Back to the BaseEnovis is trading at major long-term support, sitting near levels last seen during the 2020 lows and areas that previously acted as key support during the 2009 cycle. These zones represent historically significant demand areas where buyers have stepped in before.

It would not be surprising to see ENOV tag the $1 billion market cap level one more time as it finishes building a base. If a stock is going to survive and recover, defending the $1B valuation is a healthy and constructive signal, often marking institutional interest and long-term accumulation.

A decisive push through the $29.00 level would confirm a trend shift and open the door for a move toward the $37.98 resistance, offering strong upside from current prices. With a clearly defined stop loss at $20.00, this setup presents an excellent risk-to-reward ratio, making ENOV an attractive rebound and value recovery play.

Harmonic Patterns

AUDUSD: Neutral View First Buy and Then Sell! Hey everyone!

Our first buy swing entry is going swimmingly! We’ve got over 500 pips running positively, and we reckon price can keep going up and then when it hits our selling zone, you can swing sell too. This is a fantastic opportunity where we can wait for price to do its thing and then when it reaches the sell zone, we can execute our order. But if you’re feeling adventurous and want to take a bit of a risk, you can take a buy entry at the given point and keep it up until it reaches our sell area.

With just one shot, we can make two entries!

Good luck and trade safely!

Thanks a bunch for your unwavering support! 😊

If you’d like to lend a hand, here are a few ways you can contribute:

- Like our ideas

- Comment on our ideas

- Share our ideas

Cheers,

Team Setupsfx_

❤️🚀

TLMUSDT Forming Falling WedgeTLMUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 90% to 100% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching TLMUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in TLMUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#GBPUSD: +910 PIPS Buying Setup! Swing Setup! GBPUSD broken through the bearish trend line liquidity now we think price is likely to continue uptrend with around 910+ pips swing buying setup. We also have important news coming up this week so be careful while trading also use accurate risk management while trading.

Good luck and trade safe!

Team Setupsfx_

DOGE Bullish Setup | Harmonic + Divergence Confluence#DOGE has formed a Harmonic Pattern on the 4H timeframe and is also showing Bullish Divergence on momentum indicators.

This confluence often signals trend reversal or continuation to the upside.

Key Observations

Harmonic Pattern completed at potential reversal zone

Bullish Divergence confirmed on 4H

Price is still below resistance — breakout confirmation required

Trade Plan

Entry: Wait for a clean breakout above resistance, then enter on the retest

Target: Previous high

Stop Loss: Below harmonic invalidation level

Risk Management: Risk only 1–2% per trade

Important

No breakout = No trade.

Patience is the real edge in crypto trading.

What do you think?

Is #DOGE ready for the next rally or will this be another fake breakout?

Comment your bias

#DOGE #CryptoTrading #HarmonicPattern #BullishDivergence #Altcoins #TradingView #TechnicalAnalysis #SmartMoney

