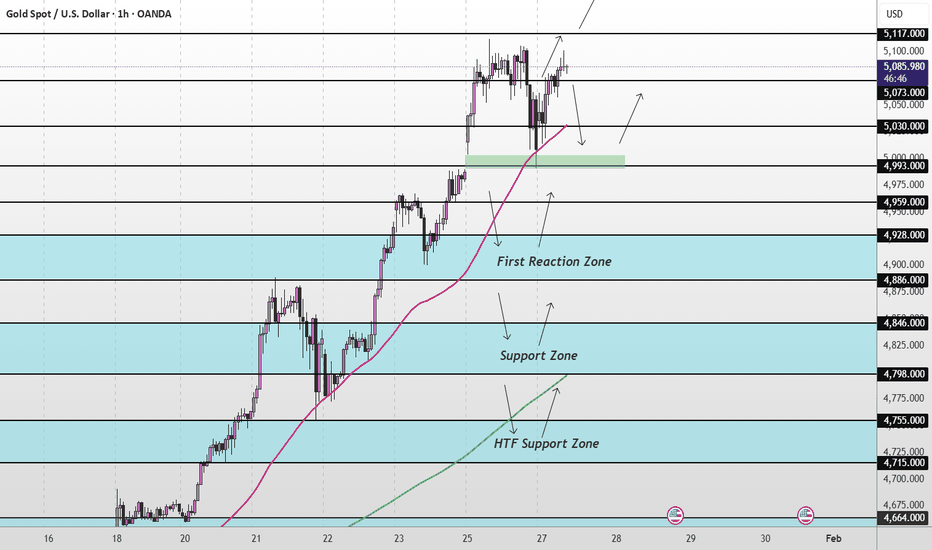

XAUUSD Week Ahead | Key Levels in FocusGold is currently trading in the first reaction zone between 5092 key resistance and 4932 support. We’ll need to see one of these levels break to establish clearer direction.

A test of 5092 is possible, but for any sustained move higher, we need a confirmed break above that level. If 4932 fails to hold, focus shifts to the lower support zones, where buyers may look to step in.

📌Key levels to watch:

Resistance:

5092(Key Resistance)

5202

Support:

4932

4843

4720

4600

4491

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

Intradaytrade

XAUUSD Weekly Outlook | Key Levels & High-Impact Data AheadGold is starting the week trading around 5003, pushing back into a key resistance area after last week’s recovery. Price is sitting close to the MA200, which may act as a dynamic resistance in the short term, while the MA50 remains the nearest dynamic support below.

For bullish continuation, price needs a clean break above 5078. If that level gives way, the upper resistance at 5202 comes into focus, with scope for further upside as long as momentum holds.

If price fails to break higher and starts rejecting from this area, a pullback into the support zone is likely. If selling pressure picks up and that zone gives way, watch the HTF support zone (4600–4491) next, followed by the deeper market structure support around 4408–4316.

📌 Key levels to watch

Resistance:

5078 → 5202 (Key Resistance Zone)

Support:

4981

4871 → 4732 (Support Zone)

4600 → 4491 (HTF Support Zone)

4408 → 4316 (HTF Market Structure Support)

👉 Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

🔎Fundamental Focus:

Main volatility drivers this week are NFP (jobs data) and US CPI.

On geopolitics, markets are still reacting to Middle East risk headlines, even as US–Iran talks are continuing (so sentiment can flip fast on any headline).

XAUUSD Intraday Plan | Can Bulls Reclaim Control?Gold failed to sustain the bullish move into 5118 yesterday, which was followed by a sharp decline into the first reaction zone, where support is holding for now.

For bulls to regain control, price needs to reclaim 4957, which would open the door for another push toward 5041 and 5118. If the current support zone fails, watch the lower support zones closely for potential reactions.

📌 Key levels to watch:

Resistance:

4957

5041

5118

Support:

4867

4792

4676

4586

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

⚠️ Volatility remains high and the range is wide — manage risk and position size carefully.

NZDUSD || Potential Bullish SetupTechnical Summary

Analysis of currently printing weekly candle of OANDA:NZDUSD indicates a pending expansion phase, with a bullish bias suggested by underlying market conditions.

