Gold After Liquidity Grab – What’s Next?XAUUSD (Gold) shows a clear sell-side liquidity sweep, followed by stabilization and early signs of bullish market structure. The recent decline appears corrective, not a trend reversal, as price quickly recovered and started forming higher lows.

Gold is now approaching a key resistance zone, where a temporary pullback is expected. A retracement into the demand area around 4600–4650 could attract fresh buying interest and act as a launch point for the next bullish move.

If demand holds, price may expand toward buy-side liquidity above previous highs near 5260, completing a classic liquidity-driven continuation setup. This scenario aligns with smart money behavior, where price revisits demand before a strong impulse.

Outlook: Bullish continuation after pullback

Key Levels: Demand support below, liquidity target above

Risk Note: Wait for bullish confirmation before entering

Goldprice

Gold Price Analysis – Key Support and Resistance LevelsThis chart outlines the key support and resistance levels for gold prices. The Key Resistance Level at 5,431.175 is a potential rejection zone, where price may face resistance. The Support Zone at 5,040.060 is being tested, and if price holds, a bounce or reversal is expected. The Critical Support at 4,949.972 is a key level for a potential bullish reversal. The Extreme Support at 4,497.334 represents a significant reversal area where price is likely to find strong support. Traders should monitor these levels for price action to confirm potential movements

Gold Price Climbs Above $5,000 At the Start of the WeekGold Price Climbs Above $5,000 At the Start of the Week

As shown by today’s XAU/USD chart, gold began the week on a bullish note: trading opened with a bullish gap above Friday’s high, lifting the price above the psychological $5,000 level.

The strengthening of gold has been driven by the following factors (according to media reports):

→ The US dollar, which is weakening ahead of key US economic data. The January employment report is due on Wednesday (it is expected to show signs of stabilisation in the labour market), followed by inflation data on Friday.

→ Political developments in Japan. The decisive victory of Prime Minister Sanae Takaichi has reinforced expectations of large-scale fiscal stimulus (“Sanaenomics”), which traditionally puts pressure on the yen and supports gold.

→ Demand from central banks. It has been reported that China’s central bank extended its gold purchases for the fifteenth consecutive month in January.

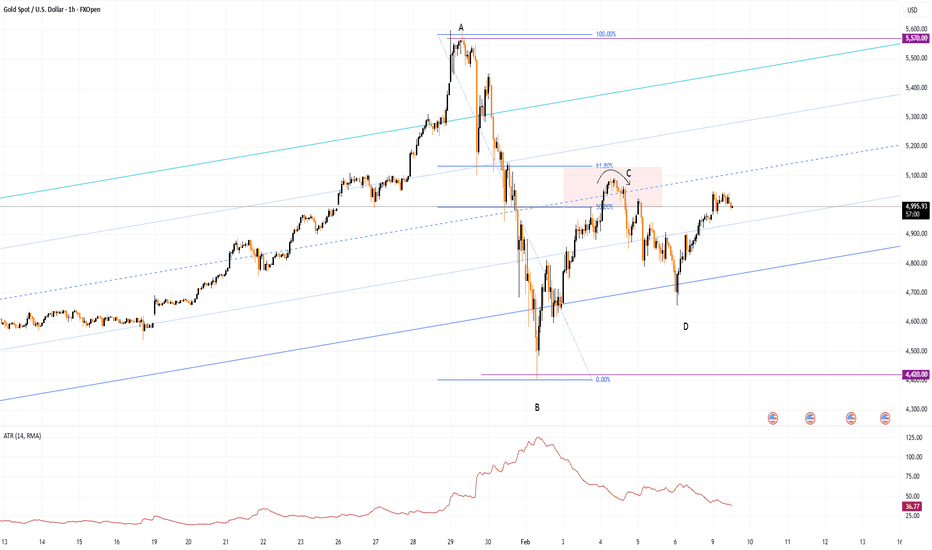

On 3 February, when analysing gold price fluctuations, we:

→ noted that the market was extremely oversold within the context of a long-term ascending channel;

→ suggested that a rebound from the zone of extreme oversold conditions could encounter a resistance area formed by the median of that channel and the classic Fibonacci levels (50% and 61.8%).

Indeed, on 4 February, after recovering into this area (with the formation of peak C), the market reversed lower and found support near the lower boundary of the aforementioned channel on Friday, 6 February.

