Is Robinhood (HOOD) Set To Soar? Analysis & Entry Plan.HOOD: The Money Heist Plan 🎭💰

Asset: ROBINHOOD MARKETS INC (HOOD)

Timeframe: Swing Trade / Day Trade

Direction: Bullish

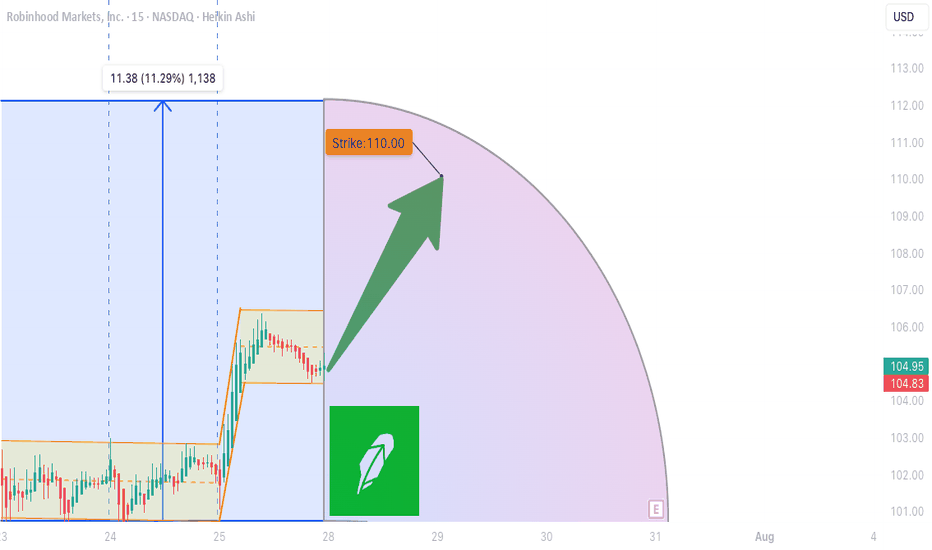

🎯 The Thief's Entry Plan (Layered Strategy)

Ladies & Gentlemen, Thief OG's! 🎭 The plan is to enter using a layered limit order approach. This allows for scaling into the position and optimizing your average entry price.

🛒 Layer Buy Zones: 108.00 | 110.00 | 112.00 | 115.00

Pro Tip: You can add more layers based on your capital and risk appetite.

⛔ The Escape Route (Stop Loss)

Every good thief needs an exit strategy. This is mine, but adjust based on your own risk!

🚨 Thief's Stop Loss: $102.00

A break below this level suggests the heist is compromised.

🎪 The Getaway (Take Profit)

The strong resistance and potential trap (overbought signals) are near our target. Escape with the stolen money before the "police barricade" forms!

💰 Primary Target: $130.00

Disclaimer: This is my plan. I am not recommending you use only my SL/TP. Manage your risk and take profits at your own discretion.

🔍 Why This Heist? The Bullish Case:

This isn't a random grab; it's a calculated plan based on multi-factor analysis.

📊 Fundamental & Technical Fuel:

🚀 Rocketing Performance: YTD +208.29%! Trading near 52-week highs shows immense strength.

💪 Blowout Earnings: Q2 EPS of $0.50 smashed estimates by +41%. Revenue growth is explosive at +71.54% YoY.

💰 Profit Machine: A stunning 50.13% profit margin – this company is highly profitable.

📈 Technical Momentum: Price is in a powerful uptrend, using key EMAs as support.

🧠 Sentiment & "The Crowd"

😰 Fear & Greed Index (Neutral 52/100): The overall market is not in extreme greed, leaving room for upside.

Sub-indicators show Greed in Momentum, Volatility, and Junk Bond Demand – a risk-on environment.

Institutional Demand: Net institutional adds are positive (702 increased positions vs. 427 decreases), with major players like JPMorgan adding significantly.

Retail Buzz: Mixed sentiment post-earnings can create opportunities; the crowd is often late.

⚠️ Risks & The Bear Case (Know Before You Go!)

High Beta (2.36): HOOD is highly volatile and will amplify any market moves. Watch related indices: SP:SPX , NASDAQ:NDX , AMEX:IWM

Macro Events: The upcoming CPI Report (Sep 11) and Fed Meeting (Sep 16-17) are key risk events that could cause market-wide volatility.

Valuation Concerns: High P/E ratio (58.45) suggests the stock is priced for perfection; any misstep could lead to a sharp pullback.

Insider Selling: Executives have been net sellers. Always a note of caution.

