Ictconcepts

Will AFRM Find a Bottom This Week Heading Into Earnings on 11/6?"Abide in me, and I in you. As the branch cannot bear fruit by itself, unless it abides in the vine, neither can you, unless you abide in me. I am the vine; you are the branches. Whoever abides in me and I in him, he it is that bears much fruit, for apart from me you can do nothing."

- John 15:4-5

Hello Traders!

As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows:

- W has seen 5 consecutive months of higher closes. Can it deliver on earnings and see another month of higher closing prices?

- AFRM and other fintech stocks will be impacted by earnings and fed rate decision this week. We are waiting to see if price goes to support first to allow for a deep discount on weekly call options

- We are expecting a retracement on AFRM to resolve some imbalances at $66.41, but to structurally hold key levels above $65, and to close the week near $80. On W we are waiting for price to get near $65 for a close at or above $80 per share.

- Our vehicle of choice this week are the $75 weekly calls on AFRM and $70 weekly calls on W

Cheers,

DTD

Financial Risk Disclaimer |

DISCLAIMER: I am not a financial adviser. The videos on my channel are for educational and entertainment purposes only. I'm just showing you guys how I invest and day trade, but remember, investing of any kind involves risk. Your investments are solely your responsibility and not mine. While day trading can bring substantial gains, it can also bring serious losses! So make sure you do your research to fully understand the market before diving in. The possibility exists that you could sustain a loss of some or all of your initial investment, and therefore should not invest money that you can't afford to lose. The fluctuation of the market can work for you or against you. You should carefully consider your investment objectives and experience before deciding to trade in the market. Again, what you invest in is solely your responsibility.

Dip Buying Levels on TSLA Post Earnings"Abide in me, and I in you. As the branch cannot bear fruit by itself, unless it abides in the vine, neither can you, unless you abide in me. I am the vine; you are the branches. Whoever abides in me and I in him, he it is that bears much fruit, for apart from me you can do nothing."

- John 15:4-5

Hello Traders!

As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows:

- TSLA earnings are highly anticipated with most retail traders expecting bullish continuation from its breakout from previous consolidation

- We are expecting a retracement to resolve some imbalances, but to structurally hold key levels either above $408 or $385, and to close the week above last week's high over $440

- Our vehicle of choice this week are the $430 weekly calls or $415 calls (if price retraces further to $390)

Cheers,

DTD

Financial Risk Disclaimer |

DISCLAIMER: I am not a financial adviser. The videos on my channel are for educational and entertainment purposes only. I'm just showing you guys how I invest and day trade, but remember, investing of any kind involves risk. Your investments are solely your responsibility and not mine. While day trading can bring substantial gains, it can also bring serious losses! So make sure you do your research to fully understand the market before diving in. The possibility exists that you could sustain a loss of some or all of your initial investment, and therefore should not invest money that you can't afford to lose. The fluctuation of the market can work for you or against you. You should carefully consider your investment objectives and experience before deciding to trade in the market. Again, what you invest in is solely your responsibility.

October 05, Forex Outlook: Key Moves to Watch This Week!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

September 28, Forex Outlook: What Can Traders Expect This Week?Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

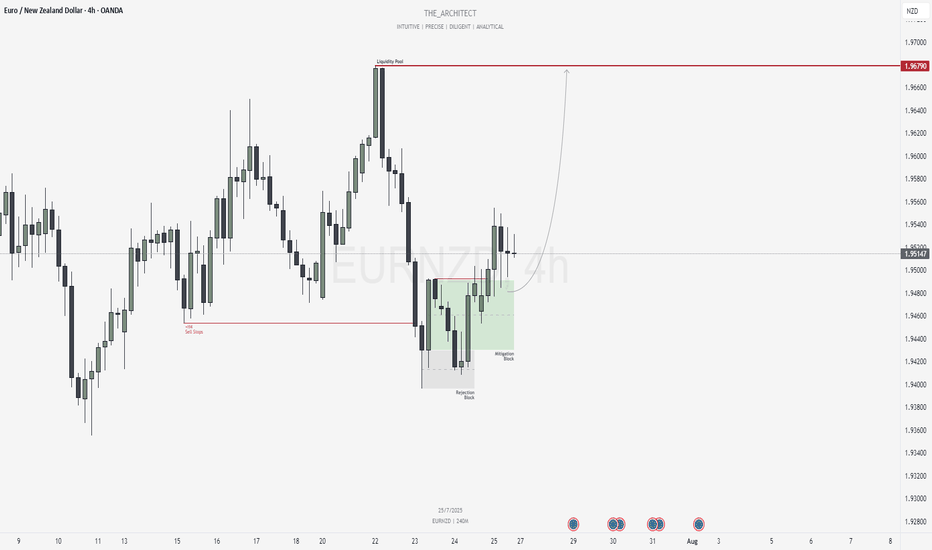

August 11, Forex Outlook: Key Market Expectations for the Week!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

August 11, Forex Outlook: What to Expect from This Weeks TradingWelcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

August 3, Forex Outlook: High-Reward Setups You Need to See Now!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

EURUSD

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

July 29, Forex Outlook : High-Reward Setups You Shouldn’t Miss!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDJPY

AUDJPY

CADJPY

EURGBP

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

Weekly Trade Outlook | Lessons in Discipline, Risk & PerspectiveGreetings Traders,

In today’s video, I’ll be walking you through my end-of-week trade outlook, breaking down every setup I took throughout the week. This session is designed to offer insight into how I apply risk management, trading rules, and maintain psychological discipline in real-time market conditions.

Whether you're struggling with emotional trading, inconsistency, or overtrading, this video will give you a fresh perspective on how structure, faith, and discipline can shape a sustainable trading approach.

Remember: respect your trading rules, pray over them daily, and ask God for the strength to remain disciplined—so you don’t become your own worst enemy in the market.

Let’s grow together,

The Architect 🏛️📈

July 21, Forex Outlook : Don’t Miss These High-Reward Setups!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

EURUSD

USDJPY

AUDJPY

CADJPY

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

July 13, Forex Outlook : This Week’s Blueprint to Profit!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Currency Pairs:

EURUSD

USDCAD

AUDUSD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

NZDUSD

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

Weekly Equities Trade Idea: CRCL Puts (Update)Hello Traders!

I'm providing an update to the CRCL trade idea from Monday July 14th. Here's what I'm watching:

- Price to open within the range from Tuesday July 15th

- Potential imbalance resolve from Monday July 14th at $204.70

- If price breaks Friday July 11th's high at $206.80 the trade is invalidated

Cheers,

DTD

Short-term Bear Case for CRCLHello Traders!

As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows:

- CRCL is a high beta stock that seems to not be moving in tandem with its peers as of late

- I am expecting volatility due to market data and monthly options expiration

- CRCL has formed a new bearish order block below another bearish order block and is wedged with a weekly bearish setup. We are anticipating expansion out of this range to the downside

- I am waiting for a re-test of $199-$205 for a full move to $155-$145

Cheers,

DTD

July 6, 2025: Strategic Forex Weekly OutlookWelcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

Higher timeframe trend analysis

Key zones of interest and potential setups

High-precision confirmations on lower timeframes

Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

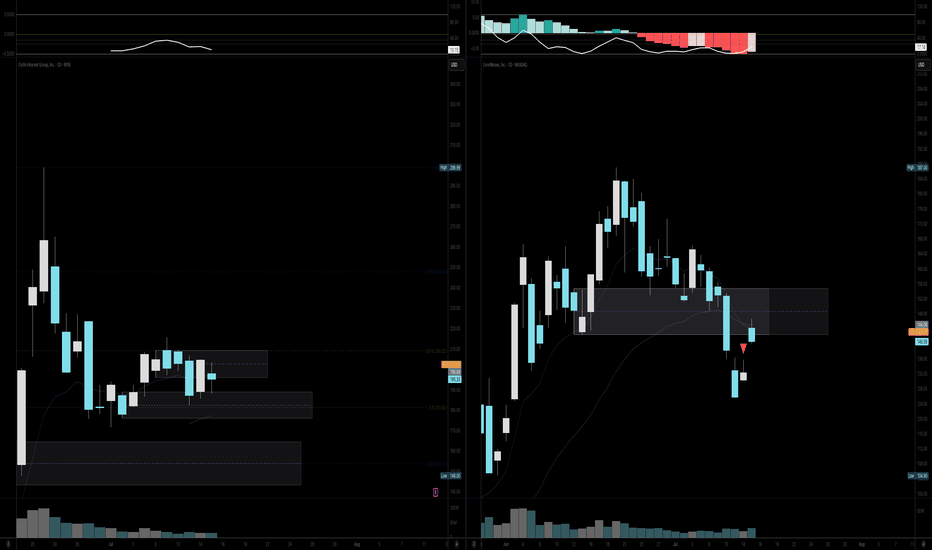

MNQ 5.20.25 Trade Idea (2)Execution, Risk management and Profit taking shown live in the next 3 posts I am about to share with you guys.

I wanted to use that 4H 10am Low as an entry and we caught it. Now we are watching to see if that was just a manipulation to trade into that bearish FVG I outlined near that Buyside liquidity area we were targetting.

Closing the day out with $110 in profits, Which you will see on Video #3

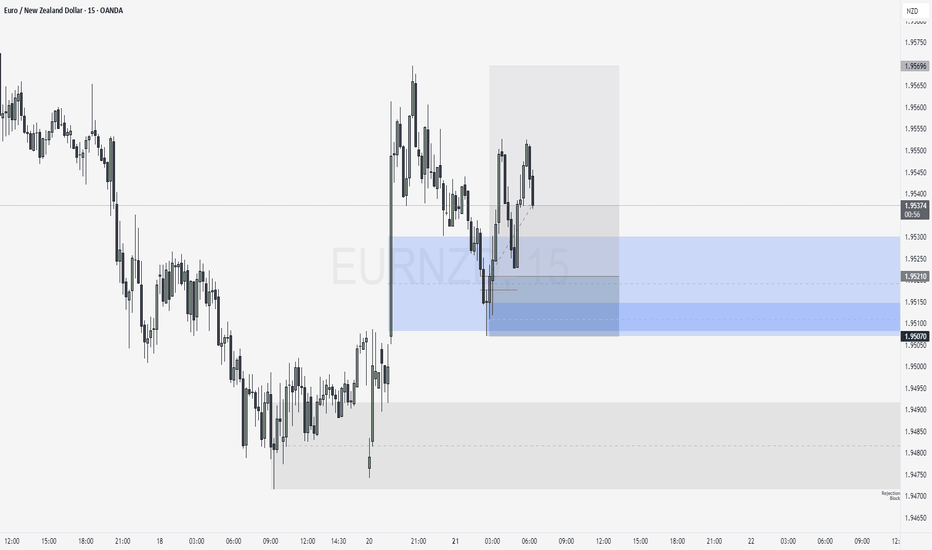

Looking to short CL to continue lowerCL is making a corrective move higher before moving down to the ultimate target of last Daily structure leg down. It retraced to Daily bearish Fair Value Gaps (internal range liquidity zones) which should act as resistance. 15M bearish structure is in Extreme premium.

I'm looking for CL to break down bullish corrective structure on 5M chart and start a final move down.

Gold is eyeing highs after a bullish daily candleThis is def a consolidation range so keep your eyes sharp and pay attention to what happens as we break into the highs. Will we displace with longs or will be be saturated by the bearish imbalances above the current hourly range?

Share with a friend in need 🔑

Review of my NQ Morning trade before FOMCThis is me going over the trade we took today that was a loss. Had we kept SL under the low of 19,541.25 we would've hit TP and caught our trade. We are done trading for today, just wanted to hop on here to share with you guys the result of the trade and outcome.

Give it a like ♥ and a 🚀 if you found this insightful.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Missed trade opportunity on MNQ due to Tight SLOnce again, we shifted sl too soon and got stopped out of a good trade. It was nice to see the outcome, it ended up tapping inside of that Volume imbalance once again before falling over quickly for the remaining sellside liqudity.

If my SL was kept at the highs we would've captured the whole move. This week I have been feeling a little tired and my birthday is this thursday guys!! lol I would hate to have a bad trading week on my BDAY 😢. I don't know if that's why I am being so cautious, I wanna enjoy my week. haha

Anyways, I will post any new trades if I get into another one. But I might call it here depending on where price is at after I post this video.

If you guys enjoyed this give it a like and share with your friends(:

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

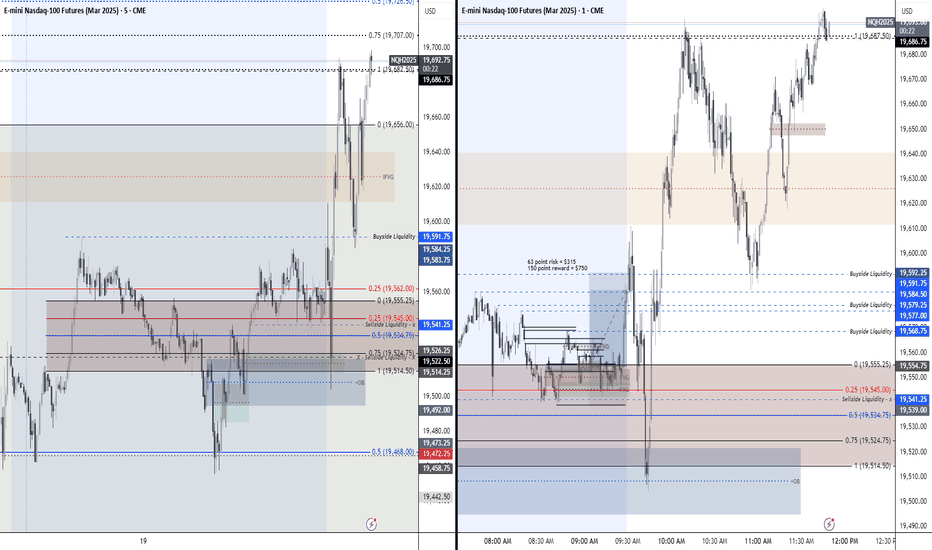

Quick 70 point scalp on NQShowing you guys a trade idea with my current thoughts on the market and price.

I will be busy today so that is all for me, taking my $370 dollars for the day and I am calling it.

Good luck and Good trading to anyone trading today!

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.