Technical Analysis of the XAU/USD Chart

Price action (expanding amplitude) during the formation of low D points to aggressive demand, which may reflect the intentions of large capital.

At the same time, analysis of the market structure based on the A–B–C–D swing points suggests that, following the burst of extreme volatility at the turn of the month (highlighted by the peak in the ATR indicator), the market is searching for a new equilibrium.

It is therefore reasonable to assume that in the near term we may see a contraction in the amplitude of price fluctuations on the XAU/USD chart. It cannot be ruled out that supply and demand will find a temporary balance around the psychological $5k level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold at Decision Point: Pullback Setup Before the Next ExpansionGold is pressing into a decision zone where structure, momentum, and macro drivers are starting to line up for a bigger move. After the sharp drop and recovery phase, price has rebuilt a series of higher lows and is now testing a confluence area near descending resistance and prior supply. From my view, this is the kind of spot where gold either rejects hard for a deeper liquidity sweep or breaks and runs fast. With volatility already elevated in metals and macro risk still simmering, I’m treating this as a high-probability reaction zone, not a random level.

Current Bias

Bullish continuation after pullback

Structure favors an upside continuation overall, but I expect a short-term dip/retest into support first, followed by a push toward the higher resistance zones marked on the chart.

Key Fundamental Drivers

Gold remains supported by macro uncertainty and geopolitical risk flow.

Services-sector resilience in the US keeps rate cuts gradual, but not off the table — which supports gold on dips rather than killing the trend.

Recent softer pockets in US labor proxies (like ADP) help keep real yield upside capped, which is gold-positive.

Crude inventory draws and energy/geopolitical headlines keep inflation-risk narratives alive — also supportive for metals.

Macro Context

Interest rate expectations: The Fed is in a restrictive hold phase. Markets still expect easing later rather than further tightening. That caps real yield upside — constructive for gold medium term.

Growth trends: US growth is slowing but not collapsing. That creates a mixed environment where gold benefits from hedging demand without facing forced liquidation.

Commodity flows: Precious metals are in a high-volatility regime. Gold is acting as the anchor, with silver and miners reacting with higher beta.

Geopolitics: Ongoing Middle East tension, Iran-related unrest, and shifting energy trade alignments (India–Russia–US oil dynamics) keep a steady background bid under safe-haven assets.

Primary Risk to the Trend

The biggest threat to the bullish path is a sharp rise in US real yields driven by hotter inflation data or a sudden hawkish shift in Fed expectations. That would pressure gold and likely trigger a deeper breakdown below the highlighted support zone.

Most Critical Upcoming News/Event

US CPI / inflation releases

Fed speaker tone around timing of cuts

Treasury yield reactions after major data prints

Gold will react more to real yield moves than to headline PMI-type data.

Leader/Lagger Dynamics

Gold is a leader asset right now.

It often leads:

Silver (higher beta follower)

Gold miners

Broader defensive positioning

It tends to move ahead of FX safe-haven flows and sometimes front-run USD weakness/strength cycles rather than wait for them.

If gold breaks higher cleanly, expect silver and mining equities to follow with amplified moves.

Key Levels

Support Levels:

4,700 zone (major demand block on your chart)

4,600–4,620 deeper support / sweep area

Resistance Levels:

5,100 zone (near-term reaction supply)

5,550–5,600 major upper resistance band

Stop Loss (SL):

Below 4,600 support zone

Take Profit (TP):

TP1: 5,100

TP2: 5,550–5,600 zone

Summary: Bias and Watchpoints

My bias on gold is bullish, but not blindly I’m expecting a pullback into the 4,700 demand zone first, with invalidation below 4,600. If support holds, the path toward 5,100 and then the 5,550–5,600 resistance band opens up. The key watchpoint is US inflation and real yields if yields spike, this setup weakens fast. If yields stay capped and risk/geopolitical tension stays elevated, dips in gold remain buy-side opportunities rather than trend breaks.

Gold at a Crossroads: Bullish Breakout or Bearish ReversalGold Technical Analysis – February 9, 2026

Following the sharp market volatility over the past few days, Gold is currently in a critical phase, trading around a key psychological level. Below are the details for the upcoming price directions:

Pivot Point: 4968

This is today’s market key. As long as the price remains above this level, the Buyers maintain control.