📈 Related Pairs to Watch

Broader Market: SP:SPX , NASDAQ:NDX

FinTech Sector: AMEX:XLF , AMEX:IPO

Meme/Retail Sentiment: NYSE:GME , NYSE:AMC

🎭 Final Heist Debrief

Short-Term: Neutral market sentiment suggests cautious optimism. Watch the macro cues (CPI/Fed).

Long-Term: Bullish fundamentals are strong, but high volatility and valuation require smart risk management.

The plan is set. The layers are in place. Execute like a pro, manage your risk, and may the odds be ever in your favor!

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#HOOD #Trading #SwingTrading #DayTrading #Bullish #Stocks #Investing #FinTech #TradingPlan #MoneyHeist #TechnicalAnalysis #Fundamentals

Hoodstock

COIN 1D Time frameMarket Snapshot

Current Price: ~$318.78

Daily Change: +5.5% (strong upward move)

🔎 Technical Indicators

RSI (14-day): ~71 → Overbought zone, signals caution.

MACD: Positive and rising → Strong bullish momentum.

Stochastic Oscillator: High → Overbought conditions, risk of short-term pullback.

ADX: ~16 → Weak trend strength despite recent move.

📈 Moving Averages

5-day MA: ~$315 → Bullish

50-day MA: ~$305 → Bullish

200-day MA: ~$314 → Bullish

All three show buy signals, confirming trend strength.

🔧 Support & Resistance

Support Levels: ~$315, ~$313, ~$311

Resistance Levels: ~$319, ~$321, ~$330

📅 Outlook

Bullish Case: If COIN sustains above ~$319, it could push toward $330 or higher.

Bearish Case: With RSI in overbought territory, a pullback toward ~$315–311 is possible.

Overall Bias: Moderately bullish, but vulnerable to short-term profit-taking.

SPX 3Hour Time frameSPX 3-Hour Snapshot

Current Price: 6,512.62 USD

Change: +0.21% from the previous close

Recent High: 6,508.23 USD (August 28, 2025)

Recent Low: 5,500.00 USD (March 13, 2025)

🔎 Technical Indicators

RSI (14): Neutral

MACD: Bullish momentum

Moving Averages:

5-period SMA: Buy signal

10-period SMA: Buy signal

20-period SMA: Buy signal

50-period SMA: Buy signal

📈 Market Sentiment

Golden Cross: The S&P 500 recently formed a "golden cross," where the 50-day moving average crossed above the 200-day moving average, indicating a bullish trend.

Business Insider

Analyst Outlook: Barclays raised its 2025 year-end S&P 500 target to 6,450, citing stronger-than-expected corporate earnings and optimism around artificial intelligence.

Reuters

📅 Outlook

Bullish Scenario: A breakout above 6,508.23 USD could lead to a push toward 6,600 USD and higher.

Bearish Scenario: A drop below 6,400 USD may test support around 6,200 USD.

Overall Bias: Moderately bullish, with positive momentum but facing near-term resistance.

GOOGL 3Hour Time frameGOOGL 3-Hour Snapshot

Current Price: $239.63

Change: +2.38% from the previous close

Market Cap: $2.13 trillion

P/E Ratio: 18.44

EPS (TTM): $9.56

Beta: 0.96

🔎 Key Levels

Resistance:

R1: $240.26 (recent high)

R2: $242.00 (next resistance zone)

Support:

S1: $236.40 (immediate support)

S2: $234.15 (next support level)

📈 Technical Indicators

RSI (14): 82.95 — Overbought, potential pullback

MACD: 9.99 — Positive momentum, but watch for divergence

Moving Averages:

5-period SMA: $228.51 — Buy signal

10-period SMA: $218.92 — Buy signal

20-period SMA: $210.54 — Buy signal

50-period SMA: $196.04 — Buy signal

📌 Market Sentiment

Recent Catalyst: U.S. judge's decision not to break up Alphabet, leading to a surge of over 6% in its shares, potentially adding more than $160 billion to its market value.

Reuters

Sector Performance: Positive momentum following recent gains and analyst upgrades.

Options Activity: Significant trading in call options at $240 strike price, indicating bullish sentiment.

📅 Outlook

Bullish Scenario: A breakout above $240.26 could lead to a push toward $242.00 and higher.

Bearish Scenario: A drop below $236.40 may test support around $234.15.

Overall Bias: Moderately bullish, with positive momentum but facing near-term resistance.

HOOD S&P 500 Inclusion = Gamma Squeeze Incoming?

