XAUUSD: Holds Key Support - Buyers Aim for $4,720 ResistanceHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish market structure, supported by a rising trend line that has guided price action from the recent swing lows. Earlier in the move, gold advanced inside a well-defined upward channel, confirming strong buyer control with consistent higher highs and higher lows. This bullish leg eventually led to a breakout attempt near the upper boundary of the channel, after which price experienced a sharp corrective move and transitioned into a consolidation phase. Following the correction, XAUUSD formed a range, where price moved sideways as buyers and sellers reached temporary equilibrium. This range acted as an accumulation zone before the next directional move. Price eventually broke out of the range to the upside, signaling renewed bullish momentum. However, shortly after the breakout, a fake breakout occurred on the downside, where price briefly dipped below support but was quickly reclaimed by buyers, reinforcing demand strength.

Currently, price is holding above a clearly defined Support Zone around 4,650, which aligns with the former range high and a key structural level. This area is now acting as demand after the successful breakout and retest. On the upside, XAUUSD is approaching a major Resistance Zone near 4,720, where selling pressure has previously emerged. The recent price action shows controlled consolidation above support, suggesting continuation rather than distribution.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,650 Support Zone and continues to respect the rising trend line. In this case, I expect buyers to remain in control and attempt another push toward the 4,720 Resistance Zone (TP1). A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside expansion.

However, a strong rejection from resistance followed by a decisive breakdown below the 4,650 support would weaken the bullish bias and signal a deeper corrective move. Until that happens, the overall structure favors buyers, and pullbacks into support are viewed as potential continuation opportunities.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

Gold

GOLD - Consolidation after the rally before the rally...FX:XAUUSD started the week with growth, hitting a new all-time high amid geopolitical risks and threats of new tariffs from the US, and is now consolidating around $4,700...

Fundamental situation

Trump threatened to impose tariffs on eight European countries over the issue of buying Greenland.

Escalating tensions around Ukraine and Iran.

Fed:

Expectations of policy easing are supporting gold, but the appointment of a new Fed chair could slow down aggressive rate cuts. The investigation into Powell continues...

This week, PCE inflation data (Thursday) and US GDP for the third quarter are important.

Gold's rise since the beginning of the year has been independent of the strengthening dollar, underscoring the strength of internal drivers. However, a confident breakout to $5,000 will require confirmation of lower inflation in the US and continued high demand for safe-haven assets. Corrections may be profitable against the backdrop of an aggressive bullish trend...

Resistance levels: 4678, 4691, 4700

Support levels: 4656, 4650, 4640

Within the current range, I focus on the zones 4656 - 4650 - 4639. There is a high probability of a long squeeze/false breakout of support. However, I do not rule out the possibility of a local correction due to the holiday in the US (low liquidity, profit-taking may trigger a correction) before growth.

Best regards, R. Linda!

Silver Strength (XAG/USD) – Safe-Haven Demand Fuels Upside📝 Description 🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD continues to show strong bullish structure on the H1 timeframe.

Price has respected a well-defined demand zone with multiple retests and rejections, confirming strong buyer interest. Silver is trading above EMA and Ichimoku cloud support, signaling trend continuation rather than exhaustion.

The broader backdrop supports metals as safe-haven assets, keeping the upside bias intact.

📍 Support & Resistance

🟡 Key Demand / Support Zone: 85.00 – 87.00

🟢 1st Resistance: 98.00

🟢 2nd Resistance / Extension Target: 101.00

Trend strength remains valid above demand with higher-high structure intact

🌍 Fundamental Context

1.Rising geopolitical tensions and trade-related uncertainty

2.Investors rotating into safe-haven assets like Silver

3.Risk-off sentiment continues to support precious metals

#XAGUSD #Silver #PreciousMetals #SafeHaven #ForexTrading #TechnicalAnalysis #PriceAction #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Markets are volatile — always manage risk properly and use a stop-loss.

💬 Support the Idea 👍 Like if you’re bullish on Silver

💬 Comment: Breakout continuation or pullback first? 🔁 Share with traders watching metals

XAUUSD (GOLD) – 4-Hour Timeframe Tradertilki AnalysisGuys,

I have prepared a XAUUSD-Gold analysis for you on the 4-hour timeframe.

My friends, the levels of 4657.0 and 4599.0 are the best buy entry points.

When price reaches these levels, I will definitely open a buy position and aim for the following targets:

My targets:

1st Target: 4690.0

2nd Target: 4730.0

3rd Target: 4790.0

My friends, since the U.S. president has recently imposed tariffs on Europe, there is currently strong buying volume in XAUUSD-Gold. From a fundamental perspective, this is the biggest reason for gold’s upward movement.

