AUDUSD Potential Bullish Bias | 0.66500 Support + USD Weakness!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66500 zone. AUDUSD remains in a well-established uptrend and is currently experiencing a healthy corrective pullback, approaching a key trendline confluence and the 0.66500 support & resistance zone, which may act as a strong demand area for bullish continuation.

From a fundamental perspective, increasing expectations of a potential interest rate cut at the upcoming FOMC meeting continue to weigh on the US Dollar. Ongoing USD weakness typically supports risk-sensitive currencies such as the Australian Dollar, further strengthening the bullish bias on AUDUSD.

As always, wait for confirmation before entry and manage risk responsibly.

Trade safe,

Joe.

Fx

USD Ascending TriangleLast year saw EUR/USD come into the year with a full head of steam on the short side, and there was widespread expectation of a parity print in the not too distant future as USD-strength ran rapidly. But - both DXY and EUR/USD set fresh extremes on January 13th and then stalled.

In EUR/USD, it was the 1.0200 handle that remained as support, and then February saw the slow build of an ascending triangle. At the time, it was easy to dismiss reversal potential, as the 1.0500 level held resistance on multiple tests. But as the month of March opened, so did the prospect of a US recession and that helped the USD to break down and EUR/USD to break out.

In early-2026 trade, it's easy to be a USD bear, just as last year was easy to be a USD bull. But so far the US Dollar has built into a similar, albeit shorter-term ascending triangle formation that points to the possibility of reversal.

The 98.77 level looms large here as that resistance from prior support has already held a couple of tests. - js

EURJPY My Opinion! BUY!

My dear friends,

Please, find my technical outlook for EURJPY below:

The price is coiling around a solid key level - 183.29

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 183.61

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHFJPY Set To Grow! BUY!

My dear subscribers,

My technical analysis for CHFJPY is below:

The price is coiling around a solid key level - 197.03

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 197.37

My Stop Loss - 196.86

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD Technical Analysis! SELL!

My dear friends,

My technical analysis for EURCAD is below:

The market is trading on 1.6126 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.6098

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD A Fall Expected! SELL!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 4460.4 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 4450.7

Safe Stop Loss - 4465.7

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EUR/USD Hammer TimeUSD bulls tried to push to start the week but so far, they've been offset by sellers. In EUR/USD, the pair had been pushing lower since Christmas Eve and that continued through early trade this week, all the way down for a trip to support at prior resistance.

The intra-day reversal, however, has been stark, and the daily bar is currently showing as a hammer formation. Ideally, hammers show after prolonged sell-offs and in that case, opens the door for bullish reversal potential. Even better is if that hammer prints after test of a big level, like a 1.1000 or 1.1500 handle. In this case, the criteria for a single candle hammer formation are met so this opens up the possibility of bullish reversal potential of that near-term trend taken from the sell-off that began just before Christmas in the week before last. I'm still more intrigued by GBP/USD for USD-weakness setups and that pair has printed a bullish engulf today which contrasts well with the building hammer in EUR/USD. - js

EUR/USD 2026: Why the Dollar Dominates Despite Global UnrestThe EUR/USD pair entered January 2026 under significant pressure. The U.S. dollar recently hit a three-week high against the euro. While geopolitical headlines scream of regime change in South America, the market remains cold. Investors are ignoring the noise to focus on iron-clad economic fundamentals. Current price action near $1.1704 reflects a clear preference for U.S. assets.

Geostrategy: The Venezuela Pivot and Risk Primacy

Geopolitics took center stage on January 3 with Operation Absolute Resolve in Venezuela. The capture of President Maduro signaled a shift in Washington’s geostrategy. Analysts initially feared a "safe-haven" stampede. However, the currency markets remained remarkably stable.

Traders now view this move as a reassertion of the Monroe Doctrine. The U.S. is securing its own hemisphere while becoming more transactional elsewhere. This strategic focus reduces long-term energy risks for the American economy. Consequently, the dollar’s "exorbitant privilege" remains unchallenged by recent kinetic actions in Latin America.

Macroeconomics: The Growth Divergence Gap

The underlying economics favor a stronger dollar throughout early 2026. The U.S. economy projects a 1.9% growth rate. Meanwhile, the Eurozone stumbles at just 1.1% [/b. This divergence stems from sticky inflation and differing fiscal capacities.

While the Federal Reserve maintains a cautious stance, the European Central Bank (ECB) faces stagnation. High energy costs continue to haunt German industry. Markets now price in fewer U.S. rate cuts than previously expected. This interest rate differential acts as a gravity well for global capital.

Leadership: The Fed’s High-Stakes Regime Change

Management and leadership at the Federal Reserve are currently under the microscope. Jerome Powell’s term concludes in May 2026. President Trump has signaled a preference for a more "pro-growth" successor. Speculation surrounds candidates like Kevin Hassett or Christopher Waller.