# 🚀 HOOD Weekly Setup (Sep 5, 2025) 🚀

**Catalyst:** 🔥 S\&P 500 inclusion → forced buying

**Options Flow:** 📊 C/P = **3.15** (extreme bullish)

**Volatility:** 😴 Low VIX → cheap calls

**Technical:** RSI mixed but catalyst > chart

---

### 📈 Trade Idea

* 🎯 **Buy \$106C** (Sep 12 Exp.)

* 💵 Entry ≈ 2.44

* 🎯 Target: 4.00 (+64%)

* 🛑 Stop: 0.98 (-40%)

* 📅 Exit: by Thu, Sep 11

* 🔥 Confidence: 75%

---

### ⚡ Bonus YOLO Play

* 🎯 \$114C (0.81) → cheap lottery ticket

* ⚠️ High risk / lower win rate

---

📌 **Consensus:** ALL models bullish (flow + catalyst)

📊 Heavy OI at 105 → dealer gamma squeeze setup

---

\#️⃣ NASDAQ:HOOD AMEX:SPY NASDAQ:QQQ AMEX:IWM #SP500#NASDAQ #OptionsTrading #UnusualWhales#GammaSqueeze#OptionsFlow#FlowTrading#WeeklyOptions#CallOptions#StockMarket#TradingView #Bullish#SP500Inclusion#StocksToWatch#MarketMoves#EarningsSeason#MomentumTrading#RiskReward

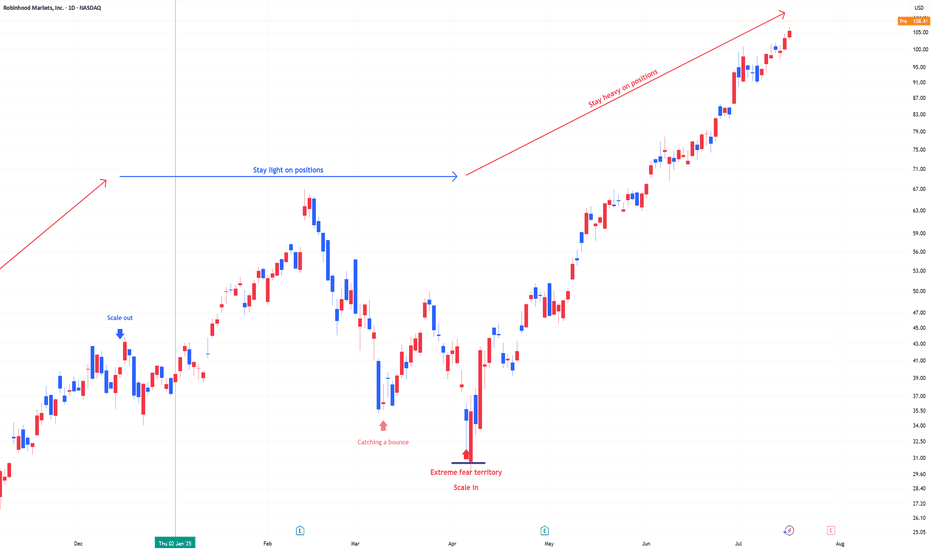

Is $HOOD headed to $85 on this pullback? Robinhood has had a great rally which is warranted given its revenue growth and innovation in the brokerage space.

Stock is currently consolidating the move from 30 to 116 - I think the current pullback can get us to ~$85 which I believe is buyable for the next move higher. With further innovation, continued revenue and profit growth, and potential S&P 500 inclusion, I think the stock can hit $120-$130 in 2026.

Robinhood - This is still not the end!🏹Robinhood ( NASDAQ:HOOD ) is not done yet:

🔎Analysis summary:

After creating a quadruple bottom formation back in 2023, Robinhood managed to rally an incredible +1.400%. It seems to be obvious that Robinhood has to correct soon, but that's not how markets work. Momentum tends to continue for much longer so Robinhood will just rally more.