NOTE – Since the U.S. president has not lifted these tariffs regarding Greenland and has opened a trade war against European countries, XAUUSD-Gold may rise even from these levels and reach my 3 targets.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

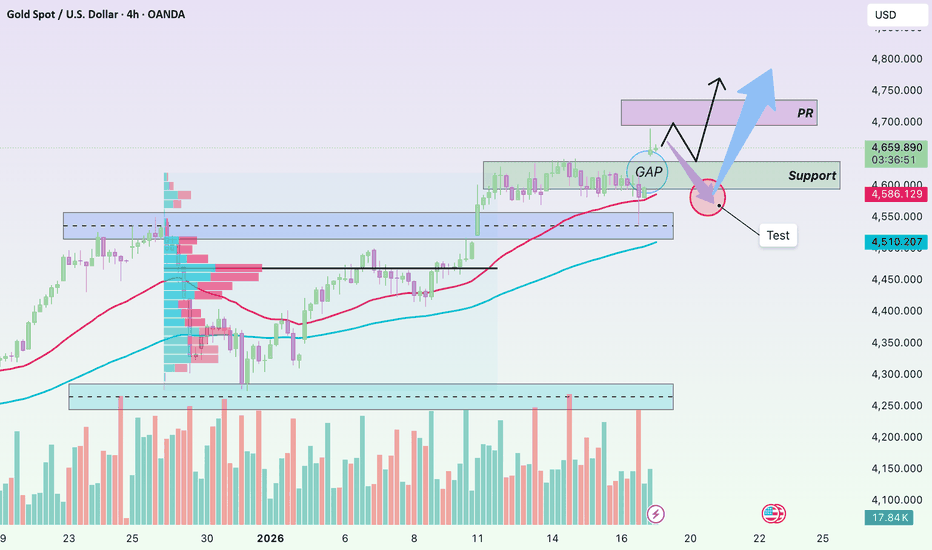

XAUUSD H1 – Bullish Structure Holds After Early-Week GapHello, I’m Louna.

From the H1 perspective, XAUUSD continues to trade cleanly within a well-defined ascending channel, confirming that the broader bullish market structure remains intact. Price is still printing higher highs and higher lows, a clear sign that buyers are firmly in control of the dominant trend.

The early-week bullish gap reinforces this bullish context. Instead of immediately filling the gap, price has held above prior balance, suggesting sustained participation from strong hands. However, with price recently pushing closer to the upper portion of the channel, the market is now slightly extended away from its internal support, increasing the probability of a short-term corrective phase.

In strong gold trends, price rarely moves in a straight line. Corrections are a healthy and necessary process—they allow liquidity to rebalance and provide confirmation that demand beneath the market remains strong rather than speculative.

The primary zone I am monitoring lies between 4,580 and 4,600. This area aligns closely with the midline of the ascending channel and a previous demand zone that has already proven its relevance. Within momentum-driven uptrends, gold often forms a higher high, attracts late buyers, and then retraces to retest structural support before continuing higher.

If price stabilizes within this zone and we see clear bullish reactions—such as strong rejection candles or improving volume behavior—the bullish structure remains healthy, and the market will be well positioned for continuation toward the upper boundary of the channel, with upside targets extending toward 4,750 and potentially 4,800.

As always, confirmation is key. Closely observe price action and volume behavior around this support zone before committing to long positions. Maintain disciplined risk management, follow your trading plan, and avoid chasing price at extended levels.

Wishing you clarity, discipline, and consistent execution in your trading.

