GBPUSD (H1) – Structure OverviewPrice continues to respect a descending channel, indicating controlled bearish market structure. Recent upside movement appears corrective rather than impulsive.

Channel Respect: Price remains below the channel’s upper boundary, maintaining bearish pressure.

H1 Order Block Reaction: Current price is testing a prior H1 supply zone, aligning with channel resistance.

Market Context: Failure to accept above this zone keeps price within the broader downward structure.

Momentum: Lower highs within the channel suggest continuation of range-to-bearish behavior unless structure changes.

⚠️ Educational analysis only. No buy/sell recommendation. Always wait for confirmation and manage risk.

Foryourpage

XAUUSD | 15M – Technical Analysis (Educational)Market Structure:

Gold is trading within a bearish market structure after a clear downside break. The recent upside move appears corrective rather than impulsive.

Technical Context:

Price previously formed a bearish BOS

Current movement shows a retracement into premium

Buy-side liquidity (BSL) is resting above recent highs

Multiple Fair Value Gaps (15M & H1) remain unmitigated

Higher-timeframe imbalance aligns with bearish continuation

Expectation:

If price trades into the highlighted FVG / liquidity zone, a reaction may occur. From a structural perspective, continuation toward lower liquidity zones remains a valid scenario unless higher-timeframe acceptance is seen.

Note:

This chart reflects a technical perspective only and is shared for educational purposes. Always apply your own confirmation and risk management.

XAUUSD (Gold) – H1 Technical AnalysisGold is currently trading within a key intraday structure on the H1 timeframe. Price has recently shown a bullish reaction from the H1 Order Block (OB), indicating short-term demand, but overall structure still favors sell-side liquidity above.

Market Structure

Price previously formed a Break of Structure (BOS) to the downside.

Current bullish move looks corrective, not a full trend reversal.

Multiple Buy-Side Liquidity (BSL) levels remain resting above current price.

Key Zones

🔴 Premium Supply Zone (H1 FVG + BPR)

This zone aligns with previous imbalance and premium pricing.

Ideal area to watch for rejection and bearish confirmation.

🔵 H1 Order Block (Demand)

Price has already reacted from this zone, suggesting temporary support.

Expectation

Price may push higher to grab buy-side liquidity.

If bearish confirmation appears inside the premium supply zone, price could continue downward toward lower liquidity levels.

As long as price remains below the premium zone, sell-side bias remains valid.

Notes

Wait for confirmation (rejection, bearish candles, or structure shift) before taking any position.

This analysis is based purely on price action, liquidity, and market structure.

Disclaimer

This idea is for educational purposes only and does not constitute financial advice. Always manage risk and trade according to your own plan.

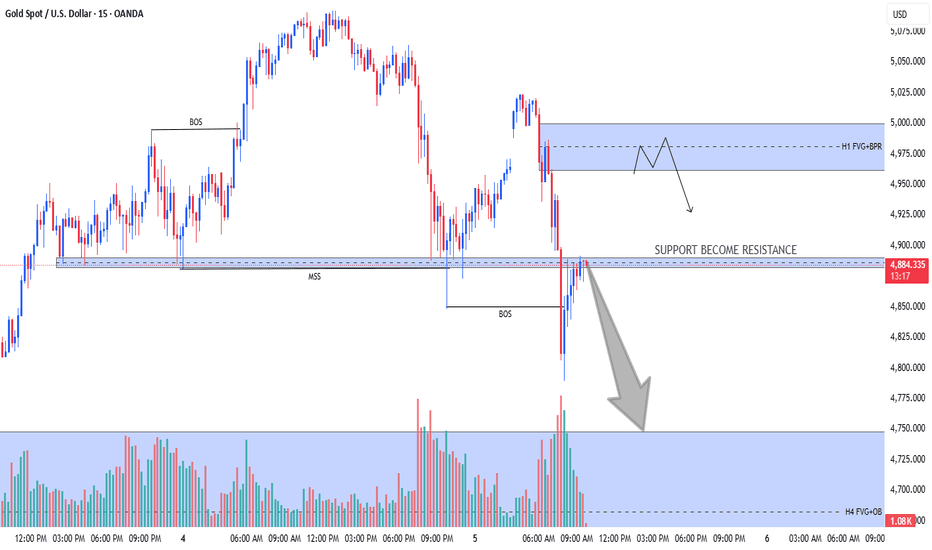

Gold next move?Gold is facing a strong resistance around the 4900 level, and the price has been repeatedly rejected from this zone, causing it to move downward each time it reaches this area. As long as the market does not achieve a confirmed close above this level, it will remain difficult for price to sustain any upward movement.