📝Levels to watch:

$150

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

$HOOD Crash Alert? Put 94C Traders Loading Up

# 🔻 HOOD Weekly Outlook: Neutral → Bearish Tilt? (Sep 2, 2025) 🔻

### 📊 Multi-Model Consensus

* **Momentum**: Daily RSI 37.1 → bearish 📉 | Weekly RSI 65.5 falling 🟡

* **Volume**: 0.6x prior week → weak liquidity ⚠️

* **Options Flow**: C/P ratio = 2.17 → strong **bullish skew** 🐂

* **Volatility**: VIX 18 → favorable environment

👉 **Net View**: **Neutral w/ Bearish Tilt**

* Price momentum & weak volume = downside risk 📉

* Heavy bullish call flow = potential contrarian fade 👀

---

### 🧠 Model Breakdown

* **Gemini / Grok / Llama / DeepSeek** → 🚫 No Trade (low conviction)

* **Claude** → ✅ Tactical Bearish PUT (contrarian call vs. flow)

---

### 🎯 Trade Setup (Tactical Play)

* **Instrument**: \ NASDAQ:HOOD

* **Direction**: PUT 🟥

* **Strike**: 94.00

* **Expiry**: 2025-09-05 (3DTE)

* **Entry**: \$0.97 (market/open)

* **Profit Target**: \$1.45 (+50%) 💰

* **Stop Loss**: \$0.48 (–50%) 🛑

* **Size**: 1 contract (small / tactical)

* **Confidence**: 60% ⚖️

⏰ Exit by **Thursday close** to avoid Friday gamma risk.

---

### ⚠️ Key Risks

* Heavy call flow → possible squeeze 💥

* Weak volume → illiquid / erratic moves

* Time decay (theta burn) accelerating 🕒

---

🔥 **Summary**:

\ NASDAQ:HOOD sits in a **neutral-to-bearish zone**. Most models = "NO TRADE", but one high-conviction model spots a contrarian PUT setup. Risk small, manage tight stops, and exit early if momentum stalls.

HOOD Momentum Setup — Buy $122 Calls

# 🚀 HOOD Weekly Options Trade Idea (2025-08-18)

📊 **TRADE DETAILS** 📊

* 🎯 **Instrument:** HOOD

* 🔀 **Direction:** CALL (LONG)

* 🎯 **Strike:** 122.00

* 💵 **Entry Price:** 0.67

* 🎯 **Profit Target:** 1.00 → 1.34 (+50% to +100%)

* 🛑 **Stop Loss:** 0.36 (\~46% premium)

* 📅 **Expiry:** 2025-08-22

* 📏 **Size:** 1 contract

* 📈 **Confidence:** 65%

* ⏰ **Entry Timing:** Market open

* 🕒 **Signal Time:** 2025-08-18 09:43:26 EDT

---

### 🔎 Quick Summary

* **Momentum:** Daily RSI 62 → bullish, but weekly RSI 82 → potential pullback risk

* **Options Flow:** Call/Put ratio 2.28 → strong institutional bullish positioning

* **Volume:** Weak weekly volume → trade with caution

* **Volatility:** VIX < 20 → favorable for options trading

* **Market Bias:** Moderate bullish overall

Get Ready: HOOD’s Bullish Wave Is Here — Ride It to Profit! 🚀 HOOD Weekly Options Play (08/11/2025) — Bullish Momentum Incoming! 🚀

**🔥 Key Signals:**

* **RSI:** Daily 70.6 / Weekly 80.1 — Strong bullish momentum

* **Options Flow:** Call/Put ratio at 2.41 — Heavy institutional call buying

* **Volatility:** VIX low at 15.54 — Perfect calm for upward moves

* **Volume Warning:** Weekly volume down 0.8x last week — Caution advised

---

**📈 Trade Setup:**

* **Trade:** Long Call

* **Strike:** \$125

* **Entry:** \$0.84 (market open)

* **Stop Loss:** \$0.42 (50%)

* **Profit Target:** \$1.68 (100%)

* **Expiry:** August 15, 2025

* **Risk:** Up to 3% of portfolio

---

**⚠️ Watch Out:**

Volume dip could challenge the move — stay alert & respect your stop!

Low volatility environment favors smooth upside moves.

---

**Summary:**

Strong bullish bias driven by institutional calls + momentum RSI — expect upside next week! Perfect time to ride the wave, but keep volume risk in check.

---

🔥 **Trade Smart, Trade HOOD!** 🔥

HOOD Lifetime Setup--Will You Miss It Again?### 🟢 **HOOD Options Flow Explodes: 2.05 Call/Put Ratio Sparks Bullish Firestorm 🔥**

**Will \$114 Be Breached This Week? Smart Money Thinks So.**

📈 **HOOD Weekly Options Breakdown – Aug 5, 2025**

---

#### 🔍 Market Snapshot:

* **Total Calls**: 178,756

* **Total Puts**: 87,243

* **C/P Ratio**: 2.05 → **BULLISH**

* **RSI**: Daily – 60.2, Weekly – 77.3 → **Uptrend Confirmed**

* **Volume**: 1.5x Previous Week → **Institutional Flow Detected**

* **Gamma Risk**: 🟡 Moderate

* **VIX**: 17.5 → Ideal for Weekly Plays

* **Time Decay**: 🔥 Accelerating

---

### 🧠 Consensus:

✅ All models confirm **strong bullish momentum**

⚠️ Some debate: Is rising volume accumulation or distribution?

---

### 🎯 Recommended Trade Setup:

> **Naked Call – HOOD \$114C (Exp: 2025-08-08)**

* **Entry**: \$0.79

* **Stop Loss**: \$0.40

* **Profit Target**:

* 🥇 Base: \$1.03 (+30%)

* 🥈 Stretch: \$1.58 (+100%)

* **Confidence Level**: 80%

* **Timing**: Enter @ market open

---

### 🔖 Tags (Hashtags for TradingView & Socials):

`#HOOD #OptionsFlow #CallOptions #BullishSentiment #WeeklyOptions #TradingStrategy #VolumeBreakout #RSI #Gamma #Robinhood #SmartMoneyMoves #HOODTradeIdea #TechnicalAnalysis #StockOptions #ViralTradeSetup`

Hood Targeting The Hights

📈 **HOOD BULLISH SETUP - WEEKLY TRADE IDEA (08/03)** 📈

**Ticker:** \ NASDAQ:HOOD | **Bias:** 🟢 *Moderate Bullish*

🔁 **Call/Put Ratio:** 2.13 = **Strong Bullish Flow**

💼 **Volume:** 166K Calls vs. 78K Puts = Institutional Interest

📉 **Gamma Risk:** LOW | ⏳ **Time Decay:** Moderate

🔥 **TRADE SETUP** 🔥

• 💥 **Buy CALL @ \$109**

• 💰 *Entry:* \$0.85

• 🎯 *Target:* \$1.70 (100% ROI)

• 🛑 *Stop Loss:* \$0.43

• ⏰ *Expiry:* 08/08/25 (5DTE)

• 🧠 *Confidence:* 65%

• 📈 *Size:* 5 contracts

• 🕒 *Entry Timing:* Market Open

💡 **Why it matters:**

Despite mixed RSI and conflicting trend models, **massive call volume + low gamma risk** supports a short-term breakout play.

📌 **Watch for confirmation at open. Tight risk/reward. High upside if momentum holds.**

HOOD WEEKLY OPTIONS TRADE (7/31/25)

### ⚡️HOOD WEEKLY OPTIONS TRADE (7/31/25)

📈 **Setup Summary**

→ Weekly RSI: ✅ Rising

→ Daily RSI: ❌ Falling (⚠️ Short-term pullback risk)

→ Call/Put Ratio: 🔥 **1.89** (Bullish flow)

→ Volume: 📉 Weak — fading conviction

→ Gamma Risk: 🔥 High (1DTE)

---

💥 **TRADE IDEA**

🟢 Direction: **CALL**

🎯 Strike: **\$110.00**

💰 Entry: **\$0.82**

🚀 Target: **\$1.62** (+100%)

🛑 Stop: **\$0.41**

📆 Expiry: **Aug 1 (1DTE)**

🎯 Entry: Market Open

📊 Confidence: **65%**

---

🧠 **Quick Insight:**

Mixed signals = *Scalper’s Playground*

✅ Weekly trend favors upside

⚠️ Weak volume & daily RSI divergence = TRADE LIGHT

---

📌 Posted: 2025-07-31 @ 11:53 AM ET

\#HOOD #OptionsTrading #WeeklyPlay #GammaScalp #TradingViewViral #HighRiskHighReward

HOOD WEEKLY TRADE IDEA (07/27/2025)

**🚨 HOOD WEEKLY TRADE IDEA (07/27/2025) 🚨**

**BULLISH OPTIONS FLOW MEETS EVENT RISK CAUTION**

📊 **Options Flow Snapshot:**

📈 **Call Volume > Put Volume**

🧮 **Call/Put Ratio: 2.30** → **Institutional Bullish Flow**

📈 **Momentum Readings:**

* 🟢 **Daily RSI: Bullish**

* 🟡 **Weekly RSI: Mixed to Weak**

➡️ *Momentum is short-term positive, but not confirmed long-term*

📉 **Volume Insight:**

* **Only 0.7x** last week’s volume

➡️ *Lack of participation = ⚠️ caution*

🌪️ **Volatility Environment:**

* ✅ **Low VIX = Great Entry Timing**

* ❗ Fed Meeting ahead = Binary Event Risk

---

🔍 **Model Consensus:**

All 5 models (Grok, Claude, Gemini, Meta, DeepSeek) say:

🟢 **Moderately Bullish Bias**

✅ Bullish options flow

✅ Daily RSI uptrend

⚠️ Weak volume + Fed caution

---

💥 **TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Long Call

* **Strike**: \$110

* **Expiry**: Aug 1, 2025

* **Entry**: ≤ \$2.90

* **Profit Target**: \$5.80 (🟢 100%)

* **Stop Loss**: \$1.47 (🔻50%)

📆 Entry: **Market Open Monday**

📦 Size: 1 Contract

📈 Risk-Reward Ratio: \~1:2

---

🧠 **Key Risks:**

* 📉 Volume Weakness = No confirmation

* ⚠️ **FED Event Risk** = Watch for Wednesday volatility

* ⏳ Theta decay as expiry nears

---

📌 **JSON TRADE DETAILS (for bots/scripts):**

```json

{

"instrument": "HOOD",

"direction": "call",

"strike": 110.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 5.80,

"stop_loss": 1.47,

"size": 1,

"entry_price": 2.90,

"entry_timing": "open",

"signal_publish_time": "2025-07-27 15:09:35 EDT"

}

```

---

🔥 Stay sharp. Ride the flow, respect the risk.

👀 Watch volume + Fed headlines!

💬 Tag your team: \ NASDAQ:HOOD Bulls loading?

\#HOOD #OptionsTrading #UnusualOptions #FedWeek #WeeklyTradeSetup #TradingView #StockMarket

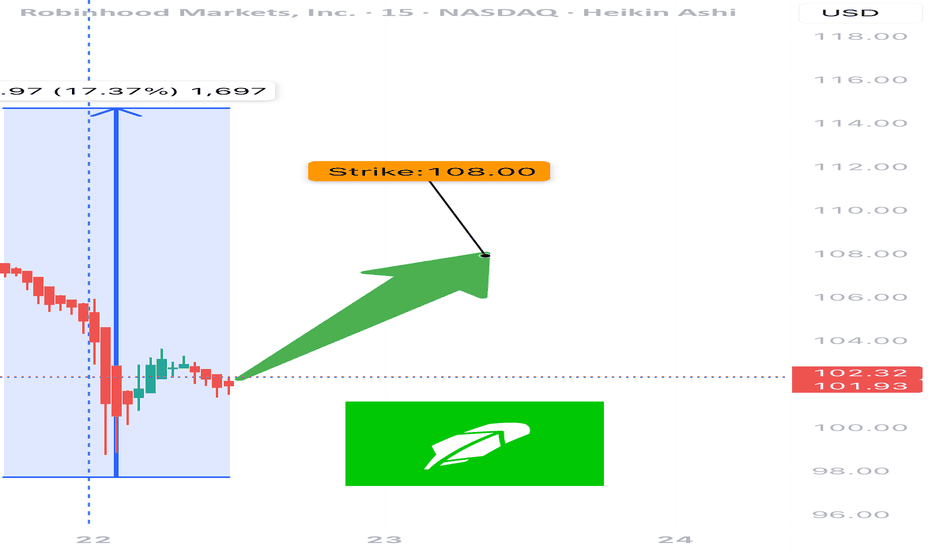

HOOD Weekly Options Setup – July 22, 2025

🔥 NASDAQ:HOOD Weekly Options Setup – July 22, 2025

Moderate Bullish Flow | RSI Divergence | 3DTE Tactical Setup

⸻

🧠 Summary Thesis:

While the call/put ratio (1.42) and favorable VIX (16.9) suggest bullish sentiment, fading RSI and neutral volume raise tactical caution. This setup is not for passive traders — it’s for those managing risk and chasing reward with intention.

⸻

📊 Trade Details

• Instrument: NASDAQ:HOOD

• Direction: CALL (Long)

• Strike: 108.00

• Entry: $0.89

• Target: $1.50 – $2.00

• Stop Loss: $0.45

• Expiry: 07/25/25 (3DTE)

• Position Size: 2.5% of portfolio

• Confidence: 65%

• Entry Timing: Market Open

⸻

🔍 Technical + Options Context

Signal Type Status

📈 Call/Put Ratio ✅ Bullish (1.42)

💨 VIX ✅ Favorable (16.9)

🔻 RSI ❌ Falling – Weak Momentum

🔇 Volume Ratio ⚠️ Neutral (1.0x)

⚡ Gamma Risk ⚠️ Moderate – 3DTE decay

⸻

📍 Chart Focus

• Resistance Zone: $108–$109

• Put Wall Support: $100 (OI heavy)

• Watch for: RSI divergence, gamma squeeze attempts

⸻

📢 Engagement Hook / Caption (Use on TV or X):

” NASDAQ:HOOD bulls are pushing 108C into expiry. Volume’s flat, RSI’s falling — but gamma might still flip the board. Risk-defined lotto or fade?”

💥 Entry: $0.89 | Target: $1.50+ | Expiry: 07/25/25 | Confidence: 65%

⸻

🎯 Who This Trade Is For:

• Short-term option scalpers looking for 1.5–2x payoff

• Traders able to manage theta/gamma into late-week expiry

• Chartists watching RSI divergence vs options flow tension

⸻

💬 Want a debit spread version, an OTM gamma scalp, or my top 3 lotto setups this week? Drop a comment or DM. I share daily flow breakdowns and AI-verified trade ideas.

⸻

This format hits all key signals:

• Informative enough for serious traders

• Viral hook for social platforms

• Clear CTA for engagement & leads

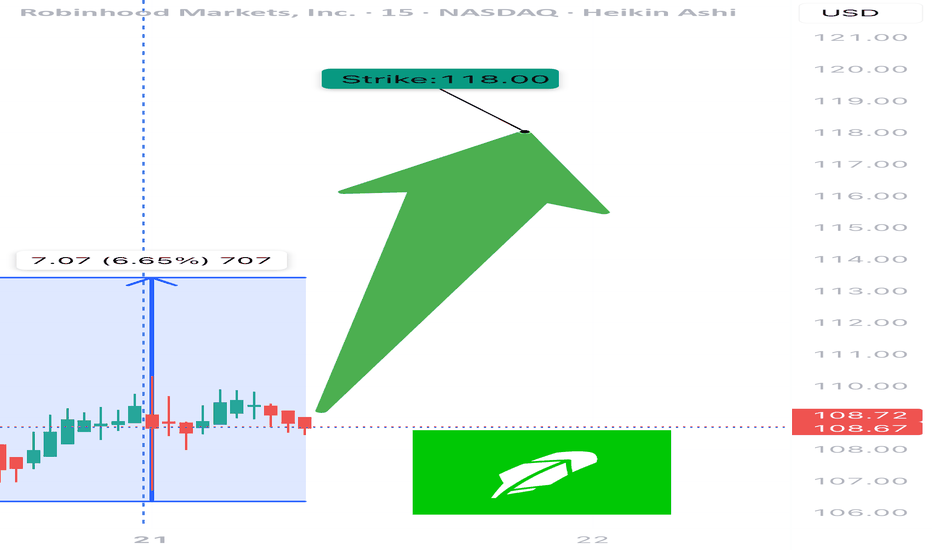

HOOD WEEKLY TRADE IDEA – JULY 21, 2025

🪙 NASDAQ:HOOD WEEKLY TRADE IDEA – JULY 21, 2025 🪙

📈 Flow is bullish, RSI is aligned, and the options market is betting big on upside.

⸻

📊 Trade Setup

🔹 Type: Long Call Option

🎯 Strike: $118.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry Price: $0.68

🎯 Profit Target: $1.36 (💯% Gain)

🛑 Stop Loss: $0.41 (~40% Risk)

📈 Confidence: 75%

🕰️ Entry Timing: Monday Open

📦 Size: 1 Contract (Adjust to risk tolerance)

⸻

🔥 Why This Trade?

✅ Call/Put Ratio = 1.83 → Bullish sentiment

✅ Strong Open Interest at $116 and $118 strikes → Institutions leaning long

🧠 RSI aligned → Technical confirmation of trend

💥 VIX stable → Favors long premium trades

📈 All models rate this as bullish, despite weak volume

⸻

⚠️ Key Risks

🔸 Volume light – fewer confirmations from broader market

⏳ Only 4 DTE → Theta risk accelerates fast after Wednesday

🛑 Tight stop is key – don’t hold through a drift

📉 Exit before Friday’s decay spike unless target is in sight

⸻

💡 Execution Tips

🔹 Get in early Monday — best pricing pre-momentum

🔹 Trail if up >30–50% early in the week

🔹 Exit by Thursday EOD unless strong momentum

⸻

🏁 Verdict:

Momentum + Flow + Technicals align.

Just don’t let the time decay catch you sleeping.

NASDAQ:HOOD 118C – Risk $0.41 to Target $1.36 💥

Clean setup. Strong structure. Watch volume confirmation midweek.

