Gold Breaks the Channel — Momentum Is Still BuildingGOLD (XAUUSD) – 1H QUICK VIEW

Technical

Clear breakout above ascending channel resistance → bullish continuation signal.

Price holds above EMA34 & EMA89, confirming strong trend control.

Current move = breakout → shallow pullback → potential next impulse.

As long as price stays above the broken trendline, upside bias remains valid.

Key Levels

Immediate support: ~4,450 – 4,430 (retest zone)

Upside extension: 4,520 → 4,580+

Macro / News Context

USD remains under pressure as markets price in future rate cuts.

Real yields stay soft, supporting non-yielding assets like gold.

Ongoing geopolitical tensions & central bank gold accumulation keep demand elevated.

Bias

Buy pullbacks, not breakouts.

Trend remains bullish unless price falls back inside the channel.

Indicators

EUR/USD Is Resting, Not Reversing.EUR/USD – SHORT & CLEAN ANALYSIS (1H)

Structure

Clear trend shift: break of descending trendline → higher highs & higher lows

Current move = bullish continuation, not exhaustion

Key Zones

Support: 1.1740 – 1.1760 (former resistance + EMA cluster)

Upside target: 1.1800 – 1.1810

Price Action

Pullbacks are shallow → buyers in control

No strong rejection candles → selling pressure weak

Macro Context

USD remains soft as markets expect a slower Fed path into year-end

EUR supported by stable ECB stance and risk-on sentiment

Bias

Bullish

Focus on buy-the-dip above support, avoid chasing tops

EURUSD Is Building MomentumEUR/USD (H1) — MARKET STRUCTURE & TECHNICAL ANALYSIS

1. Market Structure

EURUSD has clearly shifted from consolidation to an intraday bullish structure.

Price formed a base → impulsive leg → higher low

Current structure shows bullish continuation sequencing

No bearish displacement after the last push → trend integrity remains intact

This is trend continuation, not a mean-reversion setup.

2. Key Technical Zones

Support Zone: 1.1740 – 1.1750

→ Previous breakout base & demand zone

→ As long as price holds above this area, buyers remain in control

Mid Resistance / Target: ~1.1800

Upper Target (Open Path): ~1.1820 – 1.1830

Above 1.1800, liquidity opens cleanly with little historical resistance.

3. Price Action Behavior

Pullbacks are shallow and corrective

Each retracement is followed by immediate bullish response

Candles show strong closes near highs, confirming demand absorption

This is classic bullish stair-step price action.

4. Scenario Outlook

Primary Scenario (High Probability):

Short-term pullback toward 1.1765–1.1770

Continuation toward 1.1800 target

Minor consolidation → breakout toward 1.1820+ (open liquidity)

Invalidation:

Strong H1 close below the support zone

Acceptance below 1.1740 would pause the bullish sequence

Until that happens, bias remains bullish.

5. Market Context

USD remains soft-to-neutral

No immediate high-impact USD news forcing risk-off behavior

EUR strength aligns with intraday risk-on flows

This supports trend-following long positions, not counter-trend shorts.

Conclusion

EURUSD is not topping it is preparing.

Trend: Bullish

Structure: Higher high – higher low

Strategy: Buy pullbacks above support, avoid chasing highs

The chart is offering structure, momentum, and clean targets discipline now matters more than prediction.

EUR/USD Isn’t Crashing by AccidentEUR/USD – H1 Technical & Macro Breakdown

Technical Structure

- EUR/USD is currently trading in a clear short-term downtrend, defined by a descending trendline and repeated failures to reclaim the 34 & 89 EMAs. Each rebound attempt has been capped below dynamic resistance, confirming that sellers remain in control.

- Price has now rotated back into a well-defined support zone, where short-term buyers are attempting to defend. However, this is defensive buying, not trend reversal behavior. As long as price remains below the descending trendline and below the EMA cluster, any bounce should be treated as a corrective pullback, not a bullish shift.

Key technical logic:

- Lower highs + lower lows → bearish structure intact

- EMAs acting as dynamic resistance → trend pressure remains downward

- Current support zone → potential short-term bounce, but not confirmation

A sustained break back above the trendline and EMA alignment would be required to neutralize downside risk. Until then, the structure favors continuation pressure.