Scenario 1: Continued Bullish Momentum

If the price sustains its position above 4968, we expect the following movements:

First Target: Reaching the resistance level at 5050.

Expansion: Breaking and stabilizing above 5050 will open the path for Gold to reach higher levels at 5090 and eventually 5150.

Note: Reaching these highs requires sustained buying pressure.

Scenario 2: Decline and Selling Pressure (Bearish View)

Any movement below the 4968 pivot point will shift the overall trend to the downside:

The Breakout: If the price loses momentum and settles below 4968, a bearish wave will begin.

Downside Targets: The price will head toward the support level at 4920, and if pressure persists, it will test the 4880 level.

Summary:

Above 4968: Bullish (Targeting 5050, 5090, 5150).

Below 4968: Bearish (Targeting 4920, 4880).

Gold weekly chart key levels with buy and sellThis is the first of 2 charts i will be posting this week the other is a swing trade

What a week in gold 200 pip 5 minute candles never seen this in 14 years trading Gold.

Always trade with a stop loss and use good risk management especially now.

Looking for a buy entry at 4985 expect 5006,5024,5044.

For a sell entry looking at 4920 expect 4885,4860,4836.

Ill update this as the week goes by , best time to trade this is Sunday Asian session.

Am posting another chart right after this

Gold (XAU/USD) Price Outlook – Trade Setup📊 Technical Structure

OANDA:XAUUSD Gold has rallied into a major resistance zone around 5,031–5,046, where selling pressure has clearly emerged. Price action shows rejection near the upper boundary, followed by short-term consolidation and loss of bullish momentum. The broader structure suggests that the recent rebound is corrective in nature, with price vulnerable to a pullback as long as it remains capped below the resistance zone.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 5,031 – 5,046

Stop Loss: 5,060

Take Profit 1: 4,966

Take Profit 2: 4,953

Risk–Reward Ratio: Approx. 1 : 2.85

📌 Invalidation:

A sustained break and close above 5,060 would invalidate the bearish setup.

🌐 Macro Background

While Gold continues to receive medium-term support from central bank buying and expectations of Fed rate cuts, short-term sentiment has turned more balanced as risk appetite improves and geopolitical tensions ease. With traders awaiting key U.S. data such as NFP and CPI, upside momentum appears limited near resistance, favouring a corrective pullback before any renewed trend develops.

🔑 Key Technical Levels

Resistance Zone: 5,031 – 5,046

Support Zone: 4,966 – 4,953

Bearish Invalidation: Above 5,060

📌 Trade Summary

Gold is trading beneath a well-defined resistance zone after a strong rebound. As long as price fails to break above 5,060, the bias favours a sell-on-rallies approach, targeting a pullback toward the lower support band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

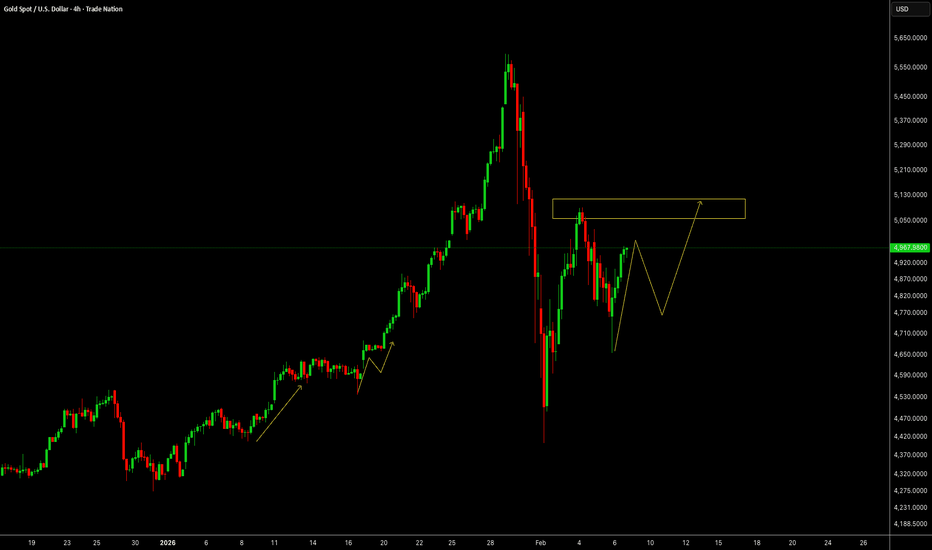

Gold Gearing Up for ExtensionGold has delivered a strong impulsive move on the 4H timeframe, breaking away from its recent range with clear momentum and volume expansion. The follow-through after the breakout suggests buyers remain in control, with price consolidating at higher levels rather than giving back gains.