⸻

#HOOD #OptionsTrading #CallOptions #WeeklySetup #TradingViewIdeas #GammaFlow #BullishFlow #UnusualOptionsActivity #ThetaRisk #Robinhood

$HOOD Swing Trade – Riding the Rocket or Chasing the Wick?

🚀 NASDAQ:HOOD Swing Trade – Riding the Rocket or Chasing the Wick? 📈

📅 Posted: July 18, 2025

💡 Strong momentum, but no institutional push – is this the top or just getting started?

⸻

🧠 Multi-AI Model Summary

Model Consensus 🟢 Cautiously Bullish

RSI (Daily): 78.5 → 🚨 Overbought territory

5D/10D Perf: +8.49% / +9.29% → 🔥 Hot trend

Options Flow: Neutral (1:1 call/put) → 💤 No strong hands

Volume: Avg (1.0x) → ❌ Weak confirmation

VIX: Low (<20) → ✅ Swing-friendly environment

“Momentum is there, but it’s skating on thin volume. Institutions are silent. Proceed with caution.”

⸻

🎯 Trade Setup – HOOD Call Option

• Strike: $110.00

• Expiry: August 1, 2025

• Entry Price (Premium): $6.30

• Profit Target: $8.10 (≈ +28.6%)

• Stop Loss: $3.80 (≈ -40%)

• Size: 1 contract

• Confidence: 65%

• Entry Timing: At market open

• Key Watch Zone: Needs breakout above $108 with rising volume for confirmation

⸻

⚠️ Risk Radar

• 📉 RSI 78.5 = high pullback risk

• 🧊 Volume lacks institutional bite

• 📊 Neutral options flow = market unsure

• 🔄 No trade? → If price opens flat or drops below $106 with low volume — sit out

⸻

🧪 Strategy Tip

This is a momentum-chaser’s trade, not a conviction play. If you’re in, monitor aggressively. Take partial profits if momentum fades.

⸻

📊 TRADE SNAPSHOT

{

"instrument": "HOOD",

"direction": "call",

"strike": 110.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 8.10,

"stop_loss": 3.80,

"size": 1,

"entry_price": 6.30,

"entry_timing": "open",

"signal_publish_time": "2025-07-18 14:04:07 UTC-04:00"

}

⸻

🔁 Like + Repost if you’re watching HOOD’s next move

💬 Comment below: Momentum magic or rug risk?

HOOD Weekly Call Option Setup – 07/14/2025 $106C | Exp. July 18

📈 HOOD Weekly Call Option Setup – 07/14/2025

$106C | Exp. July 18 | Breakout Watch Above $100 👀

⸻

🔥 BULLISH MOMENTUM BUILDING

🟢 HOOD is pushing hard into $100 resistance — price riding above 10/50/200 EMAs on all timeframes.

📊 RSI hot (65.6 on 5m / 71.6 daily), but not maxed out — short-term pullback possible, but trend still bullish.

💰 Volume + call flow favor more upside.

⸻

📰 Catalyst:

Positive crypto market sentiment = increased trading activity = good for HOOD’s core business.

VIX at 16.40 = risk-on environment = perfect for high-beta names like this one.

⸻

🎯 Trade Plan – High R/R Call Setup

Clean structure, riding sentiment — but be quick around $100.

{

"ticker": "HOOD",

"type": "CALL",

"strike": 106,

"exp": "2025-07-18",

"entry": 0.92,

"target": 1.38,

"stop": 0.46,

"size": 1,

"confidence": "70%",

"entry_timing": "market open"

}

🔹 Entry: $0.92

🎯 Target: $1.38 (+50%)

🛑 Stop: $0.46 (-50%)

📅 Expiry: 07/18/25

📈 Confidence: 70%

💼 Strategy: Naked Call

⸻

💬 Model Consensus:

“Moderately Bullish” — clean momentum + bullish call flow = good entry.

⚠️ Watch RSI + $100 resistance — quick rejection is possible.

⸻

📌 Why $106C?

🔸 OI building there → potential magnet

🔸 Cheaper than ATM but within reach

🔸 High gamma setup if we break $100 early

⸻

💡 Trade Smart:

🏃 Get in early → fade into strength

🧠 Position size accordingly → don’t get greedy

📢 Tag your trading buddy who’s still ignoring HOOD 😏

#HOOD #OptionsTrading #BreakoutSetup #CryptoMomentum #AITrading #CallOptions #FlowPlay #TradingView #0DTE #