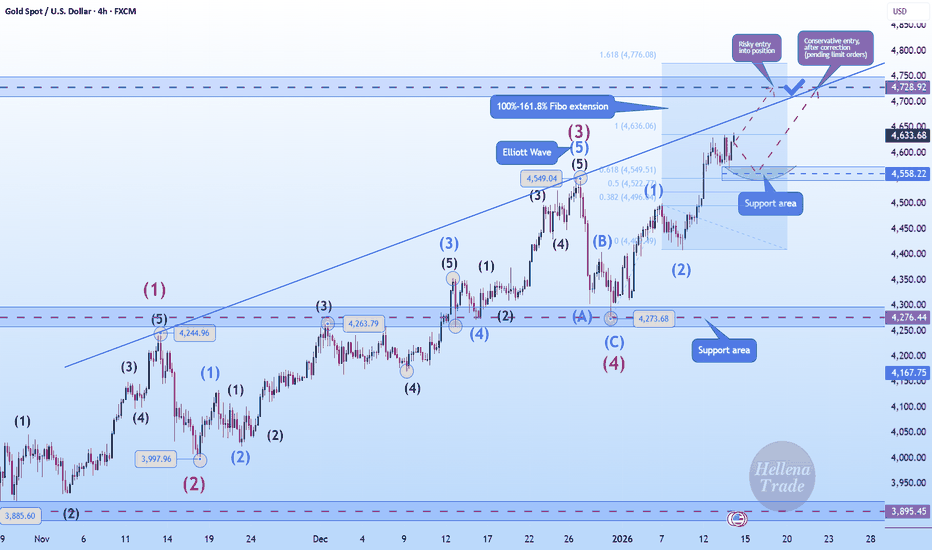

Hellena | GOLD (4H): LONG to 161.8% Fibo 4728 .Colleagues, the price is updating its maximum, and I think we shouldn't stop there.

After re-marking the waves, I realized that it would be more correct to place wave “3” at the 4549 level, since 5 waves fit well into it.

This means that the price is now in wave “5,” which can be quite unpredictable, but if we look at the blue waves, we can assume that there is now a medium-term impulse wave “3,” which means we can apply Fibonacci extension levels and see the 161.8% level as the target.

But I don't want to take such a risk and will set a slightly lower target - in the 4728 area. At the moment, we need to be very careful.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

GOLD - A long squeeze of support could trigger growthFX:XAUUSD continues to consolidate, Friday's long squeeze (false breakdown) of support provides an opportunity for growth amid geopolitical issues...

The dollar is strengthening against the backdrop of Thursday's economic data and Trump's geopolitical actions, but against this backdrop, gold is behaving quite cautiously and looks quite strong.

Trump said that tariffs on eight European countries could rise to 25% if Greenland is not sold to the US - more tariffs and an escalation of the trade war could lead to a strong market reaction.

In the new trading week, we are awaiting Trump's speech (high volatility possible), US GDP, Core PCE, and PMI. The data may set the medium-term tone for the market...

Resistance levels: 4593, 4621, 4639

Support levels: 4581, 4561, 4550

The long squeeze has shifted the market imbalance towards buyers. Locally, we are seeing consolidation in the 4581-4593 zone. A close above 4593 or a retest of 4581 could trigger further growth within the current trend

Best regards, R. Linda!

XAUUSD (Gold) – 30M Trendline BreakoutPrice has broken above the descending trendline and is holding above the key intraday support, signaling a bullish continuation bias on the 30-minute timeframe.

Key Levels:

Support: 4607 – 4613

Resistance: 4636 – 4643

Target Zone: 4660 – 4670

Bullish structure remains valid above support. Wait for a pullback and confirmation before entry. Always apply proper risk management.

Gold 30-Min — Volume Buy Reversal Triggered⚡Base : Hanzo Trading Alpha Algorithm

The algorithm calculates volatility displacement vs liquidity recovery, identifying where probability meets imbalance.

It trades only where precision, volume, and manipulation intersect —only logic.

Technical Reasons

/ Direction — LONG / Reversal 4610 Area

☄️Bullish momentum confirmed through strong candle body.

☄️Structure shifted with higher-low near key demand base.

☄️Volume expanding confirms order-flow alignment upward.

☄️Buyers reclaimed imbalance with sustained clean break.

☄️Algorithm detects rising momentum under low liquidity.

⚙️ Hanzo Alpha Trading Protocol

The Alpha Candle defines the day’s real control zone — the first battle of momentum.

From this origin, the Volume Window reveals where the next precision strike begins.

⚙️ Hanzo Volume Window / Map

Window tracked from 10:30 — mapping true market behavior.

POC alignment exposes institutional bias and breakout potential zones.

⚙️ Hanzo Delta Window / Pulse

Delta window monitors real buying vs. selling power behind each move.

Tracks volume aggression to expose who controls the candle — buyers or sellers.

When Delta aligns with Volume Map, momentum becomes undeniable.