Macro Drivers

US Dollar Strength (Primary Driver)

Recent market positioning reflects renewed demand for USD as expectations remain firm that US monetary policy will stay restrictive for longer. Even without new rate hikes, the Fed’s stance of “higher for longer” continues to support the dollar.

Yield Differential Pressure

US Treasury yields remain elevated relative to European yields. This yield spread continues to pull capital toward USD-denominated assets, pressuring EUR/USD lower.

Eurozone Growth Concerns

Markets remain cautious on the Eurozone outlook, with weak growth momentum and fragile demand. This limits EUR upside and makes the currency vulnerable whenever USD demand increases.

Risk Sentiment Rotation

Whenever global risk sentiment turns cautious, EUR tends to underperform against USD. The current environment favors defensive positioning, benefiting the dollar over risk-sensitive currencies.

Forward Expectations

Short-term: A technical bounce from support is possible, but likely corrective.

Bias: Bearish while below trendline & EMAs.

Invalidation: Only a clean break and acceptance above resistance would shift the narrative.

Key Takeaway

This is not panic selling.

This is macro pressure aligning with technical structure.

EUR/USD is being repriced lower because the dollar has the advantage — both technically and fundamentally. Until that balance changes, rebounds are opportunities for structure, not signals of reversal.

Gold Isn’t Chasing Price — It’s Following a Macro Cycle GOLD (XAUUSD) – H1 | Cycle-Based + Macro Analysis

1. Market Cycle Structure

Gold is moving inside a clean ascending channel, confirming a healthy bull cycle, not an exhaustion phase.

Each impulse leg is followed by controlled pullbacks that stay above prior structure.

No aggressive rejection at highs → acceptance near the upper channel, which is bullish.

This is a trend-continuation cycle, not a blow-off top.

2. EMA Behavior (Trend Validation)

EMA 34 & EMA 89 are stacked bullish and sloping upward.

Price consistently reclaims EMA 34 after shallow pullbacks.

This indicates institutional trend participation, not retail-driven spikes.

➡️ As long as price holds above EMA 34 on pullbacks, the cycle remains intact.

3. Price Action Logic (Cycle Progression)

The current structure shows:

Impulse → flag → impulse

No lower low printed inside the channel

Pullbacks are time-based, not price-based (sideways instead of deep drops)

This behavior typically precedes:

An expansion leg toward the upper channel boundary → new ATH attempt

4. Macro Context (Why Gold Keeps Rising)

Gold’s cycle is supported by macro tailwinds, not speculation:

Real yields remain under pressure → bullish for non-yielding assets

Central banks continue net gold accumulation

USD strength is no longer suppressing gold aggressively

Risk hedging demand remains elevated globally

➡️ This is structural demand, not short-term fear buying.

5. Outlook & Scenario

Primary Scenario (High Probability):

Shallow consolidation near current highs

Brief pullback toward channel midline / EMA support

Continuation breakout toward the upper channel → new ATH zone

Invalidation:

Only a clean break and hold below the channel + EMA 89 would break the cycle

Until then, dips are buy-the-structure, not sell signals

🧠 Final Takeaway

Gold is not overextended.

It is cycling higher in a controlled institutional trend, and price behavior strongly suggests new highs are a matter of timing, not direction.

Gold Is Not Topping — It’s Loading for $4,500XAUUSD – H1 Analysis

Market Structure:

Gold is maintaining a strong bullish structure, consolidating tightly below the previous high. This is a classic continuation setup, not a distribution phase.

Key Zones:

- Resistance Zone: The former high area has now been tested and absorbed. Price acceptance above this zone signals strength.

- Support Zone: Buyers continue to defend the higher support band, confirming higher lows and trend control.

Price Action Insight:

Sideways movement under resistance = bullish consolidation.

No aggressive sell-off after breakout → sellers are weak.

Volume remains stable, suggesting institutional accumulation rather than exhaustion.

Primary Scenario:

A brief pullback to retest the breakout zone, followed by continuation toward new highs, with $4,500 as the next psychological magnet.

Risk Scenario:

Only a strong breakdown back below the consolidation range would invalidate the bullish bias.

Conclusion:

Gold is building energy above key levels. As long as price holds above support, dips are opportunities the trend favors continuation, not reversal.

