broader structure remains intact.

Momentum indicators show mixed but stabilizing signals. RSI has recovered from near the lower end of its recent range and is moving back toward the neutral 50 level, indicating easing downside momentum rather than strong bearish pressure. MACD remains slightly negative but appears to be flattening, which can be consistent with consolidation within an established trend rather than trend reversal.

Overall, USDJPY is displaying signs of short-term consolidation within a larger bullish channel. The technical picture suggests the market is digesting recent volatility while respecting key trend-defining levels, keeping the medium-term bias constructive unless the channel structure is decisively broken.

-MW

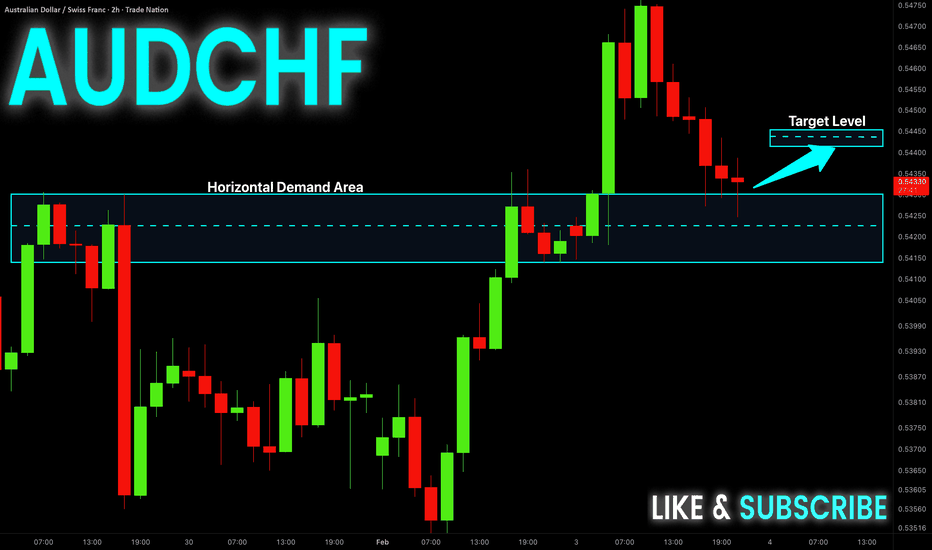

AUD-CHF Will Go UP! Buy!

Hello,Traders!

AUDCHF respects a clearly defined horizontal demand with strong bullish displacement and follow-through. Selling pressure fades after mitigation, pointing to smart money accumulation and a continuation toward higher liquidity. Time Frame 2H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHFJPY FREE SIGNAL|SHORT|

✅CHFJPY reacts inside premium at a refined supply zone with clear bearish displacement. Weak follow-through on highs suggests ICT distribution, favoring downside continuation toward resting sell-side liquidity below.

—————————

Entry: 200.87

Stop Loss: 201.35

Take Profit: 200.20

Time Frame: 3H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPNZD SWING BREAKOUT|SHORT|

✅GBPNZD strong bearish breakout below a key structure confirms ICT continuation. Price trades in discount after decisive displacement, with weak pullbacks suggesting smart money control and downside liquidity draw toward lower imbalance. Time Frame 12H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBPAUD: Bulls Will Push Higher

The analysis of the GBPAUD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USD-CHF Will Grow! Buy!

Hello,Traders!

USDCHF taps a well-defined horizontal demand and shows strong bullish reaction with clean displacement. Selling pressure weakens, hinting at smart money accumulation and a push toward higher liquidity pools. Time Frame 3H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.