Hedge Against Inflation in the Global Market1. Gold: The Timeless Inflation Hedge

Gold has historically been one of the most reliable hedges against inflation. Its value tends to rise when paper currencies lose value, making it a safe haven during times of economic uncertainty.

Why gold works: Gold is a tangible asset that isn’t tied to the performance of any single currency or government policy. When inflation increases, investors often flock to gold as a store of value, pushing prices higher.

Global impact: Central banks around the world—especially in emerging economies—have increased their gold reserves to protect against currency volatility and inflation in the dollar-dominated global trade system.

Forms of investment: Investors can choose physical gold (bars, coins), gold ETFs, gold mining stocks, or gold mutual funds. Each offers different liquidity and risk profiles.

However, gold doesn’t generate income like dividends or interest, so it’s best used as part of a diversified inflation hedge strategy rather than the sole protection.

2. Real Estate: Tangible Asset with Rising Value

Real estate is another traditional inflation hedge because property values and rents tend to rise when the cost of living increases.

Why it works: Inflation pushes up the cost of construction materials and labor, leading to higher property prices. Meanwhile, landlords can increase rent, which enhances returns.

Global examples: Real estate in countries with growing urbanization—such as India, Indonesia, and Brazil—often outpaces inflation. In developed markets like the U.S. and Europe, real estate investment trusts (REITs) offer investors exposure to property markets without owning physical property.

Best strategies: Diversify across sectors—residential, commercial, and industrial properties—and across regions to minimize local market risks.

However, real estate can be illiquid, and property taxes or maintenance costs may rise with inflation, so it’s essential to balance exposure carefully.

3. Commodities: Riding the Price Surge

Commodities such as oil, natural gas, agricultural products, and metals are directly linked to inflation because they form the foundation of production and consumption costs globally.

How they hedge: When inflation rises, commodity prices often surge due to increased demand or reduced supply. Investing in commodities allows investors to benefit from this upward price pressure.

Investment methods: Commodity futures, ETFs, and mutual funds offer exposure without the need for physical ownership.

Global relevance: The Russia-Ukraine war highlighted how energy and food prices can spike globally, influencing inflation everywhere—from Europe’s energy bills to Asia’s food markets.

Yet commodities can be volatile, influenced by weather, political instability, and global trade dynamics, so they are best used as part of a diversified inflation-protection portfolio.

4. Inflation-Protected Bonds (TIPS and Global Equivalents)

Governments issue inflation-linked bonds to protect investors’ purchasing power. In the U.S., these are known as Treasury Inflation-Protected Securities (TIPS). Other countries have similar instruments, such as the UK’s Index-Linked Gilts or India’s Inflation-Indexed Bonds.

How they work: The principal value of these bonds adjusts according to inflation, measured by a consumer price index (CPI). Interest payments are based on the adjusted principal, preserving real returns.

Benefits: They provide stable, government-backed protection against inflation with predictable income streams.

Limitations: They may underperform in deflationary periods or when interest rates rise sharply.

For globally diversified investors, combining TIPS with foreign inflation-linked bonds can smooth out regional inflation differences.

5. Equities: Long-Term Growth Against Inflation

Stocks, especially in sectors that can pass on rising costs to consumers, can also serve as an effective inflation hedge.

Why equities help: Over the long term, companies that maintain profitability and pricing power can outpace inflation.

Best-performing sectors: Energy, consumer staples, healthcare, and industrials tend to perform well in inflationary periods.

Global exposure: International diversification—investing in both developed and emerging markets—can protect against regional inflation and currency depreciation.

However, short-term market volatility can be significant during inflation spikes, so equities are most effective for investors with a long-term perspective.

6. Cryptocurrencies: The New-Age Hedge?

Digital currencies like Bitcoin have often been promoted as “digital gold,” appealing to investors looking for decentralized alternatives to fiat currencies.

Inflation argument: Bitcoin’s fixed supply of 21 million coins theoretically protects against currency devaluation caused by excessive money printing.

Global adoption: Some countries, such as El Salvador, have even adopted Bitcoin as legal tender. Many investors worldwide view crypto assets as protection from central bank policies.

Risks: Cryptocurrencies are highly volatile and influenced by market sentiment, regulation, and technology adoption. While they can act as an inflation hedge, they require a high-risk tolerance.

For balanced portfolios, a small allocation (typically 2–5%) may provide potential upside without excessive risk exposure.

7. Foreign Currencies and Global Diversification

Investing in foreign currencies or assets denominated in stable currencies can reduce exposure to domestic inflation.

Example: If the U.S. dollar weakens due to high inflation, holding assets in currencies like the Swiss franc, Japanese yen, or Singapore dollar can protect value.

