SILVER Will Go Down! Sell!

Here is our detailed technical review for SILVER.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 11,885.9.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 11,523.9 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

Forex

Dow Theory — The Foundation of Trend Reading Every Trader Must MDow Theory — The Foundation of Trend Reading Every Trader Must Master

Most traders fail not because the market is random, but because they never truly understand how trends work. Dow Theory is not outdated theory. it is the core logic behind price structure that still governs every market today. If you can read structure, you don’t need predictions.

1. The Market Moves in Trends — Not Randomly

Price does not move randomly. What looks like chaos is actually organized behavior driven by collective psychology.

A trend exists when price consistently creates structure:

- Uptrend → Higher Highs (HH) + Higher Lows (HL)

- Downtrend → Lower Highs (LH) + Lower Lows (LL)

- Sideways → Price oscillates without expanding structure

As long as this structure remains intact, the trend is valid regardless of news, opinions, or emotions.

Structure > Narrative.

2. Every Trend Has Multiple Levels

One of the biggest mistakes traders make is confusing timeframe noise with trend reversal.

Dow Theory explains that markets move in three layers at the same time:

- Primary Trend – the dominant direction (weeks to months)

- Secondary Move – corrective phases against the main trend

- Minor Swings – short-term fluctuations and noise

Most losses happen when traders fight the primary trend while reacting emotionally to minor swings.

3. The Three Psychological Phases of a Trend

Trends don’t start or end suddenly. They evolve through three distinct phases:

1️⃣ Accumulation

- Smart money builds positions quietly

- Price moves sideways

- Volatility is low

- Public interest is minimal

2️⃣ Participation

- Structure becomes clear

- Breakouts occur

- Momentum expands

- This is where most trend-following profits are made

3️⃣ Distribution

- Late buyers enter emotionally

- Volatility increases

- Smart money exits into strength

- Understanding these phases helps traders avoid buying tops and selling bottoms.

4. Structure Is the Only Valid Trend Confirmation

Indicators do not define trends, structure does.

A trend is confirmed when:

- Price breaks structure in the trend direction

- Pullbacks respect prior swing levels

- Momentum resumes after corrections

If structure is not broken, there is no reversal only a correction.

This is why predicting tops and bottoms is one of the fastest ways to lose money.

5. Volume Confirms Direction, Not Timing

Volume does not tell you when to enter.

It tells you whether the move is real.

- Rising volume with the trend → confirmation

- Weak volume during pullbacks → healthy correction

- High volume against structure → warning signal

Price leads.

Volume confirms.

6. A Trend Continues Until Structure Breaks

This is the most ignored and most important rule of Dow Theory.

A trend does NOT end because:

- Price “already went too far”

- Indicators are overbought or oversold

- Social media says “the top is in”

A trend ends only when structure breaks and fails to recover.

How to Apply This in Real Trading

A simple, repeatable framework:

- Identify the dominant structure (HH/HL or LH/LL)

- Wait for a correction, not a reversal

- Enter only when structure resumes in trend direction

- Place stop-loss where structure becomes invalid

- Hold until the market changes structure

No prediction. No guessing.

Just reading what price is already telling you.

Final Thought

Most traders don’t lose because they lack indicators.

They lose because they don’t understand trend behavior.

When you stop predicting and start reading structure, the market becomes clear, calm, and repeatable.

