5 IMPOTANT TYPES OF ELLIOTT WAVE PATTERNS !!Hello traders, today we will talk about 5 TYPES OF ELLIOTT WAVE PATTERNS

( FIRST SOME BASIC INFO )

What is Elliott Wave Theory?

The Elliott Wave Theory suggests that stock prices move continuously up and down in the same pattern known as waves that are formed by the traders’ psychology.

The theory holds as these are recurring patterns, the movements of the stock prices can be easily predicted.

Investors can get an insight into ongoing trend dynamics when observing these waves and also helps in deeply analyzing the price movements.

But traders should take note that the interpretation of the Elliot wave is subjective as investors interpret it in different ways.

(KEY TAKEAWAYS)

The Elliott Wave theory is a form of technical analysis that looks for recurrent long-term price patterns related to persistent changes in investor sentiment and psychology.

The theory identifies impulse waves that set up a pattern and corrective waves that oppose the larger trend.

Each set of waves is nested within a larger set of waves that adhere to the same impulse or corrective pattern, which is described as a fractal approach to investing.

Before discussing the patterns, let us discuss Motives and Corrective Waves:

What are Motives and Corrective Waves?

The Elliott Wave can be categorized into Motives and Corrective Waves:

1. Motive Waves:

Motive waves move in the direction of the main trend and consist of 5 waves that are labelled as Wave 1, Wave 2, Wave 3, Wave 4 and Wave 5.

Wave 1, 2 and 3 move in the direction of the main direction whereas Wave 2 and 4 move in the opposite direction.

There are usually two types of Motive Waves- Impulse and Diagonal Waves.

2. Corrective Waves:

Waves that counter the main trend are known as the corrective waves.

Corrective waves are more complex and time-consuming than motive waves. Correction patterns are made up of three waves and are labelled as A, B and C.

The three main types of corrective waves are Zig-Zag, Diagonal and Triangle Waves.

Now let us come to Elliott Wave Patterns:

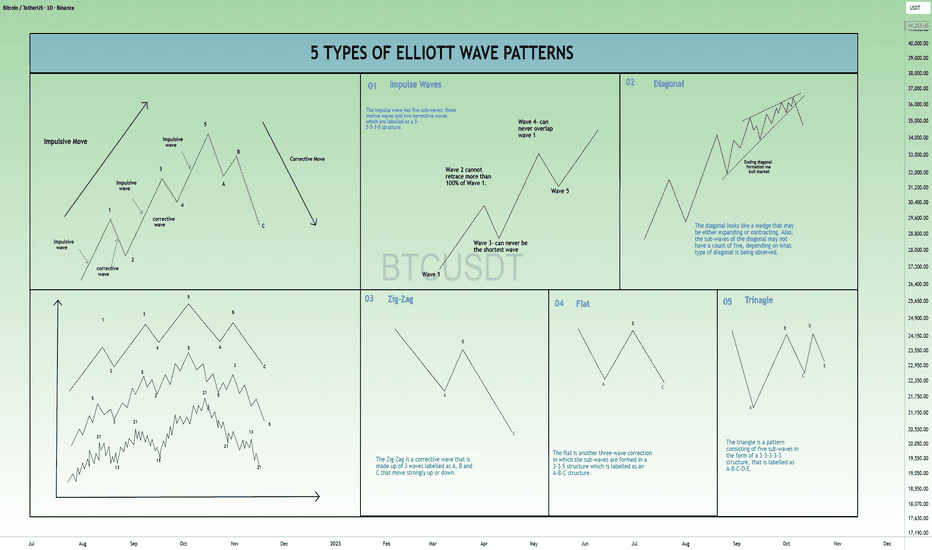

In the chart I have mentioned 5 main types of Elliott Wave Patterns:

1. Impulse:

2. Diagonal:

3. Zig-Zag:

4. Flat:

5. Triangle:

1. Impulse:

Impulse is the most common motive wave and also easiest to spot in a market.

Like all motive waves, the impulse wave has five sub-waves: three motive waves and two corrective waves which are labelled as a 5-3-5-3-5 structure.

However, the formation of the wave is based on a set of rules.

If any of these rules are violated, then the impulse wave is not formed and we have to re-label the suspected impulse wave.

The three rules for impulse wave formation are:

Wave 2 cannot retrace more than 100% of Wave 1.

Wave 3 can never be the shortest of waves 1, 3, and 5.

Wave 4 can never overlap Wave 1.

The main goal of a motive wave is to move the market and impulse waves are the best at accomplishing this.

2. Diagonal:

Another type of motive wave is the diagonal wave which, like all motive waves, consists of five sub-waves and moves in the direction of the trend.

The diagonal looks like a wedge that may be either expanding or contracting. Also, the sub-waves of the diagonal may not have a count of five, depending on what type of diagonal is being observed.

Like other motive waves, each sub-wave of the diagonal wave does not fully retrace the previous sub-wave. Also, sub-wave 3 of the diagonal is not the shortest wave.

Diagonals can be further divided into the ending and leading diagonals.

The ending diagonal usually occurs in Wave 5 of an impulse wave or the last wave of corrective waves whereas the leading diagonal is found in either the Wave 1 of an impulse wave or the Wave A position of a zigzag correction.

3. Zig-Zag:

The Zig-Zag is a corrective wave that is made up of 3 waves labelled as A, B and C that move strongly up or down.

The A and C waves are motive waves whereas the B wave is corrective (often with 3 sub-waves).

Zigzag patterns are sharp declines in a bull rally or advances in a bear rally that substantially correct the price level of the previous Impulse patterns.

Zigzags may also be formed in a combination which is known as the double or triple zigzag, where two or three zigzags are connected by another corrective wave between them.‘

4. Flat:

The flat is another three-wave correction in which the sub-waves are formed in a 3-3-5 structure which is labelled as an A-B-C structure.

In the flat structure, both Waves A and B are corrective and Wave C is motive having 5 sub-waves.

This pattern is known as the flat as it moves sideways. Generally, within an impulse wave, the fourth wave has a flat whereas the second wave rarely does.

On the technical charts, most flats usually don’t look clear as there are variations on this structure.

A flat may have wave B terminate beyond the beginning of the A wave and the C wave may terminate beyond the start of the B wave. This type of flat is known as the expanded flat.

The expanded flat is more common in markets as compared to the normal flats as discussed above.

5. Triangle:

The triangle is a pattern consisting of five sub-waves in the form of a 3-3-3-3-3 structure, that is labelled as A-B-C-D-E.

This corrective pattern shows a balance of forces and it travels sideways.

The triangle can either be expanding, in which each of the following sub-waves gets bigger or contracting, that is in the form of a wedge.

The triangles can also be categorized as symmetrical, descending or ascending, based on whether they are pointing sideways, up with a flat top or down with a flat bottom.

The sub-waves can be formed in complex combinations. It may theoretically look easy for spotting a triangle, it may take a little practice for identifying them in the market.

Bottomline:

As we have discussed above Elliott wave theory is open to interpretations in different ways by different traders, so are their patterns. Thus, traders should ensure that when they identify the patterns.

This chart is just for information

Never stop learning

I would also love to know your charts and views in the comment section.

Thank you

Learning

FinEco For Dummies | The Economic Eco-System Simplified🟢 Intro For Financial Economics & The Financial Eco-Sytem For Dummies

This little book is not about predictions or strategies.

It’s about understanding how financial markets connect, interact, and move together.

If you can read capital flows, risk appetite, and macro relationships,

markets stop feeling random and start making sense.

Financial markets are a system.

Money flows between assets based on risk, growth, inflation, and policy.

This book explains those relationships in simple terms,

so you can understand the environment before making decisions.

Most traders focus on charts.

Few understand the environment those charts live in.

This little book lays out a simple framework for reading market conditions,

capital rotation, and risk behavior, without strategies or hype.

This is a foundation, not a strategy.

A simple guide to how stocks, bonds, currencies, commodities, and crypto

fit together inside the global financial system.

Markets are not random.

They react to incentives, risk, and expectations.

This book helps you see those forces clearly.

🟢 1 - The Big Picture: Markets as a Flow System

Before charts, indicators, or trades, financial markets should be understood as a system of flows, not isolated instruments. Every market, stocks, bonds, currencies, commodities, crypto, etc is simply capital moving between buckets. Nothing trades in a vacuum. When money flows into one place, it must flow out of another.