Currency ETFs and forex trading: These allow investors to gain exposure to different currencies and hedge against inflation-driven devaluation.

Caution: Currency markets can be complex, requiring expertise to navigate geopolitical and economic factors.

Diversification across multiple economies helps smooth out the effects of localized inflationary pressures.

8. Alternative Investments: Private Equity, Infrastructure, and Art

Alternative assets are increasingly used by institutional and high-net-worth investors to hedge against inflation.

Private equity and venture capital: These investments can generate high returns through business growth that outpaces inflation.

Infrastructure investments: Assets like toll roads, utilities, and renewable energy projects often have inflation-linked revenue streams.

Collectibles and art: Tangible, scarce assets like fine art, vintage cars, and luxury watches can appreciate as the value of money declines.

Though less liquid, these assets provide diversification and long-term inflation protection, especially in global portfolios.

9. The Role of Central Banks and Policy in Inflation Control

Central banks play a key role in influencing inflation through interest rate policies and monetary tightening.

When inflation rises: Central banks often increase interest rates to reduce money supply and demand. This can strengthen currencies but also slow economic growth.

Global coordination: The U.S. Federal Reserve, European Central Bank, and Bank of Japan set policy directions that ripple through global markets.

Investor impact: Understanding these policies helps investors adjust their hedge strategies—shifting from growth assets to income or inflation-protected securities when rates rise.

10. Building a Diversified Inflation-Hedging Portfolio

The most effective way to hedge against inflation is through diversification. No single asset class can perfectly offset inflation under all conditions. A well-structured global portfolio may include:

25% Equities (with inflation-resistant sectors)

20% Real estate and REITs

15% Commodities and natural resources

15% Inflation-protected bonds

10% Gold and precious metals

10% Global currencies and foreign assets

5% Alternative investments (crypto, art, etc.)

This diversified mix balances risk and return while providing resilience against inflationary shocks.

11. The Future of Inflation Hedging: Technology and Innovation

The global market is evolving rapidly, and so are the tools to combat inflation.

Tokenized assets: Blockchain technology enables fractional ownership of real estate, commodities, and art—making inflation hedging more accessible.

AI-driven investing: Machine learning models analyze inflation data and market movements to adjust portfolios dynamically.

Green investments: Renewable energy, carbon credits, and ESG-focused funds are emerging as inflation-resilient assets due to global policy support.

As innovation continues, investors have more opportunities than ever to protect wealth in a changing world.

Conclusion: Preparing for the Inflationary Future

Inflation is an unavoidable part of the global economic cycle, but its impact doesn’t have to erode wealth. By understanding the drivers of inflation and strategically allocating assets across gold, real estate, commodities, equities, bonds, and alternative investments, individuals and institutions can safeguard purchasing power and even profit from global inflationary trends.

In a world where markets are interconnected, global diversification is the ultimate hedge. Whether through traditional assets like gold or modern options like digital currencies and AI-powered portfolios, the key lies in proactive and adaptive financial planning.

Inflation is inevitable — but with the right global strategy, your wealth doesn’t have to lose its value.

Hedgetrading

Why Hedging Is a Powerful Strategy in Trading (Antisthathmisis)⚖️📉 Why Hedging Is a Powerful Strategy in Crypto Trading 🏛️🌿

This post is educational . It’s not about predicting the market—it's about preparing for it.

And one of the most powerful tools in a trader’s toolkit is: Hedging —or as we say in Greek, Αντιστάθμηση .

Rather than gambling on direction, hedging is about staying balanced, staying strategic, and staying alive in volatile markets. Unless you are a προφήτης ('prophet') or you have inside information from Trump and Powell...

📘 Why Hedging Matters:

Most traders go all-in on one direction.

But what if you could go long on the strongest and short the weakest —at the same time?

That’s not being indecisive. That’s called being smartly hedged .

Not picking sides. Picking survival. 🔐 (αντισταθμισμένος-balanced)

📊 Examples from My Own Trading:

🔻 LUNA — One of my most successful shorts. From $100+ to nearly zero.

🔻 Pump.fan — Shorted from $0.63 to $0.24, even as Ethereum pumped.

These were not "luck." These were strategic, chart-based and fundamentally backed, hedged trades .

🏛️ Hellenic Wisdom Meets Trading 🔮🌿

In Greek we say:

“Πρόβλεψη” (pro-vlep-si) → I see what may happen

To do that, we need “Πρόγνωση” (pro-gnosi) → knowledge of what happened before

And if done well, it feels like “Προφητεία” → prophecy

But let’s be clear: I’m no prophet. I'm a trader, and my edge is in staying Αντισταθμισμένος — hedged/balanced/insured/covered.

🧠 The Edge of Antistathmisi:

✅ Long the strong

✅ Short the weak

✅ Charts and fundamentals aligned

✅ Reduce emotional exposure

✅ Create balance in chaos

Closing Thought:

Don’t chase prophecy. Chase prognosis through knowledge.

And let Antistathmisi be your guide. 🧿

One Love,

The FXPROFESSOR 💙

Mon 12th May 2025 GBP/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Buy. Enjoy the day all. Cheers. Jim

Fri 9th May 2025 AUD/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/USD Sell. Enjoy the day all. Cheers. Jim

Thu 8th May 2025 USD/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/CAD Buy. Enjoy the day all. Cheers. Jim

Wed 7th May 2025 XAU/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAU/USD Buy. Enjoy the day all. Cheers. Jim

Note: This isn’t a great setup as price is already at the previous high and the MACD is just below the zero level. But I had to take it because I am committed to my MSH (multi sequence hedging) strategy. So if you are a traditional type trader, then standing aside on this trade would probably be the smart thing to do.

Tue 6th May 2025 GBP/JPY Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/JPY Sell. Enjoy the day all. Cheers. Jim

Tue 6th May 2025 BTC/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Sell. Enjoy the day all. Cheers. Jim

Fri 2nd May 2025 NZD/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a NZD/USD Sell. Enjoy the day all. Cheers. Jim

Thu 1st May 2025 GBP/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/USD Sell. Enjoy the day all. Cheers. Jim

Thu 24th Apr 2025 XAU/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAU/USD Sell. Enjoy the day all. Cheers. Jim

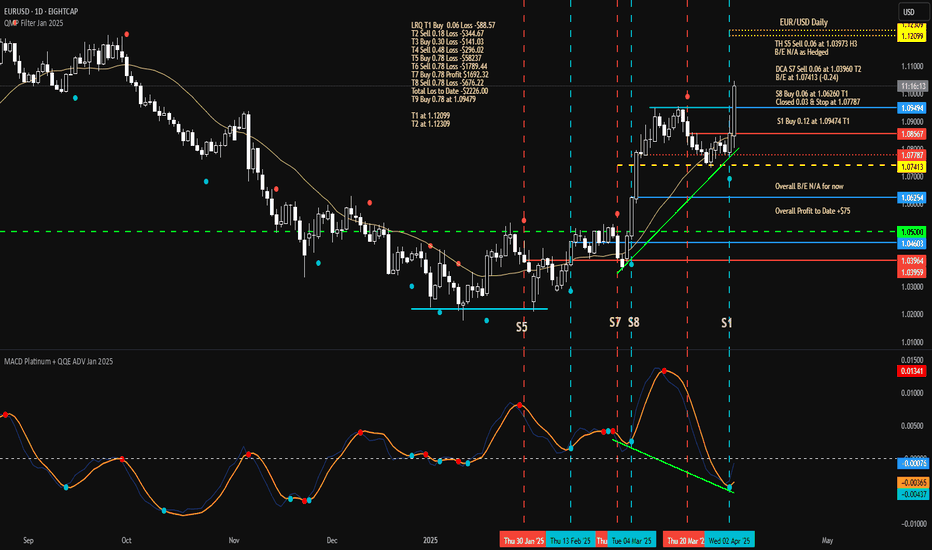

Thu 24th Apr 2025 EUR/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Sell. Enjoy the day all. Cheers. Jim

Wed 16th Apr 2025 GBP/JPY Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/JPY Buy. Enjoy the day all. Cheers. Jim

Tue 15th Apr 2025 AUD/CHF Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/CHF Buy. Enjoy the day all. Cheers. Jim

Tue 15th Apr 2025 GBP/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Buy. Enjoy the day all. Cheers. Jim

Mon 14th Apr 2025 EUR/AUD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/AUD Sell. Enjoy the day all. Cheers. Jim

Fri 11th Apr 2025 Daily Forex Charts: 8x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 8x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a AUD/JPY Buy, XAU/USD Buy, AUD/USD Buy, XAG/USD Buy, NZD/USD Buy, NZD/CAD Buy, GBP/AUD Sell & GBP/USD Buy. I also discuss some trade management. Enjoy the day all. Cheers. Jim

Thu 10th Apr 2025 USD/SGD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Sell. Enjoy the day all. Cheers. Jim

Tue 8th Apr 2025 USD/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/CAD Buy. Enjoy the day all. Cheers. Jim

Mon 7th Apr 2025 XAU/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAUUSD Sell. Enjoy the day all. Cheers. Jim

Fri 4th Apr 2025 USD/SGD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Sell. Enjoy the day all. Cheers. Jim

Fri 4th Apr 2025 XAG/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAG/USD Sell. Enjoy the day all. Cheers. Jim

Thu 3rd Apr 2025 EUR/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Buy. Enjoy the day all. Cheers. Jim