USDCAD Approaching Smart Money Sell ZoneUSDCAD is currently transitioning from an impulsive bearish leg into a corrective phase, but the broader structure still favors downside continuation. The recent selloff appears more like institutional distribution rather than a completed trend, and the ongoing rebound is likely a positioning-driven retracement rather than a true reversal.

From a technical perspective, price is attempting a pullback after breaking below a descending channel, a behavior typically associated with exhaustion followed by mean reversion. The key area to monitor now sits between 1.3750 and 1.3850, where dynamic trendline resistance aligns with a prior supply zone. If price rotates into this region and shows rejection, the probability of a lower high formation increases significantly. Above that, the macro supply cluster around 1.3880–1.3950 represents the critical invalidation zone. A sustained break above it would force a reassessment of the bearish narrative. Until then, rallies should be viewed as potential selling opportunities rather than trend shifts.

Looking at the Commitment of Traders, the Canadian Dollar is starting to show signs of accumulation. Speculators have aggressively reduced short exposure, a classic early signal of strengthening currency flows. At the same time, positioning on the US Dollar Index is flattening, suggesting the crowded long-dollar trade may be losing momentum. When CAD strength meets USD positioning fatigue, the result often translates into medium-term downside pressure for USDCAD.

Seasonality further reinforces this scenario. Historically, the pair tends to form a temporary top between February and early March before weakening into spring. This pattern aligns well with the current technical rebound, increasing the probability that the market is preparing for another leg lower rather than building a base.

Retail positioning adds an additional contrarian signal. Approximately 70% of traders are currently long, which typically indicates that smart money liquidity sits above the market. Retail participants often attempt to buy perceived bottoms, while larger players use these rallies to re-enter short exposure.

Putting everything together, technical structure, COT flows, seasonality, and sentiment, the path of least resistance still appears skewed to the downside.

Primary scenario: A corrective rally into 1.3750–1.3850 followed by bearish confirmation could open the door for a continuation toward 1.3550, with a deeper extension targeting 1.3470.

Should macro USD weakness accelerate, a move toward the 1.3350 region cannot be ruled out.

Invalidation: A daily acceptance above 1.3950 would suggest a structural shift and delay the bearish continuation.

Ict

EURUSD Deep Pullback ScenarioQuick Summary

EURUSD rallied strongly throughout the last week gaining more than 250 pips without a proper correction

A pullback is highly likely to rebalance the fair value gaps and the Key levels to watch are 1.17687 and 1.17189

A bullish reaction may occur after testing the second FVG due to inducement at that level

Full Analysis

After the strong upside movement on EURUSD throughout the week price rise more than 250 pips without performing a meaningful retracement

Such impulsive moves usually leave significant imbalance in the market which often leads to a corrective phase

Because of this a downside move is highly likely in order to rebalance the fair value gaps left behind

The first area of interest sits around 1.17687 while the second fair value gap is located near 1.17189

Price may continue lower until the second FVG is tested

This area holds additional importance because there is inducement present which can attract liquidity and support a bullish reaction

If price reaches this zone and shows strength it may serve as the base for the next upside continuation

NZDUSD FREE SIGNAL|SHORT|

✅NZDUSD trades into a premium supply PD array after bullish expansion. Bearish rejection and displacement confirm smart money distribution, favoring continuation toward sell-side liquidity below.

—————————

Entry: 0.6020

Stop Loss: 0.6034

Take Profit: 0.5996

Time Frame: 2H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

EUR/USD at Key level: Expansion or Reversal Setup?EUR/USD is currently trading within a critical technical area following a strong impulsive move to the upside. The daily structure remains constructive in the short term, but price has now reached a higher-timeframe supply zone that historically tends to attract sellers, making this level extremely relevant for the next directional decision.

From a price action perspective, the market recently broke above prior resistance with momentum, signaling underlying bullish pressure. However, the current retracement suggests the possibility of a classic continuation structure rather than an immediate reversal. As long as price holds above the ascending trendline and continues to print higher lows, the broader scenario favors another expansion leg toward the 1.2050–1.2100 area.

A deeper pullback into the underlying demand imbalance would still be technically healthy, allowing the market to rebalance before any potential continuation of the bullish move.

Looking at the COT report, non-commercial traders continue to increase long exposure while reducing short positions — a positioning shift that typically reflects growing institutional confidence in euro strength. At the same time, commercial participants remain structurally short, behavior consistent with their hedging needs during rising markets rather than a true directional signal. Overall, the latest flows maintain a moderately bullish bias.

The U.S. Dollar Index COT reinforces this view: large speculators remain net short on the dollar, suggesting that any USD rallies may remain corrective unless positioning changes materially.

Seasonality, however, introduces an important nuance. Historically, February tends to show mild euro weakness, particularly when observing the 5-year and 10-year averages. This does not necessarily invalidate the bullish structure, but it increases the probability of short-term volatility or consolidation before a more sustained continuation.

Finally, FX retail sentiment shows a slight majority of traders positioned short on EUR/USD. From a contrarian perspective, this typically supports bullish scenarios, as retail traders often attempt to anticipate reversals against still-solid trends.