yesterday

Note

☄️ we add inner Reversal 4596 : 4599 Area . ( bearish Reversal zone )

and we will Target 4560 Zone

Gold Price Respects Ascending Trend Line - Next Target 4,680Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure shown in the screenshot. XAUUSD is trading within a broader bullish structure, supported by a well-defined ascending trend line that has guided price action since the market formed a solid base and started to grow. After the initial recovery, gold transitioned into a consolidation range, where price moved sideways, showing temporary balance between buyers and sellers. This range was eventually resolved to the upside with a clean breakout, confirming renewed bullish momentum. Following the breakout, price continued higher along the rising trend line, forming higher highs and higher lows. During this advance, the market experienced several false breakouts and shallow corrections, all of which were absorbed above the trend line, highlighting strong demand on pullbacks. The area around 4,540–4,560 is clearly defined as a Buyer Zone / Support Level, where previous resistance flipped into support and buyers repeatedly stepped in. Currently, XAUUSD is trading above the Buyer Zone and holding above the ascending trend line, which keeps the bullish structure intact. Price is now approaching the Seller Zone / Resistance Level around 4,660–4,680, which aligns with a descending resistance line from prior highs. This area represents a key supply zone where selling pressure may emerge and cause a reaction or short-term consolidation. My scenario: as long as XAUUSD remains above the Buyer Zone and continues to respect the rising trend line, the bullish bias remains valid. I expect buyers to defend pullbacks into support and attempt a continuation move toward the 4,680 Resistance Level (TP1). A clean breakout and acceptance above this resistance would confirm further bullish continuation and open the door for higher targets. However, a strong rejection from the Seller Zone followed by a decisive breakdown below the Buyer Zone and trend line would weaken the bullish structure and signal a deeper corrective move. For now, price is at a key decision area near resistance, and patience with proper risk management is essential. Please share this idea with your friends and click Boost 🚀

XAUUSD – Strong Opening Gap: When Smart Money Doesn’t WaitHello everyone, Domic here.

Looking at the XAUUSD H4 chart at the start of the week, what really stands out to me is not where price is trading, but the strong bullish GAP that appeared right at the market open.

In context, this GAP formed at a very “logical” spot. Prior to the weekend, price had been holding firmly above both the EMA 34 and EMA 89, with the bullish structure fully intact. At the same time, price action was getting increasingly compressed around the 4,580–4,610 zone. When a market consolidates long enough within a strong uptrend, it often doesn’t climb step by step anymore — it jumps to a new price level. This opening GAP is a direct result of that built-up pressure.

As for the catalyst, the story behind this move is fairly familiar. Expectations of a dovish Fed stance going into next year remain unchanged, US bond yields have failed to establish a fresh upside trend, while geopolitical risks continue to support safe-haven demand. When such factors emerge or intensify over the weekend, the market often cannot react immediately. Instead, the adjustment gets priced in at the weekly open. Combined with thinner liquidity during the Asian session, it doesn’t take much buying pressure for a GAP like this to form.

The key question many traders are asking now is: will this GAP get filled?

My view is quite straightforward — not every GAP is meant to be filled . In a strong uptrend, GAPs often act as continuation signals rather than inefficiencies to be corrected. At this stage, my preferred scenario is a technical pullback toward the upper part of the GAP to “retest conviction,” followed by a continuation toward the 4,700–4,730 area. If that zone is broken decisively, it would add another layer of confirmation to the medium-term bullish trend.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

An aggressive open on gold due to the news over the weekend, not giving us the opportunity to get that pull back to pull the trigger for that target. Not all was lost, we still managed to get a couple of scalps on the red boxes but it's been a slow day with it being a holiday in the US.

What happens next?

Usually, after a bank holiday we'll see extreme volume enter the markets so we're sure to see some fireworks tomorrow. We have support below at the 4660-5 level with red box defence above at the 4687-95 level. If targeted and rejected, I would hope to see a pull back into support at least, but, that extension level of 4655 is key here. We need to stay above it to go higher and then breach 4700, otherwise, like we suggested in the KOG Report, a deep pull back is needed here to go higher.

As always, trade safe.

KOG

XAUUSD (Gold) – 4H HTF Resistance ReactionGold remains in a strong higher-timeframe uptrend after making a new high near 4639. Price is currently reacting at a major resistance zone, where a pullback toward nearby support is possible before the next directional move.

Resistance: 4680 – 4700

Support: 4550 – 4600

Major Demand: 4360 – 4400

Overall bias stays bullish, but profit-taking or retracement can occur from resistance. Watch support reaction and EMA structure for continuation confirmation. Always manage risk.

GOLD: Bullish! Buys Only! Buy The Dips!In this Weekly Market Forecast, we will analyze Gold (XAUUSD) for the week of Jan. 19-24th.

Gold is climbing higher, with Trump tariff threats as winds beneath the wings!

There is no reason to consider longs! Pullbacks should be seen as dip-buying opportunities.

It's that simple.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Breakdown after Jan 14 Volatility Event - Get some.This video highlights the continued price action I suggested would take place after the Jan 14 volatility event.

Honestly, watching the markets open tonight, moving in the direction of my trades (metals, SPY/QQQ/TECS/XLK/others). I could not be happier.