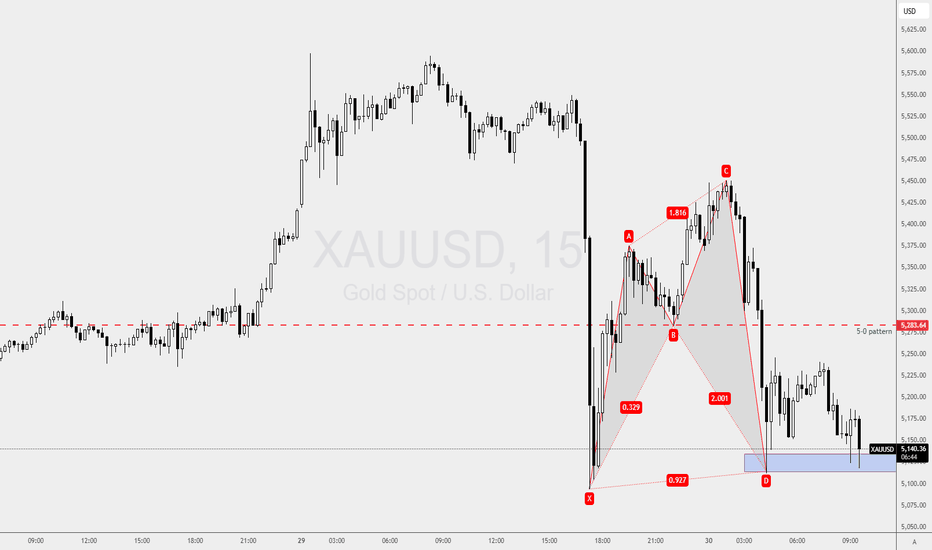

Gold Has Shifted Into a Corrective Channel — The Next Bullish Hello traders, OANDA:XAUUSD is currently trading near $5,178, following a sharp rejection from the all-time high region around $5,580–$5,600. After completing a strong impulsive advance, price action has transitioned into a well-defined descending channel, signaling a short-term corrective phase rather than immediate trend continuation.

This pullback has so far respected structure. Price remains above the rising higher-timeframe trendline and is approaching a key support zone premium around $5,020–$5,070. This area aligns with prior structural interaction and represents a critical decision zone where buyers are expected to reassess participation. Importantly, downside momentum has moderated as price moves deeper into this zone, suggesting the correction is orderly, not capitulative.

From a structural standpoint, the broader bullish trend is not invalidated. The current move should be viewed as a corrective leg within a larger uptrend, provided price holds above the $5,000 psychological and structural level. A constructive reaction from the support zone would increase the probability of a rotation back toward the descending channel resistance near $5,240–$5,280, where market behavior will determine whether a larger reversal or continuation unfolds.

On the upside, a sustained reclaim and acceptance above $5,280–$5,300 would signal that the corrective phase has likely completed, opening the door for a renewed attempt toward the prior ATH zone. Until that occurs, upside moves are best interpreted as corrective bounces, not confirmed reversals.

Invalidation remains clear and objective. A decisive breakdown and acceptance below $5,000 would weaken the higher-timeframe structure and increase the probability of a deeper correction toward the $4,920–$4,960 region.

For now, gold is not breaking its trend it is working through a structured correction.

ATH rejected. Correction active. Demand reaction will decide the next major move.

NZDJPY sell opportunityBig Picture

Overall trend: Strongly bullish

Clean impulse → correction → impulse

That falling channel you marked?

👉 Bullish continuation pattern and it already played out perfectly

What price is doing NOW

Price pushed into a clear supply / resistance zone (purple box near 93.1–93.3)

Got initial rejection, but notice this:

Pullbacks are shallow

Buyers are stepping in fast

No strong bearish displacement yet

That tells me sellers are defending, but buyers are not weak.

Key Levels

Resistance (decision zone):

🔴 93.10 – 93.30 (this is the fight)

Support:

🟣 ~91.80–92.00 (major demand)

🟣 ~90.78 (last bullish defense — very important)

Probability (out of 100)

Right now, based on structure:

Bullish continuation breakout: 60–65%

Range / consolidation under resistance: 20–25%

Deeper pullback to demand: 10–15%

Full trend reversal: <5%

What would increase bullish odds to 75%+

Clean 4H close above the purple supply

Or a pullback that holds above 92.50 with strong bullish candles

What would shift bias

Strong 4H bearish engulfing from this zone

Or acceptance back below 92.00

Until then?

This is bulls vs patience, not bulls vs bears.

BTR PRO RECOVERY DAY – Morning Loss Recovered Successfully!🔥 BTR PRO RECOVERY DAY – Morning Loss Recovered Successfully! ✅

BSE LTD | 15m | 30 Jan 2026

Today was a perfect example of why discipline beats emotion.

📌 Morning session: whipsaw / false move → loss booked

📌 But BTR PRO stayed active and gave a clean reversal opportunity

📌 Final session: strong continuation sell trade → Targets achieved 🎯

✅ Trade Highlight (Recovery Trade)

🔻 BTR PRO Sell Entry: around 2855

🛑 SL: 2868

🎯 T1 hit

🎯 T2 hit

💥 Recovery completed + profit protected

📌 No revenge trading

📌 No random entries

📌 Only BTR PRO signals + SL/Target system

🔥 BTR PRO finally recovered the morning loss and closed the day strong!

Dow Theory — The Foundation of Trend Reading Every Trader Must MDow Theory — The Foundation of Trend Reading Every Trader Must Master

Most traders fail not because the market is random, but because they never truly understand how trends work. Dow Theory is not outdated theory. it is the core logic behind price structure that still governs every market today. If you can read structure, you don’t need predictions.

1. The Market Moves in Trends — Not Randomly

Price does not move randomly. What looks like chaos is actually organized behavior driven by collective psychology.

A trend exists when price consistently creates structure:

- Uptrend → Higher Highs (HH) + Higher Lows (HL)

- Downtrend → Lower Highs (LH) + Lower Lows (LL)

- Sideways → Price oscillates without expanding structure

As long as this structure remains intact, the trend is valid regardless of news, opinions, or emotions.

Structure > Narrative.

2. Every Trend Has Multiple Levels

One of the biggest mistakes traders make is confusing timeframe noise with trend reversal.

Dow Theory explains that markets move in three layers at the same time:

- Primary Trend – the dominant direction (weeks to months)

- Secondary Move – corrective phases against the main trend

- Minor Swings – short-term fluctuations and noise

Most losses happen when traders fight the primary trend while reacting emotionally to minor swings.

3. The Three Psychological Phases of a Trend

Trends don’t start or end suddenly. They evolve through three distinct phases:

1️⃣ Accumulation

- Smart money builds positions quietly

- Price moves sideways

- Volatility is low

- Public interest is minimal

2️⃣ Participation

- Structure becomes clear

- Breakouts occur

- Momentum expands

- This is where most trend-following profits are made

3️⃣ Distribution

- Late buyers enter emotionally

- Volatility increases

- Smart money exits into strength

- Understanding these phases helps traders avoid buying tops and selling bottoms.

4. Structure Is the Only Valid Trend Confirmation

Indicators do not define trends, structure does.

A trend is confirmed when:

- Price breaks structure in the trend direction

- Pullbacks respect prior swing levels

- Momentum resumes after corrections

If structure is not broken, there is no reversal only a correction.

This is why predicting tops and bottoms is one of the fastest ways to lose money.

5. Volume Confirms Direction, Not Timing

Volume does not tell you when to enter.

It tells you whether the move is real.

- Rising volume with the trend → confirmation

- Weak volume during pullbacks → healthy correction

- High volume against structure → warning signal

Price leads.

Volume confirms.

6. A Trend Continues Until Structure Breaks

This is the most ignored and most important rule of Dow Theory.

A trend does NOT end because:

- Price “already went too far”

- Indicators are overbought or oversold

- Social media says “the top is in”

A trend ends only when structure breaks and fails to recover.

How to Apply This in Real Trading

A simple, repeatable framework:

- Identify the dominant structure (HH/HL or LH/LL)

- Wait for a correction, not a reversal

- Enter only when structure resumes in trend direction

- Place stop-loss where structure becomes invalid

- Hold until the market changes structure

No prediction. No guessing.

Just reading what price is already telling you.

Final Thought

Most traders don’t lose because they lack indicators.

They lose because they don’t understand trend behavior.

When you stop predicting and start reading structure, the market becomes clear, calm, and repeatable.