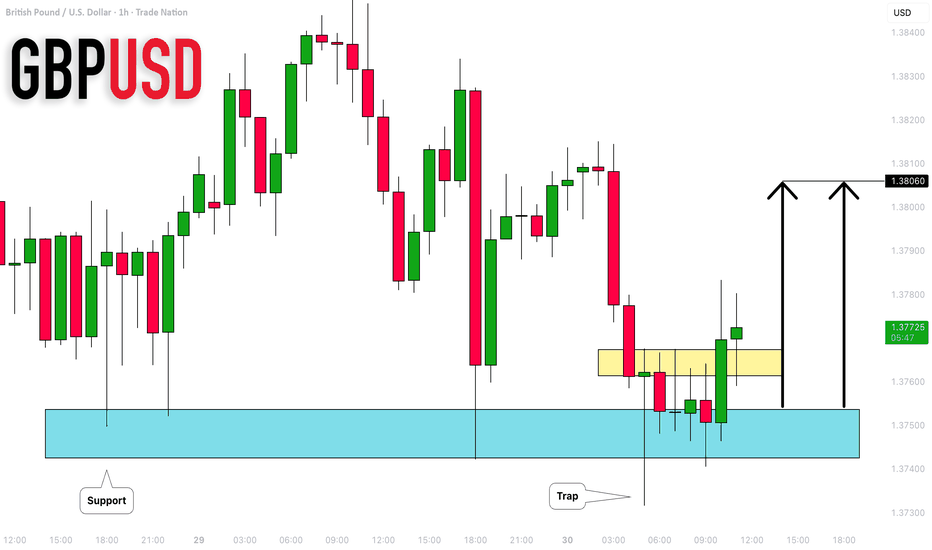

GBPUSD: Buying After Trap 🇬🇧🇺🇸

GBPUSD will likely move up after a confirmed

bearish trap below a key intraday support.

I expect a rise at least to 1.3806 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/CHF BEARS ARE STRONG HERE|SHORT

GBP/CHF SIGNAL

Trade Direction: short

Entry Level: 1.060

Target Level: 1.055

Stop Loss: 1.063

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/NZD SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

AUD-NZD downtrend evident from the last 1W red candle makes longs trades more risky, but the current set-up targeting 1.158 area still presents a good opportunity for us to buy the pair because the support line is nearby and the BB lower band is close which indicates the oversold state of the AUD-NZD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD/CHF BEARS ARE GAINING STRENGTH|SHORT

CAD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.567

Target Level: 0.565

Stop Loss: 0.569

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Silver Is Rolling Over Inside a Descending ChannelSilver has completed a clean trend transition. After a strong, well-respected ascending channel (green), price failed to sustain upside momentum and printed multiple rejection wicks at the channel top, signaling buyer exhaustion. That failure marked the start of a trend rotation, not just a pullback.

Technically, price has now broken down into a descending channel (gray), with structure flipping from higher highs to lower highs and lower lows. The orange and green moving averages have rolled over, and price is trading below dynamic resistance, confirming bearish control in the short term. Each bounce has been corrective and capped near the mid-channel — classic sell-the-rally behavior, not accumulation.

From a supply–demand perspective, the circled highs represent a distribution zone where smart money sold into late buyers. The sharp impulsive drops that followed show initiative selling, not profit-taking. As long as price remains below the descending channel resistance, rallies are likely to be faded, with downside continuation toward the lower channel boundary.

Precious metals are sensitive to real yields and USD strength. Any stabilization or rebound in the U.S. dollar, or easing of safe-haven urgency, typically pressures silver harder than gold due to its higher volatility and industrial exposure. This macro backdrop supports the current corrective-to-bearish phase rather than a fresh bullish expansion.

Silver is no longer trending up it is rotating lower inside a bearish channel. Until price reclaims the channel and holds above moving averages, the path of least resistance remains down, with bounces serving as liquidity for sellers, not signals of a new uptrend.

NZD/USD | Higher! (READ THE CAPTION)As you can see in the daily chart of NZDUSD, it has been going up for some time now and sweeping the first Buyside Liquidity on its way, and I expect it to go for the 2 buyside liquidity ahead of it, as well as the bearish breaker there. It is currently being traded at 0.60320.

Targets for the time being are: 0.60400, 0.60500, 0.60600, 0.60700 and 0.60800.

USD/JPY | retesting! (READ THE CAPTION)As you can see in the 4h chart of USDJPY, it dropped further down to 152.090, hitting all 4 bearish targets from the last USDJPY analysis, to anyone who used it, cheers. 🍻

USDJPY is currently being traded at 153.48, bouncing back up after hitting the high of the Bullish OB.

USDJPY has tested the Bearish Breaker twice now and I expect it to retest it one more time.

The bullish targets are: 153.600, 153.750, 153.90, 154.05 and 154.200.