This is a classic environment where location matters more than prediction.

Holding above structure → the continuation scenario remains valid.

A breakdown below current support → would open the door to a deeper corrective phase.

For now, the market appears to be transitioning from an impulsive phase into a decision phase.

Patience will be essential.

GBPUSD: Crowded Shorts + Bearish February SeasonalityGBPUSD continues to trade within a well-defined bullish daily structure following the impulsive breakout from the November base. Price is now consolidating inside a premium zone after the latest expansion, a condition that typically precedes either a shallow pullback or a time-based correction rather than an immediate reversal.

Technically, the market remains supported by an ascending channel and by the prior breakout shelf. As long as price holds above the key higher-low structure, the broader directional bias stays constructive.

From a positioning perspective, the COT report reveals an important crosscurrent. Non-Commercial traders remain net short on GBP futures (87,786 longs vs 103,948 shorts), suggesting that the speculative community is still leaning against the trend — a classic fuel for continuation via short covering.

However, the weekly flow provides nuance: Commercial hedgers aggressively increased short exposure (+17,811), while open interest expanded significantly. This combination often signals near-term supply and favors a rotational phase before the next directional leg.

On the USD side, positioning shows a mild stabilization attempt, with specs adding longs and trimming shorts. This does not necessarily imply a trend reversal in GBPUSD, but it strengthens the probability of a corrective phase.

Sentiment further reinforces the contrarian narrative. Retail positioning shows 67% of traders are short, indicating crowded downside exposure. When retail traders press shorts into an uptrend, rallies tend to extend as stops get triggered.

Seasonality acts as the tactical overlay here: February has historically been a negative month for GBPUSD across most lookback periods. This suggests the path of highest probability is pullback first, continuation later.

USD/JPY is under pressureUSD/JPY recently reached a major macro supply zone between 158.50 and 160.00, where the pair experienced a strong rejection. Moves like this are rarely random — they often signal institutional profit-taking and the potential beginning of a distribution phase after months of sustained bullish trend.

The broader structure remains bullish, but what appears to be changing is the sustainability of the move. Each push higher is becoming increasingly “expensive” in terms of momentum, raising the probability of a rotational phase before any meaningful continuation.

In the short term, the key magnetic level sits around 155, where price could fill the daily inefficiency. Below that, the first true institutional demand is located between 151.80 and 152.50, while a deeper correction could extend toward the 148–150 region — a critical area for preserving the medium-term bullish structure.

From a positioning perspective, the COT report is starting to show an important shift worth monitoring: the U.S. dollar remains net long, but with less aggressive exposure, while the Japanese yen is beginning to attract buying interest from commercial hedgers — behavior typically associated with accumulation phases. This is not yet a reversal signal, but it suggests the market may be entering a transitional environment.

Retail sentiment remains relatively balanced and does not yet provide a clear contrarian edge. However, historically, when USD/JPY begins to decline, many traders attempt to buy the dip, a dynamic that can unintentionally accelerate the downside move.

February seasonality tends to be moderately bullish for USD/JPY, but when institutional flows begin to diverge, positioning usually carries more weight than historical patterns.

The primary driver remains unchanged: interest rate expectations. If markets start pricing in a less hawkish Federal Reserve or a less accommodative Bank of Japan, USD/JPY could correct quickly, as phases of yen strength are rarely gradual.

Primary scenario:

A pullback toward 155, with a potential extension into the 152 area, would help rebalance the trend.

Alternative scenario:

A rapid recovery above 158 could trigger a squeeze toward 160, although such a move would likely resemble a blow-off top rather than a healthy continuation.

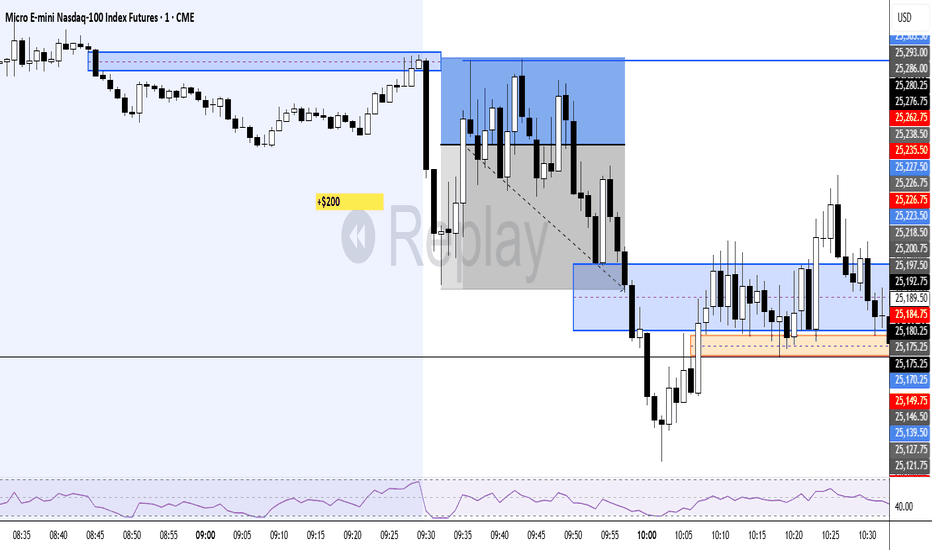

MNQ Analysis & Day Trading - Thursday February 5 2026 part 22-3 so far on the day, +$154. continue the day in part 3.