ETH Is Compressing — Breakout or Another Trap?ETH/USD – H1 Analysis

Market Structure:

ETH is moving sideways after a strong recovery from the lower support zone. Price is now compressing just below a key resistance band, signaling indecision and liquidity build-up.

Key Levels:

Resistance: The upper red zone is the main barrier. Multiple rejections here confirm heavy supply.

Support: The green support zone below remains intact and continues to attract buyers on pullbacks.

Price Action Insight:

Sideways movement under resistance = accumulation, not weakness.

Higher lows are forming, showing buyers are gradually gaining control.

This structure often precedes a sharp expansion move.

Primary Scenario:

A clean break and hold above resistance opens the path toward the higher resistance zone above.

Alternative Scenario:

Failure to break may trigger a pullback toward support to reset momentum before the next attempt.

Conclusion:

ETH is in a decision zone. Stay patient wait for confirmation. The next move is likely to be fast and directional.

BTC Is Absorbing Supply — The Breakout Is Being EngineeredBTCUSD (H1) — MARKET ANALYSIS

1. Market Structure

- Bitcoin is currently trading inside a well-defined range, bounded by a strong support zone around 85,100 – 85,800 and a major resistance zone near 90,200 – 90,600. After the sharp rejection from support, price has shifted into a higher low structure, indicating that buyers are gradually regaining control.

This is no longer panic selling it is structured accumulation.

2. Price Behavior & Order Flow

Multiple re-tests of the resistance zone without aggressive rejection show sell pressure is weakening.

Each pullback is being bought higher than the previous one → classic demand absorption.

Volatility compression inside the range suggests the market is preparing for expansion, not continuation sideways.

3. Key Zones

Support Zone: 85,100 – 85,800

→ Strong demand base where liquidity has already been cleared.

Mid-Range Pivot: ~87,800 – 88,000

→ Acceptance above this level keeps bullish structure intact.

Resistance Zone: 90,200 – 90,600

→ Break & hold above confirms trend continuation.

Invalidation: Strong H1 close below 85,000.

4. Primary Scenario (High Probability)

- Continued consolidation above mid-range support

- Formation of higher lows

- Breakout above the resistance zone

- Momentum expansion toward 92,000 – 94,000

This matches the breakout projection drawn on the chart: pullback → continuation → expansion.

5. Alternative Scenario (Lower Probability)

Rejection at resistance

Short-term pullback toward 87,500 – 88,000

As long as price holds above support, this remains a bullish re-accumulation, not a reversal.

Conclusion

BTC is not hesitating it is absorbing supply under resistance. This type of structure typically precedes a clean breakout, not a breakdown. Traders chasing emotions will get trapped; traders respecting structure will be positioned ahead of the move.

The market is not asking if it will break only when.

ETH Is Holding the Line —Consolidation Before the Expansion MoveETHUSD (H1) — MARKET ANALYSIS

1. Market Structure

Ethereum has successfully reversed the previous downtrend after breaking the descending trendline and reclaiming structure above the key support zone (~2,760–2,800). Since that breakout, price has transitioned into a range-to-accumulation structure, forming higher lows and holding above the mid-range equilibrium.

This is no longer a corrective bounce it is trend repair in progress.

2. Price Action & Behavior

Strong impulsive leg from the support zone confirms aggressive demand entry.

Current price is consolidating around 3,000–3,040, showing acceptance rather than rejection.

Pullbacks are shallow and controlled → no panic selling, supply is being absorbed.

This type of sideways price action after an impulse typically precedes continuation, not reversal.

3. Key Zones

Major Support Zone: 2,760 – 2,800

→ Structural base; as long as price holds above, bullish bias remains valid.

Mid-Range Acceptance: 2,980 – 3,020

→ Holding above this zone keeps momentum intact.

Resistance Zone: 3,150 – 3,170

→ Liquidity target and decision zone for the next expansion.

Invalidation: Clean H1 close back below 2,900.

4. Primary Scenario (Preferred)

Short-term pullback / consolidation above 3,000

Higher low formation

Expansion toward 3,100 → 3,160 resistance zone

If resistance is absorbed, continuation toward higher highs follows.

The projected path on the chart reflects this logic: pullback → continuation → breakout attempt.