This behaviour aligns with the projected path on the chart, where shallow pullbacks are being absorbed and structure remains intact. The market is showing signs of continuation rather than exhaustion, indicating that positioning is still building in the dominant direction.

If this price action holds, Gold may attempt another leg higher as momentum rebuilds.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

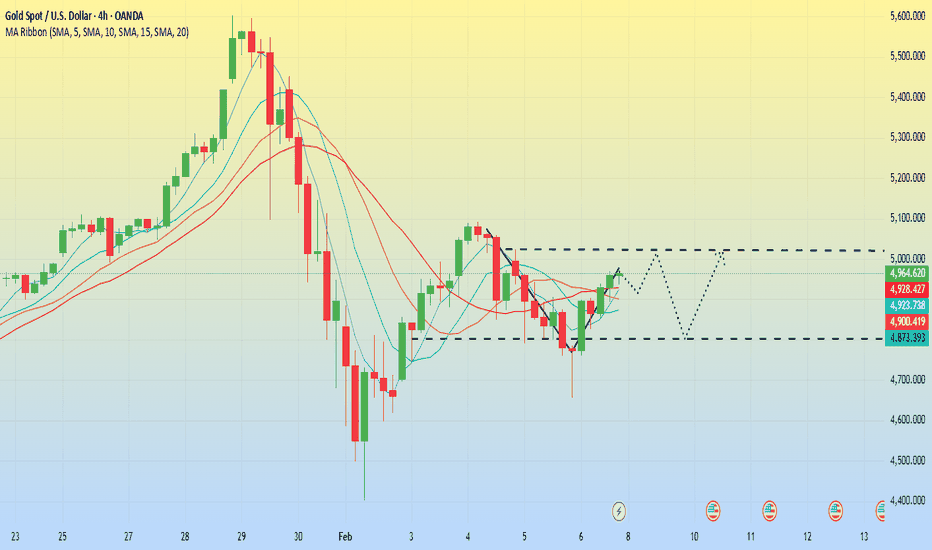

Dense data. Focus on the fluctuation range.On Friday, gold staged a V-shaped reversal, strengthening due to bargain buying and a weaker dollar, ultimately closing up 4%. Next week will be a crucial week this month, with a flurry of data releases and speeches from Federal Reserve officials.

After the market experienced a sharp decline, it entered a period of wide-ranging fluctuations this week, and this volatile trend is expected to continue for some time. However, it's important to note that the short-term high of 5600 and low of 4400 are unlikely to be breached; the market will likely fluctuate between the secondary high and low points. However, there will be a lot of data next week, which will likely intensify the market correction.

From the 4-hour chart, gold is currently facing short-term resistance around 5020-5030, while the key support level is around 4800. Gold is likely to continue fluctuating within this range next week until a new driving event or data event breaks this equilibrium and establishes a new trend.

However, regardless of whether a new market trend begins, the overall bullish pattern for gold remains unchanged. Looking at the daily chart, gold's lows are rising, ultimately forming a converging pattern upwards.

In terms of trading strategy, continue to focus on the overall range, prioritizing conservative trading with strict stop-loss orders to prevent sudden market changes from causing account losses.

GOLD 15M Chart LONGDear Traders,

Please review the 15-minute technical analysis on GOLD.

Our previous setup reached the projected targets precisely, and as anticipated, price pulled back into the demand zone to form a new price action structure. We are now seeing strong bullish confirmation supported by multiple confluences, Trendline Rejection including Smart Money Concepts, Engulfing Candle, Candle wick rejections, Order Block (OB) formation, and Fair Value Gap (FVG) development.

Key upside levels to watch are 5100 and potentially higher if momentum continues.

Entry: 4700

Target: 5050

Stop Loss: 4600

Trade with caution and proper risk management.