Additionally, the market has already collected liquidity on the downside, which increases the probability of further consolidation or corrective moves. Therefore, it is advisable to wait for a clear market close above the 4900 level. Once a strong close is established above this resistance, gold may then continue its move toward the upside.

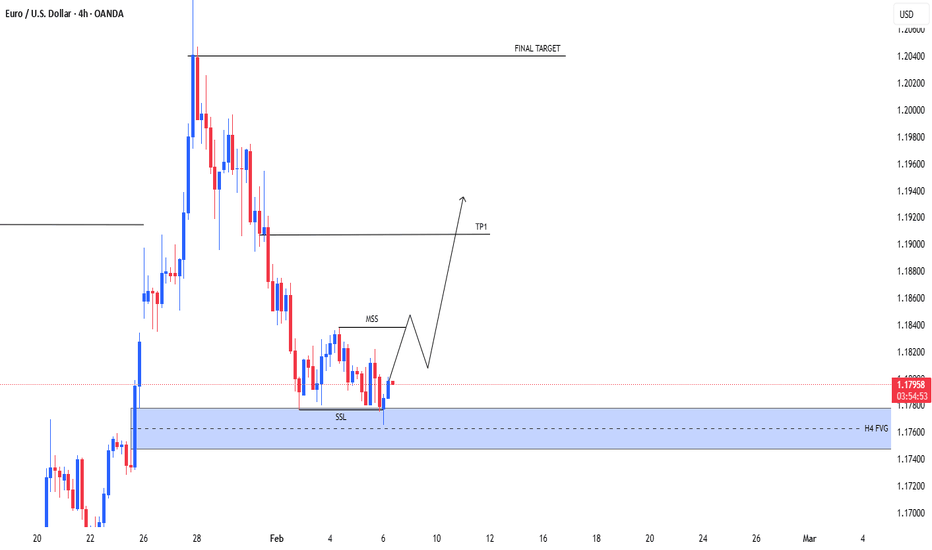

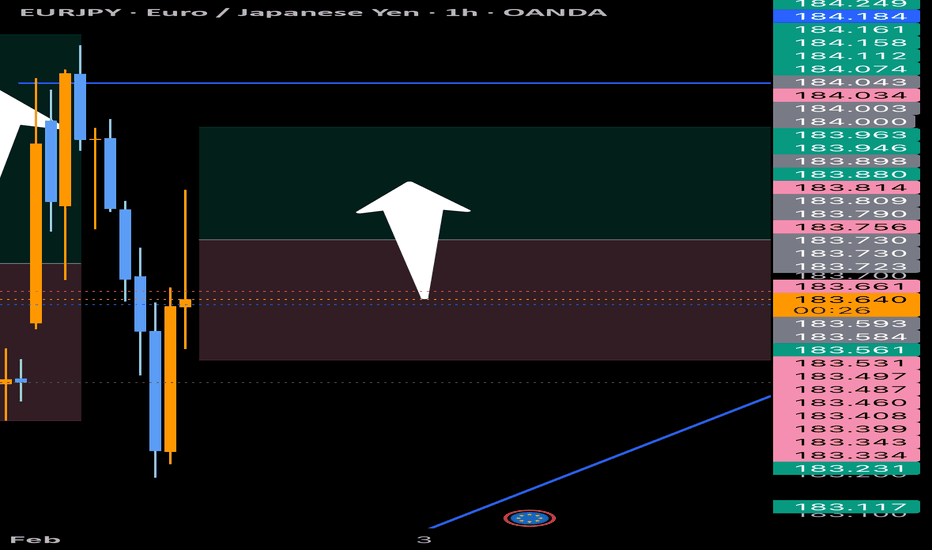

EURUSD | H4 – Technical PerspectiveEURUSD is currently trading within a broader bearish structure. The recent move into the highlighted zone appears to be a liquidity sweep, followed by a reaction from a higher-timeframe Fair Value Gap (H4 FVG).

Price remains below key resistance, and the latest upside movement looks corrective rather than impulsive. From a structural point of view, continuation toward lower liquidity remains a valid scenario unless price shows strong acceptance above recent highs.

This analysis is based purely on price action, market structure, and liquidity behavior and is shared for educational purposes only.