If it fails at retesting the bearish breaker the next targets would be as follows: 153.400, 153.250, 153.100 and 152.950

GBPUSD H4 FrameWork GU H4 – Clean Breakdown (Bearish Bias)

• HTF Context:

Price traded into premium territory after an impulsive move up.

This area aligns with H4 supply / internal liquidity, not a buy zone.

• Structure Shift:

We got a Market Structure Shift (MSS) to the downside, confirming weakness and a change in intent.

• Liquidity Logic:

• Buy-side liquidity was taken

• Price failed to hold highs

• Displacement to the downside confirms distribution

• Entry Logic:

Price retraced into a bearish OB / FVG zone, offering a high-probability sell entry.

• Target:

Price is engineered to deliver toward H4 / D1 IRL in discount

(where unfilled liquidity remains).

• Key Insight:

❌ Buying here = chasing liquidity

✅ Selling aligns with HTF bias + structure + delivery

Keep it simple 🤌

EUR/USD | Where will it go? (READ THE CAPTION)Hello folks, Amirali here.

By examining the hourly chart of EURUSD, we can see that after hitting the low of the NDOG twice, it is consolidating above the NDOG high at 1.19700. I would like to see EURUSD hit the NDOG once again, and after seeing the reaction there, we'll make a move.

If it fails to stay above the NDOG, I'd like it to go lower to the C.E. of the wick and then going back up.

Bullish targets: 1.19750, 1.19900 and 1.20050.

Bearish targets: 1.19500, 1.19420 and 1.19340.

USDJPY H1 | Bullish Bounce OffThe price is falling towards our buy entry level at 152.99, which is an overlap support.

Our stop loss is set at 152.14, which is a swing low support.

Our take profit is set at 154.73, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

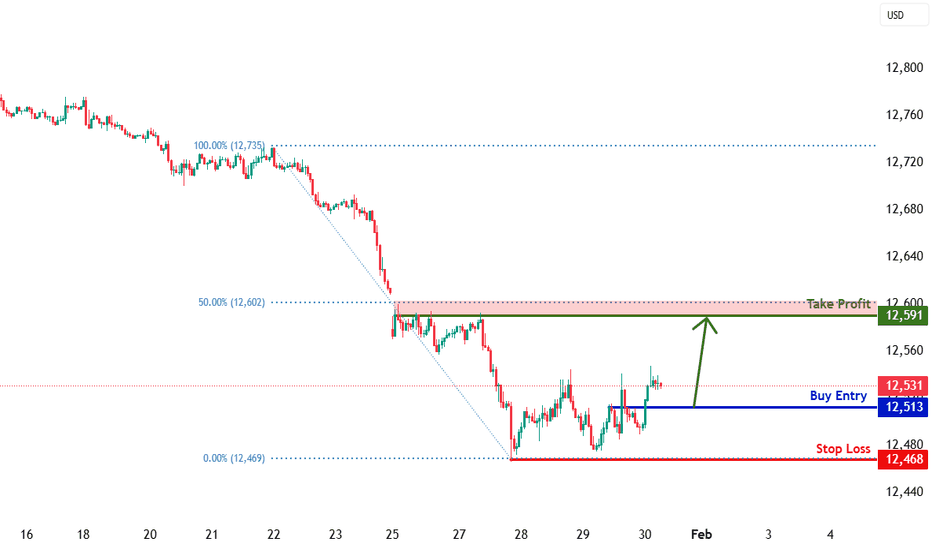

USDOLLAR H1 | Potential Bullish ReversalThe price is falling towards our buy entry level at 12.51, which is a pullback support.

Our stop loss is set at 12.46, which is a swing low support.

Our take profit is set at 12.59, which is a pullback resistance that is slightly below the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

EURUSD Bearish Continuation Toward LiquidityQuick Summary

The bearish outlook on EURUSD remains valid and Price may retrace higher toward 1.19617

After that a downside move is expected to break the equal lows formed today

This move would support continuation of the bearish trend toward the liquidity void left over the past two weeks

Full Analysis

The bearish view on EURUSD continues to hold despite short term price fluctuations

A corrective move higher is possible with price expected to reach the 1.19617 level

This upside move is considered a retracement rather than a trend reversal

From that area the market may resume its decline and target the equal lows formed earlier today

These equal lows represent a clear liquidity pool that often attracts price during bearish conditions

Breaking them would open the path for continuation of the broader downtrend

The ultimate objective of this move is the liquidity void that EURUSD has left behind over the past two weeks

That imbalance remains a strong magnet for price and supports the expectation of further downside

As long as price remains below recent highs the bearish scenario stays active

Any upward movement is viewed as an opportunity for continuation rather than a change in market direction

EURUSD Monthly Supply ReactionQuick Summary

the Price has reacted from a monthly supply zone and Further downside on EURUSD is possible

A sell setup may develop from the 1.20031 level and Entry should only be considered after a clear rejection signal

The main target is the previous low at 1.18955

Full Analysis

After price interacted with the monthly supply zone EURUSD shows potential for further downside movement

This area represents higher timeframe resistance and often acts as a strong turning point

A continuation of the decline may develop from the 1.20031 level

However selling directly from this area is not recommended without confirmation

The sell setup becomes stronger only if a clear rejection appears

This can be in the form of a reversal candle or an internal change of character which would confirm seller participation

If such confirmation is present the market is expected to target the previous low at 1.18955

This level represents a natural liquidity objective following the reaction from monthly supply

Pullback resistance ahead?Loonie (USD/CAD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 1.3651

1st Support: 1.3464

1st Resistance: 1.3792

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Heading towards 38.2% Fib resistance?USD/JPY is rising towards the pivot, which is an overlap resistance that aligns with the 38.2% Fibonacci retracement and could reverse to the 1st support.

Pivot: 154.67

1st Support: 152.16

1st Resistance: 156.21

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish continuation?Kiwi (NZD/USD) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance.

Pivot: 0.5991

1st Support: 0.5913

1st Resistance: 0.6121

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

A Triangle Appears In Bloody WatersOANDA:EURGBP seems to have found itself Consolidated into a Rising Triangle with Higher Lows into Equal Highs.

Last time price was at these levels a Harmonic pattern, the Bullish Shark, formed and we seen price make quite a rise!

Now triangle patterns are statistically known to fail 1/3 of the time but with price forming a Rising Triangle, we must assume that price could very well be looking to head back up from such an area of Support.

If price is able to Close above the Resistance of the pattern, this could generate Long Opportunities!

Fundamentally, EUR will be dealing with CPI and GDP news events tomorrow (Friday) ranging from Midnight - 4 AM. GBP will have M4 Money Supply, Mortgage Approvals and Lending releasing @ 3:30 AM.

Be Vigilant!

Bullish bounce off key support?GBP/CAD is falling towards the support level, which is an overlap support and could bounce from this level to our take profit.

Entry: 1.85474

Why we like it:

There is an overlap support level.

Stop loss: 1.8455

Why we like it:

There is a pullback support level that is slightly above the 127.2% Fibonacci extension.

Take profit: 1.8706

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish continuation setup?EUR/CHF is rising towards the resistance level, which is an overlap resistance that aligns with the 38.2% Fibonacci retracement and could reverse from this level to our target profit.

Entry: 0.92058

Why we like it:

There is an overlap resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss: 0.92353

Why we like it:

There is an overlap resistance that is slightly below the 61.8% Fibonacci retracement.

Take profit: 0.9144

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Potential bullish reversal?EUR/GBP has bounced off the multi-swing low support and could rise from this level to our take profit.

Entry: 0.8654

Why we like it:

There is a multi-swing low support level.

Stop loss: 0.8628

Why we like it:

There is a support level at the 100% Fibonacci projection and the 161.8% Fibonacci extension.

Take profit: 0.8702

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURAUD: Bearish Trend Continuation 🇪🇺🇦🇺

EURAUD will likely continue falling after completing

a correctional movement.

The next major historic support is 1.682.

Look for selling, expecting a bearish continuation to that level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.