5. Alternative Scenario (Lower Probability)

Failure to hold 3,000

Deeper pullback toward 2,920–2,950

Still considered re-accumulation, unless support is decisively broken.

Conclusion

ETH is not topping it is building energy above reclaimed structure. The market is respecting support, absorbing supply, and compressing volatility beneath resistance. This behavior strongly favors an upside continuation, not a reversal.

Patience here is key the move is being prepared, not rushed.

Bitcoin Is Being Absorbed, Not RejectedBITCOIN (BTCUSD)

Technical Structure

Price is compressed inside a well-defined sideways range, capped by the resistance band above.

Multiple failed breakdowns into support confirm strong demand absorption.

Short-term EMAs are flattening and curling up, signaling balance shifting toward buyers.

This is range trading with accumulation characteristics, not distribution.

A clean hold above support keeps the structure constructive; expansion only comes with acceptance above resistance.

Market Logic

Repeated wicks and rotations inside the box indicate liquidity being built, not trend exhaustion.

Volatility is contracting → energy is being stored, not released yet.

The projected path suggests range continuation first, then directional expansion once liquidity is cleared.

Macro Backdrop

No aggressive USD or yield shock at the moment → macro pressure is neutral.

Risk assets are in wait-and-see mode, aligning with BTC’s compression behavior.

Takeaway

This is a patience market.

Edge appears at range extremes or on a confirmed breakout, not in the middle.

Bitcoin is preparing direction comes after liquidity is fully harvested, not before.

ETH Isn't Chasing— It’s Building Pressure for the Next ExpansionETHEREUM (ETHUSD) – 1H TECHNICAL & MACRO UPDATE

Technical Structure

Price is printing higher highs and higher lows, confirming short-term bullish structure.

The support zone around 2,910–2,920 is holding firmly → buyers are defending pullbacks.

Current price is consolidating above the prior breakout level, a classic continuation setup.

Target 1 (~3,060) acts as the first liquidity objective.

Target 2 (~3,160) aligns with the next major supply zone if momentum persists.

No bearish reversal pattern is present unless price loses the highlighted support zone decisively.

Macro Context

USD strength has stalled, reducing downside pressure on risk assets.

U.S. yields are stabilizing, allowing capital to rotate back into crypto.

Broader market sentiment favors risk-on accumulation, especially for large-cap crypto like ETH.

No negative macro catalyst currently strong enough to invalidate the bullish structure.

Summary

Bias remains bullish while above support.

Expect shallow pullbacks → continuation toward Target 1, then Target 2.

Strategy favors buying pullbacks, not chasing breakouts.

ETH is advancing with structure and macro alignment this is controlled expansion, not excess.

Gold Is Building the Base for a Fresh ATH — Macro Is the FuelXAUUSD – H1 | Technical

Technical Structure

Gold is holding above former resistance, now acting as support — a classic post-breakout consolidation.

Higher lows remain intact, momentum structure is bullish.

Price is compressing just below old ATH, signaling acceptance at high levels, not rejection.

Macro Drivers Supporting a New ATH

US Dollar weakness: Expectations of rate cuts and slowing US growth continue to pressure USD.

Falling real yields: This directly supports gold as a non-yielding asset.

Central bank demand: Ongoing accumulation from global central banks keeps long-term demand strong.

Geopolitical & macro uncertainty: Sustains safe-haven flows into gold.

Scenario Outlook

Primary: Short consolidation → breakout → New ATH expansion.

Pullbacks: Any retracement toward previous breakout levels is likely buy-the-dip, not trend reversal.

Bottom Line

Gold is not chasing highs it is building value above resistance.

With macro conditions aligned, the probability favors a clean breakout into a new all-time high rather than a major correction.

Ethereum Is Resetting — Not Breaking DownEthereum on the daily timeframe is still trading within a broader corrective structure, with price rotating between a clearly defined support zone around the mid-2,700s and a heavy resistance area overhead. The recent pullback into support shows slowing downside momentum, suggesting that selling pressure is being absorbed rather than aggressively expanded. This zone has historically attracted demand, making the current move more consistent with a technical reset than a continuation of the broader downtrend.

From a structural perspective, ETH is attempting to stabilize after a prolonged decline, and the reaction from support will be critical. As long as this demand zone holds, the downside remains corrective in nature, opening the door for a recovery move back toward the upper resistance zone. A sustained push higher would signal that buyers are regaining control and could initiate a larger mean-reversion rally within the higher-timeframe range.