If you found this analysis helpful, don’t forget to support by commenting, boosting, and sharing.

The Quantum Trading Mastery

XAUUSD Short Setup: Heavy Rejection at Multi-Month Supply ZoneMarket Perspective: Gold (XAU/USD) is exhibiting a strong bearish narrative on the 15-minute timeframe. After a period of corrective recovery, the price has encountered a major institutional supply zone between 5,120 and 5,180, where aggressive selling pressure has once again been confirmed.

Technical Observations:

Supply Zone Rejection: The price action shows a clear failure to sustain momentum above the 5,150 level. This zone remains a critical structural barrier that bears are actively defending.

Trendline Breakdown: We are observing a breakdown from the local ascending trendline (blue), suggesting that the recent bullish momentum has been exhausted.

Projected Path: The analysis (black trajectory lines) indicates a high probability of a sustained decline toward lower liquidity areas. We anticipate a retest of the immediate support at 4,800 before a deeper move lower.

Trade Execution Details:

Entry Area: Around 5,057.00 - 5,060.00.

Stop Loss (SL): 5,223.21 (Placed safely above the recent supply peak to protect against volatility).

Take Profit (TP): 4,498.23 (Targeting the major demand cluster and historical support).

XAUUSD Analysis: Bearish Momentum Building at Critical SupplyMarket Overview: Gold (XAU/USD) is currently exhibiting a potential shift in market character on the 15-minute timeframe. After a period of recovery, the price has encountered a major overhead supply zone, suggesting that the recent bullish momentum may be reaching exhaustion.

Technical Breakdown:

Supply Zone Rejection: The price action confirms a significant rejection at the 5,120 – 5,150 resistance block. This purple zone remains the primary barrier for any further upside.

Trend Analysis: We are tracking an ascending trendline (blue) that has been supporting the recent move higher. However, the formation of lower highs near the resistance suggests that the bears are regaining control.

Price Path Prediction: The projected trajectory (black path-line) anticipates a breakdown from the current consolidation, followed by a series of impulsive moves toward lower liquidity areas.

Momentum Indicator: The overall structure remains bearish as long as the price maintains its position below the 5,150 level.

Key Levels to Watch:

Immediate Resistance: 5,120 – 5,150

Pivot Support: 4,800

Major Downside Target: 4,400 – 4,500

Risk Management: Traders should monitor the interaction with the blue trendline closely. A confirmed break and 15-minute candle close below the trendline would provide secondary confirmation for the bearish outlook. Always maintain strict risk-to-reward ratios and wait for clear rejection signals before commitment.

Gold : (5046.166 & Above)Gold prices looking fairly decent for today as it’s structure is indicating some buying potential especially on the (Daily Time Frame) the candle stick , shows us that it has potential to cross over the (5046.166) level , remember to keep the trading simple and (follow the trend + secure profits)

monday gold Market Structure & Momentum AnalysisMarket Sentiment: Gold is exhibiting significant bearish pressure on the 15-minute timeframe after a sharp rejection from the high-interest supply zone between 5,120 and 5,180.

Technical Breakdown:

Resistance Confirmation: The price failed to sustain momentum above the overhead purple supply block, leading to a structural shift.

Momentum Indicator: The large bearish impulse arrow indicates a high probability of a deep corrective move toward the lower liquidity zones.

Projected Trajectory: We anticipate a series of lower highs and lower lows as the market moves to clear the buy-side liquidity established during the previous rally.

Key Target: The primary downside objective is the major demand cluster near 4,484.

Breaking through 5000. Will it reach 5100?After a fierce battle between bulls and bears, gold has rebounded above $5000, with bullish sentiment reviving.

Can gold sustain this strong bull run or rebound? The key lies in breaking through $5100; only then will a further rebound be possible. The previous rebound was halted at $5100, and after a second decline to $4650, it did not break the previous low of $4400, indicating that bullish sentiment in the market has not subsided.

Central banks around the world continue to increase their gold holdings, which boosts bullish confidence. In the past two years, central banks have continuously increased their gold reserves to balance the single-asset risk of US dollar assets in their foreign exchange reserves, making gold a strategic asset of choice. Therefore, the focus is on what will support the continuation of the bullish trend. Geopolitical risks provide a temporary stimulus, but a sustained bull market requires stronger fundamental factors to form a consensus.