Additionally, Nat Gas is starting to make a big move higher. I've been positioning into this move for more than 30 days. Now, the dual Polar Vortex may setup driving very cold temps into the US/UK.

Sometimes, you have to trust the ADL predictive modeling and play those bigger moves for profits.

I just wanted to share this success and to ask you if you were able to follow my research and GET SOME as well.

We could see a big breakdown over the next 24 hours on news or social issues in the US/UK.

Get some.

GOLD - Aggressive bullish trend. Test of the 4725 zone...FX:XAUUSD continues to update its historical maximum, currently testing the 4725 zone, against the backdrop of escalating geopolitical risks and declining risk appetite...

Fundamental situation

Trump's threats to impose new tariffs on goods from the EU and the union's retaliatory measures have heightened fears of a trade war.

Escalation of the Russia-Ukraine conflict

The economic backdrop is contributing to the decline of the dollar, which in turn is supporting gold.

The key events of the week will be the US PCE inflation data (Thursday) and the revised GDP report for the third quarter.

Gold continues to rise due to geopolitical uncertainty and the weakening of the dollar. Further dynamics will depend on US inflation data — weak figures could strengthen the upward momentum, while strong figures could trigger a correction.

Resistance levels: 4725, 4750

Support levels: 4707, 4700, 4691

Growth has been halted by the psychological resistance zone of 4725. Since the opening of the session, the market has exhausted its intraday potential and may form a correction (profit-taking) and test the key support zones of 4710-4700 before continuing to grow.

Best regards, R. Linda!

Gold Weekly Levels: Break above 4630 → 4720/4725🔱 GOLD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY (NEW WEEK | JAN 2026)

✨ Bullish bias stays active for the week — but the upside is capped

🧲 Fresh overhead sell-side liquidity: 4630–4635 = first magnet

🟣 Max overbought + January ceiling: 4720–4725

📌 Expectation: limited upside from Point C in January

🧲 Fresh buy-side liquidity : 4500–4510 = preferred reload area

🛡 Bull structure invalidation: 4450 — break below invalidates outlook

🎯 Bull targets: first 4630–4635 → on valid breakout, ext 4720–4725

🏦 Core play: accumulate dips 4500–4510 reduce risk into 4630–4635

________________________________________

🗳️ Gold Weekly Scenarios — What’s Your Play?

Which path do you have for XAUUSD next week?

🅰️ Hold 4500–4510 → accumulate zone performs → rotation into 4630–4635

🅱️ Early sweep below 4510 → reclaim 4500–4510 → squeeze into 4630–4635

🅲 Direct drive into 4630–4635 → reaction/rejection → dip back toward 4500–4510 for reload

🅳 Break below 4450 → bullish outlook invalidated → downside opens further (risk-off shift)

Your key levels: 4500–4510 (buy-side) / 4450 (invalidation) / 4630–4635 (sell-side) / 4720–4725 (max-out)

________________________________________

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 Swing Structure

Gold remains in a bull-controlled tape for the new week, with the plan centered around dip accumulation + controlled upside targets:

• 4500–4510 is the fresh buy-side liquidity zone and the preferred area to build/scale long exposure.

• Bulls’ first major objective is 4630–4635, which is fresh sell-side liquidity — expect profit-taking, supply, and reaction risk there.

• If price breaks and holds above 4630–4635 (valid breakout), the market can extend into 4720–4725, defined as:

o max overbought zone

o AB swing 1.62 extension

o January 2026 max-out ceiling (expectation: limited upside beyond this in January)

• 4450 is the line in the sand: a break below invalidates the bullish outlook and exposes broader downside risk.

________________________________________

📈 Trend

Higher-timeframe bias: Bullish (new week)

Tactical: Two-phase week

Phase 1: Dip Accumulation & Rotation Higher

• Bulls ideally defend the 4500–4510 zone

• Accumulation/reloading happens on dips

• Rotation targets the overhead liquidity magnet 4630–4635

Phase 2: Breakout Decision at Supply

• 4630–4635 becomes the decision zone

• If rejected: expect rotation lower / reload behavior (watch 4500–4510 again)

• If valid breakout: extension unlocks toward 4720–4725 (January max-out zone)

________________________________________

🛡 Supports — Demand / Buy-Side Liquidity Zones

✅ 4500–4510 (Fresh buy-side liquidity)

• Primary dip-buy / accumulation zone this week

• Expect strongest bid response / “reload” behavior here

⚠️ 4450 (Bullish invalidation level)

• Break below = bullish thesis invalidated

• Opens risk for further downside continuation (structure shifts)