Strategy Framework

With the weekly candle signalling imminent expansion, we'll position for entries near POI targeting the expansion move toward our Target

Confluence Patterns

✅ Strong directional momentum candles

✅ Equal rejection wicks

✅ Change of character (CHOCH)

✅ Key levels retest

🚩 IDEA INVALIDATION

Impulsive move in a bearish direction beyond POI our pullback range.

💬 LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

👍 FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

🛡 DISCLAIMER

This content is provided for informational and educational purposes—not financial advice. Trading is risky business. Do your homework, manage your risk, and trade responsibly.

EURCHF || Potential Bullish SetupTechnical Summary

Cross-timeframe analysis of OANDA:EURCHF reveals bullish confluence from the Daily timeframe down to our Hourly timeframe, strengthening our directional outlook.

Strategy Framework

With multiple timeframes in agreement, we'll ideally wait for price to correct towards our POI before executing entries aligned with the general idea that price will move toward Target

Confluence Patterns

✅ Impulsive moves away from POI

✅ Long wick rejections

✅ Break of structure (BOS)

✅ Horizontal level rejections

🚩 IDEA INVALIDATION

Bearish pressure emerges with impulsive momentum past POI

💬 LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

👍 FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

🛡 DISCLAIMER

This content is provided for informational and educational purposes—not financial advice. Trading is risky business. Do your homework, manage your risk, and trade responsibly.

XAUUSD Intraday Plan | Sellers in Control for NowYesterday’s analysis played out as expected. After rejection at the 5562 resistance, gold reversed lower and dropped below the 5000 level.

Gold is currently trading around 5164, sitting below the MA50, with the 5117 level providing support.

If selling pressure continues, a test of the MA200 comes into focus, which may provide dynamic support. For deeper moves, watch the lower support zones for potential reactions.

If support holds and price stabilises, a retest of the MA50 remains possible. However, for another leg back toward the ATH, price will need to reclaim the key resistance zone.

📌 Key levels to watch:

Resistance:

5211

5263

5324

5377

Support:

5117

5073

4993

4959

4886

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

XAUUSD Intraday Plan | ATH Pause at ResistanceGold is flying. Levels have been updated after price reached 5602, marking another all-time high during the Tokyo session. Price is currently taking a breather just below the 5562 resistance.

For continuation higher, a confirmed break above 5562 is needed, which would open the door for a move toward 5606 and potentially higher levels. If 5562 holds as resistance, a short-term retracement is likely and would be healthy at this stage.

Watch the pullback zone first. If that gives way and selling pressure builds, the lower support zones may come into play and offer potential buy-the-dip opportunities.

📌 Key levels to watch:

Resistance:

5562

5606

5651

5689

Support:

5506

5446

5377

5324

5263

5211

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

XAUUSD Intraday Plan | Key Levels Ahead of FOMCGold has extended its rally and is now trading around 5300. Resistance and support zones have been updated accordingly.

Price has broken above the 5263 resistance, opening the 5324 target. However, a pullback is likely, and it’s important to see whether 5263 can hold as support.

If 5263 gives way, watch the pullback zone for potential reactions. Should selling pressure persist, a deeper retracement into the lower support zones may follow.

A confirmed break above 5324 would open the door for a move toward 5377.

📌Key levels to watch:

Resistance:

5324

5377

Support:

5263

5211

5157

5117

5073

5030

4993

👉 Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

🔎Fundamental focus:

With FOMC later today, sharp moves in both directions are likely. A pullback would be healthy at this stage and could offer better buying opportunities.

Gold at ATH before FOMC shakeout first or straight breakout?🧭 Macro Snapshot

Donald Trump maintains a hardline stance, increasing military presence in the Middle East → geopolitical risk remains elevated.

Tonight’s key focus: Federal Reserve

Political pressure and questions around Fed independence.

DXY continues to weaken, retesting major historical support (2020–2022) → supportive for gold.

👉 Conclusion: Geopolitics + a weaker USD set the bullish bias, while the Fed determines short-term volatility.

📊 Intraday Range to Watch

Upper range: 5,280 – 5,305

Lower range: 5,190 – 5,160

→ High probability of range trading and liquidity absorption ahead of the Fed decision.

🟢 Support

5,220–5,225 | 5,150–5,165 | 5,080–5,085 | 5,050–5,060

🔴 Resistance

5,280–5,294 | 5,300 | 5,315 | 5,380–5,385

⚠️ Strategy Notes

Expect possible fake moves / stop hunts within the range.

Avoid chasing highs or catching tops without confirmation.

Focus on price reaction at key levels and stay disciplined.

Summary: Gold is fundamentally supported, but today the key is how price reacts within 5,160–5,305.

Be patient — wait for confirmation — trade the reaction.

XAUUSD Intraday Plan | Bullish Structure HoldsGold retraced to fill the gap, followed by a strong bullish move. Price is now trading around 5085, just above the 5073 support.

The 5117 target remains open, and within the current structure, pullbacks may offer buying opportunities. The broader trend remains bullish, although quick retracements can still occur, making risk management key.

If 5073 gives way, watch yesterday’s bounce zone for potential buying interest. Should selling pressure build further, a deeper pullback into the lower support zones remains possible.

📌Key levels to watch:

Resistance:

5117

5157

Support:

5073

5030

4993

4959

4928

4886

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

Nifty Analysis EOD – January 27, 2026 – Tuesday🟢 Nifty Analysis EOD – January 27, 2026 – Tuesday 🔴

25K Resurgence: Bulls Reclaim 25,180 After Volatile Expiry Rollercoaster!

🗞 Nifty Summary

Nifty delivered a high-drama session on Tuesday, opening with a modest 21-point Gap Up despite much stronger global cues from Gift Nifty.

The bulls initially added 45 points but were met with a fierce 194-point slide that tested the critical 24,920 ~ 24,932 support zone. This area was defended with extreme conviction, sparking a massive V-shape recovery that retraced the entire fall.

After a mid-day battle and rejection at the 25,180 “fort,” the index entered a volatile consolidation phase near the CPR.

Finally, at 2:45 PM, a high-conviction trendline breach allowed bulls to conquer the 25,180 barrier, leading to a strong close at 25,234.10 (Adjusted close: 25,175.40), signaling that the buyers have officially moved back into the driver’s seat.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The day was defined by “Expiry Chaos.” The failure of the opening gap to match global expectations invited early sellers who pushed the index to a new low of 24,932.55.

However, the “resurrection” from these lows was relentless. The most significant structural shift occurred in the final hour; the breach of the intraday trendline and the successful hold above 25,180 suggest that the bearish grip has loosened. While sellers remain active near the 25,270 zone, the average closing indicates that the bulls have successfully colonized the previous resistance territory.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,063.35

High: 25,246.65

Low: 24,932.55

Close: 25,175.40

Change: +126.75 (+0.51%)

🏗️ Structure Breakdown

Type: Bullish candle with high-volatility wicks.

Range: ≈ 314 points — Reflects intense territorial fighting.

Body: ≈ 112 points — Strong directional close above the opening.

Upper Wick: ≈ 71 points — Indicates supply pressure and profit-booking near the 25,250 mark.

Lower Wick: ≈ 131 points — Massive rejection of lower prices, confirming the 24,920 floor is solid.

📚 Interpretation

The long lower shadow confirms that every dip toward the 24,930 zone was viewed as a high-value buying opportunity. Although the upper wick shows that bears are still defending the 25,270 zone, the fact that Nifty closed deep in the green following a 194-point slide is a major win for the bulls.

🕯 Candle Type

Bullish / Rejection / Recovery Candle — Confirms that the demand at lower levels has absorbed the recent selling pressure. Follow-through above 25,250 is now the key.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 262.08

IB Range: 229.30 → Big

Market Structure: Balanced

Trade Highlights:

10:40 Short Trade: Trailing SL Hit (Pattern Breakdown attempt).

14:50 Long Trade: Target Hit (R:R 1:1.42) (Trendline Breakout).