-------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Thursday February 5 2026 part 12-1 / +$404 so far on the day. Continue this day with part 2 next.

----------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Wednesday February 4 2026 part 3Great day. 4-1 / +$586

---------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Wednesday February 4 2026 part 23-1 / +$498 so far on the day. Remaining day in part 3.

----------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Wednesday February 4 2026 part 11-0 / + $200 so far on the day. Remaining day in part 2.

---------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

GBPUSD FREE SIGNAL|SHORT|

✅GBPUSD retraces into a premium supply PD array after bearish expansion. Rejection and displacement signal smart money distribution, favoring continuation toward sell-side liquidity below.

—————————

Entry: 1.3623

Stop Loss: 1.3652

Take Profit: 1.3580

Time Frame: 2H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

SELL XAUUSDGold is now trading back into a clear supply zone after a sharp impulsive bounce from the lows, and price is stalling right below a descending trendline and prior structure resistance. This area also aligns with previous rejection points, suggesting sellers may step back in to defend the zone. The bullish move into resistance looks corrective rather than impulsive. From here, a short-term sell makes sense targeting the nearest demand zone below and the recent swing low, where price previously reacted strongly before the rally.

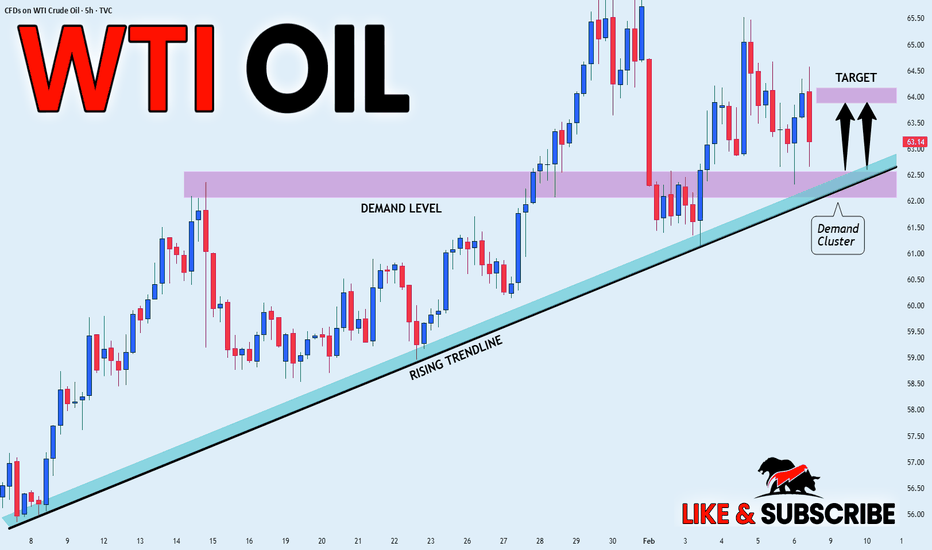

CRUDE OIL DEMAND CLUSTER|LONG|

✅WTI OIL holds a strong demand cluster aligned with the rising trendline, keeping bullish structure intact. Discounted reactions suggest smart money support, favoring continuation toward higher buy-side liquidity. Time Frame 5H.

LONG🚀

✅Like and subscribe to never miss a new idea!✅

BTC | The Calm Before the Dump... or Pump?Bitcoin is reacting from a key higher-timeframe point of interest (POI). Price has reached a high-probability FVG that broke structure to the downside with strong displacement — now forming a potential short-term ceiling.

Below, a notable sell-side liquidity pool sits near $74,558, offering a possible downside target if price continues to respect this daily FVG. Should that level give way, the next POI would be the marked bearish order block, with extended liquidity zones reaching toward the $52K region.

If both sell-side areas are taken out with strong momentum, it could confirm a deeper re-price phase before the next bullish leg.

Overall, we’re watching for how price responds within these key levels — structure will tell the story.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any trading decisions.

Daily open and close don't work... quote XDHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Gold continued the bearish sequence on the daily, H4, and H1 timeframes.

Even with slightly positive data, the New York session was almost flat.

Price stayed sideways, then formed a bull trap at 17:00.

Exactly on the marked area for a potential sell.

The target was the lower daily level.

Candle open, just below the gap.

Area 4700–4660.

Now the situation is more complex.

That level was reached in a deep way.

We also had a bullish Asian session.

Statistically, Friday tends to be more long than short on gold.

We need to be careful.

No NFP today.

We’ll evaluate together during the US session how to act.

For now, I keep these zones.

See you later live at 14:00.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

#EURUSD , Time to Fly?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURUSD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup at all but with a valid structure we can have it as QuickScalp

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold