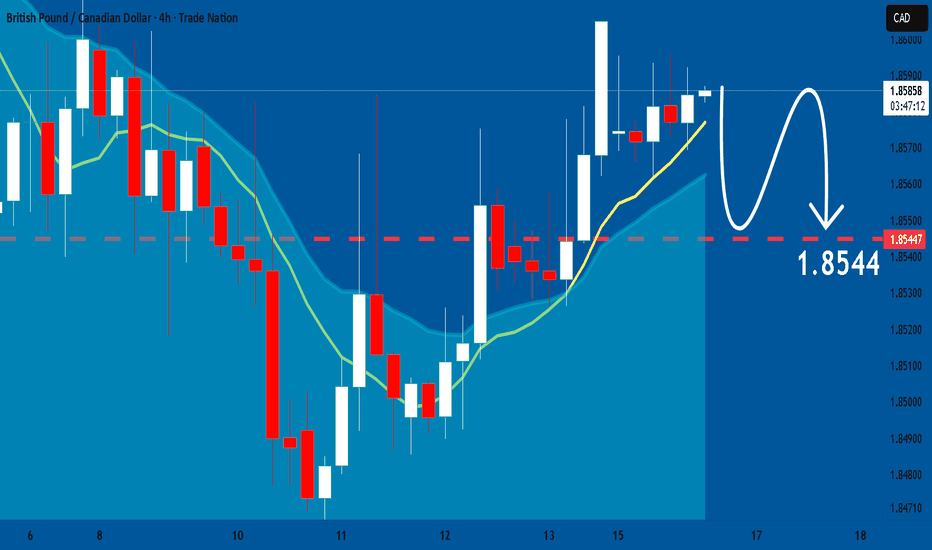

GBPCAD: Expecting Bearish Movement! Here is Why:

Balance of buyers and sellers on the GBPCAD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Forex

EURCAD A Fall Expected! SELL!

My dear subscribers,

EURCAD looks like it will make a good move, and here are the details:

The market is trading on 1.6159 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.6133

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

XRPUSDT – 1H timeframe...XRPUSDT – 1H timeframe.

🔍 Structure

Strong bullish impulse → then sharp rejection from ~1.60

Broke below short-term structure

Pullback failing under minor resistance (~1.48–1.50)

Trendline already broken

Price slipping toward lower cloud

Short-term bias: Bearish correction

📉 Sell Targets (Primary Scenario)

Current price around 1.45

🎯 TP1: 1.40

(previous support / liquidity)

🎯 TP2: 1.36

(strong horizontal demand – matches my marked zone)

🎯 TP3: 1.34

(major support / base of previous rally)

📈 Bullish Invalidation

If price reclaims and closes above:

1.50 – 1.52 (structure + cloud)

Then upside targets become:

1.55

1.60

📌 My View

Looks like a liquidity dump toward 1.36 area before any strong bounce.

GBPUSD | FRGNT WEEKLY FORECAST | Q1 | W7 | Y26📅 Q1 | W7 | Y26

📊 GBPUSD | FRGNT WEEKLY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPUSD

EUR-JPY Will Go Down! Sell!

Hello,Traders!

EURJPY strong bearish breakout below 7H horizontal supply confirms shift in structure. Premium liquidity taken, momentum accelerating lower. Expect continuation toward sell-side liquidity at target.Time Frame 7H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCAD Will Fall! Short!

Here is our detailed technical review for AUDCAD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 0.963.

The above observations make me that the market will inevitably achieve 0.942 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPY – H4 Premium Short ConceptMarket Context

Clear rejection from higher timeframe resistance (214.50–215.00 zone).

Strong bearish displacement breaking prior internal structure.

Price now retracing toward 210.00 resistance zone (previous support turned resistance).

Market structure showing lower highs after HTF rejection.

Current price is retracing into a premium pullback within a bearish leg.

🧠 Structural Narrative

1️⃣ HTF resistance held → distribution likely completed.

2️⃣ Bearish impulsive leg created imbalance.

3️⃣ Current move looks corrective, not impulsive.

4️⃣ Equal lows resting near 207.00 acting as downside liquidity.

🎯 Conditional Short Plan

📍 Entry Zone

209.80 – 210.30

(Resistance flip + premium retracement zone)

✅ Confirmation Model

Lower timeframe CHoCH bearish

Rejection wick inside resistance

Bearish displacement candle

Small FVG retrace entry

No confirmation → No trade.

❌ Invalidation

Sustained H4 close above 210.80–211.00.

🎯 Targets

TP1 → 208.00 (internal low)

TP2 → 207.00 (support liquidity)

TP3 → 205.00 (next HTF support zone)

🔄 Alternative Scenario

If price accepts above 211.00 with strong continuation,

then bullish retracement toward 212.50–213.00 becomes more probable.

📊 Risk Framework

Risk ≤ 1% per setup

Partial profits at internal structure

Avoid selling mid-range

Let resistance confirm

Bullish continuation setup?AUD/CAD is falling towards the support level which is an overlap support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.95867

Why we like it:

There is a pullback support level.

Stop loss: 0.94947

Why we like it:

There is a pullback support level.

Take profit: 0.96947

Why we like it:

There is a swing high resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Week of 2/15/26: EURUSD ForecastThe daily timeframe is currently retracing and 1h structure with it's internal is also bearish so we will follow the 1h structure for now until internal breaks to the upside. Last week EU is been in a large range, and we have marked a 4h supply zone above the range. We're going to wait patiently for buy side liquidity to be taken, look for an entry model, then enter short.

US30 Technical Analysis! BUY!

My dear friends,

Please, find my technical outlook for US30 below:

The instrument tests an important psychological level 49438

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 49916

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

US100 Is Going Down! Sell!

Please, check our technical outlook for US100.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 24,698.1.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 24,507.9 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

US30 BEARS WILL DOMINATE THE MARKET|SHORT

US30 SIGNAL

Trade Direction: short

Entry Level: 49,449.0

Target Level: 48,076.7

Stop Loss: 50,359.3

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

WTI Crude Oil Accumulating at Demand Zone

On the 1-hour timeframe, price recently experienced a sharp bearish drop and tapped into a strong demand zone around **62.00–62.40**. After the selloff, the market shifted into a tight consolidation range, showing reduced volatility and seller exhaustion — a typical accumulation behavior.

The Ichimoku cloud above price is flattening, indicating momentum loss in the downtrend. Meanwhile, structure suggests buyers are defending the demand area, forming a base. If price holds this zone, a bullish reaction toward the marked **64.00 target point** becomes likely, aligning with previous structure resistance.

Overall bias: **short-term bullish correction from demand support**.

Falling towards key support?NZD/JPY is falling towards the support level, which is an overlap support, and could bounce from this level to our take profit.

Entry: 91.72

Why we like it:

There is an overlap support level.

Stop loss: 91.12

Why we like it:

There is a pullback support level.

Take profit: 92.63

Why we like it:

There is an overlap resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Is EUR/USD Ready for the Next Bullish Expansion?🌍📈 EUR/USD “THE FIBRE” – Forex Market Trade Opportunity Guide

(Swing / Day Trade)

The Euro is showing clean bullish structure as price confirms a Simple Moving Average breakout with a successful retest, backed by a MACD Golden Crossover, signaling strengthening upside momentum and trend continuation.

This setup reflects controlled accumulation + momentum alignment, ideal for both swing and active day traders.

✅ BULLISH PLAN – TECHNICAL CONFIRMATION

🔹 Simple Moving Average (SMA):

Price has broken above the SMA and respected it on the retest, indicating a shift from distribution to accumulation.

🔹 MACD Golden Crossover:

MACD line crossing above the signal line confirms bullish momentum expansion and trend-following strength.

📌 Together, these signals validate a high-probability bullish continuation environment.

🎯 ENTRY STRATEGY – THIEF LAYER SYSTEM

You may enter at ANY PRICE LEVEL after confirmation, or apply the Thief Layer Strategy for precision positioning.

🧠 Why layering works:

• Reduces emotional execution

• Improves average entry price

• Handles pullback traps efficiently

🔐 Buy Limit Layers:

1.16800

1.17000

1.17300

(You can increase or adjust layers based on volatility and account sizing.)

⛔ STOP LOSS (THIEF SL)

📍 SL @ 1.16500

Dear Ladies & Gentlemen (Thief OG’s), always adjust your stop loss based on your own risk management rules.

This SL is a reference level, not a fixed instruction.

🎯 TARGET ZONE

Price is approaching a strong resistance zone, where:

• Overbought conditions may appear

• Liquidity traps can form

• A corrective phase is likely

💰 Our Profit Zone: 1.18500

Again, Dear Ladies & Gentlemen (Thief OG’s), this TP is optional.

Protect capital first — take money when the market offers it.