-

➡️ The Core Idea

Markets are a constant process of:

- Allocation

- Re-allocation

- Risk assessment

Investors are always asking, consciously or not:

“Where do I want my money to park right now?”

The answer changes with:

- Economic expectations

- Central bank policy

- Inflation / deflation fears

- Financial stability

- Geopolitical stress

- Liquidity conditions

Price is just the result of those decisions.

Risk Is the Organizing Principle

At the highest level, all markets organize around risk.

Capital rotates between:

- Risk-on assets → growth, leverage, expansion

- Risk-off assets → safety, preservation, defense

This is not emotional.

It is structural.

Institutions manage:

- Mandates

- Drawdowns

- Volatility targets

- Capital requirements

They must rotate.

-

➡️ The Two Master Regimes

Most market behavior can be simplified into two regimes:

➡️ 1. Risk-On Environment

Characteristics:

- Optimism about growth

- Liquidity is abundant

- Credit flows easily

- Volatility is tolerated

Money prefers:

- Equities (especially growth)

- High beta sectors

- Small & mid caps

- Emerging markets

- Cyclical commodities

➡️ 2. Risk-Off Environment

Characteristics:

- Uncertainty or stress

- Liquidity tightens

- Credit risk rises

- Volatility is avoided

Money prefers:

- Government bonds

- Strong reserve currencies

- Defensive equities

- Gold

- Cash equivalents

Most of the time, markets live between these two, rotating, not flipping instantly.

➡️ Why This Matters for Trading

If you don’t know which regime you’re in, technical setups lose meaning.

A perfect long breakout:

- Works beautifully in risk-on

- Fails constantly in risk-off

A short breakdown:

- Accelerates in risk-off

- Gets absorbed in risk-on

Your job is not to predict the future.

Your job is to identify the current state.

-

🟢 2 - Capital Rotation: How Money Actually Moves

Markets do not rise or fall as one unified object.

They rotate.

Capital is constantly shifting between:

- Sectors

- Asset classes

- Regions

- Risk profiles

This rotation is not random. It follows incentives.

-

➡️ Rotation vs Direction

A common beginner mistake is thinking:

“The market is bullish or bearish.”

In reality, markets are often:

- Bullish somewhere

- Bearish somewhere else

While headlines say “stocks are flat,” money may be:

- Leaving defensives

- Entering growth

- Rotating from large caps into small caps

- Moving from bonds into equities

- Or the opposite

Understanding where money is going matters more than knowing the index direction.

-

➡️ Why Rotation Exists

Large institutions:

- Cannot move all at once

- Cannot hold everything

- Must rebalance constantly

They rotate because of:

- Changing growth expectations

- Interest rate shifts

- Inflation outlook

- Volatility targets

- Risk management rules

This creates waves, not straight lines.

-

➡️ The Economic Cycle (Simplified)

While real life is messy, capital often behaves as if it follows a loose cycle:

Early Expansion

- Rates low or falling

- Liquidity improving

- Confidence returning

Capital prefers:

- Small caps

- Cyclicals

- Growth sectors

- High beta assets

Mid-Cycle

- Growth strong

- Earnings expanding

- Rates stable or slowly rising

Capital prefers:

- Large caps

- Technology

- Industrials

- Consumer discretionary

Late Cycle

- Inflation concerns

- Rates restrictive

- Margins pressured

Capital rotates into:

- Energy

- Materials

- Value

- Financials (if yield curve allows)

Stress / Contraction

- Growth uncertainty

- Credit risk rising

- Liquidity tightening

Capital hides in:

- Defensives

- Bonds

- Gold

- Cash (Liquidity tightening)

This is not a checklist, it’s a lens.

-

➡️ Why Broad Sector ETFs Matter

Broad ETFs allow you to:

- Observe rotation in real time

- See what is being rewarded

- Identify what is being abandoned

They act as market thermometers.

A single stock can lie.

A sector rarely does.

-

➡️ Relative Strength Is the Tell

The most important question is not:

“Is this going up?”

But:

“Is this outperforming other places capital could go?”

Outperformance = demand

Underperformance = avoidance

This relative behavior often appears before major market pivots.

-

➡️ Setting the Stage

From here, we’ll start breaking the market into functional blocks:

- Broad indices

- Sector ETFs

- Bonds

- Currencies

- Hard assets

- Others

Each block tells a different part of the story.

-

🟢 3 - Broad Market Structure: Who Leads, Who Follows

Before zooming into sectors, it’s critical to understand the hierarchy of the equity market itself.

Not all stocks matter equally.

Not all indices send the same signal.

Markets have leaders and followers.

-

➡️ The US Equity Market as a Pyramid

At the top of the pyramid sit the largest, most liquid companies.

At the bottom sit smaller, more fragile, higher-risk firms.

Large Caps

- Highly liquid

- Globally owned

- Institutional core holdings

They represent:

- Stability

- Capital preservation with growth

- Confidence in the system

Mid Caps

- More domestic exposure

- More growth-sensitive

- Less balance-sheet protection

They represent:

- Expansion

- Risk tolerance

- Economic optimism

Small Caps

- Least liquid

- Most rate-sensitive

- Highly dependent on credit conditions

They represent:

- Risk appetite

- Liquidity abundance

- Speculation tolerance

-

➡️ Why Size Matters

When confidence rises:

- Capital flows down the pyramid

- Large → Mid → Small

When stress appears:

- Capital flows up the pyramid

- Small → Mid → Large → Cash

This movement often happens before headlines change.

➡️ Reading the Market Through Indices

Broad indices act as regime filters:

SPY (S&P 500)

Represents large-cap US equity exposure

- Dominated by mega-cap tech and financials

Strength here means:

- Core capital is comfortable staying invested

- The system is stable enough to hold risk

RSP (Equal-Weight S&P 500)

Removes mega-cap dominance

- Shows participation breadth

If SPY rises but RSP lags:

- Leadership is narrow

- Risk is concentrated

- The rally is fragile

If RSP leads:

- Participation is broad

- Confidence is healthy

- Moves are more sustainable

-

➡️ Breadth Is Not a Detail - It’s a Warning System

Strong markets:

- Many stocks participating

- Many sectors contributing

- Leadership rotates smoothly

Weak markets:

- Few leaders

- Defensive hiding

- Sudden rotation spikes

Breadth deterioration often appears long before price collapses.

-

➡️ Why This Matters for Everything Else

Equity leadership sets the tone for:

- Sector performance

- Currency flows

- Bond behavior

- Commodity demand

If equities are unhealthy internally, risk assets elsewhere struggle to hold gains.

-

➡️ Key Takeaway

Markets don’t break all at once.

They weaken from the inside out.

If you learn to read:

- Size

- Breadth

- Leadership

You stop reacting and start anticipating.

-

🟢 4 - Sector ETFs: Reading the Economy Through Capital

KRE — Regional Banks

US regional banks, credit-sensitive, domestic lending.

Best in: Early recovery, rate cuts, steepening yield curve.

Struggles in: Tight liquidity, stress, rising defaults.

ITB — Homebuilders

US residential construction and housing demand.

Best in: Falling rates, easing financial conditions.

Struggles in: Rising yields, affordability stress.

SMH — Semiconductors

Global chipmakers, cyclical growth, capex-driven.

Best in: Expansion, liquidity growth, tech-led cycles.

Struggles in: Hard slowdowns, demand shocks.

XME — Metals & Mining

Steel, miners, raw materials.

Best in: Reflation, infrastructure cycles, USD weakness.

Struggles in: Deflation, global slowdown.

XLRE — Real Estate

REITs, income and rate-sensitive assets.

Best in: Falling yields, stable growth.

Struggles in: Rising rates, credit stress.

XLY — Consumer Discretionary

Non-essential spending (retail, autos, leisure).

Best in: Strong consumer, expansion phases.

Struggles in: Recessions, confidence drops.

EBIZ — E-Commerce / Digital Consumption

Online retail and digital consumer platforms.

Best in: Growth + digital shift, USD weakness.

Struggles in: Consumer pullbacks, tightening liquidity.

XLK — Technology

Large-cap US tech, growth and duration exposure.