A leadership shift toward looser policy could theoretically weaken the dollar. However, the market currently bets on institutional continuity. Investors trust the Fed’s mandate to protect the dollar’s purchasing power. This "credibility premium" keeps the greenback resilient against a fragmented European political landscape.

High-Tech and Patents: The Innovation Deficit

A deep-dive patent analysis reveals a widening chasm between the two regions. The U.S. leads in high-tech sectors like AI and quantum computing. European innovation remains fragmented across national borders. In 2025, the U.S. outpaced the EU in AI-related patent filings by nearly 3 to 1 .

* R&D Spend: The U.S. invests roughly 3.5% of GDP into R&D.

* Venture Capital: U.S. fund sizes dwarf European counterparts by double.

* Business Model: The EU’s "precautionary principle" slows high-tech adoption.

Europe’s "middle-technology trap" limits its productivity growth. Without a unified capital markets union, the Eurozone cannot fund the next technological revolution. This structural weakness creates a long-term bearish outlook for the euro.

Technology and Cyber: Securing the Digital Dollar

Cybersecurity and financial technology also play a pivotal role. The U.S. is rapidly integrating AI into its demand forecasting and logistics. These "high-tech" efficiencies lower the cost of doing business. Furthermore, the U.S. leads in developing secure, digital-first financial architectures.

European firms struggle with high regulatory hurdles like the AI Act. While these laws protect privacy, they often stifle rapid scientific advancement. Consequently, global investors view the U.S. as a safer, more innovative harbor for digital capital.

Market Outlook: January 7 and Beyond

All eyes now turn to the mingling U.S. manufacturing data and non-farm payrolls. These indicators will confirm if the U.S. "A-pillars" of growth remain intact. If data stays firm, the EUR/USD may test support at $1.1650 . The dollar's dominance is not just a trend; it is a structural reality.

EUR/USD Still Stalled at Fibo Resistance - 1.2000 for 2026?It was two very different outlays for EUR/USD in 2025, and perhaps surprisingly, the trend that many expected coming into the year showed very little run.

EUR/USD dropped like a rock in Q4 of 2024 even as the Fed cut rates, and as we pushed through the 2025 open, it seemed that there was little expectation that the pair would not test the parity handle. But - price found a low less than two weeks into the New Year and then stalled, with an assist from a key Fibonacci retracement level plotted at 1.0200.

February saw the build of an ascending triangle, but it was the March breakout that really drove the dominant trend for last year, with continuation into the end of H1 as price pushed up to find resistance at the 78.6% retracement of that same Fibonacci setup.

Since then - buyers haven't been able to break much fresh ground and as we wind into the end of the year we're trading around the same levels. Given that the Euro is 57.6% of the DXY quote, this is key as to whether the US Dollar can display trending tendency into next year. On the fundamental side, the Fed seems open to more cuts but given the blistering GDP read out of the U.S. there's a very real question as to whether inflation will continue to look subdued as we get more fresh data following the government shutdown, and then there's also the question as to whether the U.S. economy is in dire need of additional rate cuts. And, even then, markets have already built in the expectation for cuts, sot that's going to be a difficult bear for USD bears to jump across.

And on the part of the Euro, it's not like European growth is a great story at the moment, so as we go into 2026 it seems expectations are loaded on the long side of the EUR/USD pair and, from the chart, there's resistance ahead at the psychological level of 1.2000. - js

USDJPY is Nearing a Strong Resistance!Hey Traders,

In today’s trading session, we are monitoring USDJPY for a potential selling opportunity around the 156.200 zone.

Technically, the pair remains in a broader downtrend and is currently in a corrective move, retracing back toward the 156.20 area, which aligns with trend resistance and a key support/resistance flip. This zone has previously acted as a reaction level and now serves as a potential area for sellers to re-engage.

As long as price remains capped below this region, the prevailing bearish structure stays intact, with rallies viewed as corrective rather than impulsive.

Watching closely for price reaction and bearish confirmation around 156.200 before any continuation lower.

Trade safe,

Joe

NZDCAD: Bullish Forecast & Bullish Scenario

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the NZDCAD pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDNZD My Opinion! SELL!

My dear subscribers,

AUDNZD looks like it will make a good move, and here are the details:

The market is trading on 1.1523 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.1469

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSD Expected Growth! BUY!

My dear followers,

This is my opinion on the EUR/USD next move:

The asset is approaching an important pivot point 87614

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 88455

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

ETHUSD On The Rise! BUY!

My dear followers,

I analysed this chart on ETHUSD and concluded the following:

The market is trading on 2920.2 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2961.5

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

ETHUSD: Bearish Continuation is Highly Probable! Here is Why:

Balance of buyers and sellers on the ETHUSD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD Buyers In Panic! SELL!

My dear subscribers,

My technical analysis for EURUSD is below:

The price is coiling around a solid key level - 1.1796

Bias - Bearish

Technical Indicators: Pivot Points HighHigh anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.1770

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSD Sellers In Panic! BUY!

My dear friends,

Please, find my technical outlook for BTCUSD below:

The price is coiling around a solid key level - 87440

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 87816

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

ETHUSD The Target Is UP! BUY!

My dear subscribers,

This is my opinion on the ETHUSD next move:

The instrument tests an important psychological level 2946.6

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2958.1

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

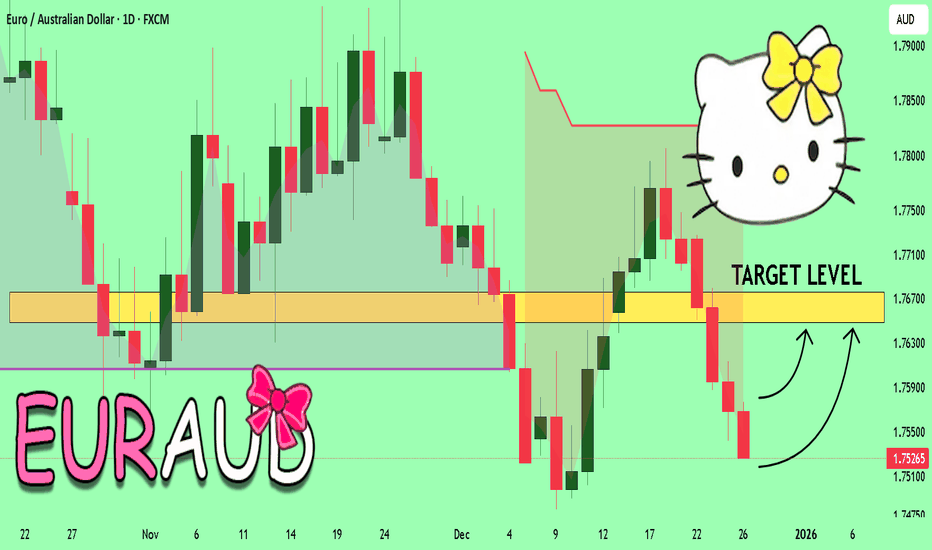

EURAUD Trading Opportunity! BUY!

My dear friends,

EURAUD looks like it will make a good move, and here are the details:

The market is trading on 1.7526 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.7648

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

ETHUSD Set To Fall! SELL!

My dear subscribers,

This is my opinion on the ETHUSD next move:

The instrument tests an important psychological level 2944.2

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2938.2

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSD Will Collapse! SELL!

My dear friends,

Please, find my technical outlook for BTCUSD below:

The price is coiling around a solid key level - 87810

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 87590

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Gold % Gain vs SPX Since 1971Debt wasn’t the problem in 1971 or 1980. It became the system after 2000.

In 1980, the U.S. owed ~30% of its GDP.

In 2000, ~55%. In 2025, ~125%.

This isn’t inflation theory. It’s arithmetic!

I have long been a critic of MMT (Modern Monetary Theory)

Or, as I like to call it more accurately, OCG (Old Currency Guess), because it deliberately confuses a Gov. currency payment system & units of account as wealth. The more we borrow, the more wealth Gov creates, according to OCG. "No sovereign currency issuer can default in its own currency," they cry out daily. So print and play give us more free stuff! We will become richer and solve all the problems of the world! Right!!

Note that Gov becomes the source of wealth, not the private sector, which actually creates wealth with our blood, sweat, tears, innovation, and risk-taking.

So-called ‘printing’ isn’t printing at all. It’s borrowing existing dollars, recycling them through spending, and stacking permanent debt claims on future output. When growth goes to servicing past promises, the economy eventually gets consumed by its own debt and collapses.

Currently, Japan is on the path to economic ruin. With a debt-to-GDP ratio of 250% double that of the US. The thing with debt is that it works great at masking the problem right up to the point it doesn't! It's that "DOESN'T" part that really matters. When creditors lose confidence and run away, that is more subjective than an objective point in economics, which makes it difficult to calculate accurately. People use that subjectivity against economics and conclude it's not science and schitt all over it.

My take is different. While I literally subscribe to no economic standalone theory, I do believe all economists should be financial experts and fully understand markets. No theory or model can deal with the real-world complexity. Definitely not MMT! They are the cancer of economics.

While people are focusing on Gold/Silver and soon start talking about Japan with 250% debt/GDP, I will urge you to look at the US instead. While US debt-to-GDP is half of that of Japan. The US has 4 times the amount of debt as Japan! Quantity is a quality of its own! It is much easier to find creditors for $9 trillion than $38 trillion. Believe that schitt!

With Trump waging a trade war against the world and taking over the FED wanting lower rates, that is F disaster in the Making! After a Nuclear war, Inflation is the absolute worst thing that could happen to humanity! A Global Currency crisis is on the horizon, and 99.9% of the people are unaware of it.

CAUTION! Is in Order!

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

AUDUSD A Fall Expected! SELL!

My dear friends,

My technical analysis for AUDUSD is below:

The market is trading on 0.6715 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.6613

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK