GBP/AUD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

The BB lower band is nearby so GBP-AUD is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 1.950.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPAUD

GBPAUD: Long Trading Opportunity

GBPAUD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPAUD

Entry - 1.9425

Sl - 1.9396

Tp - 1.9483

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPAUD – 2H chat pattern...GBPAUD – 2H chart pattern.

Clean bearish structure here. Let’s lock the targets.

What the chart is saying

Strong downtrend (lower highs & lower lows)

Price below Ichimoku cloud → bearish control

Descending trendline respected

Current price consolidating under a supply / flip zone (yellow)

Sell Targets 🎯

From current area (~1.9450):

TP1: 1.9350 – 1.9300

First liquidity + minor support

TP2: 1.9200 – 1.9150

Strong horizontal support (matches my marked zone)

Final Target: 1.9000 – 1.8950 🔥

Major demand + measured move completion

Invalidation / Stop

If 2H closes above 1.9600 – 1.9650

→ bearish idea weak

Safe SL: above 1.9700

Bias

📉 Bearish continuation while below 1.9600

GBPAUD: Bearish Drop to 1.896?FX:GBPAUD is eyeing a bearish reversal on the 4-hour chart , with price testing resistance near recent highs in a downward trendline, converging with a potential entry zone that could spark downside momentum if sellers defend amid volatility. This setup suggests a pullback opportunity post-rally, targeting lower support levels with 1:3.5 risk-reward .🔥

Entry between 1.98200–1.98800 for a short position. Target at 1.89600 . Set a stop loss at 2.00615 , yielding a risk-reward ratio of 1:3.5 . Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging the pair's dynamics near resistance.🌟

Fundamentally , GBPAUD is trading around 1.952 in early February 2026, with key events this week for both currencies. For the Australian Dollar, the RBA Interest Rate Decision on February 3 at 3:30 AM UTC (previous 3.85%) is critical, where a hike or hawkish guidance could strengthen AUD amid strong data. For the British Pound, the BoE Interest Rate Decision on February 5 at 12:00 PM UTC (previous 3.75%) represents major risk, with a potential hold or cut pressuring GBP if dovish. Overall, diverging central bank policies could favor AUD strength over GBP. 💡

📝 Trade Setup

🎯 Sell Entry:

1.98200 – 1.98800

(Entry from current price is acceptable with strict risk management.)

🎯 Target:

1.89600

❌ Stop Loss:

Daily close above 2.00615

⚖️ Risk / Reward:

≈ 1 : 3.5

💡 Your view?

GBPAUD: Bulls Will Push Higher

The analysis of the GBPAUD chart clearly shows us that the pair is finally about to go up due to the rising pressure from the buyers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP/AUD Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money. My fundamental scoring table speaks clearly: there is a -6 differential, indicating a Bearish (Moderate) bias that we cannot ignore.

Key Factor Analysis:

🏦 Current Rates: Explanation: GBP at 3.75% matches the Fed, while AUD at 3.6% remains attractive after a recent hike. Score GBP: +1 Score AUD: +1

🌍 Economic Regime: Explanation: GBP is in Expansion (Goldilocks), but AUD is in Reflation with accelerating inflation. Score GBP: +1 Score AUD: +2

📊 Rate Expectations: Explanation: BoE is in an easing cycle with a December cut (dovish), while RBA remains hawkish after a +25bp hike. Score GBP: -1 Score AUD: +1

🎈 Inflation: Explanation: Both remain above target, maintaining hawkish pressure on both central banks. Score GBP: +1 Score AUD: +1

📈 Growth/GDP: Explanation: Moderate growth for GBP (1.3%) vs. more robust but potentially unsustainable growth for AUD (2.3%). Score GBP: 0 Score AUD: 0

⚖️ Risk Sentiment: Explanation: Current market appetite is neutral with no specific bias. Score GBP: 0 Score AUD: 0

🏛️ COT Score: Explanation: GBP shows bearish positioning building, while AUD sees strong long acceleration. Score GBP: -1 Score AUD: +2

🗞️ News Bonus: Explanation: No relevant economic surprises in the last 24h for either currency. Score GBP: 0 Score AUD: 0

Currency Score Summary:

Total Score GBP: +1 (Neutral/Weak)

Total Score AUD: +7 (Strong)

Synthesis: GBP (Weak, Score +1): Under pressure due to the BoE easing cycle and bearish COT positioning. AUD (Strong, Score +7): Very strong following a hawkish RBA hike and accelerating long positions in the COT report.