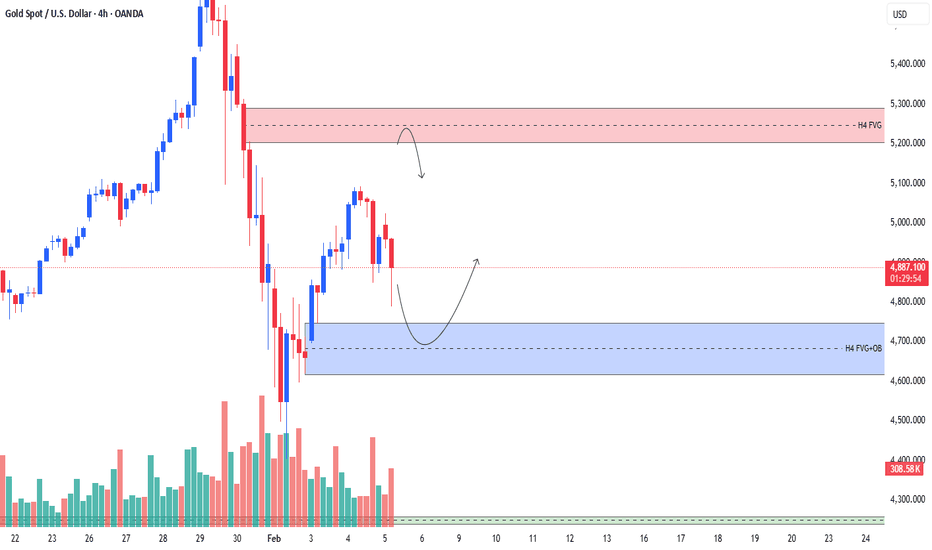

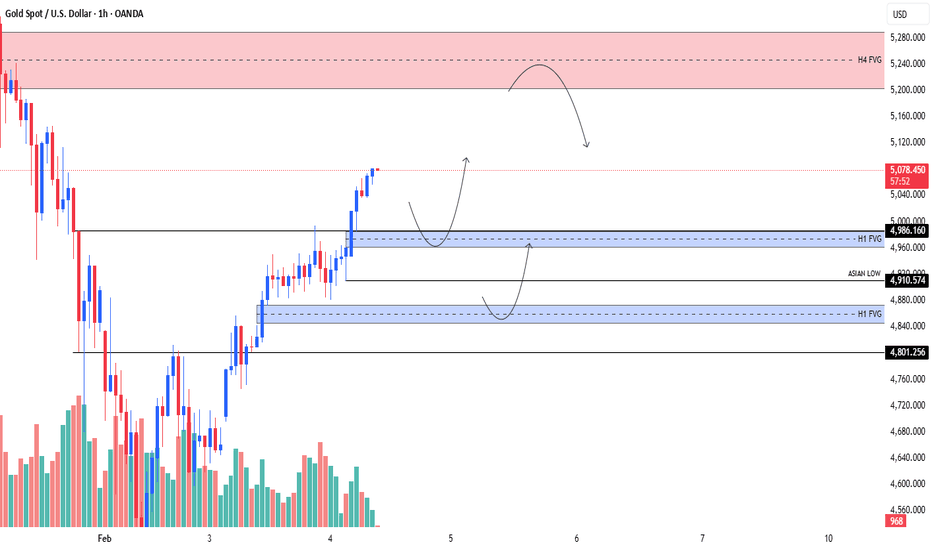

XAUUSD | H4 Market Structure ObservationPrice is currently trading between two significant H4 Fair Value Gap (FVG) zones.

The upper zone may act as a potential resistance area, while the lower zone aligns with a possible demand reaction area.

Market behavior near these zones will provide clarity on the next directional move.

This analysis is shared for educational and observational purposes only.

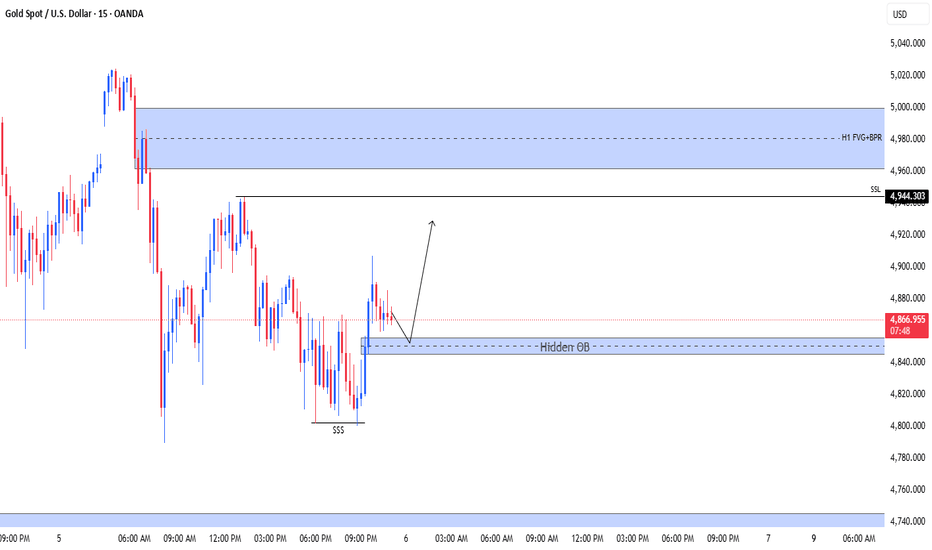

XAUUSD – M15 | Short-Term Bullish Reaction ExpectedPrice has swept liquidity (SSS) and is now reacting from a Hidden Bullish Order Block on M15.

As long as price holds above this OB, a pullback → continuation move is likely.

Upside draw remains toward the H1 FVG / BPR zone near the previous supply area.

Bias: Intraday bullish

Key idea: Liquidity sweep + hidden OB reaction

Note: Wait for confirmation before execution. This is educational, not financial advice.

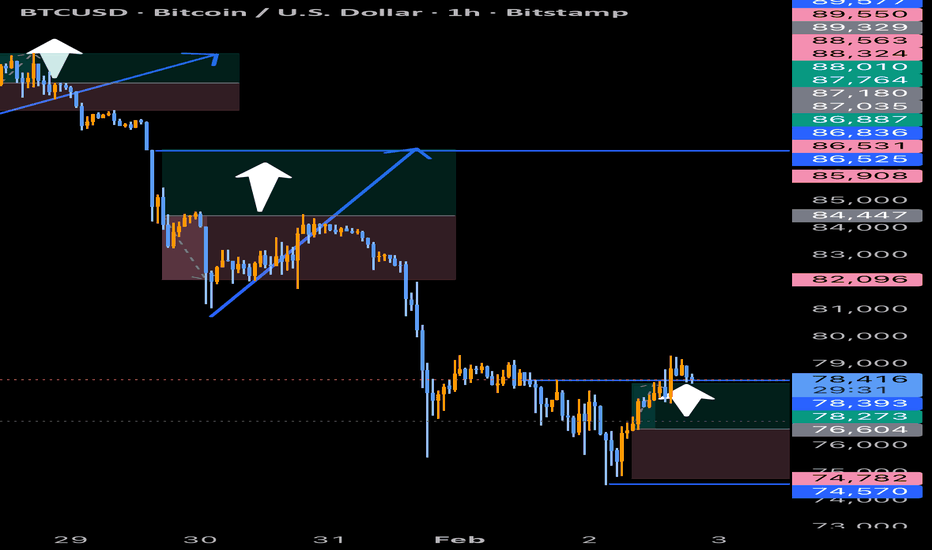

BTC : (Scalp Trade 71K+)Bitcoin giving a nice long wick with a rejection (showing and indicating) to us that there’s some present buying pressure within it and could give us a nice cool reversal towards the upside before continuing its downward trend, Prices to enter at (71 000) to (73 000) remember this is a scalp trade and always remember not to marry your positions when in profits (Trial Stop) and take partials

XAUUSD | M15 Technical ObservationFollowing a market structure shift, price is consolidating below a prior support zone that may now function as resistance.

An overhead imbalance area is also present, which could influence short-term price behavior.

This post is for chart study and educational discussion only.

XAUUSD (Gold) – HTF FVG Reaction | 1HThis chart highlights higher-timeframe Fair Value Gaps (H1/H4) and recent session liquidity levels.

Price is currently reacting within a premium area while previous H1 imbalance zones remain unmitigated below.

The idea demonstrates how price has historically interacted with imbalance and liquidity zones on Gold.

No directional bias is assumed; this is a technical structure overview only.

⚠️ Disclaimer:

This publication is for educational and analytical purposes only.

It does not constitute investment advice, trade signals, or recommendations.

Always do your own research and risk management.

ETH Breaks Support, Bearish Continuation

This is a 1-hour ETH/USD chart with Ichimoku Cloud. Price first moved sideways in a defined range, then rallied into a clear resistance zone near the top. After rejection, ETH broke down below key support and the Ichimoku cloud, confirming a bearish shift. Price is now trending lower with weak momentum, and the chart projects a downside target around 2,550, suggesting continuation of the bearish move unless price reclaims the broken level.