🔎 RELATED PAIRS TO WATCH ($ CORRELATION GUIDE)

💵 TVC:DXY – US Dollar Index (Inverse Correlation)

EUR/USD generally moves opposite to DXY

Dollar weakness = Fuel for EUR/USD upside

Watch DXY breakdowns for confirmation of EUR strength

💷 OANDA:EURGBP – Euro Strength Indicator

Rising EUR/GBP confirms broad Euro demand

Supports continuation in EUR/USD bullish setups

Weak EUR/GBP = caution on EUR/USD longs

💱 OANDA:USDCHF – Dollar Flow Companion

USD/CHF falling = USD selling pressure

Often moves inversely to EUR/USD

Breakdown in USD/CHF strengthens EUR/USD bullish bias

💴 OANDA:EURJPY – Risk Sentiment Gauge

Bullish EUR/JPY reflects risk-on market behavior

Confirms institutional Euro buying across pairs

Adds confidence to EUR/USD upside continuation

📰 FUNDAMENTAL BACKDROP

Current Market Drivers:

🏦 Federal Reserve dovish stance (recent 25bp cut)

📉 USD in 3-week downtrend

🇪🇺 ECB policy divergence creating EUR support

📊 Technical breakout aligns with fundamental USD weakness

🧭 FINAL TAKEAWAY

This EUR/USD setup blends trend structure (SMA), momentum confirmation (MACD), and professional execution (layer entries).

When correlated pairs align, this becomes a high-quality buy-side opportunity, not a random trade.

📌 Trade smart.

📌 Respect risk.

📌 Take profits without regret.

USOIL: Bulls Will Push

The analysis of the USOIL chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Chart Analysis – Bullish Reversal Toward Resistance

The 1-hour chart of Gold vs US Dollar (XAU/USD) shows a strong bullish recovery after a sharp sell-off. Price has reclaimed a key demand zone and is now pushing toward a major resistance level.

🟢 1. Demand Zone Holding (Bullish Structure Intact)

Price sharply dropped into the 4,880–4,920 support area

Strong rejection from the lows (highlighted reaction zone)

Higher low formed after the bounce

Momentum shifted bullish with consecutive higher highs and higher lows

This confirms buyers stepped in aggressively at discount levels.

🔴 2. Stop Loss Zone

The marked 4,930–4,950 region acts as invalidation.

A break below this zone would:

Disrupt bullish structure

Indicate potential continuation downside

Suggest failed breakout attempt

As long as price remains above this level, bullish bias remains valid.

🟩 3. Current Resistance Zone

Price is now testing 5,020–5,060 supply area

This zone previously acted as consolidation and breakdown area

Reclaiming and holding above it turns it into support

A clean breakout and close above 5,060 increases probability of continuation.

🎯 4. Upside Target

If breakout confirms:

Next major resistance: 5,120–5,150

Strong momentum could extend toward the psychological 5,200 region

📊 Technical Structure Summary

Level Type Price Zone Meaning

Major Support 4,880–4,920 Strong demand reaction

Invalidation 4,930–4,950 Stop loss area

Breakout Level 5,020–5,060 Key resistance flip

Target Zone 5,120–5,150+ Upside objective

📌 Bias: Bullish Above 4,950

Holding above support → continuation likely

Break and close above 5,060 → acceleration expected

Failure below 4,930 → bearish pressure returns

If you'd like, I can also provide:

A short trading plan version

Risk-to-reward breakdown

Intraday scalp vs swing perspective

Or convert this into a caption for social media 🚀

QQQ: Bullish Continuation & Long Signal

QQQ

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long QQQ

Entry - 601.88

Sl - 598.82

Tp - 607.67

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SPY On The Rise! BUY!

My dear subscribers,

SPY looks like it will make a good move, and here are the details:

The market is trading on 681.65 pivot level.

Bias - Bullish

My Stop Loss - 678.64

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 687.62

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSD Breakout from Downtrend, Eyeing FVG Refill & 70K Target

This 1H **BTCUSD** chart shows price breaking out of a descending trendline after a prolonged consolidation range. Following the breakout, price has pushed higher and is now pulling back into a marked **FVG (Fair Value Gap)** area, which aligns with the Ichimoku cloud acting as dynamic support. As long as BTC holds above this demand zone, the structure favors continuation to the upside, with the next bullish objective marked near the 71,000 level.

APPLE: Free Trading Signal

APPLE

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy APPLE

Entry Level - 255.79

Sl - 251.80

Tp - 264.27

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

BTCUSD My Opinion! SELL!

My dear subscribers,

This is my opinion on the BTCUSD next move:

The instrument tests an important psychological level 68765

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 67707

My Stop Loss - 69335

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK