Bullish momentum to extend?USD/JPY is falling towards the pivot, which is an overlap support, and could bounce to the 1st resistance.

Pivot: 154.41

1st Support: 151.03

1st Resistance: 160.23

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Harmonic Patterns

Bearish continuation setup?Lonnie (USD/CAD) could make a short-term pullback to the pivot and could reverse to the 1st support.

Pivot: 1.3733

1st Support: 1.34566

1st Resistance: 1.3908

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reversal off 61.8% Fibonacci resistance?The Kiwi (NZD/USD) is reacting off the pivot, which acts as an overlap resistance that aligns with the 61.8% Fibonacci retracement and could reverse to the 1st support.

Pivot: 0.5843

1st Support: 0.5675

1st Resistance: 0.5998

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish continuation?Fiber (EUR/USD) is falling towards the pivot, which is an overlap support, and could bounce to the 1st resistance, which acts as a multi-swing high resistance.

Pivot: 1.1687

1st Support: 1.1550

1st Resistance: 1.1807

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Potential bearish drop?The US Dollar index (DXY) is rising towards the pivot, which is an overlap resistance, and could drop to 1st support.

Pivot: 98.53

1st Support: 97.18

1st Resistance: 99.22

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

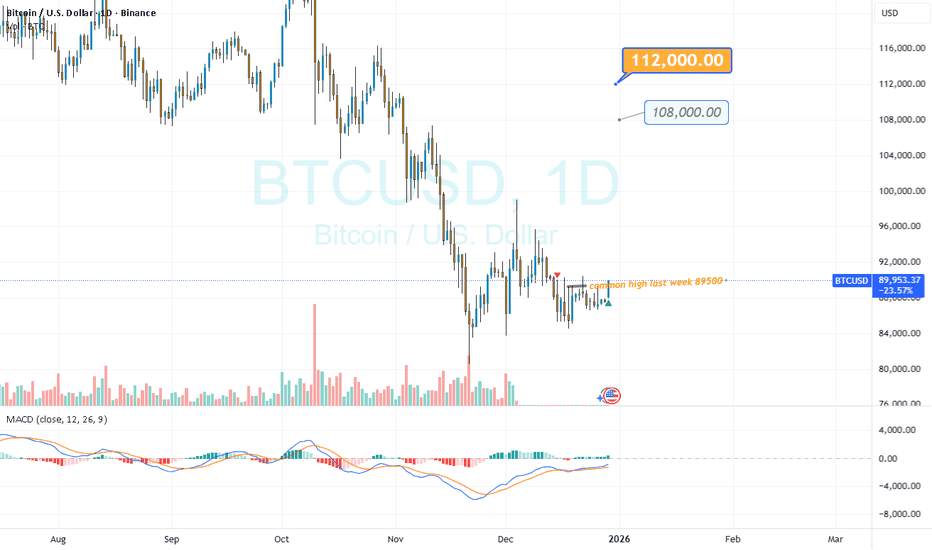

BTC | 4HCRYPTOCAP:BTC — Quantum Model

4H Zoom-In | Advance Projection

As anticipated, BTC has entered the projected advance range with an initiating impulsive move. The price has broken out of the resistance Q-structure through the divergent zone — reaching the origin of the Ending Diagonal ⓒ ➤ $93,558.29 would strongly confirm the projected Primary-degree trend reversal.

🔖 This potential reversal structure has been projected since Nov. 15 during the BTC decline.

🔖 This outlook is derived from insights within my Quantum Models framework.