________________________________________

🚧 Resistances — Upside Objectives / Liquidity Zones

🎯 4630–4635 (Fresh sell-side liquidity)

• Primary bull target for the week

• High probability reaction zone (scale out / reduce risk)

🚀 4720–4725 (Max overbought + AB 1.62 extension | Jan 2026 max-out)

• Only in play after a valid breakout beyond 4630–4635

• Treated as January’s ceiling — upside expected to be limited from Point C this month

• High-risk zone for chasing longs; prioritize execution + protection

________________________________________

🧭 Bias Next Week

Primary bias: Bullish

What you’re trading this week:

• Bulls: accumulate dips 4500–4510 → target 4630–4635 → breakout continuation toward 4720–4725

• Bears: look for rejection signals at 4630–4635 and especially 4720–4725 (January max-out)

________________________________________

⚖️ Base Case Scenario (Most likely path)

Early week: dips are bought / accumulation near 4500–4510

Mid-week: rotation higher toward 4630–4635

Late week: decision at 4630–4635

• If acceptance occurs → extension attempt toward 4720–4725

• If rejection occurs → pullback for reload toward 4500–4510

________________________________________

🚀 Breakout / Invalidation Triggers

✅ Bullish continuation trigger

• Strong push into 4630–4635 and clean breakout/acceptance above it

• Opens the path to 4720–4725

⚠️ Supply reaction trigger

• Tap/sweep into 4630–4635 + rejection behavior (stall/wicks/displacement down)

• Signals pullback risk back toward 4500–4510

🛑 Bullish invalidation trigger

• Break below 4450

• Bullish outlook invalidated; downside opens further

________________________________________

🔓 Bull / Bear Structural Lines (Updated)

🟢 Bull control zone: Above 4500–4510 (dip-buy regime intact)

🟡 Transition / decision zone: 4630–4635

🟣 January max-out zone: 4720–4725

🔴 Invalidation line: Below 4450

________________________________________

🧭 Recommended Strategy Framework (Updated)

1️⃣ Primary Play — Accumulate the dips (with structure)

Idea: bullish week → build exposure where liquidity is fresh

• Scale longs near 4500–4510

• Prefer confirmation via stabilization/reclaim behavior

• Keep risk defined with 4450 as the structural line

2️⃣ Profit-taking Plan — Sell into the first magnet

• Scale out into 4630–4635 (fresh sell-side liquidity)

• Tighten risk aggressively as price enters the zone

• Assume reaction risk increases near 4635

3️⃣ Breakout Play — Only if price proves acceptance

• If 4630–4635 breaks and holds → target 4720–4725

• Treat 4720–4725 as January max-out: reduce risk quickly, don’t overstay

________________________________________

✅ Weekly Levels

• 4720–4725: January max-out / max overbought / AB 1.62 extension

• 4630–4635: fresh sell-side liquidity (primary bull target / reaction zone)

• 4500–4510: fresh buy-side liquidity (dip accumulation zone)

• 4450: bullish invalidation (break below flips the outlook)

XAUUSD Range Breakout → Bullish Continuation SetupGold is trading inside a clear consolidation range after a strong impulse move. Price has already shown multiple breakouts from support and resistance, confirming strong market participation.

Currently, price is holding above the range midpoint and building bullish momentum. A confirmed breakout above the upper resistance zone can open the door for the next upside leg toward 4,690+ levels.

🔹 Bias: Bullish above resistance

🔹 Entry: On confirmed breakout & retest

🔹 Targets: Upper liquidity zone

🔹 Invalidation: Below range support

🔹 Market Structure: Accumulation → Expansion

⚠️ Wait for confirmation and manage risk properly.

👍 If this idea helps you, don’t forget to like, comment, and follow for more updates!

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be looking for the low to hold and for price to push upside into the target region on the chart which worked well for those following. We mentioned during the week that we would want to see a confirmed RIP from that level otherwise we will continue with the hot spots and red boxes and follow price upside, which again was successfully achieved.

On Friday however, we put caution on long trades and suggested traders wait for resistance to hold and rather than long, play the short card and attempt those lower levels mentioned in last weeks report.

As you can see, that also worked well for us in Camelot. We had another successful week, not only on Gold but all the other pairs we trade and analyse.

So, what can we expect in the week ahead?

For this week we have the key level of resistance at the 4610-12 level which if attacked early session will need to hold for us to continue with the move downside to collect the void below. There is support here at the 4590 level which may play as range support again, so let’s play caution early session due to it also being a US holiday. If we can break below that defence levels we will be looking for a temporary swing low to form around the 4520-35 region as we previously mentioned in earlier KOG Reports.