From a macro standpoint, Ethereum’s behavior aligns with the broader crypto market environment, where risk assets remain sensitive to liquidity conditions and expectations around U.S. monetary policy. With no decisive tightening shock and ETF-related narratives still providing long-term support to the crypto space, deep downside continuation lacks strong macro confirmation. However, the absence of aggressive liquidity expansion also explains why upside remains corrective rather than impulsive at this stage.

In this context, ETH is in a decision zone. Holding support keeps the recovery scenario valid and favors a move back toward resistance, while a clean breakdown would reopen downside risk. Until price leaves this range with conviction, patience remains the edge the trade appears only when structure and macro align with clear intent.

Gold Isn’t Stalling — It’s Loading Liquidity for BreakoutGOLD (XAUUSD) — DETAILED TECHNICAL & MACRO ANALYSIS

1. Market Structure

- Gold remains in a clear bullish market structure on the H1–H4 timeframes.

The impulsive leg that pushed price toward $4,380 confirms strong buyer dominance.

- Instead of rejecting sharply from the high, price has transitioned into a sideways-to-slightly-up consolidation, which is a classic continuation pattern, not distribution.

- Higher lows continue to form inside the range, showing controlled pullbacks rather than panic selling.

This behavior indicates acceptance near highs, which is a key characteristic of strong trends.

2. Key Price Zones & Liquidity Behavior

Resistance Zone: $4,350 – $4,380

This zone is being tested multiple times without aggressive rejection.

Each pullback from resistance is becoming shallower, signaling supply absorption.

Sellers are active, but they are not in control.

Support Zone: $4,250 – $4,270

Buyers consistently defend this zone.

No clean breakdown or high-volume sell-through has occurred.

This confirms that downside moves are corrective, not trend-reversing.

Liquidity Insight

Liquidity is building above the range highs.

Compression inside the box suggests the market is preparing for expansion, not exhaustion.

3. Price Action Interpretation

- Gold is forming a bullish consolidation below previous highs, often seen before breakouts.

- Volatility contraction inside the range implies energy buildup.

- Chasing price inside the range is low probability.

- Edge only appears on confirmation : a clean acceptance above resistance or a sweep-and-hold from support.

4. Macro Environment (Why Gold Is Supported)

Federal Reserve Policy

The Fed remains restrictive, but markets increasingly price rate cuts in 2025, not further hikes.

Real rates are no longer accelerating higher.

The “higher-for-longer” narrative is fully priced, reducing downside pressure on gold.

U.S. Dollar & Yields

The U.S. Dollar is struggling to extend its upside momentum.

Real yields have stabilized, removing a major headwind for gold.

This macro balance allows gold to hold elevated levels instead of correcting deeply.

Risk & Capital Flows

Risk assets (equities, crypto) remain volatile and rotational.

Capital is flowing toward defensive and hedging assets.

Central bank gold demand remains structurally strong.

Seasonality

Year-end and early Q1 historically favor gold due to:

Portfolio rebalancing

Lower liquidity amplifying moves

Institutional positioning for the new year

5. Scenario Outlook

Primary Scenario (High Probability)

Continued consolidation above support

Gradual pressure against resistance

Clean breakout → new ATH above $4,380

Alternative Scenario

Another rejection from resistance

Range extension without breakdown

Structure remains bullish as long as $4,250 holds

Only a strong, high-volume breakdown below support would invalidate the bullish thesis — currently not supported by either price action or macro data.

6. Final Conclusion

Gold is not topping — it is digesting gains.

Technically: bullish structure + acceptance near highs

Macro-wise: supportive environment, not restrictive

Behavior: accumulation and compression, not distribution

This is a macro-aligned continuation setup, where patience is rewarded and impulsive entries are punished.

GBP/USD Is Range-Bound — Macro Pressure Favors RotationMarket Structure (H1)

GBP/USD is currently trading inside a well-defined moving range, capped by a firm resistance zone near 1.3450 and supported by demand around 1.3315. Price action within this box is overlapping and corrective, confirming a non-trending environment. The sharp rejection from resistance followed by weak follow-through on rebounds shows that buyers lack conviction, while sellers have not yet forced a decisive breakdown.