Gold prices opened higher in the Asian session. The key is whether the European session can continue the upward trend and even break through $5100. If the European session fails to continue the upward trend and instead falls below the starting point of the Asian session's rise, it indicates that this rise is a trap, and gold needs a correction to confirm the support level.

In the short term, the key level to watch is $4930, the starting point of the Asian session's rise. Above this level, it is advisable to focus on long positions, but it is important to adjust your strategy promptly if the price falls below $4930. The market is constantly changing; follow the market, and any attempt to manipulate the market is dangerous.

Gold prices recover from resistance at 5095.Related Information:!!! ( XAU / USD )

XAU/USD mounts a strong rebound toward the $4,950 region as softer-than-expected US labor data reignites expectations of Federal Reserve policy easing.

The non-interest-bearing precious metal has staged a solid recovery since Thursday, benefiting from early weakness in the US Dollar on Friday. The greenback came under pressure after disappointing US labor market figures released on Thursday, which revived market speculation that the Federal Reserve could deliver additional monetary easing. Against this backdrop, investors moved to buy gold on dips, despite tentative signs of stabilization in US Treasury yields.

personal opinion:!!!

The gold market is stabilizing and beginning to accumulate more. Expectations are for a recovery back to 5095.

Important price zone to consider : !!!

Resistance zone point: 5095 , 5240 zone

Follow us for the most accurate gold price trends.

XAU/USD Bullish Thesis Supported by Market Structure🔱 XAU/USD — Gold vs U.S. Dollar

Metals Market | Institutional Edge Plan (Day / Swing Trade)

📌 Market Bias

Primary Plan: 🟢 Bullish Continuation

Gold remains supported by macro flows, liquidity positioning, and risk-hedging demand. This plan focuses on buy-side participation with controlled risk, aligned with institutional behavior.

🧠 Execution Framework (Entry Logic)

Entry Method: 🧩 Layered Limit Entries (Liquidity-Based)

You may enter at any preferred price level,

however this strategy is designed around scaled limit entries to reduce emotional execution and improve average pricing.

Preferred Buy Zones (Limit Layers):

4900

4800

4700

4600

📌 Concept: Institutions rarely enter at one price.

They scale into positions where liquidity is resting and volatility shakes out weak hands.

🎯 Target Zone

Primary Objective: 5400

🔎 Target Logic Includes:

🚓 Strong Institutional Resistance Zone

📈 Overbought Conditions on higher timeframes

Potential Late-Buyer Trap

🔗 Intermarket Correlation Alignment

➡️ At this zone, probability favors profit protection over greed.

🛑 Risk Management

Protective Stop (Extreme Invalidation): 4500

📌 This level represents a structural failure of the bullish narrative.

⚠️ Risk parameters are personal.

Use this level as a reference, not a command.

⚖️ Trader Responsibility Notice

Dear Ladies & Gentlemen (Thief OGs),

You are not required to use only my TP or SL

Adjust position size, partials, and exits based on your own risk model

Capital preservation always comes before ego

💼 Professional traders manage risk first, profits second.

🔗 Related Markets to Watch (Correlation Dashboard)

💵 USD-Based Assets

DXY (U.S. Dollar Index):

⬇️ Weak USD = ⬆️ Supportive for Gold

USD/JPY:

Yen strength often aligns with risk-off flows benefiting XAU

📉 Bonds & Rates

US10Y Treasury Yields:

Falling yields = lower opportunity cost → bullish for Gold

📊 Risk Sentiment

S&P 500 / NASDAQ:

Equity stress or volatility spikes often redirect capital into Gold

🌍 Fundamental & Macro Factors in Play

Key Drivers Supporting Bullish Bias:

🏦 Central bank gold accumulation (reserve diversification)

📉 Real yield pressure amid policy uncertainty

🌍 Geopolitical & macro risk hedging demand

🧾 Sticky inflation narratives keeping Gold relevant as a hedge

Upcoming Factors to Monitor:

High-impact U.S. inflation data

Federal Reserve policy commentary

Labor market volatility & growth outlook signals

Global risk events influencing safe-haven flows

📌 Gold moves when confidence in fiat wobbles.

🧠 Institutional Mindset Reminder

Retail chases price

Institutions build positions

Liquidity tells the truth

Patience pays the premium

Thief Trader Wishes

“Take profits without noise.