That swing low level is the line in the sand for bulls at the moment in our opinion. Breaking below should lead us into filling that gap that bears have been chasing for the last 2 weeks.

For now, we’ll stick with the plan and keep an eye on the defence levels together with the indicators to guide the way. Also, looking at the 4H liquidity indicators, we should see some bullish volume enter the markets over the next couple of days. Based on that, one of these levels are going to give the RIP!!

RED BOXES:

Break above 4608 for 4635

Break below 4590 for 4555

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAUUSD rallying on its new short-term Bullish Leg.Gold (XAUUSD) has been trading within a Channel Up exactly since the start of the new year. Friday's pull-back saw the price it the bottom of this Channel Up (Higher Lows trend-line), exactly on the 1H MA200 (orange trend-line) and the 0.382 Fibonacci retracement level from the last Higher High.

This is the exact same pattern it followed on the first Bullish Leg. As a result, we expect another +5.30% rise in total, targeting $4775 before another correction to the 1H MA200 (and 0.382 Fib) at $4685.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAUUSD – Top Asset to Watch in 2026If I had to choose one asset worth watching most closely in 2026 , I would not hesitate to name XAUUSD (Gold) .

Not because gold is “going up.”

Not because of FOMO.

But because gold is positioned at the intersection of capital flows, market psychology, and long-term economic structure .

This article is not meant to encourage trading , but to help you understand why XAUUSD deserves a serious place on the radar of both traders and investors in 2026 .

1️⃣ The 2026 Macro Landscape – Gold Is No Longer a Choice, but a Necessity

As we move into 2026, global markets are facing three major challenges :

🔹 An unclear monetary cycle

Interest rates may decline, but it is unlikely that we return to the “cheap money” era of 2020–2021.

Capital flows are becoming more cautious, prioritizing capital preservation over risk-taking .

🔹 Prolonged geopolitical and trade instability

Conflicts, trade wars, tariffs, and protectionist policies

→ No longer short-term events, but structural, long-lasting risks .

🔹 Gradual erosion of trust in fiat currencies

The USD is not collapsing — but absolute confidence is no longer guaranteed .

Even central banks are diversifying reserves and reducing dependence on a single currency.

👉 In this environment, gold does not need a reason to surge — it only needs no reason to be aggressively sold .

2️⃣ What Is Capital Flow Telling Us? – Gold Is No Longer a “Traditional Safe Haven”

What stands out is how gold’s capital structure has changed:

- Central banks have been consistently buying gold for years

- Gold ETFs are seeing capital inflows return

- Large funds view gold as a strategic hedge , not a short-term trade

📌 This leads to an important reality:

Gold is no longer reacting only to crises — it is being held with intention.

This is the foundation that allows XAUUSD to maintain a long-term trend , rather than producing short-lived spikes.

3️⃣ Market Psychology – When Traders Start Respecting Gold Again

For many years, gold was often seen as:

- Slow

- Difficult to trade

- Less attractive than crypto or equity indices

But that perception is changing .

Traders are increasingly realizing that:

- Gold responds very clearly to macro factors

- It reflects risk-on / risk-off sentiment effectively

- Liquidity is deep, spreads are stable

- Suitable for scalping, swing trading, and position trading

📈 When market psychology shifts, price behavior follows .

4️⃣ The Technical Perspective – XAUUSD Is Telling a Different Story

On higher timeframes:

- A higher high – higher low structure remains intact

- Pullbacks are corrective , not distributive

- Price consistently respects key demand zones

This suggests one thing clearly:

The market is not selling gold out of fear , but rather taking profits and re-accumulating at better levels .

That is the signature of a healthy trend , not a speculative market.

5️⃣ Why Is 2026 a “Special” Year for XAUUSD?

2026 is not a year of:

- A major crash

- An irrational bubble

Instead, it is a year defined by:

- Smart money

- Defensive positioning

- Trading based on structure and patience

👉 And gold fits this environment perfectly.

🎯 Conclusion – The Right Way to View XAUUSD in 2026

If you ask me:

- Should you go all-in on gold? → No

- Should gold be a core asset to monitor? → Yes

XAUUSD in 2026 is not about:

- Fast trades

- Catching tops and bottoms

It is about:

- Understanding capital flow

- Reading market psychology

- Trading with planning and discipline

The traders who survive are not the ones who make the most — but the ones who stay aligned with long-term capital flow.

And in 2026, XAUUSD may very well be on that side.

If you found this article valuable, feel free to leave a LIKE 👍 or COMMENT and share your perspective:

👉 Do you view gold as a short-term trading instrument, or a long-term strategic asset?

Wishing you a year of trading that is clear-minded, disciplined, and sustainable .

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our 4h chart route map and trading plan for the week ahead.

We are now seeing price play between two weighted levels with a gap above at 4610 and a gap below at 4519. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

4610

EMA5 CROSS AND LOCK ABOVE 4610 WILL OPEN THE FOLLOWING BULLISH TARGET

4676

EMA5 CROSS AND LOCK ABOVE 4676 WILL OPEN THE FOLLOWING BULLISH TARGET

4737

EMA5 CROSS AND LOCK ABOVE 4737 WILL OPEN THE FOLLOWING BULLISH TARGET

4795

BEARISH TARGET

4519

EMA5 CROSS AND LOCK BELOW 4519 WILL OPEN THE FOLLOWING BEARISH TARGET

4436

EMA5 CROSS AND LOCK BELOW 4436 WILL OPEN THE SWING RANGE

4365

4296

EMA5 CROSS AND LOCK BELOW 4296 WILL OPEN THE SECONDARY SWING RANGE

4236

4171

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

Gold Is Building a Stair-Step — Next Move Will Be Decided 1. Current Market Structure

Gold is still trading in a macro bullish trend, but what makes this chart important is the character of the advance: it’s a step-by-step expansion through multiple phases, not a single vertical pump.

- Phase 1 → Phase 2: classic accumulation-to-markup transition (higher lows + clean expansion legs).

- Phase 3: price enters a controlled consolidation zone after a strong breakout impulse this is where the market typically decides whether it’s re-accumulating for continuation or distributing at premium.

Right now, price has printed a strong push into the ATH region, but the structure is showing pause + compression, which is normal before the next expansion leg.

2. Key Zones & Market Positioning

This chart is very clear: Gold is rotating between premium supply (ATH area) and layered support zones below.

Resistance / ATH Zones

Present ATH: ~4,689 – 4,700

New ATH Target (extension): ~4,740 – 4,750

This top band is where liquidity sits if price breaks and holds above it, it can trigger a stop-driven continuation expansion.

Support Zones (Most Important)

Support Zone 1 (near-term): ~4,650 – 4,660 → This is the “defend-or-fail” level for the breakout structure.

Support Zone 2 (deeper base): ~4,570 area → A critical swing support where bullish continuation remains valid even after a deeper pullback.

GAP Zones (Liquidity Magnets)

The highlighted GAP areas act like “unfinished business” zones:

- If the market loses momentum near ATH, these gaps often attract price due to liquidity imbalance.

3. Liquidity & Price Behavior

The market is currently behaving like a textbook re-accumulation setup:

- Price expanded hard, then stalled near resistance

- The consolidation is holding above prior breakout support

- This suggests buyers are not exiting they’re absorbing supply

However, the ATH region is also a distribution hotspot, so a fake breakout is possible:

Break above ATH → trap buyers → sweep liquidity → dump into the GAP

That’s why the next confirmation candle matters more than the idea.

4. Today’s Market Scenarios

🔼 Primary Scenario – Bullish Continuation (Break & Run)

Expected flow:

- Hold above 4,650–4,660

- Push through present ATH

- Expand into new ATH target zone (4,740–4,750)

This is the clean continuation path breakout acceptance is key (not just a wick).

🔽 Secondary Scenario – Pullback Into GAP (Reset Before Next ATH)

Expected flow:

- Rejection at ATH

- Pullback into GAP zone

- Reaction/bounce from support → second attempt higher

This is still bullish, but it’s a reset cycle rather than immediate continuation.

❌ Invalidation / Bearish Shift

Only if price breaks and holds below ~4,570

- That would invalidate the stair-step bullish structure

- It would imply the market is shifting from re-accumulation → distribution

5. Macro Add-On (Why Gold Keeps Finding Buyers)

Even with short-term volatility, Gold remains structurally supported by macro forces that favor buying dips, not fading strength:

- Rate-cut expectations (lower yields = stronger Gold bid)

- Sticky inflation risk keeps hedge demand alive

- Geopolitical premium continues to underpin safe-haven flows

- Central bank reserve diversification remains a long-term tailwind

This macro backdrop doesn’t prevent pullbacks but it increases the probability that pullbacks resolve as continuation, not trend reversal.

Summary

Gold is still bullish but it’s now trading at the most sensitive place on the chart:

- ATH is the trigger zone

- 4,650–4,660 is the defense line

- A pullback into the GAP is not bearish by default — it’s often the fuel reload before expansion

As long as the market holds above the major support structure, the roadmap remains:

Hold support → Liquidity build → Break ATH → Expand to new ATH target.