Harmonic Patterns

SELLERS GOT INTERST THE PRICE ETH BEARISH FOR SOMETIME

Subsequent to the interest rate decision, the seller has indicated a willingness to allow additional time to reassess the pricing strategy, with a view toward a minor price reduction and further enhancements.

This statement is not intended to provide financial advice.

3-DRIVE SEEMS MORE PROBABLE NOWMorning folks,

So, everything goes with the plan. Congrats, this week we could get 3rd grabber in a row on weekly chart, that suppose downside acceleration. Everything mostly stands the same, but in the light of recent events, for me 3-Drive pattern down to 85K now looks more probable than reverse H&S, discussed last time.

EVen more, I'm not sure that market will reverse on 85K. Some reaction - maybe, but real reversal hardly likely...

Most Crypto Losses Are Self-Inflicted — Here’s How to Avoid ThemMost traders blame their crypto losses on volatility, market makers, or unexpected news.

That explanation feels safe — because it removes personal responsibility.

But after years of observing real trading behavior across different market cycles, one pattern stands out with brutal consistency:

Most losses in crypto are self-inflicted — not market-inflicted.

And that’s actually good news.

Because what you cause, you can also control.

The Market Is Neutral — Your Behavior Is Not

Crypto doesn’t hunt accounts.

It doesn’t care where you entered.

It doesn’t punish you personally.

Losses usually come from how traders react to price:

- Chasing momentum after late entries

- Panic-selling during healthy pullbacks

- Acting on fear instead of structure

- Forcing trades when the market offers no edge

Price only moves.

Your decisions determine the outcome.

Professionals don’t try to outsmart volatility — they learn to operate calmly within it.

Overtrading: The Most Expensive Habit Nobody Talks About

Many traders aren’t losing because their ideas are bad.

They’re losing because they trade too often.

Overtrading usually shows up as:

- Trading out of boredom

- Trading to recover a previous loss

- Trading every small fluctuation

- Trading without a fully defined setup

Every position carries risk.

More trades do not increase opportunity — they increase emotional exposure.

In professional trading, restraint is a skill, not a weakness.

If You Don’t Control Risk, the Market Will Do It for You

You can be directionally right and still lose money.

Self-inflicted losses often come from:

- Oversized positions

- Moving stop-losses under pressure

- Risking too much on a single idea

- Treating one trade as “the big one”

Professionals don’t think in individual trades.

They think in probability over time.

Their priority is simple:

- Capital preservation first

- Consistent execution second

- Profits as a byproduct

Survival always comes before growth.

Complex Charts Create Emotional Decisions

More indicators do not create better trades.

They often create conflicting signals.

Common mistakes:

- Indicator overload

- Strategy hopping

- Constant re-interpretation of the same chart

- Looking for certainty where none exists

Clear charts produce clear thinking.

Clear thinking reduces emotional damage.

Simplicity isn’t basic — it’s advanced.

Revenge Trading Turns Small Losses Into Big Ones

After a loss, the mind seeks relief — not logic.

That’s when traders:

- Increase position size

- Break their own rules

- Enter without confirmation

- Trade to “feel right” again

The market does not respond to frustration.

And it does not reward urgency.

Losses are part of the business.

Trying to erase them emotionally often compounds them financially.

The Hardest Skill in Trading: Doing Nothing

Some of the best trades are the ones you don’t take.

Not trading when:

- Structure is unclear

- Volatility is erratic

- You’re emotionally involved

- Your plan says “wait”

Doing nothing protects capital.

And capital protection is what allows long-term consistency.

How to Avoid Self-Inflicted Losses (A Practical Framework)

- Trade less, but with intention

- Risk small and consistently

- Follow one system until proven otherwise

- Accept losses quickly and emotionally neutral

- Never trade to fix a feeling

- Measure success by discipline, not outcome

Your job is not to win every trade.

Your job is to stay in the game long enough for probability to work.

Final Thought

Crypto is not dangerous because it’s unfair.

It’s dangerous because it exposes:

- impatience

- ego

- fear

- lack of structure

Once you stop fighting the market and start managing yourself, trading becomes clearer, calmer, and far more sustainable.

Most crypto losses are self-inflicted.

Recognize that — and you’ve already taken the first step to avoiding them.

💬 Do you believe psychology causes more losses than analysis in crypto trading?

Share your perspective below — let’s discuss.

TheGrove | GBPCAD buy | Idea Trading AnalysisGBPCAD broke through multiple resistance line and is now holding above the trendline and key level zone. The current pullback toward the marked support cluster suggests a potential continuation of the bullish move, provided price holds this structure.

GBP/CAD is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on Resistance level.

Hello Traders, here is the full analysis.

GOOD LUCK! Great BUY opportunity GBPCAD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

EURNZD Bullish Reversal Setup | Daily Head & Shoulders BreakoutEURNZD Bullish Reversal Setup | Daily Head & Shoulders Breakout

Market Structure Overview

EURNZD is forming a Head and Shoulders pattern on the Daily timeframe, indicating a potential trend reversal to the upside. Price is currently approaching the neckline resistance, and a confirmed breakout will open the door for strong bullish continuation.

Pattern & Technical Context

• Daily Head and Shoulders pattern forming

• Neckline acting as key resistance

• Breakout above resistance will confirm bullish reversal

On lower timeframes, momentum is shifting in favor of buyers.

Lower Timeframe Confirmation

• Bullish divergence developing on 1H and 4H timeframes

• Momentum weakening on pullbacks

• Indicates accumulation before higher timeframe breakout

Despite lower TF divergence, the main execution will be conditional on Daily breakout, not early entries.

Trade Plan (Pending Order – Conditional Buy)

Order Type: Buy Stop (on breakout confirmation)

Entry Price (EP): 1.98109

Stop Loss (SL): 1.95993

Take Profit Targets

TP 1: 2.00338

TP 2: 2.02626

TP 3: 2.04758

TP 4: 2.07015

Risk & Trade Management

• Trade activates only after daily resistance breakout

• Partial profits can be secured at each TP level

• Stop loss placed below structure to protect against false breakouts

Conclusion

EURNZD presents a high-quality bullish reversal setup. While 1H and 4H divergence signals early momentum shift, the primary confirmation remains the Daily neckline breakout. A clean break above resistance will validate the Head and Shoulders reversal and expose upside targets progressively toward 2.07015.

Wait for confirmation. Trade the breakout. Manage risk properly.

BITF | WeeklyNASDAQ:BITF — Quantum Model Projection

Bullish Alternative 📈

There has been no specific change since the prior BITF analysis. Following the advance in Minor Wave 1, the price has pulled back through Minor Wave 2, holding at the Q-Structure λ₂ along the divergent zone—setting the stage for an impulsive advance in Minor Extension Wave 3 of Intermediate (5) within the Primary Wave ⓷ uptrend.

The Q-Target ➤ $28.88 🎯 remains valid, with a probable timing window into mid-June.

🔖 This outlook is derived from insights within my Quantum Models framework. Within this methodology, Q-Targets represent high-probability scenarios generated by the confluence of equivalence lines. These Quantum Structures also serve as structural anchors, shaping the model's internal geometry and guiding the evolution of alternative paths as price action unfolds.

#CryptoStocks #CryptoMining #QuantumModels

Gold Is Breaking Higher — Next Move Depends on Pullback BehavesHello traders,

Gold has just delivered a strong impulsive expansion, lifting price decisively away from the prior consolidation and pushing the market toward new all time highs. The breakout was clean, vertical, and accompanied by clear follow-through a hallmark of initiative buying rather than short-term speculation. This confirms that the broader bullish structure remains firmly in control.

After such an aggressive push, the market is now entering a natural pause phase. This is not a signal of weakness. In strong trends, price rarely moves in a straight line. Instead, it often rotates or pulls back modestly to rebalance liquidity and allow momentum to reset. The projected retracement toward the five thousand one hundred ninety to five thousand one hundred seventy area aligns with prior structural interaction, making it a logical zone for buyers to reassess and defend.

As long as pullbacks remain corrective and contained above the highlighted support zone, the bullish thesis stays intact. Acceptance above this area would favor continuation toward the upper resistance and new ATH region around five thousand four hundred, where price discovery may temporarily slow again. This level should be viewed as a reaction zone, not a guaranteed destination.

Invalidation remains clearly defined. A decisive breakdown below the support zone would disrupt the current structure and shift focus toward a deeper consolidation or corrective phase. Until then, downside moves are best interpreted as part of a healthy trend digestion process.

Gold has already shown its hand. Now patience and structure will determine the next expansion.

Silver Is Digesting the Breakout — Continuation Depends Hello traders, Silver is currently trading near $114.60, following a strong impulsive advance that previously pushed price into all-time high territory. That expansion leg was sharp and initiative-driven, confirming that the broader bullish structure remains intact. Since then, price has transitioned into a controlled pullback and rotation phase, which is a typical response after vertical price discovery.

From a structural standpoint, the recent retracement remains corrective rather than impulsive. Price has pulled back toward the former breakout region around $112.60–$113.00, an area that now acts as a key technical reference. This zone represents short-term balance, where the market is reassessing participation rather than distributing aggressively.

Below current price, the highlighted demand zone around $104.80–$106.50 continues to serve as the major structural support. As long as silver holds above this area, downside moves should be viewed as part of a broader consolidation process, not a trend reversal. Buyers have previously defended this zone with conviction, and it remains the line that separates healthy digestion from structural failure.

On the upside, sustained acceptance above $116.00–$117.00 would signal that the consolidation phase has completed, opening the door for another expansion leg toward the $122.00–$124.00 region, where price may again pause due to profit-taking and liquidity interaction. These levels should be treated as reaction zones, not guaranteed targets.

Invalidation is clear and objective. A decisive breakdown below the $104.80–$106.50 demand zone would disrupt the current bullish structure and shift focus toward a deeper corrective phase.

For now, silver is not breaking down. it is digesting gains.

What could the growth in oil indicate?In the current market conditions (late January 2026) when oil prices have risen again, this increase is usually a sign of several important economic and political things:

🔥 1) Strong geopolitical tensions

News shows that oil prices have risen by more than 1.5% in the last few days, and this growth is due to increasing concerns about escalating tensions between the United States and Iran. The market is pricing in the fear of disruption to oil supply in the Middle East.

📌 When tensions rise in major producing countries such as Iran, the oil market makes future supply risk more expensive; this causes oil prices to rise even if current supply is sufficient.

🛢️ 2) Actual or potential supply risk

Analyses have pointed out that a political premium (additional cost) is added to the price of oil due to the risk of disruptions in oil production and exports from the Middle East region. This premium can add several dollars per barrel.

📉 3) Market fundamentals are different

Although in the medium term, official analyses (such as the EIA) say that global oil supply will outstrip demand in 2026 and should put downward pressure on prices, current geopolitical pressures have prevented a sharp decline in prices.

⭐ In short:

📌 The rise in oil prices now is more about political concerns and supply risk in the market than simply about the economy or increasing real demand.

📌 Investors see oil prices as a “risk-on” asset, and any bad political news can cause prices to rise.

📌 This growth is not necessarily a clear sign of a global economic boom, but rather a reflection of uncertainty and fears of supply disruptions.

Gold faces the 361.8% barrier at $5,608; continues to post higheThe relentless push higher in Gold continues with 8 daily all-time highs in succession.

Although we remain at overbought extremes in every time frame, dips continue to find buyers.

From a technical standpoint, we have a 361.8% Fibonacci target at $5,608. We have seen a stalling in bullish momentum overnight

Gold has broken out of the channel formation to the upside. Reverse trend line support is located at $5,360. Deeper support is located at $4,954, close to the psychological $5,000 big figure

Conclusion: we face a technical barrier at $5,608. With the safe haven product continuing to make higher highs and higher lows, the preferred stance is to buy into dips.

USD/JPY sits mid-range; rallies to be sold and dips to be boughtAlthough USD/JPY posted net daily gains yesterday, breaking the sequence of three negative performances, all price action was confined to Tuesday's range (152.09 to 154.88). This candle is known as an indecisive inside Harami.

The support is located at 151.03.

On the upside, we have resistance at 155.76. We also have the gap open at 155.73.

Conclusion: we are analysed as a trading mid-range. Look for dips to be bought, and rallies to be sold

GBP/JPY moves higher to close the 212.51 gap openCurrently trading within the BC leg of a Gartley formation.

This pattern will be completed on a move to 208.50. Bespoke support is located at 208.38.

On the upside, we have a gap open at 212.51. Further resistance is located at 214.04.

The Gartley pattern will be negated on a move through the previous swing high of 214.86

Conclusion: the immediate bias remains bullish with the gap open likely to be closed.

DXY – we have the completion of a bearish 5-wave count

DXY – we have the completion of a bearish 5-wave count. That should indicate that we see a correction to the upside. I have two support levels. 95.82 and 95.72. Resistance is currently located at 97.28. As long as the swing low remains intact, I remain bullish

I am totally bullish on gold till 6000As from last few weeks the gold is making fast and big moves in a single day of $200 or $300 and I took last time one trade from $5050 to $4240 and it made me $44000 in profit. Proofs are on my social media accounts with withdrawals. Now my suggestion to you all is do not sell gold because dollar is very week and Germany demanded it's all gold reserves from USA. When a country does not trust your system they will not do a business with you. Do not trust these fake news on social media they all are buyers and want to trick you thanks.

GER30 H4 | Bearish Reversal Off 61.8% Fib ResistanceBased on the H4 chart analysis, we can see that the price has rejected off our sell entry level at 24,979.14, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 25,258.58, which is a pullback resistance that aligns with the 78.6% Fibonacci retracement.

Our take profit is set at 24,453.48, which is an overlap support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

AUS200 H4 | Bullish Continuation SetupBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 8,850.90, which is a pullback support.

Our stop loss is set at 8,750.57, which is a pullback support.

Our take profit is set at 9,066.44, which aligns with the 161.8% Fibonacci extension.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

WULF | DailyNASDAQ:WULF — Bullish Alt. 📈 | Quantum Model

Under the 2nd alternative, Triangle Intermediate Wave (4) remains in progress, with a revised Minor Wave D now complete and Minor Wave E pulling back(~13%📉) toward Q-Structure λₛ , along the divergent zone.

🔖 This outlook is derived from insights within my Quantum Models framework.

#CryptoStocks #CryptoMining #QuantumModels

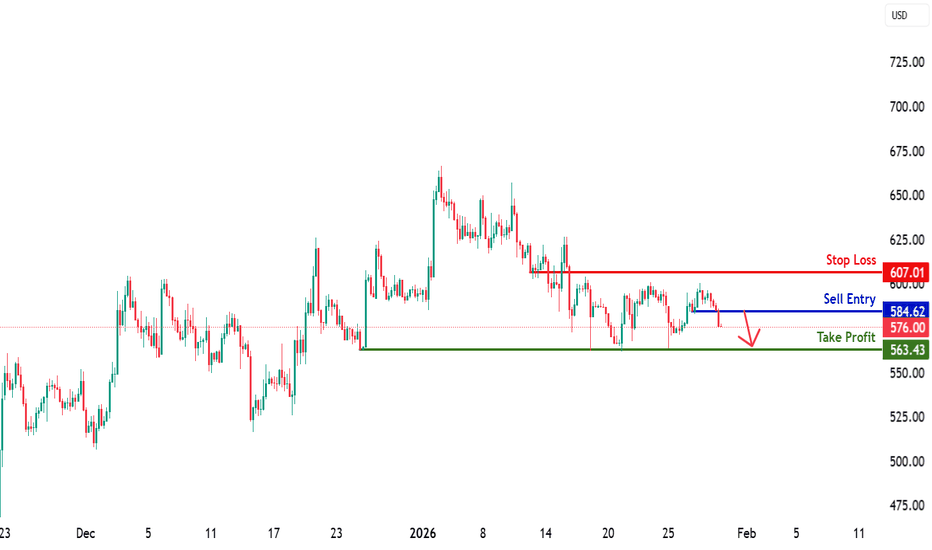

BCHUSD H4 | Bearish Drop OffThe price could rise to our sell entry level at 584.62, which is a pullback resistance.

Our stop loss is set at 607.01, which is a pullback resistance.

Our take profit is set at 563.43, which is a multi swing low support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Most Crypto Losses Are Self-Inflicted — Here’s How to Avoid ThemMost traders blame their crypto losses on volatility, market makers, or unexpected news.

That explanation feels safe — because it removes personal responsibility.

But after years of observing real trading behavior across different market cycles, one pattern stands out with brutal consistency:

Most losses in crypto are self-inflicted — not market-inflicted.

And that’s actually good news.

Because what you cause, you can also control.

The Market Is Neutral — Your Behavior Is Not

Crypto doesn’t hunt accounts.

It doesn’t care where you entered.

It doesn’t punish you personally.

Losses usually come from how traders react to price:

- Chasing momentum after late entries

- Panic-selling during healthy pullbacks

- Acting on fear instead of structure

- Forcing trades when the market offers no edge

Price only moves.

Your decisions determine the outcome.

Professionals don’t try to outsmart volatility — they learn to operate calmly within it.

Overtrading: The Most Expensive Habit Nobody Talks About

Many traders aren’t losing because their ideas are bad.

They’re losing because they trade too often.

Overtrading usually shows up as:

- Trading out of boredom

- Trading to recover a previous loss

- Trading every small fluctuation

- Trading without a fully defined setup

Every position carries risk.

More trades do not increase opportunity — they increase emotional exposure.

In professional trading, restraint is a skill, not a weakness.

If You Don’t Control Risk, the Market Will Do It for You

You can be directionally right and still lose money.

Self-inflicted losses often come from:

- Oversized positions

- Moving stop-losses under pressure

- Risking too much on a single idea

- Treating one trade as “the big one”

Professionals don’t think in individual trades.

They think in probability over time.

Their priority is simple:

- Capital preservation first

- Consistent execution second

- Profits as a byproduct

Survival always comes before growth.

Complex Charts Create Emotional Decisions

More indicators do not create better trades.

They often create conflicting signals.

Common mistakes:

- Indicator overload

- Strategy hopping

- Constant re-interpretation of the same chart

- Looking for certainty where none exists

Clear charts produce clear thinking.

Clear thinking reduces emotional damage.

Simplicity isn’t basic — it’s advanced.

Revenge Trading Turns Small Losses Into Big Ones

After a loss, the mind seeks relief — not logic.

That’s when traders:

- Increase position size

- Break their own rules

- Enter without confirmation

- Trade to “feel right” again

The market does not respond to frustration.

And it does not reward urgency.

Losses are part of the business.

Trying to erase them emotionally often compounds them financially.

The Hardest Skill in Trading: Doing Nothing

Some of the best trades are the ones you don’t take.

Not trading when:

- Structure is unclear

- Volatility is erratic

- You’re emotionally involved

- Your plan says “wait”

Doing nothing protects capital.

And capital protection is what allows long-term consistency.

How to Avoid Self-Inflicted Losses (A Practical Framework)

- Trade less, but with intention

- Risk small and consistently

- Follow one system until proven otherwise

- Accept losses quickly and emotionally neutral

- Never trade to fix a feeling

- Measure success by discipline, not outcome

Your job is not to win every trade.

Your job is to stay in the game long enough for probability to work.

Final Thought

Crypto is not dangerous because it’s unfair.

It’s dangerous because it exposes:

- impatience

- ego

- fear

- lack of structure

Once you stop fighting the market and start managing yourself, trading becomes clearer, calmer, and far more sustainable.

Most crypto losses are self-inflicted.

Recognize that — and you’ve already taken the first step to avoiding them.

💬 Do you believe psychology causes more losses than analysis in crypto trading?

Share your perspective below — let’s discuss.