Respect risk without fear.

Let the market pay you — don’t beg it.”

📈 Trade smart.

🧠 Stay disciplined.

💰 Secure the bag, protect the capital.

All Eyes on $4,920: The Decisive Pivot for Gold's Next Move!Current Status: Neutral / Bearish Bias Pivot Point: $4,920

Market Overview:

Gold is currently trading below the key pivot level of $4,920. The market is at a crossroads, and we are closely watching whether the price can maintain stability below this point or if a recovery is imminent.

📉 Bearish Scenario (Main Outlook)

As long as Gold continues to trade below the $4,920 pivot, the bearish momentum will remain intact, targeting the lower support zones:

Target 1: A retest of the immediate support at $4,820.

Target 2 (Confirmation): A decisive breakout below $4,820 will accelerate the downtrend toward $4,745 and potentially $4,690.

📈 Bullish Scenario (Corrective Rally)

If Gold gains enough buying liquidity to stage a recovery and breaks above the pivot:

Condition: A confirmed 1-hour candle close above $4,920.

Upside Target 1: Resistance at $5,015.

Upside Target 2: Further extension toward the $5,090 psychological level.

📍 Key Technical Levels

Pivot Point: $4,920

Resistance: $5,015 | $5,090

Support: $4,820 | $4,745 | $4,690

🔍 Summary

Bearish Bias: Below $4,920 (Stay cautious).

Bullish Shift: Above $4,920 (Recovery expected).

⚠️ Risk Management: Always protect your capital with a Stop Loss. High volatility is expected.

Gold Volatility Rises as NFP Delayed by US Shutdown | Feb 6 2026OANDA:XAUUSD Gold Volatility Rises as NFP Delayed by US Shutdown | Feb 6 2026

📌 Market Update: NFP Delayed (Feb 6, 2026)

The January 2026 U.S. Non-Farm Payrolls (NFP) report has been delayed due to a partial U.S. government shutdown, removing a major macro catalyst from today’s session. The absence of fresh labor data has increased uncertainty around Federal Reserve policy expectations, contributing to heightened volatility across currencies, equities, and precious metals.

Gold remains especially sensitive in this environment, as traders reassess inflation, interest rate trajectories, and systemic risk without confirmation from employment data.

Gold Performance – February 5, 2026 (Yesterday)

Gold extended its sharp correction as a stronger U.S. dollar and broad risk rebalancing triggered heavy liquidation. A rising USD pressured gold prices by making the metal more expensive for non-dollar buyers, reducing global demand.

Spot gold closed 1.8% lower at $4,872.83/oz, after falling to an intraday low near $4,791.69/oz. April gold futures also weakened, settling 1.2% lower at $4,889.50/oz, opening the session with a gap down from the prior close. Analysts noted intraday declines of nearly 4%, largely driven by margin calls, profit-taking after the historic multi-month rally, and the unwinding of leveraged long positions.

Despite the aggressive sell-off, long-term sentiment among institutional buyers remained constructive.

Gold Performance – February 6, 2026 (Today)

Gold rebounded modestly in early trade amid dip-buying and continued global equity weakness. As of early GMT hours, spot gold recovered to around $4,860–4,880/oz, gaining roughly 2% from yesterday’s lows.

Trading remains choppy, reflecting ongoing uncertainty and reduced liquidity. CME Group has raised margin requirements on gold and silver futures for the third time this year, signaling concern over extreme volatility and speculative excess.

Broader Outlook and Key Drivers

Major banks remain divided on gold’s trajectory. JP Morgan continues to project upside potential toward $6,300/oz by year-end, citing sustained central-bank accumulation, geopolitical risks, and growing concerns around fiscal dominance. In contrast, consensus forecasts remain more conservative, highlighting the wide divergence in market expectations.

In India, domestic gold prices also softened, with 24-carat gold trading near ₹15,235 per gram, reflecting global price pressure and currency effects.

Conclusion

Gold remains structurally bullish on a long-term basis, but short-term price action is dominated by volatility, forced liquidations, and macro uncertainty. With NFP delayed and markets lacking a key directional catalyst, traders should expect continued sharp swings until clarity emerges on U.S. fiscal stability, Fed policy direction, and risk sentiment.

Patience and risk management are critical in this environment.

GOLD: Latest update 04/02/2026! Dear traders,

Our last update on gold has been successful and we’re currently up over 1968 pips. This presents a good opportunity for you all to consider a second entry as the price has corrected. It’s possible the price will reverse from the area we’ve highlighted. Please remember to manage your risk accurately when trading gold as the market conditions are extremely volatile.

Good luck and trade safely.

Team Setupsfx_

Gold - Preparing the final blow off top!💰Gold ( OANDA:XAUUSD ) will rally a final +20%:

🔎Analysis summary:

Just in January alone, Gold is up another +25% so far. Looking at this very bullish parabolic rally, Gold remains super strong and is still not done with the bullrun. Until Gold retests the ultimate resistance trendline, it can easily rally another +20% from the current levels.

📝Levels to watch:

$6,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

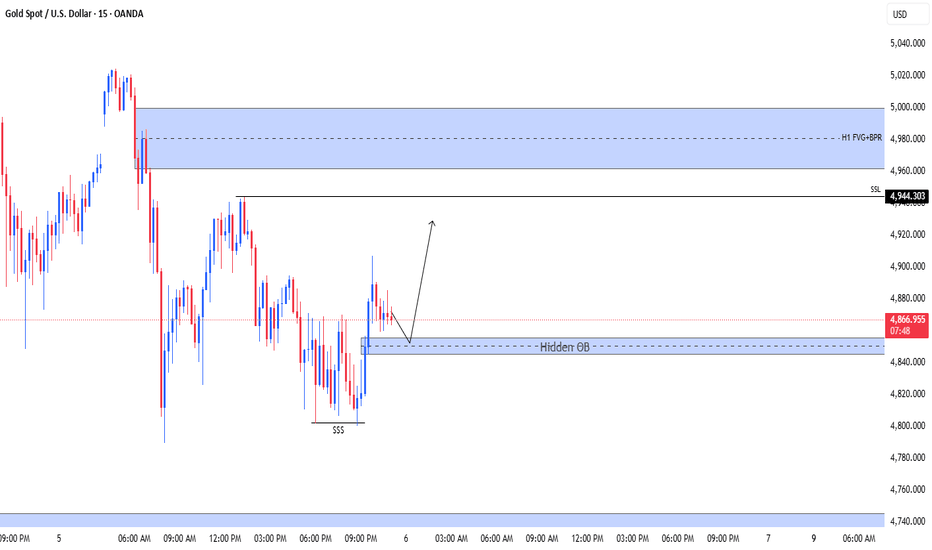

XAUUSD – M15 | Short-Term Bullish Reaction ExpectedPrice has swept liquidity (SSS) and is now reacting from a Hidden Bullish Order Block on M15.

As long as price holds above this OB, a pullback → continuation move is likely.

Upside draw remains toward the H1 FVG / BPR zone near the previous supply area.

Bias: Intraday bullish

Key idea: Liquidity sweep + hidden OB reaction

Note: Wait for confirmation before execution. This is educational, not financial advice.

Volatility continues. Trading is within the 4800-4960 range.Gold briefly tested above 5020 after opening in the Asian market on Thursday, then began to pull back and correct. During the European session, it faced renewed pressure at 4940-50, and the price is currently retracing to around 4820.

This suggests that the short-term rebound in gold has ended, and it may enter a medium-term consolidation and oscillation trend.

From a medium-term perspective, we are still more inclined to see a correction in gold. Currently, the moving averages on the 1-hour chart have crossed downwards, indicating a potential for further short-term decline. Short-term resistance can be observed at 4900, with major resistance at the 4940-60 trendline and the upper boundary of the range. The lower boundary of the range at around 4800 should be watched as support.

For short-term trading, it's important to note that the main strategy for gold in the US session is to observe the continuation of the correction, but given the still very large volatility, this poses a significant challenge to trading.

Aggressive traders can buy at 4890-4900, but due to the high volatility, it is crucial to maintain extremely small positions and close positions to take profits in real-time.

If the price tests 4960-70 again, aggressive traders can sell, with a profit target of 4820-00.

It is important to note that the current volatility is extremely high. It is crucial to maintain extremely small positions and close positions promptly after achieving a certain profit to mitigate the risks of sharp price fluctuations.I will post more strategies on the channel.