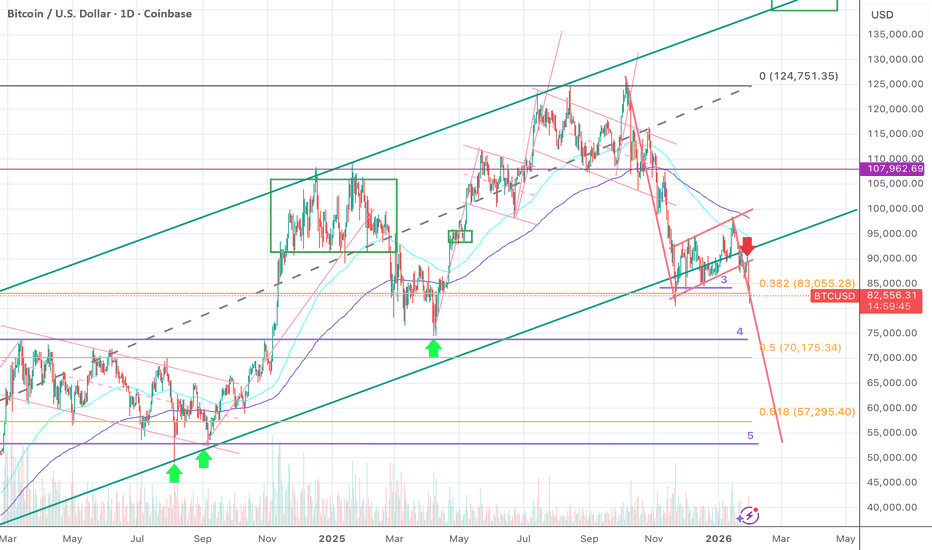

BTC Breakdown Confirmed: Deeper Correction Levels

Hi everyone!

Yesterday Bitcoin got hit hard: price dropped from 90,000 to 83,200, wiping out almost the entire weekly recovery attempt back into the 92,000 zone.

As a reminder, this risk scenario was mentioned in advance:

📌 Post from 28/01:

“As long as price hasn’t returned to the main watch zone at 92,000+ (marked with a red circle), the downside continuation scenario toward 84,000 and lower remains more than realistic.”

📌 Post from 26/01:

“I expect continuation toward stop 3 at 84,200, unless we see strong institutional buying, ETF inflows, or any major hawkish news.”

What’s happening now

- At this point, I confirm a daily close / hold below the long-term trendline, which increases the probability of a deeper correction.

- All stop-losses around 84,200 have been swept — this was the 3rd and final stop zone previously marked on the chart.

New correction levels

- 73,800 (Level 4)

A major stop-loss concentration zone for those who started building positions since early April 2025.

A historically significant level with multiple clean touches.

- 52,900 (Level 5)

Another historically important level.

Matches the measured move target of the flag pattern highlighted on the chart.

➡️ This is now my main scenario.

Bullish scenario (unchanged)

The bullish scenario remains the same:

✅ any reclaim and hold above the long-term trendline, with a return into the main watch zone at 92,000+.

Important note (Fibonacci)

Also watch 57,900 — this level aligns with the 0.618 Fibonacci retracement, measured across the entire growth cycle from January 2023 to October 2025.

This is a key zone to consider in the broader context — Fibonacci levels often work stronger than flag targets and horizontal levels.

Have a great day everyone! 🍄

⚠️ Disclamer

This material is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any asset.

Always manage your risk, use proper position sizing, and make your own decisions.

SQNS - high speculation Why Daniel Asher BUY? Who is Daniel Asher and why is he buying?

Daniel Asher is a billionaire (net worth over $960 million) and is a “10% owner” of SQNS. In January 2026, he made a series of purchases:

January 20: Bought 42,260 shares at $5.29.

January 15: Bought 39,831 shares at $5.65.

January 13: Bought 72,909 shares at $5.69.

Total: He invested over $1.1 million of his own money in January alone.

There are some good data, but also quite bad ones, but here I would rather check what happens when an insider buys so often and in large quantities.

STEXWhat does STEX actually do?

They are in the RWA (Real-World Asset) Tokenization sector. Their main goal is to bring physical gold and other commodities onto the blockchain (via their product GLDY). This is one of the hottest topics for 2026 – the digitization of physical assets.

Why are insiders buying so hard?

Morgan Lekstrom (Director) bought shares at $3.70, which is above the current market price. This is a strong signal that he believes the stock is undervalued.

Frank Giustra (a well-known billionaire and investor) also owns a large stake and has been buying aggressively.

The reason: The company just pre-paid $50 million in debt and raised $35 million in new capital. This “cleans up” their balance sheet and sets them up for massive expansion.

Gold Breaks Structure — Short BiasGold has now clearly shifted from expansion into distribution, and the chart is sending a warning signal for bulls. After the impulsive rally topped near five thousand six hundred, price failed to hold the high and formed a distribution range, followed by a strong breakdown. The most important technical signal is the loss of the demand zone around five thousand one hundred seventy to five thousand one hundred twenty. This zone previously acted as a launchpad during the markup phase, but the sharp bearish candle slicing through it confirms structural failure, not a healthy pullback. The current consolidation below this zone is corrective and weak, suggesting sellers are in control. As long as price remains below five thousand two hundred, rebounds are likely to be sold rather than chased.

From a liquidity and macro perspective, this move fits a classic post-ATH behavior. The rally into the highs aggressively cleansed buy-side liquidity, trapping late breakout buyers, while smart money distributed into strength. With U.S. yields staying elevated, the U.S. dollar stabilizing, and risk appetite cooling, gold is losing its short-term momentum bid. Liquidity is now concentrated below five thousand fifty and five thousand, with the next major magnet sitting near four thousand nine hundred to four thousand eight hundred ninety. Market psychology has flipped from fear of missing out to capital protection, and unless gold can reclaim acceptance back above the broken demand zone, the higher-probability scenario remains a continuation lower, not an immediate trend resumption.

USDJPY – The Trade I’ve Been Waiting Weeks ForFinally, the trade I’ve been eyeing is here.

I’ve been sharing with my close circle that the ultimate big trade I wanted to get into is a **short on USDJPY**. And today, I finally got my position after weeks of waiting.

The motivation behind this trade is actually quite simple.

There are two key events lining up:

A potential U.S. government shutdown this weekend.

Japan’s SNAP Election on 8 Feb 2026.

Both events point in the same direction for me — pressure on USDJPY.

A shutdown is typically not good for the U.S. economy, and historically that tends to weigh on the U.S. dollar. From that angle alone, shorting USD already makes sense.

On the Japan side, I strongly believe the probability of PM Sanae Takaichi losing her seat is relatively high. Some of her past decisions have not been popular among Japanese business owners, and her actions have also caused Japanese tourism to suffer. These are not small issues domestically.

If she were to lose the election, the Japanese yen could see an instant appreciation. We’ve witnessed similar market reactions in the past.

That said, this is not a trade call.

I’m simply sharing that I’m genuinely happy to finally be in the trade I’ve been waiting patiently for. No chasing, no rushing — just waiting for the right alignment of structure, timing, and risk.

Weeks of waiting for one trade.

That’s trading.

Sometimes the hardest part isn’t execution.

It’s patience.

Gold Compresses Inside a Symmetrical TriangleGold is currently trading around five thousand one hundred forty-six after a strong impulsive rally from below four thousand nine hundred to above five thousand five hundred. Following that markup leg, price has transitioned into a symmetrical triangle, defined by lower highs and higher lows, while holding above the rising support trendline and the EMA ninety-eight near five thousand two hundred thirty-three. This behavior signals consolidation, not weakness. Sellers are present, but they lack momentum, and every pullback toward the five thousand one hundred to five thousand one hundred fifty area continues to be absorbed rather than sold aggressively.

From a liquidity and psychology perspective, this structure reflects position rebalancing, not distribution. Buy-side liquidity remains stacked above five thousand four hundred and five thousand five hundred, while sell-side liquidity sits below five thousand one hundred. The market is compressing to build liquidity, forcing both late buyers and early shorts into poor positioning. As long as price does not accept below five thousand one hundred, the higher probability outcome remains an upside expansion, with a breakout targeting the five thousand five hundred to five thousand six hundred zone once volatility is released.

GOLD – Timing Matters More Than DirectionLast night, while I was with my close circle of friends, I shared a concern.

If GOLD were to come down crashing, we could be in deep trouble. At the same time, rising concerns over a possible U.S.–Iran strike were very much part of the discussion. These are not small geopolitical risks, and markets don’t ignore them for long.

That said, I’m not trading opinions. I’m trading timelines and structure.

There are two timelines I’m paying close attention to:

The first is the morning retracement that usually happens during the Japanese session. This often provides an early opportunity to position for USD appreciation.

The second comes around three days after a sharp fall. At that point, it’s important to observe whether there is any meaningful recovery. In the absence of it, the trend often has room to continue further.

So when the chart eventually presented a buying opportunity, I didn’t rush.

I waited.

I waited for the second retest. That second retest allows me to observe the first high the market can reach, and that first high becomes an important reference level for me. From there, trade management becomes much clearer and risk can be controlled more effectively.

This is not about predicting where GOLD must go.

It’s about patience, structure, and waiting for the market to show its hand.

As usual, this is not a trade call or a trade signal.

Just me sharing my view from years of observing how the market behaves around fear, headlines, and timing.