Trade Summary: The morning’s volatility made short positions difficult to sustain as the V-shape recovery was too aggressive. However, the strategy excelled in the final hour, capturing the decisive trendline breakout that led to the high-conviction close.

🧱 Support & Resistance Levels

Resistance Zones:

25270

25310 ~ 25335

25430

Support Zones:

25060

25025 ~ 25000

24970

24920 (Critical Floor)

🧠 Final Thoughts

“The 25,180 fort has been breached.”

Bulls have successfully defended the structural floor and managed a strong territorial gain.

For the upcoming session, we expect a bullish continuation. The next major battle will take place at the 25,310 ~ 25,335 zone.

A closing above this level would significantly strengthen the bullish sentiment and open the path for a move back toward 25,500.

For now, the focus remains on holding the intraday gains and avoiding any sharp reversal below 25,060.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Next week: Will gold listen to the Fed… or the White House?🔎 Context

Next week could be highly volatile as monetary policy and geopolitics converge.

Donald Trump signaled a potential 100% tariff on Canadian goods if Canada moves closer to trade deals with China—raising trade-war risks.

At the same time, military assets are being deployed en masse around Iran, heightening concerns that tensions could escalate.

👉 Safe-haven flows may return, with gold potentially opening the week gap-up and early buying.

🧠 Quick take

Primary trend: Bullish

At elevated prices: a short, sharp shakeout is possible to absorb liquidity

No top/bottom calls—watch price reactions at key zones

📌 Key levels to watch

🟢 Supports: 4920–4900 | 4890–4882 | 4850–4830 | 4660–4640

🔴 Observation resistances: 5006–5030–5090 | 5110–5115 | Current ATH

🎭 Weekly scenarios (reference only)

Early week: Gap-up / early push

Pre-FOMC: Chop & liquidity sweep

Then: Deep shakeout or base-building and continuation

👉 Distribution at the top—or just a pause before the next leg higher?

XAUUSD Intraday Plan | Decision Time at SupportPrice dropped into the immediate support zone, where the MA50 is providing dynamic support. We are now seeing a bounce from this area; however, a break above 4847 is needed to attempt further upside toward 4883, and above that 4928.

If price stalls and reverses from here, watch the first immediate support zone. Should selling pressure build, a deeper retracement into the lower support zones may follow, where renewed buying interest is expected.

📌 Key levels to watch:

Resistance:

4847

4883

4928

Support:

4808

4764

4722

4685

4664

4600

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

🔍Fundamental focus:

Markets are watching US GDP and Core PCE today, key inputs for Fed expectations and USD direction. Alongside macro data, ongoing geopolitical tensions keep volatility elevated, with gold remaining sensitive to both headlines and data.

1/20 - Pre-Market read and Game plan for the day. 1) Primary plan: Sell the retest (bearish continuation)

Bias stays short while below POI 1 (25,128) and especially below POI 2/PDL area.

A+ entry idea for today:

• Let price pop into POI 2 (25,096.5) or POI 1 (25,128)

• Wait for rejection (lower high, strong red candle, failure to hold above, wick + close back under)

• Targets (scale):

1. POI 3 (25,044.75)

2. POI 4 (25,021.25)

3. POI 5 FVG MID (25,002.5)

4. POI 6 (24,979.25)

• Invalidation: A clean reclaim + hold above POI 1, and especially if it starts accepting above 25,128 (don’t fight that).

Why this is clean: you’re using your POIs like “stairs” — sell at the top stair, take profit at the next stair down.

⸻

2) Secondary plan: Bounce scalp ONLY if a POI holds

If price sweeps into POI 5 / POI 6 and you get a hard rejection + reclaim (fast snap back), that’s your mean reversion scalp.

• Long scalp trigger: reclaim back above the POI you swept (ex: wick under 25,002.5 then closes back above it)

• Targets: back to POI 4 → POI 3 → POI 2

• Rule: if it accepts below the POI you’re trying to long, don’t average down — next stop becomes POI 6 / POI 8 zones.

⸻

3) Flip plan: Only get bullish above POI 1

If price reclaims POI 1 (25,128) and holds (not just wicks), then you can tell members:

• “Okay, bears failed — now we look for pullback longs into POI 1/POI 2 as support.”

• Upside “checkpoints”: 25,311 (NY PM High) then 25,430 (NY AM High / PDH)

⸻

Why you are NOT changing POIs from yesterday

1. POIs are HTF anchors, not feelings.

They’re built off prior session highs/lows, PDH/PDL, and liquidity/FVG zones. Those levels don’t change just because price is noisy.

2. POIs only change after “acceptance” or “mitigation.”

You adjust levels when price fully breaks + accepts (multiple closes through) or when the zone is clearly mitigated (used up and no longer reacting).

3. Consistency = tradable data for the community.

If you move POIs every morning, your members can’t build pattern recognition. Keeping them fixed lets everyone see the same reactions.

4. Your screenshots literally show POIs working.

Price is reacting around POI 1/2 and then stair-stepping lower — that’s exactly what POIs are for.

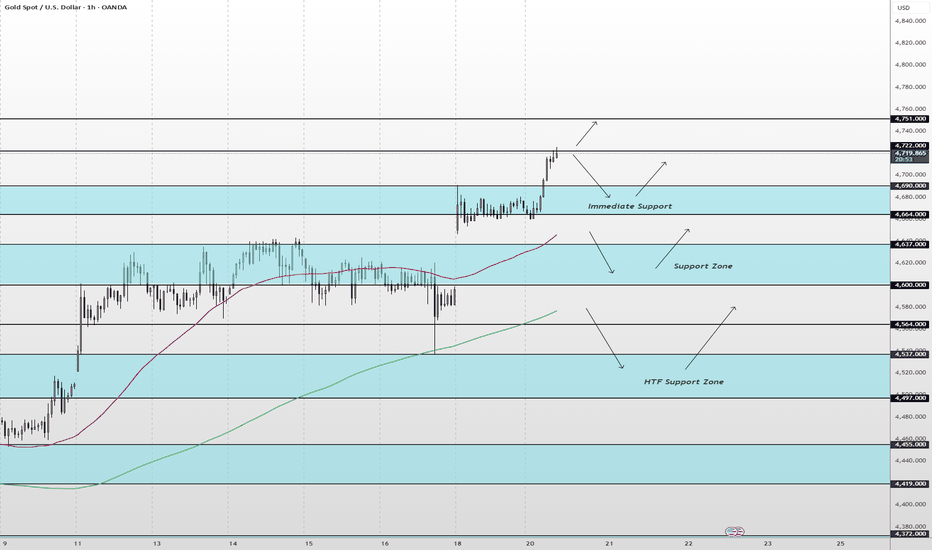

XAUUSD Intraday Plan | Technical Levels to WatchGold pushed higher after yesterday’s consolidation, reaching the 4722 resistance. For continuation to the upside, a clean break above 4722 is needed.

Failure to clear 4722 would likely lead to a retracement into lower support levels, where buyers may look to step back in.

📌Key levels to watch:

Resistance:

4722

4751

Support:

4690

4664

4637

4600

👉 Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

🔍Fundamental focus:

Geopolitical risks remain elevated, continuing to support gold as a safe-haven asset and keeping volatility elevated.

In addition, Day 1 of the World Economic Forum (WEF) is underway, with global leaders and policymakers speaking throughout the day. Any unexpected headlines or shifts in tone around growth, inflation, or geopolitics may influence risk sentiment and drive intraday volatility in gold.

Chumtrades XAUUSD H2 | Is the Liquidity Sweep Over?On Friday, the market reacted strongly after Trump’s comments regarding Kevin Hassett, when Trump expressed his preference for Hassett to remain in his current role rather than taking a new position.

👉 As a result, gold printed a long wick liquidity sweep back into the prior ATH zone, around 4530–453X, before closing back above 456X.

This brings us to the key question:

Was this sweep enough for the BUY side, or is the market still looking to test lower levels?

Political developments will be a key driver for gold direction in the coming week.

📰 Key Political Factors to Monitor

1. Trump – Greenland

The US has imposed 10% tariffs, with the possibility of increasing them to 25% on countries that do not support the annexation of Greenland

No fixed deadline, tariffs remain until Greenland becomes part of the US

→ This is a supportive factor for gold, especially amid rising geopolitical uncertainty

→ This news may directly impact the market open

→ If price reacts strongly, avoid SELLs near resistance

2. Iran – Protests

Monitor the risk of Trump returning to direct intervention

→ A potential headline-driven volatility trigger

🟢 Key Support Zones to Watch

4530 – 4535

4515 – 4510

4480 – 4482

4462

4410 – 4407

🔴 Key Resistance Zones to Monitor

4618 – 4628

4648 – 4650

4655 – 4660

4698 – 4699

⚠️ Trading Notes

Price levels are zones for observation, not instant entry points

SELL setups around 462X must be evaluated based on news reaction

If momentum accelerates on headlines → stay flat and avoid trading against strength

💬 Question for the New Week

Is the market finishing its liquidity collection on the BUY side,

or was Friday’s sweep the final test before the next leg higher?

📌 Follow www.tradingview.com for proactive market analysis, structured trade planning, and risk management insights.

BTR Update | 16 Jan 2026 |+30 POINTS PROFIT | BSE LTD📉 BTR Update | 16 Jan 2026 | Clean Short Trade

Stock: BSE LTD

Timeframe: Intraday

Indicator: BTR Price Action

🔴 Trade Execution

Signal: Short

Entry: 2840

Exit: 2810

Points Gained: +30 Points

🧠 Why This Trade Worked

✔ Clear trend confirmation

✔ No overthinking

✔ No early exit

✔ No revenge trade

✔ Followed BTR rules step by step

This was a textbook BTR short —

clean entry, clean exit, zero emotion.

📌 Key Message

❝ Profits don’t come from prediction,

they come from discipline & execution. ❞

BTR doesn’t chase price.

BTR waits for structure.

When signal appears — action is simple.

XAUUSD Intraday Plan | Key Levels Near ATHAnother day, another ATH for gold. Price is currently trading near the 4630 resistance, attempting another push higher. A confirmed break above this level would open the door toward the 4664 as the next upside target.

If price fails to reclaim this area, a healthy pullback may follow into the first support zone, where the MA50 may provide dynamic support. Should selling pressure build further, a deeper retracement could bring price into the lower support zones, where buyers are likely to step back in.

📌Key levels to watch:

Resistance:

4630

4664

4690

Support:

4585

4537

4492

4469

👉Let key levels guide your decisions — wait for confirmation and manage risk accordingly.

🔎Fundamental focus:

Markets are focused on US inflation and consumption data today, with Core PPI, PPI, and Retail Sales in the spotlight. These releases will provide insight into inflation pressures and consumer strength, which can influence USD sentiment and drive volatility in gold.

US100 M15 HTF FVG Reaction and Intraday Continuation Setup📝 Description

CAPITALCOM:US100 is holding above a short-term demand zone after a corrective pullback. Price is reacting positively from the M15 FVG, suggesting stabilization and potential continuation within the broader intraday structure.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the M15 FVG base

Preferred Setup:

• Entry: 25,690

• Stop Loss: Below 25,660

• TP1: 25,743

• TP2: 25,782

• TP3: 25,816 (HTF reaction / liquidity draw)

________________________________________

🎯 ICT & SMC Notes

• Reaction from M15 FVG confirms short-term demand

• No bearish BOS on lower timeframes

• Structure favors continuation after shallow pullback

________________________________________

🧩 Summary

As long as price holds above the intraday FVG, upside continuation toward higher liquidity remains the preferred scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

Softer PPI reduces inflation pressure while strong Retail Sales support growth. This mix favors risk-on sentiment, keeping NASDAQ biased to the upside.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

AUDUSD || Potential Bullish SetupTechnical Summary

Analysis of OANDA:AUDUSD currently printing weekly candle indicates a pending expansion phase, with a bullish bias suggested by underlying market conditions.

Strategy Framework

With the weekly candle signalling imminent expansion, we'll position for entries near POI targeting the expansion move toward our Target

Confluence Patterns

✅ Strong directional momentum candles

✅ Equal rejection wicks

✅ Change of character (CHOCH)

✅ Key levels retest

⚠ IDEA INVALIDATION

Impulsive move in direction beyond POI our pullback range.

💬 LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

👍 FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

🛡 DISCLAIMER

This content is provided for informational and educational purposes—not financial advice. Trading is risky business. Do your homework, manage your risk, and trade responsibly.

GBPUSD || Potential Bullish SetupTechnical Summary

Analysis of BLACKBULL:GBPUSD currently printing weekly candle indicates a pending expansion phase, with a bullish bias suggested by underlying market conditions.

Strategy Framework

With the weekly candle signalling imminent expansion, we'll position for entries near POI targeting the expansion move toward our Target

Confluence Patterns

✅ Strong directional momentum candles

✅ Equal rejection wicks

✅ Change of character (CHOCH)

✅ Key levels retest

⚠ IDEA INVALIDATION

Impulsive move in direction beyond POI our pullback range.

💬 LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

👍 FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

🛡 DISCLAIMER

This content is provided for informational and educational purposes—not financial advice. Trading is risky business. Do your homework, manage your risk, and trade responsibly.

XAUUSD Intraday Plan | Technical Levels to WatchGold continued its bullish momentum into Friday, closing around 4509. A break above 4492 has opened the door for a move toward the 4537 target.

In the short term, watch the first reaction zone for any minor pullbacks or consolidation.

If momentum starts to cool and price slips below 4469, focus shifts to the support zone, where buyers will need to step in to maintain the current structure. The moving averages below price may provide dynamic support. Failure to hold there would increase the risk of a deeper retracement toward the HTF support zone, which also aligns with an unfilled market gap from Monday, June 5th.

📌Key levels to watch:

Resistance:

4518(minor resistance)

4537

4585

Support:

4492

4469

4441

4419(minor support)

4393

🔎Fundamental focus:

This week’s key event is US Core CPI, which will be closely watched for signals on underlying inflation trends and potential Fed policy expectations. As the most important data point of the week, Core CPI is likely to be a major driver of USD strength and gold volatility.

Alongside macro data, ongoing geopolitical tensions remain a background risk and may continue to support gold as a safe-haven asset, contributing to elevated volatility.

US500 Long Setup – Inverse H&S + Key Support📈 US500 Long Setup – Inverse H&S + Key Support

The US500 4H chart is shaping up for a bullish continuation, with multiple technical signals aligning. Price has recently formed a potential inverse head and shoulders pattern, suggesting a reversal from the recent downtrend. With Break of Structure (BOS) confirmed and price holding above the Support Level at 6914.4, bulls are gaining control.

🟢 Trade Setup Details

- Support Level: 6914.4

- Key Levels to Watch: 6895.4 and 6824.8

- Maximum Stop Loss: 6868.2

- Take Profit Targets:

- 🎯 TP1: 6962.1

- 🎯 TP2: 6971.7

The current price action around 6925.9 shows strength, with volume supporting the bullish breakout.

🔍 Technical Highlights

- Two Break of Structure (BOS) points confirm bullish momentum.

- The inverse head and shoulders pattern adds confluence to the long bias.

- Price is holding above key support and reclaiming higher ground.

- Volume shows increasing interest on bullish candles, suggesting accumulation.

📈 Bullish Scenario

If price continues to hold above 6914.4, we could see a push toward TP1 and TP2. Watch for:

- Retest of neckline with bullish confirmation

- Momentum indicators crossing into bullish territory

- Volume spike on breakout above 6930–6940

⚠️ Risk Management

- SL below 6868.2 protects against invalidation of the inverse H&S pattern.

- Consider scaling out at TP1 and TP2 to lock in gains.

- Avoid chasing if price moves too far—wait for pullbacks or confirmation candles.

💡 Summary: US500 is showing a textbook bullish reversal setup, with inverse head and shoulders, Break of Structure, and strong support at 6914.4. With layered TP targets and a tight SL, this trade offers a clean structure and solid risk/reward.

🚀 Whether you're trading the breakout or riding the momentum toward 6970+, this setup deserves your attention.