Conclusion: With this scenario, we are only looking for Short setups. Going against this bias would be statistical suicide.

2. The Technical Setup (The "Where") 📉

Timeframe: 1h | Pair: GBP/AUD

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge. Here is where the indicator makes the difference. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (64.9%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (2): We are at the 2nd consecutive impulse. It's a young trend, so there is plenty of room for extension before reaching extreme exhaustion levels.

🔄 Retest (84.6%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone 84.6% of the time. This gives us high confidence in our entry zone.

💥 BOS/Ret Rate (60.2%): This parameter tells us that once price retraces inside the previous zone, it has a high probability of reacting and creating a new BOS.

🎯 Extension Rate (1.72x): The algorithm projects an ambitious target. We expect this move to extend 1.72 times the current pullback leg. That's where we'll take profit.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Supply Zone 1h (Red Band) at the equilibrium (0.5) level, and the stop loss a few pips above the zone.

Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.72x relative to the pullback leg.

Trade Parameters:

Entry Price: 1.96135

Stop Loss: 1.96617

Take Profit: 1.92990

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

AUDUSD: false breakout setup🛠 Technical Analysis: On the H4 timeframe, AUDUSD remains elevated after a strong rally, but price is now reacting under the key resistance zone around 0.7090–0.7100. The chart may highlights a classic false breakout scenario: a spike above the 0.71 area followed by closing below resistance would be a high-probability trigger for a short. Momentum is still supported by the moving averages (SMA 50/100/200 are rising below price), but the recent push looks stretched and vulnerable to a correction. The nearest downside magnet is the marked support at 0.6904, which aligns with the previous consolidation base. If sellers gain control from resistance, a move back into that demand zone becomes the primary expectation. A sustained breakout and hold above the resistance area would invalidate the short setup and shift bias back toward continuation higher.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a false breakout 0.71 resistance

🎯 Take Profit: 0.69042

🔴 Stop Loss: 0.71560

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

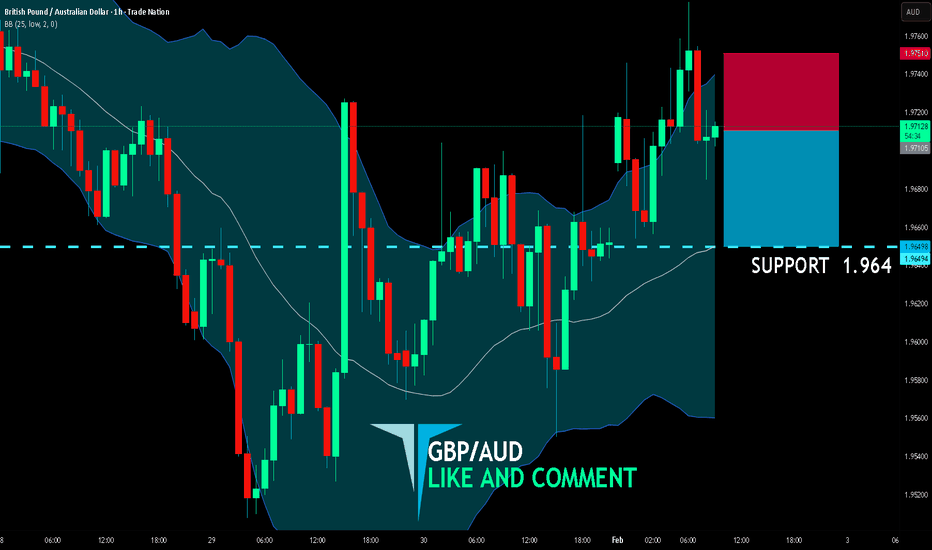

GBP/AUD SENDS CLEAR BEARISH SIGNALS|SHORT

GBP/AUD SIGNAL

Trade Direction: short

Entry Level: 1.971

Target Level: 1.964

Stop Loss: 1.975

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/AUD Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money.

My fundamental scoring table speaks clearly: there is a -4 differential, indicating a Bearish (Moderate) bias that we cannot ignore.

Key Factor Analysis:

🏦 Current Rates: Explanation: BoE at 3.75% offers an attractive carry level, while RBA at 3.6% remains the second highest in the G7. Score GBP: +1 Score AUD: +1

🌍 Economic Regime: Explanation: GBP is in a Goldilocks expansion phase; AUD is facing reflation with accelerating inflation. Score GBP: +1 Score AUD: +2

📊 Rate Expectations: Explanation: BoE is dovish with an easing trend (25bp cut in Dec); RBA remains neutral with a stable holding trend. Score GBP: -1 Score AUD: 0

🎈 Inflation: Explanation: Both currencies face high inflation above target, maintaining hawkish pressure on their respective central banks. Score GBP: +1 Score AUD: +1

📈 Growth/GDP: Explanation: Both economies show growth (GBP 1.3%, AUD 2.3%) that appears unsustainable given high inflation levels. Score GBP: 0 Score AUD: 0

⚖️ Risk Sentiment: Explanation: Market sentiment is currently in a neutral regime with no specific bias for either currency. Score GBP: 0 Score AUD: 0

🏛️ COT Score: Explanation: Commitment of Traders shows a bearish build-up for GBP, while AUD sees strong longs and accelerating purchases. Score GBP: -1 Score AUD: +2

🗞️ News Bonus: Explanation: GBP saw a strong acceleration in the services sector (PMI +2.9 to 54.3); no significant surprises for AUD. Score GBP: +1 Score AUD: 0

Currency Score Summary: Total Score GBP: +2 (Neutral/Bullish) Total Score AUD: +6 (Strong Bullish)

Synthesis: GBP (Weak, Score +2): High rates but dovish BoE in an easing cycle with heavy speculative selling. AUD (Strong, Score +6): Solid growth and very strong speculative accumulation in progress.

Conclusion: With this scenario, we are only looking for Short setups. Going against this bias would be statistical suicide.

2. The Technical Setup (The "Where") 📉

Timeframe: 1h | Pair: GBP/AUD

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge. Here is where the indicator makes the difference. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (64.7%): We are well above the 60% threshold. This tells us the market is in a healthy, directional trend. Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (1) & Streak Pct (2%): We are at the 1st consecutive impulse. It's a fresh trend, so we have plenty of room for the move to develop before it becomes overextended.

🔄 Retest (84.5%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone 84.5% of the time. This gives us high confidence in our entry zone.

💥 BOS/Ret Rate (59.8%): This parameter tells us that once price retraces inside the previous zone, it has a high probability of reacting and creating a new BOS.

🎯 Extension Rate (1.65x): The algorithm projects an ambitious target. We expect this move to extend 1.65 times the current pullback leg. That's where we'll take profit.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Supply Zone 1h (Red Band) and the stop loss a few pips above the zone.

Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.65x relative to the pullback leg.

Trade Parameters:

Entry Price: 1.96654 Stop Loss: 1.97083 Take Profit: 1.93428

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes. It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

GBPAUD oversold bounce back capped a 1.9880 resistance The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a further pullback and the loss of support within the downtrend.

Key resistance is located at 1.9880, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 1.9880 could confirm the resumption of the downtrend, targeting the next support levels at 1.9610, followed by 1.9550 and 1.9500 over a longer timeframe.

Conversely, a decisive breakout and daily close above 1.9880 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 1.9940, then 2.000.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 1.9880. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBP/AUD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

GBP/AUD pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 1.970 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPUSD: breakout setup toward 1.3940🛠 Technical Analysis: On the H1 chart, GBPUSD remains in a strong bullish structure after the “global bullish signal,” with price continuing to print higher highs and higher lows. The pair is now consolidating just below the key resistance band around 1.3843–1.3850, suggesting a potential squeeze before the next directional move. An ascending support trendline is holding the pullbacks, keeping the short-term momentum constructive. Price is trading above the SMA 50, while SMA 100 and SMA 200 stay well below, confirming trend strength. A clean breakout and hold above the resistance zone would likely trigger continuation toward the next upside objective near 1.3939. If the breakout fails, a retest of the trendline and the nearest support zone around 1.3680 becomes the first level to watch for buyers to defend.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy on a confirmed breakout and hold above 1.38431–1.38500

🎯 Take Profit: 1.39391

🔴 Stop Loss: 1.37788

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

GBPAUD: Bearish Setup With High R/R PotentialLadies and gentlemen, GBPAUD could give us a solid short trigger with killer R/R potential. Straight to the analysis, no fluff. 🧙♂️

From the daily timeframe , I'd say the trend is fully bearish with heavy downside momentum.

In the 1H timeframe , after hitting support at 1.97064 and a mostly time-based correction, we're now forming a range below the key daily resistance 1.97980 . If the range floor— 1.97652 —breaks, first target is support 1.97064 . In continuation, if the trend holds, we'll see MWC downtrend extension—so watch that support closely.

Long trigger? None right now—we need higher highs/lows on 4H first, then maybe consider it.

By the way, I’m Skeptic , founder of Skeptic Lab .

I focus on long-term performance through psychology, data-driven thinking, and tested processes.

I'll keep you updated. Capital management—don't forget it, skip the FOMO. Peace out. 🩵

GBP/AUD: Corrective Rally, Downtrend IntactGBP/AUD is trading in a clear bearish Elliott Wave structure on the 4H timeframe. The market has already completed a strong impulsive decline and is currently moving in a Wave 4 corrective pullback, which is happening inside a downward channel and near key Fibonacci retracement levels. This correction looks weak and corrective, suggesting sellers are still in control. As long as price remains below the invalidation level around 2.0050 , the bearish bias stays valid. The expectation is for the correction to finish soon, followed by Wave 5 to the downside, targeting the lower channel area and the 1.96–1.95 zone. Overall, the trend remains bearish, and any short-term bounce is likely a selling opportunity before the next leg lower.

Stay tuned!

@Money_Dictators

Thank you :)

GBPAUD topping Head and Shoulder loss of supportThe GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a further pullback and the loss of support within the downtrend.

Key resistance is located at 1.9880, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 1.9880 could confirm the resumption of the downtrend, targeting the next support levels at 1.9680, followed by 1.9620 and 1.9550 over a longer timeframe.

Conversely, a decisive breakout and daily close above 1.9880 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 1.9940, then 1.9995.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 1.9880. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPAUD Will Fall! Short!

Please, check our technical outlook for GBPAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.974.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.969 level soon.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

GBPAUD is in the Bullish Trend due Order BlockHello Traders

In This Chart GBPAUD HOURLY Forex Forecast By FOREX PLANET

today GBPAUD analysis 👆

🟢This Chart includes_ (GBPAUD market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPAUD: 89% Retail Long + Daily Supply GBPAUD remains clearly bearish on the daily timeframe: we still have a clean LH/LL structure and steady selling pressure inside a well-defined descending channel. The latest bearish leg pushed price back into a key demand zone around 1.98–1.96. This area has produced technical bounces in the past, but it has never turned into a real trend reversal. That’s why the cleanest read right now is simple: bearish trend + sellable pullback, not a reversal. Price already reacted with a sharp spike, but as long as we stay below the 2.00–2.02 supply/imbalance, any upside move is simply a potential spot for trend sellers to step back in. My main scenario is a rebound into supply followed by short continuation, targeting liquidity below the lows: 1.9650 first, then 1.9500 if momentum expands. Invalidation is clear: only a sustained recovery above 2.02/2.03 with strong daily closes and follow-through would shift the bias.

On the COT side, I don’t see positioning supporting a sustainable GBP upside, and AUD strength isn’t showing the type of structural shift needed to justify a GBPAUD reversal. This reinforces the idea that most bounces are more likely exit liquidity than real bullish restarts. Seasonality in this phase tends to move in “bursts”: quick rebounds that fade once the market reprices relative strength and flows—perfectly aligned with a bounce → continuation setup. The final piece is retail sentiment: roughly 89% long on the cross. It’s not an entry trigger by itself, but in a bearish trend it often becomes the perfect fuel for the next leg down—because when retail is this crowded on the long side, it doesn’t take much to trigger stops, pressure, and acceleration.

Operational summary: below 2.02/2.03, GBPAUD remains a sell-on-rallies market. I want to see a clean pullback, rejection into supply, then a breakdown back toward the lows.

GBPAUD Is Very Bearish! Short!

Please, check our technical outlook for GBPAUD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 2.002.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.998 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!