Best in: Liquidity expansion, falling rates.

Struggles in: Tight policy, rising real yields.

XLE — Energy

Oil & gas producers and services.

Best in: Reflation, supply constraints, USD weakness.

Struggles in: Demand destruction, growth shocks.

XLB — Materials

Chemicals, construction materials, inputs.

Best in: Early-cycle recovery, reflation.

Struggles in: Late-cycle slowdowns.

RSP — Equal-Weight S&P 500

Broad market without mega-cap dominance.

Best in: Healthy, broad-based expansions.

Struggles in: Narrow leadership, defensive markets.

SPY — S&P 500

US large-cap benchmark.

Best in: Most regimes, reflects overall risk appetite.

Struggles in: Systemic shocks.

XLI — Industrials

Manufacturing, transport, capital goods.

Best in: Expansion, infrastructure, global growth.

Struggles in: Recessions, trade slowdowns.

XLF — Financials

Banks, insurers, financial services.

Best in: Steep yield curve, economic growth.

Struggles in: Credit stress, inverted curves.

XLC — Communication Services

Media, telecom, platforms.

Best in: Growth environments, ad spending cycles.

Struggles in: Economic slowdowns.

IGV — Software

Enterprise software and digital services.

Best in: Liquidity expansion, productivity cycles.

Struggles in: Rate shocks, valuation compression.

XLV — Healthcare

Pharma, biotech, medical services.

Best in: Defensive regimes, late cycle.

Struggles in: High-risk-on rotations.

XLU — Utilities

Regulated utilities, income-focused.

Best in: Risk-off, falling yields.

Struggles in: Rising rates, strong growth cycles.

XLP — Consumer Staples

Essentials (food, household goods).

Best in: Defensive, late-cycle, risk-off.

Struggles in: Strong risk-on rotations.

Once you understand broad market structure, the next layer is sectors.

Sector ETFs are not just industries.

They are expressions of economic belief.

Each sector answers a different question:

- Growth or safety?

- Inflation or deflation?

- Rates up or rates down?

- Confidence or caution?

By watching sector behavior, you can see what investors are preparing for, not what they are reacting to.

-

➡️ Sectors as Economic Sensors

Sectors move differently because:

- They respond differently to rates

- They depend differently on credit

- They react differently to inflation and demand

This makes them ideal tools for:

- Identifying rotation

- Confirming or rejecting index moves

- Spotting regime changes early

➡️ 1. Risk-Oriented Sectors (Risk-On)

These sectors perform best when:

- Liquidity is abundant

- Growth expectations are rising

- Investors are willing to take risk

Technology - XLK / IGV / EBIZ

- Growth-driven

- Highly rate-sensitive

- Dependent on future earnings

Strength implies:

- Falling or stable rates

- Confidence in innovation and growth

- Risk-on environment

Weakness implies:

- Rising real yields

- Liquidity stress

- De-risking behavior

Consumer Discretionary - XLY

- Depends on consumer confidence

- Sensitive to employment and credit

Strength implies:

- Healthy consumers

- Economic expansion

- Optimism about income growth

Weakness implies:

- Caution

- Demand slowdown

- Household stress

➡️ Cyclical / Expansion Sectors

These sectors benefit from economic activity itself.

Industrials - XLI

- Linked to manufacturing and infrastructure

- Sensitive to growth and capex cycles

Strength implies:

- Expansion

- Business investment

- Trade and logistics activity

Materials - XLB / Metals & Mining - XME

- Sensitive to inflation and construction

- Linked to global demand

Strength implies:

- Rising inflation expectations

- Commodity demand

- Late-cycle or reflation themes

Energy - XLE

- Tied to inflation and geopolitics

- Sensitive to supply constraints

Strength implies:

- Inflation pressure

- Tight energy markets

- Often late-cycle behavior

-

➡️ 2. Defensive Sectors (Risk-Off)

These sectors attract capital when:

- Growth is uncertain

- Volatility rises

- Preservation matters more than return

Healthcare - XLV

- Inelastic demand

- Stable cash flows

Strength implies:

- Defensive rotation

- Risk reduction

- Uncertainty ahead

Consumer Staples - XLP

- Everyday necessities

- Low growth but high stability

Strength implies:

- Capital hiding

- Caution

- Late-cycle or stress environment

Utilities - XLU

- Yield-oriented

- Rate-sensitive

Strength implies:

- Demand for safety and income

- Falling rates or risk-off mood

-

➡️ Interest-Rate Sensitive Sectors

Some sectors are less about growth and more about rates.

Real Estate - XLRE

- Highly sensitive to interest rates

- Dependent on financing costs

Strength implies:

- Falling or stabilizing rates

- Yield-seeking behavior

Weakness implies:

- Rising rates

- Credit stress

Financials - XLF / KRE

- Banks reflect system health

- Credit creation and yield curve dependent

Strength implies:

- Healthy lending environment

- Confidence in the financial system

Weakness implies:

- Credit stress

- Yield curve pressure

- Systemic caution

-

➡️ Breadth and Rotation Inside Sectors

A healthy market:

- Multiple sectors leading

- Smooth rotation

- No single sector carrying the index

An unhealthy market:

- Narrow leadership

- Defensive outperformance

- Violent sector rotations

-

➡️ Key Takeaway

Sectors tell you why the market is moving.

Index price tells you that it moved.

Sector behavior tells you what investors believe.

-

➡️ Market Regime Cheat-Sheet

How to Read Sector ETFs in Context

🟢 Risk-On / Expansion

Liquidity flowing, growth rewarded

SMH — Semiconductors (cyclical tech leadership)

XLK — Technology (liquidity + duration)

IGV — Software (productivity, growth)

XLY — Consumer Discretionary (strong consumer)

EBIZ — E-Commerce (digital spending)

XLC — Communication Services (ads, platforms)

Macro backdrop:

- Falling or stable rates

- Easy financial conditions

- Weak or stable USD

- Strong equity breadth

-

🟡 Reflation / Early Cycle

Growth + inflation expectations rising

XLE — Energy (oil, supply constraints)

XME — Metals & Mining (raw materials)

XLB — Materials (inputs, construction)

XLI — Industrials (capex, infrastructure)

ITB — Homebuilders (rate relief + demand)

Macro backdrop:

- Inflation stabilizing or rising

- USD weakness

- Yield curve steepening

- Commodity strength

-

🔵 Broad & Healthy Market

Participation matters more than leaders

RSP — Equal-Weight S&P 500

SPY — Market benchmark

Macro backdrop:

- Balanced growth

- No extreme policy pressure

- Internal market strength

- Rotation instead of liquidation

-

🟠 Financial Sensitivity

Rates, credit, curve shape matter

XLF — Financials (steep curve, growth)

KRE — Regional Banks (credit health)

XLRE — Real Estate (rate sensitivity)

Macro backdrop:

Rate cuts help

Credit stability required

Stress shows early here

-

🔴 Defensive / Risk-Off

Capital preservation, not growth

XLV — Healthcare

XLP — Consumer Staples

XLU — Utilities

Macro backdrop:

- Tight liquidity

- Economic uncertainty

- Rising volatility

- Capital rotates, doesn’t disappear

How to Use This Cheat-Sheet:

- Leadership = regime signal

- Rotation ≠ crash

- Defensives leading = caution

- Cyclicals + tech leading = expansion

- Banks & housing weaken first in stress

-

🟢 5 - Bonds and Central Banks: The Gravity of Markets

If equities are the expression of confidence,

bonds are the constraint.

No market ignores bonds for long.

Interest rates determine:

- The cost of money

- The price of leverage

- The value of future cash flows

- The tolerance for risk

This makes bonds the gravitational force of financial markets.

-

➡️ Why Bonds Matter More Than Headlines

Stocks can stay irrational for a while.

Bonds can not.

Bond markets are dominated by:

- Institutions

- Governments

- Pension funds

- Central banks

They reflect:

- Inflation expectations

- Growth expectations

- Trust in policymakers

When bonds move, everything else eventually follows.

-

➡️ US Treasuries - The Global Benchmark

US Treasuries are the foundation of:

- Global pricing

- Risk-free rates

- Collateral systems

Rising yields mean:

- Tighter financial conditions

- Higher discount rates

- Pressure on growth assets

Falling yields mean:

- Easier conditions

- Support for risk-taking

- Relief for leveraged assets

-

➡️ Short-Term vs Long-Term Yields

The shape of the yield curve matters.

Rising short-term yields:

- Reflect central bank tightening

- Increase funding stress

- Pressure equities and credit

Rising long-term yields:

- Reflect inflation or growth expectations

- Hurt duration-sensitive assets

- Strengthen the currency

Falling long-term yields:

- Signal slowing growth or stress

- Support defensives and gold

-

➡️ The Federal Reserve - Liquidity Manager

The Fed does not control markets directly.

It controls liquidity conditions.

Through:

- Policy rates

- Balance sheet operations

- Forward guidance

The Fed influences:

- Risk appetite

- Credit creation

- Volatility tolerance

Markets often move in anticipation of Fed actions, not after them.

-

➡️ Japan: The Silent Anchor (BoJ & JGBs)

Japan plays a unique role in global markets.

- Ultra-low rates

- Yield curve control history

- Massive domestic savings

Japanese bonds (JGBs) act as:

- A funding benchmark

- A pressure valve for global yields

When Japanese yields rise:

- Global yields tend to follow

- Yen strengthens

- Risk assets feel pressure

This is why Japan matters even if you don’t trade it directly.

-

➡️ Fed vs BoJ - A Critical Relationship

When:

- US rates rise

- Japanese rates stay suppressed

Capital flows:

- Into USD

- Out of JPY

- Into risk assets funded by cheap yen

When that gap narrows:

- Carry trades unwind

- Volatility increases

- Risk assets struggle

-

➡️ Key Takeaway

Bonds tell you:

- How tight or loose the system is

- Whether risk-taking is rewarded or punished

- When markets are approaching stress

Ignore bonds, and everything else becomes noise.

-

🟢 6 - Currencies and FX Indexes: The Language of Capital Flows

Currencies are often misunderstood as “forex trades.”

In reality, currencies are statements of preference.

They show:

- Where capital feels safest

- Where returns are most attractive

- Which economies are trusted

- Which risks are being avoided

Currencies don’t move because of opinions.

They move because of flows.

-

➡️ Why Currencies Matter Even If You Don’t Trade FX

Every asset is priced in a currency.

That means:

- Stocks

- Bonds

- Commodities

- Crypto (later)

Are all influenced by currency strength and weakness.

If you ignore currencies, you miss:

- Hidden tailwinds

- Silent headwinds

- False breakouts caused by FX pressure

-

➡️ The US Dollar (DXY) - Global Liquidity Thermometer

The US dollar is:

- The world’s reserve currency

- The primary funding currency

- The denominator for global trade

A rising USD usually means:

- Tighter global liquidity

- Pressure on risk assets

- Stress for emerging markets

- Headwinds for commodities

A falling USD usually means:

- Easier financial conditions

- Support for equities

- Tailwinds for commodities and risk assets

The dollar is not “bullish” or “bearish.”

It is restrictive or permissive.

-

➡️ Safe-Haven Currencies - JPY and CHF

Some currencies strengthen not because of growth, but because of fear.

Japanese Yen (JPY)

- Historically used for funding

- Ultra-low rate environment

JPY strength implies:

- Risk-off behavior

- Carry trade unwinds

- Stress in global markets

JPY weakness implies:

- Risk-on

- Leverage expansion

- Yield chasing

Swiss Franc (CHF)

- Capital preservation currency

- Financial system trust play

CHF strength implies:

- Capital hiding

- Defensive positioning

- Systemic caution

Risk-Sensitive Currencies

Other currencies strengthen when:

- Growth is strong

- Commodities are in demand

- Risk appetite is healthy

These act as confirmation tools, not drivers.

Weakness here alongside strong equities is often a warning sign.

-

➡️ Currency Indexes as Regime Filters

Watching individual FX pairs can be noisy.

Indexes simplify the message.

Currency indexes help you:

- Identify broad strength or weakness

- Avoid pair-specific distortions

- See regime shifts early

If:

- USD strengthens

- JPY strengthens

- CHF strengthens

That combination rarely supports sustained risk-on behavior.

➡️ Currencies and Equity Behavior

Healthy risk environments usually show:

- Weak or stable USD

- Weak JPY

- Broad equity participation

Stress environments often show:

- Strong USD

- Strong JPY or CHF

- Narrow or defensive equity leadership

Currencies often lead equities, not the other way around.

➡️ Key Takeaway

Currencies are the nervous system of global markets.

They transmit:

- Stress

- Confidence

- Liquidity shifts

If you listen to them, markets stop surprising you.

-

➡️ Currency Regime Cheat-Sheet

*How to Read XY Indices in a Macro Context

-

USDX / DXY — US Dollar Index

Global reserve, liquidity gauge

Strong DXY → global liquidity tightens

Weak DXY → risk assets breathe

Strength signals:

- Risk-off

- Higher real yields

- Global stress

Weakness signals:

- Risk-on

- Commodity support

- EM + crypto tailwind

-

JXY — Japanese Yen Index

Carry trade & volatility trigger

Weak JPY → leverage, risk-taking

Strong JPY → carry unwind, stress

Watch for:

- USDJPY turning points

- BoJ policy shifts

- Global volatility spikes

Yen strength often precedes:

- Equity pullbacks

- Tech weakness

- Crypto drawdowns

-

CXY — Canadian Dollar Index

Commodity & energy proxy

Tracks oil, metals, global growth

Pro-cyclical currency

Strength signals:

- Risk-on

- Commodity demand

- Inflation expectations

Weakness signals:

- Growth slowdown

- Commodity pressure

-

EXY — Euro Index

Growth vs stability balance

Sensitive to global trade

Often moves opposite DXY

Strength signals:

- Global growth optimism

- Risk-on rotation

Weakness signals:

Fragmentation risk

- Banking stress

- Energy shocks

-

BXY — British Pound Index

High beta developed-market currency

Volatile, sentiment-driven

Sensitive to rates & growth

Strength signals:

- Risk-on

- Hawkish BoE expectations

Weakness signals:

- Risk-off

- Political or fiscal stress

-

AXY — Australian Dollar Index

China & global growth barometer

Closely tied to commodities & China

One of the best early growth signals

Strength signals:

- Expansion

- Commodity demand

- Risk-on

Weakness signals:

- China slowdown

- Risk aversion

-

NXY — New Zealand Dollar Index

Pure risk appetite signal

Thin liquidity, high beta

Amplifies global sentiment

Strength signals:

- Risk-on extremes

- Yield-seeking behavior

Weakness signals:

- Flight to safety

- Liquidity stress

-

➡️ How to Read *XYs Together

DXY + JXY rising → risk-off, deleveraging

DXY down + CXY / AXY up → reflation, commodities

JPY leading strength → early warning

AUD / CAD leading → growth confidence

Currencies move first.

Assets react later.

-

➡️ Key Takeaway

XY indices are not trades.

They are context engines.

If you know which currencies are gaining strength,

you know where capital is moving — and why.

Context first.

Positioning second.

-

🟢 7 - Gold and Hard Assets: Trust, Fear, and Real Value

Gold is not a growth asset.

It is not a risk asset.

It is not a productive asset.

Gold is a belief asset.

It reflects:

- Trust in money

- Confidence in institutions

- Fear of debasement

- Desire for permanence

➡️ Why Gold Exists in Modern Markets

Gold does not compete with stocks.

It competes with currencies and bonds.

Gold becomes attractive when:

- Real yields fall

- Currency purchasing power is questioned

- Financial stability is doubted

It is an alternative to:

- Paper promises

- Credit systems

- Central bank credibility

-

➡️ Gold vs Nominal Yields (Coupon rate on a bond)

A common mistake is watching gold against nominal rates.

Gold responds primarily to:

- Real yields (rates minus inflation)

- Currency strength, especially USD

Rising real yields:

- Pressure gold

- Favor cash and bonds

Falling real yields:

- Support gold

- Signal hidden stress or easing

Gold often rises before inflation becomes obvious.

- Gold and the US Dollar

- Gold and USD often move inversely.

Strong USD:

- Makes gold expensive globally

- Reduces gold demand

Weak USD:

- Supports gold

- Signals easier financial conditions

When gold rises despite a strong USD:

- That is a warning signal

- Stress or distrust is increasing

-

➡️ Gold as a Stress Barometer

Gold strength often appears when:

- Financials weaken

- Credit risk rises

- Volatility increases

- Central banks lose control narratives

Gold does not panic.

It prepares.

-

➡️ Hard Assets Beyond Gold

Other hard assets (commodities, metals) behave differently:

- They depend on demand

- They are growth-sensitive

- They can fall in deflationary stress

Gold is unique because:

- It does not depend on growth

- It does not default

- It does not dilute

-

➡️ Gold in a Healthy Market

In strong risk-on environments:

- Gold often lags

- Capital prefers productive assets

In unstable or late-cycle environments:

- Gold begins to lead

- Quietly at first

Gold strength during equity rallies is often a yellow flag.

-

➡️ Key Takeaway

Gold measures confidence in the system itself.

It does not chase returns.

It waits for doubt.

If gold starts outperforming while risk assets struggle, the market is telling you something important.

-

🟢 8 - Silver, Copper, and Oil: The Economy’s Lie Detectors

If gold measures trust,

Industrial commodities measure reality.

Silver, copper, and oil don’t care about narratives.

They respond to:

- Demand

- Production

- Energy use

- Industrial activity

They tell you whether the economy is actually functioning, not whether markets hope it is.

-

➡️ Silver - The Hybrid Asset

Silver sits between two worlds:

- Monetary metal

- Industrial commodity

Because of this, silver often behaves as:

- A leveraged version of gold when confidence is high

- An industrial proxy when growth is strong

Silver strength implies:

- Inflation expectations

- Manufacturing demand

- Liquidity abundance

Silver weakness implies:

- Industrial slowdown

- Deflationary pressure

- Liquidity stress

Silver usually:

- Lags gold in early stress

- Leads gold in reflation

Gold moves on fear.

Silver moves when fear meets demand.

-

➡️ Dr. Copper - The Doctor of the Economy

Copper is often called:

“The metal with a PhD in economics”

That’s because copper demand is tied directly to:

- Construction

- Infrastructure

- Manufacturing

- Electrification

Copper strength implies:

- Real economic activity

- Capital investment

- Expansionary conditions

Copper weakness implies:

- Demand destruction

- Growth slowdown

- Recession risk

Copper rarely lies.

If equities rally while copper falls, something is off.

-

➡️ Copper vs Equities

Healthy expansions usually show:

- Rising equities

- Rising copper

- Rising industrial demand

Danger zones appear when:

- Equities rise

- Copper falls

- Liquidity-driven rallies dominate

That divergence often precedes:

- Growth disappointments

- Equity corrections

- Risk repricing

-

➡️ Oil - The Lifeblood of the System

Oil is not just a commodity.

It is energy, and energy underpins everything.

Oil prices reflect:

- Global demand

- Transportation activity

- Industrial throughput

- Geopolitical stress

Rising oil can mean:

- Strong demand

- Inflation pressure

- Supply constraints

Falling oil can mean:

- Demand destruction

- Economic slowdown

- Deflationary forces

Context matters more than direction.

-

➡️ Oil and Inflation

Oil spikes often:

- Pressure consumers

- Hurt margins

- Force central bank responses

Sustained high oil prices:

- Act like a tax on growth

- Accelerate late-cycle dynamics

Oil collapses often:

- Signal recession

- Precede central bank easing

Putting Them Together

- Gold asks: Do you trust the system?

- Silver asks: Is inflation and demand building?

- Copper asks: Is the economy actually growing?

- Oil asks: Can the system afford this energy cost?

When all agree, markets trend smoothly.

When they diverge, volatility follows.

-

➡️ Key Takeaway

Commodities expose the difference between financial optimism and economic reality.

Equities can float on liquidity.

Commodities need demand.

If hard assets stop confirming financial markets, risk is being mispriced.

-

🟢 9 - Volatility and Options: Stress Beneath the Surface

Price tells you where markets go.

Volatility tells you how they feel about it.

The VIX and the options market are not predictors.

They are emotion and insurance markets.

They show:

- Fear

- Complacency

- Protection demand

- Risk tolerance

-

➡️ What the VIX Actually Is

The VIX measures:

- Expected volatility in the S&P 500

- Derived from option prices

- Forward-looking, not historical

Think of the VIX as:

- The price of fear

- The cost of insurance

High fear = expensive protection

Low fear = cheap protection

-

➡️ What High and Low VIX Mean

Low VIX

- Complacency

- Confidence

- Cheap leverage

- Risk-taking encouraged

This usually aligns with:

- Risk-on environments

- Strong equity trends

- Narrow pullbacks

But extremely low VIX can mean:

- Fragility

- Overconfidence

- Vulnerability to shocks

High VIX

- Fear

- Demand for protection

- Forced hedging

This usually aligns with:

- Risk-off environments

- Equity stress

- Violent price moves

But high VIX can also mean:

- Capitulation

- Opportunity

- Panic already priced in

-

➡️ Context matters.

Why VIX Is a Confirmation Tool, Not a Signal

The VIX should not be traded as a direction indicator.

Instead, it helps answer questions like:

- Is fear rising or falling?

- Is this move relaxed or stressed?

- Are investors hedging or chasing?

Examples:

- Rising equities + rising VIX = unhealthy

- Falling equities + falling VIX = complacent risk

- Falling equities + spiking VIX = stress or panic

-

➡️ Broad Options Market: Insurance Demand

Options markets reflect:

- Where traders fear losses

- Where institutions hedge exposure

- Where risk is concentrated

Heavy put demand implies:

- Protection seeking

- Defensive positioning

Heavy call demand implies:

- Speculation

- Momentum chasing

You don’t need details.

You just need to know which side is desperate.

-

➡️ Volatility and Market Regimes

Healthy markets usually show:

- Moderate or declining volatility

- Predictable rotations

- Orderly pullbacks

Unhealthy markets show:

- Volatility spikes

- Sudden regime shifts

- Failed breakouts

Volatility often changes first, price follows later.

-

➡️ Why This Belongs in the Foundation

VIX and options help you:

- Avoid false confidence

- Recognize fragile rallies

- Respect stressed markets

- Adjust expectations

They don’t tell you what to trade.

They tell you how careful to be.

-

➡️ Key Takeaway

Volatility measures psychology under pressure.

When price and volatility agree, trends persist.

When they diverge, caution is warranted.

Used simply, volatility adds clarity, not noise.

-

🟢 10 - Crypto: Liquidity, Speculation, and Confidence

Crypto is not a replacement for money.

It is not a hedge like gold.

It is not a stock.

Crypto is a reflection of liquidity, trust, and speculative appetite.

To understand crypto, you must stop asking:

“Is it valuable?”

And start asking:

“Why does capital flow here now?”

-

➡️ What Crypto Represents in the Financial Ecosystem

Crypto sits at the edge of the system.

It attracts capital when:

- Liquidity is abundant

- Trust in traditional systems weakens

- Speculation is rewarded

- Regulation feels distant

It loses capital when:

- Liquidity tightens

- Risk appetite falls

- Funding costs rise

- Fear replaces optimism

Crypto does not create liquidity.

It absorbs excess liquidity.

-

➡️ Crypto Is a Risk-On Asset

Despite its narratives, crypto behaves mostly as:

- High beta (volatile)

- Leverage-sensitive

- Confidence-dependent

Strong crypto markets usually align with:

- Weak or falling USD

- Easy financial conditions

- Tech leadership

- High risk tolerance

Weak crypto markets usually align with:

- Strong USD

- Rising yields

- Liquidity stress

- Risk aversion

Crypto exaggerates what markets already feel.

-

➡️ Bitcoin vs the Rest

Bitcoin often behaves differently from smaller crypto assets.

Bitcoin represents:

- The most liquid crypto asset

- A proxy for crypto confidence

- A store of belief, not value

Smaller crypto assets represent:

- Speculation

- Excess risk appetite

- Leverage

In stress:

- Bitcoin holds better

- Smaller assets collapse

This mirrors:

- Large caps vs small caps in equities

-

➡️ Crypto and Trust

Crypto rallies often coincide with:

- Distrust in institutions

- Banking stress

- Monetary uncertainty

- Policy confusion

But unlike gold:

- Crypto requires liquidity

- Crypto requires participation

- Crypto collapses without buyers

Gold survives fear.

Crypto needs belief and liquidity.

-

➡️ Crypto as a Timing Tool

Crypto often:

- Moves early in risk-on phases

- Peaks before broader markets

- Collapses faster in risk-off events

This makes crypto useful as:

- A sentiment amplifier

- A liquidity stress detector

Crypto rarely causes market turns.

It reveals them.

-

➡️ Why Crypto Should Be Side-eyed as Traditional Investor

Crypto helps answer:

- Are people willing to speculate?

- Is liquidity leaking out of the system?

- Is confidence rising or cracking?

Crypto is not the center of the system.

It is the canary at the edge.

-

➡️ Key Takeaway

Crypto measures belief under abundance.

When money is cheap and confidence is high, crypto thrives.

When money tightens or fear rises, crypto breaks first.

It is not a leader.

It is a mirror.

-

🟢 11 - High Impact News & The Weekly Economic Calendar

Financial markets don’t move randomly.

They move around expectations and those expectations are challenged by scheduled news.

High impact news is not about surprise headlines.

It’s about known events that can change how markets price the future.

-

➡️ What Is “High Impact” News?

High impact news is data or events that can:

- Shift central bank policy expectations

- Reprice interest rates

- Change currency flows

- Alter risk-on / risk-off behavior

Traders don’t trade the number itself.

They trade the difference between expectations and reality.

-

➡️ Why the Weekly Calendar Matters

The economic calendar tells you:

- When volatility risk is highest

- When trends can accelerate or break

- When fakeouts are more likely

Markets are often quiet before big releases

and violent after them.

Knowing the calendar helps you:

- Avoid bad timing

- Size risk correctly

- Understand sudden moves

-

➡️ Tier 1 - The Market Movers

These events can move everything at once.

Central Bank Rate Decisions (Fed, ECB, BoJ, etc.)

What they control:

- Interest rates

- Liquidity conditions

- Financial stability

Why they matter:

- Rates affect currencies

- Rates affect bonds

- Rates affect equity valuations

Markets react more to:

- Forward guidance

- Tone of communication

- Changes in wording

Rates don’t need to change for markets to move.

-

➡️ Non-Farm Payrolls (NFP)

What it measures:

- US job creation

- Labor market strength

Why it matters:

- Direct input for Fed policy

- Strong labor supports higher rates

Key components:

- Wage growth

- Participation rate

- Unemployment rate

Typical reactions:

- Strong NFP → USD up, yields up

- Weak NFP → USD down, yields down

Equities react based on what it means for rates, not jobs.

-

➡️ CPI / Inflation Data

What it measures:

- Price pressure in the economy

Why it matters:

- Determines rate direction

- Affects real yields

- Impacts purchasing power

Typical reactions:

- Hot CPI → bonds down, USD up, equities pressured

- Cool CPI → bonds up, USD down, equities supported

Inflation surprises ripple across all markets.

-

➡️ Tier 2 - Growth & Activity Signals

These shape the broader macro narrative.

➡️ PMI / ISM Data

What it measures:

- Business activity

- Economic momentum

Key level:

- Above 50 = expansion

- Below 50 = contraction

Implications:

- Strong PMI → cyclicals, commodities, equities benefit

- Weak PMI → defensives, bonds, safe havens benefit

-

➡️ Retail Sales

What it measures:

- Consumer demand

Why it matters:

- Consumption drives growth

- Confirms economic strength or slowdown

Strong sales support growth narratives

Weak sales raise recession risk.

-

➡️ GDP

What it measures:

- Overall economic output

Why it matters:

- Confirms trends already in motion

GDP rarely shocks markets.

Markets usually price it before it’s released.

➡️ Tier 3 - Context & Confirmation

These rarely move markets alone but add depth.

Includes:

- Housing data

- Consumer sentiment

- Trade balance

- Regional surveys

Useful for:

- Macro confirmation

- Long-term assessment

- Narrative validation

-

➡️ How Traders Actually Use High Impact News

Professionals focus on:

- Expectations vs outcomes

- Market reaction, not logic

- Yield and currency response first

They often:

- Reduce risk before events

- Wait for post-news structure

- Trade continuation, not the spike

-

➡️ Key Takeaways

High impact news:

- Sets volatility windows

- Tests market narratives

- Exposes weak positioning

The calendar doesn’t tell you what to trade.

It tells you when risk is highest.

If you know:

- What’s coming

- Why it matters

- Who it affects

You’re already ahead of most participants.

-

🟢 12 - Politics & Policy (For Dummies)

Politics matters to markets only when it affects:

- Growth

- Inflation

- Liquidity

- Confidence

Markets do not care about ideology.

They care about impact.

-

➡️ The Three Policy Buckets That Move Markets

1. Monetary Policy (Central Banks)

Handled by:

- Federal Reserve (US)

- ECB (Europe)

- BOJ (Japan)

- Others

Main tools:

- Interest rates

- Balance sheet size (QE / QT)

- Forward guidance

Typical market reactions:

- Rate cuts → risk-on, weaker currency, bonds up

- Rate hikes → risk-off, stronger currency, bonds down

- Dovish tone → equities up

- Hawkish tone → equities down

-

➡️ This is the most powerful policy lever.

2. Fiscal Policy (Governments)

Handled by:

- Governments

- Parliaments

- Treasuries

Includes:

- Government spending

- Tax cuts or hikes

- Stimulus packages

- Infrastructure plans

- Defense budgets

Typical market reactions:

- Stimulus → growth assets up, inflation expectations up

- Austerity → growth slows, defensive assets favored

- Large deficits → bond supply pressure, currency sensitivity

Fiscal policy works slower than monetary policy but lasts longer.

-

➡️ 3. Regulatory & Geopolitical Policy

Includes:

- Trade policy

- Sanctions

- Industrial policy

- Energy policy

- Tech regulation

Typical reactions:

- Protectionism → inflation risk, supply chain stress

- Deregulation → sector-specific rallies

- Geopolitical tension → commodities, defense, USD strength

- Stability → risk assets favored

Markets price uncertainty, not morality.

-

➡️ Key Takeaway

Politics matters only through:

- Rates

- Spending

- Rules

- Stability

Ignore the noise.

Track the economic consequences.

-

🟢 13 - Transmission Channels (Final)

Now you understand the engine.

This section explains where the effects show up.

-

➡️ Housing Markets

Sensitive to:

- Interest rates

- Credit availability

- Employment

Why it matters:

- Major household asset

- Wealth effect on consumption

- Banking system exposure

Typical signals:

- Falling housing → economic slowdown

- Rising housing → consumer confidence

-

➡️ Pensions & Long-Term Capital

Sensitive to:

- Bond yields

- Equity performance

- Demographics

Why it matters:

- Forces long-term asset allocation

- Drives demand for bonds and equities

- Creates slow, structural flows

Pensions don’t trade headlines.

They rebalance trends.

-

➡️ Government Debt

Sensitive to:

- Rates

- Inflation

- Confidence in institutions

Why it matters:

- Competes with private capital

- Influences currency credibility

- Affects future policy flexibility

Debt becomes a problem when:

- Growth < interest costs

- Confidence weakens

-

➡️ Trade & Global Capital Flows

Sensitive to:

- Currency strength

- Relative growth

- Yield differentials

Why it matters:

- Explains currency trends

- Explains sector winners

- Explains regional outperformance

Money flows where:

- Returns are higher

- Risk is perceived lower

-

➡️ Putting It All Together

Markets are not random.

They are a feedback system between:

- Policy

- Growth

- Inflation

- Risk appetite

- Capital flows

If you understand:

- Who controls liquidity

- Where growth is accelerating

- Which assets signal stress

You don’t need predictions.

You read the system!

The end.

XAUUSD Seasonality — What Most Traders MissIt Is A Contextual Framework, Not a Trading Signal

This breakdown explains gold seasonality as a recurring market behavior observed consistently across long-term price data.

Seasonality is not an indicator, not a prediction tool, and not a trading system.

It is an observable tendency driven by institutional flows, physical demand cycles, and portfolio rebalancing behavior.

Seasonality explains why specific market conditions repeat, not where price will move next..

Most traders react emotionally to news headlines. Institutions don’t.

Gold is heavily influenced by repeating seasonal flows that occur every year, regardless of news.

These flows come from:

•Physical demand cycles

•Institutional portfolio rebalancing

•Central bank accumulation

•Cultural & fiscal timing

📉 News creates volatility

📈 Seasonality creates directional bias

1. What Gold Seasonality Really Represents

Seasonality refers to the tendency for gold to perform differently across specific months of the year due to recurring demand and capital flow cycles.

Gold is not just a speculative instrument. It functions as:

•A physical commodity

•A reserve asset

•A portfolio hedge

•A store of value

Because of this, large participants operate on annual and quarterly frameworks, not short-term narratives.

►What usually happens

Across decades of data:

•Certain months repeatedly show stronger upside performance

•Other months show weaker follow-through, consolidation, or deeper pullbacks

•These tendencies repeat across different market regimes

•This behavior reflects how capital is allocated, not random price movement.

►Educational takeaway

Seasonality does not provide entries.

It provides context.

2. Historically Strong Months (Positive Flow Environment)

Over long-term historical data, some months consistently show more favorable conditions for bullish continuation.

Commonly observed strong months include:

•January

•September

•November

•December

These months consistently show:

-Positive average returns

-Sustained upside pressure

-Higher probability of trend continuation

-This doesn’t mean price only goes up — it means bullish setups perform better.

►What usually happens during these months

Markets tend to show:

•Shallower pullbacks

•More reliable breakout continuation

•Cleaner trend development

•Faster dip-buying behavior

►Why this happens

These periods often align with:

•Fresh capital allocation

•Physical demand cycles

•Central bank accumulation

•Portfolio hedging toward year-end

This creates persistent demand, not emotional speculation.

Example: September (Historically Strong)

►Educational takeaway

During strong seasonal months, trend-following strategies face less resistance, assuming structure aligns.

3. Historically Weaker Months (Rebalance & Mean Reversion Environment)

Other months tend to show weaker directional performance or more complex price behavior.

Commonly observed weaker months include:

•March

•April

•June

►What usually happens during these months

Markets often display:

•Choppy price action

•Failed breakouts

•Deeper retracements

•Prolonged consolidation ranges

►Why this happens

During these periods:

•Physical demand softens

•Institutions rebalance exposure

•Profit-taking increases

•Directional conviction declines

This shifts the market toward mean reversion and liquidity-driven behavior rather than expansion.

During these periods, gold often experiences:

•Deeper pullbacks

•Extended consolidation

•Failed breakouts

•Choppy, corrective price action

❗ Many traders blame their strategy here

✅ In reality, it’s a seasonal headwind

Example: June (Historically Weak)

►Educational takeaway

Weak months do not imply bearish markets.

They imply higher selectivity is required for continuation trades.

4. Why Seasonality Exists

Seasonality is driven by real participation, not chart patterns.

►Physical demand cycles

•Major gold-consuming regions (notably Asia) operate on:

•Cultural cycles

•Festival and gifting periods

•Long-term wealth preservation behavior

This demand is:

•Predictable

•Large-scale

•Relatively price-insensitive

►Central bank behavior

🏦 Central banks:

•Accumulate gold as strategic reserves

•Hedge currency and geopolitical risk

•Buy during weakness, not momentum spikes

►Institutional portfolio behavior

Large funds rebalance:

•Monthly

•Quarterly

•Annually

🛡 Safe-Haven Allocation

•Inflation hedging

•Geopolitical risk

•Year-end portfolio protection

📌 Seasonality = footprint of institutional behavior

This creates repeatable flow windows that leave a footprint on price.

►Educational takeaway

Seasonality is the result of institutional memory and recurring demand, not coincidence.

5. How Seasonality Should Be Used

Seasonality should never be used as a standalone trading signal.

It functions as a context filter.

►Correct use

Seasonality helps answer:

•Is continuation or correction more likely?

•Should I be aggressive or conservative?

•Should profits be held longer or taken earlier?

►Incorrect use

•Buying because a month is “bullish”

•Selling because a month is “weak”

•Ignoring structure or liquidity

📌 Real edge comes from:

Structure + Liquidity + Fundamentals + Seasonal Bias

►Educational takeaway

Seasonality adjusts expectations, not execution.

6. Strong vs Weak Month Behavior

►Strong seasonal environment

•Trend continuation performs better

•Pullbacks hold more frequently

•Runners are more likely to extend

►Weak seasonal environment

•Pullbacks are deeper

•Breakouts fail more often

•Ranges and liquidity sweeps dominate

►Educational takeaway

In strong months, patience is rewarded.

In weak months, selectivity is essential.

7. How Seasonality Fits With Structure & Liquidity

Seasonality works best when combined with structure.

Very often:

•Strong months support existing higher-timeframe trends

•Weak months exaggerate pullbacks within those trends

•Liquidity events increase during weaker environments

•The highest-quality trades occur when:

•Seasonal context aligns with higher-timeframe structure

•Liquidity provides precise execution

►Educational takeaway

Seasonality answers “what type of market am I in?”

Structure answers “which direction?”

Liquidity answers “when?”

Note

Seasonality is:

•Descriptive, not predictive

•Contextual, not mechanical

•Supportive, not standalone

The goal is not to trade more.

The goal is to trade when the market environment favors your model.

Gold does not move randomly.

It moves when demand appears — and demand is cyclical.

I have made a script which might help identify XAUUSD Seasonality and month Strength.

Disclaimer

The analysis and script is provided for educational and informational purposes only.

It does not constitute financial advice, investment advice, or a recommendation to buy or sell any instrument.

The script does not execute trades, manage risk, or replace the need for trader discretion. Market behavior can change quickly, and past behavior detected by the script does not ensure similar future outcomes.

Trading involves risk, and losses can exceed deposits. By using the script, you acknowledge that you understand and accept all associated risks.

How Overconfidence Destroys Profitable TradersHow Overconfidence Destroys Profitable Traders

Understanding Overconfidence in Trading

Welcome everyone to another article.

One of the most dangerous stages a trader can walk into is not fear… but overconfidence. (EGO)

Overconfidence in trading is essentially ego.

However, there is still an important difference:

- Confidence is a real belief built on proof, statistics, and discipline.

- Overconfidence is an inflated belief in your ability beyond the proof. This is driven by ego.

Many traders do not fail because they do not know enough.

They fail because at some point, they believe they know enough or know “everything.”

What Overconfidence appears as in Trading:

A trader builds a system. ( yay! )

They go on a clean winning streak maybe 10, 12, even 15 profitable trades in a row.

At this point, the trader begins to think and assume:

“ I’ve cracked the code. ”

- Risk gets increased .

- Position sizes get bigger .

- Rules start to bend .

Confidence continues grow until it crosses a dangerous path where belief is no longer supported by data, statistics and proof.

Reality eventually steps in.

You will never again feel as confident as you did during your first major winning streak when it looked like the market finally made sense and success was “ figured out. ”

That feeling is exactly what traps traders.

Overconfidence WILL break Risk Management

Overconfidence destroys a trader by slowly dismantling their risk management, their system, their discipline, their psychology and their consistency.

It rarely happens all at once.

First:

- “ I’ll just risk a little more this time. ”

- “ This setup looks perfect. ”

- “ I’m on a winning streak. ”

Over time, the trader begins to:

• Ignore position sizing rules ( Too many LOTS or contracts )

• Move stop losses (Increases risk)

• Add to losing trades ( Does not accept the original loss )

• Trade larger to “maximize opportunity” (Stick to what you can afford to lose )

The trader thinks and believes the system will continue to work, because it worked before.

But markets do not reward belief, they reward discipline. (I have mentioned this many times in my previous posts.)

Once risk management breaks, even a profitable system becomes dangerous and can lead to zero profits, or even down to negatives.

Overconfidence Blocks Positive criticism and continuous Learning

There is no such thing and there will never be a 100% perfecto trading system/strategy.

Losses are part of the game.

Overconfident traders struggle when reality does not meet their expectations.

Instead of adapting to the market by adjusting their strategy they:

- Resist feedback (Or consider any feedback as hate/negative criticism)

- Ignore changing market conditions (Consolidation, flat lining, barcoding etc)

- Refuse to admit the system is underperforming (Bad performance & results)

- Believe the problem can’t be them (“It’s not the system, it’s the computer!”)

But Why…?

Well because… their mind keeps rewinding the dopamine high from when everything worked perfectly and the win rate was 99%

They only remember the wins, and “ GREEN ” $$$ %%% not the probability.

The exact moment a trader believes they “can’t be wrong,” learning comes to a halt.

And in trading, when learning stops, losses accelerate, revenge trading increase, risk management collapses, and consistency becomes scrambled.

Overconfidence changes Traders into > Gamblers

Overconfidence does not just cause losses it can also change behavior.

Frustration from unexpected losses turns into:

- Anger

- Impatience

- Forced trades

- Revenge trading

Rules get ignored.

Emotions take control.

The trader may still look like a trader, but they are acting like a gambler.

The most dangerous part?

They still believe they are right…

Example: How Overconfidence Destroyed a Profitable Trader

Let’s look at Bobby.

Bobby was a profitable trader. A very successful one in his 4th year of trading.

He discovered what he believed was a 99% win-rate system.

The first month was incredible.

The second month was just as good. Cash flowing in, heaps of green.

By the third month, losses started to appear.

Instead of falling back, taking a breather and reassessing , Bobby doubled down.

Continuing to trade the same system despite clear signs of underperformance.

He was no longer focusing on perfect executions and setups, he was chasing the high.

Losses turned into frustration .

Frustration turned into anger .

Anger turned into impatience .

Soon Bobby was:

• Forcing trades

• Revenge trading

• Ignoring risk management

Bobby refused to take responsibility.

“It was my internet.”

“My computer lagged.”

“My family distraccted me.”

The excuses piled up, but the account kept shrinking.

Bobby did not fail because of the system.

Bobby failed because ego stopped him from adapting to the market and adjusting his system.

Markets Will Always Humble Ego

Markets will humble traders in ways they never expect.

No matter how experienced you are, there is always something else to learn.

Trading is not a destination, it is a constant process of adaptation towards the market. Traders who believe they “know everything” will always be reminded by the market that They. Do. Not.

Overconfidence doesn’t end trading careers immediately.

But it slowly erodes them trade by trade turning it into mental torture.

Final Thoughts

Confidence is necessary to trade.. But Ego is fatal!

The very moment a trader believes they have cracked the code is often the moment their decline begins.

Stay humble.

Respect risk.

Let statistics, not emotion, guide your decisions.

Because in trading, the market doesn’t punish ignorance it punishes ego.

Why Consistency Beats Talent in TradingWelcome all to another post! In today's post we will review the difference between Talented trading and consistent trading.

Why Consistency Beats Talent in Trading

Many new traders usually enter trading believing that success belongs to the most intelligent individuals, the most analytical, or the most “naturally gifted.” In any field.

When in reality, the market only rewards something that is far less glamorous, and that is.. consistency.

Talent can help you understand charts faster and/or grasp concepts a lot quicker, but it is consistency that determines and shows whether you survive long enough to become profitable and make a positive return.

Talent Creates Potential | Consistency Creates Results

Talent shows up early, like in the first week or two.

You might spot patterns instantly, win a few trades, or feel like trading “just makes sense” to you.

Consistency shows up later and it’s far rarer.

The market does not care how smart you are.

It only responds to:

- How often you follow your rules and system.

- How well you manage risk ( or gamble it. )

- How disciplined you are under pressure and stress

- A talented trader who trades emotionally will eventually lose, ( always lose. )

- A consistent trader with average skills can compound them steadily over time.

Why Talented Traders Often Struggle

Ironically, talent can be a disadvantage ( keep on reading )

Talented traders often:

- Rely on intuition instead of their own rules or the games rules ( or common sense. )

- Take trades outside their plan ( like above, not following their rules. )

- Increase risk after a few wins ( again, not following RM rules. )

- Ignore data because “ they feel confident ”

This leads to inconsistency big wins followed by bigger losses. ( Gambling )

The market eventually punishes anyone who treats probability like certainty.

Consistency Turns Probability into an Edge

Trading is not about being right it’s about commencing the same process over and over.

Consistency means:

- Taking only the setups you’ve defined. (Defined what A+ is)

- Risking the same amount per trade. (Risk Management)

- Accepting losses without deviation. (Moving on after a loss)

- Following your plan even after losing streaks. (Maintaining consistency)

One trade means nothing.

A hundred trades executed the same way reveal your edge.

Consistency allows probability to work for you, not against you.

The Market Rewards Discipline, Not Brilliance

The best traders in the world are not constantly trying to outsmart the market.

They:

- Trade fewer setups

- Keep their approach simple

- Protect capital first

- Let time and repetition do the work

- They understand that survival is the first goal.

- You can’t compound an account you’ve blown.

Consistency Is Boring and That’s the Point

Consistencty lacks excitement.

There are no adrenaline rushes, no heroic trades, no all-in moments.

Just repetition, patience, and restraint. This is why most people fail.

The market filters out those who chase excitement and rewards those who treat trading like a business, not entertainment.

Talent Without Consistency Is Temporary

Many traders experience early success.

Very few maintain it.

Short-term success often comes from:

- Favorable market conditions

- Random luck

- Overconfidence

Long-term success comes from:

- Process

- Risk control

- Emotional discipline

Consistency is what turns a good month into a sustainable career.

How to Build Consistency as a Trader

Consistency is a skill not a personality trait.

You build it by:

- Defining clear trading rules

- Using fixed risk per trade

- Journaling every trade honestly

- Reviewing performance regularly

- Trading less, not more

Your goal isn’t to be impressive.

Your goal is to be repeatable.

Final Thoughts

Talent may get you interested in trading.

Consistency keeps you in the game.

In a profession driven by uncertainty, the trader who shows up the same way every day will always outperform the one chasing brilliance.

In trading, consistency doesn’t just beat talent > it replaces it.

Thank you all so much for reading, I hope everyone enjoys it and that it benefits you all!

Let me know in the comments below if you have any questions or requests.

Reading institutional intentions through Volume ProfileReading institutional intentions through Volume Profile

Price moves where money flows. Simple truth that most traders overlook the most obvious source of money information: volume.

Volume Profile shows where trading happened. Not when, but where. The histogram on the side reveals which levels attracted buyers and sellers. While beginners draw support lines by candle wicks, money flows elsewhere.

Value zones versus noise zones

Point of Control (POC) marks the price level with maximum trading volume for the period. Price spent most time here. Buyers and sellers agreed on this price. Fair value at this moment.

Value Area covers 70% of traded volume. Boundaries of this zone show where the market considers the asset undervalued or overvalued. Price gravitates back to Value Area like a magnet.

Look at the practice. Price broke the high, everyone expects growth. Check Volume Profile—volume on the breakout is tiny. Big players didn't participate. Fake breakout. Price will return.

High Volume Node and Low Volume Node

HVN appears as thick sections on the profile. Many transactions, lots of liquidity. Price slows down at HVN, reverses, consolidates. These are market anchors.

LVN shows as thin sections. Few transactions, little liquidity. Price flies through LVN like a hot knife through butter. Nothing to grab onto there.

Traders often place stops behind HVN. Big players know this. Sometimes price deliberately hits those stops to accumulate positions. Called stop hunt .

Profile types and their meaning

P-shaped profile: one wide POC in the middle, volume distributed evenly. Market in balance. Breaking boundaries of such profile produces strong moves.

b-shaped profile: volume shifted to the bottom. Buyers active at low levels. Accumulation before growth.

D-profile: volume at the top. Distribution before decline. Big players exit positions.

Using profile in trading

Find areas with low volume between zones of high volume. LVN between two HVNs creates a corridor for fast price movement. Enter at HVN boundary, target the next HVN.

When price moves outside Value Area boundaries and volume appears there—trend gains strength. New value zone forms. Old levels stop working.

If price returns to old Value Area after strong movement—look for reversal. Market rejects new prices.

Session profiles versus weekly ones

Daily profile shows where trading happened today. Weekly shows where positions accumulated all week. Monthly gives the picture of big money distribution.

Profiles of different periods overlay each other. Daily profile POC can match weekly Value Area boundary. Strong zone. Price will react here.

On futures, account for session times:

Asian session forms its profile