ISMQ - interested EGX:ISMQ timeframe 1 day

Created Bullish Gartley pattern, so we can see action price in this point .

Entry level around 4.45

Stop loss 4.00

First target at 5.18

Second target 5.85

NOTE : this data according to timeframe 1 day.

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

Gartley

US Crude oil Spotits neo wave alternative count for wave 1 of wave C in lower degree and it wave C of Wave 2 or Wave A let see. Earlier posted little different wave 1 count and wave 2 count for wave C let see which one fit as in progress . In both case near $67 is invalidation point. Also bearish gartley and other harmonic pattern developed which I shown in charts in previous post. I am not SEBI registered analyst and its not buy , sell and hold recommendation and having position in it in mcx.

Spot WTI Crude oilas per neo C wave going on, 1st leg completed or wave C completed that time will tell. If wave 2 its irregular correction(possibly), need confirmation, also bearish gartley and other harmonic pattern developed But jackson hole news may impact direction and levels . Let see. Ia m not sebi registered analyst and this is not buy, sell and hold recommendation.

XABCD

Hey awesome traders! Hope you’re enjoying a well-deserved holiday. Quick summer check-in: GBPAUD just completed a clean Bullish Gartley into the PRZ, and buyers are reacting at D—poolside or beach, plan it, execute it, manage the profit.

📌 Pattern Overview

Pattern: Gartley (Bullish)

Bias: Long from D/PCZ on confirmation and structure reclaim

🔑 Key Levels

X: 2.08178

A: 2.10047

B: 2.09003

C: 2.09821

D (PRZ): 2.08540

PCZ: 2.084 – 2.087 (XA 78.6% + AB=CD/BC 1.27–1.618 confluence)

📐 Confirmation Triggers

First reaction off D printed.

Stronger confirmation: reclaim/close above 2.0900 (B pivot).

Hold of higher-lows inside 2.084–2.087 keeps the setup valid.

⚡ Trade Plan

Plan A (confirmation entry):

Wait for close > 2.0900, buy the retest.

Targets: 2.10293 – 2.10707 (T1 zone).

Trail once price clears 2.100.

Plan B (PRZ fade, smaller size):

Scale in on basing/higher-lows 2.084–2.087.

Add on 2.0900 reclaim.

🛡 Risk Management

Invalidation (aggressive): clean close below 2.0854 (D).

Conservative invalidation: below 2.0818 (X).

Stops: under 2.084–2.085 (tight) or under 2.0815–2.0820 (structure).

Move stop to BE after ~1R; partials at T1.

🎯 Targets & Path

T1: 2.10293 – 2.10707 (≈ 78.6%–100% of AD).

If momentum persists after T1, look for continuation legs toward prior swing supply.

JUFO - the same trade from 3 weeks agoEGX:JUFO timeframe 1 hour

formatted bullish pattern as follow :

entry around 28.48

stop loss : 28.30

t1: 28.85

t2: 29.18

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

EGCH - great opportunity but be carful EGX:EGCH timeframe: 1 week

Identified a bearish Gartley pattern with:

- Sell point: 11.00

- Targets: T1 at 9.55, T2 at 8.52

- Stop loss/rebuy: 12.00

However, prices may still rise if the weekly RSI closes above 70. Currently, MACD and RSI show no negative signs, and EGX30/EGX70 are reaching new highs, suggesting potential upward movement.

Disclaimer: This is not investment advice; consult your account manager before making decisions. Good luck.

Update idea: Ad

MPRC - Announce your seriousness about raising pricesEGX:MPRC timeframe: 2 hours

Identified a bearish Gartley pattern with:

- Sell point: ~36.00

- Targets: T1 at 34.30, T2 at 33.00

- Stop loss/rebuy: 36.60

If prices close above 36.60, the next resistance at 37.33 (1.618 extension of XA) could serve as another sell point. All data is on the chart.

The MACD shows a negative signal, supporting the bearish outlook. Meanwhile, EGX30/EGX70 are hitting new highs, which might push prices higher.

Given the multiple scenarios, adhere to stop losses or rebuy points to protect profits and minimize losses.

Disclaimer: Not investment advice; consult your account manager before acting. Good luck.

ELKA - Beware of the bull trapEGX:ELKA timeframe 4 hours

A completed triangle pattern supported by a potential bearish Gartley pattern targets :

T1: 2.50

T2: 2.70 up to 2.90 ( triangle pattern's target )

stop loss 2.00

This is not investment advice; consult your account manager before making decisions.

good luck

SPX500 - what's next?Further to my previous idea on SPX.

SPX respected the Resistance at FR 161.8 at 6400.

Price went down and reverted form SMA200 (4H)

Now price has completed the Perfect Gartley Pattern and reached point D.

If (against fundamentals) price reverts down from there and breaks down through SMA50 (4h), I will consider it as Bearish Validation and I will expect correction movement, which cen go down to ca 6000.

Just my humble opinion

EFIH - anther chance - low risk EGX:EFIH - 1-Day Timeframe

A bullish pattern emerged on Feb 13, but prices adjusted after the 3/2 stock split on Jun 02. Key levels:

- Entry: ~11.00

- Stop loss: 10.00 (7.00% loss)

- Support: 10.60 (6-month low)

- Targets:

- T1: 13.38 (22.24% profit)

- T2: 15.00 (37.12% profit)

This is not investment advice—only my analysis based on chart data. Consult your account manager before investing. Good luck!

Natural Gas SpotFormed Gartley though break 0.786 ratio but allowed upto starting point , also forming ABCD pattern, appear ib wave B or X later will decide b or X which wave . Let see. I am not SEBI registered analyst, this is not buy , sell , hold recommendation. Only personal view for educational purpose. Thanz. if goes wrong no offence.

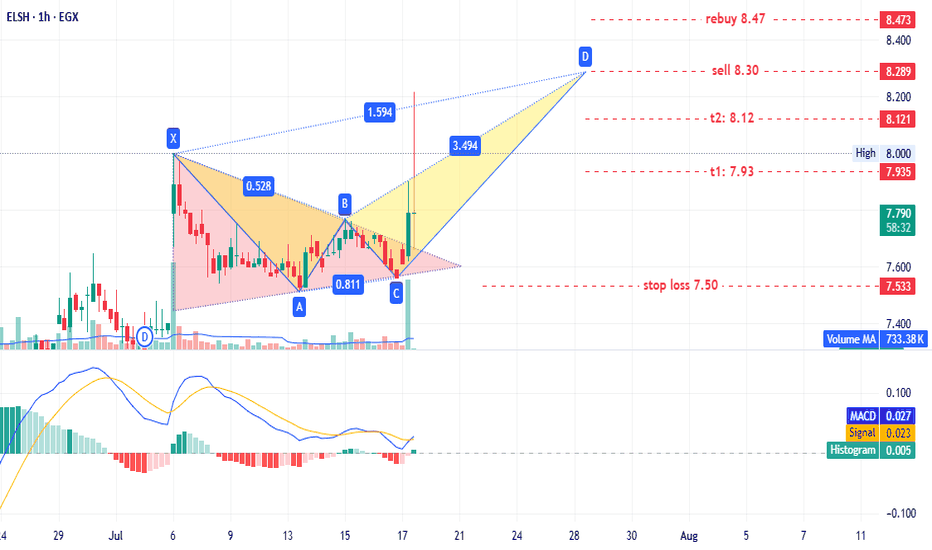

ELSH - old player EGX:ELSH timeframe: 1 hour.

A triangle pattern was identified, targeting 8.20. No new entry is recommended for shareholders, but if prices retest the triangle pattern at 7.65–7.60, it could present a low-risk entry opportunity.

This may also form a potential bearish Gartley pattern with targets:

- T1: 7.93

- T2: 8.12

- T3: 8.30 (sell point)

Stop loss: 7.50.

If prices continue rising and close above 8.47, consider rebuying what was sold at 8.30.

Disclaimer: This is not financial advice, only our analysis based on chart data. Consult your account manager before investing.

Good luck!

Pi Network Faces Scrutiny as Market Cap Hits $3.4BPi Network, the mobile-first crypto project that attracted millions of users with its "mine-on-your-phone" concept, is facing growing scrutiny as its market capitalization has surged to $3.4 billion, despite lingering concerns over its actual utility and use cases. As hype continues to propel its valuation, the community and broader crypto market are demanding answers: What can Pi really do?

Background and Growth

Launched in 2019 by a team of Stanford graduates, Pi Network aimed to democratize cryptocurrency mining by enabling users to earn tokens on their smartphones without expensive hardware. Through aggressive referral-based marketing and a user-friendly interface, it reportedly attracted over 50 million users globally.

However, after years in beta and a still-limited mainnet release, the Pi token is not yet fully tradable on major exchanges, and its price remains speculative. Despite that, Pi's market cap is estimated at $3.4 billion based on limited OTC (over-the-counter) trading and projected supply metrics.

Utility Concerns Intensify

With a large user base and growing token valuation, the pressure is on for Pi Network to deliver tangible value. Key concerns include:

Lack of utility – Most users cannot use Pi to pay for goods or services in real-world scenarios.

No open mainnet – While a “closed mainnet” has launched, the network still lacks full public blockchain access, hampering transparency and developer participation.

Centralization – Pi’s governance and decision-making remain opaque, raising questions about decentralization and long-term sustainability.

No listings on major exchanges – Without real-time market discovery, token valuation remains speculative and potentially misleading.

Community Reaction

Many early adopters continue to support Pi, viewing it as a long-term project that needs time to mature. Some local communities even organize Pi-based bartering systems. However, critics argue that without real-world use cases, Pi remains a glorified points system rather than a functional cryptocurrency.

The disconnect between market cap and utility has fueled concerns of a speculative bubble. In fact, some compare Pi to past projects like BitConnect, which promised much but delivered little.

The Road Ahead

To maintain its momentum and justify its valuation, Pi Network must:

Open its mainnet to public interaction and developer contributions.

Secure listings on reputable exchanges to enable transparent price discovery.

Establish real-world utility, such as integration with e-commerce, payments, or DeFi applications.

Improve transparency around tokenomics, governance, and long-term roadmap.

Failure to address these areas could result in an erosion of community trust and capital flight to more proven projects.

Conclusion

Pi Network’s $3.4 billion market cap is both impressive and problematic. It highlights the power of community-driven growth but also underscores the risks of hype-driven valuations. As the crypto market matures, utility—not just marketing—is what will determine long-term success. For Pi, the clock is ticking to move from potential to performance.

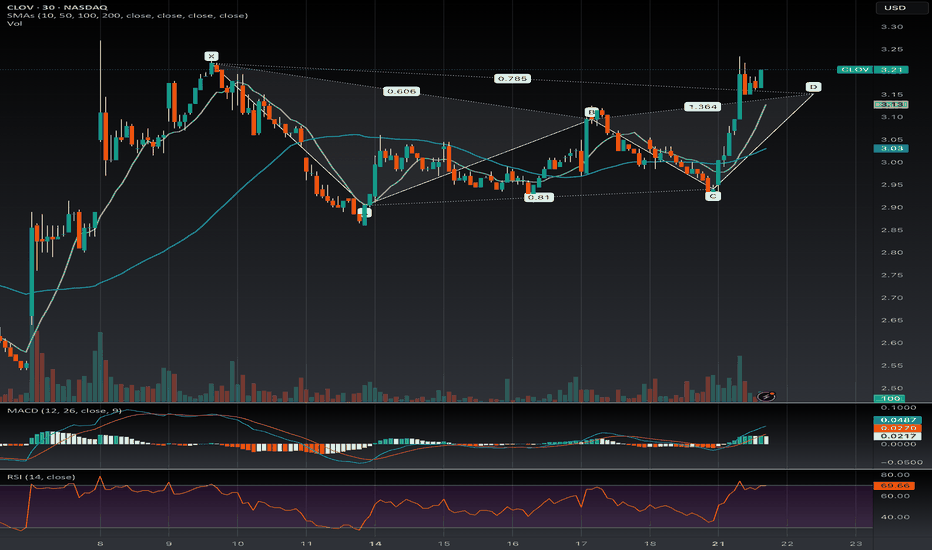

$CLOV Short Term Bearish Gartley NASDAQ:CLOV is forming a Bearish Gartley pattern with the D point projected at $3.10, nearing a potential reversal as of Monday, July 21, 2025. The RSI at 68.46 is close to overbought territory, adding support to the possibility of a bearish move if confirmed below $3.10. Keep an eye on a break below $3.10 with increased volume.

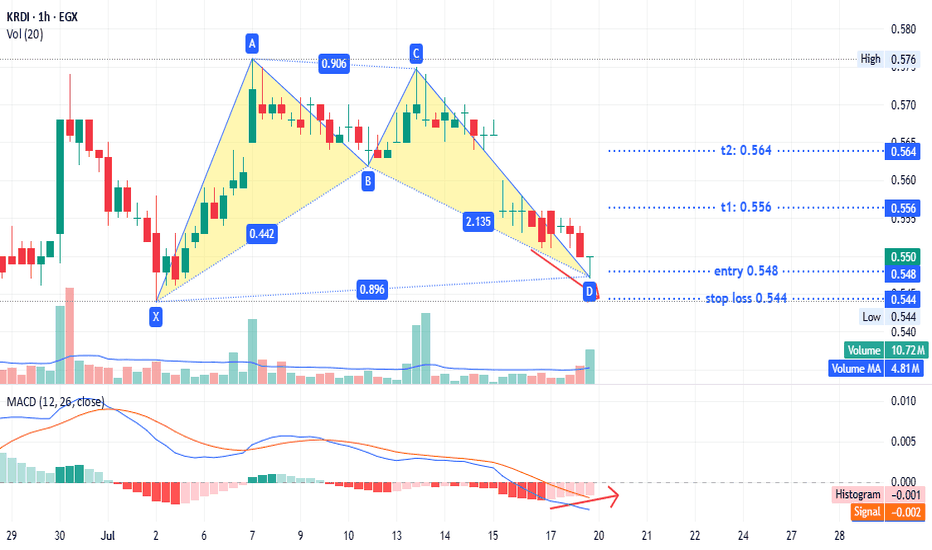

KRDI - just for fun but secured TASE:KRDI timeframe 1 hour

created bullish pattern

entry 0.548

stop loss : 0.544

T1: 0.556

T2: 0.564

MACD show positive diversion may that support our idea

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

Bitcoin harmonic pattern. Back to back Gartley. BTCGOLD ratio.The BTC/GOLD ratio has experienced a significant correction, currently standing at 27 gold ounces per 1 Bitcoin, down from a peak of 41, representing a decline of 34%.

Gold, priced at $3,114 in US Federal Reserve notes, is in a sustained bull market.

It is reasonable to anticipate that the digital equivalent of gold will gain traction once gold stabilizes at a higher price point.

The Gartley pattern is recognized as the most prevalent harmonic chart pattern.

Harmonic patterns are based on the idea that Fibonacci sequences can be utilized to create geometric formations, which include price breakouts and retracements.

The Gartley pattern illustrated indicates an upward movement from point X to point A, followed by a price reversal at point A. According to Fibonacci ratios, the retracement from point X to point B is expected to be 61.8%.

At point B, the price reverses again towards point C, which should reflect a retracement of either 38.2% or 88.6% from point A.

From point C, the price then reverses to point D. At point D, the pattern is considered complete, generating buy signals with an upside target that aligns with points C and A, as well as a final price target of a 161.8% increase from point A.

Often, point 0 serves as a stop-loss level for the entire trade. While these Fibonacci levels do not have to be precise, greater proximity enhances the reliability of the pattern.

Will these consecutive Gartley patterns succeed in bolstering Bitcoin's strength? We will soon discover the answer.