Why Most Traders Lose and How to Flip the Script

It’s no secret: most retail traders lose money.

Not because the markets are “rigged,” but because trading is a game of probabilities, discipline, and psychology.

Let’s break down why losses happen, the psychology behind them, and how to build a better plan to stay in the game long-term.

1. Why Most Traders Lose

There are a handful of mistakes that account for the majority of blown accounts:

🔸 Overleveraging – Using too much size turns small moves against you into catastrophic losses.

🔸 Lack of risk management – Without stop-losses, max drawdown rules, or position sizing, one bad trade can erase weeks of gains.

🔸 Chasing trades – Entering late after a big move due to FOMO, only to sell at the bottom.

🔸 No system – Random entries and exits with no strategy mean your results are left entirely to chance.

🔸 Emotional trading – Anger, revenge trades, and greed lead to impulsive decisions that sabotage even good setups.

Most traders know these mistakes on paper, but knowledge alone doesn’t prevent them. The real enemy is psychology.

2. The Psychology Behind Losing

When most people think about why traders lose, they picture bad entries or poor technical skills. But the truth is, the biggest battles aren’t fought on the charts—they’re fought in the mind. Understanding the psychology behind losing is critical, because it explains why traders keep repeating the same mistakes even when they “know better.”

Loss Aversion

Psychologists have proven that humans feel the pain of losing about twice as strongly as the pleasure of winning. In trading, this shows up in two destructive ways: holding onto losing positions far longer than we should, and selling winning positions far too early. A trader might watch a loss grow from -5% to -20% because closing the trade would mean admitting they were wrong. On the flip side, the moment a trade turns green, they take profit too quickly, just to escape the fear of it slipping back to red. Over time, this creates an inverted risk/reward profile—small wins and big losses—the exact opposite of what successful trading requires.

Confirmation Bias

Once a trader enters a position, the human brain naturally looks for reasons to justify it. They’ll scroll through charts, social media, or news feeds, paying attention only to the information that supports their trade, while ignoring anything that contradicts it. This tunnel vision can be deadly, because markets don’t care about opinions—they reward objectivity. A good trader must learn to question their own bias constantly, asking not “why am I right?” but “what would prove me wrong?”

Ego and Revenge Trading

Every trader knows the sting of a losing trade. But what comes next separates amateurs from professionals. The inexperienced trader often lets ego take over. Instead of stepping back, they try to immediately “win back” what was lost, usually by doubling their position size, rushing into another setup, or abandoning their strategy entirely. This revenge trading spiral often leads to much larger losses. The market punishes desperation, and it rewards patience. The ability to walk away after a loss and reset emotionally is one of the hardest but most valuable skills to develop.

The Illusion of Control

Many traders believe that the more time they spend staring at charts or the more trades they take, the better their results will be. This illusion of control often leads to overtrading, which drains both capital and emotional energy. In reality, trading is about probabilities, not control. No amount of screen time can eliminate uncertainty. The edge lies in preparation, discipline, and executing a plan—not in micromanaging every tick of price action. Paradoxically, the less you feel the need to control the market, the more control you gain over your own decisions.

3. How to Prevent Frequent Losses

The good news: most of these pitfalls can be managed with structure and discipline.

✔️ Risk Per Trade – Never risk more than 1–2% of your total capital on a single position.

✔️ Predefine Rules – Before you click buy/sell, know your entry, stop, and target.

✔️ Accept Losses – Treat them as the “cost of doing business.” Even pros lose 40–50% of trades.

✔️ Quality > Quantity – Fewer, higher-probability trades often outperform constant scalping or chasing.

✔️ Journal Every Trade – Write down why you entered, why you exited, and what you felt. This exposes patterns in your behavior.

4. Building a Better Plan

Trading without a plan is gambling. Building a system gives you consistency.

Define Your Edge: What makes your trade valid? Is it a technical setup, a market structure, or a specific confluence of signals?

Backtest Your Strategy: Test your rules on historical data before risking real money.

Stick to Probabilities: No setup wins 100%. Focus on consistency over a large sample size.

Emotional Control Routine: Walk away after a big loss, set daily limits, and never trade tired or stressed.

Takeaway

Most traders lose not because they’re “bad” but because they don’t treat trading like a business.

By mastering psychology, defining risk, and following a plan, you stop thinking in terms of single trades → and start thinking in terms of long-term probabilities.

Trading isn’t about being right every time.

It’s about surviving long enough for your edge to play out.

Learntrading

US-China Trade War: Causes, Impacts, and Global ImplicationsHistorical Context of U.S.-China Economic Relations

Early Engagement

The United States normalized relations with China in 1979, following Deng Xiaoping’s reforms and China’s opening up to global markets.

Over the next three decades, U.S. companies moved manufacturing to China to take advantage of cheap labor and efficient supply chains.

China, in turn, gained access to advanced technologies, investment capital, and export markets.

Entry into the World Trade Organization (WTO)

In 2001, China’s entry into the WTO was a turning point. It marked its deeper integration into the global economy.

China rapidly grew into the “world’s factory,” and its exports surged.

However, the U.S. and other Western nations accused China of unfair practices: state subsidies, currency manipulation, forced technology transfers, and weak intellectual property protections.

The Growing Trade Imbalance

By the 2010s, the U.S. trade deficit with China exceeded $300 billion annually.

American policymakers began questioning whether trade with China was truly beneficial, especially as U.S. manufacturing jobs declined.

These tensions set the stage for a conflict that was as much about economics as it was about strategic rivalry.

The Outbreak of the Trade War (2018–2019)

Trump Administration’s Policies

In 2017, U.S. President Donald Trump labeled China as a “trade cheater,” accusing it of unfair practices.

By 2018, the U.S. imposed tariffs on steel, aluminum, and billions of dollars’ worth of Chinese goods.

China retaliated with tariffs on U.S. agricultural products, automobiles, and energy.

Escalation

By mid-2019, the U.S. had imposed tariffs on over $360 billion worth of Chinese imports, while China hit back with tariffs on $110 billion of U.S. goods.

The dispute extended beyond tariffs: restrictions were placed on Chinese technology firms like Huawei and ZTE.

Phase One Deal (2020)

After months of negotiations, the U.S. and China signed a “Phase One” trade deal in January 2020.

China pledged to purchase an additional $200 billion worth of U.S. goods and services over two years.

The deal addressed some issues like intellectual property and financial market access but left most tariffs in place.

Core Issues Driving the Trade War

Trade Imbalance

The U.S. imports far more from China than it exports, leading to a massive trade deficit.

While economists argue deficits are not inherently bad, politically they became a symbol of “unfairness.”

Intellectual Property (IP) Theft

American firms accused Chinese companies of copying technology and benefiting from weak IP protections.

Forced technology transfers—where U.S. firms had to share technology with Chinese partners as a condition for market entry—were a major point of contention.

State Subsidies and Industrial Policy

China’s state-driven model, including its “Made in China 2025” plan, aimed to dominate advanced industries like AI, robotics, and semiconductors.

The U.S. viewed this as a threat to its technological leadership.

National Security Concerns

The U.S. raised alarms over Chinese companies’ ties to the Communist Party, particularly in sectors like 5G, AI, and cybersecurity.

Huawei became a focal point, with Washington warning allies against using its equipment.

Geopolitical Rivalry

The trade war is also a battle for global leadership.

China’s rise threatens the U.S.-led order, prompting Washington to adopt a more confrontational stance.

Economic Impacts of the Trade War

On the United States

Consumers: Tariffs increased prices of everyday goods, from electronics to clothing, hurting U.S. households.

Farmers: China imposed tariffs on soybeans, pork, and other agricultural products, devastating American farmers who depended on Chinese markets.

Manufacturers: U.S. firms reliant on Chinese supply chains faced higher input costs.

GDP Impact: Estimates suggest the trade war reduced U.S. GDP growth by 0.3–0.5 percentage points annually.

On China

Export Decline: Chinese exports to the U.S. fell sharply, pushing firms to seek new markets.

Economic Slowdown: Growth dipped from above 6% to below 6%—the lowest in decades.

Technology Restrictions: Huawei and other tech giants faced disruptions in accessing U.S. chips and software.

Resilience: Despite the tariffs, China remained competitive due to diversified global markets and strong domestic consumption.

On the Global Economy

Supply Chains: The trade war disrupted global supply chains, prompting companies to diversify into countries like Vietnam, India, and Mexico.

Global Trade Growth: The WTO reported global trade growth slowed significantly in 2019 due to tensions.

Uncertainty: Businesses worldwide delayed investments amid fears of escalating tariffs and restrictions.

The Role of Technology and Decoupling

The trade war expanded into a tech war, especially in semiconductors, AI, and 5G.

Huawei Ban: The U.S. restricted Huawei from buying American components, pressuring allies to exclude Huawei from 5G networks.

Semiconductors: The U.S. tightened export controls on advanced chips, aiming to slow China’s technological rise.

Decoupling: Both nations began reducing dependency on each other, with companies shifting supply chains and governments investing in domestic industries.

This technological rivalry is often seen as the most critical and long-lasting element of the U.S.-China conflict.

Political Dimensions of the Trade War

Domestic Politics in the U.S.

The trade war became central to Trump’s political messaging, appealing to voters frustrated by globalization.

While tariffs hurt some sectors, they gained support among those seeking a tough stance on China.

Domestic Politics in China

China framed the trade war as foreign bullying, rallying nationalist sentiment.

The Communist Party emphasized self-reliance and doubled down on domestic technological innovation.

International Politics

Allies were caught in the middle:

Europe opposed Chinese trade practices but resisted U.S. pressure to take sides.

Developing nations saw opportunities as supply chains shifted.

COVID-19 and the Trade War

The pandemic, which began in China in late 2019, further complicated the trade war.

Supply Chain Shocks: COVID-19 highlighted global dependency on Chinese manufacturing for medical supplies, electronics, and more.

Geopolitical Blame: The U.S. accused China of mishandling the pandemic, worsening tensions.

Phase One Deal Collapse: China struggled to meet its purchase commitments due to the global recession.

In many ways, COVID-19 deepened the push toward decoupling and reshaping global trade patterns.

Global Implications of the US-China Trade War

Restructuring of Global Supply Chains

Companies are diversifying production away from China to reduce risks.

Southeast Asia, India, and Latin America are emerging as alternative hubs.

Impact on Global Institutions

The WTO struggled to mediate, highlighting weaknesses in the global trade system.

Calls for reforming trade rules to address issues like subsidies and digital trade gained momentum.

Pressure on Other Countries

Nations are forced to align with either the U.S. or China on issues like 5G, data security, and AI.

Middle powers like the EU, Japan, and Australia face tough choices in balancing relations.

Global Economic Slowdown

The IMF repeatedly warned that trade tensions could shave trillions off global GDP.

Slower global trade affects everything from commodity prices to investment flows.

Long-Term Outlook: Is the Trade War the New Normal?

The U.S.-China trade war represents more than a dispute over tariffs. It reflects a structural shift in global power dynamics.

Competition vs. Cooperation: While both countries remain economically interdependent, trust has eroded.

Persistent Rivalry: The Biden administration has largely continued Trump-era tariffs, indicating bipartisan consensus on confronting China.

Technology Cold War: The battle for dominance in semiconductors, AI, and 5G is set to intensify.

Partial Decoupling: Complete separation is unlikely, but critical sectors like technology, defense, and energy may increasingly operate in parallel ecosystems.

Conclusion

The U.S.-China trade war is one of the defining geopolitical and economic conflicts of the 21st century. What began as a tariff battle has evolved into a comprehensive strategic rivalry, encompassing trade, technology, national security, and global influence.

Both nations have paid economic costs, but the deeper impact lies in the reshaping of the global economy. Supply chains are being reorganized, trade institutions are under pressure, and countries around the world are recalibrating their positions between two superpowers.

Whether the future brings renewed cooperation or deepening confrontation depends on political will, economic necessity, and the evolving balance of power. What is clear, however, is that the trade war has fundamentally altered the trajectory of globalization and set the stage for decades of U.S.-China competition.

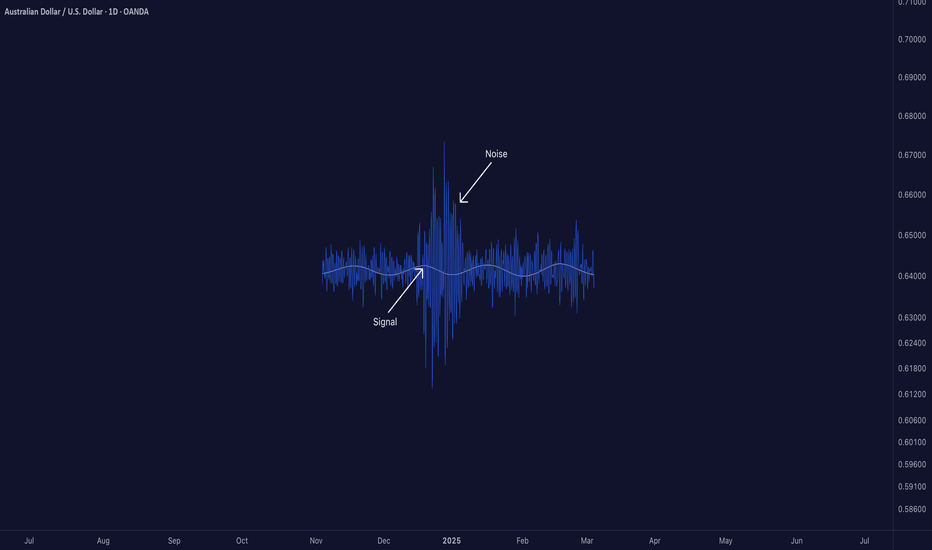

Carry Trade in the Global Market1. What is a Carry Trade?

A carry trade is a financial strategy where investors:

Borrow or fund positions in a currency with low interest rates (funding currency).

Use those funds to buy a currency or asset with a higher interest rate (target currency or investment).

Earn the difference between the two rates (the interest rate spread), while also being exposed to currency fluctuations.

Example (Simplified):

Suppose the Japanese yen has a 0.1% interest rate, and the Australian dollar (AUD) has a 5% interest rate.

A trader borrows ¥100 million (Japanese yen) at near-zero cost and converts it into AUD.

The funds are invested in Australian bonds yielding 5%.

Annual return ≈ 4.9% (before considering currency fluctuations).

If the AUD appreciates against the yen during this time, the trader earns both the interest rate differential + capital gains. If AUD depreciates, the trade may turn into a loss.

2. The Mechanics of Carry Trade

Carry trade is not as simple as just switching between two currencies. It involves global capital flows, leverage, interest rate cycles, and risk management.

Step-by-Step Process:

Identify funding currency: Typically one with low or negative interest rates (JPY, CHF, or USD in certain cycles).

Borrow or short-sell this currency.

Buy high-yielding currency assets: Such as government bonds, corporate debt, or equities in emerging markets.

Earn interest spread daily (known as the rollover in forex markets).

Monitor exchange rates since even small currency fluctuations can offset interest gains.

Why It Works:

Differences in monetary policies across central banks create yield gaps.

Investors with large capital seek to exploit these spreads.

Global liquidity cycles and risk appetite drive the demand for carry trades.

3. Historical Importance of Carry Trade

Carry trades have been a cornerstone of currency markets, shaping global financial cycles:

1990s – Japanese Yen Carry Trade

Japan maintained near-zero interest rates after its asset bubble burst in the early 1990s.

Investors borrowed cheap yen and invested in higher-yielding assets abroad (Australia, New Zealand, emerging markets).

This caused yen weakness and strong capital inflows into emerging markets.

2000s – Dollar and Euro Carry Trades

Before the 2008 financial crisis, investors borrowed in low-yielding USD and JPY to invest in high-yielding currencies like the Brazilian Real, Turkish Lira, and South African Rand.

Commodity booms amplified returns, making the carry trade highly profitable.

2008 Global Financial Crisis

Carry trades collapsed as risk aversion spiked.

Investors unwound positions, leading to a surge in yen (JPY) and Swiss franc (CHF).

This showed how carry trade unwind can cause global market turbulence.

2010s – Post-Crisis QE Era

Ultra-low rates in the US, Japan, and Europe sustained carry trade strategies.

Emerging markets benefited from capital inflows but became vulnerable to sudden outflows when US Fed hinted at tightening (2013 “Taper Tantrum”).

2020s – Pandemic & Beyond

Global central banks slashed rates during COVID-19, reviving conditions for carry trades.

However, the 2022–23 inflation surge and rate hikes by the Fed created volatility, making carry trades riskier.

4. Global Carry Trade Currencies

Funding Currencies (Low Yield):

Japanese Yen (JPY): Classic funding currency due to decades of near-zero rates.

Swiss Franc (CHF): Safe-haven status and low yields.

Euro (EUR): Used in periods of ECB ultra-loose policy.

US Dollar (USD): At times of near-zero Fed rates.

Target Currencies (High Yield):

Australian Dollar (AUD) & New Zealand Dollar (NZD): Stable economies with higher yields.

Emerging Market Currencies: Brazilian Real (BRL), Turkish Lira (TRY), Indian Rupee (INR), South African Rand (ZAR).

Commodity Exporters: Higher rates often accompany higher commodity cycles.

5. Drivers of Carry Trade Activity

Carry trades thrive when global financial conditions are supportive.

Interest Rate Differentials – Larger gaps = higher carry.

Global Liquidity – Abundant capital seeks higher yields.

Risk Appetite – Investors pursue carry trades in “risk-on” environments.

Monetary Policy Divergence – When one central bank keeps rates low while others tighten.

Volatility Levels – Low volatility encourages carry trades; high volatility kills them.

6. Risks of Carry Trade

Carry trades may look attractive, but they are highly risky.

Currency Risk – A sudden depreciation of the high-yielding currency can wipe out gains.

Interest Rate Shifts – If the funding currency raises rates or target currency cuts rates, the carry spread shrinks.

Liquidity Risk – In crises, traders rush to unwind, leading to sharp reversals.

Geopolitical Risk – Wars, political instability, or sanctions can collapse carry trades.

Leverage Risk – Carry trades are often leveraged, magnifying both profits and losses.

7. The Role of Central Banks

Central banks indirectly shape carry trades through:

Rate setting policies (zero-rate or tightening cycles).

Forward guidance that signals future moves.

Quantitative easing (QE) that floods markets with liquidity.

Capital controls in emerging markets that try to manage inflows/outflows.

8. Case Studies in Carry Trades

The Yen Carry Trade (2000–2007)

Massive inflows into risky assets globally.

Unwinding during 2008 caused yen to spike 30%, triggering global asset sell-offs.

The Turkish Lira (TRY)

High rates attracted carry trades.

But political instability and inflation led to currency crashes, wiping out investors.

Brazil and South Africa

During commodity booms, high-yield currencies like BRL and ZAR became popular targets.

However, they were also prone to volatility from commodity cycles.

9. Carry Trade in Modern Markets

Today, carry trades are more complex and algorithm-driven. Hedge funds, banks, and institutional investors run quantitative carry trade strategies across forex, bonds, and derivatives.

Tools Used:

FX swaps & forwards

Options for hedging

ETFs & leveraged funds tracking carry trade strategies

Example – G10 Carry Index

Some financial institutions track “carry indices” that measure returns from long high-yield currencies and short low-yield currencies.

10. Advantages of Carry Trade

Predictable Income – Earn from interest rate differentials.

Scalability – Works in global FX markets with high liquidity.

Diversification – Access to multiple asset classes.

Potential for Leverage – High returns if managed correctly.

Conclusion

Carry trade is one of the most fascinating and impactful strategies in the global financial system. By exploiting interest rate differentials across countries, it provides traders with a potential source of profit. However, history has shown that the carry trade is a double-edged sword: highly rewarding in stable times, but brutally punishing during crises.

Understanding its mechanics, historical patterns, risks, and modern applications is essential for any trader, investor, or policymaker. The carry trade is more than just a strategy — it is a barometer of global risk appetite, liquidity, and monetary policy divergence.

For those who master it with discipline and risk management, the carry trade remains a powerful tool in navigating global markets.

Spot Forex Trading1. Introduction to Spot Forex Trading

In the world of global finance, foreign exchange (Forex) stands as the largest and most liquid market. With a daily trading volume surpassing $7.5 trillion (as per the Bank for International Settlements), the Forex market dwarfs equities, bonds, and commodities combined. At the very core of this enormous ecosystem lies the spot Forex market, where currencies are exchanged instantly “on the spot.”

Spot Forex trading is not only the foundation of international trade and investments but also the most popular form of retail currency speculation. Unlike forward or futures contracts, the spot market involves a direct exchange of one currency for another at the prevailing market rate, typically settled within two business days. For traders, it is the purest way to participate in currency fluctuations and capitalize on global economic dynamics.

In this guide, we’ll explore the mechanics, strategies, risks, and opportunities of spot Forex trading in depth.

2. What is Forex & How the Spot Market Works?

Forex (FX) is short for foreign exchange – the global marketplace where national currencies are exchanged. Currencies are always traded in pairs (e.g., EUR/USD, USD/JPY, GBP/INR) because one is bought while the other is sold.

The spot Forex market is the part of FX where transactions occur “on the spot” at the current market price (known as the spot rate). While in practice settlement usually occurs within T+2 days (two business days), retail traders through brokers see it as instantaneous execution.

Example:

If EUR/USD = 1.1000, it means 1 Euro = 1.10 US Dollars.

A trader buying EUR/USD expects the Euro to appreciate against the Dollar.

If the pair moves to 1.1200, the trader profits; if it drops to 1.0800, the trader loses.

The beauty of spot Forex lies in its simplicity, liquidity, and accessibility.

3. Key Features of Spot Forex

Decentralized Market – Unlike stocks traded on exchanges, Forex is an OTC (over-the-counter) market. Trading happens electronically via banks, brokers, and liquidity providers.

High Liquidity – The sheer size ensures that major pairs (like EUR/USD) have tight spreads and minimal slippage.

24-Hour Trading – Forex operates 24/5, from the Sydney open (Monday morning) to New York close (Friday evening).

Leverage – Traders can control large positions with small capital, magnifying both profits and losses.

Accessibility – With brokers and trading platforms, retail traders worldwide can access spot Forex with as little as $50.

4. Major Currencies & Currency Pairs

Currencies are categorized into majors, minors, and exotics.

Major Pairs (most traded, high liquidity): EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD, AUD/USD, NZD/USD.

Cross Pairs (without USD): EUR/GBP, EUR/JPY, GBP/JPY, AUD/JPY.

Exotic Pairs (emerging market currencies): USD/INR, USD/TRY, USD/ZAR.

Most spot Forex volume is concentrated in majors, especially EUR/USD, which alone makes up ~25% of daily turnover.

5. Spot Forex vs. Forwards & Futures

Feature Spot Forex Forward Contracts Futures Contracts

Settlement T+2 days (practically instant for traders) Custom date agreed Standard dates

Trading Venue OTC (banks, brokers) OTC Exchange-traded

Flexibility High High Limited (standardized)

Use Case Speculation, trade settlement Hedging by corporates Hedging & speculation

Spot Forex is more liquid and flexible than forwards and futures, making it the preferred market for short-term traders.

6. Market Participants

The spot Forex market is vast, with multiple players:

Central Banks & Governments – Influence currency supply, demand, and stability.

Commercial Banks – The backbone of FX, providing liquidity and interbank trading.

Corporations – Engage in Forex to settle international trade and hedge risks.

Hedge Funds & Institutional Investors – Speculate with huge volumes, influencing trends.

Retail Traders – Millions of individuals trading through brokers.

Retail trading, though small compared to institutions, has grown rapidly due to online platforms.

7. How Spot Forex Trading is Conducted

Trading Platforms – MetaTrader (MT4/MT5), cTrader, and proprietary broker platforms.

Execution Models:

Market Maker – Broker sets bid/ask spread.

STP/ECN – Orders sent directly to liquidity providers, offering raw spreads.

Pricing – Derived from interbank market quotes.

Spreads & Commissions – Brokers earn via spreads or commissions per trade.

Execution speed, spreads, and broker reputation matter greatly in Forex trading.

8. Leverage & Margin in Spot Forex

One of the most attractive yet dangerous features of spot Forex is leverage.

Example: With 1:100 leverage, a trader can control a $100,000 position with just $1,000 margin.

Margin call occurs if losses reduce equity below required margin.

High leverage allows for big profits but equally big losses—making risk management essential.

9. Factors Influencing Currency Prices

Currencies reflect global macroeconomics. Key drivers:

Interest Rates – Higher rates attract investors (stronger currency).

Inflation – High inflation erodes purchasing power (weaker currency).

Economic Data – GDP, jobs reports, CPI, trade balance.

Political Stability – Elections, wars, policy changes impact FX.

Global Risk Sentiment – “Risk-on” favors emerging markets; “Risk-off” drives money to USD, JPY, CHF.

Central Bank Actions – QE, rate hikes, interventions move currencies massively.

10. Trading Strategies in Spot Forex

Scalping – Very short-term, multiple trades for a few pips profit.

Day Trading – Open/close trades within a day, avoiding overnight risk.

Swing Trading – Holding positions for days/weeks to capture larger moves.

Trend Following – Riding long-term momentum.

Counter-Trend Trading – Betting on reversals at key levels.

Carry Trade – Borrowing in low-interest currency (JPY) to invest in high-yield (AUD, NZD).

Each strategy has its own risk-reward profile and suits different personalities.

Conclusion

Spot Forex trading is a fascinating arena where global economics, politics, and psychology meet. It is the purest and most direct form of currency exchange, providing unmatched liquidity, accessibility, and opportunity. However, with great potential comes great risk—especially due to leverage.

For those who approach it with education, discipline, and risk management, spot Forex can offer immense opportunities. For the unprepared, it can be unforgiving.

In the end, success in Forex isn’t about predicting every move—it’s about managing risk, staying consistent, and playing the probabilities wisely.

Global Positional TradingWhat is Positional Trading?

Positional trading is a style of trading where positions are held for a longer duration, typically:

Short-term positional trades → A few weeks.

Medium-term positional trades → 1–3 months.

Long-term positional trades → 6 months or more.

The primary goal is to capture big trends rather than small fluctuations. Positional traders look for macro or sectoral themes and align themselves with the direction of the market.

When applied globally, positional trading expands to:

Global stock indices (S&P 500, Nikkei 225, DAX, FTSE 100).

Currencies (EUR/USD, USD/JPY, GBP/USD).

Commodities (gold, crude oil, natural gas, agricultural products).

Bonds and yields (US 10-year, German bunds).

ETFs that track global sectors or regions.

Why Global Positional Trading?

Trading is no longer restricted to national markets. With the rise of online brokerages, access to global markets has become easier. Global positional trading is powerful because:

Diversification of Opportunities

A trader is not limited to domestic equities but can trade across multiple asset classes worldwide.

Example: If US equities are consolidating, opportunities may exist in Japanese equities or crude oil.

Macro Trends Dominate

Global interest rate cycles, inflation, commodity demand, and geopolitical tensions create long-lasting moves.

Example: The Russia-Ukraine war in 2022 caused months-long surges in crude oil and natural gas.

Riding the “Big Waves”

Unlike intraday volatility, positional traders focus on multi-week/month moves.

Example: The US dollar index (DXY) uptrend during 2022 lasted nearly a year.

Time Flexibility

Global positional traders don’t need to watch charts every second.

Analysis can be weekly/monthly, making it more practical for part-time traders.

Core Principles of Global Positional Trading

Trend Following

The core philosophy is: “The trend is your friend.”

Traders identify global macro trends and align with them.

Fundamental & Macro Analysis

Positional trades often rely on fundamental shifts (interest rates, inflation, GDP growth, trade policies).

Technical Confirmation

Long-term charts (daily, weekly, monthly) are used to confirm entries and exits.

Patience and Discipline

Unlike scalpers, positional traders need to hold through volatility to capture the big picture.

Risk Management

Since positions are held longer, stop-loss levels are wider.

Position sizing becomes critical to avoid large drawdowns.

Global Market Instruments for Positional Trading

1. Equity Indices

S&P 500 (USA), Nasdaq, Dow Jones, DAX (Germany), FTSE (UK), Nikkei 225 (Japan), Hang Seng (Hong Kong), Nifty 50 (India).

Example: A trader might go long on S&P 500 if the US economy shows strong earnings growth.

2. Currencies (Forex)

Major pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF.

Emerging pairs: USD/INR, USD/BRL, USD/ZAR.

Example: If the US Fed raises interest rates while Europe cuts them, traders may hold long USD positions for months.

3. Commodities

Precious metals: Gold, Silver.

Energy: Crude oil, Natural gas.

Agriculture: Soybeans, Wheat, Coffee.

Example: During inflationary phases, gold often trends upward for months.

4. Bonds & Yields

Positional trades can be taken on US Treasury bonds, German bunds, etc.

Example: Rising US yields may lead to a bearish bond trade held for months.

5. ETFs and ADRs

Traders can access international assets through Exchange Traded Funds (ETFs) or American Depository Receipts (ADRs).

Key Strategies in Global Positional Trading

1. Trend Following Strategy

Enter in the direction of the global trend.

Example: Long gold during inflationary environments.

2. Breakout Strategy

Identify consolidations and trade the breakout.

Example: Crude oil breaking above $100 in 2022 after consolidation.

3. Mean Reversion Strategy

Buy oversold assets, sell overbought ones.

Example: A currency pair retracing after extended uptrend.

4. Carry Trade Strategy

Borrow in low-interest currency, invest in high-interest currency.

Example: Short JPY (low rate), long AUD (high rate).

5. Sectoral / Thematic Strategy

Position based on global sector themes.

Example: Renewable energy stocks during global energy transition policies.

Tools for Global Positional Trading

Charting Platforms (TradingView, MetaTrader, Thinkorswim).

Fundamental Data Sources (Bloomberg, Reuters, Investing.com, FRED).

Economic Calendars (To track central bank meetings, GDP, inflation).

Sentiment Indicators (Commitment of Traders report, VIX index).

Risk Management Tools (Position sizing calculators, stop-loss automation).

Time Frames for Global Positional Trading

Weekly charts: Best for identifying major trends.

Daily charts: Fine-tuning entries/exits.

Monthly charts: Macro view for long-term investors.

Risk Management in Global Positional Trading

Use wider stop-loss levels due to longer holding periods.

Allocate 2–5% risk per trade.

Hedge with options/futures if needed.

Diversify across asset classes (stocks + commodities + forex).

Advantages of Global Positional Trading

Capture large, sustained moves.

Lower stress compared to intraday.

Fits part-time traders with limited screen time.

More aligned with fundamentals.

Higher profit potential per trade.

Challenges and Risks

Global Event Risk → Wars, pandemics, trade disputes.

Overnight/Weekend Gaps → Sudden gaps in global markets.

Currency Risk → Holding international positions in foreign currencies.

Patience Required → Trades may take months to play out.

Capital Lock-In → Funds are tied up for long durations.

Examples of Global Positional Trades

Gold during 2020 COVID-19 Crisis

From $1,450 to $2,070 within 5 months.

Positional traders captured nearly 40% upside.

US Dollar Index (DXY) in 2022

Fed rate hikes → USD rallied for 10 months.

Long USD positions were classic positional trades.

Crude Oil after Russia-Ukraine War

Jumped from $70 to $130 within weeks.

Positional long trades yielded massive returns.

Psychology of Global Positional Traders

Patience → Letting the trade develop without closing too early.

Conviction → Believing in the analysis despite short-term volatility.

Adaptability → Switching positions when fundamentals change.

Future of Global Positional Trading

Increasing access via global brokers and apps.

Rising importance of AI-driven analysis for global trends.

Crypto markets adding new positional opportunities.

Geopolitics (US-China trade war, Middle East tensions) making macro trades more relevant.

Conclusion

Global positional trading is about looking beyond short-term noise and focusing on big global trends. It allows traders to participate in long-lasting moves across equities, forex, commodities, and bonds by combining macroeconomic analysis, technical charts, and disciplined risk management.

It requires patience, strong research, and conviction but rewards traders with opportunities to ride the “big waves” of global markets—whether it’s the US dollar’s strength, crude oil surges, or gold’s safe-haven rally.

For traders seeking to diversify, reduce daily stress, and capture significant profits, global positional trading is one of the most effective strategies in today’s interconnected financial world.

Impact of Rising US Treasury Yields on Global EquitiesPart 1: Understanding US Treasury Yields

1.1 What Are US Treasury Yields?

US Treasuries are debt securities issued by the US government to finance its operations. They come in different maturities—short-term bills (up to 1 year), medium-term notes (2–10 years), and long-term bonds (20–30 years). The yield on these securities represents the return an investor earns by holding them until maturity.

Yields move inversely to bond prices. When investors sell Treasuries, prices fall and yields rise. Conversely, when demand is high, yields drop.

1.2 Why Are US Treasuries Called “Risk-Free”?

The US government is considered the safest borrower in the world, backed by its ability to tax and print dollars. Thus, Treasuries are seen as risk-free assets in terms of default. This status makes them the benchmark against which global borrowing costs, equity valuations, and investment decisions are calibrated.

1.3 Drivers of Rising Treasury Yields

US Treasury yields rise due to:

Federal Reserve policy (interest rate hikes, balance sheet reductions).

Inflation expectations (higher inflation erodes bond value, pushing yields up).

Economic growth outlook (strong growth boosts demand for capital, raising yields).

Government borrowing (higher fiscal deficits increase supply of Treasuries, pressuring yields higher).

Part 2: Link Between Treasury Yields and Global Equities

2.1 The Discount Rate Effect

Equity valuations are based on the present value of future cash flows. When Treasury yields rise, the discount rate (the rate used to calculate present value) increases. This reduces the attractiveness of equities, especially growth stocks with earnings expected far into the future.

2.2 Opportunity Cost of Capital

Investors compare expected equity returns with risk-free Treasury yields. If yields rise significantly, the relative appeal of equities declines, causing fund flows to shift from stocks to bonds.

2.3 Cost of Borrowing for Corporates

Higher yields mean higher borrowing costs globally. For companies dependent on debt, rising yields squeeze margins and reduce profitability, pressuring stock prices.

2.4 Risk Sentiment and Volatility

Sharp increases in yields often spark volatility. Equity markets prefer stable interest rates. Sudden upward movements in yields are interpreted as signals of tightening liquidity or higher inflation risks, both of which unsettle investors.

Part 3: Historical Case Studies

3.1 The 2013 “Taper Tantrum”

In 2013, when the Federal Reserve hinted at tapering bond purchases, US Treasury yields surged. Emerging markets experienced massive capital outflows, and their stock markets plunged. This episode underscored the global sensitivity to US yields.

3.2 The 2018 Yield Spike

In 2018, the 10-year US Treasury yield touched 3.25%, triggering global equity sell-offs. Investors worried about higher discount rates and slowing global liquidity. Technology and high-growth sectors were hit hardest.

3.3 The 2022 Bond Rout

The Fed’s aggressive rate hikes in 2022 pushed the 10-year yield above 4%. Global equities, including the S&P 500, Europe’s Stoxx 600, and Asian indices, fell into bear markets. The pain was widespread—ranging from US tech giants to emerging-market stocks.

Part 4: Sector-Wise Impact of Rising Yields

4.1 Growth vs. Value Stocks

Growth stocks (e.g., technology, biotech) are most sensitive. Their long-duration cash flows are heavily discounted when yields rise.

Value stocks (e.g., banks, industrials, energy) often fare better. Banks, in particular, benefit from higher interest rates via improved net interest margins.

4.2 Banking & Financials

Higher yields typically boost profitability for banks and insurers, as they can lend at higher rates. Global financial stocks often outperform during rising-yield phases.

4.3 Real Estate & Utilities

These sectors are bond proxies—investors buy them for stable dividends. When Treasury yields rise, their relative appeal diminishes, leading to underperformance.

4.4 Commodities & Energy

Commodities often benefit indirectly if yields rise due to stronger growth expectations. However, if yields rise because of inflation and monetary tightening, commodities may face demand destruction risks.

Part 5: Geographic Sensitivities

5.1 United States

US equities are most directly impacted. The Nasdaq (tech-heavy) suffers more than the Dow Jones (value-oriented).

5.2 Europe

European equities track US yields closely. Higher yields in the US can lead to stronger dollar, pressuring European exporters. Additionally, Europe’s bond yields often rise in sympathy, tightening financial conditions.

5.3 Emerging Markets

Emerging markets are the most vulnerable. Rising US yields trigger:

Capital outflows (investors shift to safer US assets).

Currency depreciation (raising import costs and inflation).

Stock market sell-offs (especially in countries reliant on foreign capital).

For example, India, Brazil, and Turkey often see sharp corrections when US yields spike.

5.4 Asia (Japan, China)

Japan: Rising US yields weaken the yen (as investors chase dollar returns), which can help Japanese exporters but hurt domestic equities tied to imports.

China: Sensitive due to capital flows and trade dynamics. Rising US yields often pressure Chinese equities, especially during growth slowdowns.

Part 6: Currency & Global Equity Interplay

Rising US yields usually strengthen the US dollar. A stronger dollar reduces profits of US multinationals, pressures commodity prices, and creates headwinds for emerging-market equities. For global investors, currency-adjusted returns from foreign equities decline when the dollar is strong, further reducing equity allocations abroad.

Part 7: Broader Macroeconomic Implications

7.1 Liquidity Tightening

Higher yields reduce global liquidity. Central banks in other countries often follow the Fed to prevent capital flight, tightening financial conditions worldwide.

7.2 Inflation & Growth Trade-Off

Rising yields often reflect inflationary pressures. Central banks respond with rate hikes, slowing global growth. Equity markets suffer as both margins and valuations come under pressure.

7.3 Safe-Haven Flows

Paradoxically, in times of global turmoil, US Treasuries attract safe-haven flows, lowering yields again. But during inflationary cycles, this dynamic weakens, making equities more vulnerable.

Part 8: Coping Strategies for Investors

8.1 Diversification

Investors hedge against rising yields by diversifying into value stocks, commodities, and sectors benefiting from higher rates (like banks).

8.2 Global Allocation

Allocating across geographies can help. For instance, some Asian and European stocks may perform better depending on currency moves and domestic cycles.

8.3 Use of Derivatives

Investors use interest-rate futures, options, and currency hedges to manage risks from rising yields.

8.4 Tactical Shifts

Moving from growth to value, reducing exposure to high-duration equities, and increasing allocation to inflation-hedged assets are common strategies.

Part 9: Future Outlook

The long-term trajectory of US Treasury yields depends on:

US fiscal deficits and borrowing needs.

Federal Reserve policy normalization.

Global inflation cycles.

Geopolitical shifts in demand for US Treasuries (e.g., de-dollarization trends).

For global equities, this means heightened sensitivity to yield cycles. Investors must closely monitor not only the direction but also the pace of yield movements. Gradual increases may be absorbed, but sharp spikes usually destabilize global equities.

Conclusion

The relationship between US Treasury yields and global equities is one of the most powerful forces in financial markets. Rising yields act as a tightening mechanism, reducing equity valuations, increasing corporate borrowing costs, triggering capital outflows from emerging markets, and strengthening the US dollar. The effects vary across sectors and geographies—hurting growth stocks, real estate, and emerging markets, while benefiting banks and certain value-oriented sectors.

History shows that equity markets can tolerate moderate, steady increases in yields, particularly when driven by strong growth. However, rapid spikes often cause global turbulence. For investors, understanding these dynamics and positioning portfolios accordingly is crucial.

In essence, rising US Treasury yields are not just an American story—they are a global story, shaping equity performance from Wall Street to Mumbai, from Frankfurt to Tokyo.

Impact of Currency Fluctuations on Global TradeIntroduction

Global trade is the lifeline of the modern economy. It connects countries, industries, and consumers across borders, enabling the exchange of goods, services, capital, and technology. However, at the core of every international transaction lies a critical factor that often gets overlooked in public discussions—currency exchange rates.

Currency fluctuations—the rise and fall of the value of one currency relative to another—play a significant role in shaping trade flows, competitiveness, profitability, and even the stability of entire economies. Exchange rate volatility can determine whether exports are competitive in global markets, how much importers pay for foreign goods, and how investors allocate capital across nations.

This essay explores the impact of currency fluctuations on global trade, breaking down causes, mechanisms, case studies, and long-term implications. It also looks at how governments, central banks, corporations, and financial institutions respond to mitigate risks associated with exchange rate volatility.

Understanding Currency Fluctuations

Currency fluctuations occur when the value of one currency rises or falls relative to another. The foreign exchange (forex) market, the largest financial market in the world, facilitates the buying and selling of currencies. Exchange rates are influenced by supply and demand, interest rates, inflation, political stability, monetary policy, and market speculation.

For example, if the Indian Rupee (INR) weakens against the US Dollar (USD), then Indian exporters receive more rupees for each dollar earned, making exports more competitive. On the other hand, importers must pay more for foreign goods priced in dollars, making imports costlier.

Key terms:

Appreciation: When a currency strengthens relative to another.

Depreciation: When a currency weakens relative to another.

Volatility: The degree of variation in currency values over time.

Causes of Currency Fluctuations

Monetary Policy & Interest Rates

Central banks influence exchange rates through interest rate decisions. Higher interest rates attract foreign capital, strengthening the currency, while lower rates weaken it.

Inflation Levels

Countries with lower inflation typically see currency appreciation, as purchasing power is preserved. High inflation erodes value.

Trade Balances

Nations running trade surpluses (exports > imports) often see stronger currencies, while deficits weaken them.

Capital Flows & Foreign Investment

Strong inflows of foreign direct investment (FDI) or portfolio investment increase demand for a currency, boosting its value.

Political & Economic Stability

Stable countries attract investors, strengthening their currency, while instability leads to capital flight and depreciation.

Market Speculation

Traders in the forex market bet on future movements, sometimes amplifying volatility.

Mechanisms of Impact on Global Trade

1. Export Competitiveness

When a country’s currency depreciates, its exports become cheaper for foreign buyers, boosting demand.

When a currency appreciates, exports become expensive, reducing competitiveness.

2. Import Costs

Currency depreciation increases the cost of imported raw materials, fuel, and machinery.

Appreciation makes imports cheaper, lowering input costs for domestic industries.

3. Profit Margins of Businesses

Exporters benefit from weaker domestic currencies, while import-heavy industries suffer.

Multinational corporations with global operations must manage “translation risk” when consolidating earnings from various currencies.

4. Balance of Payments (BoP)

Persistent depreciation can reduce trade deficits by discouraging imports and encouraging exports.

However, volatility creates uncertainty that disrupts long-term trade agreements.

5. Consumer Prices & Inflation

Currency depreciation makes imports costlier, leading to inflationary pressures in domestic markets.

This reduces consumer purchasing power and alters consumption patterns.

Case Studies: Real-World Examples

1. The US Dollar and Global Trade

The US dollar is the world’s reserve currency, used in most international trade. When the dollar strengthens:

Emerging markets struggle, as their imports become costlier.

US exporters lose competitiveness abroad.

Oil and commodity prices (often denominated in USD) rise for other countries.

2. Japan’s Yen Depreciation (2012–2015)

Japan deliberately weakened its yen under “Abenomics” to boost exports.

Japanese automakers and electronics manufacturers benefited.

Import costs for energy and food rose, impacting consumers.

3. Indian Rupee Volatility

The INR often faces depreciation pressures due to oil imports and trade deficits.

Exporters in IT and textiles gain from weaker rupee.

Oil importers, airlines, and electronics manufacturers face higher costs.

4. Eurozone Crises (2010–2012)

During the sovereign debt crisis, euro depreciation initially supported European exports. However, uncertainty discouraged investment and hurt overall trade confidence.

5. Chinese Yuan Management

China manages its currency to remain competitive in global trade. A weaker yuan supports Chinese exports, though it has often drawn criticism from trading partners accusing China of “currency manipulation.”

Short-Term vs Long-Term Impacts

Short-Term Effects:

Exporters and importers immediately feel gains or losses from currency shifts.

Volatility disrupts pricing strategies, contracts, and supply chains.

Long-Term Effects:

Persistent depreciation can erode investor confidence, discouraging capital inflows.

Companies may relocate production to hedge against currency risks.

Exchange rate instability may encourage protectionism and tariffs.

Sector-Wise Impact

Energy Sector

Oil prices, usually denominated in USD, fluctuate with dollar strength. Importing nations face inflation when their currency weakens.

Technology & Services

Outsourcing destinations like India benefit when their currency weakens, as dollar earnings translate into higher domestic revenue.

Manufacturing & Automobiles

Export-oriented industries gain from weaker home currencies. However, dependency on imported raw materials can offset benefits.

Agriculture & Commodities

Farmers in export-driven economies gain from weaker currencies. But fertilizer, equipment, and fuel imports become costlier.

Tools to Manage Currency Risks

1. Hedging Instruments

Forward Contracts: Lock in exchange rates for future transactions.

Options: Provide flexibility to buy/sell at a fixed rate.

Swaps: Exchange currency cash flows between parties.

2. Diversification

Multinationals diversify production and sourcing across countries to reduce exposure.

3. Central Bank Intervention

Central banks buy/sell currencies to stabilize volatility.

4. Trade Agreements

Regional trade blocs (e.g., EU, ASEAN) reduce intra-region currency risk by using common or pegged currencies.

Winners and Losers in Currency Fluctuations

Winners: Exporters during depreciation, importers during appreciation, forex traders exploiting volatility.

Losers: Import-dependent industries during depreciation, debt-heavy countries with foreign loans, consumers facing inflation.

Broader Economic Implications

Global Supply Chains

Exchange rate volatility complicates cost management in multinational supply chains.

Foreign Debt Servicing

Countries with debt denominated in foreign currencies face higher repayment costs if their currency depreciates.

Trade Wars & Protectionism

Currency disputes can lead to accusations of manipulation, tariffs, and retaliatory trade measures.

Financial Market Volatility

Sudden currency swings trigger capital outflows from emerging markets, destabilizing stock and bond markets.

Future Outlook

Digital Currencies & CBDCs: The rise of central bank digital currencies could reduce transaction costs and lower forex volatility.

Regionalization of Trade: More trade within blocs may reduce exposure to dollar dominance.

Greater Use of Hedging Tools: Firms will increasingly rely on sophisticated financial instruments to manage risk.

Geopolitical Uncertainty: Wars, sanctions, and supply chain disruptions will continue to drive currency volatility.

Conclusion

Currency fluctuations are both an opportunity and a risk in global trade. While depreciation can stimulate exports, it also raises import costs and inflation. Appreciation makes imports cheaper but hurts exporters. The net effect depends on a nation’s trade structure, economic resilience, and ability to manage risks.

For businesses, managing currency risk is now as important as managing production or marketing. Governments must balance exchange rate stability with economic growth, while central banks act as guardians against excessive volatility.

In an interconnected world, no nation is immune from the impact of currency swings. Exchange rate management and risk mitigation strategies will remain central to ensuring global trade continues to thrive despite fluctuations.

Role of IMF in Global Currency Stability1. Historical Background of IMF and Currency Stability

1.1 Bretton Woods System

The IMF was founded in 1944 at the Bretton Woods Conference in the aftermath of World War II, when global economies faced destruction and currency instability.

The conference aimed to create a system where exchange rates were fixed to the US dollar, which in turn was pegged to gold at $35 per ounce.

The IMF’s primary role was to oversee this system, provide short-term loans to countries facing balance of payments difficulties, and prevent “beggar-thy-neighbor” policies like competitive devaluations.

1.2 Collapse of Bretton Woods (1971–73)

In 1971, the United States suspended the dollar’s convertibility to gold, leading to the collapse of Bretton Woods.

Exchange rates became flexible, and the IMF shifted its role from managing fixed exchange rates to monitoring floating rates and providing guidance on currency and economic policies.

1.3 Post-Bretton Woods Era

The IMF adapted by focusing on surveillance of global exchange rate policies, promoting currency stability through advice, and intervening during financial crises.

It also expanded its role in lending and conditionality, ensuring member countries adopted reforms that contributed to overall stability.

2. Objectives of the IMF in Ensuring Currency Stability

The IMF’s Articles of Agreement highlight several key goals linked directly to currency stability:

Promote International Monetary Cooperation – Encouraging collaboration among member countries to avoid policies harmful to others.

Facilitate Balanced Growth of International Trade – Stable currencies promote smoother trade, avoiding volatility in import/export costs.

Promote Exchange Stability – Discouraging currency manipulation or destabilizing devaluations.

Assist in Establishing a Multilateral System of Payments – Ensuring convertibility of currencies and reducing exchange restrictions.

Provide Resources to Members Facing Balance of Payments Difficulties – Offering loans to stabilize currencies during crises.

These objectives highlight the IMF’s fundamental commitment to safeguarding global monetary stability.

3. Mechanisms of IMF in Maintaining Currency Stability

The IMF operates through a combination of surveillance, financial assistance, technical assistance, and policy guidance.

3.1 Surveillance

The IMF conducts regular monitoring of member countries’ economic and financial policies.

Bilateral surveillance: “Article IV Consultations” where IMF economists review a country’s fiscal, monetary, and exchange rate policies.

Multilateral surveillance: Reports like the World Economic Outlook (WEO), Global Financial Stability Report (GFSR), and External Sector Report highlight risks to global stability.

This surveillance acts as an “early warning system” for potential currency crises.

3.2 Financial Assistance (Lending)

The IMF provides loans to countries facing balance of payments crises, which helps stabilize their currency.

Types of lending:

Stand-By Arrangements (SBA) – short-term assistance.

Extended Fund Facility (EFF) – medium-term loans for structural adjustments.

Flexible Credit Line (FCL) – for countries with strong fundamentals.

Poverty Reduction and Growth Trust (PRGT) – concessional loans for low-income countries.

By providing liquidity, the IMF prevents sudden currency collapse.

3.3 Technical Assistance and Capacity Building

The IMF helps countries develop strong institutions, including central banks, financial regulatory systems, and fiscal frameworks.

Training in monetary policy management reduces risks of mismanagement that could destabilize a currency.

3.4 Special Drawing Rights (SDRs)

The IMF issues SDRs as an international reserve asset.

SDR allocations provide liquidity to member states during crises, helping them stabilize currencies without excessive borrowing.

4. Role of IMF During Currency Crises

4.1 Latin American Debt Crisis (1980s)

Many Latin American countries faced hyperinflation and currency collapse due to high debt and oil shocks.

IMF provided rescue packages with conditions such as fiscal austerity and structural reforms.

4.2 Asian Financial Crisis (1997–98)

Countries like Thailand, Indonesia, and South Korea suffered from speculative attacks and sharp currency depreciations.

The IMF intervened with large bailout packages to stabilize currencies and restore investor confidence.

4.3 Global Financial Crisis (2008–09)

IMF injected liquidity through lending and SDR allocation, ensuring member countries could support their currencies amidst global panic.

4.4 Eurozone Sovereign Debt Crisis (2010s)

Greece, Portugal, and Ireland faced currency and debt instability.

IMF, in coordination with the European Central Bank and European Commission, provided rescue packages to protect the euro.

4.5 Recent Interventions (2020–2023)

During the COVID-19 pandemic, IMF provided emergency financing to more than 90 countries to stabilize currencies affected by capital flight and reduced exports.

SDR allocations worth $650 billion in 2021 boosted global reserves.

5. IMF’s Policy Tools for Currency Stability

Exchange Rate Policies – Advises countries on maintaining competitive yet stable exchange rate regimes.

Monetary Policies – Encourages inflation control to avoid currency depreciation.

Fiscal Discipline – Promotes sustainable debt to prevent currency crises.

Capital Flow Management – Recommends policies to manage sudden inflows or outflows of capital.

Reserve Management – Encourages countries to build adequate foreign exchange reserves for stability.

6. Criticisms of IMF’s Role in Currency Stability

Despite its importance, the IMF has faced significant criticisms:

6.1 Conditionality and Sovereignty

IMF loans often come with strict conditions (austerity, privatization, liberalization).

Critics argue this undermines national sovereignty and imposes uniform “one-size-fits-all” policies.

6.2 Social Costs of Reforms

Austerity measures often lead to unemployment, reduced social spending, and increased poverty.

Example: Asian Financial Crisis reforms worsened unemployment and poverty initially.

6.3 Bias Toward Developed Economies

The IMF is accused of favoring advanced economies, especially the U.S. and European countries, given their larger voting shares.

Developing countries often feel underrepresented in decision-making.

6.4 Inability to Prevent Crises

IMF is often reactive rather than proactive. It intervenes after a crisis begins, rather than preventing it.

Its surveillance system has sometimes failed to detect vulnerabilities early.

7. Reforms and Future Role of IMF in Currency Stability

To remain effective, the IMF has been evolving:

7.1 Governance Reforms

Rebalancing voting shares to give emerging markets (China, India, Brazil) greater influence.

7.2 Strengthening Surveillance

Using big data, AI, and real-time monitoring of capital flows to identify risks faster.

7.3 Flexible Lending Programs

Introduction of new instruments like Flexible Credit Line (FCL) and Short-term Liquidity Line (SLL) tailored to different needs.

7.4 Role in Digital Currencies

With the rise of central bank digital currencies (CBDCs) and cryptocurrencies, the IMF is working on guidelines to ensure they do not destabilize global exchange systems.

7.5 Climate and Currency Stability

Climate change can create macroeconomic instability (through disasters, commodity shocks).

IMF is incorporating climate-related risks into its surveillance and lending frameworks, linking them indirectly to currency stability.

8. Case Studies: IMF and Currency Stability

8.1 Argentina (2001 and 2018 Crises)

Severe currency depreciation due to unsustainable debt and capital flight.

IMF provided large bailout packages, though critics argue reforms worsened recession.

8.2 Iceland (2008 Financial Crisis)

IMF intervened after banking collapse led to currency freefall.

Its assistance stabilized the krona and allowed recovery.

8.3 Sri Lanka (2022 Crisis)

IMF provided assistance after the rupee collapsed due to debt and foreign exchange shortages.

Reforms included fiscal restructuring and exchange rate flexibility.

9. Importance of IMF in Today’s Globalized World

Globalization makes economies interdependent; currency fluctuations in one country can trigger contagion.

Emerging markets with volatile currencies rely heavily on IMF assistance.

Safe-haven role – IMF’s existence reassures markets that an international “lender of last resort” exists.

Crisis manager – Whether it’s debt crises, pandemics, or geopolitical shocks, IMF acts as a stabilizer for currencies.

Conclusion

The IMF has been a cornerstone of the international monetary system since its inception. Its central mission of maintaining global currency stability has evolved over decades—from overseeing fixed exchange rates under Bretton Woods to managing floating rates and responding to crises in a highly globalized world.

Through surveillance, lending, technical assistance, and the issuance of SDRs, the IMF has consistently provided mechanisms to stabilize currencies during crises. While criticisms about conditionality, governance, and social impacts remain, the IMF continues to adapt to the challenges of a changing global economy.

In the 21st century, as new threats emerge—from cryptocurrencies and capital flow volatility to climate shocks—the IMF’s role in global currency stability remains indispensable. Without such an institution, the risk of disorderly currency collapses, financial contagion, and global recessions would be far greater.

Ultimately, the IMF stands not just as a financial institution but as a global cooperative framework that fosters trust, stability, and resilience in the world’s monetary system.

ESG Investing in Global MarketsChapter 1: Understanding ESG Investing

1.1 Definition of ESG

Environmental (E): Concerns around climate change, carbon emissions, renewable energy adoption, water usage, biodiversity, pollution control, and sustainable resource management.

Social (S): Focuses on human rights, labor practices, workplace diversity, employee well-being, community engagement, customer protection, and social equity.

Governance (G): Relates to corporate governance structures, board independence, executive pay, transparency, ethics, shareholder rights, and anti-corruption measures.

Together, these dimensions create a holistic lens for evaluating companies beyond financial metrics, helping investors identify long-term risks and opportunities.

1.2 Evolution of ESG

1960s-1970s: Emergence of ethical investing linked to religious and social movements, e.g., opposition to apartheid or tobacco.

1990s: Rise of Socially Responsible Investing (SRI), focusing on excluding “sin stocks” (alcohol, gambling, weapons).

2000s: The United Nations launched the Principles for Responsible Investment (PRI) in 2006, formally embedding ESG into mainstream finance.

2010s onwards: ESG investing surged amid global concerns over climate change, social inequality, and corporate scandals.

1.3 Why ESG Matters

Risk Management: Companies ignoring ESG risks (e.g., climate lawsuits, governance failures) face financial penalties.

Long-Term Returns: Studies show firms with strong ESG practices often outperform peers over the long run.

Investor Demand: Millennials and Gen Z increasingly prefer ESG-aligned investments.

Regulatory Push: Governments worldwide are mandating ESG disclosures and carbon neutrality goals.

Chapter 2: ESG Investing Strategies

Investors adopt multiple approaches to integrate ESG factors:

Negative/Exclusionary Screening – Avoiding industries such as tobacco, coal, or controversial weapons.

Positive/Best-in-Class Screening – Selecting companies with superior ESG scores relative to peers.

Thematic Investing – Focusing on ESG themes like renewable energy, clean water, or gender diversity.

Impact Investing – Investing to generate measurable social and environmental outcomes alongside returns.

Active Ownership/Stewardship – Using shareholder influence to push for ESG improvements in companies.

ESG Integration – Embedding ESG considerations directly into financial analysis and valuation.

Chapter 3: ESG in Global Markets

3.1 North America

The U.S. has seen rapid growth in ESG funds, though political debates around ESG (especially in energy-heavy states) have created polarization.

Major asset managers like BlackRock, Vanguard, and State Street integrate ESG into products.

Regulatory frameworks (SEC climate disclosure proposals) are shaping ESG reporting.

3.2 Europe

Europe leads globally in ESG adoption, with strong regulatory support such as the EU Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy.

Scandinavian countries (Norway, Sweden, Denmark) are pioneers in sustainable finance, often divesting from fossil fuels.

ESG ETFs and green bonds dominate European sustainable investment flows.

3.3 Asia-Pacific

Japan’s Government Pension Investment Fund (GPIF), one of the world’s largest, actively invests in ESG indices.

China is promoting green finance under its carbon neutrality by 2060 pledge, but faces challenges in standardization and transparency.

India is witnessing growth in ESG mutual funds, driven by SEBI (Securities and Exchange Board of India) regulations and corporate sustainability goals.

3.4 Emerging Markets

ESG in emerging markets is growing but uneven.

Investors face challenges such as limited disclosure, weaker governance, and political risks.

Nonetheless, ESG adoption is rising in markets like Brazil (Amazon deforestation issues), South Africa, and Southeast Asia.

Chapter 4: ESG Performance and Market Impact

4.1 Financial Returns

Research indicates ESG funds often perform competitively with, or even outperform, traditional funds. Key findings include:

ESG funds are more resilient during downturns (e.g., COVID-19 crisis).

Companies with high ESG ratings often enjoy lower cost of capital.

4.2 Green Bonds and Sustainable Finance

Green Bonds have grown into a $2 trillion+ market globally, financing renewable energy, clean transport, and sustainable infrastructure.

Other innovations include sustainability-linked loans and social bonds.

4.3 Corporate Transformation

ESG pressure has driven oil majors (e.g., Shell, BP) to diversify into renewables.

Tech firms (e.g., Apple, Microsoft) are committing to carbon neutrality.

Banks and insurers are phasing out financing for coal projects.

Chapter 5: Challenges in ESG Investing

Despite growth, ESG investing faces several obstacles:

Lack of Standardization: Different ESG rating agencies use varied methodologies, creating inconsistency.

Greenwashing: Some firms exaggerate ESG credentials to attract investors without real impact.

Data Gaps: In emerging markets, ESG disclosures are limited or unreliable.

Short-Termism: Many investors still prioritize quarterly returns over long-term ESG impact.

Political Backlash: ESG has become politicized, particularly in the U.S., leading to regulatory tensions.

Chapter 6: Case Studies

6.1 Tesla – A Controversial ESG Icon

Tesla is often seen as a leader in clean technology due to its role in electric mobility. However, concerns about labor practices, governance issues, and supply chain risks (e.g., cobalt mining) complicate its ESG profile.

6.2 BP & Energy Transition

After the 2010 Deepwater Horizon disaster, BP rebranded itself as a greener energy company, investing heavily in renewables. This illustrates how ESG pressure can push legacy firms toward transformation.

6.3 Unilever – Social & Environmental Responsibility

Unilever integrates ESG principles deeply into its operations, focusing on sustainable sourcing, waste reduction, and social equity, earning strong support from ESG investors.

Chapter 7: Regulatory and Institutional Landscape

UN PRI: Global standard promoting ESG integration.

TCFD (Task Force on Climate-Related Financial Disclosures): Encourages climate risk reporting.

IFRS & ISSB (International Sustainability Standards Board): Working on global ESG reporting frameworks.

National Regulations:

U.S. SEC climate disclosures.

EU SFDR & EU Taxonomy.

India’s Business Responsibility and Sustainability Report (BRSR).

Chapter 8: Future of ESG Investing

The future of ESG investing is shaped by megatrends:

Climate Transition: Net-zero commitments will drive massive capital flows into clean energy, green tech, and sustainable infrastructure.

Technology & Data: AI, big data, and blockchain will improve ESG measurement, reducing greenwashing.

Retail Investor Growth: ESG-focused ETFs and robo-advisors will make sustainable investing more accessible.

Integration with Corporate Strategy: ESG will move from a reporting exercise to a core business strategy.

Emerging Market Potential: Growth in Asia, Africa, and Latin America will define the next wave of ESG capital allocation.

Conclusion

ESG investing is no longer an optional strategy—it is becoming a main pillar of global finance. Investors, regulators, and corporations recognize that long-term economic prosperity is inseparable from sustainability, social responsibility, and sound governance. While challenges such as greenwashing, inconsistent standards, and political backlash persist, the momentum is undeniable.

As global challenges like climate change, inequality, and governance scandals intensify, ESG investing provides a roadmap for channeling capital toward solutions that create sustainable financial returns and a better world. In the next decade, ESG will not just influence markets—it will define them.

Global Private Equity Trends1. Introduction

Private equity (PE) has emerged as one of the most powerful forces in global finance. Over the last four decades, it has transformed from a niche investment strategy practiced by a handful of firms into a multi-trillion-dollar asset class that shapes industries, creates jobs, restructures companies, and influences the broader global economy.

The private equity model—raising capital from institutional investors, acquiring or investing in private companies, actively managing them, and ultimately exiting at a profit—has proven highly successful. Today, pension funds, sovereign wealth funds, university endowments, and family offices rely on private equity as a key component of their portfolios.

But the private equity industry is not static. It evolves in response to macroeconomic conditions, technological innovation, regulatory shifts, and investor demands. In recent years, global private equity trends have reflected both challenges—rising interest rates, geopolitical instability, inflation—and opportunities—digital transformation, ESG investing, and emerging market growth.

2. Historical Evolution of Private Equity

The origins of private equity date back to the mid-20th century. In the 1940s and 1950s, early venture capital firms in the U.S. funded technology startups and post-war industrial companies. The modern private equity boom began in the 1980s, with leveraged buyouts (LBOs) making headlines—most famously the $25 billion buyout of RJR Nabisco by KKR in 1989.

The 1990s saw PE expand into Europe and Asia, with institutional investors increasingly allocating capital. By the 2000s, private equity had become mainstream, with mega-funds raising tens of billions of dollars. The global financial crisis of 2008 slowed activity, but the industry rebounded strongly in the 2010s, fueled by low interest rates and abundant liquidity.

By the 2020s, private equity assets under management (AUM) exceeded $10 trillion, cementing its role as a dominant force in global finance.

3. The Global Scale of Private Equity

As of 2024, global private equity AUM is estimated to exceed $12 trillion, making it one of the fastest-growing segments of the alternative investment universe. North America remains the largest hub, followed by Europe and Asia-Pacific. However, new regions—such as the Middle East and Africa—are increasingly attracting investor interest.

Private equity firms vary in size, from global giants like Blackstone, KKR, Carlyle, and Apollo, to specialized boutique firms focused on specific sectors or geographies. This diversity contributes to a wide spectrum of investment strategies, from billion-dollar buyouts to small growth-capital investments.

4. Key Drivers of Private Equity Growth

Several forces underpin the rise of private equity:

Institutional Investor Demand: Pension funds and sovereign wealth funds allocate heavily to private equity for higher returns compared to public markets.

Low Public Market Returns: Sluggish equity markets push investors toward alternative assets.

Operational Value Creation: Unlike passive stockholders, PE firms actively manage portfolio companies, improving efficiency and profitability.

Globalization of Capital: Cross-border deals and global funds create opportunities beyond domestic markets.

Technological Innovation: PE firms increasingly invest in tech-driven companies and use data analytics to enhance decision-making.

5. Regional Trends in Private Equity

North America

The U.S. remains the largest and most mature private equity market.

Mega-funds dominate, but mid-market firms thrive in niche strategies.

Strong focus on technology, healthcare, and financial services.

Europe

Regulatory oversight is stronger, especially post-Brexit.

Countries like the U.K., Germany, and France are major PE hubs.

Infrastructure and ESG-driven deals are gaining traction.

Asia-Pacific

China and India are hotbeds of growth equity and venture deals.

Japan and South Korea are seeing more buyouts.

Sovereign wealth funds in Singapore and the Middle East play key roles as LPs.

Middle East & Africa

The Gulf states, especially Saudi Arabia and the UAE, are deploying sovereign wealth funds into global private equity.

Africa offers opportunities in infrastructure, fintech, and consumer markets, though risks remain high.

Latin America

Brazil and Mexico are leading PE markets.

Focus on energy, fintech, and consumer growth stories.

Political instability is a limiting factor.

6. Sectoral Trends in Private Equity

Technology

Cloud computing, cybersecurity, fintech, and AI startups attract significant PE capital.