The latest impulsive move into the range was quickly absorbed, and price is now rotating back toward the mid-to-lower portion of the structure. As long as the pair remains below resistance, upside attempts are mean-reverting, not trend-defining.

Liquidity & Price Behavior

This range is acting as a liquidity container. Repeated tests of both extremes suggest ongoing stop-hunting rather than accumulation for a breakout. The projected path toward the lower boundary aligns with how price typically behaves in balanced conditions — rotating until liquidity is fully cleared.

Macro & Policy Context

From a macro perspective, conditions currently weigh on GBP:

The U.S. dollar remains supported by relatively higher yields and a still-restrictive Federal Reserve stance.

Markets continue to price rate cuts cautiously, keeping USD demand elevated during periods of uncertainty.

In contrast, the UK outlook remains softer, with slower growth expectations limiting GBP upside.

This macro divergence explains why GBP/USD struggles to accept above resistance and why rallies are being sold into rather than extended.

Conclusion

GBP/USD is not setting up for a breakout it is rotating within a macro-constrained range.

Failure at resistance favors continuation toward the support zone.

Only a clean acceptance above 1.3450 would shift the structure bullish.

Until then, patience remains key. The edge lies in reacting to range extremes, not anticipating trend continuation.

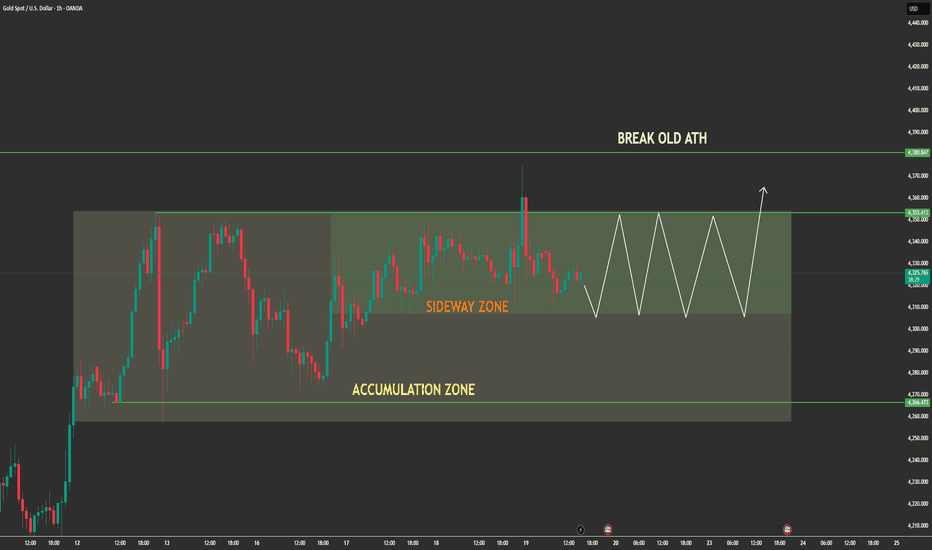

This Is Not a Breakout Yet — Gold Is Quietly Loading the MoveOANDA:XAUUSD 1H Technical Analysis

Market Structure

Gold is no longer trending impulsively. Price has transitioned into a clear accumulation → sideways expansion phase right below the old ATH.

What matters here is behavior, not direction.

- Strong impulsive leg already completed

- Price failed to immediately break higher

- Market shifted into range compression instead of reversal

This confirms buyers are still in control, but they are absorbing supply rather than chasing price.

Key Zones on the Chart

Upper Range / Pre-ATH Supply: ~4,350 – 4,380

- Sideway Zone (Value Area): Mid-range where price is rotating

- Accumulation Base: ~4,260 – 4,280 (range low / demand pocket)

Price continues to respect the range boundaries:

- Highs are capped → liquidity building above

- Lows are defended → no breakdown structure

This is balanced price action, not weakness.

Price Action Logic

Inside the box:

- Overlapping candles

- Repeated up/down rotations

- No follow-through selling

This is time-based correction, not price-based correction.

Markets often do this before expanding through major highs.

Scenarios Ahead

Primary (Higher Probability):

- Continued oscillation inside the range

- Liquidity builds on both sides

- Expansion → break above old ATH

Alternate:

- Sweep lower range once more

- Immediate reclaim

- Same upside continuation

A clean break below the accumulation base would be the only structure failure — and that has not happened.

Bottom Line

Gold is not stalling.

It is compressing energy inside value.

When this range resolves, it will not be subtle.

Bitcoin Is Not Trending — It’s Testing Conviction.BTC/USD – 1H Technical Analysis

Market Structure

- Bitcoin is clearly trading inside a well-defined horizontal range, bounded by a firm support zone below and a heavy resistance zone above. There is no trend dominance at the moment price is rotating, not expanding.

This is a range-controlled market, not a breakout or breakdown phase.

Key Zones

- Resistance Zone: ~89,800 – 90,300

- Mid-Range Value: ~87,700 – 88,200

- Support Zone: ~85,100 – 85,500

Price has repeatedly:

- Rejected from resistance with strong wicks

- Found aggressive buying interest at support

- Returned back to value without follow-through

That behavior confirms liquidity cycling, not directional intent.

Price Action Read

The latest move is a support bounce, not a trend reversal.

- The impulsive drop into support was immediately absorbed

- Buyers stepped in, pushing price back into the range

- However, upside momentum weakens as price approaches mid-range

This suggests the market is resetting positioning, not committing yet.

Scenarios Ahead

Primary Scenario (Range Continuation):

- Short-term pullback into mid-range

- Another rotation toward resistance

- Final liquidity sweep before a real breakout attempt

Breakout Scenario (Confirmation Required):

- Clean acceptance above resistance

- Holding above the range high

- Only then does upside expansion become valid

Until that acceptance happens, all upside moves are still range trades.

Bottom Line

Bitcoin is not bullish or bearish right now.

It is forcing traders to choose patience or punishment.

The real move begins after the range breaks not inside it.

Ethereum Is Loading — Breakout or Fake Move?ETHUSD (H1) — Quick Market Analysis

Market Structure

ETH is holding a short-term bullish structure after a strong rebound from the lower demand zone.

Price is printing higher lows, showing buyers are gradually regaining control.

Key Levels

Support Zone: ~2,915 – 2,920

Current Pivot: ~2,970 – 2,980

Target 1: ~3,050

Target 2: ~3,160

Price Behavior

Price is consolidating above support, forming a bullish continuation pattern.

No strong rejection yet → selling pressure remains weak.

The dotted path suggests a pullback → higher low → expansion structure.

Scenarios

Primary Scenario (Bullish):

Hold above support → push toward Target 1, then extension to Target 2.

Alternative Scenario:

A brief dip toward support to absorb liquidity before continuation higher.

Summary

ETH is not topping it’s pausing and building energy.

As long as support holds, upside targets remain valid.

Bitcoin Isn’t Trending — It’s Trapping TradersBTCUSD (H1) — Focused Market Analysis

Market Structure

BTC is clearly stuck in a range, with price repeatedly rejecting from the upper resistance zone and holding above a well-defined support zone.

No higher highs or lower lows → no trend, only balance.

Key Zones

Resistance Zone: ~89,800 – 90,200

Support Zone: ~84,800 – 85,200

Current Price: Trading near the mid-range → low R:R for breakout trades.

Moving Averages

Price is entangled with EMAs, confirming indecision and sideways conditions.

MAs are flat → momentum is neutral.

Price Behavior

Repeated liquidity sweeps at both extremes.

Dotted projection highlights a range-expansion cycle, not a trend.

Breakouts inside the range are likely fake moves.

Scenarios

Primary Scenario (High Probability):

Continued sideways oscillation between support and resistance.

Breakout Scenario (Only valid if):

Strong close above resistance with volume → opens upside continuation.

Breakdown below support → shifts market to bearish extension.

Summary

Bitcoin is not ready to trend.

Patience > prediction. Trade the range or wait for a confirmed breakout.

Correction Is Not a Reversal — Gold Is Reloading 1. Market Structure Overview

- Gold is still trading within a medium-term bullish structure, but price has entered a short-term corrective phase after failing to hold above the upper resistance zone.

- Strong rejection occurred at the POC / resistance area 4.35x – 4.38x, confirming active profit-taking.

The current price action is developing a classic ABC correction:

- Wave A: Completed with a sharp pullback.