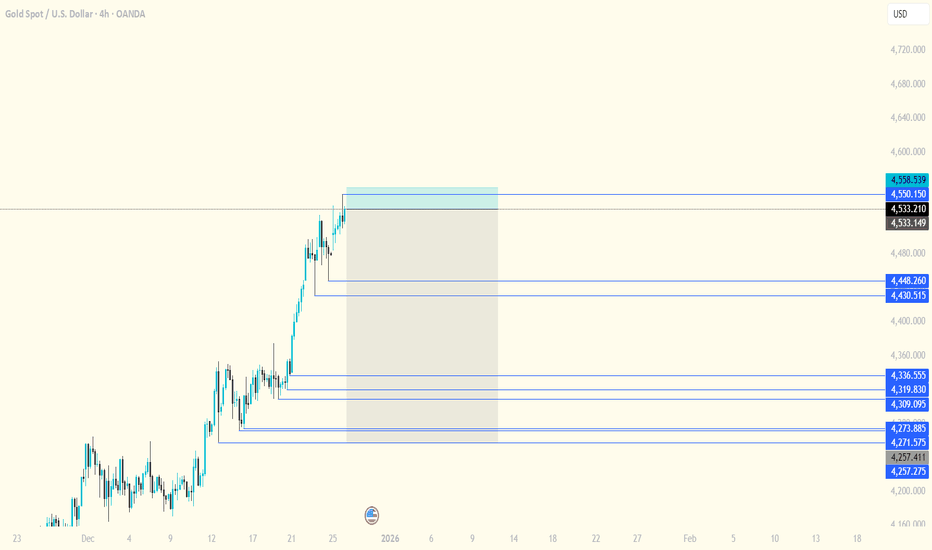

Gold gearing up for another liftoff?The uptrend in gold is approaching a decisive moment, where both headlines and price behavior are highly sensitive. On the 2H timeframe, price continues to respect the rising structure that has been in play since mid-December, and the 4,500 USD/oz zone remains well-defended, with swift buying reactions each time price dips back into the area.

On the fundamental side, gold is supported by expectations of Fed rate cuts, along with ongoing safe-haven flows fueled by persistent geopolitical uncertainty. Thin liquidity near year-end may further amplify moves in the direction of the dominant bias — and for now, that bias still leans bullish.

A reasonable short-term scenario is to wait for price to revisit the 4,495 – 4,510 region for safer long entries, targeting nearby levels around 4,555 USD and 4,600 USD. Risk protection should ideally sit below 4,470 USD, guarding against deeper pullbacks.

Gold isn’t rising because the chart “looks good” — it’s rising because the market needs it. The next 24 hours may bring volatility, but as long as 4,500 holds firm, a fresh upside impulse could emerge — a move that rewards the patient.

PEPE/USDT - Break the Trendline or Continue Lower?Structurally, PEPE is still in a bearish trend after a strong rejection from its previous high area. Price continues to move below a descending trendline, which acts as a major dynamic resistance. Each approach toward this trendline has resulted in rejection, confirming that selling pressure remains dominant.

At the current level, price is attempting to form a base (consolidation), but no valid trend reversal has been confirmed yet.

---

📐 Pattern Analysis (Detailed Explanation)

🔻 Descending Trendline (Downtrend Structure)

The yellow diagonal line represents consistent lower highs

This structure confirms a clear downtrend

A break above the trendline would indicate a potential trend shift

📊 Bearish Continuation Structure

After a sharp drop, price moves sideways with a bearish bias

This often represents a distribution or continuation phase

Without a breakout, the probability favors further downside

---

📉 Resistance Zones (Supply Areas)

Key resistance levels marked by yellow dashed lines:

0.00000495

0.00000550

0.00000650

0.00000735

0.00001025

These levels previously acted as strong reaction zones and may cause price rejection if retested.

---

🟢 Bullish Scenario (If Breakout Occurs)

Bullish momentum is only valid if:

1. Price breaks and closes above the descending trendline on the daily timeframe

2. The breakout is supported by increasing volume

Bullish Targets (Step by Step):

🎯 0.00000495 (nearest resistance)

🎯 0.00000550

🎯 0.00000650

🎯 0.00000735

🎯 0.00001025 (optimistic target with strong momentum)

📌 As long as price remains below the trendline, any upside move should be considered a relief rally, not a trend reversal.

---

🔴 Bearish Scenario (Primary Bias)

If price:

Fails to break the descending trendline, or

Breaks down below current support

Bearish Targets:

🔻 Retest of 0.00000360

🔻 Previous low around 0.00000278

A breakdown below this level may open room for further downside continuation

📌 The lower-high & lower-low structure remains intact → bearish trend is still active.

---

🧠 Conclusion

Primary trend: Bearish

Price remains below the descending trendline

Bullish bias only becomes valid after a confirmed daily breakout

Until then, the best approach is wait and react, not predict

#PEPEUSDT #PEPE #CryptoAnalysis #CryptoTrading #TradingView #Downtrend #BearishMarket #Altcoin #MemeCoin #SupportResistance #Trendline #PriceAction #DailyChart #Breakout #TechnicalAnalysis

BTC & Others. Thoughts..

Hi,

For leverage traders

Reasonable expectation & positions.

My POV.

Per Asset

BTC 1300-1500$

XRP 0.02-0.05$

Gold 15-25$

You can do it differently. ( All accounts are in your hands, so are your profits and losses )

So letme explain (not for gurus yeah)

You see.. everyday. There are volatility, buy sell, low high.

There are ranges, varies to asset.

Assuming you know your thing,

That it's going to be a good 2-3day for X specific target. But you stopped out.

Your position size is wrong OR your stop too near (unreasonable)

You can verify it yourself.

You can have a good guru. But you always hit SL.

Change this. You might get a better results coz you have got the direction right( in the first place).

I used to do these stupid thing. Right direction, hit my stop and it moves.. all the way to initial plan direction.

You are better, it's a matter of adjustment and realization.

I don't teach. Sometimes someone out there, needs some pointers; from the obvious.

Hope this gives you some relief, that you are not at wrong. Just tweaking.

If hit SL, you are satisfied, because it's not supposed to do abnormal(to you). E.g move against you 2000 points on BTC.

Go go 2026

All the best

Not a guru

nb/ and MM

COW/USDT — This Demand Zone Could Decide the Next Move?📐 Pattern Analysis (Detailed Explanation)

🔻 1. Descending Trendline (Major Resistance)

The downward-sloping yellow line shows consistent selling pressure

Every upward move has been capped → Lower Highs

This trendline acts as a dynamic key resistance

👉 A break above the trendline = early signal of trend change

---

🟨 2. Strong Demand Zone (0.22 – 0.19)

This area has:

Repeatedly held price from further decline

Triggered strong bullish reactions in the past

Indicates buyer accumulation (smart money area)

👉 As long as price holds above 0.19, reversal potential remains valid

---

🔄 3. Price Structure

Previous structure: Lower Highs + Lower Lows (Bearish)

Current structure: Base formation / ranging phase

This suggests:

Selling pressure is weakening

Buyers are gradually absorbing supply

---

🟢 Bullish Scenario (Reversal / Breakout)

Bullish Confirmation Requirements:

1. Price holds above 0.22

2. Strong breakout and close above the descending trendline

3. Ideally supported by increasing volume

Upside Targets:

🎯 0.267

🎯 0.325

🎯 0.367

🎯 0.458 (Major Resistance)

📌 A valid breakout may shift the market from bearish into bullish continuation.

---

🔴 Bearish Scenario (Support Breakdown)

Bearish Conditions:

1. Daily / 2D close below 0.19

2. Failure of the demand zone

3. No significant bullish reaction from buyers

Downside Targets:

📉 0.16

📉 0.13 (Previous low / extreme support)

📌 A breakdown below the demand zone signals bearish continuation and invalidates the reversal setup.

---

🧠 Technical Conclusion

COW/USDT is currently at a key decision-making zone

Best risk–reward lies within the demand zone (0.22–0.19)

Trendline breakout → early bullish signal

Demand breakdown → bearish continuation

⚠️ Wait for candle confirmation and volume validation before entering.

---

#COWUSDT #CryptoAnalysis #TechnicalAnalysis #Altcoin #DescendingTrendline #DemandZone #SupportResistance #PriceAction

SUI/USDT - Breakouts! Is This the Start of a Trend Reversal?On the 12-hour timeframe, SUI/USDT has successfully broken above the descending resistance trendline that had capped price action since October. This breakout indicates weakening selling pressure and opens the door for a trend transition from bearish toward early bullish conditions.

Price is currently trading around 1.48 USDT, hovering near the former trendline area, suggesting a post-breakout consolidation / retest phase.

---

Pattern Explanation

The dominant technical structure now is:

Descending Trendline Breakout (Potential Trend Reversal)

The long-term descending trendline has been decisively broken

Bearish lower-high structure is losing control

Sideways movement above the trendline suggests a successful retest attempt

Technically, this pattern often marks the early stage of a trend reversal, as long as price holds above the breakout zone.

---

Key Levels

Support (Post-Breakout):

1.45 – 1.48 USDT → Critical breakout retest zone

1.35 USDT → Invalidation level

Resistance / Upside Targets:

1.65 – 1.72 USDT → Nearest resistance

1.96 USDT → Strong supply zone

2.05 – 2.37 USDT → Major resistance area

2.70 USDT → Extended bullish target if reversal fully develops

---

Bullish Scenario (Primary Scenario)

The bullish case becomes the primary scenario if:

1. Price holds above the 1.45 – 1.48 USDT support zone

2. The former trendline acts as new support

3. Bullish continuation candles appear

Bullish Targets:

TP1: 1.65 USDT

TP2: 1.72 USDT

TP3: 1.96 USDT

TP4: 2.05 – 2.37 USDT

---

Bearish Scenario (Invalidation Scenario)

The bearish scenario only applies if:

1. Price falls back below the broken trendline

2. A strong close occurs below 1.35 USDT

Bearish Targets:

1.23 USDT

Lower supports if selling pressure accelerates

As long as price remains above the breakout area, bearish continuation is not favored.

---

Conclusion

The breakout above the descending trendline on SUI/USDT represents a potential early trend reversal signal. The key focus now is whether price can defend the breakout zone as support.

➡️ Holding above support = bullish continuation

➡️ Break back below = false breakout

This is a critical decision zone for the next directional move.

---

#SUIUSDT #SUIBreakout #TrendReversal #CryptoAnalysis #TechnicalAnalysis #Altcoin #SupportResistance #CryptoTrading

XLM/USDT Waiting for Confirmation: Fake Bounce or Trend ReversalXLM/USDT on the 8-hour timeframe is still trading under a clear bearish trend. Price continues to form lower highs and lower lows, confirming strong selling pressure. However, recent price action shows consolidation near the lower range, which could act as a short-term reaction zone.

---

Pattern Explanation

The chart highlights the following key patterns:

1. Descending Trendline (Major Dynamic Resistance)

The yellow descending trendline acts as the main dynamic resistance

Price has been repeatedly rejected from this level

As long as price remains below this trendline, the overall bias stays bearish

2. Bearish Continuation Structure

Market structure remains intact with consistent lower highs

Any upward move so far appears corrective rather than a true reversal

This suggests the market is still in a distribution phase

---

Key Levels

Resistance Levels:

0.2370 – minor resistance / short-term reaction area

0.2600 – key resistance from previous breakdown

0.3000 – 0.3300 – strong supply zone

0.3500 – major resistance

Support Levels:

0.2230 – 0.2150 – current consolidation and local support

0.2030 – 0.1950 – strong support zone if further breakdown occurs

---

Bullish Scenario

The bullish scenario becomes valid if:

Price breaks and closes decisively above the descending trendline

Followed by a confirmed close above 0.2370

Ideally supported by increasing volume

Bullish Targets:

0.2600

0.3000

0.3300

A successful breakout would signal bearish structure invalidation and open the door for a medium-term trend reversal.

---

Bearish Scenario

The bearish scenario remains dominant if:

Price fails to break the descending trendline

Rejection occurs around the 0.2370 – trendline area

Price breaks below 0.2150 support

Bearish Targets:

0.2030

0.1950

This would confirm a bearish continuation toward lower demand zones.

---

Conclusion

XLM/USDT remains under strong bearish control, with the descending trendline acting as a critical level. Until a confirmed breakout occurs, price is more likely to continue its downtrend or consolidate. Traders should stay patient and wait for clear confirmation before taking positions.

---

#XLMUSDT #Stellar #CryptoAnalysis #TechnicalAnalysis #Downtrend #BearishMarket #Altcoins #CryptoTrading #MarketStructure #SupportResistance #Trendline

BTC | 4HCRYPTOCAP:BTC — Quantum Model

4H Zoom-In | Advance Projection

Price is currently compressed within a tight range between key support and resistance Q-Structures, holding above the supportive confluence zone.

It remains consolidated along the edge of the resistance Q-Structure, within its divergent zone.

The overall structure signals a potential for a projected advance, specifically a Minute-degree impulsive 3rd wave within Minor Wave 3, provided the price sustains acceptance above the resistance Q-structure and successfully breaks out of the divergent zone.

🔖 This outlook is derived from insights within my Quantum Models framework.

🔖 This potential reversal structure has been projected since Nov. 15 during the BTC decline.

Today's Trading Strategy: Buy on DipsToday's Trading Strategy: Buy on Dips

Gold is seeking a breakout above $4550 and could potentially reach new highs. Be patient and wait for a pullback before the upward move begins.

Currently, we can see gold forming an ascending triangle pattern, facing resistance around $4550.

The Asian trading session may remain strong.

Current Key Support Levels: $4510/$4480

Current Resistance Level: $4550

Reviewing our article before Christmas, you can clearly see that I accurately predicted gold would reach new highs.

Gold experienced a short squeeze before Christmas.

Today is the first week after the holidays, and gold is highly likely to continue its upward trend. However, the risk of a pullback has also increased.

This is a conclusion drawn from over ten years of experience.

This is also the basis for our consistent profitability.

Over the past three months, our win rate has been as high as 85%, with profits exceeding $50,000 per lot. My channel will continue to provide 1-2 high-quality trading signals for free.

Thank you for the increasing number of people following my trading.

I. Today's News Impact Analysis (December 29th)

Today's market focus is on two important news items:

1. Policy: The Chicago Mercantile Exchange Group (CME Group) raised margin requirements for gold futures trading after the market closed today. Higher margin requirements will directly increase trading costs, potentially dampening speculative bullish sentiment and forcing some leveraged traders to reduce their positions. This is a risk management measure at the exchange level.

2. Geopolitics: The phone call between the leaders of Russia and Ukraine, and the meeting between the leaders of the United States and Ukraine, indicate progress in peace negotiations. Easing geopolitical tensions will weaken market risk aversion, putting short-term pressure on gold prices.

Overall Impact Assessment: Today, the market faces significant short-term headwinds (margin increases) and negative news (easing geopolitical risks). This explains the volatility in gold prices after reaching record highs. The market may need time to digest this news, and short-term volatility may intensify.

My personal view: Gold prices may initially fall before rising this week, potentially reaching a high of $4600, but may first pull back to the support level of $4470-$4500.

I recommend buying on dips. Key intraday price levels:

Resistance: Near the historical high of $4550 and the psychological level of $4600.

Support: First, pay attention to the psychological level of $4500, with stronger support in the $4470-$4500 area.

Two trading strategies:

Cautious chasing the rally, wait for a pullback: Given the overbought short-term technical indicators and the negative impact of increased margin calls, chasing the rally carries significant risk. A more prudent strategy is to wait for the price to pull back to key support areas (e.g., around $4500 or $4470), confirm stabilization, and then consider establishing long positions, with the target of a new high.

Managing the risk of a short-term pullback: If the price fails to hold above $4550 and falls below $4500 on the same day, it may further test support levels. Traders should be wary of a technical sell-off that could be triggered by increased margin requirements.

Silver Bells, Silver Bells, Silver all the way...Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Dashing through the snow

"In a One Horse" open sleigh

Over the hills we go

Laughing all the way

Bells on Bobtails ring

Making spirits bright

What fun it is to ride and sing

A Silver song tonight...

Happy Silver New Year!

The Boredom Stage of Trading - Why Most Traders Quit HereGood morning, all, thank you all for coming today.

Today we will be looking into the “ Boredom ” Phase of trading, and why most new traders quit because of it. Lets begin.

What Is the Boredom stage during Trading?

Boredom in trading is the stage where the excitement goes away, but the results have not arrived yet.

You are no longer a beginner filled with hype, joy and excitement.

You are aware of, and understand the basics, you have a strategy, and you know what you should be doing.

Yet progress feels slow , repetitive , and unrewarding .

There are less trades, fewer emotional highs, and long stages of patiently waiting.

This is where trading begins to feel boring , and for many traders, boredom feels like failure, it feels like they are failing since they are not “ doing anything. ”

This phase is not a sign you are doing something wrong it is a sign you are doing something right .

How the Boredom stage Affects Traders

Boredom secretly ruins traders because it does not feel dangerous.

During this period, traders will often:

• Start forcing trades just to feel active or “ alive ” like they are doing something.

• Break rules out of impatience ( breaking their own system )

• Abandon strategies that are working ( same as above )

• Chase excitement instead of probability ( they seek the 100x return )

• Confuse “ no trades ” with “ no progress ” ( If you follow your system and wait, you are making progress )

The market rewards patience, but boredom pushes traders toward action.

This creates losses, frustration, and eventually self-doubt. ( Which no one wants )

Many traders do not fail because they lack knowledge or skill. They fail because they cannot tolerate stillness. ( They psychology weakens when they face boredom. )

Why the stage Phase Occurs

The boredom phase takes place when trading becomes process-driven instead of emotion-driven. ( It becomes mechanical )

Early trading is exciting because:

• Everything feels new

• Wins feel euphoric

• Losses feel catastrophic

• The market feels fast and you feel uncertain

• You are eager to learn more

As you improve, your trading becomes:

• More selective and tight

• More rule-based and systematic like

• Slower and quieter ( calm )

• Less emotionally stimulating

This shift removes chaos, but it also removes excitement.

The market hasn’t changed.

You have.

And most people mistake this emotional flatline as a sign that something is missing.

( This is where “ The market rewards patience ” comes in. The market rewards those who wait. )

How to Overcome the Boredom stage

The key to overcoming boredom is understanding that trading is not meant to entertain you. ( It is just like a 9-5, you must follow rules, a system. Just in your own routine. )

Practical ways to handle this phase:

• Reduce screen time once your plan is complete. ( Do not over trade )

• Focus on execution quality, not trade quantity. ( Quality over quantity )

• Track rule-following instead of PnL. ( Did you follow your system? )

• Journal boredom-triggered decisions. ( Losses from impatience? )

• Accept that waiting is part of the job. ( Strengthen your mind by waiting. )

Professionals do not trade more and when they are bored, they trade less.

The goal is not to feel engaged and hyped up.

The goal is to remain consistent and disciplined.

Why the Boredom stage Is a Filter, not a Problem

The boredom stage exists to separate traders who want excitement from traders who want results. ( Splits Gamblers from Real Traders )

Most people quit and give up here because:

• There is no longer any dopamine .

• Progress feels slow, painful or invisible.

• Social media makes others look “ active ” when it is actually not.

• Patience feels unproductive since the mind is sitting “ idle .”

But this stage is where real traders are built.

If you can:

• Follow rules without excitement. ( Follow your system )

• Sit through days with no trades. ( Accept the process of waiting )

• Trust your edge without constant validation. ( Ensure to backtest to prove this. )

• Stay disciplined when nothing happens. ( Do not give in to FOMO. )

You have already passed a major psychological barrier.

The boredom phase is not a dead end it is a gateway that sits at the end of a long run.

Those who quit here were never meant to last.

Those who stay quietly move closer to consistency and mental freedom.

Final Thoughts

Every profitable trader has survived the boredom phase.

Most failed traders quit during it because of weak psychology.

If trading feels boring, repetitive, and uneventful, that is good.

That means emotions are leaving and structure is taking its place.

The market does not reward excitement.

It rewards endurance, patience, discipline, consistency and proper risk management.

btcusd bitcoin bounce to 100k then down all year long to 50kBear Market Phase (Throughout 2026):

Bitcoin is expected to enter a prolonged bear market lasting the entire year of 2026, resulting in a significant decline to around $50,000 or potentially even lower by Christmas 2026.

Dead Cat Bounces: Multiple short-term recoveries (dead cat bounces) are anticipated during this period.

The next one is projected around mid-February 2026, coinciding with the start of Chinese New Year, potentially pushing the price up to approximately $100,000 temporarily.

As of simlirat to late 2022 the next lower high, occurring sometime in April or May 2026.

Consolidation and Decline will follow and Bitcoin is expected to trade in a choppy range between $80,000 and $60,000 for much of the year, culminating in a final capitulation event a sharp downward candle that drives the price down to $50,000 by the end of 2026.

Next Bull Cycle a major 10x bull run is to begin 2027 potentially reaching $500,000 by mid-2029, following the next Bitcoin halving event in 2028.

Bitcoin: Downtrend Structure and Key Acceptance ZoneBitcoin remains in a short-term downtrend, with a clear sequence of lower highs and lower lows. This trend is highlighted by the descending channel.

The latest move within this structure is corrective, forming a compression/triangle that has already reached resistance. While a trend break is possible, current price behavior still favors continuation rather than reversal.

From a volume profile perspective, the 82,000–71,000 range represents a low-activity zone where price barely traded in the past. Such areas typically act as zones where the market seeks to build acceptance and accumulation.

For this reason, the higher-probability outcome remains another impulsive leg to the downside.

The key level is 82,000, which marks the origin of the last impulse within the corrective structure of the downtrend (FRL context). A sustained acceptance below this level would confirm continuation.

Until then, downside remains conditional, not confirmed.

Canadian Dollar vs. US Dollar. The Spring is CompressingIn previous posts, we have already begun to look at the key drivers of the US outperformance over the past decade.

The US market dominance has been largely driven by the rapid rise of tech giants (such as Apple, Microsoft, Amazon and Alphabet), which have benefited from strong profit growth, global market reach and significant investor inflows.

Unsatisfactory International Performance

Markets outside the US have faced headwinds including multiple stifling sanctions and tariffs, slowing economic growth, political uncertainty (especially in Europe), a stronger US dollar and the declining influence of high-growth tech sectors.

The Valuation Gap. By 2025, US equities will be considered relatively expensive compared to their international peers, which may offer more attractive valuations in the future.

Recent Shifts (2025 Trend)

Since early 2025, international equities have begun to outperform the S&P 500, and European and Asian equities have regained investor interest. Global market currencies are also widely dominated by the US dollar.

Factors include optimism around the following three big themes.

DE-DOLLARIZATION. DE-AMERICANIZATION. DIVERSIFICATION.

De-dollarization is the process by which countries reduce their reliance on the US dollar (USD) as the world's dominant reserve currency, medium of exchange, and unit of account in international trade and finance. This trend implies a shift away from the central role of the US dollar in global economic transactions to alternative currencies, assets, or financial systems.

Historical context and significance of the US dollar

The US dollar became the world's primary reserve currency after World War II, as enshrined in the Bretton Woods Agreement of 1944. This system pegged other currencies to the dollar, which was convertible into gold, making the dollar the backbone of international finance. The United States became the world's leading economic power, and the dollar replaced the British pound sterling as the dominant currency for global trade and reserves.

The dollar has been the most widely held reserve currency for decades. As of the end of 2024, it still accounts for about 57% of global foreign exchange reserves, far more than the euro (20%) and the Japanese yen (6%). However, this share has fallen from over 70% in 2001, signaling a gradual shift and prompting discussions about de-dollarization.

How De-Dollarization Works

Countries looking to reduce their reliance on the dollar are pursuing several strategies:

Diversifying reserves: Central banks are holding fewer U.S. dollars and increasing their holdings of other currencies, such as the euro, yen, British pound, or new alternatives such as the Chinese yuan. While the yuan's share remains small (about 2.2%), it has grown, especially among countries like Russia.

Using alternative currencies in trade: Countries are entering into bilateral or regional agreements to conduct trade in their own currencies rather than using the dollar as an intermediary. For example, China has introduced yuan-denominated oil futures (the "petroyuan") to challenge the petrodollar system.

Increasing gold reserves: Many countries, including China, Russia and India, have significantly increased their purchases of gold as a safer reserve asset, reducing their dollar holdings.

Developing alternative financial systems: Some countries and blocs, such as BRICS, are working to develop alternatives to the US-dominated SWIFT payment system to avoid the risk of sanctions and gain true economic and political independence.

Reasons for de-dollarization

The move towards de-dollarization is driven by geopolitical and economic factors:

Backlash against US economic hegemony: The US often uses dollar dominance to impose sanctions and exert political pressure, encouraging countries to seek financial sovereignty.

Rise of new economic powers: Emerging economies like China and groups like the BRICS are seeking to reduce their vulnerability to U.S. influence and promote regional integration and alternative financial infrastructures.

Geopolitical tensions: Conflicts like the war in Ukraine have intensified efforts by countries like Russia to remove the dollar from their reserves to avoid sanctions.

Implications and outlook

While the dollar remains dominant, a more de-dollarized world is already changing global economic power. The U.S. may lose some advantages, such as lower borrowing costs and geopolitical influence. For the U.S. economy, de-dollarization could lead to a weaker currency, higher interest rates, and reduced foreign investment, although some effects, such as inflation from a weaker dollar, could belimited .

For other countries, de-dollarization could mean greater economic independence and less exposure to U.S. policy risks. However, no currency currently matches the dollar’s liquidity, stability, and global recognition, so a full transition is unlikely in the near future .

Summary

De-dollarization is a complex, ongoing process that reflects a gradual shift away from the global dominance of the U.S. dollar. It involves diversifying reserves, using alternative currencies and assets, and creating new financial systems to reduce dependence on the dollar.

Driven by geopolitical tensions and the rise of emerging economic powers, de-dollarization challenges the entrenched role of the dollar but is unlikely to completely replace it anytime soon.

Instead, it is leading to a more multipolar monetary system in international finance, increasing demand for alternative investments to the U.S.

Technical task

The main technical chart is presented in a quarterly breakdown, reflecting the dynamics of the Canadian dollar against the US dollar

CADUSD in the long term.

With the continued positive momentum of the relative strength indicator RSI(14), flat support near the level of 0.70 and a decreasing resistance level (descending top/ flat bottom) in case of a breakout represent the possibility of price growth to 0.80, with the prospect of parity in the currency pair and strengthening of the Canadian dollar to all-time highs, in the horizon of the next five years.

--

Best wishes,

Your Beloved @PandorraResearch Team 😎

BITCOIN: Major Wyckoff Distribution Ongoing, Look for the Signs.Hello There,

the bitcoin price in the recent weeks has been very volatile, increasing crucial bearish price actions. Following these dynamics, I have spotted important signs that reveal in what state the bitcoin price currently is. These signs are important hints on where the price action is likely to move within the upcoming times. Also fundamentally, these dynamics are supported by major events and underlying market sentiments.

When analyzing the bitcoin dynamic, I am also looking at historical developments and how the price action moved. Therefore, a smart trader can spot these patterns over time and position oneself appropriately in the market. Connecting the dots to the current state of the market, I have spotted a crucial underlying pattern, which is called Wyckoff distribution. This type of pattern is an almost sure sign that the market is undergoing a trend-changing bearish reversal.

Considering the volatile price action here, bitcoin just dumped massively since testing the $123,000 level. From there on, massive bearish developments pushed the price below the $85,000 mark. This is also an important sentiment for the market. Because below the $100,000 price level is now a huge resistance. With round numbers always being massive resistance levels.

This crucial resistance of $100,000 was also confirmed since the Preliminary Supply (PSY) and Buying Climax (BC) the bitcoin price formed earlier. As this resistance was confirmed several times, there is a high likelihood that it will hold in the near future as well. With further inflection points such as the major descending resistance, the major upper resistance angle is formed.

As Wyckoff distributions move in several stages till a much more pronounced bearish move pushes the price far below established supports, bitcoin is already in the later stages of this distribution cycle. With rising short open interest, this will give fuel to unfold a main bearish price action towards lower levels. The Wyckoff distribution for Bitcoin consists of the following completed, ongoing, and upcoming parts/phases.

Phase A:

The bitcoin prior uptrend has stopped, which was a hint towards a reversal likely to happen.

Preliminary Supply (PSY): First evidence of supply entered the market with bitcoin short volume increasing.

Buying Climax (BC): An abnormal move into bullish spheres, which can’t go on forever, signals that the trend is likely to reverse.

Secondary Test (ST): This is very crucial for Bitcoin in this dynamic, as Bitcoin did not establish substantially higher highs; the price was rejected from the local levels. Marking the phase B in the distribution with clear signs of weak hands pushed out of the market.

Phase B

UT in Phase B: The upthrust above previous resistance levels marks a last try for Bitcoin to form significant higher highs. This did not happen, and Bitcoin pulled back again into the range. It is the most critical bearish sign here.

Phase C

In the next phase, C, several Last Points of Supply (LPSY) will be expected. We see a lot of bearish pressure in the market as whales throw their bitcoin into the market. Bearish volume increases. Short increases. All these bearish signs support the last points of supply. A final push below the support is determined by a Sign of Weakness (SOW), which shows that the market is likely to continue in the bearish direction.

In any case, the bearishness of this whole constellation should not be underestimated. As it is unlikely that this level holds and Bitcoin has the ability to continue to form new highs, a major bear market is likely to enter. Once the Wyckoff distribution pattern is completed, the bear market will unfold in its full determination.

Therefore, thank you very much for watching.