- Wave B: Ongoing technical rebound.

Importantly, price remains above the major moving averages, meaning the primary uptrend is still intact.

This correction is technical in nature, not a trend reversal.

2. Market Context & Liquidity Behavior

Sellers are active near the highs, but downside momentum remains controlled.

The market is likely seeking liquidity clearance before deciding the next impulsive move.

The 4.26x – 4.20x zone stands out as a key re-accumulation area where buyers may step back in.

3. Today’s Price Scenarios

🔹 Primary Scenario (High Probability)

Price continues its corrective leg toward 4.26x – 4.20x.

This zone acts as a decision point:

Holding above it → supports re-accumulation and trend continuation.

Strong breakdown → opens room for a deeper short-term correction.

🔹 Alternative Scenario (Lower Probability)

Failure to reclaim strength after the correction may extend downside pressure.

Confirmation only occurs if support is decisively broken with volume.

4. Intraday Trading Setups — Re-Accumulation Focus

📌 SETUP 1 – Intraday Sell (Correction Timing)

XAUUSD SELL ZONE: 4369 – 4372

Take Profit: 4366 – 4361

Stop Loss: 4376

📌 SETUP 2 – Intraday Buy (Re-Accumulation Zone)

XAUUSD BUY ZONE: 4262 – 4265

Take Profit: 4268 – 4273

Stop Loss: 4258

⚠️ Always apply strict risk management to protect capital.

5. Summary & Trading Guidance

Main Trend: Bullish

Short-Term State: Correction → Re-accumulation

Bias: Wait for price to reach key zones, avoid chasing highs

👉 Today’s session is a balancing phase. The market’s reaction at the support zone will define whether gold resumes its uptrend or extends the correction. Patience and discipline remain the optimal strategy.

ETH Is Free — But Not Trending YetETH/USD – 1H

Price has broken the descending trendline, signaling selling pressure is weakening.

However, this is a technical rebound, not a confirmed uptrend.

Key Levels

Support: 2,760–2,800 (strong buyer reaction)

Current zone: 2,940–2,960 (decision area)

Resistance: 3,150–3,160 (major supply)

Outlook

Base case: range / shallow pullback, then a retest toward 3,050–3,160.

Bullish continuation only if price closes and holds above 3,160.

Bottom Line

Momentum has improved, but the real move comes after resistance breaks.

Patience beats prediction here.

Ethereum Isn’t Weak — It’s Being AbsorbedETH/USD – H1 Technical Breakdown

Ethereum is currently trading inside a well-defined sideways range, bounded by a firm support zone near the lower box and a clearly defended resistance band above. This is not random consolidation it is structured balance, where liquidity is being built rather than released.

On the price action side, ETH has repeatedly swept liquidity near the support zone and responded with sharp rebounds, indicating aggressive absorption by buyers. Each sell-off into the lower boundary has failed to extend, suggesting that downside momentum is being capped. Meanwhile, upside attempts are still capped by the resistance zone, keeping price compressed inside the range.

From a trend and moving average perspective, price is now attempting to reclaim the short-term EMA, while the longer EMA still acts as a dynamic ceiling. This creates a classic compression environment: volatility contracts, fake moves appear, and impatient traders are forced out.

Market Logic Going Forward

- As long as ETH holds above the support zone, downside remains corrective, not trend-defining.

- A clean acceptance above the resistance zone would signal range resolution, opening room for expansion toward the upper targets.

- Until that happens, ETH is in a positioning phase, not a trending phase — chasing candles inside the box remains low probability.

Key Takeaway

This is not a market choosing direction yet. It is a market testing commitment. The real move begins when price leaves the range with acceptance, not when it reacts inside it.

This Pullback Is Not a Sell SignalEUR/USD is still bullish inside a clear ascending channel. Price is consolidating near the upper half of the structure this is pause, not reversal.

Key Points

Structure: Higher highs & higher lows remain intact

Support: EMA 34 & EMA 89 + channel support holding

Current move = supply absorption, not distribution

Scenarios

Main: Hold above channel → continuation toward 1.176 → 1.180 → 1.184

Risk: Only a clean break below channel invalidates the bullish setup

Bias: Buy pullbacks, don’t chase

Strong trends pause before they move again.